If your South African business deals with anyone overseas, you know that international payments are just part of the job. But let's be honest, it's rarely straightforward. The whole process can feel like a maze of exchange controls, confusing fees, and rules that seem to change overnight.

This guide isn't just about how to make a single payment. It's about building a smart, strategic approach to how your business moves money across borders.

It’s Time to Rethink Your International Payment Strategy

Sending money abroad has moved on from being a simple task for the back office. For any South African business with global ambitions, it's now a core part of financial strategy. The old-school way of doing things through traditional banks is being seriously challenged by digital-first solutions that offer far better transparency, speed, and value for money.

For CFOs and finance teams, really getting to grips with how cross-border finance works can unlock some serious cost savings and make the whole operation run smoother.

Think of this guide as your roadmap. We’re going to pull back the curtain on everything from the South African Reserve Bank (SARB) regulations to how you can work out the true cost of a transfer—no hidden surprises. Once you understand the mechanics, you stop being a passenger and start driving the decisions.

The Scale of the Game is Getting Bigger

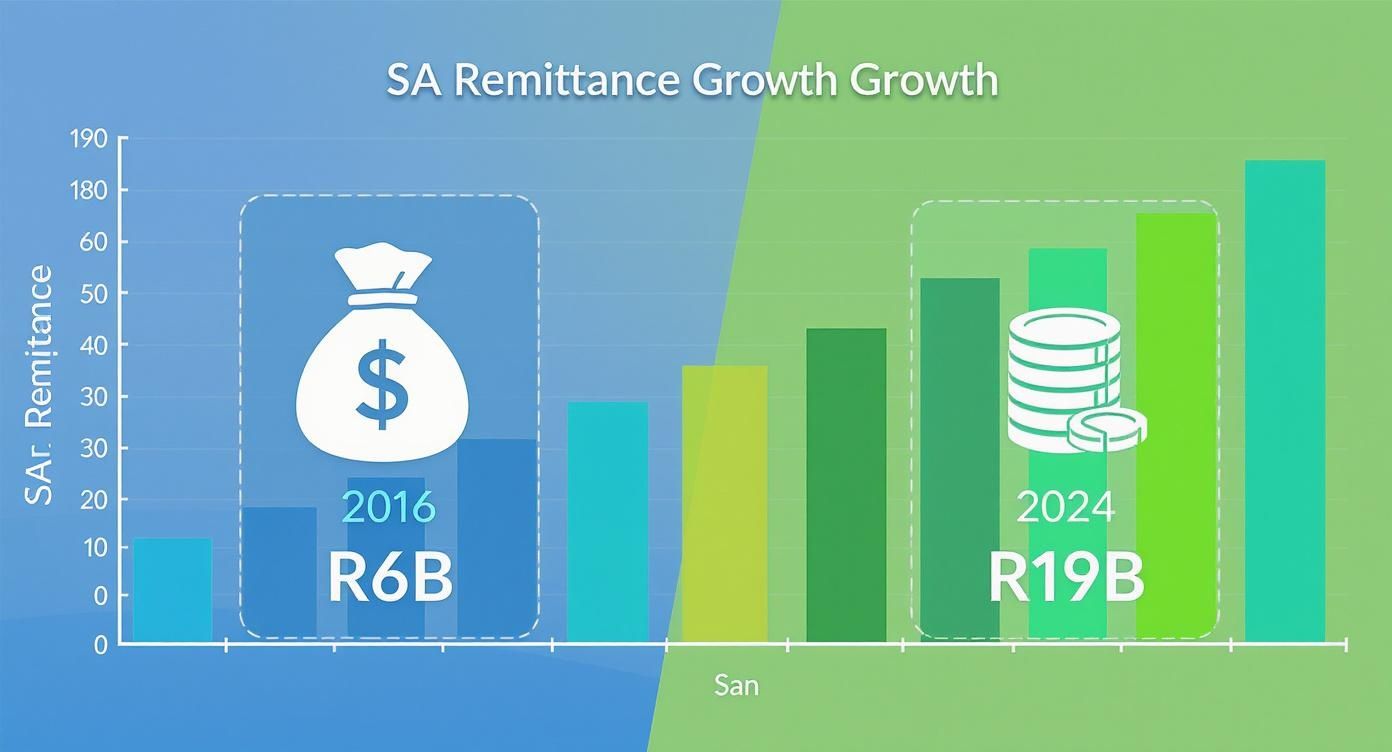

Why does this all matter so much right now? Just look at the numbers. The sheer volume of money flowing out of South Africa, especially to our neighbours, shows just how connected our economy has become. This growth makes getting your payment systems right more critical than ever for keeping suppliers happy and supply chains moving.

Over the last decade, the formal remittance market from South Africa into other SADC countries has absolutely exploded. We've seen outflows jump from around R6 billion in 2016 to over R19 billion in 2024—that's more than a threefold increase. The number of individual transactions also shot up from about 4.8 million to 15.7 million in that same period. If you're interested in the data, you can explore detailed research on SADC payment flows.

Where to Focus for the Biggest Wins

To build an international payment system that actually works for your business, your finance team needs to zero in on a few key areas. Sticking with the status quo is easy, but a proactive look at your current setup can make a massive difference to your bottom line and efficiency.

Here’s where to start looking:

- Cost Transparency: It’s time to hunt down those hidden costs. We’re talking about the FX spreads and intermediary bank fees that rarely show up on the initial quote.

- Regulatory Compliance: Every single money transfer overseas must be 100% compliant with SARB’s exchange control rules. Getting this wrong means delays, or worse, penalties.

- Operational Speed: How long does it actually take for your money to land with an international supplier? Cutting that time down improves your cash flow and builds better business relationships.

- Smarter Tech: Modern platforms can automate the compliance paperwork, give you real-time tracking, and offer far better control over your finances. It's a game-changer.

Nail these four areas, and you'll turn what was once a costly headache into a real competitive advantage for your business.

Uncovering the True Cost of an Overseas Transfer

When your business needs to send money overseas, the fee you see upfront is almost never the full picture. It’s just the tip of the iceberg. The real, and often much larger, costs are usually hidden just beneath the surface, quietly eating into your bottom line. To get a firm grip on your international payment expenses, you have to look past the advertised price and understand the three distinct layers that make up the total cost.

The sheer volume of money leaving South Africa makes this more critical than ever. Just look at the growth in formal remittances.

We’ve seen a massive jump from R6 billion in 2016 to a projected R19 billion in 2024. With this much capital flowing across our borders, finding transparent and cost-effective ways to manage payments is no longer a "nice-to-have"—it's a strategic necessity for any business operating internationally.

The Hidden Cost of the FX Spread

First up is the single biggest—and most frequently overlooked—cost: the foreign exchange (FX) spread.

Think of the spread as the provider's built-in profit margin on the currency itself. It’s the gap between the mid-market rate (the "real" exchange rate you see on Google or Reuters) and the less favourable rate your bank or provider actually gives you. For a large business transaction, a seemingly tiny spread of 1-2% can easily translate into thousands of rands lost.

The FX spread is the oldest trick in the book. A provider might shout about "zero fees," but they're often just hiding their profit in a wider, less competitive spread. This can make the transfer far more expensive than a service with a transparent fee and a fair exchange rate.

Understanding the Upfront Transfer Fees

The second layer is the one you actually see: the explicit transfer fee. This is what the provider charges for the service of moving your money. While these are usually more transparent than the FX spread, their structure can vary wildly.

You'll typically run into one of these models:

- Fixed Fee: A flat charge for every transaction, no matter the size. This can be great for large, one-off payments but quickly becomes expensive if you’re making smaller, more frequent transfers.

- Percentage-Based Fee: The provider takes a cut of the total amount you’re sending. This model can get very costly, very fast, especially as your payment values go up.

- Hybrid Model: A mix of both, where you might pay a smaller fixed fee plus a small percentage on top.

Knowing which model your provider uses is key to forecasting your costs accurately and making apples-to-apples comparisons.

The Unpredictable SWIFT Network Fees

Finally, we have the third and often most frustrating layer: the correspondent bank fees, better known as SWIFT fees.

When you send a money transfer overseas through a traditional bank, the funds don't just zip from your account in Johannesburg to your supplier's in Berlin. Instead, the payment gets passed along a chain of intermediary or "correspondent" banks, and each one can take a slice of the pie for its troubles.

The worst part? These fees are often completely unknown when you initiate the payment. This means the final amount your supplier receives can be less than what you sent, leading to reconciliation headaches and potentially damaging supplier relationships. This is a standard, if outdated, feature of the legacy SWIFT system that many banks still rely on.

This clunky system is a big reason why South Africa remains one of the most expensive G20 countries for sending money. According to the World Bank, the average cost to send money from South Africa was a staggering 15.23% in the first quarter of 2025—miles above the global average and the UN's target of 3%. You can read the full World Bank report on remittance prices for a deeper dive.

Cost Component Breakdown for a R150,000 Transfer

Let's look at a practical example. Seeing the numbers side-by-side really highlights how a poor exchange rate can dwarf an upfront fee.

| Cost Component | Traditional Bank | Modern Fintech Provider (like Zaro) | Impact on Your Business |

|---|---|---|---|

| Upfront Fee | R500 (fixed) | R300 (0.2% fee) | A visible but often minor part of the total cost. |

| FX Spread | 2.5% (R3,750) | 0.5% (R750) | This is the silent killer. A 2% difference costs you R3,000 on this single transaction. |

| SWIFT Fees | ~R400 (unpredictable) | R0 (uses modern payment rails) | Hidden fees cause reconciliation nightmares and short-payments to suppliers. |

| Total Cost | R4,650 | R1,050 | The "cheaper" upfront fee from the fintech saves the business R3,600. |

As the table shows, focusing only on the upfront fee is a classic mistake. The real cost is buried in the spread and the unpredictable network fees.

By dissecting these three components—the spread, the transfer fees, and the SWIFT charges—your finance team can finally calculate the true, all-in cost of every international payment. This clarity is the first step toward building a smarter, more cost-effective global payment strategy.

Navigating South African Exchange Control Regulations

If your business sends money overseas, compliance isn't just a box to tick—it's the very foundation of every transaction you make. The South African Reserve Bank (SARB) sets the rules of the game with its Exchange Control Regulations, a framework built to manage the flow of capital and keep the country's finances stable.

Getting these rules wrong is a recipe for trouble. We're talking about delayed payments, outright rejections, and even hefty penalties that can disrupt your entire supply chain and sour relationships with your international partners. It’s best to think of these regulations not as a roadblock, but as a clear rulebook for operating on the global stage.

At its core, the system is designed to monitor every Rand that leaves South Africa. For a business, this means every single international payment has to be justified with the right paperwork to prove it's for a legitimate commercial reason.

Why Business Compliance Is a Different Ball Game

While individuals get a Single Discretionary Allowance to send money abroad each year, businesses play by a much stricter set of rules. There's no blanket annual allowance for a company. Instead, every payment must be tied directly to a permissible, trade-related activity, like paying for imported goods or international software services.

This is where Balance of Payments (BOP) reporting enters the picture. Each time you send money to a foreign supplier, your bank or payment provider has to categorise the transaction and report it to SARB. This is non-negotiable.

To do this, you need a clear paper trail. And the most important document in that trail? A valid commercial invoice.

A commercial invoice is the golden ticket for an international business payment. It’s the proof that connects your money transfer to actual goods or services, satisfying the regulators that it's a legitimate business expense. Without one, your payment is almost guaranteed to be stopped in its tracks.

The Twin Pillars of Compliance: KYB and KYC

Before any provider can move your money, they are legally required to know who they're dealing with. This is done through two processes designed to clamp down on financial crime like money laundering and terrorist financing.

Think of these as the gatekeepers of the financial system.

1. Know Your Customer (KYC)

This is all about verifying the people behind the business. Your provider will need to confirm the identities of the company's directors, key officers, and anyone with a significant stake in the business (typically 25% or more ownership).

2. Know Your Business (KYB)

This is the corporate version of KYC. The provider has to verify the business entity itself. They need to be sure they are dealing with a properly registered, legally operating company—not a front for illicit activity.

Getting Your Paperwork in Order

The single best thing you can do to avoid headaches is to have your documentation ready before you need to make a payment. While a modern fintech partner like Zaro will have a slick digital onboarding process, the required documents don't change.

To fly through the KYB and KYC checks, your finance team should have this folder ready to go:

- Company Registration Documents: Your official registration papers from the CIPC (Companies and Intellectual Property Commission).

- Proof of Business Address: A recent utility bill (less than three months old) confirming where your business operates.

- Director and Shareholder IDs: Certified copies of the ID documents or passports for all the key individuals involved.

- Proof of Address for Individuals: A separate, personal proof of address for each director and major shareholder.

Having these documents organised and on hand turns onboarding from a week-long ordeal into a quick, painless process. By taking these compliance steps seriously, you shift them from being a bottleneck to just another part of a smooth, efficient global payment system.

Comparing Your Payment Provider Options

Choosing a partner for your international payments is one of the biggest financial decisions you'll make. Get it right, and you can save thousands on every transfer while making your operations run like clockwork. Get it wrong, and you’ll watch profits get eaten up by fees and your team get bogged down by frustrating delays.

For South African businesses, this choice really comes down to two paths: the old-school security of a traditional bank or the slick efficiency of a modern fintech platform. This isn't just a minor detail—it has a direct impact on your cash flow, transaction speed, and how much time your finance team spends on admin.

The Traditional Bank Approach

For years, commercial banks have been the go-to for any business needing to complete a money transfer overseas. They’re familiar, they feel safe, and their long-standing reputation offers a certain sense of comfort. You could say they are the devil you know.

But that long history often comes with a hefty price tag, thanks to outdated systems and pricing models that feel anything but transparent. The banking system was designed for a different era, and frankly, the cracks are beginning to show.

- High and Hidden Costs: Banks are masters of the wide FX spread, where they bake a substantial profit margin directly into the exchange rate you’re offered. It's often their biggest money-maker on these payments, but you’ll rarely see it broken down for you.

- Slow and Manual Processes: Payments run on the decades-old SWIFT network, which means your money could take several business days to arrive. It often hops between multiple intermediary banks along the way, and each one might slice off a fee for its trouble.

- Cumbersome Compliance: Getting set up or having a payment approved can feel like a full-time job. Expect paperwork, trips to the branch, and endless manual follow-ups that soak up your finance team’s precious time.

When your business makes international payments regularly, these little frictions quickly add up. They become a real drag on your financial performance and operational agility. The perceived safety of a bank often comes at a very steep price.

The Rise of Modern Fintech Platforms

This is where fintechs come in. They’ve built their businesses by directly tackling the biggest headaches of the traditional banking system. These are digital-first platforms, designed from scratch with modern tech to make international payments faster, cheaper, and a whole lot clearer for businesses.

This move to digital is shaking up the entire market. A 2024 analysis of the South African cross-border transfer sector found that outward digital remittances made up about 64% of the digital market's revenue. As more fintechs enter the space, the increased competition is pushing costs down and forcing everyone to be more transparent.

Fintechs don’t just offer a slight improvement; they offer a fundamentally better way of doing things.

The core advantage of a specialised fintech provider lies in transparency and efficiency. By stripping out hidden FX markups and using modern payment rails, they can deliver a service that is not only cheaper but also significantly faster and easier for your finance team to manage.

Here’s what you can generally expect:

- Transparent Pricing: Fintechs usually give you access to the real mid-market exchange rate and charge a clear, low fee on top. This takes the guesswork out of it and lets you forecast your costs accurately.

- Exceptional Speed: By avoiding the sluggish SWIFT network, many fintechs can get funds to your international suppliers within a single business day—sometimes even in a few hours.

- Digital-First Experience: The whole nine yards—from onboarding and KYB verification to making and tracking payments—happens on a clean online platform you can access from anywhere.

- Integrated Compliance: These platforms build compliance right into the process. You can upload invoices and manage your documentation digitally, creating a simple and clear audit trail.

This approach turns a money transfer overseas from a complex administrative nightmare into a straightforward digital task. To help you sort through the options, you can explore various currency transfer companies and see how different providers compare. It's the best way to figure out which model—the old-guard bank or the new-school fintech—is the right fit for your business.

A Step-By-Step Guide to Your International Payment

Knowing the theory is one thing, but walking through the actual process makes it all click. Let’s break down exactly how a modern business payment works when you use a digital-first platform. This isn't the old, paper-heavy process you might be used to; it's a series of clear, logical steps designed to give your finance team full control.

The whole thing kicks off with a simple, one-time setup that swaps bank queues for a streamlined online verification.

Step 1: Onboard and Verify Your Business

Before a single rand can be sent, the platform needs to tick its regulatory boxes. This isn’t just red tape; it's a critical step that ensures every transaction complies with South African law and international anti-money laundering standards.

This is handled through a secure, digital Know Your Business (KYB) process. You'll be asked to upload key company documents—like your CIPC registration papers and proof of address—directly to the platform. It's a once-off task that creates your verified business profile, and you're good to go.

Step 2: Get a Live Exchange Rate Quote

With your account set up, you’re ready to make a payment. Your first move is to see the real, live cost. Forget the vague "daily rates" offered by traditional banks; a good fintech platform gives you an executable quote in real-time.

You simply punch in the amount you need to send and the currency it's going to. The platform then shows you everything:

- The live mid-market exchange rate.

- A clear, upfront transfer fee.

- The final amount that will land in your beneficiary's account.

Often, this quote is "locked in" for a brief window, giving you a moment to confirm the details without worrying about the market moving against you. This level of transparency is what a modern money transfer overseas should be all about.

The ability to lock in a live rate is a massive advantage. It completely removes the risk of currency swings that can happen between initiating a payment and its final processing. This means your supplier gets paid the exact amount you agreed on, and your own costs are fixed. No surprises.

Step 3: Fund Your Transfer Locally

Once you’ve accepted the quote, it's time to fund the transfer. But you aren't sending your rands directly into the global banking system. Instead, you make a simple local Electronic Funds Transfer (EFT) from your South African business bank account to the payment provider’s local ZAR account.

It’s a straightforward domestic transfer—fast, cheap, and something every finance team does daily. As soon as the platform receives and reconciles your funds, which usually takes just a few minutes, your international payment is primed for the next step.

Step 4: Provide Beneficiary and Compliance Details

With the money in place, you’ll enter the recipient's details. Getting this right is crucial to avoid any hold-ups. You'll need their full name, bank name, account number, and the correct international banking code (like an IBAN or SWIFT/BIC code).

Next, you'll be prompted to upload the necessary compliance document—almost always the commercial invoice for the payment. This is done right there on the platform, instantly linking the document to the specific transaction. The result is a clean, simple, and compliant audit trail.

Step 5: Track and Confirm Your Payment

After hitting 'confirm', the platform takes over. Your rands are converted into the foreign currency at the rate you locked in and sent on their way through modern, efficient payment networks.

You can then watch the payment's progress in real-time on your dashboard. You’ll get notifications as it hits key milestones and a final confirmation once the money has been safely deposited. That old anxiety of "where's the money?" is completely eliminated.

Making Strategic Choices for Global Payments

Managing how your company sends money overseas is far more than just a back-office task. It’s a powerful lever for boosting your financial performance. For finance leaders in South Africa, the real win comes from zooming out—moving beyond the mechanics of a single payment to take a hard look at your entire global payments strategy. It's about shifting from just doing transactions to actively optimising them.

This means asking some tough questions about your current process. Are you unknowingly losing thousands of rands to bloated foreign exchange spreads? Are unpredictable SWIFT fees creating a nightmare for your reconciliation team? A smart strategy starts by recognising that these aren't just the "cost of doing business." They are inefficiencies you can, and should, solve.

Recapping the Core Principles

To build a financial strategy that’s both competitive and resilient, you have to get the fundamentals of cross-border payments right. The most powerful changes almost always come from nailing three critical areas.

- Shrink the FX Spread: Never accept an exchange rate at face value. The spread is where most providers tuck away their profit, and squeezing it offers the biggest single opportunity for savings.

- Demand Fee Transparency: Insist on a clear, all-in cost breakdown before you hit send. This means no more surprise correspondent bank fees that throw your cash flow planning into chaos.

- Use Tech for Compliance: Modern platforms can automate the documentation and reporting that SARB requires. This slashes manual work, cuts down the risk of human error, and gives you a clean, digital audit trail for every single payment.

Your Path Forward

The final step is to take decisive action. A great place to start is with a simple audit of your international payments from the last quarter. Calculate the true all-in cost you’ve been paying by comparing the exchange rates you got against the mid-market rate on those specific days. The results are often startling.

Proactively managing international payments transforms them from a necessary cost centre into a strategic advantage. By critically assessing your provider and exploring modern solutions, you gain superior control, reduce costs, and build a more efficient global financial operation.

This analysis will give you a clear benchmark. Armed with that data, you can start looking at providers that offer genuine price transparency and smarter technology. Making a strategic choice is no longer about saving a few rands on a transaction fee; it’s about building a robust financial infrastructure that truly supports your company’s global ambitions.

Frequently Asked Questions About Overseas Transfers

Even with the best strategy in place, the nitty-gritty of sending money overseas can still throw up a few questions. We get it. Here are some of the most common queries we hear from South African finance teams, with straight-talking answers to help you manage your global payments with confidence.

What Is the Biggest Hidden Cost in an Overseas Transfer?

Hands down, the single biggest hidden expense is the foreign exchange (FX) spread. It’s the classic sleight of hand in the industry. Many providers shout about “zero fees,” but they’re quietly building their profit into the exchange rate they give you.

The spread is simply the gap between the wholesale rate that banks trade at and the less favourable retail rate you’re offered. For a business moving significant sums, a seemingly tiny percentage difference here can end up costing you thousands of rands more than a straightforward transfer fee. The golden rule? Always, always compare the final amount your beneficiary receives, not just the advertised fee.

How Long Does an International Transfer Take?

This can be a real "how long is a piece of string?" question. With a traditional bank, you’re often looking at 2-5 business days for the money to land. That’s because the SWIFT network can sometimes feel like a long and winding road, passing through several intermediary banks along the way.

The newer fintech players have changed the game completely. By using more direct payment routes, they can often get your money there on the same day or the next business day. The only catch is making sure all your beneficiary details and compliance documents are in order from the get-go.

The speed of your payment is no longer just a matter of convenience. Faster settlement times improve cash flow, reduce currency risk, and strengthen relationships with international suppliers who get paid on schedule.

What Are the Essential Documents for a Business Transfer?

To keep everything above board with the South African Reserve Bank (SARB), you'll almost always need a valid commercial invoice for the payment. This is your proof that the transaction is for legitimate business purposes and is absolutely essential for your Balance of Payments (BOP) reporting.

Beyond that, when you first set up your account—the Know Your Business (KYB) process—be prepared to provide:

- Your company registration documents (like your CIPC certificate)

- Proof of your business address

- ID documents for all directors and significant shareholders

Can I Lock in an Exchange Rate for a Future Payment?

Absolutely, and you should. Most modern fintech providers offer tools to help you manage currency risk for payments you need to make down the line. The most common way to do this is with a forward exchange contract (FEC).

An FEC lets you lock in today’s exchange rate for a transaction that will only happen in the future. It’s an incredibly powerful tool for protecting your profit margins against a volatile rand. You remove the guesswork and bring some much-needed predictability to your international cash flow.

Ready to eliminate hidden fees and streamline your international payments? Zaro offers transparent pricing with real exchange rates, no spreads, and no SWIFT fees. Get the control and efficiency your business deserves. Learn more and sign up today at Zaro.