Let's get one thing straight right from the beginning: making money from forex isn't some get-rich-quick fantasy. It’s a real skill, one that's built on a solid foundation of strategy, discipline, and a deep understanding of how the market actually works. Think of this guide as your no-nonsense starting point for navigating the world of forex trading in South Africa.

Understanding the South African Forex Market

Before you even think about placing your first trade, you need to get the lay of the land. The foreign exchange market is a global beast, but it has its own unique quirks here in South Africa. To succeed, you have to understand this specific environment. This isn't just about clicking "buy" or "sell"—it's about making smart, informed decisions.

South Africa is a heavyweight on the continent. In fact, it's still the largest forex trading hub in Africa, with a daily turnover that often tops $20 billion. The growth in retail trading here has been massive, thanks in large part to the strong regulatory oversight from the Financial Sector Conduct Authority (FSCA). They work to protect traders like you and keep brokers in line.

Key Forex Concepts for South African Traders

To get started, you have to speak the language. There are a few core forex terms that are absolutely non-negotiable for anyone looking to trade successfully from South Africa. These concepts are the bedrock of every single trading decision you will ever make.

Here's a quick look at the fundamentals that every South African trader should have locked down.

| Concept | Brief Explanation | Why It Matters in SA |

|---|---|---|

| Currency Pairs | The foundation of forex. You're always trading one currency against another, like the US Dollar vs. the South African Rand (USD/ZAR). | The USD/ZAR is one of the most volatile and popular pairs for local traders. Understanding its drivers is crucial. |

| Leverage | A tool that lets you control a large position with a small amount of capital. It can amplify profits but also magnifies losses. | In a volatile market like ours, misuse of leverage is the quickest way to wipe out an account. It demands extreme respect. |

| The Spread | The small difference between the buy and sell price of a currency pair. This is essentially the broker's fee for the trade. | A "tight" (low) spread is better for you. High spreads on ZAR pairs can eat into your potential profits quickly. |

Mastering these terms isn't just about sounding smart; it's about making better, more profitable decisions when your own money is on the line.

A Mindset for Success

At the end of the day, successful trading comes down to how you manage your money and your emotions. It helps to think of it like running a business, applying the principles of modern financial planning and analysis to your trading account.

Your trading capital is your business inventory. Protecting it is your primary job. Profits are the byproduct of excellent risk management, not reckless pursuit.

This means you need to set realistic goals. Only trade with money you can truly afford to lose. And most importantly, develop a disciplined, almost detached mindset. Without this business-like approach, it’s far too easy to let emotions like greed or fear take over, and that's the fastest way to an empty account. Your real goal is to build a strong foundation for a long and sustainable trading journey.

Setting Up Your Forex Trading Toolkit

Before you even think about placing your first trade, you need to get your toolkit in order. Diving into forex without the right setup is a bit like trying to build a house with just a hammer – you’ll get frustrated fast, and the results won't be pretty. A solid foundation is more than just a good strategy; it's about having the right practical tools from day one.

Let's start with the basics: your hardware and internet connection. You don't need a top-of-the-line gaming rig, but a reliable computer and a fast, stable internet connection are non-negotiable. In a market that moves in milliseconds, a lagging connection can be the difference between a profitable trade and a painful loss. I've seen it happen. Many serious traders in South Africa also have an uninterruptible power supply (UPS) on standby – an absolute must to counter the unpredictability of loadshedding.

Choosing the Right Broker is Everything

This is probably the single most important decision you'll make. For anyone trading in South Africa, the rule is simple: only trade with a broker regulated by the Financial Sector Conduct Authority (FSCA).

Think of FSCA regulation as your safety net. It means the broker has to play by a strict set of rules, including keeping your money in a separate account from their own company funds. So, if they run into financial trouble, your capital is protected. An unregulated broker offers you zero protection. It's just not worth the risk.

Practice Makes Perfect: The Power of a Demo Account

Before you put any real Rands on the line, you absolutely must open a demo account. It’s a trading simulator that uses live market data but with virtual money. This is your risk-free sandbox, and it’s invaluable for a few reasons:

- Test-Drive Your Strategy: See how your trading ideas actually hold up in real market conditions without losing a cent.

- Get Comfortable with the Tech: Every trading platform is slightly different. Use this time to master placing orders, setting stop-losses, and managing your positions without fumbling around when real money is involved.

- Understand Your Own Psychology: Trading can be an emotional rollercoaster. A demo account helps you get a feel for the market’s pace and how you react to both wins and losses.

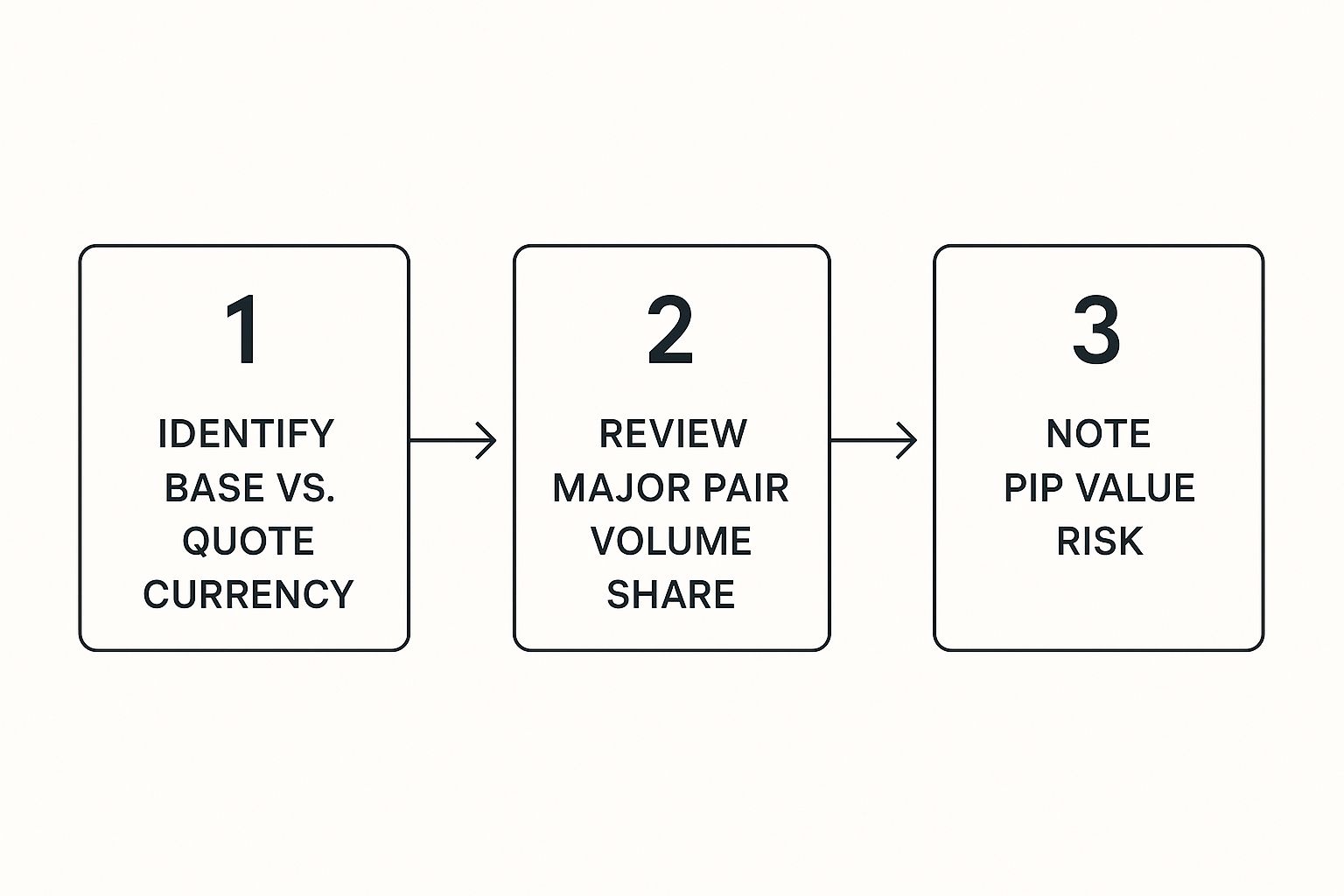

This is also the perfect place to get to grips with understanding currency pairs, a fundamental skill.

This process gives you a methodical way to break down any currency pair, from its structure to its unique risk profile, all within the safe environment of your demo account.

Getting Your Paperwork in Order

Once you feel confident and are ready to open a live account, your FSCA-regulated broker will need to verify your identity. This is part of the FICA (Financial Intelligence Centre Act) requirements here in South Africa, a standard procedure to prevent money laundering.

Pro Tip: Have your documents ready to go before you even start the application. You'll need clear, scanned copies of your South African ID or passport and a recent proof of residence (like a utility bill or bank statement). Getting this sorted upfront makes the whole process so much faster and smoother, letting you focus on the market instead of admin.

Crafting a Trading Strategy That Actually Works

Let's be blunt: trading on a whim is the quickest way to empty your account. The traders who last, the ones who actually make consistent money, don't rely on guesswork. They operate with a clear, pre-defined plan.

To consistently pull money from the forex market, you need a personal trading strategy. Think of it as the business plan for your trading activities. It's the playbook that guides every single decision you make, removing emotion and gut feelings from the equation.

This isn't just a loose set of ideas in your head. It needs to be a written document, tailored to your personality, your lifestyle, and the amount of risk you can stomach.

Finding a Trading Style That Fits You

Before you can even think about the specifics of your strategy, you have to find a trading style that suits you. The amount of time you can realistically commit and your general temperament are the biggest factors here.

Let's break down the common approaches:

- Scalping: This is the fast lane. Scalpers jump in and out of trades within seconds or minutes, aiming to skim tiny, frequent profits. It demands intense focus and is definitely not for the faint of heart.

- Day Trading: As the name suggests, day traders open and close all their positions within a single trading day. They never hold trades overnight, which requires you to be at your screen analysing the markets for several hours each day.

- Swing Trading: This is a popular middle-ground. Swing traders hold positions for several days, sometimes even weeks, aiming to capture the larger "swings" in price. It’s a much better fit if you can't be glued to the charts all day.

There's no "best" style here—only the one that's best for you. For a busy SME owner, a swing trading approach is far more manageable than the constant attention that day trading demands.

Combining Technical and Fundamental Analysis

Your strategy will stand on two core pillars of market analysis. A truly solid plan uses a bit of both to build a complete picture of what the market is doing.

Fundamental analysis is all about the big-picture economic stuff. As a South African trader, this means keeping a close eye on interest rate announcements from the SA Reserve Bank (SARB) or major economic data coming out of the US. These events are notorious for causing huge moves in pairs like the USD/ZAR.

Technical analysis, on the other hand, is the art of reading price charts. Here, you're using indicators and chart patterns to spot trends, identify key support and resistance levels, and pinpoint potential entry or exit points. This is how you nail down the timing of your trades.

Your trading plan is your constitution. It outlines what you will do, what you won't do, and how you will react to every foreseeable market event. Trade without it, and you're just gambling.

Documenting Your Trading Plan

A plan that only exists in your head doesn't count. You absolutely must write it down. This physical document becomes your anchor, holding you accountable when the market gets choppy and emotions are running high.

Here’s the bare minimum it needs to cover:

- Entry Rules: What specific conditions must be met before you even think about entering a trade? Be precise. "The price must bounce off the 50-day moving average" is a rule. "It looks like it's going up" is not.

- Exit Rules: Where will you take your profit? More importantly, where will you cut your losses? You need to define these price levels before you enter the trade.

- Position Sizing: How much of your capital are you willing to risk on a single trade? This is the cornerstone of risk management and will keep you in the game long-term.

By creating and, most importantly, sticking to this plan, you shift from gambling on currency movements to running a structured, repeatable process designed for long-term success.

How to Manage Risk and Protect Your Capital

If you're asking how to get money from forex consistently, you need to know the answer isn't about some secret strategy that never loses. It's not that glamorous. The real key, the thing that separates the pros from the crowd, is mastering risk management.

Frankly, it's the single most important skill you can learn. Protecting your capital is your number one job. Without it, you're out of the game. This means getting serious about setting hard, non-negotiable rules for every single trade you even think about placing.

The Non-Negotiable Orders

Before you ever hit "buy" or "sell," you absolutely must know your exit points. This isn't something you figure out on the fly when the market is moving and your emotions are running high. You decide it beforehand with two crucial order types.

- Stop-Loss Orders: Think of this as your safety net. It’s a pre-set order that automatically closes your trade if the market turns against you by a certain amount. It defines your maximum acceptable loss on that position, taking the painful guesswork out of cutting a loser.

- Take-Profit Orders: This is the other side of the coin. It’s an order that automatically closes your trade once it reaches a profit target you've already decided on. This discipline helps you lock in gains and fights off the greed that so often turns a good trade into a bad one.

Let me be clear: every single trade needs both a stop-loss and a take-profit order. No exceptions. This is the bedrock of disciplined trading.

You don't get to decide if a trade is a loser; the market does. Your job is to decide, in advance, how much you're willing to let the market prove you wrong.

The 1 Percent Rule for Staying in the Game

One of the most powerful rules I've ever come across is the 1 percent rule. The principle is simple: never risk more than 1% of your total trading capital on any single trade.

So, if you have an R10,000 account, your maximum risk per trade is just R100. That might sound incredibly cautious, but its real power is in survival. By risking such a tiny fraction, you give yourself the ability to withstand a string of losses without blowing up your account. It forces you to be patient and selective, protecting you from the financial ruin of one or two catastrophic decisions.

A Sober Look at Leverage

Leverage gets advertised as a ticket to massive profits from a small account, but it's a wickedly sharp double-edged sword. It magnifies everything—your wins and your losses. Using high leverage without a firm grip on risk management is the fastest way I know to get a margin call and wipe out your account.

Treat leverage with the respect it deserves. Use it as a tool to control a sensible position size, not as a lottery ticket for high-risk gambles. Your goal is to stay in the game long enough to let your strategy play out. While we're talking about trading risks here, understanding the broader general risk management principles for businesses can give you a really valuable, big-picture view on protecting your capital.

Finding the Best Times to Trade Forex in South Africa

Making a real success of forex trading isn’t just about what you trade; it’s about when. The market is open 24 hours a day, but that doesn't mean every hour offers a real opportunity. For traders here in South Africa, timing your activity to coincide with the market's peak energy can be the difference between a winning and a losing strategy.

If you’ve ever found yourself staring at a chart that’s barely moving, you’ve experienced a quiet market. When major global markets overlap, however, everything changes. Trading volume and volatility spike, and it's this movement that creates the potential for profit.

Capitalising on Market Overlaps

From my experience, the most powerful trading periods happen when different international sessions are open at the same time. For us in South Africa, the one that matters most is the overlap between the London and New York sessions.

Let’s break that down:

- The London Session: This is the heavyweight champion of forex trading, accounting for a huge portion of the daily global volume. It brings massive liquidity, especially for pairs involving the Euro (EUR) and British Pound (GBP).

- The New York Session: Just as the London traders are getting ready for their lunch break, the New York market fires up. This period is dominated by USD pairs and often gets a jolt from major economic news coming out of the United States.

When these two financial centres are active simultaneously, the market hits its stride. This is when you'll find the highest liquidity and the most significant price moves—exactly what you need to get your trades executed efficiently.

The real magic happens between 2 PM and 5 PM SAST. This is the sweet spot where both London and New York are in full swing. If you're going to see big, decisive moves, it’s usually during these hours.

Your Prime Trading Window in SAST

So, what does this all mean for a trader sitting in Johannesburg or Cape Town?

Market data and years of observation point to one clear conclusion: the best time to trade forex in South Africa is between 9:00 AM and 5:00 PM South African Standard Time (SAST).

This window neatly covers the entire London session and, crucially, that high-energy overlap with New York. Trading within these hours gives you the best shot at catching meaningful currency movements. If you'd like to dive deeper, you can learn more about how FSCA regulation and broker deposit requirements fit into this strategy.

Think of it this way: being strategic with your time is as vital as your rules for entering and exiting a trade. Trading outside these peak hours can feel like trying to sail a ship with no wind. You just won't get very far.

Focus your energy and your capital on the periods that offer maximum opportunity. Knowing when to be at your screen is half the battle; knowing when it’s time to step away and live your life is the other.

Got Questions About Forex Trading in South Africa? We’ve Got Answers

Stepping into the world of forex trading for the first time? It's natural to have a long list of questions. Getting clear, straightforward answers is the first step to building the confidence you need to get started. Let's tackle some of the most common queries we hear from new traders in South Africa to help clear things up.

How Much Money Do I Really Need to Start Trading Forex?

You’ll see brokers advertising that you can start with next to nothing, but let's be realistic. To trade properly, you should aim for a starting capital of around R1,500 to R3,500.

This isn't an arbitrary number. This amount gives you enough breathing room to place meaningful trades while still sticking to sound risk management principles, like the 1-2% rule. If you start with too little, you're setting yourself up for failure. A single small loss could wipe out a significant chunk of your capital, tempting you to take massive risks just to make a decent return.

My advice is always the same: get comfortable on a demo account first. Once you're consistently profitable there, fund a live account with money you are genuinely prepared to lose.

Do I Have to Pay Tax on Forex Profits in South Africa?

Yes, absolutely. In South Africa, profits from forex trading are considered taxable income. The South African Revenue Service (SARS) expects you to declare these earnings, and it's a non-negotiable part of trading legally and responsibly.

Your profits might be taxed as regular income or as capital gains, depending on how frequently you trade. The key is to keep meticulous records of every single trade—both your wins and your losses. I can't stress this enough: consult with a tax professional who has experience with traders. They'll make sure you're compliant and can save you a world of headaches.

Think of tax compliance as a core part of your trading strategy, not an afterthought. Keeping detailed records from day one is one of the best business decisions you'll make. It will save you from immense stress and potential penalties later on.

How Do I Get My Profits Out of a Forex Broker Account?

If you're using a broker regulated by the FSCA, withdrawing your funds is usually a secure and straightforward process. Reputable brokers are serious about protecting your money and offer several ways to get it, including direct bank transfers into your South African account or through well-known e-wallets.

The process is simple: you'll log into your broker's secure portal and submit a withdrawal request. First, though, your identity has to be fully verified to comply with FICA regulations—this is for your own protection. Just be mindful of any bank transfer fees or currency conversion costs that might pop up, as these can differ from broker to broker.

What’s the Best Currency Pair for a Beginner to Trade?

When you're just starting out, it's a smart move to stick with the major currency pairs. Think EUR/USD or GBP/USD. These pairs are traded in massive volumes around the world, which gives you two significant advantages: lower trading costs (what we call "tighter spreads") and price movements that are generally more predictable.

It might be tempting to jump straight into trading the USD/ZAR because it feels familiar, but I'd advise against it. The Rand is an emerging market currency, which means it can be incredibly volatile and often swings wildly based on local political and economic news. It’s a pair best left to seasoned traders who really understand the unique risks involved.

Ready to manage your foreign exchange without the hassle and hidden costs of traditional banking? Zaro offers South African businesses a transparent way to handle cross-border payments at real exchange rates. Simplify your international transactions and take control of your finances.

Learn more and get started at https://www.usezaro.com.