To figure out your price margin, you take your selling price, subtract the Cost of Goods Sold (COGS), and then divide that result by the selling price. When you express that as a percentage, you’ve got the exact profit you make on every single sale. Getting this simple formula down is the absolute first step toward real profitability.

The Exporter’s Guide to True Profitability

If you're a South African exporter, understanding your real profit margin isn't just an accounting exercise—it's a survival strategy. It’s easy to feel overwhelmed by volatile exchange rates and the hidden bank fees that chip away at your earnings, but protecting your bottom line starts with this one crucial calculation.

A common trip-up for business owners is confusing price margin with markup. They sound similar, but they tell two completely different stories about your company's financial health. Getting the distinction right is fundamental to setting prices that don’t just cover your costs but actually drive sustainable growth.

Margin vs. Markup: The Core Difference

The easiest way to keep these two straight is to remember what each one measures your profit against. Margin measures profit as a percentage of your revenue (your selling price). Markup, on the other hand, measures profit as a percentage of your cost.

Here’s a quick breakdown to keep in mind:

- Price Margin: This is all about the profitability of each sale. It answers the question, "What percentage of the final price is pure profit?"

- Markup: This is about the pricing process. It answers, "How much did I mark up the cost to arrive at my selling price?"

This isn't just about semantics; it's a crucial distinction. A healthy-looking markup doesn't always translate into a healthy margin, especially once all the other hidden costs start creeping in.

Here’s a table that breaks it down even further, which I find helps keep it crystal clear.

Margin vs Markup at a Glance

| Concept | Formula | Focus | Primary Use Case |

|---|---|---|---|

| Price Margin | (Revenue - COGS) / Revenue |

Profitability | Analysing financial performance and overall business health. |

| Markup | (Revenue - COGS) / COGS |

Pricing | Setting the initial selling price based on the cost of goods. |

As you can see, the formulas are similar but the denominator changes everything, shifting the entire perspective from cost to revenue.

Knowing the difference is about perspective. Margin gives you a view from the finish line (profit from revenue), while markup is your view from the starting block (price based on cost).

For exporters, this difference gets amplified. The cost of your goods is just one piece of the puzzle. Cross-border transaction fees, currency conversion spreads, and other charges can quickly eat away at what looked like a solid markup.

In a market this tough, precise margin calculations are everything. In fact, data from Statistics South Africa shows the trade sector's profit margin is a razor-thin 4 cents per rand. That really drives home how much every single fee counts.

Thankfully, modern fintech solutions are starting to strip away these traditional cost layers, giving you a much clearer path to profitability and setting the stage for the practical strategies we'll cover next.

Getting to Grips with the Core Profit Margin Formula

You don't need to be a financial whiz to figure out your price margin. In fact, the core formula is surprisingly simple, yet it's the most powerful tool you have for checking the financial health of your business on a sale-by-sale basis. Before we get into the weeds of international costs, you absolutely must nail this down first.

The one formula you need to burn into your brain is the Gross Profit Margin formula.

Gross Profit Margin = (Revenue - Cost of Goods Sold) / Revenue

Let’s quickly break that down. Revenue is simply the total money you bank from a sale (your selling price). Your Cost of Goods Sold (COGS) covers the direct costs of making that product. The result shows you exactly what percentage of your selling price is pure profit.

A Practical Example in Rands

Let's say you're a South African business exporting beautiful, handcrafted leather bags to a shop in the United States. We'll run the numbers for one bag, keeping everything in ZAR for now.

- Selling Price (Revenue): You sell each bag for R3,000.

- Cost of Goods Sold (COGS): The leather, buckles, and direct labour cost you R1,200.

Now, let's pop those numbers into the formula.

First, you find the gross profit: R3,000 (Revenue) - R1,200 (COGS) = R1,800

Then, you divide that profit by the revenue: R1,800 / R3,000 = 0.60

To get the percentage, just multiply by 100: 0.60 x 100 = 60%

Boom. Your gross profit margin is a very healthy 60%. What this really means is that for every R100 you make in sales, R60 is gross profit before you start paying for other things like marketing, rent, or admin staff.

The Same Calculation in US Dollars

As an exporter, you need to be just as comfortable doing this in your customer's currency. Let's imagine the exchange rate means your R3,000 bag is priced at $165 in the US.

- Selling Price (Revenue): $165

- Cost of Goods Sold (COGS): $66 (your R1,200 cost, converted at the same rate)

Let's run the formula again with these figures.

Calculate the gross profit: $165 (Revenue) - $66 (COGS) = $99

Divide by the revenue: $99 / $165 = 0.60

And convert to a percentage: 0.60 x 100 = 60%

Notice anything? The margin stays at a solid 60%, no matter which currency you use for the calculation. This simple maths gives you a clear baseline for your profitability.

Once you’ve got a handle on the basics, you can explore a more detailed product margin calculation formula to get even more granular with different items. Nailing this core concept gives you the solid foundation you need before we start tackling the tricky international costs that can quietly eat away at this number.

Uncovering the Hidden Costs That Silently Erode Your Margin

That simple profit margin formula gives you a nice, clean number. It feels good. But for South African exporters, this initial figure is often just the beginning of the story. The real challenge in figuring out your price margin accurately is spotting the less obvious costs that are quietly eating away at your profits.

These are the expenses that don't show up on your first Cost of Goods Sold (COGS) spreadsheet but sneak in later to shrink your bottom line. Think of your calculated gross margin as your potential profit. Hidden fees are like leaks in a bucket—the more you have, the less profit actually makes it into your bank account.

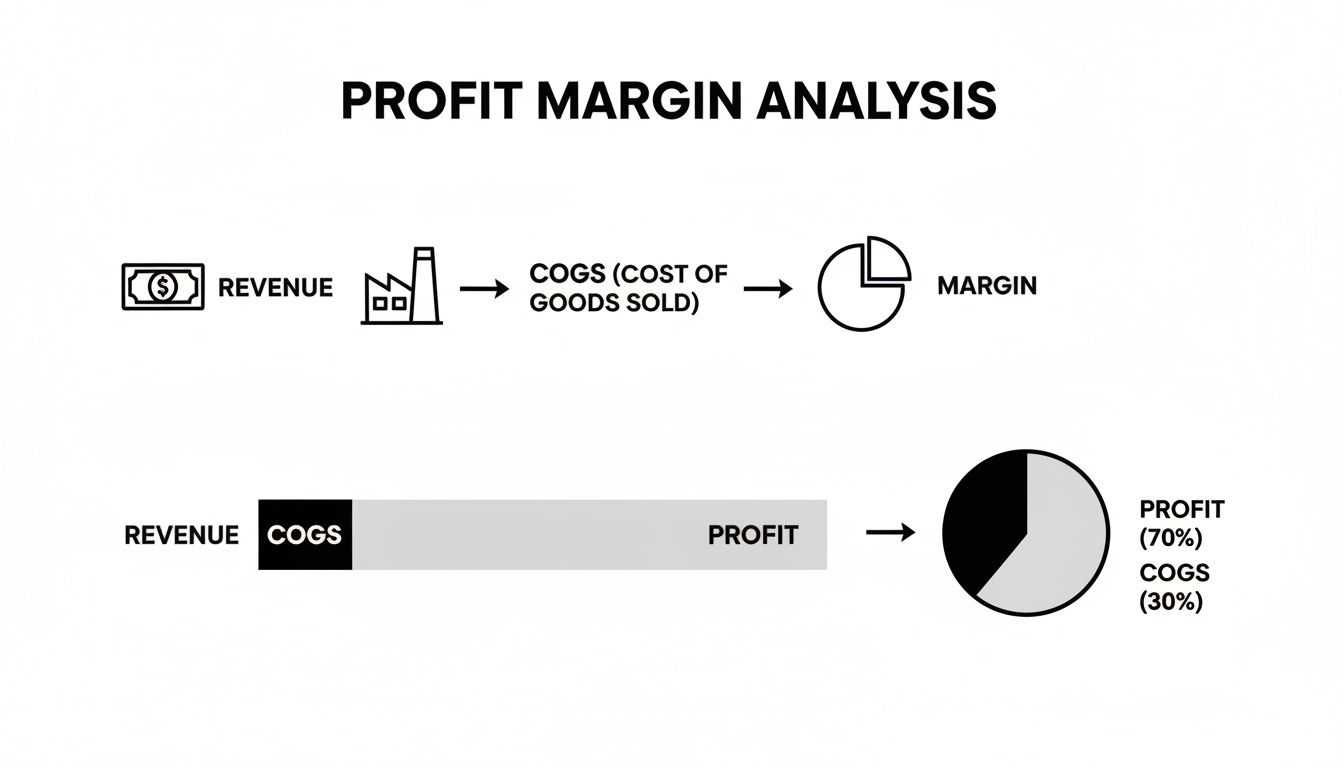

This visual shows the basic flow from revenue to your final margin. But that arrow between COGS and Profit? That’s where these hidden costs often lurk.

This breakdown covers the core parts, but it’s absolutely crucial to expand what you include in your COGS to reflect the true cost of an international deal.

The Margin Killers Hiding in Plain Sight

When you're dealing with cross-border payments, traditional banking systems introduce several layers of fees. Some are disclosed, sure, but others are buried deep in the fine print or, more often, blended into the exchange rate itself.

Here are the most common culprits you need to watch out for:

- Currency Conversion Spreads: This is easily the most significant hidden cost. Banks almost never offer the true mid-market exchange rate. Instead, they add a markup or "spread" to the rate and pocket the difference. It might look like a tiny percentage, but on a large transaction, it can translate into thousands of Rands lost.

- SWIFT Fees: The Society for Worldwide Interbank Financial Telecommunication (SWIFT) network is the standard for international bank transfers. Using it, however, comes with fees that can range anywhere from R250 to over R750 per transaction, depending on your bank and where the money is going.

- Intermediary Bank Charges: Your payment doesn't always go straight from your bank to your recipient's. It often passes through one or more "correspondent" banks along the way. Each of these banks can slice off its own handling fee directly from the payment, meaning your client or supplier gets less than you actually sent.

These costs aren't just minor annoyances; they are direct attacks on your profit margin.

The Real-World Impact on a R1,000,000 Deal

Let's put this into perspective with a practical "before and after" scenario. Imagine you've just secured an export deal worth R1,000,000. After running the numbers, you've calculated your initial gross margin at a very respectable 15%, which is R150,000.

Now, let's see how that margin holds up when pitted against traditional banking fees versus a modern fintech solution like Zaro.

By eliminating hidden spreads and fixed fees, you aren't just saving money—you are directly reclaiming lost profit margin. You did the hard work to earn that 15%; don’t let an outdated system steal nearly 3% of it.

South African banks maintained a net interest margin of 3.0538% in 2021, a figure that often mirrors the hidden spreads applied to foreign exchange. In fact, traditional FX markups can erode an exporter's margins by 2-5%. By eliminating these spreads, a business can reclaim that entire percentage, turning a modest 4% trade margin into a much healthier 6-8%. You can review the full data on bank margins in South Africa to see how these metrics impact business costs.

A Cost Comparison: Before and After

To truly see the difference, let’s look at a side-by-side comparison. The table below illustrates the stark difference in costs and the direct impact on your final profit margin for that R1,000,000 deal.

| Impact of Fees on a R1,000,000 Export Deal | |||

|---|---|---|---|

| Cost Component | Traditional Bank | Zaro Platform | Margin Impact |

| FX Spread (2.5%) | R25,000 | R0 (Zero Spread) | +R25,000 |

| SWIFT Fee | R500 | R0 (No SWIFT) | +R500 |

| Intermediary Fees | R350 (Average) | R0 (Direct) | +R350 |

| Total Fees | R25,850 | R0 | R25,850 Saved |

| Profit Kept | R124,150 | R150,000 | Retain 100% of Margin |

The numbers don't lie. Using a traditional bank would cost you R25,850 on this single transaction, slashing your hard-earned 15% margin down to just 12.4%.

By switching to a zero-spread, no-fee platform, you keep your entire R150,000 profit. This isn't a minor tweak—it's a fundamental shift in profitability that directly impacts your ability to compete and grow.

Smart Pricing Strategies to Protect Your Profits

Knowing your price margin is just the start. The real game is defending it. If you're a South African exporter, you know the volatile Rand-Dollar exchange rate isn't just a news headline—it's a constant risk to your bottom line. To stay profitable, you need to stop reacting and start planning.

This is where your margin calculation becomes more than just a number; it becomes your primary tool for building a financial defence against currency swings and all the other unexpected costs that pop up in international trade.

Setting Intelligent Price Floors

Think of a price floor as the absolute lowest price you can sell your product for and still hit your target profit margin. It’s not the price on your website; it's your financial line in the sand. To figure this out, you have to work backwards, starting with the margin you need and then factoring in every single cost, including those tricky international payment fees.

Here’s how to set a price floor that actually works:

- Factor in Everything: Don't just stop at your Cost of Goods Sold (COGS). You need to include shipping, insurance, and—crucially—a buffer to absorb a sudden dip in the Rand.

- Keep it Fresh: The ZAR/USD rate doesn't stand still, and neither should your pricing. Review your price floors at least quarterly, or even monthly during really volatile periods, to make sure they're still protecting you.

- Know Your "No": A solid price floor gives you a powerful tool in negotiations. It’s your hard limit, stopping you from taking a deal that seems good on paper but actually costs you money in the end.

This isn’t about being inflexible; it’s about being prepared. When you know your absolute minimum, you can make sharp, smart decisions on the fly without having to scramble for a calculator.

Your price floor is your non-negotiable profit boundary. It stops you from making emotional pricing decisions during high-stakes negotiations and protects your baseline profitability, no matter how the market shifts.

Building Currency Clauses into Contracts

One of the most effective shields you can have is a currency adjustment clause, sometimes called a Currency Adjustment Factor (CAF). This is a simple but powerful provision you add to your sales contracts. It allows you to adjust the final invoice price if the exchange rate moves past a certain point.

For instance, your clause could state that if the Rand weakens against the Dollar by more than 3% between the order date and the payment due date, the invoice will be adjusted to reflect the change. This moves some of the currency risk from your shoulders to the buyer's, or at the very least, creates a fair way to share the burden.

Of course, you need to introduce this clearly. Don't position it as a penalty. Frame it as what it is: a standard business practice to ensure fair pricing for everyone in a market that's always in motion.

Holding Funds in Multi-Currency Accounts

Here’s a strategy that many exporters overlook: don't rush to convert your foreign currency back into Rands, especially when the rate isn't in your favour. By using a multi-currency account, like the USD and ZAR accounts offered by Zaro, you can hold onto your earnings in dollars.

This gives you strategic control. You can watch the market and wait for a better exchange rate before bringing your funds home, which directly increases your profit margin without you having to change your prices one bit.

Better yet, you can use the dollars in your USD account to pay international suppliers directly. This lets you sidestep the expensive double-conversion fees (ZAR to USD to another currency) that traditional banks love to charge. Just holding and converting your funds strategically can add several percentage points back to your bottom line over the year.

Building Financial Controls for Predictable Growth

Getting your price margin calculations right is one thing, but that accuracy is completely dependent on the quality of the data you're feeding into the formula. Once you've got the maths down, the real work begins: building a system of governance that protects your profits and makes your growth predictable.

It really boils down to establishing strong internal controls. Without them, your numbers are just educated guesses. You could be underpricing deals, getting your profitability wrong, and making major strategic decisions based on information that's shaky at best. Sustainable growth is built on a foundation of data you can trust, and that takes more than a simple spreadsheet.

This is where modern financial platforms come in. They’re built for this kind of governance, moving beyond basic transactions to offer features that provide real oversight and cut down on human error—absolutely essential for any exporter looking to scale securely.

Implementing Robust Internal Governance

To get a firm grip on these controls and pave the way for predictable growth, many businesses turn to comprehensive financial services that have these governance tools built right in. The key features you need to look for and implement are multi-user access with custom permissions and detailed reporting. This structure is your best defence against operational risk.

Here’s what that looks like on the ground:

- Multi-User Access: You can assign specific roles to team members. For instance, your finance manager gets full access to approve payments, while an operations coordinator might only be able to view transaction histories without being able to move money.

- Custom Permissions: This is about controlling who sees what. You can lock down sensitive margin data, set payment limits for certain users, and even create an approval workflow where larger transactions need a second person to sign off.

- Detailed Reporting: The ability to generate reports showing who did what and when is crucial. This audit trail is priceless for accountability, catching mistakes early, and proving compliance.

When you connect your process for calculating price margin to solid internal governance, it stops being a simple calculation and becomes a powerful tool for managing risk.

This approach creates a secure financial environment where your data stays clean and is only seen by the people who are supposed to see it. At the end of the day, this isn't just about avoiding errors. It’s about building a financially transparent operation that partners, investors, and banks can actually trust. That level of control is what separates a business that’s always reacting from one that grows predictably and securely.

Answering Your Top Questions on Price Margin

Even with the formulas down pat, the real world of exporting throws a few curveballs. When you're dealing with international clients, currency fluctuations, and all the costs in between, some practical questions always pop up. Let's tackle the ones I hear most often from fellow South African exporters.

How Often Should I Be Recalculating My Margins?

If you’re only looking at your margins once a year, you’re flying blind. Especially with the Rand's habit of taking us all on a rollercoaster ride against the Dollar.

As a bare minimum, you should be reviewing your margins quarterly. But honestly, that’s just a baseline.

When the markets get choppy or a key supplier suddenly hikes their prices, you need to be more nimble. In those situations, a monthly review is your best defence. It stops you from getting caught out by a sudden shift and ensures your pricing is always working for you, not against you.

What’s a Good Profit Margin for an Export Business?

This is the classic "how long is a piece of string?" question. The honest answer is: it depends entirely on your industry. If you're shipping high volumes of a raw commodity, a 5-10% margin might be fantastic. But if you’re exporting handcrafted leather goods, you'd be looking for something closer to 50%, maybe even more.

Forget about chasing some generic industry average. The only number that matters is the one your business needs to survive and grow. A "good" margin is one that comfortably covers every single cost—both obvious and hidden—and leaves you with enough cash to handle risks and reinvest.

Start by getting forensic about your own costs. Once you know that number, you'll know what margin you need to be profitable.

Can I Just Increase My Prices to Improve My Margin?

You can, but proceed with caution. Slapping a higher price tag on your product is the quickest way to widen your margin, but it can just as quickly drive your customers away if they don't see the value.

Before you jump to a price hike, explore these other levers first:

- Trim Your Costs: Have you shopped around for shipping partners lately? Could you source raw materials more cost-effectively without compromising on quality? Every Rand saved on costs is a Rand added directly to your margin.

- Slash Transaction Fees: This is a big one. Many businesses don't realise they're losing 2-5% of their revenue to poor exchange rates and bank fees. Moving to a zero-spread platform is like giving yourself a raise without changing your prices one bit.

- Add More Value: Instead of just charging more, can you justify charging more? Think about offering premium packaging, an extended warranty, or faster shipping. Customers are often willing to pay more when they feel like they're getting more.

The smartest approach is usually a mix of these strategies. A few small cost reductions combined with a modest price increase backed by real value is far more sustainable in the long run.

Ready to stop letting hidden bank fees and volatile exchange rates chip away at your profits? With Zaro, you get the real exchange rate with zero spread and no SWIFT fees, putting you back in complete control of your price margins.

See how much you can save and start protecting your profits today.