Sending money overseas is the lifeblood of global trade for any South African business, but it's often more complex than it first appears. It's easy to think of it as a simple bank deposit, but it’s more like a specialised courier service for your money—one with multiple stops, checks, and potential delays along the way.

Why Mastering Global Payments Is Critical for Your Business

For a South African company operating in a global marketplace, getting cross-border payments right isn't just an admin task; it’s a strategic necessity. Whether you're paying an international supplier, receiving payment from an overseas customer, or managing operational costs abroad, the efficiency of your transfers directly impacts your bottom line.

Delays can sour supplier relationships, while hidden fees quietly chip away at your profit margins. Getting a handle on the process means you can operate with confidence, knowing your financial operations are both secure and cost-effective.

The Real-World Impact on Your Operations

The fallout from a poorly managed international payment system is real and can ripple through your entire business. Recognising these challenges is the first step toward building a more robust financial strategy.

Here’s where you’ll feel the pinch:

- Cash Flow Management: Unpredictable transfer times and unexpected costs make it incredibly difficult to forecast cash flow accurately. A payment that arrives days late could mean missing out on early payment discounts or, worse, getting hit with late fees.

- Supplier Relationships: Consistent, on-time payments are the foundation of trust with international partners. Delays or short payments caused by sneaky intermediary bank fees can quickly strain these vital relationships.

- Profitability: The true cost of sending money abroad is often masked by poor exchange rates and hidden charges. These costs might seem small individually, but they add up fast and directly eat into the profitability of each transaction.

- Operational Efficiency: Time spent tracking lost payments, wrestling with compliance paperwork, and reconciling transactions is time your finance team could be spending on more strategic work.

By demystifying the process, this guide provides a clear roadmap to navigate confusing regulations, uncover hidden costs, and help you select the right payment partner for your unique needs.

For businesses navigating global markets, understanding strategies like an offshore company setup for international trade can be a key part of your overall guide to sending money abroad. Expanding your operational footprint often requires a sophisticated approach to managing cross-border finances.

Ultimately, the goal is to equip you and your team to make smarter, more cost-effective decisions for all your cross-border payment needs. We’ll break down every component—from the technical journey your money takes to the regulatory hurdles you'll need to clear—to ensure you are fully prepared for success.

How Your Money Actually Travels Across Borders

Sending money from your South African business to an international supplier isn't as simple as an EFT. It’s a journey with a few important stops along the way. Knowing this path helps you understand timelines, figure out what's causing a delay, and appreciate why choosing the right payment partner is so crucial.

Let's say your business in Johannesburg needs to pay a supplier in Hamburg, Germany. You're not actually sending a bundle of rands across the ocean. Instead, you're kicking off a series of secure messages and balance sheet adjustments that shift the value from your bank account to theirs.

The Key Players in the Journey

The classic way to handle an international funds transfer relies on a network of banks cooperating. You can think of it as an international courier service for money, where each bank has a specific job to get your "package" — the payment — to its final destination.

Here are the main players involved:

- Your Bank (The Originating Bank): This is where it all starts. Your South-African-based bank takes the funds from your account and packages the payment instructions for the trip.

- Correspondent Banks (The Middlemen): This is where things can get a bit complicated. If your bank doesn't have a direct line to the supplier's bank in Germany, it uses one or more correspondent banks to pass the payment along. Each of these stops can add time and, more importantly, extra fees.

- The Recipient's Bank (The Beneficiary Bank): The end of the line. The German bank receives the instructions and credits your supplier's account.

The traditional cross-border payment network is a system built decades ago on these bank-to-bank relationships. It’s secure, no doubt, but this multi-step process is exactly why businesses get hit with high fees and slow transfer times.

Following the Digital Breadcrumbs

So, how do all these banks talk to each other? They use a highly secure messaging network called SWIFT (Society for Worldwide Interbank Financial Telecommunication). A SWIFT message is like a detailed shipping label for your money, containing all the critical details for the transfer.

To make sure this message is spot on, you'll need a couple of specific codes:

- A SWIFT/BIC Code: This is an 8-11 character code that acts like a bank's unique postal code, telling the network exactly which institution to send the money to.

- An IBAN (International Bank Account Number): Mostly used in Europe and other regions, an IBAN pinpoints the specific account at that bank. It combines the country, bank, and account details into one long string to prevent the payment from getting lost.

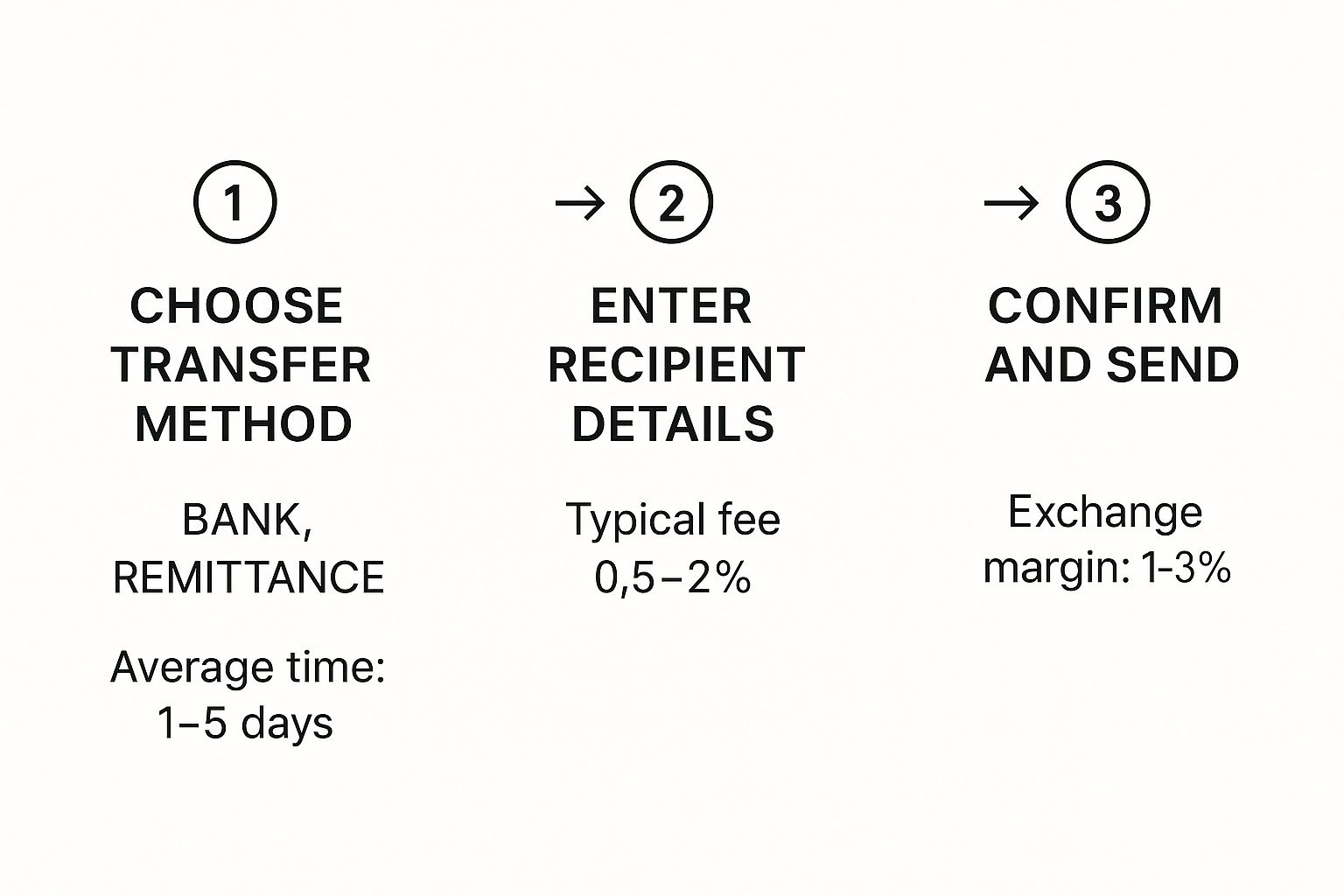

This visual breaks down the typical stages, showing where costs and delays often creep in.

As you can see, costs pop up at nearly every step — from the initial sending fees and exchange rate markups to sneaky deductions by those intermediary banks.

Common Headaches in the Process

While this old-school system works, it’s famous for its pain points. A standard international funds transfer can take anywhere from 1-5 business days, and sometimes even longer if anything goes wrong. Delays are often caused by simple mistakes in the payment details, extra compliance checks, or a processing snag at one of the intermediary banks.

Even worse, each of those correspondent banks might take its own fee directly out of the money you sent. This is the reason your supplier sometimes receives less than you intended, a frustrating situation that messes up your accounting and can strain your relationship. This lack of transparency is a massive headache for businesses that need to make precise, on-time payments.

Navigating South African Exchange Control Rules

For any South African business sending money overseas, the process isn't just about finding the best rate; it’s about playing by the rules. The South African Reserve Bank (SARB) acts as the country's financial gatekeeper, using a system called exchange control to monitor and manage the flow of money in and out of South Africa.

Think of exchange control like a set of traffic lights for your money. It's not there to stop you, but to ensure everything moves in an orderly and legal fashion. The main goals are to keep the economy stable, protect the value of the Rand, and stop illicit activities like money laundering.

For your business, this means every international payment needs to follow a specific process and be backed by the right paperwork. Getting this wrong can lead to serious headaches, including long delays, rejected transfers, and even financial penalties.

Understanding Your Allowances

The SARB has different rules and allowances for individuals and businesses. One of the most important for individuals, including directors or sole proprietors wanting to invest offshore, is the Foreign Investment Allowance (FIA).

Under the current Exchange Control Regulations, South African residents can transfer up to R10 million abroad each calendar year for investment purposes using their FIA. You don't need to ask the SARB for permission first, but there's a catch: you absolutely must have a valid tax clearance certificate from SARS and be ready to prove where the funds came from.

For larger transfers over R50,000, it’s worth noting that currency brokers often beat the banks on exchange rates and fees. You can find more practical advice about transfer options for South Africans on wise.com.

The whole system boils down to accountability. The SARB needs to see that the money leaving the country is legitimate and that all the necessary taxes have been paid. This is why your documentation is your most powerful tool.

When it comes to business transactions, the rules are directly linked to what you're paying for. If you're paying an overseas supplier for goods, for instance, you'll need to produce commercial invoices and customs documents to verify the trade.

The Role of Tax Clearance and Documentation

A Tax Clearance Certificate (TCC) from the South African Revenue Service (SARS) is non-negotiable for any transfer using the FIA. This document is SARS’s way of confirming that your tax affairs are in order.

To get your TCC, you’ll need to formally apply to SARS and provide a few key things:

- Proof of your tax compliance status: This shows that all your returns have been filed and you're up to date on payments.

- Evidence of the source of funds: Think bank statements, payslips, or audited financials that clearly show the money's origin.

- Details of the transaction: You'll need to explain where the money is going and its intended purpose.

Beyond the TCC for investments, every single business payment needs a clear paper trail. Always be ready to give your bank or payment provider the supporting documents for each transaction. This typically includes:

- Invoices: For paying international suppliers or service providers.

- Contracts: For payments linked to cross-border agreements.

- Bills of Lading: For any transaction that involves shipping goods.

Honestly, missing or incorrect documentation is the number one reason transfers get stuck or blocked. This is where a good payment partner really proves their worth. Someone who knows the ins and outs of these requirements can guide you on exactly what’s needed for each payment, saving you a world of time and frustration.

Decoding the True Cost of an International Transfer

The fee you see upfront for an international transfer is almost never the full story. Think of it like booking a flight: the ticket price looks great, but then you get hit with extra costs for baggage, seat selection, and airport taxes. To really understand what you're paying, you need to dig a little deeper than the advertised transfer fee and uncover the costs hiding in the fine print.

Getting this right is a big deal for your business’s bottom line. Losing just a few percentage points on every single transaction can quietly drain thousands of Rands from your profits over a year, often without you even noticing.

Let's break down the three main parts that make up the total cost of your payment.

The Upfront Transfer Fee

This is the one everyone sees. It’s the straightforward, advertised charge a bank or payment provider quotes for sending your money. For instance, your bank might charge a flat R400 for any SWIFT transfer, no matter how much you’re sending.

But while it's easy to spot, this fee can be a bit of a red herring. Some providers will lure you in with a temptingly low upfront fee, only to make their money back through other, less obvious charges. It’s the first piece of the cost puzzle, but it’s definitely not the most important one.

The Exchange Rate Margin

This is where the real cost is often buried. The exchange rate margin (or spread) is simply the gap between the real exchange rate banks use to trade currencies among themselves and the less favourable rate they offer you as a customer.

It's essentially a hidden service charge baked right into the rate. If the real ZAR/USD exchange rate is 18.50, your bank might offer it to you at 18.90. That extra 40 cents on every single dollar is their profit. It might not sound like a lot, but on a large payment, this margin can end up costing you far more than any flat transfer fee.

This exchange rate margin is where traditional financial institutions make a substantial part of their profit on international payments. A seemingly small margin of 2-4% can quietly cost your business thousands on a single large transaction.

Surprise Intermediary Bank Fees

Remember those correspondent banks we talked about? Well, each one that touches your payment on its journey across the globe might decide to take a little slice for their trouble. These are known as intermediary or correspondent bank fees, and they are notoriously unpredictable.

These fees, which typically range from R200 to R800 per bank, are taken directly out of the money you're sending. This is the main reason your supplier in the USA might receive less than the invoice amount, leading to awkward conversations, reconciliation headaches, and strained business relationships. Often, you won’t even know these fees were charged until your recipient calls to say the payment came up short.

Let’s look at a quick comparison to see how this plays out in the real world.

Cost Comparison: Traditional Bank vs. Modern Payment Platform

Here’s a hypothetical look at sending R150,000 to a supplier in the USA, showing how different fee structures can drastically change the final outcome.

| Cost Component | Traditional Bank | Modern Payment Platform |

|---|---|---|

| Amount to Send | R150,000 to USA | R150,000 to USA |

| Advertised Fee | R500 (flat SWIFT fee) | R0 (no transfer fees) |

| Real Exchange Rate | R18.50 / $1 | R18.50 / $1 |

| Offered Exchange Rate | R18.95 / $1 (2.4% margin) | R18.50 / $1 (0% margin) |

| Intermediary Fees | ~ R400 (deducted) | R0 (direct routing) |

| USD Sent | $7,915.57 | $8,108.11 |

| Recipient Receives | ~$7,894.46 | $8,108.11 |

| Total Hidden Cost | ~ R4,068.75 | R0 |

The difference is stark, isn't it? The business using the traditional bank lost over R4,000 to hidden margins and surprise fees, even though the advertised fee was only R500.

To avoid these costly surprises, you should always ask any potential provider a few direct questions before you commit.

- What is the exact exchange rate you will apply to my transfer?

- Can you guarantee that the full amount will arrive with my recipient?

- Are there any other potential fees, like from intermediary banks, that could be deducted along the way?

Demanding this level of transparency is the first step toward taking back control of your cross-border payment costs and making sure your money works as hard for your business as you do.

Choosing the Right International Payment Partner

Picking a provider for your international payments is one of the most important financial decisions your business will ever make. This isn't just about sticking with your bank or trying out a flashy new fintech app. It’s about finding a genuine partner who understands your business and helps you reach your financial goals.

The right partner can save you thousands of Rands, get your suppliers paid faster, and free up your finance team from chasing payments. But get it wrong, and you could be dealing with lost profits, damaged supplier relationships, and a mountain of administrative headaches.

Your Evaluation Checklist

To make the right call, you need to look past the marketing fluff. A solid evaluation framework helps you focus on what really matters to your bottom line and operational efficiency.

Here’s a practical checklist to get you started:

- Fee Transparency: Are all costs laid out clearly from the start? Insist on a full breakdown of transfer fees, exchange rate margins, and any hidden intermediary bank charges. A partner you can trust will show you the all-in cost before you click "send".

- Transfer Speed and Reliability: How long will it actually take for the money to land? Ask for realistic timelines, not just the best-case scenarios they advertise. A dependable provider gives you predictable settlement times, which is crucial for managing your cash flow.

- Platform Usability: Is the platform actually easy to use? A clunky, confusing interface is a recipe for errors and wasted time. You want a clean design, simple workflows, and helpful features like real-time payment tracking.

- Customer Support: When a payment goes missing, you need to talk to a real person, fast. Find out how responsive their support team is. Can you get hold of an expert who genuinely understands the tangled web of cross-border payments?

Security and Compliance Features

In international finance, security isn't just a feature; it's everything. The partner you choose must have rock-solid measures in place to protect your money and your data.

Keep an eye out for these non-negotiables:

- Regulatory Compliance: Make sure the provider is a registered Authorised Dealer with the South African Reserve Bank (SARB). This is your proof that they operate under strict legal oversight.

- Data Encryption: All your information, whether it’s in transit or stored, should be protected by bank-level encryption. No exceptions.

- Access Controls: A good platform lets you set different permission levels for your team members. This is a basic but critical tool for good financial governance, ensuring people only have access to what they need.

Choosing a partner is about more than just transactions; it’s about trust and efficiency. The right solution should feel like an extension of your finance team—proactively solving problems and adding value beyond just moving money.

Modern platforms are built from the ground up to fix the classic headaches of an international funds transfer. Take a solution like Zaro, for example. It completely gets rid of hidden exchange rate markups and intermediary fees, so you know exactly what you're paying. By automating the compliance paperwork and offering strong internal controls, it turns a complex process into a straightforward, predictable task.

This focus on clear data and transparency isn't just a trend; it's becoming a global standard. In fact, institutions like the Bank for International Settlements (BIS) and our own South African Reserve Bank are pushing for better data quality to slash costs and speed up payments across Sub-Saharan Africa. The financial tracking infrastructure here has often been fragmented, and improving it is a top priority. You can read more about these global efforts to improve payment data insights on g20.org. It’s a powerful reminder of why picking a transparent partner is so critical for your business.

Frequently Asked Questions

Getting into international payments can feel a bit daunting, and it's natural for questions to pop up. We've gathered some of the most common ones we hear from South African businesses to give you clear, straightforward answers.

What’s the Real Difference Between a Bank and a Currency Broker?

Think of it like this: your bank is a bit like a general practitioner, while a currency broker or a modern payment platform is a specialist.

A traditional bank does a bit of everything – loans, savings, and yes, international payments. Because it's just one part of their massive operation, their exchange rates often aren't the sharpest and their fee structures can be quite rigid.

On the other hand, a currency specialist lives and breathes foreign exchange. Their entire business is built around offering better exchange rates and more transparent fees. For any business that regularly sends or receives money from overseas, that specialisation can translate into serious savings and access to expert support when you need it.

What Documents Do I Need for a SARS Tax Clearance Certificate?

For any South African wanting to use their annual R10 million Foreign Investment Allowance, getting a Tax Clearance Certificate (TCC) from SARS is a must. The exact requirements can change, but you'll generally need to have these documents ready to show that your tax affairs are in order:

- Proof of Tax Compliance: This shows SARS you're up-to-date with all your personal and business tax returns and have paid any money owed.

- Proof of Funds: You’ll need to prove where the money you're sending came from. This could be bank statements, records of investments, or audited financials for your company.

- Transaction Details: Be prepared to explain where the money is going and what it’s for.

Getting this paperwork sorted out beforehand makes the whole application process a lot less painful.

How Can My Business Manage Exchange Rate Risk?

Exchange rate volatility is a huge headache. A sudden dip in the Rand can wipe out the profit on a deal you thought was a winner. The good news is you don't have to just cross your fingers and hope for the best. One of the most effective tools is a forward contract.

A forward contract lets you lock in today's exchange rate for a payment you need to make in the future. It’s a simple agreement that removes all the guesswork and protects your business from nasty market surprises.

Imagine you have to pay a supplier in the US $50,000 in three months' time. With a forward contract, you can fix the ZAR/USD rate right now. It doesn't matter if the market swings wildly over the next 90 days – you'll pay the exact rate you agreed on, keeping your budget and profit margins safe.

Ready to stop paying hidden fees and take back control of your international payments? Zaro gives South African businesses the real exchange rate, with zero markups.

Discover a smarter way to manage your international funds transfer with Zaro.