Sending money abroad should be straightforward, but it rarely is. When you move funds from a South African bank account to an international one, the real cost is often buried in hidden fees and poor exchange rates from the big banks. It’s frustrating how these costs chip away at the final amount your recipient gets. The modern way to handle these transfers focuses on real-time exchange rates and transparent, low fees, so you always know what you're paying.

The Modern Way to Handle International Payments

For any South African business dealing with overseas suppliers or clients, sending money internationally has always felt like a necessary evil. The whole process is often murky, and the final cost is usually a nasty surprise. You see a "transfer fee," but the real damage is done in the inflated exchange rate margins that banks conveniently forget to highlight.

This old way of doing things creates a ton of uncertainty. It makes budgeting a nightmare and nibbles away at profits that should be going back into your business. And that's before you even get to the admin headache of dealing with South African Reserve Bank (SARB) regulations and making sure every document is spot on.

Moving Beyond Traditional Banking Hurdles

The problems with old-school international payments run deep and are baked into systems that haven't changed in decades. If you're a business owner, you've likely run into these issues:

- Hidden Costs: Banks love to advertise low transfer fees, but they make their money back (and then some) by offering you a lousy exchange rate. This hidden margin can be anywhere from 2-5% on every single transaction.

- Slow Processing Times: A standard SWIFT transfer can take a painful 3 to 5 business days. That’s a long time for your cash to be in limbo, especially when you have critical supplier payments to make.

- Complex Compliance: Juggling SARB compliance, like Balance of Payments (BoP) reporting, is a manual, tedious, and error-prone job if you don't have the right tools or support.

Moving from a traditional bank to a specialised fintech platform isn’t just about cutting costs. It’s about taking back control and bringing efficiency and predictability to a crucial part of your business. This isn't just an operational tweak; it's a strategic move that can give you a real competitive edge.

The High Cost of Regional Transfers

The pain of cross-border payment costs is especially sharp when you're dealing with transfers within Southern Africa. The costs for payment corridors involving South Africa are just ridiculously high, creating massive friction for regional trade.

For instance, transfer fees from South Africa to Mozambique can average 11.8% with Money Transfer Operators and an unbelievable 22.4% through banks. These insane costs hit smaller transactions the hardest and push people away from using formal, safe financial channels. You can get a deeper understanding of how remittance costs impact regional economies on the IMF's website.

It’s a tough choice for businesses: stick with the slow, expensive banks or try a modern fintech solution? Let's break it down.

Comparing Traditional Banks and Modern Fintech Solutions

| Feature | Traditional Banks | Fintech Platforms (e.g., Zaro) |

|---|---|---|

| Exchange Rates | Often include a hidden margin of 2-5% over the mid-market rate. | Offer rates very close to the real-time, mid-market rate. |

| Fees | Multiple fees (transfer, correspondent bank, receiving fees) that are not always clear. | Typically one single, transparent, and low fee per transfer. |

| Transfer Speed | Slow, often taking 3-5 business days via the SWIFT network. | Much faster, with many transfers completing within 24 hours. |

| Compliance | The process can be manual, paper-based, and time-consuming. | Automated, built-in compliance features for SARB reporting (like BoP). |

| User Experience | Can involve branch visits, complex forms, and outdated online portals. | Simple, intuitive online platforms accessible from anywhere, anytime. |

The difference is clear. While banks have been the default for years, they simply can't match the speed, transparency, and efficiency that a purpose-built fintech platform offers today.

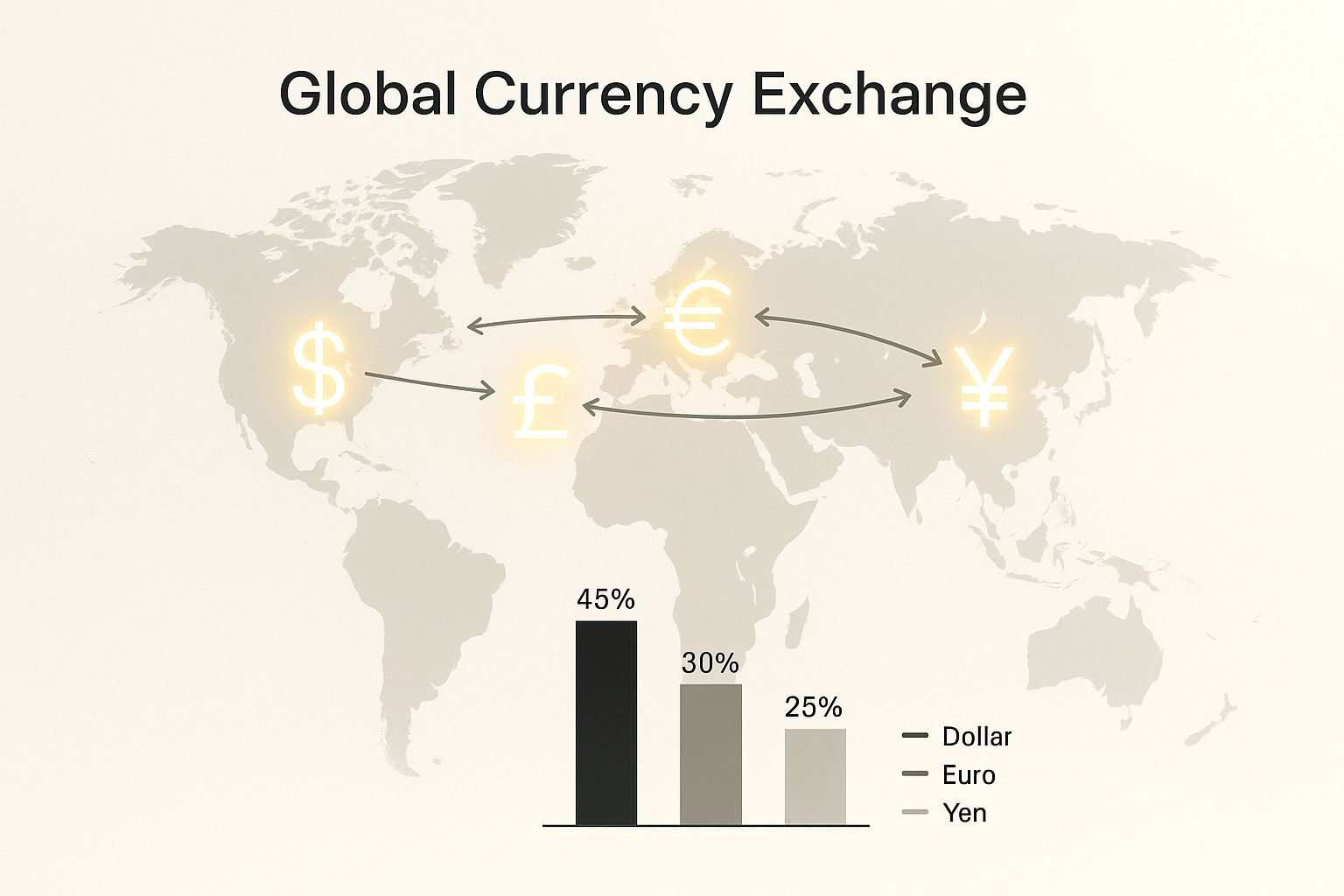

This image really drives home the complex web of global currencies that modern solutions are designed to untangle.

What you're seeing is a visual representation of how a modern, efficient money transfer system can sidestep the usual bottlenecks. Instead of a long, winding road, platforms like Zaro create a direct and clear path for your funds to get where they need to go.

Getting Your Paperwork in Order Before You Send a Cent

Before you even dream of hitting ‘send’ on an international payment, a bit of upfront work with your documents can save you from a world of pain. I’ve seen it happen time and again: a single mistake in the paperwork leads to costly delays, unwanted attention from the South African Reserve Bank (SARB), or even an outright rejection of the payment.

Think of this prep work as laying a solid foundation. Getting your documents right isn't just about bureaucracy; it's what ensures your money actually moves smoothly from A to B. Skipping this step is probably the most common—and most avoidable—mistake businesses make when sending funds abroad.

The Must-Have Documents for SARB Compliance

The SARB needs to know that every rand leaving the country is for a legitimate reason. For businesses, this means having two key documents ready for almost every single transaction.

First up is your valid tax clearance certificate from SARS. This is non-negotiable. It’s your proof that the business’s tax affairs are in order. If it's expired or missing, your payment is dead in the water. Always check the expiry date.

Next, you need to fill out the correct Balance of Payments (BoP) form. This form is how you tell the SARB why you're sending the money, using specific codes for different types of payments.

- BoP Category 401/416: This is your code for paying for imported goods.

- BoP Category 407: Use this one for paying international service providers, like a marketing consultant in London or a software subscription from the US.

- BoP Category 305: This is for repaying an international loan.

Choosing the wrong code is a classic blunder that flags your payment for a query, causing frustrating delays. This is where a good platform helps. Zaro, for instance, builds the BoP reporting right into the payment process, guiding you to select the right code so your declaration is spot-on every time.

Getting your compliance sorted from the get-go isn't just about ticking boxes. It’s about showing you're a diligent business, which builds a clean transaction history and makes all your future international payments much, much easier.

Why Every Detail of Your Beneficiary’s Info Matters

Once your own paperwork is sorted, the next landmine is getting the beneficiary’s details wrong. A single typo in an account number or a name can send your funds into a black hole—stuck in limbo, impossible to track, and a nightmare to get back.

Seriously, double-check these details. Then check them again.

- Beneficiary Full Name: It has to match the name on the bank account. Exactly. No nicknames or abbreviations.

- Bank Account Number/IBAN: For payments to Europe and many other places, you'll need the International Bank Account Number (IBAN). It’s a long string of letters and numbers, so it's incredibly easy to mistype.

- SWIFT/BIC Code: This is the international address for the receiving bank. Get it wrong, and your money could end up at the wrong bank or simply fail to send.

Picture this: you’re sending R150,000 to a key supplier in Germany. You accidentally swap two numbers in their IBAN. That payment won't just be a bit late. It could land in a complete stranger's account or be rejected by the German bank, taking days or even weeks to bounce back—minus hefty bank fees. The knock-on effect? A damaged supplier relationship and a stalled supply chain.

Treat these details with the same level of care you’d use for your own bank account.

Making the Transfer: How to Protect Your Profits

You’ve got your compliance sorted and your beneficiary details are ready to go. Now comes the critical part: actually making the transfer in a way that protects your bottom line.

This isn't just about clicking a "send" button. It’s a strategic move where timing and choosing the right tool can make a massive difference to your margins.

Getting a Handle on Forex Risk

Let's be honest, currency markets can be brutal. A sudden dip in the Rand can eat into your profits before you've even had your morning coffee. This is what we call foreign exchange exposure.

You have a couple of solid ways to manage this risk. The most common are spot transfers and Forward Exchange Contracts (FECs). Think of them as two different tools for two different jobs.

Spot transfers are your go-to for immediate needs. They use the live exchange rate and typically settle within 24-48 hours, making them perfect for paying an urgent invoice. The downside? You're completely exposed to whatever the market is doing at that moment.

Forward Exchange Contracts (FECs) are your shield against volatility. They allow you to lock in an exchange rate today for a payment you need to make weeks or even months down the line. This gives you certainty.

A bit of homework here goes a long way. I always recommend clients look at spot and forward rate charts over the past few months. You’ll start to see patterns and get a feel for the typical swings, which helps you decide when to lock in a rate.

Spot vs. Forward Contracts: A Real-World Example

Imagine you need to pay a supplier in Germany in three months. The ZAR/EUR rate looks pretty good right now, but you’re worried the Rand might weaken.

If you wait and do a spot transfer later, a 5% drop in the Rand means your payment suddenly costs 5% more. Ouch.

But if you book a forward contract today, you lock in the current rate. Your finance team now knows exactly how many Rands they need to set aside. No guesswork, no nasty surprises.

By using a forward contract, you can effectively lock in a favourable rate and insulate your business from the chaos of volatile currency markets.

The good news is that modern platforms like Zaro make this incredibly simple. You can see live rates for both options and book your chosen contract in just a few clicks. For a deeper dive into how payment schedules impact your cash flow, this guide on understanding different payment terms is a fantastic resource.

How to Lock in Rates With an FEC

A Forward Exchange Contract (FEC) lets you secure an exchange rate for up to 12 months in advance. It’s a powerful way to bring predictability to your international payments.

Usually, you'll need to put down a small deposit, so just be sure to factor that into your cash flow planning.

The process is straightforward:

- Pinpoint your upcoming foreign payments and their due dates.

- Agree on the rate and any deposit required with your provider.

- Get written confirmation of your locked-in rate.

- When the time comes, simply fund the contract and the payment is made at the agreed-upon rate.

Pro tip: Many platforms offer rate alerts. Set one up for your target exchange rate, and you'll get a notification when the market hits your sweet spot. It saves you from having to watch the charts all day.

Making It Happen on a Modern Platform

Once you've decided between a spot or forward contract, the execution should be seamless. A good platform dashboard is your mission control.

Look for tools that give you real-time rate visibility, multi-stage approval workflows (a lifesaver for preventing errors), and a clear audit trail for every transaction. On Zaro, for example, you see the mid-market rate with zero spread, and interactive charts help you visualise your options.

Key takeaway: Having access to real-time rate data and intuitive booking tools empowers you to execute international transfers efficiently and with confidence.

Finally, always keep an eye on market news. Being ready to adjust your strategy is what separates savvy operators from the rest. And a final check of your payment confirmation for any rate discrepancies or hidden fees is always a good idea. With these practices, you're not just sending money—you're protecting your business.

Keeping Your International Payments on Track

That feeling of relief when you’ve finally sent money abroad is great, but don't close the books just yet. What happens after you click 'send' is just as important. It’s where you make sure the funds land safely and your own financial records are kept spotless.

If you don't have a solid process for tracking and reconciling these payments, you’re basically inviting confusion. Think supplier disputes, frantic emails, and a massive headache when it’s time to do your taxes. This final stage is all about diligence; it’s your peace of mind that every rand is accounted for.

From Your Account to Theirs: Following the Money

Once you’ve initiated a payment, it doesn’t just teleport into the recipient's account. It goes on a bit of a journey, and understanding the different stops along the way is key.

- Processing: This just means your payment provider has received the instruction and is getting it ready to go.

- In Transit: The money has officially left your side and is now making its way through the global banking system.

- Delivered/Settled: Success! The funds have arrived at the recipient's bank and should be available to them shortly.

Delays are part of the game sometimes, often due to things like correspondent banks doing extra checks or a sneaky public holiday in the recipient's country. If a payment seems stuck, your first move should be to grab the transfer receipt or proof of payment. This document will have a unique reference number (for SWIFT payments, this is usually a UETR) which is your golden ticket for tracing the funds.

A clean, downloadable proof of payment is non-negotiable. It’s your proof you held up your end of the deal and gives your supplier everything they need to chase up their own bank if there’s a hold-up.

The Not-So-Fun Part: Perfecting Reconciliation

Let’s be honest, for most finance teams, reconciliation is the most painful part of paying international suppliers. Trying to match the rand amount you sent on a Monday with the euro amount that landed on a Wednesday—after all the fees and rate conversions—can feel like solving a Sudoku puzzle in the dark.

This is where being organised really pays off. As soon as a payment is marked as complete, save the proof of payment and the final transaction statement. These docs should clearly break down the starting ZAR amount, the exact exchange rate used, all the fees, and the final foreign currency figure. This is the only way to log the expense accurately in your books.

Many businesses find that dedicated invoice reconciliation software can be a lifesaver here, helping to automate a lot of that manual matching work.

We designed Zaro to make this much less of a headache. We give you a simple, detailed history for every single payment. All the critical data is right there in one place, which dramatically cuts down on the time you'd otherwise spend hunting for numbers and matching figures. By making this a standard part of your process, you guarantee your books are always accurate and ready for an audit. It's the final, crucial step to closing the loop on every money abroad transfer.

Common Money Transfer Mistakes and How to Dodge Them

Learning from someone else's mistakes is one of the smartest things you can do in business. When it comes to a money abroad transfer, a small slip-up can quickly snowball into big costs, frustrating delays, and even unwanted attention from the South African Reserve Bank (SARB).

I've seen too many South African businesses turn a routine transaction into a major headache by falling into the same traps. The good news? Once you know what they are, they're surprisingly easy to avoid.

Overlooking the True Cost of the Transfer

This is the big one. So many businesses fixate on the advertised transfer fee and completely miss the real killer: the hidden margin baked into the exchange rate. The big banks are notorious for this. They'll offer you a rate that looks okay on the surface, but it’s often miles away from the live mid-market rate. That difference? It's pure profit for them, straight out of your pocket.

Don't get caught out. Always demand a fully transparent quote before you agree to anything. Ask for the exact exchange rate you’re getting and, crucially, the final foreign currency amount that will land in your supplier’s account.

A provider that’s serious about transparency will show you the real-time mid-market rate right next to their own offer. If they can’t—or won’t—that’s a massive red flag. You're almost certainly paying too much.

Using Incorrect Compliance Codes

Choosing the wrong Balance of Payments (BoP) code is another classic blunder. It seems like a small admin detail, but it’s a fast track to getting your payment flagged by the SARB. That means queries, delays, and a potentially damaged relationship with your supplier.

For instance, you might use code 401 (for imported physical goods) when you’re actually paying for a software subscription. That payment needs code 407, and the mismatch will stop your transaction in its tracks.

- The fix is simple: Just take a moment to double-check you're using the right BoP code for every single payment.

- A better way: This is where good tech helps. Platforms like Zaro build BoP reporting right into the payment process. The system guides you to pick the correct code, ensuring your declaration is spot-on every time and your funds don’t get stuck in compliance limbo.

Neglecting Regional Financial Nuances

South Africa occupies a unique position in the region's financial ecosystem. It’s a major hub for sending and receiving funds across Southern Africa. Yet, remittance inflows have historically been quite low as a percentage of GDP—just 0.24% back in 2020. As you can explore in the World Bank data, this points to a complex financial environment that goes far beyond simple personal remittances. Ignoring these regional dynamics means you might misjudge the complexity and requirements of a transfer.

By steering clear of these common pitfalls, you can start mastering your international payments, saving a whole lot of time and money in the process.

Got Questions About Sending Money Abroad? We've Got Answers

Sending money internationally from South Africa can feel like navigating a maze. From compliance hurdles to confusing exchange rates, it's natural to have questions. We hear them all the time from business owners just like you. Let's clear up some of the most common ones.

What's the Usual Suspect for Payment Delays?

Nine times out of ten, it’s a compliance hiccup. An international payment getting stuck is almost always down to incorrect or missing paperwork. We see it constantly – someone uses the wrong Balance of Payments (BoP) code for their transaction, or they submit a tax clearance certificate that’s already expired.

Another classic mistake? A simple typo. Getting one digit wrong in an IBAN or using an outdated SWIFT/BIC code can send your money on a wild goose chase. This can lead to frustrating delays that stretch from days into weeks while everyone tries to figure out where the funds went.

How Do I Actually Get the Best Exchange Rate?

Forget the advertised rates you see from your bank; they’re almost guaranteed to have a hidden markup baked in. To get the best deal, you need to get as close as possible to the real-time, mid-market exchange rate. Think of this as the "wholesale" rate that banks use when they trade with each other.

The smartest move is to partner with a modern financial platform that gives you direct access to this rate with transparent, upfront fees. When there's no hidden percentage skimmed off the top of your exchange, you stop losing money in the margins. Over a year, those savings really add up.

Are There Limits on How Much My Business Can Send Overseas?

Yes, there are, and they’re set by the South African Reserve Bank (SARB). The limits depend on who is sending the money and why.

- For Individuals: You have a Single Discretionary Allowance (SDA) of R1 million per calendar year.

- For Larger Investments: If you have tax clearance, you can use an additional Foreign Investment Allowance (FIA) of up to R10 million.

- For Businesses: Here’s the good news. For legitimate business payments, like paying an international supplier for goods, there’s generally no limit. The key is having your ducks in a row with the right documents—like the supplier's invoice and a valid tax clearance certificate—to prove the payment is for a real trade transaction.

What Is a Forward Exchange Contract, and Do I Need One?

A Forward Exchange Contract (FEC) is a financial tool that lets you lock in today's exchange rate for a payment you plan to make in the future (anywhere up to 12 months from now). It's all about managing risk and creating certainty.

So, should you use one? If you've got a hefty invoice due in three months and you're worried the rand might take a dive, an FEC is your best friend. It removes the guesswork. You lock in your rate, know exactly what the payment will cost you in rands, and protect your profit margin from any nasty surprises caused by a volatile currency market.

Ready to take the complexity out of your international payments? With Zaro, you get access to real exchange rates, automated compliance, and a clear view of every transaction. Discover a smarter way to manage your money abroad transfer today.