If your South African business operates on the global stage, you know that getting money across borders isn't just a task—it's a critical part of your success. Whether you're paying international suppliers, managing a remote team, or getting paid by clients overseas, how you handle these payments matters. A lot.

Why Getting Overseas Payments Right is a Game-Changer

In today’s interconnected economy, the speed and cost of your international transactions hit your bottom line directly. Slow, expensive transfers can frustrate suppliers, stall projects, and quietly eat away at your profit margins. It’s like trying to compete in a sprint while dragging an anchor behind you.

So many businesses get stuck in the old way of doing things, facing the same old problems that create friction and uncertainty.

The Usual Headaches with International Payments

Let's be honest, the traditional system can be a nightmare. Here are a few of the most common hurdles businesses face:

- Those Sneaky Hidden Fees: It's rarely just the one transfer fee you see upfront. Banks often build a markup into the exchange rate and then there are "correspondent" bank fees that get sliced off along the way. The amount that lands is often less than what you sent.

- The Waiting Game: Traditional SWIFT transfers can take days to land. This leaves both you and your recipient guessing, creating cash flow uncertainty and a whole lot of "has it arrived yet?" emails.

- Regulatory Red Tape: Dealing with the South African Reserve Bank's (SARB) forex regulations can feel like a full-time job. The paperwork and manual reporting can be a huge administrative drain.

Getting past these challenges isn’t just about saving a bit of cash. A smooth payment system builds trust with your global partners and gives you the agility to move quickly and compete effectively.

For businesses looking to really streamline their international finance, some even explore options like opening a business bank account in Dubai or other major trade hubs. This guide will walk you through a modern approach, showing how platforms like Zaro offer a much-needed, transparent alternative to the old, complex world of global finance.

Decoding the True Cost of Sending Money Abroad

Getting a grip on your international payment strategy starts with one thing: understanding what it really costs to send money overseas. The transfer fee you see advertised is often just the tip of the iceberg. Lurking beneath the surface are a host of other charges that can quickly eat into your profits.

Think of it like getting a quote from a builder. The initial price might look great, but then come the "sundries" and "disbursements" that weren't mentioned upfront. Traditional banks have a similar model for international payments, making it incredibly difficult to know exactly how much will land in your recipient's account.

Unpacking the Hidden Fees

The biggest culprit is usually the exchange rate markup. Instead of giving you the real mid-market rate (the one you see on Google or XE.com), most providers quietly add their own margin. A small percentage might not sound like much, but when you're dealing with business-sized transactions, it can easily add up to thousands of Rands lost on a single payment.

But the exchange rate isn't the only place you'll find extra costs. You also have to contend with:

- SWIFT or Correspondent Bank Fees: Your money doesn't just fly directly from your bank to the recipient's. It hops between several intermediary banks in the global SWIFT network, and each one can take a little bite out of the total along the way. These fees are unpredictable and are often deducted from the amount you sent.

- Receiving Bank Fees: To add insult to injury, the recipient's bank might also charge a fee just for accepting an incoming international payment. This means even less of your money makes it to its final destination.

This is a common frustration for businesses, where every cent counts.

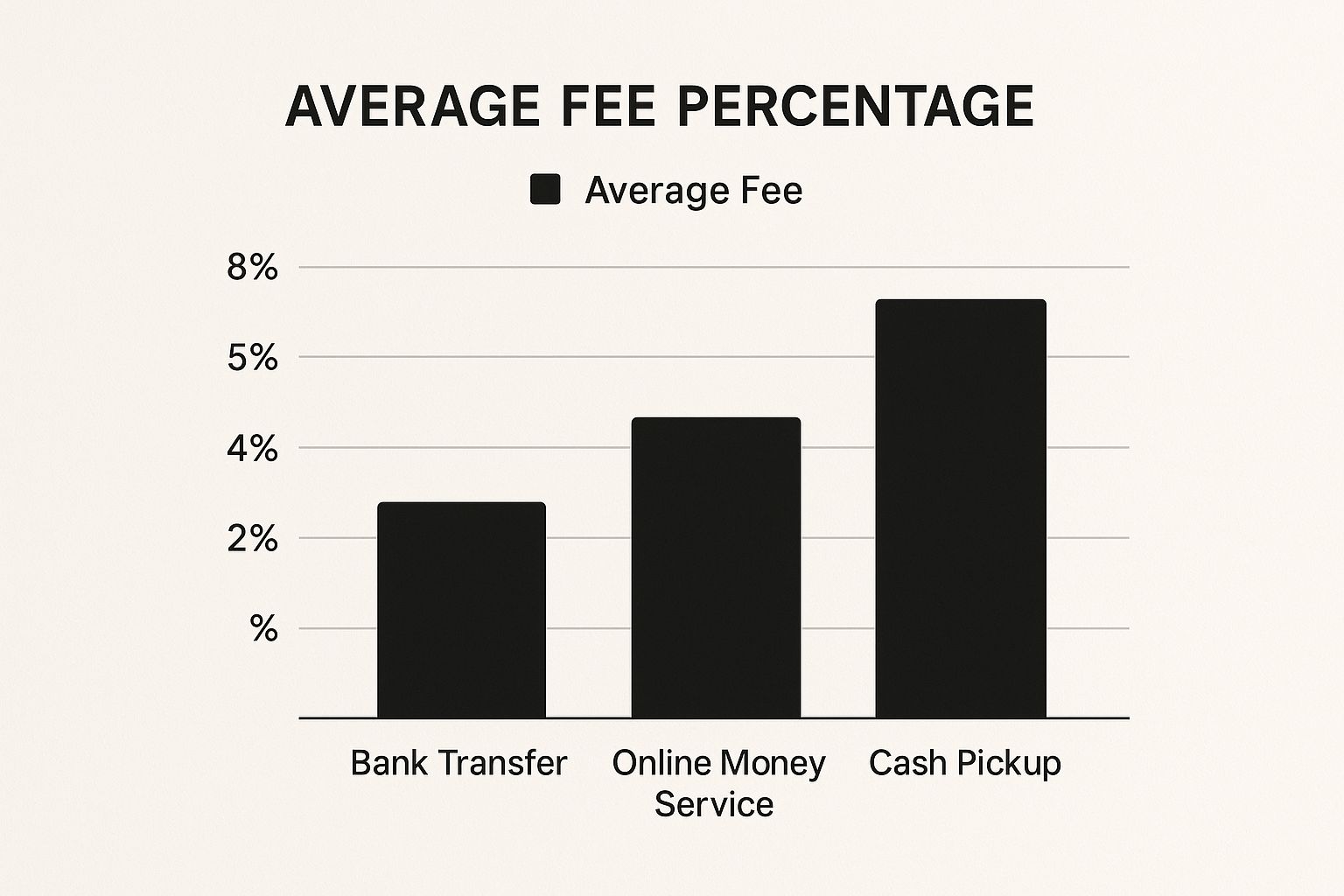

As you can see, sticking with old-school bank transfers often means paying the highest price, which highlights why so many businesses are now looking for better, more transparent options.

Comparing International Transfer Costs: Traditional Bank vs. Zaro

Let's put this into perspective with a real-world example. Say your business needs to send ZAR 100,000 to a supplier in Germany. The costs can look dramatically different depending on who you use.

| Cost Component | Traditional Bank (Estimated) | Zaro (Typical) |

|---|---|---|

| Upfront Transfer Fee | R250 – R500 | R0 (Fee-free transfers) |

| Exchange Rate Markup | 1.5% - 3.0% (R1,500 – R3,000) | 0% (Real mid-market rate) |

| SWIFT/Intermediary Fees | R150 – R750 (Unpredictable) | R0 |

| Receiving Bank Fee | R100 – R400 (Deducted from total) | R0 |

| Total Estimated Cost | R2,000 – R4,650+ | R0 |

The difference is stark. With a bank, you could lose up to 4.65% of your transfer value to a combination of fees, many of which are completely hidden until the transaction is complete.

The Real-World Impact on African Economies

These high costs aren't just an inconvenience for businesses; they have a massive impact across the entire continent. In 2023, the money sent home to Africa by migrants—known as remittances—topped an incredible $90 billion. This is a financial lifeline that often dwarfs official development aid.

Yet, the average cost to send that money to the region is a staggering 8.4 percent. For families and small businesses, this means a huge slice of every transaction gets lost along the way. If you'd like to dive deeper, a detailed analysis by Welthungerhilfe breaks down the economic effects of these remittance costs.

This is precisely the outdated model that modern fintech platforms like Zaro are designed to fix. By offering the real exchange rate with zero markup and getting rid of hidden SWIFT fees, they bring total transparency to the process. You know the exact cost upfront, which means the full amount you send is the full amount that arrives. Every time.

This shift towards straightforward, low-cost solutions gives South African businesses the power to accurately budget for their international payments, make smarter financial decisions, and ultimately, keep more of their hard-earned money where it belongs.

Navigating South African Forex Regulations

If your South African business sends money transfers overseas, you know that compliance isn't just a box to tick—it's the very bedrock of every single transaction. The South African Reserve Bank (SARB) governs all foreign exchange (forex) activities, and for good reason. These rules are in place to keep the economy stable and clamp down on illegal financial activity.

Getting your head around these regulations is the first step. It’s what stands between a smooth payment and a costly, frustrating delay.

Think of the process as a series of checkpoints. Each one is designed to confirm that your payment is legitimate, properly documented, and correctly reported within the national financial system. If you miss one, your entire international supply chain or payroll can grind to a halt. Nailing the process from the get-go is absolutely essential.

Understanding Key Allowances and Documentation

While the rules for businesses are distinct, it helps to understand the allowances available to individuals, as they form part of the broader forex landscape.

- Single Discretionary Allowance (SDA): Any South African resident can send up to R1 million offshore per year without needing to get tax clearance first.

- Foreign Investment Allowance (FIA): Need to send more? There's an additional R10 million allowance, but this one requires a Tax Compliance Status (TCS) PIN directly from SARS to proceed.

For businesses, however, the system isn't based on allowances. It's all about proving that every cent sent abroad is for a legitimate, documented trade purpose.

At its core, the principle is straightforward: you must show why the money is leaving South Africa. This isn't just bureaucratic red tape; it's a critical control for maintaining the integrity and transparency of our financial system.

The Paper Trail That Powers Your Payments

To get your money transfers overseas approved, you need to have your documents in order. This is precisely where the wheels often fall off when dealing with traditional banks.

Here’s what you’ll almost always need:

- Invoices: An official, detailed invoice from your international supplier or service provider. This is non-negotiable.

- Balance of Payments (BoP) Forms: You’ll need to fill out a BoP form for every single payment. This tells SARB what the money is for—goods, services, royalties—which helps them compile national economic data.

This is where the friction really starts. Transfer limits at major banks might force you to split a large payment into several smaller ones, and guess what? Each one needs its own full set of paperwork. It’s this web of requirements that explains why a standard international transfer can easily take days to clear.

This is where modern platforms like Zaro make a real difference. They build the compliance steps right into the payment process itself. The system prompts you for the right documents at the right time and makes BoP reporting a simple click. It takes a tedious, manual chore and makes it a quick, seamless part of your workflow.

While forex rules are specific, having a grasp of broader compliance guidelines is also a smart move for any business with a global footprint, ensuring you’re covered from every angle.

Untangling the Knots in Cross-Border Payments

Ask any business owner who deals with international suppliers, and they’ll have a story for you. Maybe it’s about a container of crucial stock stuck in customs because the payment didn’t clear on time. Or perhaps it’s the awkward email from a partner asking why the amount that landed in their account was short. These aren't just minor frustrations; they’re real, tangible problems that can grind a business to a halt and sour important relationships.

When you’re sending money overseas, you just want it to get there—quickly, and in full. But the old-school banking system often feels like an obstacle course, littered with hidden costs and delays.

The Case of the Vanishing Rands

Here’s a scenario that plays out all too often. You send R150,000 to a supplier in Europe for a big order. A few days go by, and then the email lands: they only received R148,900. Where on earth did the missing R1,100 go?

The culprit is almost always correspondent bank fees. Your payment doesn’t fly directly from your bank to theirs. It gets passed along a chain of intermediary banks within the global SWIFT network, and each one can skim a little off the top for their troubles. The worst part? You often have no idea how many banks are in the chain or what they’ll charge. It’s a bit like posting a package and having every courier along the way take a "handling fee" out of the contents.

This lack of transparency means your supplier gets less than you intended, which can complicate your accounts and make you look unreliable.

The Agonising Week-Long Wait

Then there’s the waiting game. You urgently need to pay for raw materials to keep your production line running, but the transfer takes five, six, or even seven business days to arrive. While your money is in limbo, your timeline is in chaos, and your supplier is left wondering if they can count on you.

It's not just that the system is slow. These delays are a tangled mess of compliance checks, mismatched banking hours across time zones, and clunky, manual processes. Every single step is another chance for something to go wrong.

This uncertainty doesn't just strain your relationships; it creates serious cash flow headaches and makes it impossible to plan with confidence.

A Modern Fix for Old Problems

Thankfully, you no longer have to put up with these headaches. New payment platforms have been built from the ground up to solve the very issues that make traditional international transfers so painful.

Here’s how they cut through the complexity:

- No More Hidden Fees: Forget the mystery of correspondent bank charges. Modern platforms show you the total cost upfront. The amount you send is the exact amount that arrives. Problem solved.

- Track Your Money in Real-Time: Instead of guessing where your payment is, you get a clear view of its journey from start to finish. No more anxious follow-ups or chasing vague updates.

- Compliance That Just Works: The nightmare of manual paperwork for every single payment is gone. Compliance is built into the system, automating the checks and reports that used to cause all those delays.

By tackling these core problems head-on, businesses can finally leave the slow, expensive, and opaque world of old-school banking behind. It’s about swapping uncertainty for control, so you can spend your time building your business, not chasing your money.

How to Simplify Your Overseas Money Transfers

If you've ever dealt with unpredictable delays and surprise fees, you know the old way of sending money transfers overseas is fundamentally broken. Thankfully, a new generation of financial platforms offers a smarter, more transparent way forward—one built to solve the exact problems that South African businesses face every day.

Think about paying an international software provider. What used to be a multi-day ordeal buried in paperwork and uncertain final costs can now be handled in just a few clicks. This isn't a small tweak; it’s a complete overhaul of how we manage global commerce, putting you back in the driver's seat of your finances.

Experience Absolute Transparency and Control

The biggest headache with traditional transfers has always been the lack of clarity. Modern platforms like Zaro tackle this problem head-on by showing you everything upfront. You see the real, mid-market exchange rate and the final amount your recipient will get before you commit. No hidden markups, no surprise fees skimmed off by correspondent banks along the way.

This "what you see is what you get" approach completely removes the financial guesswork from cross-border payments. It allows for accurate budgeting and, just as importantly, builds trust with your global partners because they always receive precisely what they're owed.

For example, a local e-commerce store paying a supplier in China can lock in a rate and know with 100% certainty that the full invoice amount will arrive. This simple guarantee prevents those awkward conversations about short payments and keeps the supply chain running without a hitch.

Automate Compliance and Track Every Step

Another massive hurdle is dealing with SARB reporting and compliance. Instead of manually slogging through Balance of Payments (BoP) forms for every single transaction, a platform like Zaro builds this right into the process. The system simply asks for the necessary documents, like an invoice, and handles the reporting for you. That’s hours of admin time saved.

This integrated approach is part of a much bigger push to improve how money moves across borders. South Africa has long been a key player in the region's financial plumbing, running the SADC Integrated Regional Electronic Settlement System (SADC RTGS) since 2013. Now, the focus is on catching up with global standards like the G20 Roadmap for Enhancing Cross-border Payments to cut costs and boost transparency. You can read more about these regional efforts directly from the South African Reserve Bank.

On top of that, total visibility is the new standard. You can track your payment in real-time, from the moment it leaves your account until it's confirmed on the other side. That stressful "black hole" where your money seems to vanish for days? It’s a thing of the past. It’s this combination—transparent costs, automated compliance, and real-time tracking—that gives businesses the efficiency, savings, and peace of mind needed to compete globally.

Choosing the Right International Payment Partner

Picking a provider for your overseas money transfers isn't just a simple transaction. It's a decision that directly impacts your cash flow, your relationships with suppliers, and even your potential for growth.

https://www.youtube.com/embed/D6soJMP9wB8

Think about it: hidden fees you didn't budget for can slowly eat away at your profits. Unexpected delays can damage your reputation with a key international partner. That’s why you have to look past the flashy headline rate and dig a little deeper.

What to Look For in a Partner

When you’re comparing options, it’s easy to get lost in the details. Here’s what really matters:

- Honest Fees: Are all the costs laid out plainly? You need to know about any exchange rate mark-ups, correspondent bank charges, or other hidden fees before you commit.

- Fair Exchange Rates: Look for a provider that offers the real mid-market rate. This is the true exchange rate, without any hidden margins baked in.

- Speed: How quickly will your money actually arrive? Faster settlement times mean fewer headaches and less disruption for your business.

- Built-in Compliance: The last thing you need is a compliance nightmare. A good partner should make meeting SARB rules and handling BoP reporting almost effortless.

Focusing on these points helps you find a partner who offers genuine value, not just the cheapest advertised price. You need someone who brings predictability and trust to every single payment you make.

Take a look at how a traditional bank stacks up against Zaro on these key points:

| Criterion | Typical Bank | Zaro |

|---|---|---|

| Fee Mark-ups | 1.5% – 3.0% | 0% |

| SWIFT Charges | R150 – R750 | R0 |

| Delivery Time | 2 – 5 business days | 1 – 2 business days |

“True transparency in overseas payments stops hidden costs from undermining business relationships.”

How to Make Your Decision

Ready to put this into practice? Here's a straightforward way to choose with confidence.

- First, get a clear picture of your needs. How much are you sending, how often, and to which countries?

- Next, vet each potential provider against the checklist above. Don't be afraid to ask tough questions.

- Finally, run a small test transfer. It’s the best way to see their real-world speeds and rates for yourself.

Final Action Steps

Once you've narrowed it down, it's time for the final checks:

- Get a few quotes for the same transfer and compare the final amount that will land in the recipient's account.

- During your test transfer, pay attention to how long it takes and how responsive their support team is if you have a question.

- Take a look at their compliance tools. Is SARB reporting genuinely seamless, or is it just another box-ticking exercise?

A little due diligence now will save you a world of trouble later.

With Zaro, you get a single platform to manage your foreign exchange, automated compliance checks that take the pressure off, and bank-level security for every transaction.

If you’re ready for clarity and real cost savings on every international payment, visit Zaro to see how we can help.

Got Questions? We’ve Got Answers

Sending money overseas from South Africa can feel a bit like navigating a maze. There are costs, regulations, and timelines to worry about. We get it. Here are some of the most common questions we hear from business owners, along with straightforward answers to help you see the clearer path forward.

So, What’s This Really Going to Cost Me?

When you send money internationally, the total cost isn't just one single fee. It's usually a combination of a few different things that can quickly add up and eat into your profits.

Here’s what to look out for:

- The provider's transfer fee: This is the upfront charge you pay for the service.

- The exchange rate markup: Many providers add a margin on top of the real exchange rate. This is often a hidden cost.

- Correspondent bank fees: Sometimes, other banks in the middle of the transfer take a cut.

- Receiving bank charges: The bank on the other end might also charge a fee to process the incoming payment.

The key is transparency. You should always know exactly what you’re paying before you hit send. No surprises.

How Long Until My Money Actually Arrives?

The waiting game is one of the most frustrating parts of international payments. How long it takes really depends on who you use. A transfer with a traditional bank can sometimes feel like it's travelling by sea, taking 2–5 business days or even longer if it has to hop between several intermediary banks.

Modern fintech platforms, on the other hand, are built for speed.

| Provider Type | Typical Delivery Time |

|---|---|

| Traditional Banks | 2–5 Business Days |

| Fintech Platforms | 1–2 Business Days |

It's easy to see why so many businesses are moving away from the old-school way of doing things. A few days can make a huge difference in business.

Can I Lock in an Exchange Rate Before It Changes?

Absolutely. Currencies fluctuate constantly, and a sudden dip can throw your entire budget off. That's why locking in a rate is so important.

With Zaro, you can secure the mid-market rate for a full 24 hours with no extra charge. It’s our way of taking the guesswork out of the equation so you can be confident in the amount you're sending and receiving.

Is it Possible to Hold Different Currencies?

Yes, and it’s a smart way to manage your international cash flow. Zaro allows you to hold balances in both ZAR and USD. This means you can hold onto foreign currency when the rate is favourable, pay suppliers without converting every time, and react quickly to market opportunities. Topping up is as simple as a local bank transfer.

What’s the Deal with All the SARB Paperwork?

Ah, compliance. It’s non-negotiable when sending money out of South Africa. The South African Reserve Bank (SARB) has a few key requirements to ensure everything is above board.

You’ll generally need to provide:

- A detailed supplier invoice that clearly states what the payment is for.

- A completed Balance of Payments (BoP) form for every single transfer.

- Your tax clearance status if the payment is over R1 million.

- Extra supporting documents if you're using your Foreign Investment Allowance.

Wrangling all this manually for every payment is a huge time-sink and, frankly, a headache.

How Does Zaro Make This Any Easier?

We built Zaro specifically to solve these problems. Instead of juggling compliance, tracking payments, and hunting for fair rates, you can do it all in one place.

Here’s how we simplify things:

- We handle the paperwork. Document collection and SARB reporting are automated.

- You get the real rate. We give you the mid-market exchange rate with a 0% markup.

- No hidden fees. What you see is what you pay. No SWIFT fees, no intermediary bank charges.

- Know where your money is. Track your payment’s status in real-time.

Simply put, Zaro gives you back the time you’d otherwise spend on payment admin, so you can focus on what really matters: growing your business.

Ready to take control of your international payments? Explore how Zaro can cut costs, speed up transfers, and automate compliance.