Sending money overseas used to be a real headache. I remember the days of queuing at the bank, drowning in paperwork, and then being hit with vague exchange rates and hidden fees. It was slow, expensive, and you never quite knew how much would land on the other side.

Thankfully, things have changed. Digital platforms like Zaro have completely flipped the script, making international transfers faster, clearer, and a whole lot cheaper than the old-school way. This guide will walk you through exactly how to get it done.

Why Going Digital is a Game-Changer

If you've ever dealt with a traditional bank for a money overseas transfer, you know the drill. It was an event. You’d set aside time to go to a branch, fill out form after form, and just hope for the best on the fees.

Today, South Africans are moving away from that model for good reason. We expect efficiency and transparency, and that’s what digital-first services deliver. They tackle the biggest frustrations of traditional banking head-on by giving you direct control over your money.

This isn't a small niche, either. The total value for outward remittances from South Africa is projected to hit around $927.73 million USD. That's a huge amount of money flowing across borders, underscoring the need for reliable and modern transfer solutions. You can dig deeper into South Africa's remittance market data on Statista.

What You Actually Get with a Modern Service

Switching from your bank to a dedicated service for international payments isn't just about a slicker app. The differences in the actual experience are night and day.

It really boils down to a few key improvements:

- Speed & Convenience: Forget bank hours. You can send money from your phone or laptop whenever it suits you, whether you’re at home or on the go.

- Honest Pricing: You see the exact exchange rate and all fees upfront. No more nasty surprises or hidden charges deducted from the final amount.

- Live Tracking: Watch your money's journey in real-time. This simple feature provides huge peace of mind for both you and the person waiting for the funds.

- Better Rates: Digital services typically offer exchange rates much closer to the mid-market rate, which means more of your money makes it to its destination.

Honestly, the biggest shift is the predictability. Knowing precisely what a transfer will cost and when it will arrive before you press send takes all the stress out of the process.

Let's break down the practical differences.

Modern vs Traditional Money Overseas Transfers

This table gives a quick snapshot of why so many people are making the switch from traditional banks to more agile, digital-first services for their international transfers.

| Feature | Digital Service (e.g., Zaro) | Traditional Bank |

|---|---|---|

| Speed | Often within minutes or same-day | 3-5 business days, sometimes longer |

| Fees | Low, transparent, and shown upfront | High, often with hidden correspondent bank fees |

| Exchange Rate | Close to the mid-market rate | Marked-up rate with a built-in profit margin |

| Convenience | 24/7 online or via app | Limited to banking hours and branch visits |

| Tracking | Real-time, step-by-step updates | Limited or no tracking available |

| Process | Simple, fully digital setup | Manual paperwork and in-person verification |

The comparison makes it clear. While banks are reliable, they were built for a different era. Digital services are designed specifically for the way we manage our finances today.

Ultimately, this is about more than just slick technology. It's about a fairer, more user-friendly service. By simplifying the tricky compliance stuff, being transparent with pricing, and drastically speeding up the whole process, platforms like Zaro are setting a new standard for how South Africans move money around the world.

Getting Your Account Ready for International Transfers

Before you can send your first rand-denominated money overseas transfer, there's a quick but crucial one-time setup you’ll need to complete. This isn't just about picking a username; it’s about getting your account fully verified to meet South Africa's strict financial regulations.

Think of it as the digital equivalent of RICA for your bank account. Getting this sorted out properly from the start is the key to making sure your funds are secure and your future transfers go off without a hitch.

This verification is what the industry calls "Know Your Customer" or KYC. It’s a non-negotiable step for any legitimate financial service, designed to confirm your identity and prevent nasty stuff like fraud and money laundering. For you, it’s an essential layer of security.

With Zaro, the whole process is handled online, so you can do it from your couch. You’ll just need to provide a couple of documents to prove you are who you say you are.

Gathering Your Verification Documents

My advice? Get your documents ready before you start the sign-up. A few minutes of prep here will save you a lot of time and potential back-and-forth later.

You’ll need two main things:

- Proof of Identity: A clear copy of your South African ID is a must. This can be your green barcoded book or the newer smart ID card. Just make sure the picture is sharp and all four corners of the document are visible.

- Proof of Address: You'll need a recent document (no older than three months) that clearly shows your name and physical residential address. A utility bill, a recent bank statement, or a municipal rates account are perfect for this.

A common slip-up I see is people submitting a document with a P.O. Box. Make sure it's your physical address and that it matches the details you entered during registration.

Takeaway: This verification step isn't just red tape. It's a legal requirement under the Financial Intelligence Centre Act (FICA) here in South Africa. Getting it done right ensures your transfers are fully compliant and keeps the whole system secure.

Completing the Verification Process

Once you’ve uploaded your documents, the Zaro compliance team gets to work reviewing them. This is usually pretty quick—often sorted within a single business day. You'll get an email as soon as your account is active and ready for that first money overseas transfer.

If there’s any problem, like a blurry image or an expired document, the team will email you with clear instructions on what to fix. The faster you respond, the faster you get approved. It’s that simple.

Once you're verified, that's it. You won't have to do it again. Your account is then primed and ready for you to send funds across the globe, securely and without any fuss.

Getting to Grips with Fees, Exchange Rates, and Transfer Limits

When you're sending money overseas, the final amount that actually lands in your recipient's bank account comes down to three things: the fees, the exchange rate, and the legal limits. Getting a handle on these before you hit "send" is the key to avoiding any nasty, expensive surprises down the line.

It's easy to get fixated on the upfront transfer fee, but often, the real cost is tucked away in a less-than-favourable exchange rate. Even a tiny difference in the rate can mean a loss of hundreds, if not thousands, of rands, especially on bigger transfers. This is where modern platforms like Zaro really pull ahead of traditional banks, which have a reputation for marking up their rates.

Breaking Down the Costs

Every international payment comes with some sort of fee structure. Zaro was built with transparency in mind, so you’ll always see a clear, fixed fee before you commit. No hidden charges, no surprise correspondent bank fees popping up a week later.

This is a refreshing change. The cost of sending money to and from Africa has historically been sky-high. In fact, even now, the average cost to send just $200 to countries in Africa is around 8.4%, which is way above the global average of 6.49%. You can read more about Africa's remittance costs on tralac.org.

Why the Exchange Rate is King

Think of the exchange rate as the engine driving your transfer. It determines exactly how many US Dollars, Euros, or British Pounds your rands turn into. Zaro gives you access to the live, mid-market exchange rate—the very same rate banks use when they trade with each other.

- Mid-Market Rate: This is the 'real' exchange rate, free from any markup. It's the fairest rate you'll find anywhere.

- Bank Rate: The big banks usually add a margin or "spread" on top of the mid-market rate. It's essentially a hidden fee that cuts into the amount your recipient gets.

By sticking to the mid-market rate, Zaro makes sure the maximum value of your money is protected during the conversion. Honestly, this is probably the single biggest factor in making your money overseas transfer cheaper.

Staying Within South Africa’s Transfer Limits

Finally, anyone living in South Africa has to work within the country's exchange control regulations, which are overseen by the South African Reserve Bank (SARB). These rules set the legal limit on how much money you can send out of the country each year.

Here are the two main allowances you need to know about:

- Single Discretionary Allowance (SDA): Every South African adult can send up to R1 million overseas per calendar year for almost any valid reason—think gifts, travel funds, or helping family abroad. The best part? You don't need a tax clearance certificate for this.

- Foreign Investment Allowance (FIA): If you need to send more than your R1 million SDA, you can use the FIA. This gives you an additional R10 million per year. For this, though, you'll need to get a Tax Compliance Status (TCS) PIN from SARS to show that your tax affairs are all in order.

Knowing these limits is crucial. Zaro helps you stay on the right side of the law by keeping track of your annual allowances, making sure every transfer is not just affordable and secure, but also fully compliant with South African regulations.

Making Your First Money Overseas Transfer

Right, your account is verified and you're ready to send your first transfer. This is the exciting part! The process itself is really simple, but knowing exactly what to expect can make it feel a lot smoother.

Let's walk through a real-life example to make it crystal clear.

Say you need to send money to your niece who's studying in the UK. Her rent is due, and you want the funds to get there fast, without any drama. This is exactly what the Zaro app is built for—it takes just a few taps.

Kicking Off the Transfer

First things first: you need to decide how much to send. One of the handiest features is that you can work in either direction. You can type in the amount in South African Rands (ZAR) you want to send, or you can specify the exact amount in British Pounds (GBP) that your niece needs to receive.

This flexibility is a game-changer.

If her rent is exactly £1,000, you just pop that figure in. Zaro instantly calculates the equivalent ZAR amount based on the live mid-market exchange rate, adding its transparent fee on top. There’s no guesswork or nasty surprises; you know she’ll get the precise amount she needs.

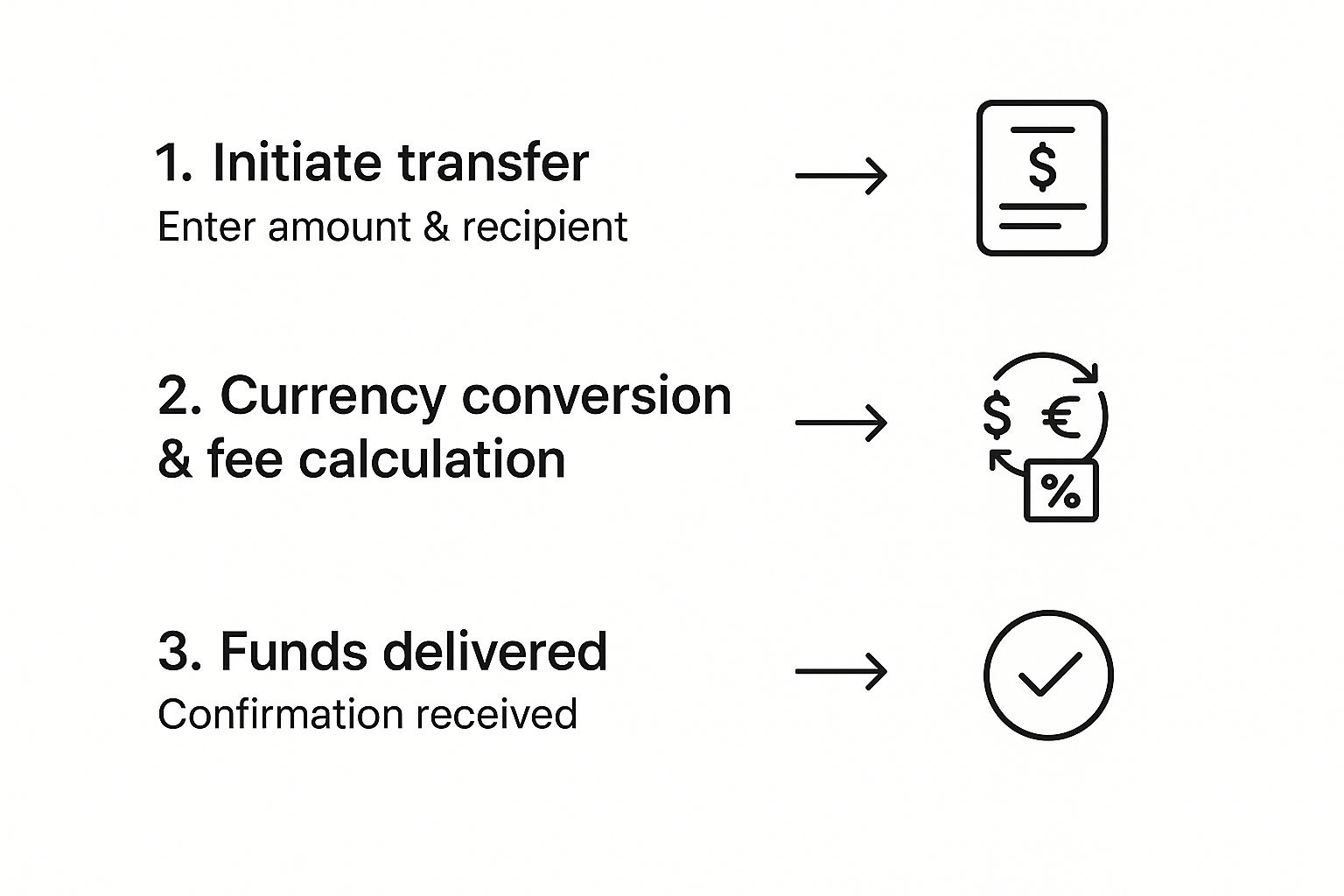

This simple flow is what makes it so straightforward.

As you can see, once you start the transfer, Zaro handles all the currency conversion and fee calculations before sending the money on its way, keeping you in the loop the entire time.

Getting the Recipient's Details Spot On

Now, this next bit is the most important part of any money overseas transfer. Getting this right from the start will save you from a world of potential headaches and delays. You’ll need your recipient's bank details, and it's vital to know that different countries use different formats.

Here’s a quick rundown of what you’ll usually need:

- For the UK: You'll need their full name, their 6-digit sort code, and their 8-digit account number.

- For Europe (the SEPA region): The key here is the IBAN (International Bank Account Number). It’s a long string of letters and numbers that combines the country code, bank details, and account number all in one.

- For the USA: Typically, you'll need an ACH routing number along with the recipient's account number.

My number one tip here? Always, always copy and paste this information directly from a message or email your recipient sends you. It’s so easy to make a typo when you're manually entering a long string of digits. Just one wrong number can cause the transfer to bounce back or get stuck in limbo for days.

Funding and Watching Your Money's Journey

Once you’ve triple-checked the recipient’s details, it’s time to fund the transfer. It couldn't be simpler. You just select your ZAR wallet in the app and confirm the transaction. The funds are immediately earmarked for your transfer.

From that moment on, you’re never left wondering where your money is. Zaro gives you real-time tracking right inside the app, so you can see its progress every step of the way. You’ll watch the status change from "Processing" to "In Transit" and finally to "Delivered."

Here’s what those statuses actually mean:

- Processing: Your transfer is in the system and is undergoing the final compliance checks.

- In Transit: The money has left the building! It's now travelling through the payment network on its way to the recipient’s bank.

- Delivered: Success! The recipient's bank has acknowledged they have the funds, and the money should appear in their account very shortly.

For most major destinations like the UK or Europe, transfers are typically done and dusted within 1-2 business days, though I’ve often seen them arrive even faster. This live tracking takes all the classic anxiety out of sending money across borders, giving both you and your recipient complete peace of mind.

Pro Tips for Safe and Efficient Transfers

When you’re sending money across borders, a bit of planning can make all the difference. While modern platforms have definitely taken the headache out of a lot of it, adopting a few smart habits will help protect your funds and make sure they get where they’re going without a hitch. These are the practical tips I’ve picked up over the years that really work.

Timing your money overseas transfer can have a bigger impact than you’d think, affecting both the cost and the speed. Exchange rates are always moving, and even a tiny shift can mean a noticeable difference, especially on larger transfers. It pays to keep an eye on currency trends; locking in a good rate can save you a decent amount of cash.

But it’s not just about the rates. You also have to think about what’s happening on the other side of the world.

Mind the Clock and Calendar

One of the easiest traps to fall into is forgetting about weekends and public holidays in the country you’re sending money to. A transfer sent from South Africa on a Friday afternoon might just sit there until Monday morning in the UK or Europe before anyone even starts processing it.

To get around this, I always try to send funds earlier in the week. A Tuesday morning transfer, for example, has the whole business week ahead of it on both ends to get processed and land in the recipient’s account. This simple change in timing can shave days off the waiting period.

It's interesting to see the bigger picture, too. While remittances are a lifeline for many families, the total amount coming into South Africa is quite small compared to our economy, making up about 0.24% of GDP back in 2020. This shows how diverse our economy is, but it also reminds us how vital every single one of those transfers is to the families who rely on them. You can dig into South Africa's remittance data on TradingEconomics.com for more context.

Double Check, Then Check Again

Honestly, the biggest risk in any transfer is simple human error. One wrong digit in an account number or IBAN can send your money into a black hole or have it bounce back—often with fees deducted. Before you hit that final confirmation button, make it a rule to check, re-check, and then check every single detail one last time.

Here’s the best way to do it: never type out a recipient's bank details from memory or a scribbled note. Always copy and paste the information directly from an official invoice or a message from the person you're paying. This pretty much eliminates the chance of a typo.

Finally, you have to be on guard for scams. Be extremely suspicious of any last-minute email saying a supplier has suddenly changed their banking details. Always, always pick up the phone or use another trusted channel to confirm that kind of request before you action any money overseas transfer. It’s a simple call that could save you from a massive financial headache.

Common Questions About Sending Money Abroad

When you're getting ready to send money overseas for the first time, it's completely normal to have a few questions buzzing around. While the process itself is pretty straightforward, getting answers to common queries can make you feel a lot more confident hitting that 'send' button.

Let's walk through some of the questions we hear most often.

How Long Does an International Transfer Take?

This is the big one, isn't it? The truth is, the speed of a money overseas transfer can be all over the map, taking anywhere from a few hours to 3-5 business days. One thing's for sure: digital platforms like Zaro are almost always quicker than the old-school high-street banks.

So, what causes the time difference? A few things come into play:

- The destination country: Some countries just have more efficient banking systems. A transfer to the UK might land faster than one to a more remote location.

- The recipient's bank: Even after your money arrives, the receiving bank has its own internal processes that can add time.

- Currencies involved: Popular currency routes, like ZAR to GBP, are usually faster than less common pairings.

A pro tip? Try to initiate your transfer early in the business week. This helps you steer clear of the delays that public holidays and weekends can cause.

What Information Do I Need From the Recipient?

Getting this part right is absolutely critical. You need to be precise. To make sure your money gets to the right person without any hitches, you'll need a specific list of details. My advice is to always double-check this information with the recipient before you even start the transfer.

Here's what you'll generally need to ask for:

- Their full legal name, exactly as it appears on their bank account. No nicknames!

- Their complete physical address.

- The name and address of their bank.

- Their bank account number.

- A country-specific code. This could be an IBAN for Europe, a sort code for the UK, or a SWIFT/BIC code for most other countries.

The safest bet is to ask the recipient to email you the details and then simply copy and paste them directly into the transfer form. A single typo or a wrong digit can cause major delays or even get your funds sent back.

Can I Cancel a Transfer After I've Sent It?

This really depends on how far along the transfer is. If you spot a mistake right after you've confirmed the payment, you need to move fast.

If the money hasn't been processed and sent out to the recipient's bank yet, there's a decent chance you can stop it. Get in touch with Zaro's support team immediately. But once the funds have landed and been credited to the recipient's account, it's final. The transaction can't be reversed at that point.

Ready to make your first international payment with confidence? With Zaro, you get transparent fees, real exchange rates, and a simple, secure platform designed for South African businesses. Experience a better way to send money globally today.