Before you can even think about trading forex, you've got to wrap your head around what it actually is. It's not just numbers on a screen; it's the massive, global marketplace where national currencies are traded against one another. The value of these currencies is constantly shifting based on everything from economic reports and interest rate decisions to political stability. Getting a grip on the fundamentals—things like currency pairs, pips, and lots—is your non-negotiable first step.

Your First Steps into the Forex Market

Welcome to the world of foreign exchange, or forex (FX) as it’s better known. This is, without a doubt, the biggest financial market on the planet. To put it in perspective, the daily trading volume regularly blows past $7.5 trillion.

Unlike the stock market, which has centralised exchanges like the JSE, the forex market is completely decentralised. It’s an over-the-counter (OTC) network of banks, institutions, and traders, all connected electronically. This global nature means it runs 24 hours a day, five days a week, following the sun from Sydney to New York.

At its heart, forex trading is simply buying one currency while selling another at the same time. You’re speculating that the currency you buy will increase in value relative to the one you sell. It’s this constant tug-of-war between currency values that creates opportunities for traders.

Who’s Actually Trading in the Market?

It’s easy to think of forex as just individual traders like us trying to make a profit, but we're a very small part of the picture. The real heavy-hitters are the ones moving the market.

- Central Banks: These are the big guns. Think of the South African Reserve Bank (SARB) or the US Federal Reserve. They manage their country’s currency and interest rates, and when they make a policy announcement, the market listens—and reacts, often dramatically.

- Major Commercial Banks: Giants like Citibank and Deutsche Bank are the backbone of the market. They trade colossal amounts for their clients and themselves, creating what’s known as the interbank market, where the bulk of the action happens.

- Multinational Corporations: Any company doing business across borders—from a tech giant to an importer—has to exchange currencies to pay for supplies or repatriate profits. Their combined activity creates real supply and demand.

- Retail Traders: That’s you and me. We access the market through brokers, speculating on currency movements with our own capital.

Getting to Grips with Pairs, Pips, and Lots

In forex, you never just trade a single currency. You're always trading a currency pair, comparing the value of one currency against another. Some popular examples are the Euro vs the US Dollar (EUR/USD) or the US Dollar vs our South African Rand (USD/ZAR).

The first currency in the pair is called the base currency, and the second is the quote currency. The exchange rate simply tells you how much of the quote currency you need to buy one unit of the base. If the USD/ZAR rate is 18.5000, it means you need R18.50 to buy one US dollar.

Price changes are measured in tiny increments called "pips" (Percentage in Point). For most currency pairs, a pip is the fourth decimal place (0.0001). With Rand pairs, however, a pip is usually the second decimal place (0.01). So, if USD/ZAR moves from 18.50 to 18.51, that's a one-pip move.

Finally, the size of your trade is measured in lots. The industry standard is a standard lot, which is 100,000 units of the base currency. That’s a lot for a beginner, which is why most people start with mini lots (10,000 units) or even micro lots (1,000 units). Starting small is crucial for managing your risk while you're still learning the ropes.

Choosing Your Broker and Trading Platform in South Africa

Picking the right broker is probably one of the most critical decisions you'll make on your trading journey. Think of it this way: this is the company you're trusting with your trading capital and your access to the markets. Reliability isn't just a nice-to-have; it's everything.

For anyone trading in South Africa, your first filter should always be regulation. The only thing that matters here is whether the broker is authorised by the Financial Sector Conduct Authority (FSCA). This is your number one layer of protection. An FSCA licence means the broker has to play by the rules, including keeping your money in a separate bank account from their own operational funds. This is called segregation of client funds, and it protects you if the brokerage firm ever runs into financial trouble.

Before you even consider opening an account, find the broker's FSCA licence number on their website and verify it on the official FSCA portal. It takes two minutes and can save you a world of pain later.

Finding the Right Account Type for You

Once you have a shortlist of properly regulated brokers, the next thing you'll see is a menu of different account types. They aren't all the same, and they're built for traders with different goals, experience levels, and, frankly, different amounts of starting capital.

Here’s a quick rundown of what you’ll typically find:

- Micro Accounts: If you're just starting out, this is where you should be looking. These accounts let you trade with tiny contract sizes (called micro-lots), which means the money you're risking on each trade is much smaller. It's the perfect way to get a real feel for the live market without betting the farm.

- Standard Accounts: This is the workhorse account for most retail traders. You can trade standard contract sizes (100,000 currency units) but still have the flexibility to trade smaller mini and micro lots. The pricing is usually straightforward, with the broker's fee built into the spread you see on your screen.

- ECN (Electronic Communication Network) Accounts: These are geared towards more seasoned traders. ECN accounts plug you directly into the network of big banks, which means you often get much tighter spreads. The catch? You'll pay a small, fixed commission on every trade you open and close.

Don't let ego drive your decision. Starting with a micro account is the smart play. It lets you learn the ropes with minimal risk. You can always upgrade later.

Trader's Tip: Don't get fixated on just the spreads. Look at the all-in cost. That includes things like overnight swap fees (the cost of holding a trade open past the market close) and any charges for depositing or withdrawing your money. These little costs nibble away at your profits over time.

Navigating the Account Opening Process

Opening a trading account isn't like signing up for a social media profile; it's more like opening a bank account. Brokers are legally required to verify who you are to prevent things like money laundering. This is known as Know Your Customer (KYC).

You'll need to have a couple of documents ready to upload. It's usually a smooth process if you have everything on hand:

- Proof of Identity: A clear photo or scan of your South African ID book/card or your passport.

- Proof of Residence: A recent utility bill (like an Eskom or municipal account) or a bank statement. The key is that it must be less than three months old and clearly show your full name and physical address.

Verification typically takes a day or two. Once you get the green light, you can fund your account and you're ready to access the platform.

Your Cockpit: The Trading Platform

The trading platform is your command centre. It's the software where you'll analyse price charts, plan your trades, and hit the 'buy' or 'sell' button.

In the world of retail forex, two names dominate: MetaTrader 4 (MT4) and its younger, more powerful sibling, MetaTrader 5 (MT5). Most good brokers will offer you a choice of both.

While MT5 is technically more advanced with more chart timeframes and built-in indicators, MT4 is still massively popular. Why? Because it’s simple, robust, and has a gigantic ecosystem of custom-built tools and automated trading robots (known as Expert Advisors) that have been developed for it over nearly two decades.

No matter which one you choose, your first port of call is the demo account. This is non-negotiable. A demo account lets you trade with virtual money on the real, live market feed. Get in there and get your hands dirty. Learn how to place an order, how to set a stop-loss, how to add an indicator to your chart, and how to customise the layout. Make your first hundred trades in this risk-free environment. It’s an invaluable education.

Getting to Grips with Orders, Leverage, and Risk

So, you've found your way around the trading platform. Fantastic. Now it's time to move beyond simply mashing the ‘buy’ or ‘sell’ button. Real trading starts when you understand how to control your entries and exits with precision, and most importantly, how to manage your risk. This is the stuff that separates serious traders from gamblers.

Placing a trade isn't a one-size-fits-all deal. Your platform is packed with different order types, which are basically your tools for telling the broker exactly how and when to get you in or out of the market. Getting these down is non-negotiable if you want to execute any real strategy.

The most straightforward is the Market Order. You hit the button, and your broker executes the trade instantly at the best price available at that very second. It's perfect for those moments when you see a perfect setup and just need to get in now. The only catch is slippage—in a fast-moving market, the price you actually get might be slightly different from the one you saw on your screen a split-second ago.

Planning Your Moves with Limit and Stop Orders

For those who can't (or don't want to) stare at charts all day, there are more strategic ways to enter the market. This is where you start to plan your trades in advance.

Limit Orders: Think of a Limit Order as setting your ideal price. You tell your broker, "I only want to buy or sell if the price hits this specific level." A Buy Limit is placed below the current market price, while a Sell Limit goes above it. Say USD/ZAR is trading at 18.50, but your analysis suggests it will dip to 18.40 before climbing. You can set a Buy Limit at 18.40, and your trade will trigger automatically if and when the market gets there.

Stop Orders: A Stop Order is for catching momentum. It’s designed to get you into a trade once the price breaks through a key level. A Buy Stop is placed above the current price, and a Sell Stop is placed below it. This is a classic tool for breakout traders who want confirmation that a currency pair is really on the move before they commit.

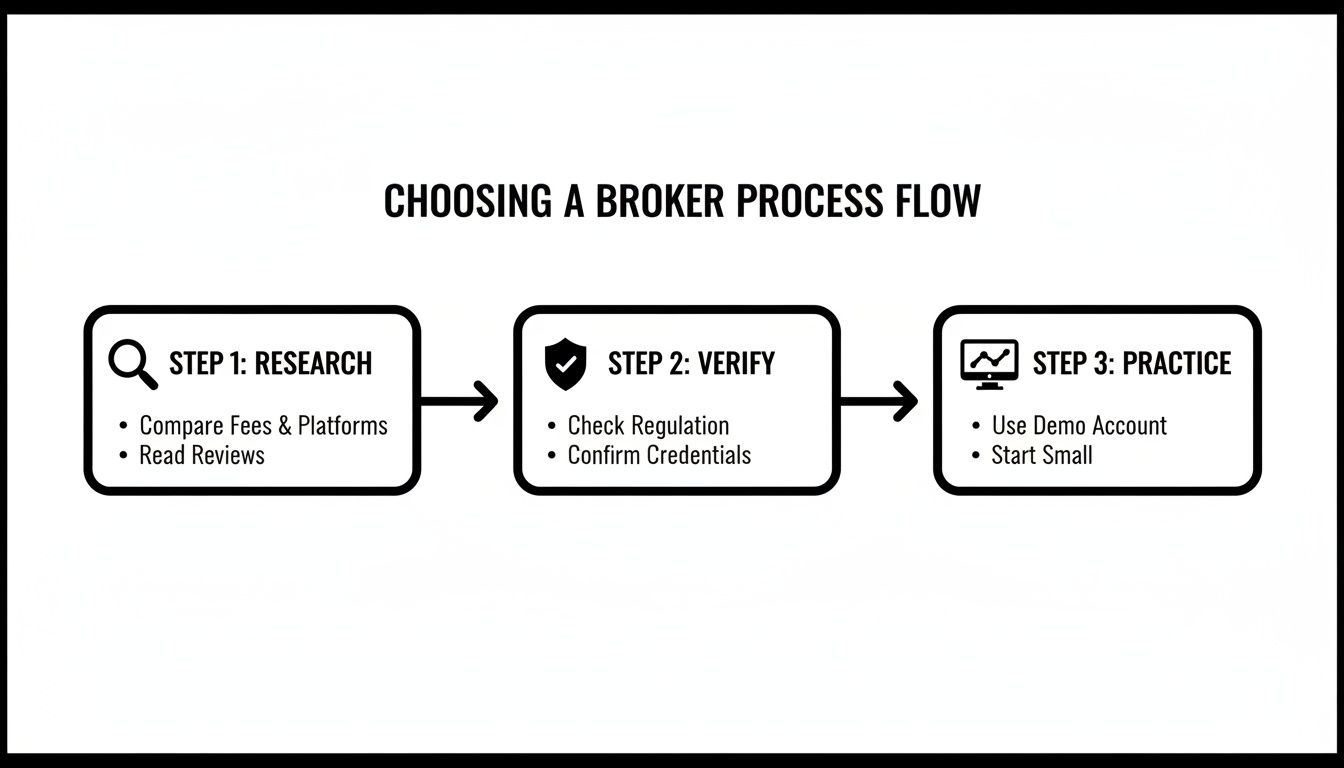

This whole process—from research to practice—is a structured journey. It's not just about clicking buttons.

As you can see, mastering your trade orders is just one piece of a much larger, more disciplined puzzle you need to solve before putting real money on the line.

That Double-Edged Sword: Leverage and Margin

Ah, leverage. It's probably the most exciting and dangerous concept in forex. In simple terms, it's a loan from your broker that lets you control a large position with a relatively small amount of your own cash. For instance, with 100:1 leverage, you could control a R100,000 position with just R1,000 from your account.

That R1,000 is your margin. It's not a fee; it's a good-faith deposit your broker holds to keep your trade open. Leverage is incredible because it can amplify your profits from tiny price moves. But—and this is a big but—it’s a double-edged sword. It magnifies your losses just as viciously.

A small market move against you can easily wipe out your entire margin. This triggers a margin call, where the broker automatically closes your losing trades to protect themselves. Treat high leverage as a powerful tool, not a target. Using it wisely is crucial for survival.

The Absolute Cornerstone of Trading: Risk Management

If I could drill one thing into every new trader's head, it would be this: risk management is everything. It isn't about trying to avoid losses—losses are a normal and unavoidable part of the business. It’s about making sure that no single trade, or even a string of bad trades, can knock you out of the game for good.

Your two most critical tools here are the Stop-Loss and Take-Profit orders.

- A Stop-Loss (SL) is an order you set at a specific price to automatically close a losing trade. It’s your safety net, your emergency brake.

- A Take-Profit (TP) is the happy opposite. It automatically closes a winning trade when it hits your price target, locking in those profits before the market has a chance to turn around.

A huge part of this is learning how to set stop losses properly, as it defines your maximum risk on any trade before you even click "buy."

This brings us to the most important rule in trading: The 1-2% Rule. It’s simple: never risk more than 1% to 2% of your total trading capital on a single trade. If you have a R10,000 account, your maximum acceptable loss on any given trade should be between R100 and R200. Period.

This simple rule forces you to think before you trade, calculate your position size properly, and protect your capital with discipline. It's what makes trading sustainable, allowing you to weather the inevitable losing streaks and stay in the market long enough to actually learn, improve, and eventually find consistent success.

Building Your First Forex Trading Strategy

Think of a trading strategy as your personal roadmap through the markets. It’s a set of rules you create to stop yourself from guessing or making emotional decisions. It dictates what you trade, but more importantly, when and how you get in and out of a position. This framework is what keeps you disciplined when the market noise gets overwhelming.

A lot of newcomers get stuck here, thinking they need some secret, complex formula to succeed. The truth? The best strategies, especially when you're starting out, are often the simplest. Sticking to a basic, logical plan consistently will serve you far better than a "perfect" but complicated strategy that you can't actually follow under pressure.

For anyone keen to learn how to trade forex, the local South African market is a great place to start. It's the undisputed forex trading hub of the continent, with daily trading volumes hitting over $2.21 billion. This incredible activity, generated by an estimated 190,000 daily traders, means there are plenty of opportunities for a well-thought-out strategy. You can read more about South Africa's leading role in the African forex market to understand the scale.

An Introduction to Technical Analysis

Most beginner strategies are built on a foundation of technical analysis. This is essentially the art of reading price charts to find patterns and trends, which can help you make an educated guess about where the market might be heading next. The core belief is simple: all the news, data, and sentiment is already baked into the price you see on your screen.

Understanding how to interpret charts is a huge part of developing your strategy. For a deeper dive, this comprehensive guide to technical analysis in trading is a fantastic starting point.

Two Simple Strategies to Get You Started

To show you what this looks like in practice, let's walk through two of the most common and effective strategies for new traders. They are straightforward, logical, and provide a solid base to build upon.

| Beginner Forex Strategy Comparison | | :--- | :--- | :--- | | Strategy Feature | Trend Following | Support & Resistance | | Core Concept | Identify the market's main direction and trade with it. "The trend is your friend." | Identify key price levels where the market has previously reversed. | | Ideal Market | A market that is clearly moving up or down over time (trending). | A market that is moving sideways or in a predictable range (ranging). | | Key Indicators | Moving Averages (e.g., 20-period and 50-period crossover). | Horizontal lines drawn at historical price peaks (resistance) and troughs (support). |

These approaches give you a clear-cut way to analyse the market instead of just reacting to random price movements.

Trend Following with Moving Averages

One of the most intuitive ways to trade is trend following. The idea is dead simple: figure out which way the market is moving and jump on board. You're not trying to pick the exact top or bottom; you're just riding the wave for as long as it lasts.

A brilliant tool for this is the moving average (MA). It smooths out all the jerky price action into a single, flowing line, making the underlying trend much easier to spot. A classic technique involves using two MAs: a "fast" one (like a 20-period) and a "slow" one (like a 50-period).

- Buy Signal: When the faster MA crosses above the slower one, it can be a sign that an uptrend is starting.

- Sell Signal: When the faster MA crosses below the slower one, it often indicates a new downtrend is taking shape.

Trading Support and Resistance

Another foundational strategy revolves around support and resistance levels. These are just horizontal areas on your chart where the price has repeatedly stalled or reversed in the past.

- Support: Think of this as a floor. It’s a price level where buyers have historically stepped in, stopping a downtrend and pushing the price back up.

- Resistance: This acts like a ceiling. It’s a level where sellers have tended to take control, halting an uptrend.

The basic strategy is to buy when the price nears a solid support level (betting on a bounce) or to sell near strong resistance (expecting it to be rejected again). You can also trade the breakout—for instance, if the price smashes through a resistance level, that old ceiling might just become the new floor (support).

Trader's Tip: The real magic happens when you combine strategies. For example, if your moving averages confirm a strong uptrend, you could then wait for the price to pull back to a known support level to find a high-probability entry point.

Creating Your Personal Trading Plan

A strategy tells you what to look for in the market, but a trading plan is all about you. It's your personal rulebook that governs every single action you take. This is what separates professional, disciplined trading from gambling.

Your plan absolutely must define:

- Which currency pairs you’ll trade: Don't try to watch everything. Focus on a few pairs you understand, like USD/ZAR or EUR/USD.

- What timeframes you’ll analyse: Are you a day trader on the 1-hour chart or a swing trader using the daily chart?

- Your exact entry criteria: What specific conditions must be met? (e.g., "The 20 MA must cross above the 50 MA on the 4-hour chart.")

- Your exact exit criteria: How do you get out? This means your Stop-Loss for losing trades and your Take-Profit target for winners.

- Your risk management rules: How much capital will you risk per trade? The 1-2% rule is non-negotiable.

Writing this down isn't optional. It forces you to think clearly and holds you accountable. When you’re in a live trade with real money on the line and your heart is pounding, you don’t have time to think—you just follow the plan. That’s how you build consistency.

Taking the Plunge: From Demo to Live Trading

Making the leap from a demo account to a live trading environment is a massive milestone. It's less about the mechanics—you already know how to place a trade—and far more about getting your head in the game. The safety net of virtual money is gone, and suddenly, every pip movement feels personal because your own hard-earned capital is on the line.

A demo account is a fantastic tool, but only if you use it the right way. The aim isn't to rack up a massive imaginary balance by taking wild, unrealistic risks. Think of it as a flight simulator. Your job is to consistently follow your trading plan, drill your risk management rules, and get so comfortable with your platform that it becomes second nature. Aim to take at least 50-100 trades in your demo account, sticking to your strategy without deviation.

The Psychology of Real Money

The second you switch to a live account, the rules of the game change entirely. Two powerful emotions that were probably sleeping during your demo trading will wake up with a jolt: fear and greed.

Fear can make you freeze up on a perfect trade setup or cut a winning trade way too soon, terrified of letting a small profit slip away. Greed is just as dangerous. It's the little voice that tells you to hold onto a losing trade "just in case" it turns around, or to double down after a few wins because you feel invincible. Simply being aware that these emotions are coming is half the battle.

The biggest shock for new live traders is how a loss actually feels. Losing R500 of real money is a completely different experience from losing R500 in a demo. Your discipline will be tested in ways a demo account can never truly prepare you for.

This emotional rollercoaster is precisely why you need a plan for the transition. You don't just want to flip a switch; you want to slowly wade into the live market.

How to Transition Like a Pro

Jumping straight from a demo account into a full-sized standard account is often a recipe for a blown account. The smarter play is to ease into the live environment with a small amount of money you are genuinely okay with losing.

Here’s a practical approach:

- Start with a Micro or Cent Account: Open a live account with the smallest deposit your broker allows. This lets you trade with micro-lots, where each pip is worth a tiny fraction of a standard lot. You get the full psychological experience without risking significant capital.

- Focus on Process, Not Profits: Forget about making money for your first month. Seriously. Your only goal should be to execute your trading plan perfectly. Did you stick to your 1% risk rule on every single trade? Did you take every valid setup your strategy gave you? That’s your new measure of success.

- Keep a Detailed Trading Journal: Write everything down. Log your reasons for entering a trade, how you were feeling, and the final outcome. This journal will become your best trading coach, highlighting your psychological triggers and weak spots in your strategy.

This gradual approach builds the two things you really need: real-world confidence and steel-plated discipline. The timing couldn't be better, as the opportunity within South Africa's financial markets is growing. The local foreign exchange market was valued at USD 3,861.60 million in 2024 and is expected to climb to USD 6,852.50 million by 2033. This growth, detailed in South Africa's FX market growth report on imarcgroup.com, shows just how relevant forex is becoming for both individuals and businesses. By mastering the psychological jump from demo to live, you’re setting yourself up to participate in this dynamic market with your eyes wide open.

Business FX Needs vs. Speculative Trading

It’s crucial to understand the massive difference between trading forex as an individual and managing foreign exchange for a business. They both happen in the same market, but their goals are worlds apart.

When you learn how to trade forex, you're stepping into the ring as a speculator. Your goal is to profit from the constant ebb and flow of currency prices.

A business, on the other hand, isn't speculating—it's operating. A South African company importing parts from China or paying a software subscription in US Dollars isn't trying to make a profit on the exchange rate. They’re simply trying to protect their bottom line. For them, currency volatility is a direct threat to their profitability, not an exciting opportunity.

From Speculation to Cost Management

Think of it this way: a retail trader spends hours staring at charts, trying to predict the next move in the USD/ZAR pair. A business owner just needs to settle a $50,000 invoice without losing a small fortune to a bad exchange rate or surprise fees from their bank.

Their focus is on predictability, not pips.

This is exactly where a service like Zaro comes in, and it's built specifically for South African businesses. Zaro isn't a trading platform; it's a payments and FX solution designed to cut costs and remove uncertainty from international business.

The core difference comes down to intent. Traders actively take on risk hoping for a profit. Businesses use FX management to get rid of risk and shield their budgets from currency chaos.

For any business, the best exchange rate is the real one. Zaro gives businesses access to the real spot exchange rate with zero spread and no hidden markups. This ensures that when they make an international payment, they aren't losing money unnecessarily.

By using multi-currency accounts, a company can hold, send, and receive money in different currencies. This gives them the power to pay suppliers or get paid by clients without being forced into a currency conversion at a terrible time. It turns foreign exchange from a risk into a straightforward part of doing business.

Got Questions About Forex Trading? We’ve Got Answers.

Stepping into the world of forex trading naturally comes with a lot of questions, especially if you're based in South Africa. Let's tackle some of the most common ones to give you the clarity you need to start with confidence.

How Much Money Do I Need to Start Trading Forex?

This is probably the first question on everyone's mind, and the answer might surprise you. Technically, you can get started with very little. Many regulated brokers offer micro or cent accounts that you can open with as little as R200.

But let's be realistic. The real question isn't what's the minimum, but what's a sensible amount to start with. A more practical starting capital is somewhere in the R2,000 to R5,000 range. This gives you enough room to breathe—you can apply proper risk management principles without your positions being so tiny that they're meaningless, yet it's not so much money that a few early mistakes will cause serious financial stress.

Is Forex Trading Taxable in South Africa?

Yes, it absolutely is. Any profits you make from forex trading are considered income and are taxable in South Africa. The South African Revenue Service (SARS) will treat these earnings as either personal income or business income, which usually depends on how often you trade and what your intentions are.

It’s vital to keep meticulous records of every single trade you make—the winners and the losers. I can't stress this enough: speak to a qualified tax professional in South Africa. They'll make sure you're compliant and help you file your returns correctly.

Expert Tip: Start treating your trading like a business from the very first day. This mindset shift includes diligent record-keeping for tax season, which will save you a world of trouble later on.

How Long Does It Take to Learn How to Trade Forex?

Think of learning to trade as a marathon, not a sprint. You can pick up the fundamentals—how to read a chart, place an order, understand the jargon—within a few weeks. But that’s just the beginning.

Achieving consistent profitability is a whole different ball game. It’s a long-term process of mastering your strategy, refining your risk management, and, most critically, conquering your own trading psychology. For most aspiring traders, it takes at least one to two years of serious dedication, consistent practice, and continuous learning to find their footing. Don't look for shortcuts; they don't exist. Success is built on disciplined effort over a long period.

For South African businesses, foreign exchange isn't about speculation—it's about protecting your profits from currency swings. Zaro offers a completely different approach with transparent, fee-free international payments at the real exchange rate. This helps you slash costs and manage currency risk without the guesswork. See how much you can save on your next global payment at https://www.usezaro.com.