If your South African business deals with international suppliers or customers, foreign exchange is more than just a line item in your accounting. It's a dynamic, ever-present factor that can either protect or erode your hard-earned profits. Think of it less as a simple banking chore and more as a strategic part of your financial management. To get started, you need to understand a few core ideas, like spot rates and forward contracts, and learn to spot hidden costs like the spread.

Getting to Grips with Foreign Exchange for Your Business

For any South African business with global ties, foreign exchange (FX) isn't about speculating on market movements—it's a critical operational reality. Simply treating it as another bank transaction is a mistake that can cost you dearly.

Every time you pay a supplier in dollars or get paid by a European client, you're exposed to currency risk. The ZAR/USD rate is constantly on the move, reacting to everything from local economic data to global political shifts. This volatility has a direct and immediate impact on your bottom line. Even a small, unfavourable swing in the exchange rate can wipe out the profit margin you worked so hard to secure.

That's precisely why a passive approach—just taking whatever rate your bank offers on the day—is no longer good enough for businesses looking to grow and protect their finances.

The Core Concepts You Need to Master

First things first, let's cut through the jargon. Understanding these basic terms is your first step towards taking control of your international payments.

- Spot Rate: This is the live, current market price to exchange one currency for another, right now. If you need to pay an overseas invoice today, you'll be dealing with the spot rate.

- Forward Contract: This is an absolute game-changer. It's a simple agreement to exchange a set amount of currency on a future date, but at a rate you lock in today. It’s your best tool for removing uncertainty from future cash flows.

- The Spread: Here’s the hidden cost. The spread is the difference between the price a dealer buys a currency (the bid) and the price they sell it (the ask). It’s their profit margin, and traditional banks are notorious for wide, costly spreads that eat directly into your money.

Grasping these ideas is what separates a passive rate-taker from a proactive manager of a company's currency exposure.

A Real-World Scenario: The Stellenbosch Wine Exporter

Let's make this practical. Picture a wine estate in Stellenbosch that lands a fantastic deal to export R1,500,000 worth of wine to a US distributor. The payment is due in US dollars in 90 days.

On the day the deal is signed, the USD/ZAR rate is 18.50. The exporter is expecting to receive about $81,081. But over the next three months, some positive local economic news strengthens the Rand to 17.90 against the dollar.

When the payment finally lands, that same $81,081 is now only worth R1,451,350. That’s a loss of nearly R50,000 in revenue, purely because the currency moved against them. A simple forward contract could have locked in the original 18.50 rate, completely protecting their expected Rand income.

By not having an FX strategy, the business was effectively gambling on the exchange rate—and it lost. Proactive currency management is all about taking that gamble off the table.

The scale of this market is massive. South Africa's foreign exchange market hit USD 3,861.60 million and is on track to reach USD 6,852.50 million by 2033, with a projected compound annual growth rate of 6.58%. This growth, driven by robust trade and our position as a financial hub in Africa, underscores why getting a handle on your currency strategy is more critical than ever. You can dig into more details on the South African FX market from IMARC Group.

Getting Your Business Ready for Global Transactions

Before you can dive into spot trades or forward contracts, you need to lay the groundwork. Shifting from FX theory to actual trading means getting your business properly set up with a financial partner. This initial step is absolutely critical for security and for making sure you’re operating within South Africa's financial regulations.

This process all boils down to two key verification stages: Know Your Business (KYB) and Know Your Customer (KYC). They might sound like a bit of a headache, but these checks are essential safeguards. They protect your business from fraud and help build a trusted financial environment for everyone. Thankfully, unlike the old days of branch visits and mountains of paperwork, modern platforms like Zaro have made this a quick, entirely digital process.

The Onboarding Documents You'll Need

To get started, it pays to have a few key documents ready to go. This isn't just bureaucratic red tape; it’s about proving your business is legitimate and confirming who has the authority to act on its behalf. It’s a non-negotiable for any regulated financial institution.

Here’s a typical checklist of what you'll need to upload:

- Company Registration Documents: Your official CIPC papers that prove your business is a registered legal entity in South Africa.

- Proof of Business Address: A recent utility bill (dated within the last three months) to confirm where you operate from.

- Director and Shareholder Info: A list of all directors and major shareholders, which will be checked against your CIPC documents.

- IDs for Key People: A clear copy of the ID or passport for every director and ultimate beneficial owner (UBO).

Having these files organised beforehand will make the online verification fly by. We’re talking a few minutes, not the days or weeks you might expect from a traditional bank.

Think of the KYB/KYC process not as a hurdle, but as your first line of defence. A platform that takes these checks seriously is one that also takes the security of your money seriously.

Once your business is verified, you’re ready to activate and fund your multi-currency accounts or digital wallets. This is where you'll really see the advantage of a modern FX platform. You can set up both ZAR and USD wallets without paying setup fees or worrying about maintaining high minimum balances.

Funding and Using Your Accounts

Topping up your new wallets is as straightforward as making a local EFT. You'll get unique local banking details for your ZAR wallet, so you can transfer funds directly from your main South African business account. The money reflects quickly, ready for you to convert currencies or make international payments.

This simple, digital-first approach gives you instant access to the global marketplace. For businesses looking to expand their international footprint, it can also be useful to understand related processes like opening a U.S. bank account online for non-residents, which can work hand-in-hand with your multi-currency wallet.

With a funded account, you're officially ready to move from planning to action. You can now execute real-time foreign exchange trades with total control and transparency.

Choosing the Right FX Strategy for Business Payments

Alright, you’ve got your accounts set up and funded. Now comes the crucial part: actually managing your international payments. The secret here isn’t about becoming a currency market wizard; it's about matching the right tool to the right job.

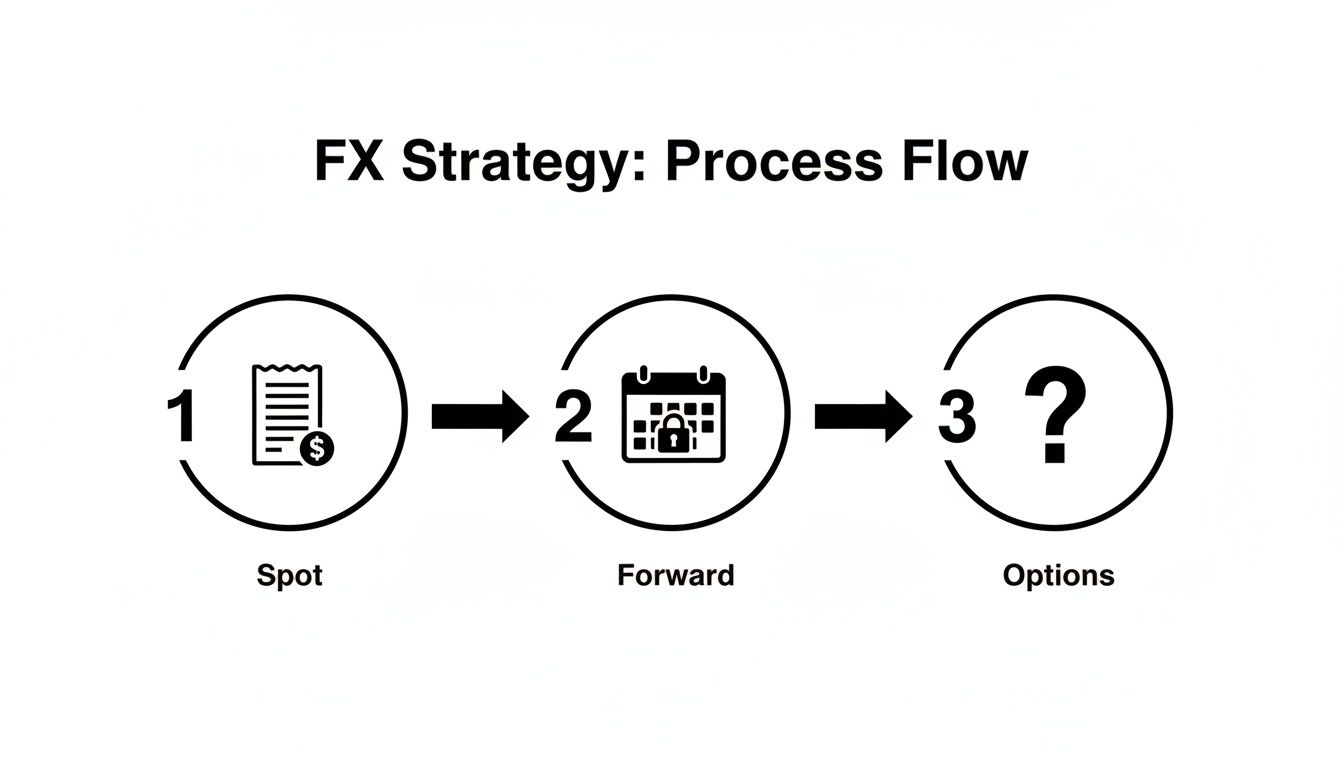

Not all global transactions are the same. The choice you make between a spot trade, a forward contract, or an option directly hits your bottom line, your exposure to risk, and your ability to forecast cash flow. This is about making smart, deliberate decisions for your business, not speculating on market swings. Your business needs a flexible toolkit to handle everything from an urgent supplier invoice to revenue you know is coming in three months.

Let's break down the three primary tools you'll be using.

Spot Trades: The Go-To for Immediate Needs

A Spot Trade is the bread and butter of foreign exchange. It’s simple: you agree to buy or sell a currency at the current live market rate—the "spot rate"—and the deal settles almost immediately, usually within two business days. This is your workhorse for payments that need to happen right now.

Think of a Cape Town-based BPO firm. They've just been hit with an invoice from their international software provider for $5,000, and it's due this week. To settle up, their finance manager needs to convert ZAR into USD fast. They’ll execute a spot trade, swapping the required amount of Rand at that moment's live USD/ZAR rate to get the funds on their way.

Spot trades are perfect when you're:

- Paying invoices for imported goods or services that are due immediately.

- Converting foreign currency from a sale that just landed in your account.

- Dealing with any kind of ad-hoc, unplanned international payment.

The big win here is simplicity and speed. The flip side? You're completely at the mercy of the exchange rate on that specific day. A spot trade offers zero protection if the market suddenly moves against you.

Forward Contracts: Securing Future Certainty

This is where you shift from being reactive to proactive. A Forward Contract is an incredibly powerful tool for any business that deals with future foreign currency payments or receipts. It lets you lock in an exchange rate today for a transaction that will happen weeks or months down the line. You agree on the rate, the amount, and the date, effectively taking currency volatility completely off the table.

Picture a manufacturing company in Durban that imports essential components from Germany. They've just placed a massive order for €100,000 worth of parts, but the payment isn't due for 90 days. The current EUR/ZAR rate looks pretty good, but they’re nervous the Rand could weaken over the next three months, making that €100,000 bill significantly more expensive in ZAR.

By entering into a forward contract, they can secure today's rate for their payment in 90 days. It doesn’t matter if the Rand tanks or soars; they know exactly how much ZAR their €100,000 payment is going to cost them. This transforms a future unknown into a fixed, budgetable expense.

A forward contract isn't about outsmarting the market. It's about making a business decision to not gamble with your profit margins. It provides absolute cost certainty, which is gold for financial planning.

In a strong trade environment, this kind of planning is non-negotiable. South African businesses recently celebrated a preliminary trade balance surplus of R21.8 billion, with exports reaching R186.4 billion. When you're dealing with numbers of that magnitude, a traditional bank markup of 3-5% can wipe out your entire profit. Using platforms like Zaro, which offer the real exchange rate with no spread, ensures those hard-won gains aren't eaten up by hidden fees. You can dig into the latest official figures by reading the South African trade statistics from SARS.

Currency Options: Gaining Flexibility

While a forward contract locks you into a rate, a Currency Option offers a different kind of advantage: flexibility. An option gives you the right, but not the obligation, to buy or sell a currency at a pre-agreed rate on a future date. For this privilege, you pay a premium upfront. Think of it as an insurance policy against a worst-case scenario.

Here’s how it works:

- If the market moves against you, you can exercise your option and trade at your protected, pre-agreed rate.

- If the market moves in your favour, you simply let the option expire and trade at the even better live spot rate.

This is a more advanced strategy, best suited for situations with a high degree of uncertainty. For example, if you’re bidding on a big international contract and aren't sure you'll even win the business. An option provides a safety net while still letting you catch a lucky break.

For most small to medium-sized businesses, however, the straightforward certainty of forward contracts usually strikes the best balance between cost and risk management.

Executing Trades and Managing International Payments

Okay, so your accounts are funded and you've got a strategy mapped out. Now for the real-world part: actually making trades and handling your international payments.

Forget the old days of phoning up your bank, getting a rate you couldn't really question, and then just hoping the SWIFT payment went through. Modern platforms have completely changed the game, making the mechanics of an FX trade surprisingly straightforward and transparent. Let's walk through how it works in practice, so you can see how this technology puts you firmly in control.

Let’s use a common scenario. Say your business needs to pay a US-based supplier an invoice for $10,000. On a fintech platform, this entire process becomes a predictable, self-service operation. You simply log in, see the live USD/ZAR rate for yourself, and execute the transfer in a matter of minutes. No phone calls, no opaque quotes, no waiting.

The whole point is to strip away the friction and guesswork that used to make global payments so frustrating.

This diagram shows the different routes you can take depending on your needs.

As you can see, whether it's an immediate spot trade, locking in a future rate with a forward, or using an option for more flexibility, it's all managed from one place.

A Practical Walkthrough: From Quote to Settlement

Let's get specific with that $10,000 supplier payment. The workflow is designed for total visibility, so you know exactly what you're paying and when the money is expected to land.

Here’s a snapshot of what this looks like on a platform like Zaro:

- Log in: First, you access your secure dashboard. You'll see your ZAR and any foreign currency wallet balances right there.

- Set up the payment: You’d choose to send funds from your ZAR wallet to a USD beneficiary.

- Enter the amount: You have two options here. You can either specify that the supplier must receive exactly $10,000 (and the system calculates the ZAR cost), or you can decide to convert a set amount of Rands.

- Choose the beneficiary: Select your supplier from a saved list or quickly add their US bank details. Managing your beneficiaries properly is a small thing that saves a lot of time on recurring payments.

- Review the live quote: This is the moment of truth. The platform shows you the real exchange rate, the total ZAR cost, and confirms that there are no hidden fees. This is a live quote, usually held for 30-60 seconds, giving you a window to lock it in.

- Execute: One click on "Confirm," and the deal is done. Your Rands are converted, and the international payment is on its way.

From there, you get an instant confirmation and can track the payment’s progress right through to final settlement.

Managing Your Operations and Team

In any growing business, managing foreign exchange isn't a one-person show. That’s why modern platforms are built for finance teams, offering enterprise-level controls that you just don't get with standard banking apps.

A great example is setting up custom user permissions. You could allow a junior finance clerk to prepare payments and load new beneficiaries, but require the CFO's final sign-off to execute any trade over a certain amount. This creates a secure, auditable workflow and seriously minimises risk.

The goal is to embed international payments directly into your financial operations, making them as routine and manageable as local payroll. This level of control and visibility is a significant departure from the opaque, gatekeeper model of legacy FX services.

Of course, executing trades is only half the battle; you also need to track the financial impact precisely. This is where a flawless cash flow calculation becomes critical for monitoring liquidity and understanding how your FX activity affects your bottom line in real time.

By eliminating hidden costs and providing clean, clear reporting, you get the accurate data you need to ensure your FX strategy is perfectly aligned with the overall financial health of your business. Every rand and dollar is accounted for.

Implementing Smart Hedging and Risk Management

Let's be honest: volatility is just a fact of life when you're dealing with the South African Rand. For any business with international customers or suppliers, managing this currency risk isn't an optional extra—it’s a core part of sound financial planning. This is where we get practical, moving past theory and into proactive strategies that genuinely protect your bottom line.

Learning to manage foreign exchange for your business is all about turning currency volatility from a constant threat into a predictable variable. The real goal here is to build a defence against those unfavourable market swings that can chew through your carefully calculated profit margins before you even realise it.

Building a Defensive Strategy for Importers

We see this scenario play out all the time with South African importers. Imagine you run a company bringing in electronic components from the United States. You’ve just agreed to a $50,000 order, and the invoice is due in 90 days.

Right now, the USD/ZAR exchange rate is 18.20. That puts your expected cost at a neat R910,000. But you know from experience how much the Rand can move in three months. If the rate weakens to 19.00 by the time you have to pay, that same invoice suddenly costs you R950,000. Just like that, you’re looking at an unplanned expense of R40,000.

This is exactly where a forward contract becomes your best defence. By locking in the 18.20 rate today for your payment in 90 days, you guarantee your cost will be R910,000, no matter what the live market does. This strategy, known as hedging, gives you absolute cost certainty.

Hedging isn’t about trying to outsmart the market. It’s about deciding that the risk of a negative currency swing is one your business isn’t willing to take. You’re simply trading the potential for a favourable move for the guarantee of stability.

That kind of stability is gold. It lets you budget accurately, it protects your margins, and it removes a massive source of financial anxiety from your plate.

Protecting Revenue for Exporters

The logic works just as well for businesses on the other side of the trade—the exporters. Let's take a local software company that’s just signed a $100,000 contract with a client in Europe, with payment due in 60 days.

At today's USD/ZAR rate of 18.50, they’re expecting to receive R1,850,000. But what happens if some positive local news strengthens the Rand to 17.80 over the next two months? Their $100,000 revenue is suddenly worth only R1,780,000. That’s a R70,000 shortfall that has nothing to do with their performance.

Once again, a forward contract is the answer. By locking in the 18.50 rate, the company secures its future Rand-denominated revenue. It’s a proactive step that ensures their hard-earned international sales aren't devalued by factors completely outside their control.

Creating a Formal FX Risk Management Policy

As your international trade volumes grow, it's wise to move from ad-hoc hedging to a formal policy. This doesn’t have to be some unwieldy, 50-page document. It just needs to clearly outline your company's approach to currency risk.

A good, basic policy should define:

- Risk Appetite: How much currency risk is your business truly willing to accept?

- Hedging Thresholds: At what value should a foreign transaction automatically be hedged? (e.g., all payments over $20,000).

- Approved Instruments: Which tools are you authorised to use? (e.g., spot trades and forward contracts only).

- Responsibilities: Who on the team is responsible for monitoring rates and executing the hedges?

Putting this framework in place creates consistency and makes your risk management deliberate rather than reactive. It gives your finance team clear guidance and demonstrates sound financial governance to investors and stakeholders.

Thankfully, our ability to manage this volatility is supported by a strong national financial position. South Africa's gross foreign exchange reserves recently hit a record $75.89 billion, with a hefty $51.795 billion held in foreign currency. This substantial buffer, which has averaged $37,228.65 million since 1998, provides a stable backdrop that helps businesses weather the ZAR’s natural fluctuations. You can explore more on the country's foreign exchange reserves to see the full data.

By implementing these smart hedging strategies, you can turn unpredictability into a structured, manageable part of doing business globally.

Got Questions About Business Foreign Exchange? We've Got Answers.

As South African businesses step onto the global stage, the theoretical side of foreign exchange quickly gives way to practical, everyday questions. Moving from a textbook to the real world means getting to grips with the nitty-gritty: How does SARS view this? What's the actual difference between all these financial tools?

We hear these questions all the time from business owners and CFOs trying to manage their company's FX exposure. This isn't about speculative trading; it's about smart financial management for your business. Let's tackle some of the most common queries to give you the clarity you need to protect your bottom line.

How Does SARS Handle FX Gains and Losses?

For any South African business, foreign exchange gains and losses aren't filed in some special category. They are simply treated as part of your company's regular income and are subject to standard income tax through SARS.

It's actually quite straightforward. Imagine your company imports components from the US, but the Rand weakens against the Dollar before you settle the invoice. That extra cost you have to swallow to buy the dollars is an FX loss. The good news is this loss can typically be claimed as a tax-deductible expense, which helps lower your overall taxable income.

On the flip side, if you're an exporter and the Rand weakens before you bring your USD earnings home, you'll end up with more Rands than you originally budgeted for. That pleasant surprise is considered an FX gain, and it's taxable.

The real secret here is that meticulous record-keeping is completely non-negotiable. You must be able to show the spot rate on the day of the transaction and the day you settled the payment. Using a platform that gives you clear, downloadable transaction histories makes this a whole lot easier when it's time to do your tax submissions.

While this covers the basics, we always suggest chatting with a qualified tax advisor. They can offer advice that's specific to your business structure, making sure you're fully compliant and making the most of the regulations.

How Can My Small Business Get Started with Hedging?

Hedging isn't some complex dark art reserved for massive corporations with entire treasury departments. Any small or medium-sized business (SME) can start hedging effectively, and the simplest way to begin is by using forward contracts.

Let's walk through a real-world example. Say you know you have to pay a USD invoice to a supplier in three months. Instead of worrying about where the Rand might be then, a forward contract lets you lock in today's USD/ZAR exchange rate for that future payment. Just like that, you've removed all the uncertainty. You know exactly what that payment will cost in Rands, and you can budget with total confidence.

Getting started is a simple, practical process:

- Map out your cash flow: First, look at your payment schedules and identify all the confirmed foreign currency payments and receipts you have coming up over the next few months.

- Pinpoint your biggest risks: Not all exposures are equal. Find the largest or most critical future transactions where a bad move in the exchange rate would really hurt your margins.

- Start small and see the benefit: You don't have to hedge everything at once. Begin with your most predictable and significant transactions to experience the peace of mind that comes with cost certainty.

Modern financial platforms have thankfully made these tools much more accessible, tearing down the high walls that traditional banks used to put up for smaller businesses.

Is a USD Bank Account Better Than a Fintech Platform?

Holding a Foreign Currency Account (FCA) with a traditional South African bank is one option for managing US Dollars, but it’s an old-school approach that often comes with serious downsides. You're typically looking at high monthly fees, pitiful interest rates, and—most importantly—terrible conversion rates when you need to move money between your ZAR and USD accounts.

A modern fintech platform offers a much smarter, more cost-effective way forward.

| Feature | Traditional Bank FCA | Modern Fintech Platform (like Zaro) |

|---|---|---|

| Account Fees | Often includes monthly maintenance fees. | Typically no monthly fees or minimum balances. |

| Exchange Rate | A marked-up rate with a hidden spread. | The real, live spot rate with zero spread. |

| International Payments | Incurs SWIFT fees (R500-R800 per payment). | No SWIFT fees on international transfers. |

| Transparency | Rates and fees are often opaque. | Full visibility on rates and zero hidden costs. |

The real advantage of a fintech solution is efficiency. You can hold a digital USD wallet, fund it without fuss, and convert currencies at the true market rate whenever you need to. For any business managing regular cross-border payments, this translates directly into significant savings, faster settlements, and much greater control over your money.

Ready to take control of your international payments with zero hidden fees and real exchange rates? With Zaro, you can manage your foreign exchange exposure and execute low-cost global transfers effortlessly. Get started with Zaro today and see how much your business can save.