Diving into the world of forex investing as a South African business requires more than just a whim; it demands a solid strategy, watertight risk controls, and a genuine feel for the local market. The key is to select an FSCA-regulated broker, manage your funds in ZAR-based accounts to sidestep conversion costs, and stick to a disciplined trading plan. Success comes when you stop speculating and start treating forex as a calculated part of your business.

Your Starting Point to Invest in Forex From South Africa

Getting started in forex from South Africa is easier than ever before. Technology has opened the doors, and our local regulatory environment is robust. But don't mistake accessibility for guaranteed profit. To make a real go of it in the world's largest financial market, you need a structured and informed game plan.

This guide is built for South African businesses ready to move from theory to action. We’re cutting through the generic fluff to give you a roadmap that speaks directly to the challenges and opportunities you'll face right here at home.

The South African Forex Landscape

Forex trading has absolutely exploded in South Africa, making us one of the most active trading hubs on the continent. This boom is driven by easier access to global markets and a savvier generation of local traders.

Crucially, the integrity of our market is protected by the Financial Sector Conduct Authority (FSCA). They keep brokers in line with strict compliance standards, which helps shield investors from fraud. This strong regulatory oversight has built a foundation of trust, encouraging both local businesses and global players to get involved. You can read more about what’s next for our local forex market and its regulations over on ITWeb.

We’re going to focus on the essentials you need to get right from the start:

- Choosing an FSCA-Regulated Broker: I'll explain exactly why local regulation is a non-negotiable for keeping your capital safe.

- Managing ZAR Accounts: You’ll see just how much you can save by using Rand-denominated accounts and avoiding unnecessary, often hidden, conversion fees.

- Developing a Real Strategy: We'll move past chasing "hot tips" and show you how to build a repeatable plan for when to buy and when to sell.

- Implementing Risk Controls: Success isn’t just about the winning trades; it’s about managing your losses so you can stay in the game long-term.

The goal here is simple: to give you the practical knowledge to make your trading activities support your bigger financial objectives. This isn't a get-rich-quick scheme; it's about applying sound business principles to the currency markets.

By zeroing in on these practical steps—from funding your account to placing that first disciplined trade—you’ll be ready to tackle the South African forex market with confidence and a clear plan.

Choosing Your FSCA-Regulated Broker and Platform

The very foundation of your forex venture is your trading infrastructure, and that begins with picking the right broker. For any South African business serious about trading forex, this is a critical first step. Let's be clear: selecting a broker regulated by our own Financial Sector Conduct Authority (FSCA) isn't just a good idea—it's non-negotiable.

Think of the FSCA licence as your primary line of defence. It ensures your business's capital is kept in segregated accounts, separate from the broker's operational funds, and that the broker operates under strict local laws. Without it, you're venturing into the Wild West. An offshore broker might dangle the carrot of sky-high leverage, but if things go south, you'll have virtually no legal ground to stand on. The FSCA provides a level of security you simply can't afford to skip.

Beyond the FSCA Licence: What Really Matters

Getting that FSCA tick is the first hurdle, but the race isn't over. A truly suitable broker needs to fit seamlessly into your business's financial workflow, especially when it comes to dealing in our local currency.

One of the most overlooked—yet crucial—features is whether the broker offers ZAR-denominated trading accounts. It might seem trivial, but opening an account in US dollars creates a constant, low-level drain on your capital. Every time you deposit or withdraw funds from your ZAR bank account, you're hit with conversion fees and at the mercy of the broker's exchange rate spread. These little costs add up, eroding your funds before you've even placed a single trade. A ZAR account cuts out that friction completely.

Here’s a practical checklist of what to look for:

- Competitive Spreads and Fees: The spread—the tiny difference between a currency pair's buy and sell price—is how most brokers make their money. You want this to be as tight as possible, particularly on major pairs like EUR/USD and the highly relevant USD/ZAR. Don't forget to check for other costs like overnight swap fees or inactivity penalties.

- Reliable Local Funding Methods: Can you fund your account with a simple Electronic Funds Transfer (EFT) from your South African bank? This is a must. It bypasses the headaches and steep fees that come with international wire transfers, making the whole process quicker and cheaper.

- A Rock-Solid Platform: Your trading platform is your command centre. It has to be fast, stable, and absolutely cannot freeze up when the market gets choppy—which is precisely when you need it most.

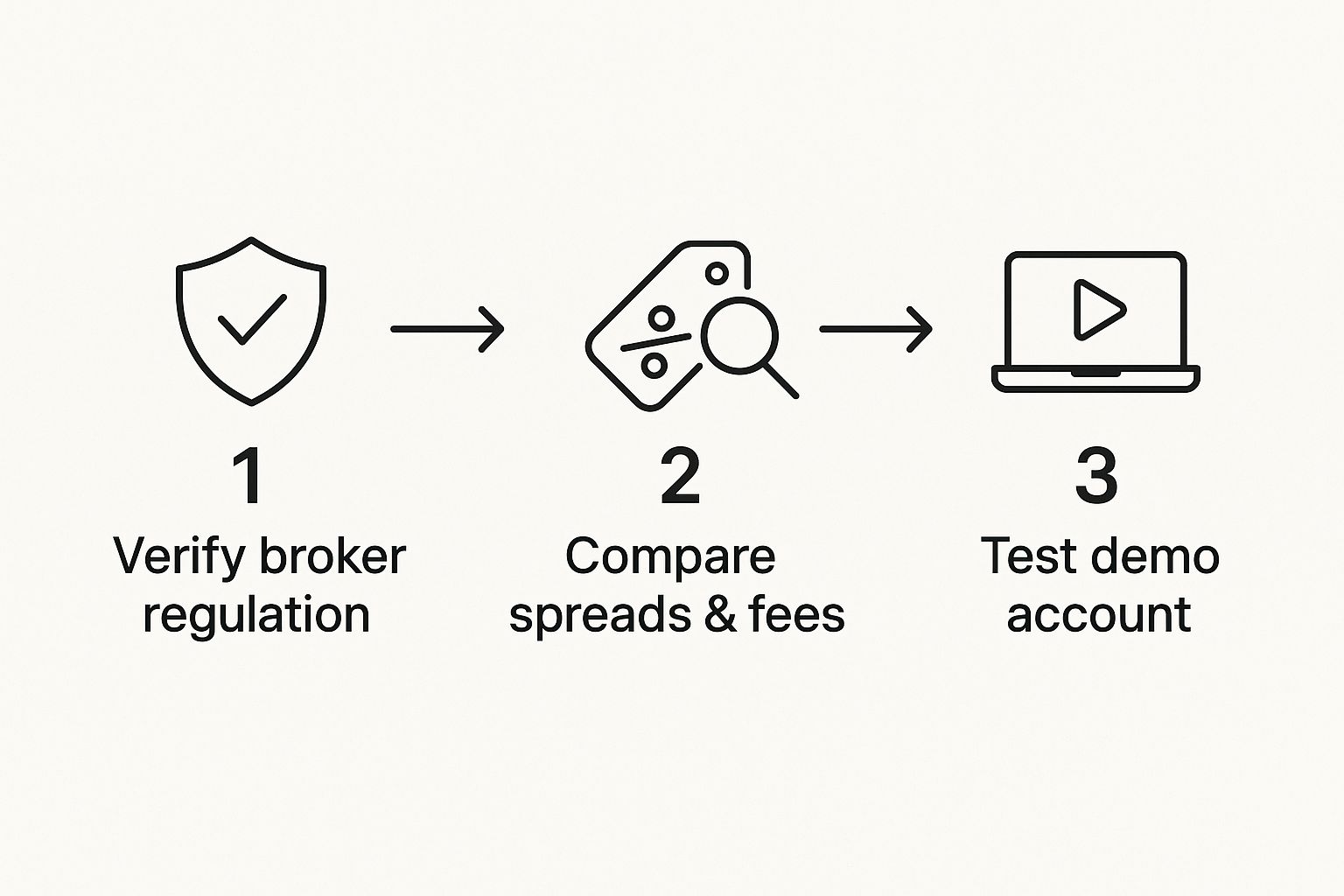

This flow chart breaks down the essential vetting process for any potential broker.

Running through this simple sequence helps you cover all the bases, from fundamental security to day-to-day usability, before you commit your business's capital.

To make this easier, here’s a breakdown of what you should be evaluating when you compare your options.

Key Criteria for Selecting an FSCA-Regulated Broker

| Feature | What to Look For | Why It Matters for South African Traders |

|---|---|---|

| FSCA Regulation | A valid FSP (Financial Service Provider) number that you can verify on the FSCA website. | This is your guarantee of local oversight, client fund protection, and a legal framework to resolve disputes. It's non-negotiable. |

| ZAR Accounts | The option to open and operate a trading account denominated in South African Rand (ZAR). | It eliminates the need for constant currency conversions, saving you money on fees and unfavourable exchange rate spreads for every deposit and withdrawal. |

| Local Funding Options | Support for local bank EFTs, PayGate, Ozow, or other South African payment gateways. | Provides fast, cheap, and hassle-free funding directly from your local business bank account, avoiding the high costs and delays of international wire transfers. |

| Spreads on USD/ZAR | Consistently low and competitive spreads on the USD/ZAR pair, not just the major currency pairs. | If you plan to trade the Rand, a tight spread is crucial for profitability. High spreads on our local currency pair can quickly eat into your potential returns. |

| Trading Platform | A stable, fast platform like MetaTrader 4/5 or a well-regarded proprietary platform. Always test the demo account first. | A reliable platform ensures your orders are executed quickly and at the price you expect, especially during high-volatility news events. |

| Customer Support | Accessible, knowledgeable support with an understanding of the local market, ideally available during South African business hours. | When you have an issue with funding or a trade, you need someone who can help you promptly and understands the local context—not a call centre on another continent. |

Ultimately, choosing a broker is about finding a long-term partner whose services align perfectly with your business’s operational and trading needs.

Comparing Trading Platforms: MetaTrader vs Proprietary

Once you have a shortlist of brokers, your attention will turn to the trading platform itself. Most FSCA-regulated brokers will give you a choice between globally recognised software and their own in-house systems.

The names you’ll see most often are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Think of these as the industry standard—the trusted workhorses. They're renowned for powerful charting capabilities, a massive library of technical indicators, and excellent support for automated trading strategies (known as Expert Advisors, or EAs). While MT5 is the newer version with more timeframes and tools, MT4 remains incredibly popular for its straightforward interface and huge community.

On the other hand, some brokers invest in developing their own proprietary platforms. These can be a real pleasure to use, often boasting a cleaner design and better integration with that broker's unique features, like news feeds or account management tools. The only real drawback is that you become tied to that broker's ecosystem.

My Pro Tip: Never, ever fund a live account without first taking the demo account for a thorough test drive. This is your chance to get a real feel for the platform. Check the execution speed, watch the live spreads during peak market hours, and make sure the interface works for you—all without risking a single Rand.

The FICA Verification Process

With your broker and platform chosen, the final administrative step is getting your account verified. This is done according to the Financial Intelligence Centre Act (FICA), the same anti-money laundering protocol you follow when opening a new bank account in South Africa. It’s a standard procedure.

You will almost always be asked to provide:

- A clear, certified copy of your ID document or passport.

- A recent proof of residence, like a utility bill or bank statement (usually not older than three months).

South Africa's trading environment is robust, built on a strong foundation of trader education and disciplined strategy. Thanks to the FSCA's solid regulatory oversight, a secure space has been created for traders to thrive. With minimum deposits often starting between $100 and $200, the market is accessible enough for serious businesses to get started. For more on what it takes, you can find great insights into the success factors for South African forex traders on DailyForex. This regulatory backbone is what ensures that when you're ready to put capital to work, you're doing so in a fair and secure environment.

Getting Your Capital into the Market: Funding and the ZAR Exchange

Alright, you’ve picked a solid, FSCA-regulated broker and your account is verified. Now for the real-world step: moving your capital into the market. This isn't just a simple bank transfer. For a South African business, how you fund your account is a critical decision that can define your profitability before you even place a single trade.

The choices you make right now—your account's base currency, your deposit method—will either protect your hard-earned capital or let it get eaten away by hidden fees and poor exchange rates. Let's get this right from the start.

The ZAR vs. USD Account Dilemma

One of the first forks in the road is deciding between a ZAR-denominated or a USD-denominated trading account. Most international brokers push USD accounts, but for any South African business wanting to invest in forex, sticking with a ZAR account is almost always the smarter move.

Why? It’s simple. When you run a ZAR account, you cut out a whole layer of unnecessary currency conversion. Funding is just a local bank transfer. Your balance, profits, and losses are all in Rands, which makes everything straightforward and easy to track against your local business operations.

Funding a USD account from South Africa, on the other hand, means you’re instantly hit with a currency exchange. Your Rands are converted to Dollars at the broker's rate, which is guaranteed to have a markup. A slice of your capital vanishes before it even has a chance to work for you.

Think about it this way: every time you deposit and every time you withdraw from a USD account, you’re paying a conversion fee. It’s a constant, slow leak. By using a ZAR-based account with a broker that supports it, you plug those leaks and keep more of your money where it belongs—in your trading account.

Smarter Ways to Fund Your Account

How you get your money into the account is just as important. International wire transfers might seem standard, but they’re often painfully slow and loaded with correspondent bank fees. Honestly, they’re a poor choice for most of us here.

Instead, look for a broker offering these local, cost-effective options:

- Local EFTs (Electronic Funds Transfers): This should be your first choice. It’s as easy as paying a local supplier—fast, secure, and usually free or very cheap.

- South African Payment Gateways: Platforms like Ozow or PayGate make deposits instant, pulling funds directly from your SA bank account.

- E-wallets (Skrill, Neteller): These are quick, no doubt, but always check the fee schedule. Sometimes the convenience costs more than it’s worth, especially when it comes to withdrawals.

The aim here is to cut down on financial friction. Every single Rand you save on banking fees is a Rand you can put to work in your trading strategy.

Don't Get Caught by the Exchange Rate

Even with a ZAR account, you'll face currency exchange when you start trading pairs like EUR/USD or GBP/JPY. This is where you need to do a little homework on your broker.

Don't just glance at the exchange rates you see on the news—that’s the interbank rate, and you’re not going to get it. To see what you’ll actually get, run a small test. Deposit a small amount of Rands, and then immediately request a withdrawal of that same amount.

Compare what you sent to what you got back. The difference between those two figures is the real, round-trip cost of their currency conversion. This simple check unmasks the spread they're really applying. A good broker will be transparent with a competitive rate. Figuring this out early saves you from discovering later that your broker is profiting a little too much from just moving your money around.

Building a Forex Trading Strategy That Works for You

Alright, your account is funded and ready to go. This is the moment where theory meets reality, and unfortunately, it's where many new traders go wrong. It’s easy to get caught up chasing market noise, following tips from online forums, or jumping on every volatile price swing.

To really succeed, you need to stop reacting and start acting. That means building a structured, repeatable trading strategy that guides your every move. A strategy isn't just a hunch; it's a solid rulebook. It tells you exactly when to get in, how to manage the trade, and when to get out, pulling emotion out of the driver's seat and replacing it with disciplined, calculated decisions.

Grounding Your Strategy in Analysis

Most trading approaches boil down to two main schools of thought: fundamental analysis or technical analysis. Neither one is "better"—the right one is the one that clicks with how you think.

Fundamental Analysis: This is about looking at the big picture—a country's economic health—to figure out where its currency might be headed. For anyone trading the Rand, this means keeping a close eye on announcements from the South African Reserve Bank (SARB). Things like interest rate decisions, inflation numbers (CPI), and GDP figures can move the USD/ZAR in a big way.

Technical Analysis: This approach tunes out the news and focuses entirely on what the price charts are saying. Technical traders use indicators like moving averages, the RSI (Relative Strength Index), and classic chart patterns to spot trends and predict what’s next. Their belief is that all the important information is already baked into the price you see on the screen.

Honestly, many of the best traders I know blend the two. They might use fundamental analysis to decide what to trade (maybe they see signs of Rand weakness from poor economic data) and then use technical analysis to pinpoint the exact moment when to execute that trade.

Popular Forex Strategies for the SA Market

Let's look at a couple of proven strategies and how they apply right here in the South African market.

1. Trend Following

This is probably the most intuitive strategy out there. You simply identify which way a currency pair is moving—up or down—and you ride that wave. For example, on a daily chart of the USD/ZAR, you could watch the 50-day and 200-day moving averages. A classic signal for a new uptrend (meaning a weaker Rand) is when the faster 50-day average crosses above the slower 200-day average. For many, that’s a clear signal to buy.

2. Swing Trading

Swing traders aren't glued to their screens all day. They aim to catch the "swings" in the market that unfold over several days or even weeks. Let's say your business exports to Europe. You’d be watching the EUR/ZAR. If you notice the pair hitting a price level where it has historically struggled to climb higher (a resistance level) and starts to turn, a swing trader might sell, expecting it to drop back down over the next few weeks.

No strategy is a silver bullet. The market is always changing, and what worked last month might not work next month. That's why you have to keep learning and be ready to adapt. It’s the only way to stay in the game for the long haul.

The South African market is a fantastic place to trade, with a daily turnover topping $20 billion. This huge volume is partly because African currencies can be quite volatile, which creates opportunities for traders who know what they're doing. This dynamic environment is the perfect testing ground for a well-thought-out strategy.

Before you risk a single Rand, you absolutely must learn how to backtest trading strategies against historical data. This means you run your rules on past price action to see how they would have performed. It's a critical step for finding flaws and building real confidence in your plan.

Defining Your Rules of Engagement

Whatever strategy you land on, it needs to have crystal-clear, non-negotiable rules. Your trading plan is your business plan, and it has to answer these questions without hesitation:

- What’s my entry signal? Is it a specific candlestick pattern? An indicator crossing a certain line?

- How much am I risking per trade? A common rule of thumb is a strict 1% of your total account balance.

- Where is my stop-loss? This is your emergency exit. It defines the maximum you’re willing to lose on this one trade.

- What’s my profit target? Where will you get out to lock in your winnings?

Writing this all down turns trading from a gamble into a disciplined process. It’s what will keep you grounded and prevent you from making panicked, emotional decisions when real money is on the line.

Mastering Your Risk and Money Management

If you’ve developed a solid trading strategy, you're halfway there. But the other half is what really separates the pros from the crowd: mastering risk and money management. It might not be the most exciting part of trading, but it’s the single most important skill for staying in the game long-term when you invest in forex.

It's a huge mistake to think that winning trades are what make you profitable. The real secret is how you manage your losses. Without strict rules, one bad decision can easily wipe out weeks of hard-earned gains. Let's dig into the non-negotiable rules for protecting your capital.

Setting Your Defensive Lines

Before you even dream about profits, you need to decide on your maximum pain point for every single trade. This is where your stop-loss and take-profit orders come in. Think of them as pre-set instructions you give your broker, taking raw emotion completely out of the picture once a trade is live.

A stop-loss order is your ultimate safety net. It automatically closes your trade if the market moves against you by a specific amount. You're deciding, with a clear head, the absolute maximum you're willing to lose on that one trade. It’s what stops a bad trade from becoming a disaster.

On the flip side, a take-profit order automatically closes your position when it hits a profit target you’ve set. This is crucial for locking in gains and fighting that greedy impulse to hold on for "just a little more," only to watch a winning trade turn against you.

The Game-Changing Power of Position Sizing

So, how much should you risk on a trade? This is where position sizing changes everything. Instead of just guessing how many lots to trade, you calculate your position size based on a small, fixed percentage of your total account balance.

Here’s the golden rule that seasoned traders live by: never risk more than 1-2% of your trading capital on any single trade.

Let's make this real. Imagine you have a R100,000 trading account.

- With a 1% risk rule: Your maximum loss on any trade is capped at R1,000.

- With a 2% risk rule: Your maximum loss is capped at R2,000. No exceptions.

This rule directly determines your position size. If your stop-loss on a USD/ZAR trade is 50 pips from your entry point, you calculate a position size where those 50 pips equal your R1,000 (1%) risk limit. This discipline ensures that a string of losses—which happens to everyone—is just a manageable drawdown, not an account-killer.

A trader's career isn't defined by their biggest win, but by how they navigate their worst losing streak. Strict position sizing is what ensures you survive to trade another day.

Aiming for a Positive Risk-to-Reward Ratio

The final piece of the puzzle is making sure your potential rewards are always bigger than your potential risks. We measure this with the risk-to-reward ratio, which simply compares what you stand to win (the distance to your take-profit) against what you stand to lose (the distance to your stop-loss).

Having a positive ratio is essential if you want to be profitable over the long haul.

- A 1:1 ratio means you’re risking R1,000 to potentially make R1,000.

- A 1:2 ratio means you’re risking R1,000 to potentially make R2,000.

- A 1:3 ratio means you’re risking R1,000 to potentially make R3,000.

You should always be looking for a minimum ratio of 1:2. Why is this so powerful? Because it stacks the odds firmly in your favour. With a 1:2 risk-to-reward setup, you only need to be right on 34% of your trades to break even. Anything above that is profit. This lets you be wrong more often than you're right and still grow your account. It takes away the pressure to be perfect and shifts the focus to running a profitable system.

By combining these three pillars—stop-losses, disciplined position sizing, and positive risk-to-reward ratios—you build a powerful defensive framework. This is the structure that gives you the confidence to trade, knowing your capital is protected by logic, not hope.

Common Questions About Forex Investing in South Africa

Dipping your toes into the forex market naturally brings up a lot of questions, especially when you're running a business in South Africa. You have to think about local rules, understand the real costs, and figure out what's actually achievable. Let's tackle some of the most common queries head-on to give your business a clearer path forward.

We'll get into the nitty-gritty of what every South African business owner needs to know, from the legal stuff to taxes and how much cash you genuinely need to get started.

Is Forex Trading Legal in South Africa?

Let's clear this up right away: yes, forex trading is perfectly legal in South Africa. It’s a common first question, and the answer is straightforward.

But there's a huge string attached. You absolutely must trade through a regulated broker. The main watchdog here is the Financial Sector Conduct Authority (FSCA). They're the ones who make sure brokers play fair, keep your money safe, and maintain a level playing field.

Think of an FSCA-regulated broker as your first and most critical line of defence. Dealing with an unregulated offshore company is like walking a tightrope with no safety net—if things go south, you have virtually no legal protection for your capital.

Before you even think about sending money, find the broker’s FSP (Financial Service Provider) number and double-check it on the official FSCA website. It takes five minutes and can save you a world of trouble.

What’s the Real Minimum Capital Needed to Start?

You’ll see brokers advertising accounts you can open with just R150 (about $10). Honestly, that's more of a marketing gimmick than a serious starting point. Trading with such a tiny amount makes proper risk management impossible.

A single bad trade—or even just normal market volatility—could wipe out an account that small before your strategy has any chance to prove itself.

For a business looking to trade seriously, you need enough capital to weather the market's inevitable ups and downs.

- A sensible starting point: Aim for somewhere between R3,500 and R7,500 ($200-$500). This gives you enough breathing room to size your trades correctly without risking your entire account on one or two positions.

- Why it matters: With a balance of, say, R7,500, you can stick to the classic 1-2% risk rule. Risking just R75 on a trade allows you to take a few losses without being knocked out of the game. It’s about longevity.

Your starting capital is your business's trading inventory. You wouldn't open a shop with just one item on the shelf, right? The same logic applies here.

How Are Forex Profits Taxed?

This is the one that trips up so many new traders. Forex profits are not tax-free in South Africa. The South African Revenue Service (SARS) treats them as income, which means they're subject to your personal or corporate income tax rate.

It's your responsibility to declare every cent of profit on your annual tax return. Ignoring this can lead to some very unpleasant penalties and legal headaches down the line.

Meticulous record-keeping is non-negotiable. You need to track:

- Every winning trade

- Every losing trade (losses can often be offset against your gains)

- All broker commissions and fees

Tax law can get complicated, especially with foreign currencies in the mix. I strongly recommend you chat with a qualified tax professional. They’ll give you advice for your specific situation, make sure you're compliant with SARS, and help you get your tax affairs in order from day one.

While forex trading requires careful management, handling international payments for your core business shouldn't be nearly as complex. Zaro is built to remove the friction from cross-border transactions for South African companies. We give you access to real exchange rates—no spread, no hidden fees—so your business keeps more of its hard-earned money. Whether you’re paying overseas suppliers or bringing in export revenue, our platform delivers the transparency and control you need. Learn how to simplify your global payments and take charge of your international cash flow.