Yes, forex trading is perfectly legal in South Africa, but it’s not the Wild West. You have to play by the rules. Think of it like driving a car—you're free to drive anywhere, but you still need a valid licence and must obey the traffic laws. It’s the same with forex; regulations are there to protect your money and keep the financial system stable.

The Official Rules for South African Forex Trading

So, let's get straight to it: is forex trading legal in South Africa? The short answer is a resounding yes, but only if you operate within the official legal framework.

These rules aren’t meant to trip you up. They exist to shield you from scams and help maintain economic stability. The most important rule of all is incredibly simple: always trade with a broker licensed by the Financial Sector Conduct Authority (FSCA). The FSCA is the top financial watchdog in the country, and their stamp of approval is non-negotiable.

When a broker has an FSCA licence, it's a clear signal that they’ve met tough standards for fairness, security, and ethical behaviour. It's your best assurance that you’re dealing with a legitimate company and not some fly-by-night operation.

Why Regulation Matters So Much

Choosing a regulated broker is the single most critical decision you'll make as a trader. Unregulated brokers operate in the shadows, outside the law, and offer zero protection for your hard-earned capital. If they decide to vanish with your money, you'll have little to no legal way to get it back.

On the other hand, an FSCA-regulated broker gives you peace of mind with concrete protections:

- Fund Safety: They are legally required to keep your money in separate, segregated bank accounts, completely apart from their own company funds. This means your money can't be used to pay their bills.

- Fair Practices: They have to follow strict rules of conduct, ensuring they treat you fairly and transparently.

- Legal Recourse: If a dispute arises, you have an official, established process for seeking a resolution.

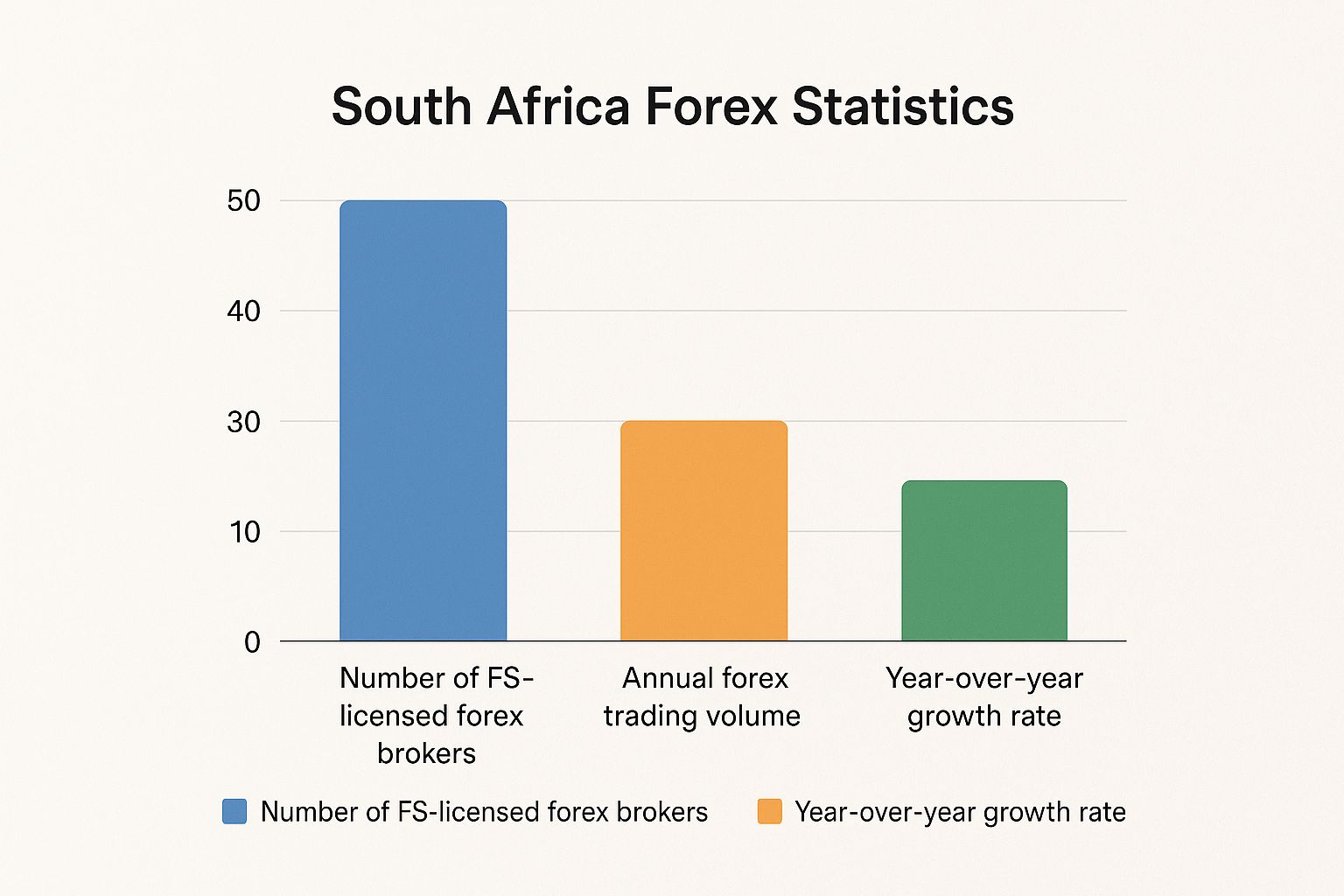

The infographic below really paints a picture of just how significant the regulated forex market has become in South Africa.

This data isn't just numbers; it shows a healthy, growing market built on a solid legal foundation. This foundation is primarily based on the Currency and Exchanges Act of 1933 and the Exchange Control Regulations of 1961.

These long-standing regulations are enforced by the South African Reserve Bank (SARB), which keeps a close eye on money moving in and out of the country. To get a better grasp of this, you can learn more about South Africa's exchange control insights and how it fits into the bigger financial picture.

To make things even clearer, let's break down the difference between trading the right way and the wrong way.

Legal vs Illegal Forex Trading at a Glance

This table summarises the key differences between legal, regulated forex trading and illegal, unregulated activities in South Africa.

| Aspect | Legal & Regulated Trading | Illegal & Unregulated Trading |

|---|---|---|

| Broker Status | Licensed by the FSCA. | No licence or a fake licence from a weak regulator. |

| Fund Safety | Client funds are kept in segregated accounts. | Funds are mixed with company money; high risk of loss. |

| Legal Protection | You have legal recourse through the FSCA or courts. | No legal protection or path to recover lost funds. |

| Transparency | Clear terms, fair pricing, and audited operations. | Hidden fees, manipulated prices, and opaque practices. |

| Capital Transfers | Funds moved through official, SARB-compliant channels. | Often involves suspicious payment methods or P2P transfers. |

| Promotional Claims | Realistic marketing, clear risk warnings. | Promises of guaranteed high returns and "no-risk" trading. |

Ultimately, sticking to the legal path isn't just about following rules—it's about protecting yourself and ensuring you have a fair chance at success in the markets.

Understanding the FSCA and Broker Regulation

If you want to trade legally and safely in South Africa, you first need to get acquainted with the main referee in our financial markets: the Financial Sector Conduct Authority (FSCA).

Think of the FSCA as the guardian of your financial interests. Its entire purpose is to make sure that financial institutions, including forex brokers, play by the rules and operate fairly, efficiently, and transparently. When a broker holds an FSCA licence, it’s far more than just a certificate hanging on their wall. It’s proof that they’ve passed a series of tough tests designed to protect you, the trader.

This official oversight is precisely what separates legal forex trading from a risky gamble.

The Power of an ODP Licence

When it comes to forex brokers that offer derivative products like CFDs (Contracts for Difference), there's a specific licence you need to look out for: the Over-the-Counter Derivative Provider (ODP) licence. This is a critical detail.

An ODP licence isn't just another piece of paper; it's a confirmation that the broker is legally authorised to offer these complex instruments and is held to a very high standard.

Some of these non-negotiable rules include:

- Segregated Client Funds: Your trading capital must be kept in a bank account that is completely separate from the broker’s own company funds. This is a huge safety net, protecting your money if the brokerage ever runs into financial difficulty.

- Sufficient Operating Capital: The broker must maintain a minimum amount of capital on hand. This ensures they can always meet their financial obligations to clients without any issues.

- Fair Business Practices: They are required to have transparent and ethical procedures for everything, from how they execute your trades to how they handle any complaints you might have.

A broker's FSCA licence is your first and most powerful line of defence. It transforms trading from a gamble on a company's integrity into a regulated activity with clear protections and legal recourse.

Getting a feel for these protections is vital. To get a bigger picture of how this kind of oversight works, you can look into strategies for regulatory compliance for banks, which shows just how deep these principles run throughout the financial system.

How to Verify a Broker's Licence

Never, ever just take a broker's word for their regulatory status. You can—and absolutely should—verify it for yourself directly on the FSCA's official website. It’s a simple check that can save you a world of trouble and helps you instantly spot the legitimate players from the potential fraudsters.

Here’s a quick and easy way to do it:

- Visit the FSCA Website: Head over to the official FSCA portal and find their public search tool for authorised Financial Service Providers (FSPs).

- Search for the Broker: You can search using the broker's name, but for a more precise result, use their FSP number. Any reputable broker will have this number clearly displayed on their website.

- Confirm the Details: Once you find them, check that the licence is active. Most importantly, make sure it covers the specific services they are offering you, like CFD or forex trading under an ODP authorisation.

This whole process takes just a few minutes, but the peace of mind it provides is invaluable. It confirms you’re dealing with a broker who is legally allowed to operate in South Africa and is accountable to our top financial regulator.

How SARB Exchange Controls Affect Your Trading

While the FSCA keeps a close eye on the brokers, there's another major player you need to know about: the South African Reserve Bank (SARB). Think of it this way: if the FSCA is the referee on the field, the SARB is the gatekeeper managing the flow of money in and out of the country.

This gatekeeping is done through a system called exchange controls. These aren't some new rules dreamed up overnight; they've been a cornerstone of South Africa's economic strategy for decades, originally designed to prevent a mass exit of capital during uncertain times. For those interested in the backstory, you can dig into the history of South Africa’s exchange control policies and where they came from.

For you as a retail trader, these controls have a very direct impact. They set the legal limits on how much money you can send overseas to fund an international forex account each year.

Your Annual Offshore Allowances

As a South African resident, you have two main allowances to work with. These dictate the total amount you can transfer out of the country for investment purposes—and yes, that includes funding your forex trading account with a broker based abroad.

Here are the two allowances you absolutely must know:

- Single Discretionary Allowance (SDA): This is your first port of call. It lets you send up to R1 million offshore every calendar year without needing any special paperwork from SARS. For most retail traders, this is more than enough and it's the simplest way to get started.

- Foreign Investment Allowance (FIA): If you're looking to move a larger sum, the FIA gives you an additional R10 million allowance per year. The catch? You'll need to get a Tax Clearance Certificate from SARS to prove your tax affairs are all in order before you can use it.

Let me be clear: understanding these allowances isn't just a good idea, it's a legal must-have for any South African trading with an international broker. Pushing past these limits without the right approvals is a serious violation of exchange control regulations.

Staying on the Right Side of the SARB

So, how does this all work in the real world? It's actually more straightforward than it sounds. When you're ready to fund that overseas account, you'll almost always do it through your local South African bank.

Your bank is an authorised dealer for the SARB, which means they handle the nuts and bolts of the transfer. They'll ask you what the money is for and keep a running tally of your transfers against your annual SDA limit. This is how every rand sent offshore is tracked and kept compliant.

Sticking to these rules is fundamental to answering the question, "Is forex trading legal in South Africa?" By respecting the SARB's exchange controls, you're making sure your trading activities are fully above board, leaving you free to focus on the markets without any legal worries hanging over your head.

Your Tax Responsibilities with SARS

Making money in the forex market is one thing; keeping it is another. For every successful trader, there's a not-so-silent partner: the South African Revenue Service (SARS). Many new traders get so caught up in charts and pips that they forget this crucial piece of the puzzle.

Let’s be clear: any profit you make from forex trading is considered taxable income in South Africa. It’s not a grey area. Failing to declare your gains can land you in some seriously hot water, with penalties and interest that can wipe out your hard-earned profits.

Think of it just like any other income. You wouldn't expect to get your salary without paying tax, and trading profits are no different. Getting your head around your tax duties from the very start is non-negotiable for anyone serious about trading legally and sustainably.

How Forex Profits Are Taxed

For the vast majority of retail traders in South Africa, forex profits are simply treated as income tax. This means at the end of the tax year, you add up all your net trading profits and include them with your other income, like your salary.

Your total income then determines which tax bracket you fall into. The more you earn overall, the higher the rate you'll pay on those trading profits. It’s that straightforward.

This is why keeping meticulous records is an absolute must. It's not just good admin; it's a legal requirement to back up the numbers you report to SARS.

Your trading journal should have everything:

- Date and time of every trade

- The currency pair you traded

- Your entry and exit prices

- The size of your position

- The final profit or loss, converted to Rands

This detailed log is your evidence. It shows SARS precisely how you calculated your final profit or loss for the tax year, leaving no room for questions.

Hobby Trader vs a Trading Business

The way SARS views your trading activity—as a casual hobby or a proper business—can also have a big impact on your tax bill, especially when it comes to losses.

The real test for SARS often boils down to your intent, frequency, and whether you have a systematic approach. If you’re trading consistently with a clear strategy to make money, they’re likely to see it as a business.

Let's break down the two scenarios:

- Trading as a Hobby: If you're just dipping your toes in the market occasionally and it’s not your main source of income, SARS will probably classify it as speculative. You still have to declare every cent of profit. The catch? You generally can’t use your trading losses to reduce your taxable income from other sources, like your job.

- Trading as a Business: If you're a full-time trader with a formal business plan and trading is your primary way of making a living, you might be seen as a professional. The big advantage here is that you can often deduct your trading losses from your profits and even carry losses forward to offset future gains.

No matter which boat you're in, one thing is certain: profits must be declared. Staying on the right side of SARS is the only way to ensure your trading success is both profitable and legal.

How to Choose a Safe and Legal Forex Broker

Alright, you've got a handle on the rules of the road. Now for the most important decision you'll make as a trader: picking a broker you can actually trust. This single choice is what separates trading legally within the regulated framework from straying into risky territory.

Forget the flashy ads promising the world. This is about doing your homework to protect your hard-earned money and ensure you're getting a fair shake. The process starts with one simple, non-negotiable question.

Your Non-Negotiable Starting Point: FSCA Regulation

Before you even think about spreads, leverage, or fancy trading platforms, your first move is to verify the broker's regulatory status. Is this broker licensed by the FSCA? As we've discussed, this is the gold standard for operating legally in South Africa.

Think of an FSCA licence—especially an ODP authorisation—as your first line of defence. It confirms the broker is being watched and held to a high standard, filtering out the vast majority of scams from the get-go. But that's just the start.

Beyond the Licence: Finding the Right Fit

Once you’ve confirmed their FSCA licence number, you can start digging into the details that will shape your day-to-day trading experience. A broker might be legal, but that doesn't automatically make them a good fit for you.

Here’s what else to put under the microscope:

- User-Friendly Platforms: Is their trading software intuitive or a complete headache? Look for industry-standard platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which are known for their reliability and robust tools.

- Competitive Fees: What are their spreads (the gap between the buy and sell price) and commissions? Sneaky, high fees are a silent killer of profits. Transparency here is key.

- Local Support: Can you get help from a real person during South African business hours? When things go wrong, you don’t want to be stuck waiting for a response from a different time zone.

- Convenient Funding: Do they support local payment methods, like EFTs from South African banks? This makes getting your money in and out of the account infinitely simpler and faster.

Choosing a broker is like hiring a business partner. Their reliability, transparency, and support directly impact your potential for success. Never rush this decision; due diligence is your best investment.

A Quick Checklist for Your Broker Hunt

To make things easier, use this checklist as you compare different brokers. It helps you systematically evaluate each option to ensure you cover all the critical bases.

Broker Selection Checklist

| Criteria | What to Look For | Why It Matters |

|---|---|---|

| Regulation | An active FSCA licence number (check their website and the FSCA's public register). | This is your primary safeguard against fraud and ensures the broker operates legally in South Africa. |

| Trading Costs | Low, transparent spreads and commissions. Look for a clear fee schedule. | High costs directly reduce your profitability on every trade. |

| Platform Stability | Reliable, well-known platforms like MT4/MT5 with minimal downtime. | A platform that freezes or crashes at a critical moment can lead to significant losses. |

| Customer Support | Local phone number, live chat, and email support available during ZA business hours. | You need accessible and helpful support when you encounter technical or account issues. |

| Funding Methods | Support for local bank EFTs, debit/credit cards, and other convenient options. | Easy deposits and, more importantly, fast withdrawals are crucial for managing your capital. |

| Reputation | Positive user reviews on independent sites and a long history of operation. | A broker's track record and what other traders say about them reveals a lot about their integrity. |

Taking the time to tick these boxes will give you peace of mind, knowing your chosen partner is not only compliant but also well-suited to help you on your trading journey.

Considering International Brokers

It’s perfectly legal for South Africans to use an international broker, and many traders do. If you go this route, however, you must play by the SARB's exchange control rules. This means funding your account using your Single Discretionary Allowance (SDA) of up to R1 million or your Foreign Investment Allowance (FIA) of up to R10 million.

Crucially, ensure any offshore broker is regulated by another top-tier authority, like the UK’s Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). This adds a powerful layer of protection, even without local FSCA oversight.

A huge part of this selection process comes down to risk. A good broker provides the tools, but you still need to know how to use them. A solid foundation in mastering risk management in trading is just as important as picking the right platform. By combining a reputable broker with smart trading habits, you set yourself up for a much safer and more sustainable experience.

Spotting and Steering Clear of Forex Scams

Knowing the legal lay of the land is your first line of defence, but it’s just as important to know what a scam looks like from a mile away. The forex market is a legitimate place to trade, but its sheer size and complexity unfortunately attract a host of scammers looking to prey on eager traders in South Africa.

The biggest, brightest red flag you'll ever see is the promise of guaranteed, sky-high, or just plain unrealistic profits. Let's be clear: real trading always involves risk. Anyone who tells you differently isn't offering an investment strategy; they're selling you a fairy tale. Often, they’ll crank up the pressure, making you feel like you have to deposit money right now or miss out on a "once-in-a-lifetime" opportunity.

Schemes That Pop Up Time and Again

Scammers can be clever, but their tricks tend to follow a few familiar scripts. You need to be especially cautious when you encounter these common tactics:

The "Expert" Account Manager: This is where someone gets in touch, offering to trade on your behalf for a cut of the profits. They'll ask for your account login details—something a real broker would never do—which gives them total control to drain your funds.

Dodgy Signal Sellers: These services lure you in with promises of "expert" trading signals that can supposedly predict the market's every move, all for a hefty subscription fee. The reality is that these signals are usually vague, unreliable, or just made up.

Pyramid and Ponzi Schemes: These are often cleverly disguised as investment seminars, educational courses, or multi-level marketing setups. The returns don't come from actual trading; they come from recruiting new people into the scheme. Eventually, the whole thing comes crashing down, and the newest investors lose everything.

If there's one golden rule in forex, it's this: if it sounds too good to be true, it absolutely is. A healthy dose of scepticism is your best friend when you're looking at online financial offers.

The best way to protect yourself is to always press pause and do your own homework. Never, ever share your trading account password or personal banking information with anyone. Double-check every claim, especially when it involves promises of fast, easy money. If you approach every offer with caution and stick with regulated brokers, you can trade with confidence and easily sidestep the traps laid by con artists.

Got Questions? We've Got Answers

Even when you think you've got the rules down, a few specific questions always pop up. Let's tackle some of the most common queries we hear from South African traders about keeping their forex activities above board.

Do I Really Need a Licence to Trade Forex Myself?

Nope, you don't. As an individual retail trader in South Africa, you don't need to go out and get a special licence to trade. The onus is on the professionals—the brokers and financial institutions offering trading services are the ones who need to be licensed.

Your job is to tick three crucial boxes: First, make sure you're trading with a broker that has the FSCA's stamp of approval. Second, declare all your profits to SARS because, yes, they are taxable. Finally, stick to the South African Reserve Bank's (SARB) exchange control rules whenever you're moving money offshore.

Is It Okay to Use an International Broker?

Absolutely. It's completely legal to use an international broker that isn't regulated by the FSCA. In fact, many South Africans do just that, often looking to brokers regulated by other heavyweights like the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) to access different trading platforms or better spreads.

The key thing to remember is that when you fund these offshore accounts, you're playing by South Africa's exchange control rules. This means you'll use your R1 million Single Discretionary Allowance (SDA) or, for larger amounts, your R10 million Foreign Investment Allowance (FIA). You have to process these transfers through an authorised dealer, which is usually just your local bank.

A word of caution: dealing with completely unregulated brokers is a massive gamble. You could lose every cent with zero legal protection or a way to get it back. On top of that, SARS still expects its cut of any profits, and not declaring them can land you in hot water with hefty fines and legal trouble. It's always smarter and safer to stick with regulated players.

Protecting your capital goes beyond just avoiding scams. Mastering effective investment risk management is a non-negotiable skill for anyone serious about trading. It gives you a solid foundation to make smarter decisions across the board, from picking a broker to managing your open positions.

At Zaro, we make international finance simple for South African businesses. If your company is tired of hidden fees and wants the real exchange rate for global payments, see how we can save you time and money. Find out more about our transparent cross-border payment solutions at https://www.usezaro.com.