Sending money abroad can feel like a shot in the dark. You’re wrestling with hidden fees, stacks of paperwork, and timelines that seem to change on a whim. For finance teams in South Africa, this is more than just a minor headache; it’s a serious operational drag that directly impacts cash flow and, ultimately, the bottom line. The secret isn't just to make transfers, but to build a smart, proactive strategy for all your international payments.

Untangling Your International Payments

For too many businesses in South Africa, the way they send money overseas is stuck in the past. They're still relying on the old-school banking system, and that legacy approach creates a lot of friction. What should be a simple transaction quickly becomes an expensive, drawn-out process. It's not uncommon for finance teams to get blindsided by cryptic bank charges or find their payments frozen because of a manual compliance check.

This isn't just about administrative pain; it's about real money draining from your business. Those hidden fees and less-than-ideal exchange rates quietly chip away at your profit margins with every single transfer. The problem is especially sharp for companies doing business across the region.

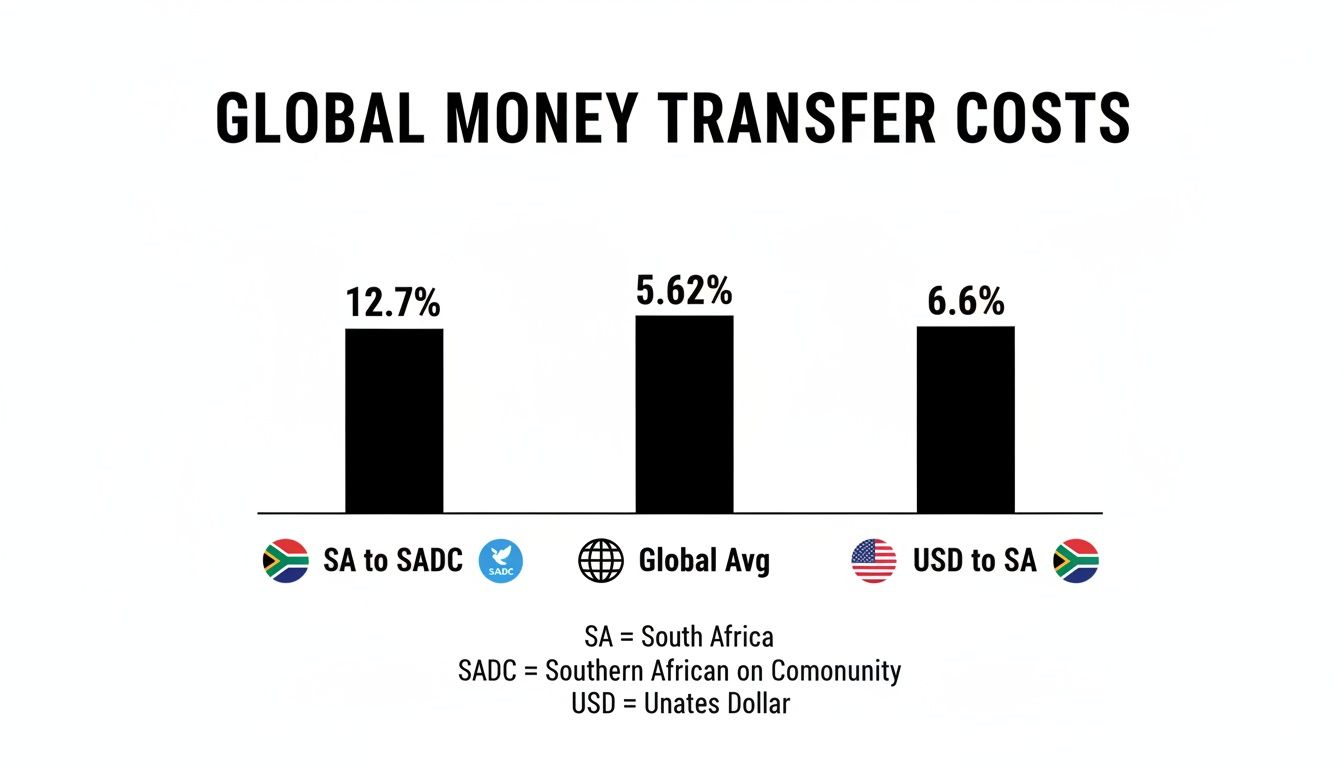

The cost of sending money abroad is a massive hurdle. Remittance fees to countries within the Southern African Development Community (SADC) corridor can average a staggering 12.7%. Even a simple USD 200 transfer to South Africa costs around 6.6% on average, which is well above the G20 average. You can dig into the specifics in the complete report on cross-border payments.

When you start scaling those percentages across multiple international transactions—as any growing business does—they add up to a significant and often unnecessary expense.

A Smarter Way to Handle Global Payments

It’s time for a new playbook. A modern approach to international payments rests on three core pillars that tackle these old problems head-on. By shifting your thinking, you can finally ditch the outdated methods and get real control over your global cash flow.

- Slash Your Costs: This is about more than just the transfer fee you see upfront. True cost efficiency means getting the real, mid-market exchange rate without any hidden markups. It also means killing off those sneaky intermediary bank charges, like SWIFT fees, that pop up unexpectedly.

- Nail Your Compliance: Don't treat compliance as a roadblock you have to swerve around. It should be a smooth, automated part of your payment process. This ensures every single payment sails through SARB regulations without causing frustrating delays.

- Get Crystal-Clear Visibility: Your finance team needs a single, unified view of all international cash movements. Think real-time payment tracking, transparent reporting, and the ability to hold and manage multi-currency accounts without being forced into costly conversions.

Focusing on these three areas is how South African businesses can completely overhaul their international payment operations. The goal is to stop being a passive "sender of funds" and start actively managing your global treasury. This is how you dramatically lower the true, all-in cost of sending money abroad. Thankfully, modern fintech platforms are providing the tools to make this shift, finally giving businesses the transparency and control they’ve been missing.

Traditional Banks vs Modern Fintech for International Transfers

Choosing a provider is one of the most critical decisions a finance team will make. While traditional banks have been the default for decades, new fintech platforms offer a fundamentally different approach. Understanding the trade-offs is key.

Here’s a side-by-side look at what you can typically expect.

| Feature | Traditional Banks | Modern Fintech Platforms |

|---|---|---|

| Exchange Rates | Often include a 2-5% markup on the mid-market rate, which isn't always disclosed. | Typically offer rates very close to the mid-market or "real" exchange rate. |

| Fees | Complex fee structures: transfer fees, intermediary bank fees (SWIFT), and receiving fees. | Simple, transparent fee structure. Often a single, low percentage-based or flat fee. |

| Speed | Slow. Transfers can take 3-7 business days to clear due to multiple intermediary banks. | Fast. Transfers are often completed within 24 hours, with some happening instantly. |

| Compliance & Paperwork | Manual, paper-heavy processes. Requires submitting physical BOP forms and supporting docs for each transfer. | Digital and integrated. Compliance is built into the workflow with online document uploads and smart checks. |

| Transparency & Tracking | Limited visibility. Once sent, tracking the payment's status is difficult (the "black box" effect). | Real-time tracking from start to finish. You know exactly where your money is at all times. |

| Customer Support | Often routed through general call centres with long wait times and staff not specialised in forex. | Dedicated expert support focused on cross-border payments, providing faster, more knowledgeable help. |

As you can see, the choice is no longer just about who can move the money. It's about finding a partner that provides speed, transparency, and efficiency—all of which have a direct impact on your company's financial health. Modern platforms are built from the ground up to solve the exact pain points that businesses have endured with the legacy banking system.

Unpacking the Real Cost of Your International Transfer

When you need to send money overseas, the price you see advertised is almost never what you actually pay. For any South African business, getting a firm grip on the true, all-in cost of an international payment is non-negotiable—it's about protecting your budget and your profit margins.

The big, bold exchange rate and the promise of a "low fee" are just the tip of the iceberg. To find out what a transfer is really costing you, you have to calculate the landed cost. This is the total ZAR amount it takes to get the foreign currency into your supplier's bank account. It means looking past the marketing spin and digging into the three things that actually drive the cost.

Looking Beyond the Advertised Rate

Calculating the real cost means you have to change how you think about it. Don't get bogged down by individual fees. Instead, you need to bundle all the costs into a single, effective exchange rate. It’s the only way you can make a proper, apples-to-apples comparison between different providers.

Here are the three cost drivers you absolutely have to account for:

- Upfront Transfer Fees: This is the one everyone sees. It’s usually a flat fee or a small percentage of the transaction. But with traditional banks, this often hides extra SWIFT charges from intermediary banks that help the payment along its journey.

- The Foreign Exchange (FX) Spread: This is the big one, and it’s where most people get caught out. It's the gap between the "mid-market" rate (the real rate banks use to trade with each other) and the much worse rate you're offered. This markup, often 2-5% with traditional banks, is pure profit for them.

- Timing and Delays: A transfer that takes three to five business days to clear is a massive risk. The ZAR/USD exchange rate can swing wildly in that time, meaning the final cost in Rands could be way higher than you planned for.

This chart really drives home how expensive transfers from our region are compared to the rest of the world. It’s a stark reminder to question every fee.

The numbers don't lie. Sending money from South Africa, especially within the SADC region, is incredibly pricey. This shows just how much hidden fees and poor exchange rates are hitting local businesses.

A Real-World Example: How Hidden Costs Add Up

Let’s make this practical. Imagine your business, an exporter in Cape Town, needs to pay a US software supplier an invoice for USD 50,000.

You ask for quotes from two providers on the same day. The real, mid-market exchange rate is R18.00 to the US Dollar.

Provider A: Your Regular South African Bank

- Quoted Exchange Rate: R18.54 / $1 (a hefty 3% markup)

- Upfront Transfer Fee: R500

- Potential SWIFT Fee: R250 (a nasty surprise often charged by the receiving bank)

Provider B: A Modern Fintech Platform (like Zaro)

- Quoted Exchange Rate: R18.00 / $1 (the real mid-market rate)

- Upfront Transfer Fee: R0

- SWIFT Fee: R0

Now, let's crunch the numbers and see the total landed cost in Rands for each.

| Cost Component | Traditional Bank | Modern Fintech Platform |

|---|---|---|

| ZAR for USD 50,000 | R927,000 (50,000 x 18.54) | R900,000 (50,000 x 18.00) |

| Transfer Fee | R500 | R0 |

| SWIFT Fee | R250 | R0 |

| Total Landed Cost (ZAR) | R927,750 | R900,000 |

On this one payment, that "small" 3% FX markup cost your business an extra R27,750. That’s not a rounding error; it’s a significant expense hidden in plain sight. If you’re making several of these payments a month, these hidden costs can easily run into hundreds of thousands of Rands a year.

The takeaway here is simple: The exchange rate is almost always the biggest cost factor. An offer of "zero fees" means nothing if the provider is pocketing a huge chunk from the FX spread.

How to Work Out Your Effective Exchange Rate

To put your finance team in control, there’s a simple formula to cut through the marketing noise and find the true cost. It helps you calculate your effective exchange rate—what you are actually paying for each unit of foreign currency once every single fee is included.

The formula is dead simple:

Total ZAR Cost (including all fees) / Foreign Currency Amount Received = Effective Exchange Rate

Let's plug the numbers from our bank example into this formula:

R927,750 / USD 50,000 = R18.555 / $1

See that? Even though the bank quoted you R18.54, your effective rate was even higher once the fees were tacked on. By running this quick calculation for every provider you consider, you’ll instantly see who offers genuine value, not just clever marketing. It's a simple check that ensures your decisions are based on hard numbers, protecting your bottom line every time you send money abroad.

Mastering Compliance for Faster Transfers

For many South African businesses, compliance feels like a bureaucratic hurdle designed to slow everything down. It's the part of sending money abroad that’s filled with jargon, endless paperwork, and frustrating back-and-forth emails.

But what if you flipped that script? Instead of seeing compliance as a roadblock, think of it as a green light. When you handle it proactively, it actually speeds the whole process up.

Getting your compliance right from the start means quicker onboarding with any payment provider and seamless, delay-free transactions. You wouldn't show up to a crucial meeting unprepared, and the same principle applies here.

Your Essential KYB and FICA Checklist

When you open an account with a financial institution, they are legally required to verify who you are. This process is known as Know Your Business (KYB), and in South Africa, it's governed by the Financial Intelligence Centre Act (FICA). The goal is simple: to prevent financial crime.

Instead of scrambling for documents every time you need to make a payment, I always advise clients to create a digital "compliance pack." Think of it as a secure folder containing all your up-to-date verification documents, ready to be shared with a new provider at a moment's notice.

Your compliance pack should include clear, high-quality scans of these essentials:

- Company Registration Documents: Your official CIPC (Companies and Intellectual Property Commission) registration certificate is non-negotiable.

- Proof of Business Address: A recent utility bill (not older than three months) or a valid lease agreement for your office.

- Director and Shareholder Information: Certified ID copies for all directors and any shareholders who own 25% or more of the company.

- Proof of Bank Account: A bank-stamped letter confirming your business’s banking details.

- Tax Information: Your company's VAT registration certificate, if you're registered.

Having these documents organised and accessible can turn a week-long onboarding marathon into a one-day sprint.

Pro-Tip: Save all your documents as clearly labelled PDF files (e.g., "Company_Name_CIPC_Docs_2024.pdf"). This small organisational step makes a huge difference. It shows you're professional and prepared, which helps build immediate trust with your payment partner.

Decoding SARB Regulations for Your Business

Beyond just verifying your company, every transfer leaving South Africa is governed by the South African Reserve Bank (SARB). Understanding these rules isn't just for big corporations; they directly impact your business's ability to trade internationally.

The SARB uses a system of allowances and reporting codes to manage capital flowing out of the country. For businesses, this mostly means reporting the reason for each payment using specific Balance of Payments (BOP) codes. Paying an overseas supplier for goods has a different code than paying for international software services, for instance.

The good news is that modern fintech platforms often build this reporting right into their payment flow. It becomes a simple dropdown selection rather than another manual form to fill out.

No matter your industry, conducting a thorough compliance risk assessment is crucial for ensuring your international transactions are smooth and above board. It's about understanding your obligations upfront to avoid nasty surprises and penalties down the line.

Understanding Key Allowances

While many SARB rules apply to large-scale investments, there are two concepts that often pop up. It's useful for business owners and directors to know what they are, even if they mostly apply to individuals:

- Single Discretionary Allowance (SDA): This lets South African residents send up to R1 million abroad each year for almost any legitimate reason, without needing a tax clearance certificate. While it's an individual allowance, business owners sometimes use it for certain personal overseas expenses.

- Foreign Investment Allowance (FIA): This is the big one, allowing individuals to move up to R10 million abroad per year for investment purposes. This requires getting a Tax Compliance Status (TCS) PIN from SARS.

For most of your day-to-day business payments, like settling supplier invoices, you won't be using these individual allowances. Your payments will be cleared as legitimate trade-related transactions, backed by documents like invoices. The real key is to partner with a provider who gets SARB reporting and can guide you correctly, making sure every transfer is fully compliant without creating extra work for your team.

Executing Your Transfer with Treasury Best Practices

With your compliance pack sorted, you can now shift your focus from preparation to execution. This is where the real strategy comes in—moving beyond just making payments to actively managing your international cash flow. It’s about using the right tools to gain control, slash costs, and get a clear view of every single money transfer abroad. The goal here is to build a smart, secure treasury function, even if you’re a small or medium-sized business.

Smart Account Funding and Management

The old way of sending money overseas was painful. You’d have to instruct your bank, get stuck with a lousy exchange rate, and then cross your fingers that the money arrived on time. Modern platforms have completely flipped this on its head. It all starts with smarter account funding that puts you firmly in control.

For your Rand-based expenses and supplier payments, it should be as easy as a local EFT. On a platform like Zaro, you simply fund your dedicated ZAR wallet with a standard bank transfer. This creates a ready pool of funds you can use for international payments, letting you skip the cumbersome forex desk process every single time.

But what about getting paid in foreign currency? This is where many South African exporters really feel the pinch. Traditional banks often force you to convert USD payments into ZAR immediately, and they do it at a terrible rate that eats into your hard-earned revenue.

The modern solution is to operate a dedicated USD account. This lets you receive USD from your international clients and hold it as dollars. You're no longer at the mercy of the day's exchange rate; you decide when—or even if—you want to convert those funds back to ZAR.

This one simple change gives you massive control over your cash flow and hedging strategy.

Essential Treasury Tips for SMEs

You don't need a huge finance department to manage your international treasury like a professional. A few smart practices can have a massive impact on your bottom line, turning your payment process from a cost centre into a real competitive advantage. I’ve seen firsthand how these techniques separate the businesses that thrive globally from those that are just getting by.

Here are a few actionable treasury tips to get you started:

- Time Your FX Conversions: Don’t just convert funds the moment an invoice is due. By holding foreign currency, you can watch the market. This lets you convert your USD to ZAR when the rate is in your favour, squeezing more value out of your export earnings.

- Hedge Against Volatility: Keeping some of your funds in USD acts as a natural buffer against ZAR volatility. If the Rand weakens, your dollar holdings become more valuable, which can help offset rising import costs. It’s a simple, effective hedge.

- Use Multi-Currency Accounts for Operations: If you’re regularly paying a US-based software provider or a European supplier, hold funds in a USD or EUR account. You can pay them directly from that balance, avoiding the cost and hassle of ZAR conversions for every single invoice.

These aren’t complex financial instruments; they are practical, accessible strategies that any SME can implement with the right platform. It’s all about shifting your mindset to actively manage your currency exposure instead of just reacting to it.

Implementing Enterprise-Grade Controls

As your business grows, so does the risk of a costly mistake or, worse, fraud. Giving one person the keys to the entire financial kingdom just isn’t a scalable or secure option. Strong internal controls are non-negotiable when you’re managing any money transfer abroad.

Thankfully, modern payment platforms are built for this, offering features that used to be reserved for large corporates. The most important of these is multi-user access with different permission levels.

Here’s how it works in practice:

- Initiator Role: You can give a team member—say, an accounts payable clerk—the "Initiator" role. They can set up new beneficiaries, upload invoices, and prepare payments for approval. Crucially, they cannot actually move any money themselves.

- Approver Role: A senior person, like a financial manager or the business owner, gets the "Approver" role. They're notified when payments are ready. They log in, check the details against the supporting documents, and give the final go-ahead to release the funds.

This separation of duties, often called the "maker-checker" principle, is a cornerstone of sound financial governance. It dramatically cuts the risk of unauthorised payments and creates a clear audit trail for every transaction. This level of control gives you the confidence to delegate work without losing oversight, allowing your finance team to operate both efficiently and securely as you expand your global footprint.

How Zaro Puts These Principles into Practice

We’ve walked through the theory—the hidden costs, the compliance headaches, and the treasury best practices for sending money abroad. Now, let’s see how a purpose-built platform like Zaro turns all that theory into tangible, day-to-day results for South African businesses.

Think of it this way: instead of wrestling with your bank’s clunky, opaque system, Zaro offers a digital-first solution built to solve the two biggest pain points—the foreign exchange (FX) spread and sneaky transfer fees. By giving you the real, mid-market exchange rate without any markup, Zaro immediately cuts out the single largest hidden cost you face.

This shift towards transparency couldn't be more timely. South Africa's formal remittance market has exploded, growing from R6 billion in 2016 to over R19 billion in 2024. That growth comes from a massive jump in transaction volume, from 4.8 million to 15.7 million annually. As the South African Reserve Bank highlights, businesses are clearly moving towards more formal, regulated, and transparent ways of making international payments.

A Real-World Example: Before and After Zaro

Let's ground this in reality with a common scenario. Imagine a South African Business Process Outsourcing (BPO) company that pays 10 international contractors $2,000 each every month. Their total monthly payroll is $20,000.

Before Zaro: The Old Way with a Traditional Bank

The finance team would have to instruct their bank to process ten separate SWIFT payments. The bank quotes them a rate with a 2.5% markup and tacks on a fee for every single transfer. The numbers speak for themselves.

- Real Exchange Rate: R18.20 / $1

- Bank's Quoted Rate (with 2.5% markup): R18.65 / $1

- Total in ZAR (at marked-up rate): R373,000 ($20,000 x 18.65)

- Hidden FX Cost: R9,000 (The difference you lose in the spread)

- Transfer Fees (R350 x 10): R3,500

- Total Monthly Cost: R376,500

After Zaro: The Smart Way with the Real Exchange Rate

Now, the BPO uses Zaro. They fund their ZAR wallet and pay all ten contractors from one simple platform, getting the real exchange rate and paying zero transfer fees.

- Real Exchange Rate: R18.20 / $1

- Total in ZAR (at real rate): R364,000 ($20,000 x 18.20)

- Hidden FX Cost: R0

- Transfer Fees: R0

- Total Monthly Cost: R364,000

In this everyday business scenario, switching to Zaro saves the company R12,500 every single month. Annually, that’s a direct saving of R150,000 that goes straight back to the bottom line—all from eliminating the hidden costs on their regular international payments.

Enterprise Controls and Global Spending

Saving money is one thing, but maintaining control is just as crucial. Zaro is built with enterprise-grade features that give finance teams complete command over their payment workflows.

This means you can implement multi-user permissions—letting one person initiate payments while a manager gives the final sign-off. It’s a simple but critical check and balance for any growing business.

The detailed reporting also gives you total visibility into your transactions. No more black boxes. Every payment is tracked, logged, and easily accessible, which makes reconciliation and auditing a breeze.

But it doesn't stop at large payments. The platform also helps with day-to-day global spending. Zaro can issue both ZAR and USD debit cards linked directly to your business accounts. This lets your team pay for software subscriptions, online advertising, or travel expenses at the same real exchange rate. You completely sidestep the poor rates and foreign transaction fees that banks typically slap on corporate credit cards, ensuring every Rand and Dollar is put to its best use.

A Few Common Questions We Hear All the Time

Even the sharpest finance teams run into specific questions when it’s time to send money across borders. Let's tackle some of the most common queries we get from South African businesses.

A big one is always about timing. Is there a "best" time to make a transfer? While you can't predict the market perfectly, you can be smart about it. We always advise clients to avoid sending large sums right before major economic news drops—think interest rate announcements or GDP figures from either South Africa or the destination country. That’s when the markets get choppy.

Then there's the question of proving you've actually paid an overseas supplier. Your standard bank statement often won't cut it. What you really need is a SWIFT MT103 confirmation. This document is the gold standard; it traces the entire journey of the funds from your account to theirs. Any good payment platform should be able to generate one for you.

Can We Just Pay Our International Invoices in Rands?

It’s a tempting thought: just pay the ZAR amount and let your supplier figure out the rest. Technically, you can, but it’s a bad move for a few reasons.

When you do this, you're essentially handing off the currency risk—and the conversion costs—to your supplier. What do you think they'll do? They'll pad their next invoice to cover that uncertainty.

Paying in their local currency (USD, EUR, GBP, etc.) is simply better business. It’s professional, puts you in the driver's seat on the exchange rate, and builds trust. When you handle the conversion yourself with a transparent platform, you know you're getting the best deal on every single money transfer abroad.

Where Does South Africa Fit into Global Money Flows?

It's useful to zoom out and see the bigger picture. South Africa's role is a bit different from many of its neighbours. The country is a net sender of remittances, which speaks to its role as a major economic hub on the continent.

To put some numbers on it, in 2023, the entire African continent received around USD 90 billion in remittances. Of that, Southern Africa—including SA—only accounted for about USD 5 billion.

This pattern shows that, on balance, more money flows out of South Africa than into it. This fact alone should be a massive motivator for businesses like yours to lock down the most efficient and affordable ways to manage those outbound payments. For a closer look at the numbers, you can dig into this analysis of financial flows across Africa.

Are There Limits on How Much My Business Can Send Abroad?

This is probably the most critical question of all. For individuals, there's the R1 million Single Discretionary Allowance (SDA). But for businesses, things are different.

The good news is there’s no fixed annual limit for legitimate business payments. As long as you have the paperwork to back it up—like a proper invoice for goods or services—you can transfer what you need to.

The catch? Your record-keeping has to be flawless. The South African Reserve Bank (SARB) needs to see a clear, legitimate reason for every Rand that leaves the country.

Your ability to send money abroad for business isn’t capped by a specific Rand amount. It’s limited only by your ability to prove each transaction is for legitimate trade. Keeping your invoices and contracts in perfect order is non-negotiable.

This is where working with a provider that automates the compliance side of things becomes a game-changer. It ensures your payments go through smoothly, without getting stuck in frustrating SARB queries.

Ready to stop overpaying on international transfers and take control of your global payments? Zaro offers the real exchange rate, zero transfer fees, and the enterprise-grade tools you need to manage your money with confidence. Get started with Zaro today.