Converting dollars to rands seems simple on the surface: you take the dollar amount, multiply it by the exchange rate, and get your rand value. The formula is USD Amount × Exchange Rate = ZAR Amount. But here’s the catch most people miss: the exchange rate you see on Google is almost never the one you actually get.

Understanding the difference between the real, mid-market exchange rate and the marked-up rates offered by traditional banks is crucial. For any South African business, this isn't just a minor detail—it's a factor that can quietly eat into your profits.

Your Quick Guide to Converting Dollars to Rands

Getting this calculation right is more than just an academic exercise. Whether you're a local business bringing export revenue back home or paying an overseas supplier, the gap between the real exchange rate (often called the spot rate) and the rate from your bank can cost you thousands.

Simply put, the exchange rate you lock in directly determines your profitability.

The Real-World Financial Impact

Let's ground this in a real scenario. Imagine a South African business that just invoiced a US client. On a given day—let's say February 5, 2026—the official rate published by the South African Reserve Bank might be 16.0718 rand to the dollar.

At that rate, a $1,000 invoice should convert to R16,071.80. This rate reflects a stronger rand, a welcome recovery from the all-time high of 19.93 back in April 2025, which hammered importers. If you’re curious, you can dive into historical currency data on the South African Reserve Bank's statistics page.

But when you go to your bank, they won't offer you 16.0718. They’ll add their "spread" and might offer something like 15.50. Suddenly, your $1,000 is only worth R15,500. That's a R570 difference straight out of your pocket, lost to a hidden fee on a fairly small transaction.

Scale that up. For a business processing a $100,000 payment, that seemingly small spread balloons into a staggering R57,000 loss. This is precisely why knowing the true calculation is essential for your company's financial health.

The good news is that there are alternatives. Modern platforms like Zaro operate differently. They use the real-time spot rate without adding a spread. So, if you were to transfer $10,000 at a rate of 16.03, you’d receive exactly R160,300. No hidden markups, no lost revenue.

Let's look at how this plays out in a direct comparison.

The Real Cost of Your USD to ZAR Conversion

This table breaks down a $10,000 conversion, showing what you get with a real rate versus a typical bank rate that includes a hidden 3% spread.

| Conversion Factor | Real Rate (e.g., Zaro) | Typical Bank Rate (with 3% Spread) |

|---|---|---|

| USD Amount to Convert | $10,000 | $10,000 |

| Advertised Exchange Rate | 16.03 ZAR per USD | 16.03 ZAR per USD |

| Actual Rate You Receive | 16.03 | 15.55 |

| Total ZAR Received | R160,300 | R155,500 |

| Hidden Cost (The Spread) | R0 | R4,800 |

The numbers don't lie. The "convenience" of using a traditional bank can end up costing you dearly. By paying attention to the real rate, you ensure the money you've earned actually makes it to your balance sheet.

Nailing Down the Real Exchange Rate

Before you can even begin to calculate your dollars to rands, you need the right starting number. A quick Google search will give you a rate, but for business, you need the mid-market rate. This is the raw, wholesale exchange rate that banks and big financial players use to trade currencies with each other—it's the rate before any markups are added for the rest of us.

Think of it as the truest price of a currency at any given moment, the exact midpoint between what buyers are willing to pay and what sellers are asking for on the global market. Getting this figure right is the first step to a transparent conversion.

Where to Look for Credible Rates

Don't just rely on the first number a search engine throws at you. For accurate, professional-grade data, you need to go to the source. Here are the places I always check:

- Financial Data Giants: Websites like OANDA, Xe, and Bloomberg are the gold standard for live, real-time currency data.

- The South African Reserve Bank (SARB): For official reporting and accounting, the SARB's daily published rates are what you’ll need to use.

Getting a handle on this rate isn't just a numbers game; it’s about understanding the market's pulse. The USD/ZAR pair is notoriously volatile, often jumping in response to anything from global gold prices to local economic news. The rate you see at 9 AM could be noticeably different by the time you're ready to make a payment at 3 PM.

Here's a crucial tip for any finance team: The live rate you lock in when you transact will almost always be different from the daily closing rate you use in your financial statements. Knowing how to manage that small gap is key to keeping your books clean.

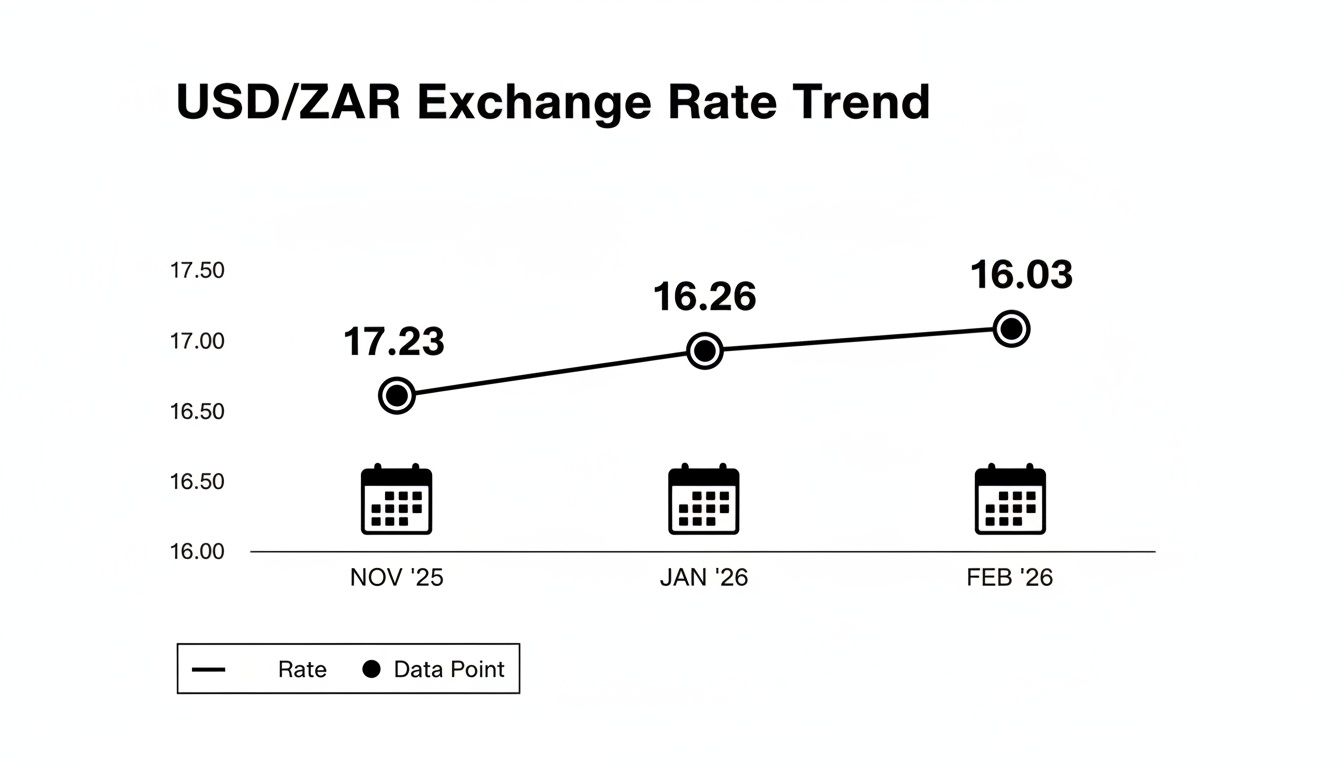

Just look at the historical data to see how much these swings can affect your bottom line. South African SMEs have lost countless rands over the years to bad calculations and hidden bank fees. The USD/ZAR rate, for example, hit a peak of 19.93 during the 2025 crisis before making a strong recovery. More recently, the rate in January 2026 was 16.2625—a 5.6% drop from the 17.2297 we saw in November 2025, which shows the rand was strengthening.

If you want to dive deep into these trends yourself, you can explore decades of data on the St. Louis Fed's FRED economic data website.

Getting Real: Calculating Beyond the Spot Rate

Multiplying your dollars by the spot rate you see on Google gives you a nice, clean number. The problem? That's not the amount that will ever actually land in your bank account. To get an accurate picture of how many rands you’ll end up with, you have to account for the hidden costs that banks and payment providers build into the process. This is where your bottom line can really take a hit.

The main culprit is something called the exchange rate spread. Think of it as the difference between the 'real' mid-market rate and the slightly less favourable rate your provider offers you. It's their profit margin, and it's rarely advertised in flashing lights.

Just look at how much the rate can move on its own. This chart shows the USD/ZAR trend over a few months, illustrating how market volatility alone can dramatically alter your outcomes.

You can see a clear strengthening of the rand during this period. What that means in practice is that a dollar would have bought you significantly fewer rands in February than it did back in November. Timing, as they say, is everything.

Unpacking the Real Costs of Conversion

The spread is just the beginning. A whole host of other transaction costs can chip away at the final amount you receive. Keep an eye out for these:

- SWIFT Fees: The standard charge for sending money internationally. This can be anything from R250 to over R800 per transfer.

- Receiving Fees: Believe it or not, some South African banks will charge you a fee just to accept an incoming payment from overseas.

Let's put this into a real-world scenario. Imagine a Johannesburg-based BPO needs to pay an international contractor $5,000. The mid-market rate is a healthy 16.10, but their bank's rate, after the spread, is 15.70.

At the perfect spot rate, the conversion would be $5,000 x 16.10 = R80,500. But with the bank's rate, it's $5,000 x 15.70 = R78,500. That’s a R2,000 loss from the spread alone before any other fees are even considered.

Tack on a R450 SWIFT fee, and the true cost of this transaction is R2,450 higher than what the spot rate suggested. For any financial manager trying to stick to a budget, these "small" hits add up incredibly fast. What looked like a profitable project can quickly slide into the red if these tangible costs aren't forecasted properly. This is exactly why a precise calculation must always go beyond a simple multiplication.

How Rate Volatility Impacts Your Invoices

To illustrate how much timing matters, let’s look at how the cost of settling the same $100,000 invoice would have changed based on historical exchange rates over a few months.

Impact of Rate Volatility on a $100,000 Invoice

| Month (2025/2026) | Average USD/ZAR Rate | Cost in ZAR | Difference from Cheapest Month |

|---|---|---|---|

| November 2025 | 18.25 | R1,825,000 | + R85,000 |

| December 2025 | 18.01 | R1,801,000 | + R61,000 |

| January 2026 | 17.68 | R1,768,000 | + R28,000 |

| February 2026 | 17.40 | R1,740,000 | - |

The difference is stark. Settling that invoice in November instead of February would have cost the business an extra R85,000. This isn't a small discrepancy; it's a significant operational cost that underscores the importance of not just what rate you get, but when you lock it in.

A Practical Walkthrough with Real Business Scenarios

Okay, let's move from theory to reality and see how these numbers actually stack up in the real world. I find that looking at a couple of common business scenarios really drives home how much the conversion method can impact the final rands you end up with.

Scenario 1: The Cape Town Exporter

Picture a wine exporter based in the Western Cape. They’ve just closed a deal with a US distributor and need to bring $50,000 back into their South African account.

On the day they decide to make the transfer, the real mid-market exchange rate is sitting at 17.50 ZAR to the US dollar.

Let's see how this plays out with two different providers:

- Fintech Platform (like Zaro): They give you the real rate, no funny business. The maths is straightforward: $50,000 × 17.50 = R875,000. The exporter gets the full value.

- Traditional Bank: The bank, on the other hand, adds its typical 3% spread. This pushes the rate they offer down to just 16.975. Now the calculation is: $50,000 × 16.975 = R848,750.

Just like that, R26,250 vanishes into the bank's pocket. For an exporter working on tight margins, that's a huge chunk of profit simply gone. It shows that while smart currency conversion is key, so is understanding the bigger picture of your market. For instance, knowing how to build a Total Addressable Market calculator can give you the context needed for sustainable growth.

Scenario 2: The Tech Company’s Software Bill

Now let's look at a tech company in Durban. They have a recurring monthly invoice of $5,000 for some critical software they use from a US provider.

It might not seem like a massive amount, but those small spreads and hidden fees compound month after month, turning into a serious drain on their resources.

This gets even trickier when you factor in exchange rate volatility. We recently saw the USD/ZAR rate take a nosedive of 19.4%, dropping from a peak of 19.93 in April 2025 all the way down to 16.03 by February 2026. Traditional banks often add their 2-4% spreads right on top of this volatility, costing SMEs billions.

Think about it: over a single year, even a relatively "small" 2.5% spread on that $5,000 monthly bill adds up to a R26,250 loss (assuming an average rate of 17.50). That’s not just a cost of doing business; it’s money that could have been spent on hiring, marketing, or development.

How Modern Tools Flip the Script on Conversion

Anyone who's managed international payments the traditional way knows the headache. It was always a defensive game. You’d start with a bank’s inflated exchange rate, try to account for mysterious SWIFT fees, and then brace yourself for other hidden costs that would inevitably pop up. It was a messy, frustrating process that guaranteed you were leaving money on the table.

Thankfully, that’s no longer the only way to do things. Modern financial platforms have completely changed the calculation. By tackling the two biggest problems head-on—the rate markups and the surprise fees—they give you access to the actual mid-market exchange rate. This simple change makes calculating your payments incredibly straightforward.

From Guesstimate to Guarantee

What was once a complicated, multi-step formula full of variables is now beautifully simple. Your calculation moves from a rough estimate to an exact figure you can actually rely on.

Let's look at the difference:

- The Old Way: (USD Amount × The Bank's Inflated Rate) – SWIFT Fee – Receiving Bank Fee = Final ZAR Amount (Maybe)

- The Modern Way: USD Amount × Real Exchange Rate = Final ZAR Amount (Exactly)

This isn’t just a small improvement; it has a massive impact on your company's financial planning. When you know you’re getting the real rate with zero spread, your cash flow becomes predictable. No more chasing down payments that arrive short or trying to explain budget variances caused by bad exchange rates.

By cutting out hidden spreads and unpredictable costs like SWIFT fees, modern platforms offer total cost certainty. For a business in South Africa, this translates directly into better profitability and far less time wasted on financial admin.

Ultimately, this lets your finance team shift from putting out fires to proactively managing your money. You spend less time on tedious reconciliations, gain true clarity for budgeting, and—most importantly—you keep more of your own money where it belongs. The whole process of converting dollars to rands goes from being a drain on your resources to a simple, efficient task.

Common Questions About USD to ZAR Calculations

Even once you've got the basic formula down, a few practical questions always pop up when it's time to make a real-world international payment. Calculating dollars to rands is about more than just multiplication; it's about understanding the entire context of the transaction. Let's tackle some of the most common queries I hear from business owners.

What's the Best Time of Day to Convert USD to ZAR?

This is a classic one. Yes, it's true that currency markets are busiest during certain hours, especially when the London and New York trading sessions overlap (which is usually around 15:00 to 19:00 SAST). But honestly, trying to "time the market" for a fractional gain is a high-risk game for most businesses.

A much smarter approach is to focus on cost certainty, not daily speculation. When you use a platform that guarantees the real exchange rate with zero spread, you lock in the best possible rate the moment you transact. This completely removes the guesswork and the risk of trying to predict where the market will go next.

Expert Tip: Don't play the currency trading game. Consistent access to the real mid-market rate is far more valuable and less risky than trying to chase minor daily fluctuations. It protects your profits without you needing to become a full-time forex analyst.

How Should I Record Dollar-to-Rand Conversions in My Books?

Good bookkeeping is non-negotiable for financial health. When you convert USD to ZAR, the golden rule is to record the final rand value that actually landed in your account, on the specific date the conversion took place.

It's crucial that you use the actual exchange rate you received for that transaction, not just a generic daily rate you pulled from a website. Modern payment platforms make this easy by providing detailed transaction statements that show the exact spot rate used. This simplifies reconciling your accounts and keeps your financial records perfectly accurate, which is a lifesaver come audit time.

Besides the Exchange Rate, What Other Fees Should I Watch Out For?

The hidden spread in the exchange rate is usually the biggest culprit, but it's rarely the only cost. If you're still using traditional banks for international transfers, you need to be on the lookout for other explicit fees that chip away at your final amount.

- SWIFT Fees: These are the standard charges for sending money across international borders and can easily cost anywhere from R250 to over R800 for a single payment.

- Receiving Fees: Believe it or not, some banks will also charge you a separate fee just for the "service" of accepting and processing an incoming foreign currency payment.

Before you ever authorise a transfer, always demand a complete, line-by-line breakdown of all the charges. That transparency is the only way to do an accurate calculation and know what you're truly paying.

Ready to stop losing money to hidden fees and unpredictable exchange rates? With Zaro, you get the real mid-market exchange rate on every transaction, guaranteed. Take control of your international payments and see exactly how much you can save. Get started with Zaro today.