Think of a margin call in forex trading as a critical warning bell from your broker. It’s not a fine or a penalty; it’s a crucial safety alert telling you that the funds in your account have dipped below the minimum required to keep your trades open. Essentially, it’s a protective measure to stop your account from going into a negative balance if your trades continue to move against you.

What a Margin Call Really Means

Trading on margin is a bit like putting down a deposit to control a much larger asset. In the world of forex, this deposit lets you use leverage, which magnifies both your potential profits and, just as importantly, your potential losses. A margin call is that pivotal moment when your broker signals that this "good-faith deposit" is shrinking too fast because the market isn't moving in your favour.

This warning goes off when your account equity—the real-time value of your account—falls below a specific threshold called the maintenance margin. This is the safety net your broker puts in place.

The Two Core Margin Concepts

To really get your head around this, you need to understand the two types of margin that act as the pillars of your account's health:

- Initial Margin: This is the upfront capital you need in your account simply to open a new leveraged trade. Think of it as the initial down payment.

- Maintenance Margin: This is the minimum amount of equity you must keep in your account to hold your existing trades open. If your account value drops below this line, you’ll get the margin call.

A margin call is your broker’s way of saying, "Your account is in danger of being wiped out. You either need to deposit more funds to support your positions or start closing some trades to lower your risk."

This is especially relevant in South Africa's fast-paced forex market, where managing leverage is key. With leverage ratios often climbing from 10:1 to 100:1, even a tiny 1% swing in price can have a massive impact on a trader's margin. Local trading forums suggest that margin calls hit an estimated 30-40% of leveraged accounts each year, particularly during volatile periods affecting pairs like the ZAR/USD.

It’s a stark reminder of why you absolutely must understand how margin works before you place your first trade. To get a better feel for how different brokers manage these situations, you can discover more insights about margin call procedures on Markets.com.

How Margin and Leverage Create Risk and Opportunity

In the world of forex, margin and leverage are two sides of the same coin. Think of leverage as a loan from your broker that lets you control a much larger position in the market than your own capital would normally allow. The small amount of your own money you put up to secure that loan? That's your margin.

This relationship is what makes forex trading so powerful. It's the engine that drives both incredible opportunity and, if you're not careful, significant risk.

For instance, with a leverage ratio of 100:1, every ZAR 1 you put down as margin lets you control a ZAR 100 position. This means even tiny price movements can lead to substantial profits. A mere 1% favourable move on a ZAR 100,000 position would net you a ZAR 1,000 profit—a massive return on the much smaller margin you actually deposited.

But here’s the catch. This power is a double-edged sword. The same leverage that blows up your gains will do the exact same thing to your losses. That same 1% price move going against you would create a ZAR 1,000 loss. This can eat into your margin very quickly and push you dangerously close to getting a margin call in forex trading.

Your Account’s Vital Signs

To trade safely, you have to keep a close eye on your account's health. Think of it like a patient's vital signs monitor; these key figures tell you exactly where you stand and how much risk you’re exposed to in real-time. Knowing these numbers isn't just a good idea—it's essential for survival.

Your trading platform shows you this snapshot constantly:

- Account Equity: This is the live, current value of your account. It's your starting balance plus or minus the profit or loss from any trades you have open.

- Used Margin: This is the total amount of your money that's currently locked up to maintain your open positions. It's like a good-faith deposit.

- Free Margin: This is what’s left over. It’s the usable capital in your account available to open new trades. You find it by subtracting your Used Margin from your Account Equity.

- Margin Level %: This is the most critical health indicator for your account. The formula is (Equity / Used Margin) x 100. A high percentage means you're in good shape; a falling one is a massive red flag.

As your open trades move against you, your equity shrinks. This, in turn, causes your Margin Level Percentage to plummet. If it drops below a certain threshold set by your broker, a margin call is triggered automatically.

For a deeper dive, it's worth exploring educational resources on understanding the fundamentals of margin and leverage. Getting a solid grip on these concepts is the first, most crucial step toward managing risk and protecting your hard-earned capital.

Key Forex Margin Terminology Explained

To help you get comfortable with these vital signs, here’s a quick-reference table breaking down the most important terms you'll encounter every day.

| Term | Definition | Importance for a Trader |

|---|---|---|

| Account Equity | The real-time value of your account, including profits and losses from open positions. | This is your account's "true" current worth. It's the number that really matters. |

| Used Margin | The amount of your capital held by the broker to keep your current trades open. | It shows how much of your capital is currently at risk to support your positions. |

| Free Margin | The difference between your Equity and Used Margin. It's the money available to open new trades. | This is your firepower. If it hits zero, you can't open any new positions. |

| Margin Level % | A percentage calculated as (Equity / Used Margin) x 100. | This is your account’s health score. If it falls below the broker's minimum, it triggers a margin call. |

Treating these terms as just numbers on a screen is a rookie mistake. They are the pulse of your trading account, and learning to read them correctly will make all the difference in your trading journey.

A Real-World Margin Call Scenario

Theory is great, but nothing hits home like seeing the numbers play out in a real trade. Let's follow a trader, Sipho, to see how quickly things can go wrong and trigger a margin call in forex trading.

Sipho funds his new trading account with ZAR 15,000. He’s been watching the EUR/USD, which is sitting at 1.0800, and feels confident it’s about to shoot up. He decides to go big and buys one standard lot (100,000 units).

His broker requires a 2% margin for this pair. Let’s break that down:

- Total Position Value: 100,000 EUR * 1.0800 = $108,000

- Margin Needed: $108,000 * 2% = $2,160

Here's the first problem. Sipho's ZAR 15,000 account, at an exchange rate of ZAR 18.50 per dollar, is only worth about $810. He doesn't have enough capital. But with leverage, he can still open the trade. Using 200:1 leverage, his required margin drops to just $540 (around ZAR 9,990). The trade is on, and he has what feels like a healthy amount of free margin.

When the Trade Turns Sour

For a little while, the market moves his way, and he sees some profit. But then, some unexpected economic news comes out of the Eurozone, and the EUR/USD pair takes a nosedive. It falls from 1.0800 to 1.0725, a sharp drop of 75 pips.

On a standard lot, every pip is worth $10. A 75-pip move against him means he’s now sitting on a $750 unrealised loss (75 pips x $10). This completely devastates his account balance.

- Starting Equity: $810

- The Loss: -$750

- Current Equity: $60 ($810 - $750)

His Used Margin is still locked at $540. Now, let’s look at the most important number: his Margin Level.

Margin Level % = (Equity / Used Margin) x 100

($60 / $540) x 100 = 11.1%

This is a catastrophe. Sipho's broker issues a margin call at 100% and has a stop-out level of 50%. His margin level has crashed way past both of those critical thresholds. The broker's system doesn't wait—it triggers the margin call and immediately moves to stop him out.

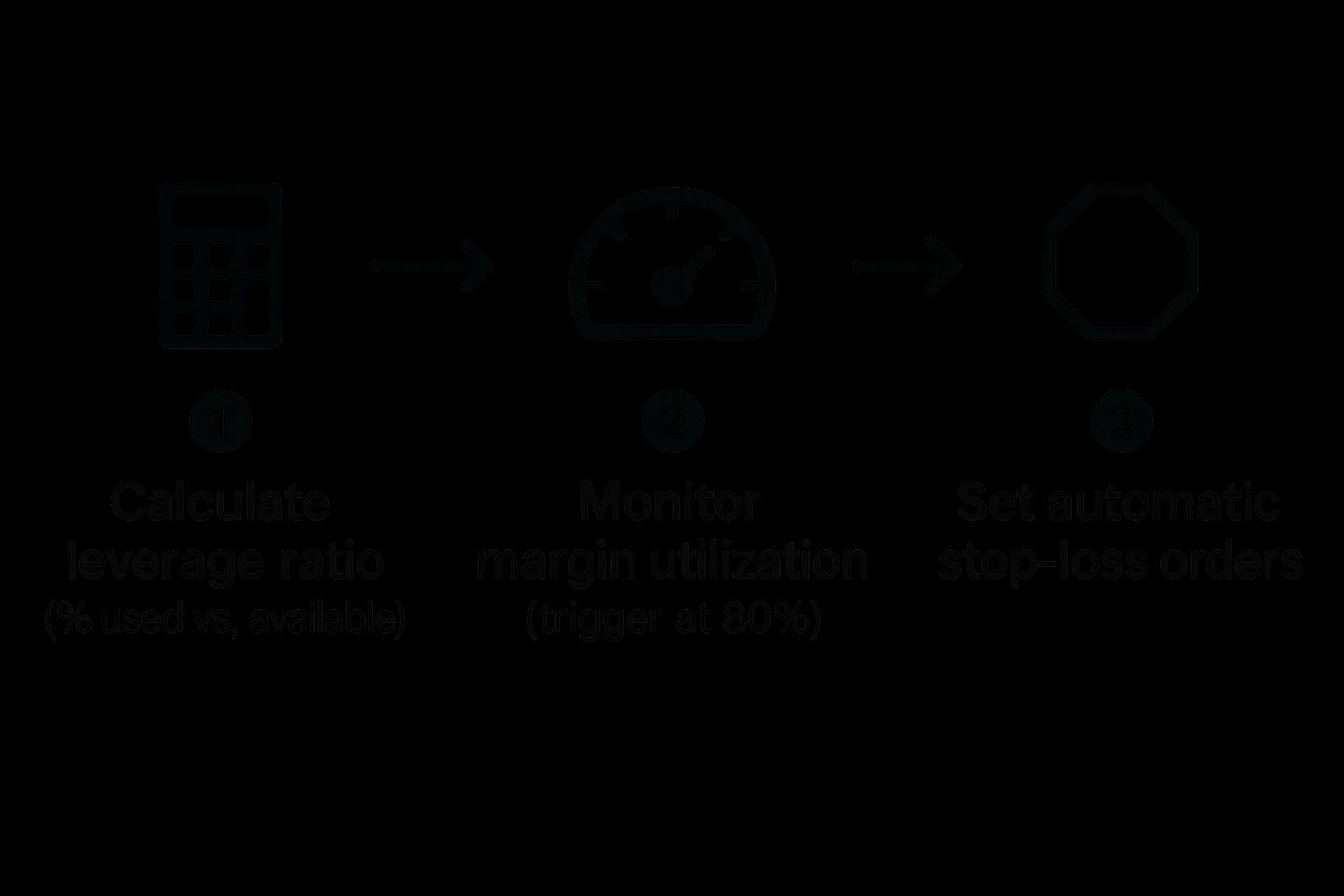

The image below gives a simple three-step overview for keeping an eye on your account to avoid exactly this kind of disaster.

As you can see, staying on top of your risk from the very beginning is the key to protecting your capital.

The Two Possible Endings

Because Sipho's margin level fell below the 50% stop-out point, there’s only one way this can end for his trade.

- Forced Liquidation (The Stop-Out): The broker’s automated system closes his EUR/USD position immediately. This isn't a choice; it's a safety mechanism to stop the bleeding. All that’s left in his account is the remaining equity of $60 (about ZAR 1,110). In a single trade, he has wiped out over 92% of his starting capital.

- What Could Have Been (The Smart Way): Imagine if Sipho had set a simple stop-loss order at 1.0770. That would have represented a 30-pip loss, or $300. His position would have closed automatically, leaving him with $510 in his account. It's still a painful loss, but his account would have survived to trade another day. That one small step would have saved most of his money.

What Really Triggers a Margin Call?

To stop a margin call from happening, you first need to understand why it happens in the first place. Sure, a market moving against you is the immediate trigger, but the real reasons almost always lie in your trading strategy and your approach to risk. A margin call isn't just bad luck; it’s usually the end result of a few high-risk habits.

The number one culprit? Over-leveraging. I like to think of leverage as a financial amplifier. A little bit can boost your gains, but cranking it up to the max amplifies your losses just as easily, making your account incredibly sensitive. When you use too much leverage, you leave yourself with virtually no cushion for the market's natural ups and downs. Even a tiny price move against your position can vaporise your available margin in an instant.

Forgetting the Golden Rules of Risk Management

Another huge factor is simply failing to use basic risk controls. The most common mistake I see is traders not setting a stop-loss order on every single trade. Your stop-loss is your emergency exit—it’s the line you draw in the sand to protect your capital. Trading without one is like tightrope walking without a safety net.

Just as risky is holding onto positions during extremely volatile times, like when major economic news is announced or during unexpected political events. These moments can create huge, unpredictable price swings that can bleed an account dry in seconds—far faster than anyone can react manually.

A margin call is rarely a surprise. It’s the predictable outcome of using too much leverage, not defining your risk with a stop-loss, or trading carelessly in volatile markets.

The South African Context

The dangers of over-leveraging are crystal clear right here in the South African forex market. A look at local broker data from 2023 revealed that roughly 25% of retail traders received at least one margin call. What’s really telling is that traders using leverage greater than 50:1 were involved in nearly 70% of these cases.

This became painfully obvious during market shocks, like when the Rand dropped sharply in March 2023. The frequency of margin calls shot up by 45%. In that period, forced liquidations led to traders losing, on average, 35% of their initial account balances—a harsh lesson in risk management. You can get further details on margin call prevention on fpmarkets.com to better prepare yourself.

So, let's break down the most common triggers that will lead you straight to a margin call:

- Excessive Leverage: Using the maximum leverage your broker offers just because it’s there, rather than what your strategy and account can actually handle.

- No Stop-Loss: Entering a trade without a pre-determined stop-loss order to automatically limit your downside.

- Over-Trading: Opening too many positions at once. This ties up too much of your margin and leaves no breathing room if the market turns.

- Holding Through Volatility: Keeping trades open during high-impact news events without tightening your stops or reducing your position size.

Proven Strategies to Avoid Margin Calls

A margin call in forex trading isn’t some random event that strikes out of the blue. It’s the direct result of a trade’s risk growing too big for the account to support. The good news? Avoiding one is completely within your control. It all comes down to a disciplined and proactive approach to managing your capital and your trades.

Think of what follows as your tactical playbook for keeping your capital safe. By putting these clear, repeatable actions into practice, you’ll build a solid defence against margin calls and be able to trade with far more confidence.

Use Leverage Wisely

If there’s one single culprit behind most margin calls, it’s the misuse of leverage. Your broker might offer you a massive leverage ratio, but that doesn't mean you have to take it. Treat leverage like a power tool—it's essential for getting the job done, but it can be incredibly dangerous if you handle it carelessly.

Choosing your leverage level should be a strategic decision, not an automatic one. It needs to be based on your account size, your experience level, and what you’re comfortable risking. A lower leverage ratio gives you a much bigger buffer against the market’s inevitable swings, giving your trades more room to breathe without putting your whole account in jeopardy.

Implement Strict Risk Management

This is non-negotiable. Solid risk management is the very foundation of any sustainable trading career. In simple terms, it means every single trade you enter must have a pre-planned exit strategy for when things go south.

- Set Stop-Loss Orders: A stop-loss is your safety net. It’s an automated order that gets you out of a trade at a specific price to cap your loss. Honestly, trading without one is one of the quickest ways to get that dreaded margin call notification.

- Adhere to the 1-2% Rule: This is a golden rule for a reason. Never risk more than 1-2% of your entire account balance on any single trade. This discipline ensures that even a string of losses won’t wipe you out, which helps keep your margin level healthy.

A trader's primary job is not to make profits, but to manage risk. The profits will follow as a natural byproduct of excellent risk control.

Here in South Africa, where brokers are regulated by the Financial Sector Conduct Authority (FSCA), margin calls are a crucial mechanism to protect traders from ending up with a negative balance. The data is clear: traders who consistently use stop-loss orders and stick to conservative leverage cut their chances of getting a margin call by over 60%. This just goes to show the direct impact that disciplined risk management has on your account's survival.

Monitor Your Margin Level Continuously

Your margin level percentage is your account's heartbeat. Don't just set your trades and forget about it. You need to be actively watching this number, especially when you have several positions running at once. If you see it dipping towards your broker’s warning level (often around 100%), that’s your cue to take immediate defensive action.

This could mean a few things:

- Closing one or more of your positions (it’s usually best to start with the least profitable ones).

- Reducing the size of an existing position to free up some of your used margin.

- Adding more funds to your account, but only if you are still genuinely confident in your open trades.

Avoid Over-Trading

It’s a classic mistake: opening too many positions at once, particularly if they’re all related (like buying several different USD pairs). Doing this ties up a huge chunk of your capital as used margin, leaving you with very little "free margin" to absorb any market moves that go against you.

Keep your number of concurrent trades limited to a level your account can comfortably handle. It really is a case of quality over quantity. This simple principle is one of the most effective ways to protect yourself from a margin call in forex trading. To really get this right, you need data-driven strategies for managing your risk. If you want to dive deeper into the analytical side of making sound financial decisions, it’s worth exploring quantitative analysis in finance.

Got Questions About Margin Calls? We've Got Answers

Even when you think you’ve got a handle on margin calls, some specific questions almost always pop up. It's totally normal. Getting straight answers to these common queries is the best way to build real confidence in managing your trading account and steering clear of trouble.

Let's dive into some of the most frequent questions I hear from traders.

What if I Can't Meet a Margin Call?

This is the big one. If a margin call hits and you can't deposit more funds or close positions yourself, the broker has to step in. They won't wait long.

This is where the automatic liquidation process, known as a 'stop out', kicks in. The broker's system will start closing your open trades for you. It usually starts with the biggest losing position and continues until your margin level is back above the required minimum. Think of it as an emergency brake—it's there to stop your account from going into a negative balance, which protects both you and the broker from catastrophic losses.

Will a Stop-Loss Order Prevent a Margin Call?

A stop-loss is a non-negotiable tool for managing risk, but it's not a magic shield against a margin call. Here’s why: a stop-loss is designed to cap the loss on a single trade.

A margin call, on the other hand, is about the overall health of your entire account. It’s triggered when your total account equity dips too low relative to the margin you're using. So, even if one position hits its stop-loss, the combined losses from your other open trades could still be enough to drag your margin level down into the danger zone.

And don't forget about slippage, especially in wild, fast-moving markets. This is when your stop-loss triggers but gets filled at a much worse price than you intended. That extra loss could be the very thing that tips your account over the edge into a margin call.

Do All Brokers Handle Margin Calls the Same Way?

Not quite. While the basic concept is the same everywhere, the specifics can vary from broker to broker. You need to pay close attention to two critical percentages in their terms:

- Margin Call Level: The point where the broker sends you a warning. It’s your heads-up that you're in trouble.

- Stop-Out Level: The point of no return. This is the margin level where the broker starts automatically closing your trades.

For instance, one broker might set their margin call level at 100% and the stop-out at 50%. Another, more cautious broker might warn you at 80% and start liquidating positions at 40%. Before you even think about placing a trade, you absolutely must dig into your broker’s agreement and know their exact numbers.

Zaro helps South African businesses take control of their global finances with total clarity. Say goodbye to hidden fees and guesswork on exchange rates for your international payments. Find out more at https://www.usezaro.com.