Think of the live exchange rate as the "at-cost" price for a currency. It's the raw, wholesale rate that big banks and financial institutions use when they trade massive amounts with each other, before anyone adds a single cent of markup.

When you Google "USD to ZAR" or see a rate flash across a financial news channel, that's what you're looking at—the purest reflection of what one currency is worth against another at that exact second.

What Is The Live Exchange Rate And Why Does It Matter?

It’s a bit like buying fruit directly from the farm instead of from a fancy grocery store. The price at the farm gate is the true wholesale cost. By the time that same fruit lands on the store shelf, a markup has been added to cover transport, staffing, and, of course, profit.

The live exchange rate is the financial world's farm-gate price.

Also known as the mid-market rate, it represents the exact midpoint between what buyers are willing to pay (the "bid" price) and what sellers are asking for (the "ask" price) on the global currency markets. It’s the fairest, most accurate rate out there, and it’s always on the move, driven by real-time supply and demand. For any South African business trading internationally, this isn't just theory—it’s the foundation of your financial stability.

The Hidden Cost of a Bad Rate

Here’s the catch: when your business sends or receives money internationally through a traditional bank, you almost never get the live exchange rate. Instead, you're given a 'retail' rate, which quietly includes the bank's markup, often called the "spread." This spread is pure profit for the bank, and it can eat away at your bottom line without you even noticing.

Let’s run through a quick example. Imagine you need to pay an invoice for $50,000 to an overseas supplier.

- The Live Exchange Rate (USD/ZAR) is 18.50.

- Your bank's Retail Rate, with a 3% spread, is 19.05.

At the live rate, the payment should cost you R925,000. But using the bank's inflated rate, that same invoice suddenly costs R952,500.

That’s a difference of R27,500—a hidden fee that vanishes from your account on a single transaction. Now, imagine that cost multiplying across dozens of supplier payments, repatriated profits, and other international transfers throughout the year. It adds up, fast.

For South African SMEs, a seemingly tiny percentage difference between the live rate and a bank's retail rate can quietly siphon off thousands of Rands from your revenue. This directly impacts your cash flow, profitability, and your ability to forecast with any real accuracy.

Live Rate Vs Bank Rate: A Quick Comparison

To see the difference clearly, let's break down how these two rates stack up against each other. The live rate is the benchmark for fairness, while the bank rate is what most businesses have historically been forced to accept.

| Feature | Live Exchange Rate (Mid-Market Rate) | Traditional Bank Rate (Retail Rate) |

|---|---|---|

| Source | The direct midpoint of global buy/sell orders. | The mid-market rate plus a variable markup (spread). |

| Transparency | Fully transparent. It's the "true" rate. | Opaque. The markup is rarely disclosed upfront. |

| Cost | The lowest possible rate before any fees are added. | Always more expensive due to the hidden spread. |

| Accessibility | Historically for large institutions; now accessible via platforms like Zaro. | Standard for consumers and SMEs at most banks. |

| Predictability | High. You see the real cost in real-time. | Low. The final cost is often a surprise. |

Understanding this table is the first step towards taking control of your international payments. You can either accept the hidden costs or seek out a solution that gives you access to the real rate.

Why Transparency Creates Predictability

Getting access to the live exchange rate is about much more than just saving money on one deal. It's about bringing much-needed transparency and predictability to your entire international operation.

When you work with the mid-market rate, you eliminate the guesswork. You know exactly what your foreign currency transactions are going to cost, which makes budgeting and financial planning incredibly accurate. This clarity empowers you as a CFO or business owner to make smarter, data-driven decisions.

Instead of trying to budget for vague and unpredictable bank markups, you can focus on what really matters: running your business and navigating market volatility with confidence. That shift from hidden pricing to transparent execution is the key to building a more resilient and profitable global business.

The Hidden Costs Eating Into Your Profits

When you ask a traditional bank for a foreign exchange quote, the number you see isn't the whole story. It’s not the real, live exchange rate. What you’re getting is a retail rate, and it’s been carefully calculated to include the bank’s profit margin. This small, often overlooked difference is where hidden costs start to quietly chip away at your company's bottom line.

The main offender here is the forex spread—the gap between the mid-market rate and the rate you're actually offered. You can think of it as a built-in service fee that’s rarely pointed out. The bank buys currency at the wholesale price (the live rate) and sells it to you at a higher price, keeping the difference for themselves.

It might only look like a few percentage points on paper, but when you're dealing with large international payments, the impact adds up fast. These aren't just minor rounding errors; they're significant costs that directly cut into your profitability.

Seeing the True Cost of a Transaction

On top of the spread, other fees can pile up and inflate the cost of your international payments even more. Many banks use the SWIFT network to send money across borders, and every intermediary bank involved in the chain can take its own cut. These fees are unpredictable and often only show up after the fact, making accurate financial planning a real headache for CFOs.

Let’s run through a quick example to see how this plays out for a South African business.

Scenario: A local Business Process Outsourcing (BPO) company has to pay a $5,000 USD invoice to an international contractor.

To see the real-world difference, let's compare what it would cost using a traditional bank versus a platform that gives you access to the live exchange rate.

- Live Exchange Rate (USD/ZAR): 18.50

- Traditional Bank's Rate (with a 4% spread): 19.24

- Additional SWIFT & Admin Fees: R450

With these figures, we can calculate the true cost difference.

| Metric | Live Rate Fintech Platform | Traditional Bank |

|---|---|---|

| Exchange Rate Applied | 18.50 ZAR per USD | 19.24 ZAR per USD |

| Cost to Buy $5,000 USD | R92,500 | R96,200 |

| Additional Fees | R0 | R450 |

| Total Cost in ZAR | R92,500 | R96,650 |

That's a difference of R4,150 on a single $5,000 payment. It's not just a fee; it's a huge chunk of potential profit lost to an inefficient and cloudy system. For a company making dozens of these payments every year, those hidden costs can easily run into the tens or even hundreds of thousands of Rands.

Volatility Pours Salt on the Wound

This problem gets even worse when you factor in market volatility. The South African Rand has had a rollercoaster year against the US Dollar. The ZAR/USD pair has moved by 16.61%, trading in a wide range that hits both importers and exporters hard. When your business is already trying to manage such wild market swings, the extra burden of hidden bank spreads and fees—which can add another 5-7% in costs—just makes a tough situation tougher. You can explore the historical ZAR volatility on Investing.com to see for yourself.

The lack of transparency in traditional forex services makes cash flow management a constant battle. When you can't predict the final cost of a payment, budgeting becomes guesswork, and profit margins are left vulnerable to surprise charges.

Why This Destroys Financial Predictability

For any CFO or business owner, predictability is everything. You need to know your costs to price your products, manage cash flow, and make smart decisions. Hidden forex costs throw a spanner in the works.

They introduce a variable you can neither control nor accurately forecast. This uncertainty complicates everything, from setting a budget for an overseas marketing campaign to figuring out the final landed cost of imported goods. By sticking with opaque banking partners, businesses are essentially accepting a system that works against their financial stability.

The first step to taking back control is demanding access to the live exchange rate and moving away from providers who profit from keeping you in the dark.

How Real-Time Forex Data Actually Works

That live exchange rate you see flashing on a news ticker or a trading screen doesn't just appear from nowhere. It's the heartbeat of a colossal, decentralised global network where trillions of dollars, euros, yen, and, of course, rands are traded every single day. This rate is the real-time pulse of the global economy, all powered by technology that moves information at nearly the speed of light.

To really get how this data lands on a platform like Zaro, you have to go to the source. The foreign exchange market isn't a physical place like the JSE. It’s a vast, interconnected web of major global banks—the 'Tier 1 liquidity providers'—that are constantly buying and selling currencies from each other. Their combined activity creates the raw buy and sell prices that become the foundation for every live rate you see.

The Role of APIs in Delivering Live Data

So, how does that raw data travel from the global market to your screen in an instant? The magic ingredient is a piece of tech called an Application Programming Interface, or API.

Think of an API as a secure, super-fast messenger. Financial data aggregators plug directly into the feeds from those big global banks. They calculate the mid-market rate and then use an API to deliver that live information straight to a fintech platform. This digital messenger never sleeps, updating the rate multiple times a second to make sure what you're seeing is a true reflection of the market right now.

This is what allows modern platforms to give businesses direct access to the real, live exchange rate. It’s a direct line of communication, cutting out the frustrating delays and middlemen that bog down older financial systems.

Speed Matters: Latency and Accuracy

In the world of forex, a millisecond can be the difference between a good deal and a bad one. The time it takes for data to travel from the source to you is called latency. Keeping latency low is absolutely crucial for ensuring the rate you're quoted is the rate you actually get when you transact.

High latency, or a slow data feed, means the rate you see is probably already out of date—a snapshot of where the market was a few seconds, minutes, or even hours ago. This is a massive problem with many legacy banking systems.

Traditional banks often work with "batched" rates, which they might only update a few times a day. To protect themselves from market swings between these updates, they have to build a wide buffer into their pricing. That buffer is a cost that ultimately gets passed on to you, the client.

A modern fintech platform, on the other hand, uses a low-latency API to pull data directly and continuously. This direct feed means there's no need for a massive "just-in-case" buffer, which allows for much fairer and more precise pricing. It guarantees the live exchange rate you use for your transaction is genuinely live.

This technological edge is everything. It’s the difference between the direct, transparent model of modern finance and the slow, opaque systems of the past, and it’s why a direct feed is non-negotiable for any South African business serious about cost efficiency and predictability in its global payments.

How to Use Live Exchange Rates to Benefit Your Business

Knowing what a live exchange rate is is one thing. Actually using it to save real money and gain control over your company's finances is where it gets interesting. For South African CFOs and founders, this isn't some abstract financial theory—it's a hands-on strategy to directly boost your bottom line across all your international operations.

Let's move from the concept to concrete examples. By looking at a few common business scenarios, we can see exactly how getting access to the real, mid-market rate turns everyday financial tasks into major opportunities for savings and stability.

Paying International Supplier Invoices

For any South African importer or manufacturer, paying for goods from overseas is a constant. This is also where those hidden bank spreads do the most consistent damage to your cash flow.

Imagine a Cape Town-based company importing electronic components from a supplier in Germany. The invoice is for €50,000.

- The Live Exchange Rate (EUR/ZAR) is 19.85.

- A traditional bank, however, quotes them a retail rate of 20.44 (a 3% markup).

Here's how that plays out: on a platform offering the live rate, the payment costs R992,500. Through the bank, that same invoice suddenly costs R1,022,000.

That’s a R29,500 loss on a single transaction—money that could have gone straight back into stock, marketing, or operations. When you're managing cash flow, mastering financial strategies for import export is crucial to keeping these kinds of costs from chipping away at your profits.

To put this into perspective, here's a simple breakdown of how those hidden costs stack up on a smaller, everyday transaction.

Cost Savings Example Paying A $10,000 USD Invoice

| Metric | Traditional Bank Transaction | Live Rate Fintech Transaction |

|---|---|---|

| Invoice Amount | $10,000 USD | $10,000 USD |

| Live Rate (USD/ZAR) | Not used for the transaction | 18.50 |

| Bank's Quoted Rate (3% markup) | 19.05 | N/A |

| Transaction Fee | R500 (average) | R250 (example) |

| Total ZAR Cost | ($10,000 x 19.05) + R500 = R191,000 | ($10,000 x 18.50) + R250 = R185,250 |

| Your Total Savings | R5,750 |

Even on a routine payment, the savings are immediate and significant. Now, multiply that by all your international payments for the year, and the impact on your bottom line becomes crystal clear.

Maximising Your Export Revenue

For South African exporters, the challenge is on the other side of the coin, but the stakes are just as high. When you repatriate your earnings from abroad—bringing your USD or EUR revenue back home to Rand—every fraction of a per cent counts. Using the live rate means you get the full value of what you’ve earned.

The Rand's legendary volatility makes this incredibly important. Just look at the last six months: the ZAR to USD rate swung from a high of 0.0636 down to a low of 0.0563. That's a 12.97% difference.

A Durban-based fruit packer dealing in USD might get lucky and repatriate earnings at the peak, but if their bank is skimming 3-5% off the top with poor rates and fees, that advantage is gone.

By bringing funds home at the live exchange rate, exporters sidestep these markups and lock in the maximum Rand value for their goods, which flows directly to the profit line.

When your business operates on tight margins, the difference between a bank’s retail rate and the live mid-market rate isn’t a minor detail—it can be the difference between a profitable quarter and a disappointing one.

Smarter Foreign Exchange Risk Management

Beyond just saving on individual transactions, the live exchange rate is a powerful tool for strategic financial planning. Unpredictable currency swings can wreak havoc on budgets and forecasts, turning a profitable deal into a loss overnight.

Giving your finance team access to real-time data allows them to:

- Time Payments Strategically: You can watch the live rates and execute large payments or repatriations when the market moves in your favour, even if that window is brief.

- Improve Budget Accuracy: Using the live rate as the baseline for your financial models leads to far more accurate forecasts for international project costs and revenue.

- Hedge More Effectively: While not a hedging tool itself, a live rate platform gives you the precise data needed to execute forward contracts with a clear view of the true market price.

This level of insight shifts a business from being reactive to proactive. Instead of falling victim to currency volatility and hidden fees, you can actively manage your exposure and protect your margins with confidence. By using the live rate as your single source of truth, you cut through the noise of bank spreads and get a much clearer picture of your company's global financial health.

A Practical Guide to Using Live Exchange Rates

For many South African businesses, the idea of getting your hands on the real live exchange rate can feel a bit out of reach. It sounds complicated, like something only giant corporations can access. But the reality is, modern financial platforms have torn down those old walls, making the whole process surprisingly simple. You don't need to jump through hoops to move away from the often-murky world of traditional bank rates. It's just a few straightforward steps.

This guide will show you exactly how your business can sidestep the old way of doing things and start making international payments at the genuine spot rate. Say goodbye to hidden spreads and nasty surprises.

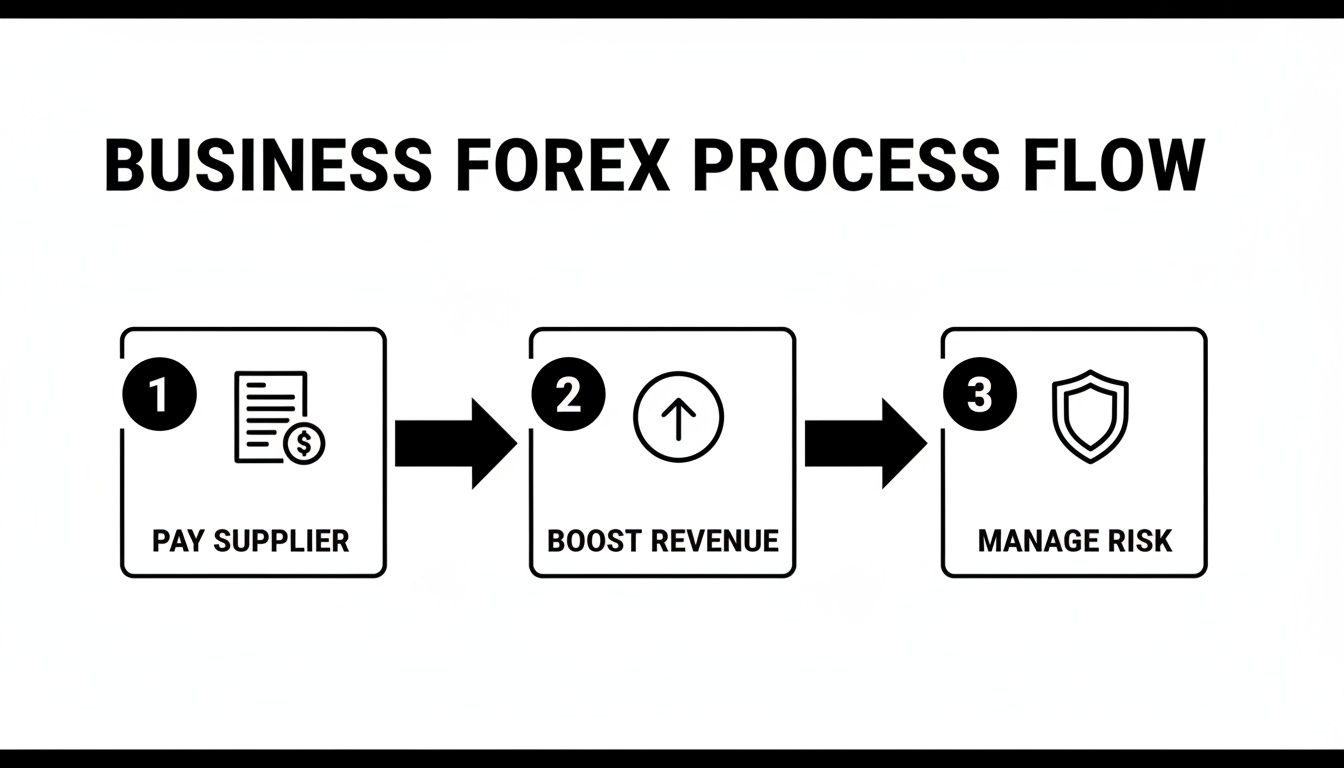

The process is designed to improve the core financial operations of your business—from paying suppliers to protecting your revenue.

As you can see, using true market rates has a direct impact on your ability to pay suppliers on time, get more from your export earnings, and manage your financial risk effectively.

Step 1: Getting Set Up and Verified

First things first, you need to get onboarded. Forget the mountains of paperwork and endless back-and-forth you might associate with opening a bank account. Modern platforms handle this digitally with a Know Your Business (KYB) verification. You'll simply upload your company registration documents and director details online.

It's a secure and efficient process, usually wrapped up within a day. This builds a compliant foundation for all your transactions without bogging you down in admin. The goal is to get you ready to trade, not to keep you waiting.

Step 2: Funding Your Accounts

Once your business is verified, you’ll get access to your own locally held ZAR and USD accounts. Topping them up is as easy as making a domestic bank transfer from your primary business account. No confusing international wire instructions or intermediary banks needed.

You just transfer Rands to your ZAR account or Dollars to your USD account. This simple funding method means your money is ready to go the moment you spot a favourable rate, giving you complete control over your timing.

Step 3: Making an International Payment

This is where you see the power of the live exchange rate in action. When it's time to pay an overseas supplier, the entire process is completely transparent.

- Pick your currency: Choose what you need to send, whether it’s USD, EUR, GBP, or something else.

- See the live rate: The platform shows you the real-time, mid-market exchange rate. No spread. What you see is precisely the rate you get.

- Confirm the amount: You enter how much you want to send. The system instantly calculates the conversion using that live rate, showing you the exact cost.

- Send the payment: A final click, and the payment is on its way.

There are no hidden markups and no surprise SWIFT fees nibbling away at the total. The cost you approve is the final cost, bringing much-needed predictability to your international payments.

For a finance team, this is a game-changer. A CFO can set up multi-user access with specific permissions, allowing team members to handle payments while maintaining full oversight. It’s both secure and efficient.

This step-by-step approach takes the mystery out of international payments. By switching to a platform built on transparency and direct market access, South African businesses can finally break free from the cycle of hidden fees. Seeing and using the live exchange rate is no longer a privilege—it’s a powerful tool for any business looking to compete on the global stage.

Common Questions About Live Exchange Rates

Even when you see the clear advantages, moving away from a long-standing banking relationship can feel like a leap of faith. It's completely normal to have questions about how using a live exchange rate actually works on a day-to-day basis.

Let's walk through some of the most common queries and clear up a few myths. My goal here is to give you the clarity and confidence to manage your international payments like a pro.

Is The Live Exchange Rate The Same As The Rate I See On Google?

For all practical purposes, yes. The rate you see when you do a quick search on Google or check a trusted financial source like Reuters is the mid-market rate. Think of it as the true wholesale price of a currency—the direct midpoint between what buyers are willing to pay and what sellers are asking for on global markets.

This is the most honest, live exchange rate you can get.

Here's the crucial part: this is almost never the rate your bank gives your business. Banks take that fair mid-market rate and add their own markup, often called a "spread," to make their profit. So while Google shows you the real-time value, your bank statement will show you a less favourable rate that has their charge baked in. Modern fintech platforms were built to close this gap, giving your business a direct line to the real mid-market rate without the hidden costs.

How Can A Platform Offer No Spread?

This question gets right to the heart of the difference between a modern fintech and a traditional bank. Legacy banks often depend on wide spreads and a confusing list of other fees (like SWIFT charges) to turn a profit. A big reason for this is that their internal systems are often decades old, incredibly complex, and expensive to maintain.

Modern platforms, on the other hand, are built from the ground up on efficient, lean technology. This slashes the operational overheads.

Instead of profiting from an unpredictable markup on every single transaction, the business model is built around transparency. The value comes from providing speed, security, and powerful tools that help your business run more efficiently.

This simple shift removes the old conflict of interest. The platform’s success is tied to your savings and efficiency, not to how much it can quietly skim off a poor exchange rate.

How Quickly Does The Live Exchange Rate Update?

The live exchange rate is always moving. It updates multiple times every single second, reacting instantly to global trades, economic news, central bank policies, and geopolitical events. This constant movement is exactly why a real-time data feed is the only way to ensure fair pricing.

When you make a payment through a traditional bank, you're often given a rate that's already hours old or a fixed "daily rate." This rate always includes a hefty buffer to protect the bank from any market swings that might happen during the day—a buffer that your business pays for.

With a platform that uses a direct, live feed, the rate you lock in is accurate to that precise moment. This protects you from sudden market dips and guarantees you’re getting the fairest possible price.

Are Live Exchange Rates Only For Large Corporations?

This is probably one of the most damaging myths out there. The truth is, small and medium-sized enterprises (SMEs) are the ones that get hurt the most by poor exchange rates and hidden bank fees.

Large corporations have the trading volume and clout to negotiate better rates directly with banks. They often have entire treasury departments dedicated to managing currency risk. SMEs, however, usually don't have that kind of leverage and are forced to accept whatever standard retail rate their bank offers.

A 3% spread on a $10,000 payment to a supplier might be a rounding error for a massive company, but for a growing South African business, that's a significant and unnecessary hit to your capital.

The volatility of the Rand makes this even more critical. Looking at historical trends, we can see just how much the ZAR can move. Data from the South African Reserve Bank shows the Rand swinging from 16.2625 per USD to a peak of 17.4252, before strengthening back to 15.9974—a net recovery of 6.64% in just five months. This kind of volatility directly hammers the bottom line of small South African export businesses, and bank spreads just pour salt on the wound.

Gaining access to the live exchange rate levels the playing field. It gives SMEs the financial transparency, cost savings, and predictability that were once only available to the biggest players, empowering them to compete more effectively on the world stage.

Ready to stop losing money to hidden fees and unpredictable rates? With Zaro, you can access the real, live exchange rate with zero spread and no SWIFT fees. Take control of your international payments, improve your cash flow, and bring predictability to your global operations. Get started with Zaro today.