So, you're ready to get started with forex trading in South Africa? Excellent. The good news is that it’s a completely legal and well-regulated market, which makes things much safer for beginners.

Your first move is simple: find a broker regulated by the Financial Sector Conduct Authority (FSCA), open an account, and fund it with Rands. From there, you can start trading popular currency pairs like the USD/ZAR.

Your First Steps into Forex Trading in South Africa

Jumping into the foreign exchange market might feel a bit intimidating, but the actual process to get started is surprisingly straightforward. The most important thing to remember right off the bat is that forex trading is perfectly legal and regulated here in South Africa. This gives you a critical layer of protection as you begin.

The one name you absolutely need to know is the Financial Sector Conduct Authority (FSCA). Think of them as the market watchdog. Their job is to keep financial markets fair and to protect consumers (that's you!) from dodgy operators. Choosing a broker with an FSCA license isn't just a good idea—it's the single most important decision you'll make to keep your money safe.

A Few Core Ideas for Beginners

Before you even think about placing your first trade, it pays to get your head around a few fundamental concepts. These are the building blocks for every single decision you'll make in the market.

- Currency Pairs: Forex is always traded in pairs. A pair like USD/ZAR, for example, tells you how many South African Rands it takes to buy one US Dollar. When you trade it, you’re basically betting on whether the Rand will get stronger or weaker against the Dollar.

- ZAR-Based Accounts: This is a big one for South Africans. Opening a trading account in Rands (ZAR) is a game-changer. It means you can deposit and withdraw from your local bank account directly, sidestepping those annoying and expensive currency conversion fees that can quietly chew away at your profits.

- Leverage and Margin: Leverage is a powerful tool that lets you control a large market position with a relatively small amount of your own capital. It can seriously amplify your profits, but be warned—it does the exact same thing for your losses. It demands respect.

The journey into forex trading in South Africa starts with a solid foundation. If you prioritise finding a regulated broker and get to grips with the local currency dynamics from day one, you’ll set yourself up for a much safer and more strategic trading experience.

Once you have these basics down, you can move forward with a lot more confidence. The next logical step is to dig a bit deeper into the specific local regulations and the economic news that really moves the Rand.

Navigating the South African Forex Market

Before you even think about putting your first Rand on the line, you need to get the lay of the land. Trading forex in South Africa isn't just about watching currency charts; it’s about operating within a specific, well-regulated financial system designed to keep your money safe.

Two main players set the rules here. First, you have the South African Reserve Bank (SARB), our central bank. Their decisions on interest rates and monetary policy are a big deal and can directly move the value of the Rand. But for your day-to-day protection as a trader, the most important name to know is the Financial Sector Conduct Authority (FSCA).

The FSCA: Your Watchdog in the Market

Think of the FSCA as your first line of defence. Their job is to make sure financial firms, including forex brokers, play fair and are transparent with their clients. For this reason, choosing a broker that is licensed by the FSCA isn't just a good idea—it's absolutely essential.

An FSCA license is a big deal. It forces a broker to:

- Keep your trading funds in a separate bank account, completely segregated from their own company cash.

- Follow strict rules for financial reporting and auditing.

- Maintain a fair and open trading environment for all clients.

Skipping this check is like driving without a seatbelt. You might get away with it for a bit, but you're taking a massive, unnecessary risk. The FSCA's website is the first place you should go to check up on any broker you're considering. A legitimate broker will have their FSP number on their site, which you can then verify directly on the FSCA’s public search.

The strong oversight from bodies like the FSCA, combined with proactive policies from the SARB, has helped create a really solid and growing forex market here. These frameworks are a huge part of why forex trading in South Africa has become safer and more accessible for everyday investors.

The numbers back this up. The South African forex market was valued at around USD 3.86 billion and is expected to climb to about USD 6.85 billion by 2033. This isn't happening by accident. It's partly thanks to regulatory updates from the SARB and the National Treasury aimed at modernising how forex works, like easing some exchange controls. These moves bring our local market more in line with global standards, making it an attractive place for everyone. If you're interested, you can discover more insights about South Africa's growing forex market and the reforms behind its growth.

What Makes the Rand Tick?

Beyond the rules and regulations, your success will come down to understanding what actually moves the ZAR. The Rand is what's known as a "commodity currency," which is just a fancy way of saying its value is often linked to the global prices of the stuff we export.

Keep an eye on these key drivers:

- Commodity Prices: Gold, platinum, and coal are the big ones. When their prices go up on the world stage, the Rand often gets stronger because our export earnings increase.

- Interest Rate Decisions: When the SARB hikes interest rates, it tends to attract foreign investment from people chasing better returns, which can push the ZAR's value up. The opposite often happens when they cut rates.

- Local and Global News: Don't underestimate the impact of news. Political stability (or instability), GDP growth reports, and major international events can all send ripples through the currency markets.

Getting a solid grasp on these local dynamics—from the protective role of the FSCA to the economic forces that push and pull the Rand—is the foundation for making smarter, more confident trading decisions. It's this groundwork that will help you navigate both the opportunities and the risks you'll face.

How to Choose an FSCA-Regulated Forex Broker

Picking your forex broker is probably the biggest decision you'll make in your trading journey. This isn't just about finding a platform with fancy charts; it's about partnering with a secure, reliable company that gets the needs of South African traders. Your absolute top priority? Regulation by the Financial Sector Conduct Authority (FSCA).

An FSCA license is the one thing you can't compromise on. It's your assurance that the broker plays by strict local rules, including the critical practice of keeping client funds in separate accounts from their own operational cash. This segregation means your money is ring-fenced and safe, not being used to pay the broker's bills—a fundamental safety net every trader needs.

Verifying a Broker's License

Never just take a broker's word that they're regulated. You have to check it yourself. It’s a quick, simple step that can save you a world of pain later on.

Every licensed firm has a Financial Service Provider (FSP) number, which they should display proudly on their website, usually tucked away in the footer. Grab that number and head straight to the FSCA's official public search portal. Pop in the FSP number and confirm the license is active and belongs to the company you're researching. If you can't find them, or the details don't line up, that’s a massive red flag. Just walk away.

As you look at different FSCA-regulated brokers, it also pays to have a basic understanding key compliance requirements like KYC and AML. Knowing this gives you a better appreciation for the rigorous checks legitimate brokers must perform to protect you and keep the market fair.

Key Features for South African Traders

Once you’ve confirmed a broker is legit, the next step is to see if they’re a good fit for trading from South Africa. It’s the small, practical details that often have the biggest impact on your profitability.

Here's what I always look for:

ZAR-Denominated Accounts: This is a game-changer. A ZAR account means you can deposit, trade, and withdraw in Rands, completely dodging those annoying (and often costly) currency conversion fees every time you move money.

Local Funding Options: Does the broker support local Electronic Funds Transfers (EFTs) from South African banks like FNB, Standard Bank, or Absa? This is almost always faster and cheaper than dealing with international wire transfers.

Competitive Spreads on USD/ZAR: The spread is the broker's fee baked into every trade. For a popular pair like USD/ZAR, you need this to be as tight as possible. Even a tiny fraction of a pip difference adds up fast over hundreds of trades.

Reliable Trading Platforms: Most solid brokers will give you access to the workhorses of the industry: MetaTrader 4 (MT4) or MetaTrader 5 (MT5). They're known for being robust, having great charting tools, and supporting automated trading systems.

Key Features of FSCA-Regulated Forex Brokers

To put it all together, here’s a quick table summarising what really matters when you're comparing your options.

| Feature | What to Look For | Why It Matters for South African Traders |

|---|---|---|

| FSCA Regulation | A valid and active FSP number, verifiable on the FSCA website. | Your primary protection against fraud and ensures your funds are segregated. |

| ZAR Accounts | The option to hold your account balance in South African Rands. | Avoids currency conversion fees on deposits, withdrawals, and profit-taking. |

| Local Payment Methods | Support for local bank EFTs, Payfast, or other SA-friendly options. | Faster, cheaper, and more convenient funding and withdrawal processes. |

| Spreads on USD/ZAR | Low and competitive spreads, ideally below 1.5 pips for this major pair. | Directly reduces your trading costs, which boosts your potential net profit. |

| Customer Support | Local phone number, live chat with SA-based hours, and responsive email. | Quick access to help when you need it, without worrying about time zones. |

| Trading Platforms | Access to stable, well-known platforms like MT4 or MT5. | Ensures reliable trade execution, advanced analysis tools, and platform stability. |

These features aren't just 'nice-to-haves'; they are essential for a smooth and cost-effective trading experience from South Africa.

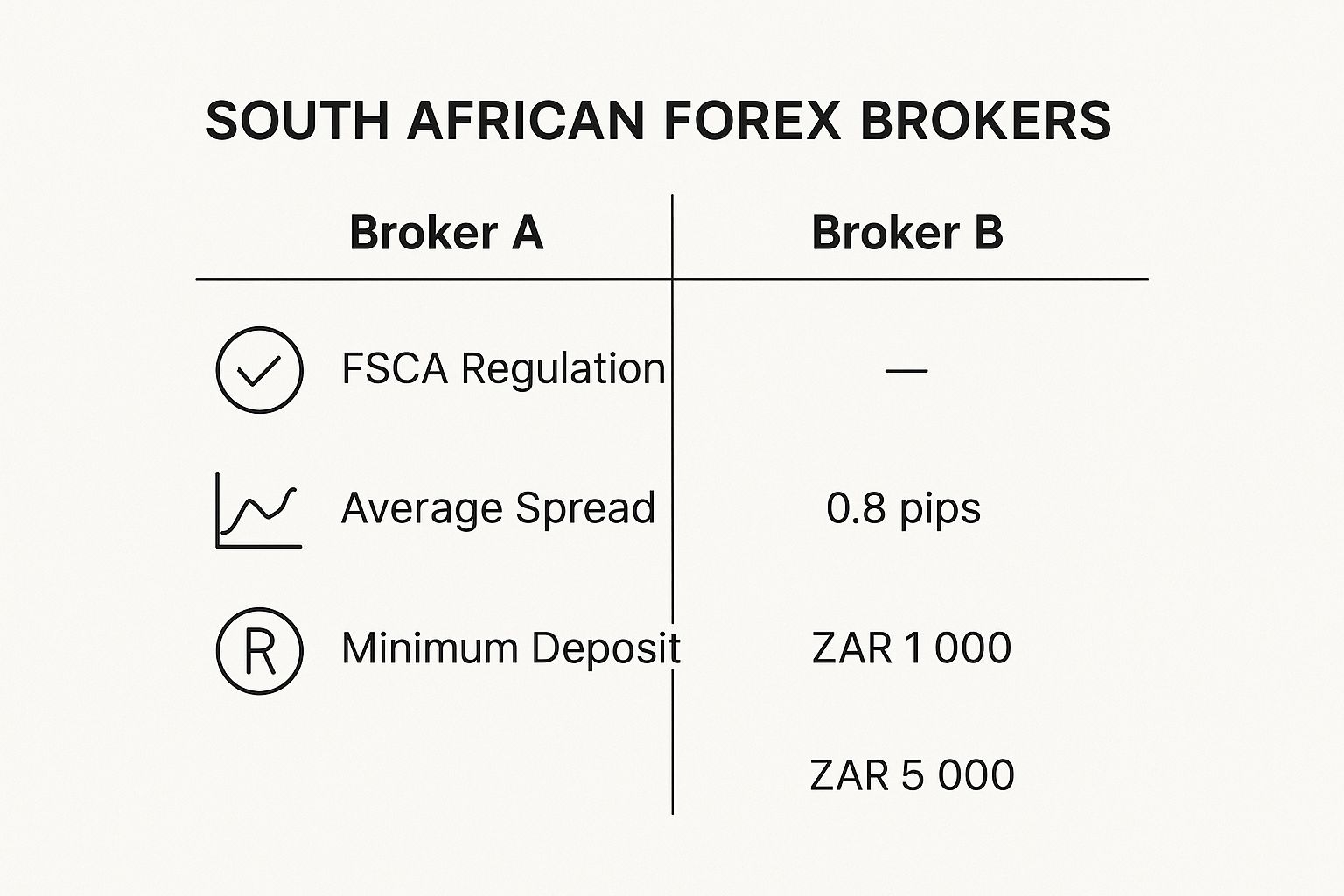

This infographic gives a clear visual of why these details matter, comparing two different brokers.

As you can see, the regulated broker not only provides security but also offers a much lower barrier to entry and cheaper ongoing trading costs. It reinforces why doing your homework upfront is so crucial.

Choosing a broker is like hiring an employee you're entrusting with your capital. Take your time, do your homework, and prioritise security and local convenience above all else. Your future trading self will thank you for the diligence you show today.

Getting Your Trading Account Opened and Funded

So, you’ve picked out an FSCA-regulated broker. Excellent choice. Now comes the real first step: actually opening and funding your account. This isn't just a bit of admin; it’s your first taste of how a legitimate, secure financial institution operates.

For anyone in South Africa, this means you'll have to go through the FICA process. Don’t let this put you off—in fact, you should see it as a green flag. Any broker that insists on FICA documents is playing by the rules and has your protection in mind.

You'll almost always be asked for clear copies of two main documents:

- Proof of Identity: Your green ID book, Smart ID card, or a valid passport will do the trick.

- Proof of Address: This needs to be something official with your name and physical address, like a recent utility bill or a bank statement. Make sure it’s not older than three months.

This is standard procedure for any regulated financial service in South Africa, so it’s a good sign when a broker asks for it.

How to Get Money Into Your Account

Once your account is verified, it’s time to put some capital in. South African traders have a few solid options, but they differ quite a bit in terms of speed and, crucially, cost.

Your best bet, in most cases, is a Local Electronic Funds Transfer (EFT). This lets you send Rands directly from your SA bank account—whether it's FNB, Standard Bank, Absa, or another—straight to the broker's local bank account. It’s generally quick (funds often clear within a business day) and comes with the lowest fees.

Credit and debit cards are another route, and their main advantage is speed. Deposits are usually instant, which is great if you spot an opportunity and want to trade right away. Just keep an eye on the fees; your bank might charge you, and so might the broker.

Then you have e-wallets like Skrill or Neteller. These are also known for being very fast. The catch? The fees can sometimes stack up when you deposit into the e-wallet and then again when you transfer to your trading account, so always check the fine print.

Here’s a pro tip that will save you a lot of hassle and money: always open a ZAR base currency account if you can. This simple decision means you won't pay currency conversion fees every time you deposit or withdraw. The Rands you send are the Rands you get.

A Quick Look at Your Funding Options

Let's break down the common methods so you can see them side-by-side.

| Funding Method | Speed | Typical Cost | Best For... |

|---|---|---|---|

| Local Bank EFT | 1-2 Business Days | Low to None | Cost-conscious traders making any size deposit. |

| Credit/Debit Card | Instant | Moderate (check fees) | Traders needing to get funds in and start trading fast. |

| E-Wallets | Instant to a few hours | Varies (can be high) | Quick transfers, but you need to watch the fee schedule. |

Thinking through how you'll fund your account from the get-go is a smart move. It helps you cut down on needless costs, leaving more of your hard-earned capital ready for what it’s actually for: trading the markets.

Building Your First Forex Trading Strategy

Alright, your account is funded and ready to go. The real work begins now. We're moving from the setup phase to the crucial question: how will you actually trade?

A "trading strategy" sounds intimidating, but it doesn't have to be some complex algorithm. At its core, it's just a simple set of rules you can stick to, no matter what. This plan is your defence against making emotional, heat-of-the-moment decisions that almost always end badly.

First, let's talk about how you get into a trade. You have two main tools at your disposal: a market order and a limit order. A market order is for when you want to get in now, buying or selling at the best available price. A limit order is more patient; you set the exact price you’re willing to trade at, and the order only fills if the market hits your level.

Your Most Important Risk Management Tool

Before you even dream about profits, you need to be obsessed with managing your risk. There is one tool that does this better than any other: the stop-loss order. This is an instruction you give your broker to automatically close your trade if the market moves against you by a pre-set amount. It's your escape hatch.

Frankly, you should never place a trade without one. A stop-loss is the safety net that ensures one bad trade doesn't blow up your entire account.

Let's say you buy USD/ZAR at 18.50. You could set your stop-loss at 18.40. If the price unexpectedly tumbles, your trade is closed, and your loss is capped. It’s a manageable, pre-defined hit—not a catastrophic one.

A good trading strategy is less about predicting the future and more about managing probabilities. The stop-loss is your non-negotiable rule for staying in the game long enough for the probabilities to work in your favour.

A powerful tool many traders use to find these entry and exit points is the Relative Strength Index (RSI). It's a technical indicator that helps you spot when a currency pair might be overbought or oversold. Getting to grips with indicators like the RSI can give you a real edge. You can learn more from this guide on how the Relative Strength Index (RSI) explained for traders works in practice.

Combining Analysis for a Clearer Picture

A solid strategy rarely relies on just one thing. The best approach is to combine two types of analysis, which gives you a much clearer view of the market.

- Fundamental Analysis: This is the big-picture stuff. For us in South Africa, it means keeping a close eye on SARB interest rate decisions, the price of commodities like gold, and any major political news that could spook the markets.

- Technical Analysis: This is where you get your hands dirty with charts. You're looking at historical price action, patterns, and trends to get a feel for where the price might go next.

The fundamental backdrop is incredibly important. For instance, South Africa's foreign exchange reserves recently climbed to a new high of $70.42 billion, with our gold reserves hitting $13.76 billion. Why does that matter? Strong reserves give the South African Reserve Bank more firepower to stabilise the Rand, which is a key piece of information for any ZAR trader.

Calculating Your Risk-to-Reward Ratio

Every single trade you consider needs to pass one final test: the risk-to-reward ratio. This is a simple calculation that compares how much you're risking (the distance to your stop-loss) with how much you're hoping to gain (the distance to your take-profit target).

Let's use our earlier example where you buy USD/ZAR at 18.50.

- Your stop-loss is placed at 18.40 (you're risking 10 cents per unit).

- Your take-profit target is set at 18.80 (you're aiming for a 30-cent gain).

In this trade, your risk-to-reward ratio is 1:3. You are risking one part to potentially gain three parts. Disciplined traders only take trades where the potential reward significantly outweighs the risk. This single habit is a cornerstone of long-term survival and profitability in the forex market.

Answering Your Final Forex Questions

As you gear up to make your first trade, it's natural for a few last-minute questions to pop up. Let's tackle some of the most common queries I hear from new traders in South Africa. Getting these sorted will help you trade with more confidence from day one.

How Much Money Do I Really Need to Start Trading?

Forget the myth that you need a massive pile of cash to get into forex. The truth is, there's no single magic number. Most FSCA-regulated brokers here in South Africa will let you open an account with a minimum deposit of around ZAR 1,000 to ZAR 1,500. Some don't even have a minimum.

But the better question isn't what you can start with, but what you should start with. Trying to trade with a tiny amount like R200 is a recipe for frustration because you can't manage your risk properly. A more sensible starting point is somewhere between ZAR 3,000 and ZAR 5,000. This gives you enough breathing room to place smaller trades while sticking to the golden rule of risking only 1-2% of your capital per trade.

Do I Have to Pay Tax on My Forex Profits in South Africa?

Yes, you absolutely do. The South African Revenue Service (SARS) views any profit from forex trading as income, and it's subject to income tax. It's your legal responsibility to declare it.

Your profits are usually taxed at your marginal income tax rate, just like your salary. This is why keeping meticulous records of all your trades—both wins and losses—is so important. You can often offset your losses against your gains, which can lower your tax bill. When in doubt, it’s always a smart move to chat with a tax professional to make sure you're fully compliant with SARS.

When Are the Best Times to Trade from South Africa?

The forex market might be open 24/5, but not all hours offer the same opportunities. The real action happens when the market is most active, liquid, and volatile. For us in the South African Standard Time (SAST) zone, the sweet spot is when the London and New York trading sessions overlap.

This prime trading window usually falls between 3:00 PM and 7:00 PM SAST. During these hours, you'll notice much bigger price swings in major pairs like EUR/USD and GBP/USD, which means more potential trading setups.

South Africa has truly stepped up as a leader in the continent's forex scene, with a buzzing community of traders to prove it. The local market pushes a daily trading volume of roughly $2.21 billion, with about 190,000 traders jumping in every day. If you're curious, you can dive into more facts about the booming African forex trading scene to see just how big it's become.

With these common questions answered, you should feel much more prepared to tackle the markets. Understanding your capital needs, tax duties, and the best times to trade puts you in a much stronger position.

For South African businesses dealing with international payments, getting a fair exchange rate is non-negotiable. Zaro cuts through the noise by offering real exchange rates with zero spread and no hidden fees, letting you sidestep the expensive markups charged by traditional banks. Take control of your global transactions and improve your cash flow. Visit Zaro to see how you can simplify your cross-border payments.