An international fund transfer is simply the process of sending money from a bank account in one country to an account in another. It's the engine that powers global trade, allowing both businesses and individuals to move money across borders safely and securely.

How International Fund Transfers Really Work

At first glance, sending money across borders can seem complicated, but it’s actually a pretty logical system. Think of it like a carefully managed relay race, where your money is the baton. The whole point is to get that baton from your bank to the recipient's bank—often thousands of kilometres away—without a single hiccup.

This race has a few key runners. It kicks off with your bank (the sender) and finishes with the recipient's bank. But in between, you often have one or more correspondent banks. These are intermediary institutions that have established relationships with both your bank and the recipient's. This whole network is linked together by a secure messaging system, most famously the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network.

The Journey of Your Funds

It’s a common misconception that the SWIFT network actually moves money. It doesn't. Instead, it sends secure payment orders between banks. When you kick off an international fund transfer, your bank pings a SWIFT message to the next bank in the chain, telling it exactly where to send the funds. This is precisely why getting the details right is absolutely critical.

- Recipient's Full Name and Address: This makes sure the money lands with the right person or company.

- Bank Account Number/IBAN: This is the specific account number for the recipient. Many countries use an International Bank Account Number (IBAN) to make this process smoother.

- SWIFT/BIC Code: Think of this as the bank's unique international post code. The Bank Identifier Code (BIC) ensures the payment instructions go to the correct financial institution.

Just one tiny mistake in any of these details can cause frustrating delays or even result in the transfer being bounced back.

The entire system is built on a chain of trust and communication between banks. Each step is a checkpoint to verify the transaction, making sure the "baton" is passed correctly and that everything complies with international anti-money laundering (AML) regulations.

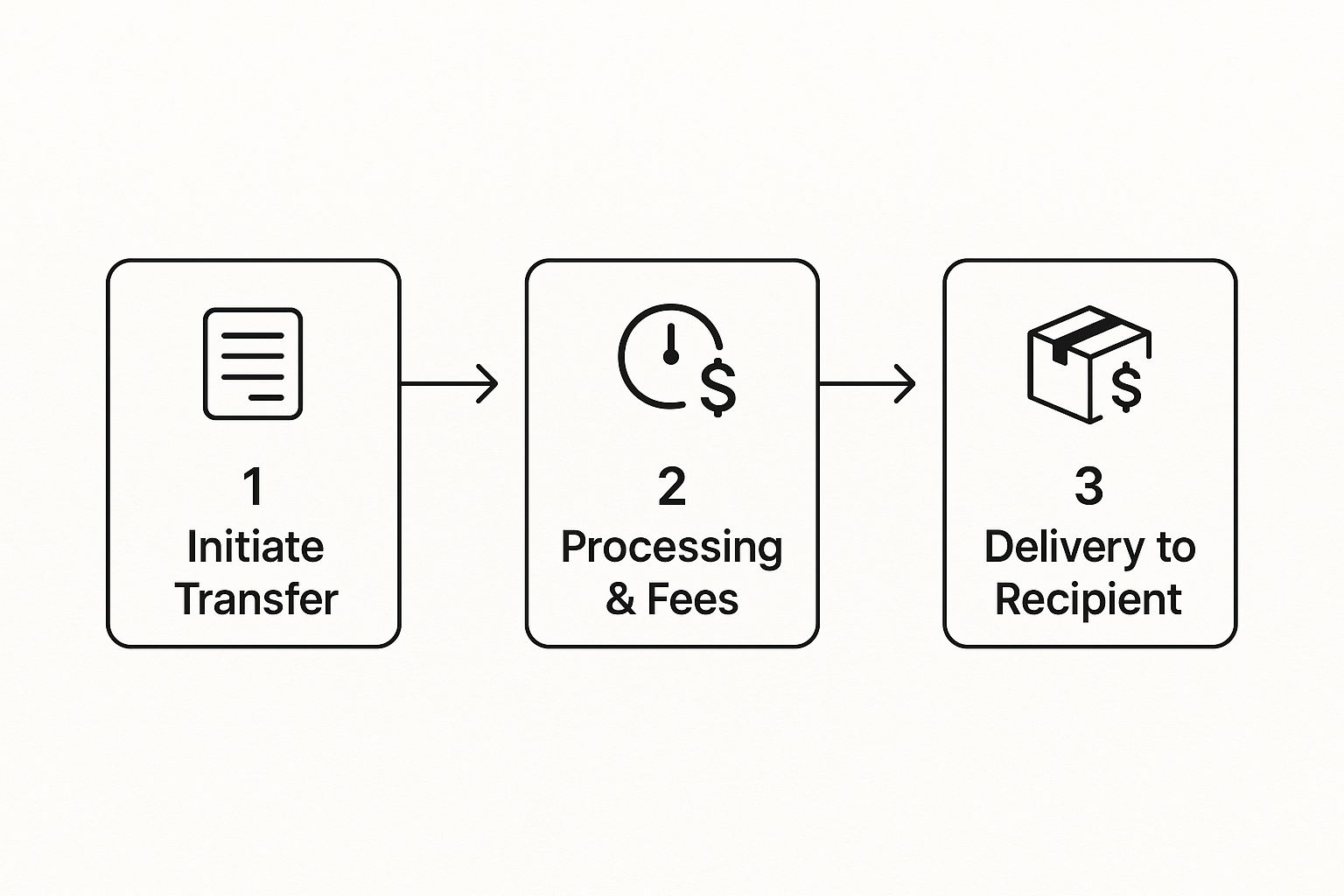

This infographic gives you a simplified look at the key stages involved.

As you can see, the journey from start to finish has multiple steps where fees are taken and compliance checks are carried out.

The Role of Intermediary Banks

So, why are these correspondent banks even needed? Well, your bank here in South Africa probably doesn't have a direct link to a small regional bank in Germany, for example. The intermediary bank steps in as a trusted middleman, taking the payment instruction from your bank and passing it along to its final destination.

Each bank in this chain usually shaves off a small fee for its part in the process, which is why the final cost can sometimes be a bit of a mystery. Newer fintech platforms like Zaro are changing the game by finding ways to bypass this complex and expensive network, creating a more direct and transparent route for your money.

Unpacking the Real Cost of Sending Money Abroad

When you set up an international fund transfer, that initial fee you see is rarely the whole story. It's more like the tip of the iceberg. The final cost is often buried in complex calculations and extra charges that only show up after the transaction is done.

To really get a grip on what you're paying, you have to look past that advertised transfer fee. The true price is a mix of two things: the obvious fee and the less obvious cost hidden inside the exchange rate. Understanding both is the key to avoiding some nasty financial surprises.

The Upfront Transfer Fee

This is the most straightforward part. It's the flat fee or percentage a bank or service charges just for moving your money. While it's easy to see, it's often not the biggest chunk of the total cost.

Many providers will lure you in with promises of "low fees" or even "zero-fee transfers." Be wary of this. A low upfront fee is often a sign that they're making their money somewhere else in the transaction – which brings us to the much bigger, hidden expense.

The Hidden Cost: Exchange Rate Markups

This is where the real cost of most international transfers is hiding. The exchange rate you get isn't usually the "real" one. What banks and many services do is take the mid-market rate—the true rate you’d see on Google or Reuters—and add their own margin, or "spread."

Think of it like buying oranges at a market. The farmer sells them to a vendor for R10 each (that's the mid-market rate). The vendor then sells them to you for R12. That R2 difference is the vendor's markup. In a fund transfer, the bank is the vendor, and their profit is the spread they add to the exchange rate.

A tiny-looking difference in the exchange rate can make a massive dent in the final amount your recipient gets. A markup of just 2-5%, which is pretty standard for traditional banks, can mean thousands of Rands lost on a large business payment.

Let’s say you’re sending R500,000. A 3% markup means you've lost R15,000 before the money has even left your account. That’s why focusing only on the upfront transfer fee can be a very expensive mistake.

The Trail of Hidden Bank Fees

As your money makes its way through the global SWIFT network, other fees can pop up along the route. Your bank might not have a direct line to the recipient's bank, so the payment has to hop between several "intermediary" or "correspondent" banks.

Each one of these middlemen can take a slice for their trouble. These fees are notoriously hard to predict and can include:

- Intermediary Bank Fees: Charges taken by one or more banks that handle the transfer mid-journey.

- Receiving Bank Fees: The recipient’s bank might also charge a fee just for processing an incoming international payment.

When you add it all up, the amount that finally lands in the recipient's account can be a lot less than what you sent. To get a better handle on these moving parts, it helps to understand what influences exchange rates and how market forces can impact your bottom line.

To give you a clearer picture, let's break down where these costs typically come from.

Fee Breakdown for a Typical International Fund Transfer

This table shows the different fees you might run into, helping to clarify the total cost of sending money across borders.

| Fee Type | Description | Typical Cost Range (Example) |

|---|---|---|

| Upfront Transfer Fee | The visible fee charged by the sending institution to initiate the transfer. | R150 – R500 flat fee, or 0.5%–2% of the transaction amount. |

| Exchange Rate Markup | The "spread" added to the mid-market exchange rate. This is a hidden percentage. | 1% – 5% of the transaction amount. |

| Intermediary Bank Fee | A handling fee charged by one or more banks in the SWIFT network chain. | R200 – R800 per intermediary bank. |

| Receiving Bank Fee | A fee charged by the recipient's bank for processing the incoming international payment. | R100 – R400, often a flat fee. |

As you can see, the costs can stack up quickly, making transparency a real challenge. High costs and slow processing are major headaches, especially in sub-Saharan Africa. Recognising this, the G20 has even launched a roadmap to make cross-border payments cheaper, faster, and more open for everyone.

This is exactly the problem that platforms like Zaro were built to solve. By giving you access to the real exchange rate with zero markup and getting rid of SWIFT fees, you get total clarity and control over the true cost of every international fund transfer.

Navigating South African Exchange Control Regulations

Sending money out of South Africa isn't just a simple transaction; it's a process governed by a framework designed to protect the country's economic stability. These rules are known as Exchange Control Regulations, and they're managed by the South African Reserve Bank (SARB).

While the term "regulations" might sound a bit intimidating, getting a handle on them is the key to making sure your transfers are smooth and fully compliant. At their core, these rules manage how much money can leave the country, ensuring that large capital outflows don't disrupt the economy.

Understanding Your Annual Allowances

For individuals, the SARB has set up specific annual allowances that dictate how much you can legally send abroad without needing special permission. These are divided into two main categories, each with its own purpose.

The first, and most widely used, is the Single Discretionary Allowance (SDA).

- What it is: A straightforward allowance available to every South African resident over the age of 18.

- Annual Limit: You can send up to R1 million offshore per calendar year, which runs from 1 January to 31 December.

- What it covers: It's incredibly flexible. You can use it for almost any legitimate reason, like sending gifts, covering travel expenses, making donations, or helping out family overseas.

The real beauty of the SDA lies in its simplicity. For any transfer under this R1 million limit, you don’t need to get a Foreign Tax Clearance Certificate from SARS. This makes it the perfect go-to for smaller, personal transfers.

For those looking to move larger sums for investment, there’s a separate, more substantial allowance called the Foreign Investment Allowance (FIA).

- What it is: The FIA is specifically for South African residents who want to make significant investments in other countries.

- Annual Limit: It allows you to transfer an additional R10 million offshore each calendar year.

- Key Requirement: Unlike the SDA, using this allowance requires you to be in good standing with SARS and to obtain a Foreign Tax Clearance Certificate beforehand.

When you combine them, these two allowances mean an individual can send a total of up to R11 million abroad annually, as long as all the rules are followed.

The Role of FICA and KYC in Your Transfer

To keep every international fund transfer above board, South Africa has strict identity verification rules in place. This is where you’ll encounter the Financial Intelligence Centre Act (FICA) and Know Your Customer (KYC) processes.

Don't think of these as just bureaucratic red tape. They are critical safeguards against financial crimes like money laundering and financing terrorism. Whenever you set up a transfer, your bank or payment provider is legally required to check who you are and where the money is coming from.

Typically, this just means providing a few standard documents:

- Your valid South African ID or passport.

- Proof of your residential address (a recent utility bill works perfectly).

- A little information on why you're making the transfer.

These checks are all about confirming that the transaction is legitimate and meets both local and global anti-money laundering (AML) standards. It might feel like an extra step, but it’s what keeps our financial system secure for everyone. For companies expanding globally, navigating these kinds of legal and financial frameworks is essential, which is why many turn to solutions like Employer of Record (EOR) services.

Broader Economic Context and Reforms

South Africa's exchange controls are a key part of a bigger strategy: maintaining financial stability while still encouraging foreign trade and investment. In recent years, we've seen reforms aimed at modernising these regulations. For example, in 2022, the foreign exposure limits for institutional investors were harmonised and raised to 45%. An International Monetary Fund review noted that South Africa's deep financial markets were robust enough to absorb these capital outflows without any major issues.

By getting to know these rules, you can manage your international payments with confidence, knowing every transaction is both efficient and 100% compliant.

How to Choose the Right Transfer Method

Sending money overseas used to be simple because you only had one real option: the bank. Today, you’re faced with a dizzying array of choices, from your trusted bank to sleek fintech apps. The key isn't to find the single "best" way to send money but to find the best way for this specific transfer.

It all comes down to a balancing act between four key things: speed, cost, convenience, and security. A massive, urgent payment to secure a new supplier has completely different needs than a small, regular payment to an overseas contractor. Understanding these trade-offs is what separates a smart financial decision from a needlessly expensive one.

Traditional Banks: The Old Guard

For years, the only way to handle a serious international fund transfer was to walk into your bank and arrange a wire transfer through the SWIFT network. It's a system built on decades-old correspondent banking relationships, and for many, it still feels like the safest, most reliable option. That's why many businesses still turn to it for their biggest, most critical transactions.

But that feeling of security comes at a steep price. Bank wires are almost always the slowest and most expensive route. The costs stack up quickly: you've got the upfront transfer fee, a hefty markup on the exchange rate, and often, surprise fees from intermediary banks that get skimmed off the top before your money even arrives. The whole process can take anywhere from 2 to 5 business days, leaving both you and your recipient in the dark.

- Best for: Very large, one-off payments where security is the absolute top priority and you aren't worried about high costs or slow delivery.

- Drawbacks: High fees, terrible exchange rates, sluggish processing times, and a frustrating lack of transparency about the final cost.

Online Money Transfer Services: The Modern Alternative

Over the last decade, a new breed of specialised online platforms has emerged to challenge the old, inefficient banking system. These fintech services, often called money transfer operators (MTOs), are built to be faster and dramatically cheaper. They pull this off by using clever technology to bypass the clunky and expensive SWIFT network altogether.

What you get is transparency. These platforms show you exactly how much your recipient will get before you hit send. Services like Zaro go a step further by offering the real mid-market exchange rate with no markup, completely cutting out the single biggest hidden cost in international payments.

It's a common misconception that these newer services are less secure. In reality, security is their top priority. They are fully regulated financial institutions that employ bank-level security, encryption, and rigorous identity checks. They are bound by the same strict anti-money laundering (AML) and counter-financing of terrorism (CFT) rules as any traditional bank.

With the options laid out, how do you decide? Let's put them side-by-side.

Comparison of International Transfer Methods

This table gives you a clear, at-a-glance look at the different ways to send money abroad, highlighting their key features to help you choose the right service for your needs.

| Method | Best For | Typical Speed | Cost Structure |

|---|---|---|---|

| Traditional Bank Wire | Large, high-value transfers where security is the primary concern over cost and speed. | 2–5 business days | High upfront fees, significant exchange rate markups, and unpredictable intermediary fees. |

| Online Transfer Service | Regular business payments, paying overseas staff or suppliers, and personal transfers where speed and low cost are vital. | Minutes to 24 hours | Low or no transfer fees, competitive exchange rates with minimal markups, and full transparency. |

So, what’s the verdict? The best method for your international fund transfer really hinges on your priorities. If you need to move a huge sum and are willing to pay a premium for a familiar, albeit slow, process, your bank might still do the job.

But for the vast majority of modern business needs—paying suppliers, running global payroll, or getting paid by international clients—online platforms offer a combination of speed, savings, and ease of use that legacy banks simply can't match.

The Future of Cross-Border Payments in South Africa

The way we handle international payments is on the brink of a massive overhaul, finally moving on from the sluggish and expensive systems we’ve put up with for decades. For South African businesses, this shift is a game-changer. It points to a future where paying a supplier in another country is as straightforward as a local EFT. This isn't just wishful thinking; it's being driven by a new wave of financial technology designed to fix the industry's oldest headaches.

At the core of this change is a move toward real-time, direct payment channels. Think of it like building a new highway that goes straight from Johannesburg to London, completely bypassing the old scenic route that zigzagged through multiple towns. Your international fund transfer will no longer have to bounce between several intermediary banks, each one adding its own delay and clipping a fee off the top.

The Rise of Mobile-First and Instant Payments

The future is clearly digital, and it fits right in your pocket. New platforms are being designed from the ground up with the user in mind, letting businesses manage everything from one clean, simple dashboard. This kind of accessibility is a massive win for agile South African companies that need to make quick decisions and send funds without being stuck waiting for banking hours or wrestling with stacks of paperwork.

This digital push isn’t just about making things easier; it’s about making them faster. Seriously faster. Imagine paying an international supplier and they see the money in their account almost immediately. That’s the end goal here. Emerging payment tech is aiming to settle cross-border transactions in minutes, not days.

This move towards instant payments will completely reshape how businesses manage their cash flow. The power to send a near-instant international fund transfer means you can secure goods faster, settle invoices quicker, and build much stronger relationships with your global partners.

Blockchain and a Clear View of Your Money

Another exciting development is how technologies like blockchain could bring a whole new level of transparency to the table. While it's not the standard for every payment just yet, its core ideas—secure, verifiable, and transparent records—are heavily influencing the design of new platforms. This focus on clarity means you’ll know exactly what a payment will cost and where it is every step of the way.

The growth in this space is undeniable. Global payment revenues are climbing, and Africa is set to see a compound annual growth rate (CAGR) of 11% by 2028, which is well ahead of the global average. As sending money online becomes the norm, security is more important than ever. It's telling that 84% of local consumers report feeling safer when identity verification is part of the process. You can dig deeper into these digital payment trends and revenue forecasts from Nedbank Group.

All these trends are coming together to set a new standard for cross-border payments—one that is finally faster, cheaper, and a whole lot more transparent for South African businesses.

Got Questions About International Fund Transfers? We've Got Answers

If you’re sending money across borders, you’re bound to have a few questions. It’s a process that can seem complicated, but getting a handle on the key details makes everything much smoother. Let's walk through some of the most common queries that pop up.

What on Earth Is a SWIFT Code?

Think of a SWIFT code (you might also see it called a BIC) as a bank's international post code. It’s a unique identifier that banks around the globe use to talk to each other and make sure your money lands in exactly the right place.

When you're doing a classic bank-to-bank wire transfer, you'll almost certainly be asked for the recipient's SWIFT code. Without it, the transfer is a non-starter. Your funds could end up in limbo, delayed for weeks, or bounced right back to you—minus a fee for the hassle.

So, How Long Does an International Transfer Actually Take?

This is the big one, and the honest answer is: it depends. The speed of your transfer comes down to the method you use, where the money is going, and which banks are involved.

- Traditional Bank Wires: Using the old-school SWIFT network, you can expect the money to arrive in 2-5 business days. It's a slow journey with a few stops along the way.

- Modern Online Services: Fintech platforms are built for speed. They often get the job done in just a few minutes or a couple of hours.

Don't forget that things like public holidays, different time zones, and extra security checks from the banks can throw a spanner in the works and add unexpected delays.

The key thing to realise is that speed is directly linked to technology. Older systems like SWIFT are naturally slower because the money has to hop between several "correspondent" banks. Newer platforms have built more direct, efficient routes to get your money there faster.

Help! Can I Cancel a Transfer I Already Sent?

Whether you can hit the brakes on a transfer depends entirely on where it is in the process. If you catch it early enough—before the funds have been credited to the recipient's account—you can usually stop it by getting in touch with your provider straight away.

Once the money has landed, however, it's generally a done deal and you can't reverse it. It's also worth knowing that even if you successfully cancel, you might be hit with a cancellation fee and could lose out on the currency exchange. This is why it pays to double-check every single detail before you hit send.

What Details Do I Need to Send Money Abroad?

Having your ducks in a row from the start will save you a massive headache. To make sure your international transfer goes off without a hitch, you'll need this information for the person you're paying:

- Their full name and physical address.

- The name and address of their bank.

- Their bank account number. In Europe and many other places, this will be an IBAN (International Bank Account Number).

- The bank's specific SWIFT/BIC code.

You'll also need to provide your own ID for security reasons. This is a standard procedure that helps prevent money laundering and keeps the financial system safe.

Ready to bypass the delays and hidden fees of traditional transfers? With Zaro, you get access to real exchange rates with zero markups and no SWIFT fees, ensuring your international payments are fast, transparent, and cost-effective. See how much you can save at Zaro.