So, you’re ready to trade forex in South Africa? At its core, it’s a straightforward process: you’ll open an account with a broker regulated by the Financial Sector Conduct Authority (FSCA), fund it with Rand (ZAR), and then use their platform to buy or sell currency pairs.

But real success? That comes down to having a solid trading strategy, iron-clad risk management, and a firm grasp of the local rules.

Your Guide to Forex Trading in South Africa

Getting into the forex market for the first time can seem intimidating, but it doesn't need to be. Let's get one thing straight: there are no secret formulas or get-rich-quick schemes here. Becoming a capable trader is a marathon, not a sprint, built on a solid foundation of good education, a clear plan, and disciplined execution.

Your first move isn't memorising what a 'pip' is. It's about understanding the entire environment you're stepping into. This means getting to grips with how the market works and, crucially, recognising the importance of proper regulation.

Why South Africa Has Become a Forex Hotspot

The local scene provides a really dynamic and unique setting for forex traders. South Africa is the biggest player on the continent, with daily forex turnover topping $20 billion. This incredible volume is driven by a surge in everyday people getting involved, backed by much-improved technology.

This growth is also underpinned by robust regulatory oversight from the FSCA. They enforce strict rules to shield traders from scams and build genuine trust in the market. As you learn more about the future of forex trading in SA, you'll see how these protections create a safer space for everyone.

Laying the Groundwork: Your First Steps

Before you even think about looking at a chart or placing your first trade, it's essential to map out your path. A structured approach will help you sidestep those classic, costly beginner mistakes and prepare you for the long haul. Think of it as creating a business plan, but for your trading.

The goal isn't to avoid losses—they are an inevitable part of trading. The real key is to make sure your winning trades are bigger than your losing ones over time. This shift in mindset, from chasing quick profits to managing risk smartly, is what truly separates successful traders from the crowd.

To get started on the right foot, I always advise focusing on these three foundational pillars:

- Learn Before You Earn: Seriously commit to learning the lingo. Understand how currency pairs like the popular USD/ZAR move and what economic factors push them around.

- Choose Your Broker Wisely: Who you trade with is one of the most important decisions you'll make. Make sure any broker you consider is regulated by the FSCA. This is non-negotiable for keeping your funds safe.

- Build Your Plan: Start with a simple trading strategy and define your risk tolerance from day one. You should know exactly how much you're willing to lose on any single trade before you even think about clicking "buy" or "sell."

To help you visualise the entire process from start to finish, I've put together a quick checklist.

Quick Start Checklist for Forex Trading in South Africa

This table breaks down the essential stages every new trader in South Africa should follow. Think of it as your roadmap from novice to active participant.

| Stage | Key Action | Primary Goal |

|---|---|---|

| 1. Education | Learn forex basics, terminology, and market analysis. | Build a strong foundational knowledge to make informed decisions. |

| 2. Broker Selection | Research and choose an FSCA-regulated broker. | Ensure your funds are secure and you have reliable platform access. |

| 3. Account Setup | Complete the application, verify your identity (FICA), and open a demo account. | Practise trading with virtual money in a risk-free environment. |

| 4. Funding | Deposit ZAR into your live account using a permitted method. | Prepare your account for real trading. |

| 5. Trading | Develop a strategy, start small, and execute your first trades. | Apply your knowledge and strategy in the live market. |

| 6. Management | Stick to your risk plan, keep a trade journal, and manage your offshore allowance. | Maintain discipline, learn from mistakes, and ensure compliance. |

Following these stages in order gives you a logical progression, preventing you from jumping into the deep end without knowing how to swim. It's about building competence and confidence one step at a time.

Understanding the Rules: The FSCA and Your Taxes

Before you even think about putting a single Rand on the line, we need to talk about the rules of the game. Trading forex in South Africa is perfectly legal, but there are two major players you absolutely cannot ignore: the Financial Sector Conduct Authority (FSCA) and the South African Revenue Service (SARS). Getting this part wrong is a sure-fire recipe for disaster.

Think of the FSCA as your financial watchdog. Its main job is to protect you from scams, dodgy brokers, and bad financial advice. So, when you see a broker advertising that they are "FSCA regulated," it's a big deal. It means they've been vetted, licensed, and are held to incredibly high standards.

This isn't just some marketing gimmick; it's your most critical line of defence in the trading world.

What FSCA Regulation Really Means for You

So, what does an FSCA licence actually do for you? In short, it forces a broker to play by a strict set of rules designed to keep your money safe and ensure they treat you fairly.

Here’s what that protection looks like in the real world:

- Segregated Funds: Your trading capital must be kept in a bank account that is completely separate from the broker's own operational funds. If the brokerage firm hits financial trouble, your money can't be used to pay their bills. It's ring-fenced and protected.

- Transparent Operations: A regulated broker has to be upfront and honest about all their costs. This means no nasty surprises like hidden fees or sudden changes to their spreads and trading conditions.

- A Formal Complaint Process: If you get into a serious dispute with an FSCA-regulated broker, you aren't on your own. You have an official channel to lodge a complaint with the FSCA and have them step in to mediate.

I can't stress this enough: never, ever trade with an unregulated broker. It doesn’t matter how tempting their promised spreads or massive bonuses seem. The risk of them being a scam and disappearing with your money is just too high. Verifying a broker's licence is non-negotiable.

How to Verify a Broker's FSCA Licence

Thankfully, checking a broker's credentials is a simple but vital step that takes less than five minutes. Don't just take their word for it—verify it yourself, directly on the official FSCA website.

Head over to the FSCA’s public search portal for Financial Service Providers (FSPs). You can search using the broker's name or their FSP number, which should be clearly displayed somewhere on their website (usually in the footer).

If you search for them and they don't pop up, or if the details listed don't match what's on their site, that's a massive red flag. Close the tab and walk away.

Your Tax Obligations to SARS

Right, let's talk about the taxman. As soon as you start turning a profit, the South African Revenue Service (SARS) will want its share. Any money you make from forex trading is considered income and you absolutely must declare it.

For most active traders, these profits are taxed as regular income, not as capital gains. This means the profit you make is added to your other annual income (like your salary) and taxed at your marginal rate. Be careful here—a good year of trading could easily push you into a higher tax bracket, meaning those profits get taxed at a higher percentage.

The key to staying on the right side of SARS is meticulous record-keeping. You need a clean, detailed log of all your trades to accurately figure out your net profit or loss for the tax year.

To make tax season less of a headache, get into the habit of tracking everything:

- Every Single Trade: Note the date, currency pair, entry price, and exit price for every position you open and close.

- Profits and Losses: Keep a running tally of the profit or loss from each individual trade.

- Broker Statements: Download and securely save your monthly and annual account statements. These are your official records.

Honestly, it’s a smart move to chat with a tax professional who understands trading income. They can give you advice specific to your situation, making sure you stay fully compliant and handle your forex trading in South Africa responsibly.

How to Choose the Right Forex Broker in South Africa

Picking a forex broker is one of the most critical decisions you'll make as a trader. Think of them as your partner and your direct line to the markets. This isn't about falling for flashy ads; it's about finding a firm that genuinely fits your trading style and understands the South African landscape. The right choice sets you up for success, while the wrong one can be a constant source of frustration and hidden costs.

It’s no secret that retail forex trading is booming in South Africa. We've seen a staggering compounded annual growth rate of about 30% year-on-year since 2023, making our market a real leader on the continent. This explosive growth is largely thanks to better internet infrastructure and the rise of mobile trading, which has opened the doors for so many of us. You can get a broader perspective on this by reading about the outlook for forex trading in Africa.

With all this interest, there’s a flood of brokers trying to get your attention. Your job is to cut through that noise and find a partner you can trust.

Core Features to Scrutinise

When you start comparing brokers, it's easy to get bogged down in a long list of features. Let's sideline the marketing fluff and concentrate on what actually impacts your trading and your wallet as a South African.

Here are the non-negotiables I always look for:

- FSCA Regulation: This is your first and most important checkpoint. An FSCA licence means the broker operates under strict local rules designed to protect your money and ensure fair dealing. If a broker isn't regulated by the FSCA, just walk away.

- ZAR Accounts: Always look for brokers offering accounts in South African Rand (ZAR). This is a game-changer. It means you can deposit, trade, and withdraw in Rands, completely sidestepping the expensive and unpredictable conversion fees that eat into your profits.

- Realistic Minimum Deposits: You don't need a huge pile of cash to get started. Many excellent brokers let you open an account with as little as R200 to R1,500. This lets you get your feet wet with capital you are truly comfortable risking.

- User-Friendly Trading Platforms: Most brokers will offer access to MetaTrader 4 (MT4) or MetaTrader 5 (MT5). They’re the industry standard for good reason—they're powerful, reliable, and surprisingly easy to get the hang of, even for beginners.

Comparing Broker Features for South African Traders

To help you sift through the options, it's useful to have a clear framework for comparison. The table below breaks down the key features you should be evaluating when you look at potential brokers. It goes beyond the basics and helps you think about why each feature is important for your specific situation.

| Feature | What to Look For | Why It Matters for You |

|---|---|---|

| Regulation | A valid FSCA (Financial Sector Conduct Authority) licence number. | This is your primary layer of protection, ensuring your funds are segregated and the broker operates transparently. |

| Account Currency | The option to open an account denominated in ZAR (South African Rand). | It saves you money by eliminating currency conversion fees on every deposit, trade, and withdrawal. |

| Spreads & Commissions | Clear information on typical spreads (fixed or variable) and any commission fees. | This directly impacts your trading cost. Low spreads mean more of the market movement translates into your profit. |

| Trading Platforms | Access to reliable platforms like MT4 or MT5, plus any proprietary options. | A stable, intuitive platform is crucial for executing trades quickly and accurately without technical glitches. |

| Customer Support | Local South African phone number, live chat, and fast email responses. | When you need help with a deposit or a trade, you want fast, effective support that understands your context. |

| Deposit & Withdrawal | Convenient local methods like EFT, Ozow, or local bank transfers. | Easy, fast, and low-cost funding and withdrawal methods mean you can manage your capital efficiently. |

Looking at brokers through this lens helps you make a choice based on solid, practical criteria rather than just marketing hype. Always prioritise regulation and local features like ZAR accounts and support.

Understanding Broker Types

You'll quickly notice that not all brokers work the same way. The two main models are Market Makers and ECN brokers. Knowing the difference is crucial for finding one that aligns with your trading approach.

A Market Maker, also known as a dealing desk, essentially creates the market for you. They take the opposite side of your trade—they buy when you sell, and sell when you buy. These brokers often offer fixed spreads and commission-free trading, which can feel simpler and more predictable for newcomers.

An ECN (Electronic Communication Network) broker acts as a bridge, connecting you directly to other market participants like banks, institutions, and other traders. This direct access typically results in much tighter, variable spreads, but you'll pay a small commission on every trade you place.

My advice for most beginners in South Africa? A Market Maker is often a great place to start. The straightforward cost structure (what you see is what you get on the spread) makes it easier to calculate your potential profit and loss on a trade without worrying about commission fees. As you gain experience and trade larger volumes, the tighter spreads of an ECN model might become more attractive.

Comparing Account Types

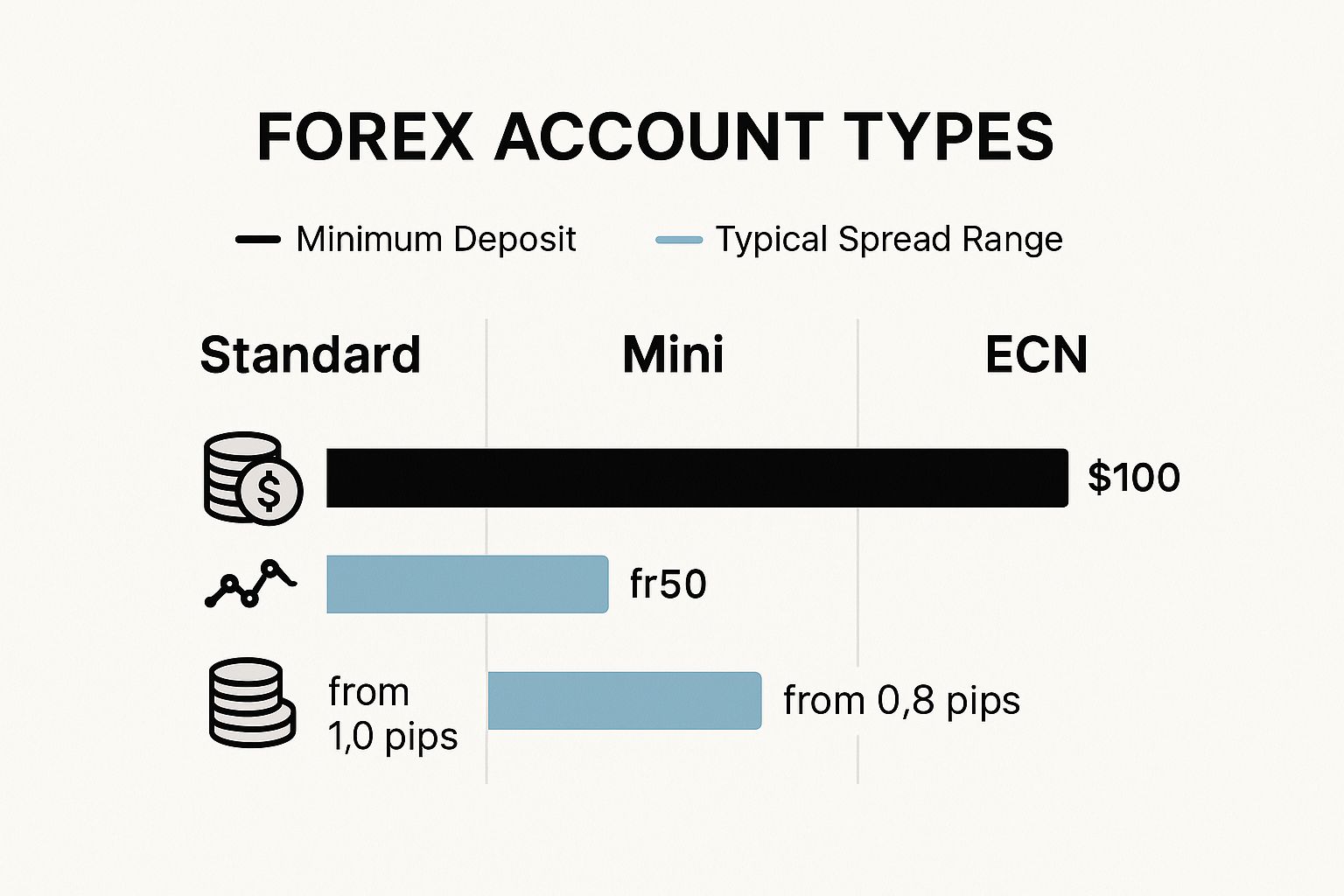

Brokers don't just have one-size-fits-all accounts; they offer different tiers to suit various needs and budgets. The image below gives a great visual breakdown of what you can typically expect.

As you can see, an ECN account might boast the tightest spreads, but it often comes with a much higher minimum deposit. For most people starting out, a Standard or Mini account provides a much more accessible entry point into the market.

Your Final, Crucial Step Before Committing

Before you deposit a single Rand, there's one last thing you absolutely must do: open a demo account.

This is your chance to test-drive the broker in a completely risk-free environment. You'll be trading with virtual money, but on the live market feed. Use this opportunity to get a real feel for the platform. See how easy it is to place and manage trades. Watch the spreads during busy market hours—are they as tight as advertised? Send a question to their customer support team and see how quickly and helpfully they respond.

Spending a week or two on a demo account is probably the smartest investment of time you can make. It will tell you more about a broker than any review ever could and give you the confidence that you've made the right choice.

Developing Your Trading Plan and Managing Risk

Jumping into the forex market without a solid plan is a bit like trying to navigate the Karoo without a map. You might get by on pure luck for a while, but sooner or later, you're going to get seriously lost. Successful, long-term trading isn’t about hitting one huge jackpot; it’s about a deliberate, repeatable strategy and, most importantly, iron-clad risk management.

Think of your trading plan as your personal business plan. It’s a set of rules you define for yourself—rules that govern every single decision, effectively taking emotion out of the driver's seat. This document is what keeps you consistent, focused, and accountable to your goals.

Finding a Trading Style That Fits You

Before you even think about a specific strategy, you need to find a trading style that clicks with your personality, your daily schedule, and what you hope to achieve. There’s no "best" style—the right one is simply the one you can stick to, day in and day out.

- Day Trading: Day traders live in the moment. They open and close all their positions within a single trading day, making sure they’re flat by the time the market closes. This style demands your full attention for hours at a time, making quick decisions based on small price movements. It's intense, but it completely sidesteps overnight risks.

- Swing Trading: Swing traders look to capture the "swings" in the market that unfold over several days or even a couple of weeks. This approach is far less time-intensive, making it a popular choice for those with a full-time job. You’ll be relying more on daily charts and fundamental news to spot emerging trends.

- Position Trading: This is the long game. Position traders hold trades for weeks, months, or sometimes even years. Their focus is on major macroeconomic trends, and they couldn't care less about the minor, day-to-day market noise. This requires incredible patience and a deep grasp of fundamental economic drivers.

Honestly, this choice is crucial. A day trading strategy is useless if you can only check your charts on your lunch break. Be realistic about your time and temperament.

The Cornerstone of Survival: Risk Management

If you remember only one thing from this guide, let it be this: excellent risk management is what separates traders who survive from those who blow up their accounts. It’s your ultimate defence against the market's wild and unpredictable nature.

The goal of a trader isn't to be right on every trade. The goal is to make more money when you're right than you lose when you're wrong. This simple truth is the foundation of every successful risk management framework.

The first rule every new trader should learn is the 1% Rule. The principle is brilliantly simple: you should never risk more than 1% of your total trading capital on any single trade. If you’re working with a R20,000 account, your maximum acceptable loss on one position is R200. No exceptions. This rule ensures that a string of bad trades won't knock you out of the game, giving you enough capital to survive and wait for your winning setups.

Putting Risk Management into Practice

Knowing the theory is one thing, but applying it consistently is what truly matters. Two tools will become your closest allies: the stop-loss order and proper position sizing.

A stop-loss is an order you set with your broker to automatically exit a losing trade once it hits a specific price. It’s your non-negotiable exit plan and your most important safety net. Frankly, you should never enter a trade without one.

Position sizing is how you figure out how much currency to trade to stay within that 1% risk limit. It’s not about how many lots you feel like trading; it’s a cold, hard calculation.

Let's walk through a real-world example with the USD/ZAR pair to see how this works.

- Account Capital: R30,000

- Risk per Trade (1%): R300

- Entry Price (Buy USD/ZAR): 18.5000

- Stop-Loss Price: 18.4000 (1000 points, or 100 pips, below entry)

- Pip Value: On a standard lot of USD/ZAR, each pip is worth about R100.

Now, if you just went ahead and bought a standard lot, a move to your stop-loss would cost you R1,000 (100 pips x R100/pip). That's way over your R300 risk limit! This is where position sizing saves you. To stick to your plan, you'd need to trade a much smaller size (like a mini or micro lot) so that a 100-pip loss equals exactly R300. Your trading platform can help you calculate this precisely before you place the trade.

Understanding ZAR Volatility

Trading ZAR pairs like USD/ZAR or GBP/ZAR means you have to respect their volatility. The Rand is famously sensitive to both local political news and global market sentiment. While this creates fantastic trading opportunities, it also ramps up the risk.

For example, South Africa's foreign exchange reserves hit a healthy $68.116 billion in May 2025, which helps cushion the currency. Despite this, the ZAR can still swing wildly on the back of global events like commodity price shifts or geopolitical tensions. You can learn more about how these factors create forex opportunities in South Africa on CTFX.

This volatility often means you need to use wider stop-losses for ZAR pairs, just to avoid getting stopped out by normal market chatter. As a result, you must adjust your position size down to make sure that wider stop still honours your 1% risk rule. A strong risk framework isn't just a good idea—it's your essential shield when trading the Rand.

A Practical Walkthrough of Your First Live Trade

Alright, this is where the theory meets reality. You've done the hard work: you’ve picked a solid, FSCA-regulated broker, you've put in the hours on a demo account, and you have a trading plan you trust. Now it’s time to put some real skin in the game.

Let’s be clear: trading with real money feels completely different. Every pip movement seems amplified. The goal here isn't to get overwhelmed, but to break it down into a calm, methodical process. We'll walk through it step-by-step so that big, intimidating leap becomes a series of small, confident actions.

Getting Your ZAR Account Funded

First things first, you need trading capital. The best brokers operating in South Africa make this part incredibly easy by offering local funding methods. This is a game-changer because it means you can sidestep the hassle of international wire transfers and, more importantly, dodge those painful currency conversion fees.

You’ll typically find these ZA-friendly options:

- Electronic Funds Transfer (EFT): This is my go-to. You simply transfer funds directly from your South African bank account (like FNB, Absa, or Standard Bank) into the broker's local one. It’s clean and simple.

- Ozow or PayFast: These are excellent local payment gateways. They allow for secure, instant payments right from your banking app. They’re fast, reliable, and built for the South African market.

- Credit/Debit Cards: While an option, be aware that some banks can be a bit sensitive and might block transactions to forex brokers. Fees can sometimes be higher here, too.

Personally, I almost always stick with a direct EFT or Ozow. It’s usually the cheapest and most straightforward way to get your Rands into your trading account without any fuss. The funds typically reflect within one business day.

Analysing the Chart for an Entry

With your account funded, it's time to hunt for an opportunity. Let's use a local favourite, the USD/ZAR pair, as our example. Your trading plan—the one we’ve talked about building—is your map. It tells you precisely what to look for, whether that's a specific chart pattern, a signal from an indicator like the RSI, or a reaction to a major news announcement.

You open the chart and see the price is quoted as 18.5520 / 18.5580.

What does this mean? You’re seeing two prices:

- The Bid Price (18.5520): This is the price where you can sell USD.

- The Ask Price (18.5580): This is the price where you can buy USD.

That tiny gap between them is the broker's spread – essentially their fee for the service. For a 'buy' trade to become profitable, the market's bid price needs to climb higher than your entry price of 18.5580.

Placing the Trade: Market vs. Pending Orders

Based on your analysis, you’ve decided the US Dollar looks set to strengthen against the Rand. You’re ready to buy. You have two main ways to get into the market.

Market Order

This is the most direct approach. You’re telling your broker: "Get me in, right now, at the best price available." It’s for when your setup is present and you want immediate execution. Simple and instant.

Pending Order

This is more strategic. You're giving your broker an instruction to open a trade for you only if the price hits a specific level you’ve chosen. For instance, you could place a 'Buy Limit' order down at 18.5000, hoping for a small dip to get in at a better price before the expected rise.

For your very first trade, a market order is often the simplest and least stressful choice. You've identified your setup, you're ready to go. You’ll just need to specify your position size (which you've calculated based on your 1% risk rule!), set your protective stop-loss, and hit that "Buy" button.

And just like that, you're in a live trade.

The moments after you click "buy" or "sell" are often the most intense. Suddenly, every small tick of the market feels magnified. This is normal. Your job now is to trust your plan, not your emotions. Avoid the rookie mistake of constantly watching the trade; it will only lead to stress and poor decisions.

Managing the Live Trade—and Your Mind

Once your trade is open, the real work begins. The technical part is done; now the mental game starts. You'll feel a powerful urge to meddle—to snatch a tiny profit too early or, even worse, to move your stop-loss further away because you're afraid of taking a loss.

Resist that urge.

Your trading plan is your anchor in this emotional storm. It must have pre-defined rules for where you'll take profit and where your stop-loss is placed to protect your capital. Do not deviate from these rules mid-trade. The analysis you did before entering the trade was done with a calm, objective mind. Any decisions you make now, in the heat of the moment, will almost certainly be driven by fear or greed.

Check on the trade, but don't obsess. Trust that your stop-loss is there to do its job. Whether this very first trade ends as a small win or a small, managed loss is completely irrelevant. The true victory is executing your plan perfectly from start to finish. That discipline is what will build a long-term, successful trading career.

Common Questions About Forex Trading in South Africa

Diving into the forex market for the first time? It's completely normal to have a ton of questions. As you figure out how to trade forex in South Africa, you'll likely wonder about everything from how much money you need to whether you're even allowed to do this. Let's tackle some of the most common queries we hear from new traders.

Is Forex Trading Legal in South Africa?

Yes, it absolutely is. Trading forex is perfectly legal in South Africa, but it's important to understand that it’s a regulated industry. The Financial Sector Conduct Authority (FSCA) is the watchdog that keeps an eye on the market to make sure things are fair and that you, the trader, are protected.

What this means in practice is that you have to trade through a broker that holds a proper FSCA licence. It’s non-negotiable. On top of that, remember that any profits you make are taxable, so you'll need to declare them to the South African Revenue Service (SARS). You also have to play by the exchange control rules set out by the South African Reserve Bank (SARB).

How Much Money Do I Need to Start?

This is probably the number one question we get, and the answer might surprise you. Many solid, regulated brokers will let you open an account with as little as R200 to R1,500.

But here’s the real talk: the most important question isn't the minimum deposit. It's "how much can I truly afford to lose?" You should never, ever fund a trading account with money you need for rent, groceries, or any other essential living costs. Start small, get your process down, and only think about adding more capital once you’ve found some consistency.

Kicking things off with a modest amount, say R2,000, is a great way to experience the real emotions and mechanics of live trading without putting yourself in a stressful financial position.

Can I Trade Forex on My Phone?

You certainly can. The explosion in mobile trading is one of the main reasons the market has grown so much in South Africa. The industry-standard platforms, MetaTrader 4 and MetaTrader 5, have incredibly powerful mobile apps for both Android and iOS.

These aren't watered-down versions, either. From your phone, you can:

- Analyse charts using a full set of technical indicators.

- Place, manage, and close your trades no matter where you are.

- Keep a close eye on your account balance and performance in real-time.

- Set up price alerts and get notifications about market-moving news.

This kind of accessibility means that even if you have a packed schedule, you can still participate in the markets without being chained to your desk.

What Is the Best Currency Pair to Trade?

If you're just starting out in South Africa, the smart move is to stick with the major currency pairs. These are the most heavily traded pairs in the world, usually involving the US Dollar, which means they have tons of liquidity and the tightest spreads. This makes them more predictable and cheaper to trade.

Think along the lines of:

- EUR/USD (Euro / US Dollar)

- GBP/USD (British Pound / US Dollar)

- USD/JPY (US Dollar / Japanese Yen)

It can be tempting to jump straight into trading our local currency with a pair like USD/ZAR. While the volatility can be exciting, that same volatility makes it much riskier for a newcomer. The Rand is notorious for its sharp, sudden moves, which can wipe out an account in minutes if you're not careful. Get comfortable with the majors first before you try to tame the ZAR.

How Do I Withdraw My Profits?

Getting your hands on your earnings is a secure and simple affair, provided you've chosen an FSCA-regulated broker. If you've been wise and picked one that offers ZAR accounts and local banking, the process is even smoother.

Typically, you’ll just log into your broker's client portal, find the "Withdrawals" section, and choose your method. For most South Africans, this will be a direct bank transfer (EFT) to your local bank account. The broker then processes the request, and you can expect the funds to land in your account within one to three business days. It’s always a good idea to double-check your specific broker’s withdrawal policy and processing times.

Are you a South African business tired of unpredictable FX rates and hidden fees on international payments? Zaro offers the solution. We provide access to real exchange rates with zero spread, eliminating the markups that erode your profits. With ZAR and USD accounts, seamless local funding, and enterprise-grade security, you gain complete control over your global transactions. See how much you can save with Zaro today.