For any South African SME working with overseas partners, sending or receiving money internationally is just part of the daily grind. But let's be honest, it's often a major headache, riddled with frustrating delays and costs that seem to appear out of nowhere.

It feels a bit like sending a critical package overseas. You pay for a service expecting it to arrive on time for a set price, but instead, you're hit with surprise fees, confusing detours, and frustrating delays.

Demystifying Your Global Payments

This guide is designed to pull back the curtain on that entire process. We'll give you a clear map of what’s really happening behind the scenes when you pay a foreign supplier or get paid by an international client. We're going to tackle the biggest pain points head-on—like those unpredictable costs and slow settlement times—and show you how smarter, more affordable solutions can put you back in the driver's seat of your global cash flow.

For South African SMEs, mastering the import-export business isn't just about finding customers or suppliers. True success hinges on making sure the money moves smoothly, reliably, and affordably between you and your partners around the world.

The Real Cost of Sending Money Abroad

When you make an international payment, you're doing more than just moving funds from A to B. You're navigating a complex financial network, much of which is built on old, clunky infrastructure. This system creates several friction points that can quietly eat into your profits and even strain your business relationships.

Here are the biggest culprits:

- Hidden Exchange Rate Markups: This is the classic trap. Banks often advertise low, flat transfer fees, but they make their real money on the exchange rate they offer you. That gap between the real mid-market rate and their rate is a hidden cost that can add up to a significant amount, especially on larger payments.

- Surprise Intermediary Bank Fees: Traditional bank transfers, particularly those using the SWIFT network, can be a bit like a relay race where every runner takes a cut. Your payment might pass through several "intermediary" banks before it reaches its destination, and each one might slice off a fee. This means the amount your supplier receives is often less than what you actually sent.

- Painfully Slow Settlement Times: Waiting days for a payment to land is more than just an inconvenience. It can disrupt your supply chain, put projects on hold, and erode the trust you've built with your international partners. These delays are unfortunately common in older systems where money has to jump through multiple institutional hoops.

An international account transfer isn't just another transaction; it's a vital part of your global business engine. Getting this process right directly impacts your bottom line, your operational efficiency, and your ability to compete on the world stage.

Once you get a handle on these core problems, you can start looking for solutions that offer genuine transparency and speed. The goal is to switch from a system that works against you to one that actually fuels your international growth. This guide will give you the practical insights you need to make that shift happen.

Understanding How Your Money Crosses Borders

Sending money from your South African business account to an overseas supplier can feel like a total black box. You hit 'send', and a few days later, it arrives... but sometimes with a chunk missing. To figure out what's really going on, we need to lift the bonnet and look at the different "highways" your money travels on.

The Old Way vs. The New Way

Think of the traditional banking system as a network of slow, winding country roads. When you make a payment, it doesn’t go straight from your bank to your supplier's. Instead, it makes several stops at 'intermediary' banks along the way. Each stop adds time and, you guessed it, a handling fee. This is the old world of SWIFT transfers.

To get a real handle on how funds move globally, it helps to understand the role of SWIFT in international transfers, the messaging system that underpins most of this communication. In stark contrast, modern payment platforms have built a direct expressway, using smarter, digital networks to bypass all those costly detours. The result? Your money arrives faster and in full.

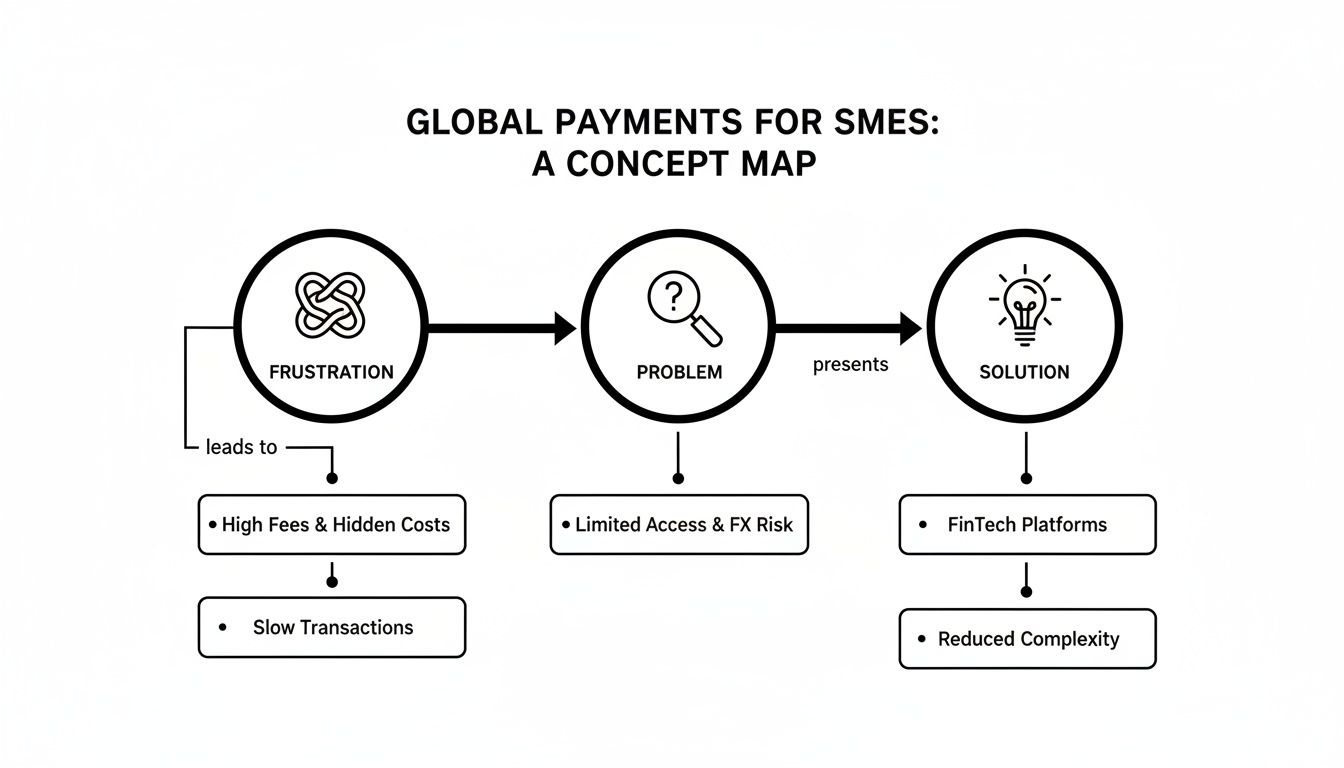

This whole journey, from the initial frustration with opaque systems to finding a clear, direct solution, is something most SMEs can relate to.

The map shows how pinpointing the core problems—like hidden fees and maddening delays—is the first step to finding a solution that actually works for your business.

Decoding the Two Main Costs

Putting the route aside, there are two specific costs that consistently chip away at your profits during an international transfer. Knowing exactly what they are is the first step to dodging them.

Transfer Fees: These are the obvious charges. Your bank might quote you a flat fee, maybe R250 or R500, to kick off the payment. It seems simple enough, but this is usually just the tip of the iceberg. It rarely covers the "handling fees" charged by all those intermediary banks along the way.

Foreign Exchange (FX) Markups: This is the silent killer—the hidden cost where businesses lose the most. It's the gap between the 'real' exchange rate you see on Google (the mid-market rate) and the less-than-great rate your bank actually gives you.

A bank's exchange rate is never the true market rate. It includes a built-in profit margin, or 'spread,' that can silently cost your business thousands on large or frequent transactions. This markup is just a fee in disguise.

For South African SMEs, these costs aren't just an annoyance; they're a genuine drag on growth. In a country where exporting is the lifeblood for so many small businesses, these cross-border payments are essential. Yet, even in a crucial trade corridor like South Africa-Zimbabwe, average transfer costs can climb as high as 12.7% of the transaction value. It’s a problem that stems from old-school operational hurdles and a simple lack of competition.

The Final Checkpoint: Compliance and KYB

Before your money even starts its journey, it has to get through a critical security checkpoint. Welcome to the world of compliance, often called Know Your Business (KYB) or Know Your Customer (KYC).

Think of it as passport control for your money. Financial institutions are legally obligated to verify who is sending the money, who is receiving it, and that the transaction is legitimate. This isn't optional—it's what keeps the global financial system secure.

But the way this is handled can be night and day. With a traditional bank, you might be looking at a slow, paper-heavy process that adds days just to get your business onboarded. Modern platforms, on the other hand, use technology to make this verification fast and smooth, turning a potential bottleneck into a quick, secure step that gets you ready to transact globally without the wait.

Choosing the Right International Payment Method

Picking the right partner for an international account transfer is one of the most critical financial decisions any South African SME will make. Get it right, and you protect your profit margins. Get it wrong, and you’ll watch hidden fees silently eat away at them.

The choice really comes down to two main camps: the old guard of traditional banks versus the new, more agile fintech platforms. Each takes a completely different path to get your money across borders, and understanding those differences is the key to finding a partner that fits your business’s need for speed, clarity, and cost-effectiveness.

The Traditional Bank Route

For decades, if you wanted to send money abroad, your bank was the only game in town. They rely on the long-established SWIFT network, a system that’s undeniably reliable but was built for a very different era of global business.

When you send money this way, it's not a direct flight. It’s more like a connecting flight with multiple layovers, often passing through several intermediary banks before it finally lands. This multi-step journey is precisely why transfers can take a sluggish 3-5 business days to settle. Worse still, each bank in that chain can take a little slice for themselves, leading to that frustrating moment when your recipient gets less than what you actually sent.

The biggest sting, however, is the lack of transparency in their pricing. Banks typically bake their profit into the foreign exchange (FX) rate they offer you, which is often far from the real mid-market rate. This hidden markup, or "spread," is where they make their money, and it can cost your business a small fortune on every single international account transfer.

The convenience of using your existing business bank is often overshadowed by opaque pricing and slow processes. What seems like the simplest choice can quickly become the most expensive one.

This old model is feeling the pressure, especially in a market that demands efficiency. South Africa's role as a cross-border payments powerhouse in sub-Saharan Africa is clear, commanding a massive 78.16% share of total transaction value on certain platforms. This growth, underscored by a huge 125% year-on-year surge in pay-in transactions, highlights an urgent need for smarter, faster payment solutions. You can explore more data on South Africa's role in global payments to grasp the scale of this shift.

The Modern Fintech Alternative

Fintech platforms like Zaro were built from the ground up to solve the very problems the traditional banking system created. Instead of piggybacking on the slow and expensive SWIFT network, they use their own digital payment rails and local banking partnerships to move money much more directly.

For your business, this approach unlocks some massive advantages:

- Speed: Transfers are significantly faster. We’re talking same-day or next-day arrivals, which is a game-changer for keeping supplier relationships strong and managing cash flow.

- Transparency: You get the real mid-market exchange rate, with no hidden markups. Fees are laid out clearly upfront, so you know the exact cost before you even press "send."

- Cost Savings: By cutting out the intermediary banks and their fees, not to mention the FX spreads, the total cost of each international account transfer drops dramatically.

These platforms are also built with real people in mind, offering intuitive online dashboards, simple beneficiary management, and solid security features like multi-user controls for your finance team.

International Account Transfer Methods: A Head-to-Head Comparison

To really see the difference, it helps to put the two methods side-by-side. The table below breaks down the factors that have the biggest impact on your bottom line and your team's efficiency.

| Feature | Traditional Banks (via SWIFT) | Modern Fintech (e.g., Zaro) |

|---|---|---|

| Transfer Speed | Slow, typically 3-5 business days. Delays are common due to the intermediary bank "chain". | Fast, often same-day or next-day settlement. |

| Total Cost | High, made up of a fixed fee plus a hidden 2-5% FX markup and potential intermediary fees. | Low, with transparent fees and zero FX markup. You get the real mid-market rate. |

| Transparency | Low. The true cost is buried in a poor exchange rate, making it incredibly difficult to calculate. | High. All costs are shown upfront, so you know exactly how much your recipient will get. |

| Security | High, with established regulatory compliance and security protocols. | Enterprise-grade, featuring bank-level encryption, multi-user controls, and full regulatory oversight. |

| User Experience | Often requires branch visits or navigating clunky, outdated online portals. The process can be slow. | Simple, fast, and entirely online. Designed for self-service with a user-friendly interface. |

At the end of the day, the right partner doesn't just offer a service—they give you a competitive advantage. For South African SMEs competing on a global stage, every rand saved on transaction costs is another rand you can reinvest into growing your business. Choosing a modern fintech solution is choosing a system built for the speed of business today.

Your Playbook for Making Global Payments

Knowing the theory is one thing, but putting it into practice is where the real value lies. Let's move beyond the concepts and get into the nuts and bolts of how your business can manage global payments efficiently. Think of this as your step-by-step guide to a simpler workflow, powered by a modern platform.

This playbook covers the entire process in four key stages: getting money into your account, paying your beneficiaries, tidying up the books, and managing your team. Follow these steps, and you’ll build a global payment system that’s streamlined, secure, and genuinely cost-effective.

Step 1: Funding Your Accounts Locally

Before you can pay anyone, you need to get your money into the system. With older banking methods, this could be a painfully slow and expensive process. Modern fintech solutions, however, have completely changed the game by using local payment rails.

To get started, you simply make a standard local bank transfer from your South African business account to your multi-currency account. That’s it. You sidestep the high costs and lengthy delays of SWIFT right from the beginning. The funds usually land in your account quickly, ready for you to send anywhere in the world.

Step 2: Paying Your International Beneficiaries

Once your account is funded, making an international account transfer becomes incredibly straightforward. The whole process is designed to be quick and intuitive, which means your finance team can stop wrestling with clunky bank portals.

Here’s a typical rundown of how it works:

- Set Up a New Beneficiary: The first time you pay a supplier or contractor, you’ll enter their details—name, address, and banking info like an IBAN or SWIFT/BIC code. This is a one-time setup; their details are saved securely for all future payments.

- Enter Payment Details: Simply choose the beneficiary, type in the amount, and select the currency. Crucially, the platform will show you the real mid-market exchange rate and any small fees upfront. No hidden costs, no nasty surprises.

- Confirm and Send: Give it a final check, click send, and you're done. The money is on its way, often arriving at your beneficiary’s bank account on the same day or the next.

What was once a cumbersome, multi-step chore is now a routine task that takes just a few minutes.

Step 3: Simplifying Your Reconciliation

Let's be honest, one of the biggest headaches in managing global payments is reconciliation. Manually matching payments to invoices and bank statements is tedious and ripe for human error. This is where a modern platform really shines by giving you a clear, real-time audit trail.

Every transaction is logged on your dashboard. You can see precisely when it was sent, the exact exchange rate you got, and confirmation of when it was delivered. This detailed history makes month-end bookkeeping a breeze, freeing up your finance team to focus on more strategic work.

A clear and accessible transaction history isn't just a nice-to-have; it's a powerful tool for financial control. It gives you complete visibility over your global cash flow and simplifies your entire accounting process.

Step 4: Implementing Team Controls and Permissions

As your business grows, security and oversight become paramount. You can’t afford to have a free-for-all with your company’s funds. You need to control who can do what.

Enterprise-grade payment platforms are built with this in mind, offering robust multi-user controls. This functionality allows you to:

- Assign different roles: You can set up team members who can only prepare payments and separate managers who have the authority to approve them.

- Set payment limits: Customise spending limits for different people on your team to keep a tight grip on your budget.

- Maintain a clear audit log: Every action taken by every user is tracked, adding a critical layer of security and accountability.

By putting these controls in place, you create a secure payment environment that protects your business while enabling your team to work efficiently. This playbook transforms the often-dreaded international account transfer into a manageable, transparent, and secure part of your daily operations.

See How Much Your Business Can Really Save

It's easy to glaze over terms like 'foreign exchange markups' and 'intermediary fees'. They sound abstract, like someone else's problem. But the reality is, they have a direct and often painful impact on your bottom line. The way you handle an international account transfer isn't just an admin task; it's a strategic decision that can either leak profit or protect it.

So, let's move away from the theory and look at some real-world numbers that any South African SME will recognise. When we break it down, you can see just how much money is left on the table by sticking with old-school banking.

Example One: Receiving Export Revenue

Picture this: your business exports beautiful, locally made goods. You've just landed a big order and received a payment of $50,000 from a customer in the United States. Now, you need to get that money into your Rand account to pay salaries, cover costs, and actually see your profit.

Here’s how that simple conversion can play out very differently:

- Mid-Market Exchange Rate: Let's say the true, live rate is $1 = R18.50. This is the real value.

- Traditional Bank Rate: The bank offers you R18.13. That difference isn't a discount; it's their hidden markup, in this case, a hefty 2%.

- Modern Fintech Rate: A platform like Zaro gives you the mid-market rate of R18.50, no smoke and mirrors.

Let's do the maths and see what lands in your ZAR account.

Bank Conversion: $50,000 x 18.13 = R906,500

Fintech Conversion: $50,000 x 18.50 = R925,000

That's an extra R18,500 in your pocket. It’s not a saving; it's your hard-earned revenue that would have simply vanished into the bank’s profit margin. Imagine making a few of these transactions a year—that difference could easily pay for a new employee or a much-needed equipment upgrade.

Example Two: Paying International Contractors

Let's say you run a Business Process Outsourcing (BPO) company. Your success depends on a great team of remote contractors, including a skilled developer in Kenya who you pay $3,000 every month. For you, paying them on time and in full isn't just about logistics; it's about trust.

Here’s what it costs to send that payment:

- Payment Amount: $3,000

- Bank Costs: Your bank might hit you with a R500 transfer fee plus a 2.5% FX markup. On top of that, you could get stung by intermediary bank fees of around $20.

- Fintech Costs: The platform charges one small, transparent fee—say, 0.5%—with no FX markup and zero intermediary fees.

The breakdown for a single payment is eye-opening:

| Cost Component | Traditional Bank | Modern Fintech (e.g., Zaro) |

|---|---|---|

| Transfer Fee | R500 | R0 (fee is percentage-based) |

| FX Markup (at R18.50/$1) | R1,387.50 | R0 |

| Intermediary Bank Fee | R370 (approx. $20) | R0 |

| Fintech Percentage Fee | N/A | R277.50 ($15) |

| Total Monthly Cost | R2,257.50 | R277.50 |

That’s a yearly saving of over R23,700 on just one contractor. More importantly, this approach ensures your team member gets their full salary without any surprise deductions, which is invaluable for building loyalty.

Example Three: Settling a Supplier Invoice

Finally, what if you run an import business and need to pay a supplier in Europe an invoice for €20,000? Here, speed and reliability are everything. A late or incorrect payment can halt your supply chain and seriously damage a crucial business relationship.

The problem isn't just cost, but also time and uncertainty.

- Traditional Bank Transfer: Using the SWIFT network, this payment could take 3-5 business days to land. The fees are often opaque, meaning your supplier might receive less than the full €20,000. That creates an accounting mess and instant friction.

- Modern Fintech Transfer: The international account transfer is often done within a day. Because the pricing is completely transparent, you know your supplier gets the exact invoice amount, every single time.

When your supplier is paid in full and on time, you become a preferred partner. That kind of operational excellence is a genuine competitive advantage that goes way beyond just saving a few Rand.

These scenarios all tell the same story. The right payment platform isn't just a tool for sending money. It's a core part of your financial strategy that boosts profits, strengthens relationships, and makes your entire operation run more smoothly.

Your Checklist for Choosing a Payment Partner

Picking the right partner for your international account transfers is a massive decision for your business. To get past the sales pitches and find a solution that genuinely helps, you need to be asking the sharpest questions. Think of this checklist as your guide to vetting any potential provider.

Use these straightforward, no-fluff questions to make sure you’re choosing a partner that values honesty, security, and your company’s financial health. With these answers in hand, you’ll be ready to pick a platform that actually fuels your global ambitions.

Questions About Cost and Transparency

The real price tag on an international transfer is often buried in the fine print. Your first job is to dig up every single potential fee so you know exactly how much money is going to land in the destination account.

- Do you offer the real, mid-market exchange rate? Don't settle for anything less than the rate you see on Google or Reuters, with zero markup. This is where you'll find your biggest savings.

- Can you give me a complete breakdown of all fees? Ask for an itemised list: transfer fees, percentage-based fees, monthly account charges. You shouldn't have to deal with any surprises later on.

- Are there any hidden intermediary or receiving bank fees? A truly modern partner will use payment rails that bypass these outdated costs completely.

The aim here is total cost certainty. Before you even think about hitting 'send', you should know the exact amount your recipient will get, down to the last cent.

Questions About Speed and Operations

How efficiently your money moves is just as important as how much it costs. A slow, clunky process can hold up projects and strain relationships with your suppliers. Your partner's operational smoothness has a direct impact on your own.

- How quick is your onboarding and verification process? A good provider should have your business verified and ready to go within a day or two, not drag it out for weeks.

- What's the typical settlement time for payments to our key markets? Look for platforms that can deliver funds on the same day or the next day to your main business destinations.

- What kind of team-based controls do you offer? As your team grows, you'll need things like multi-user access, custom permissions, and approval workflows to keep everything secure and under control.

Choosing a partner for your international account transfer isn't just about finding the cheapest rate; it's about finding the smartest, most reliable way to manage your global payments.

Frequently Asked Questions

When you start digging into global payments, a few key questions almost always pop up. For South African business owners, getting straight answers to these is the first real step toward building a smarter, more affordable payment system. Let's tackle the questions we hear most often.

How Long Does an International Account Transfer Actually Take?

This is a massive point of frustration, and for good reason. The honest answer? It all depends on the "payment rails" your money is travelling on.

Think of a traditional international account transfer using the SWIFT network like a long-haul flight with a few layovers. Your payment gets passed from one intermediary bank to the next, and each stop adds time and complexity. This is why you’re often left waiting 3 to 5 business days for the funds to finally land.

Modern payment platforms work more like a direct, non-stop flight. They use their own digital networks and local bank accounts in different countries to skip all the middlemen. The result? A much quicker journey, with your money often arriving the same or next business day.

What’s the Real Difference Between a Bank’s FX Rate and the ‘Real’ One?

Getting your head around this is absolutely crucial for protecting your bottom line. The "real" exchange rate has a name: the mid-market rate. It's the midpoint between what buyers and sellers are trading a currency for on the global market—it's the rate you see on Google or Reuters. You can think of it as the truest, most honest value of a currency at any given moment.

Banks almost never give you this rate. Instead, they build a markup or "spread" on top of it.

That spread is just a hidden fee, plain and simple. A bank might quote you an exchange rate that's 2-4% worse than the mid-market rate. On a R500,000 transfer, that seemingly small difference could cost you anywhere from R10,000 to R20,000 in a fee you didn't even know you were paying.

A good payment partner, on the other hand, will be transparent. They’ll give you the real mid-market rate and charge a small, clearly stated fee for the service. No smoke and mirrors.

Are These Fintech Platforms Genuinely Safe for Large Business Transfers?

It’s a fair question, and the answer is a resounding yes. Modern, enterprise-grade payment platforms are not just slick consumer apps; they're powerful financial tools built from the ground up with serious security.

Here are the non-negotiable security layers to look for:

- Regulatory Licensing: Any platform worth its salt is regulated by official financial authorities, just like a bank is.

- Bank-Grade Encryption: Your transaction data should be protected with the highest level of encryption available.

- Proper Team Controls: You need the ability to set up multi-user permissions. This lets you decide who on your team can create, approve, and just view payments, giving you an essential layer of internal control.

With these measures in place, sending a large international account transfer through a reputable fintech provider is just as secure as using a bank—and a whole lot more efficient.

Ready to stop overpaying for slow, complicated international payments? Zaro offers South African businesses access to real exchange rates, transparent fees, and lightning-fast transfers.