Moving money in and out of South Africa is a non-negotiable part of business, but let's be honest—it's often a painful process. It feels like a minefield of surprise costs, confusing rules, and frustrating delays. The key to effective money transfers to South Africa isn't just about finding a provider; it's about understanding the system and moving beyond outdated banking methods that chip away at your profits.

This guide is designed to give your finance team a clear, practical path forward.

Getting a Grip on Cross-Border Payments for Your SA Business

For years, South African businesses have just accepted slow settlement times and lousy exchange rates as the cost of doing business globally. This isn't just an inconvenience; it eats directly into your bottom line, throws your cash flow projections into chaos, and ties up your team in unnecessary admin.

Every day you spend waiting for a SWIFT payment to land is another day that capital isn't working for your business.

This struggle is universal. It doesn't matter if you're paying a software supplier in the US, bringing home revenue from an export deal in Europe, or paying a team of freelance developers around the world. Every single transaction can feel like a hurdle.

The Real-World Headaches for Finance Teams

When you drill down, the problems really boil down to three things:

- Controlling Costs: The big banks are notorious for layering fees. You see the transfer fee, sure, but then there are the intermediary bank charges and the biggest hidden cost of all: the markup on the foreign exchange (FX) rate. That spread can easily cost you thousands of rands on a single decent-sized payment.

- Speed (or lack thereof): A standard wire transfer can take anywhere from 3 to 5 business days to actually land in the recipient's account. This creates bottlenecks in your supply chain and can delay payroll. In a global market that moves in real-time, waiting a week for money to move is a massive disadvantage.

- The Compliance Burden: Trying to navigate the South African Reserve Bank (SARB) regulations can be a nightmare. Getting the right Balance of Payments (BoP) forms filled out and making sure you have all the correct supporting documents for every transfer is a manual, time-consuming slog that’s ripe for human error.

The moment you really understand the different payment networks, how the FX market actually works, and the regulatory landscape, everything changes. Your international payments stop being a costly bottleneck and start becoming a strategic advantage that makes doing business globally smoother and more profitable.

There Is a Better Way

The good news? You don't have to be stuck with these inefficient, old-school systems anymore. Modern fintech platforms were built specifically to solve these problems. They use smarter payment rails, give you direct access to real-time exchange rates without the hidden markups, and automate a huge chunk of the compliance and reporting work.

In this guide, we'll get into the nitty-gritty of how these different systems work. We’ll compare the old way with the new, more efficient solutions now on the table. By the end, you'll see exactly how to make your money transfers to South Africa a tool that helps your business grow, rather than holding it back.

Getting to Grips With International Payment Pathways

When you need to send money across borders, it doesn't just teleport from your account to the recipient's. Your funds travel along specific financial networks, and each one has its own set of rules, costs, and quirks. If you’ve ever been frustrated by slow transfers or surprise fees, understanding these pathways is the first step to getting back in control.

For decades, the banking world has relied on the SWIFT network, but it’s no longer the only option on the table. In fact, for most businesses, it's often the least efficient. Let's walk through the three main routes your money can take so you can make smarter, more cost-effective decisions.

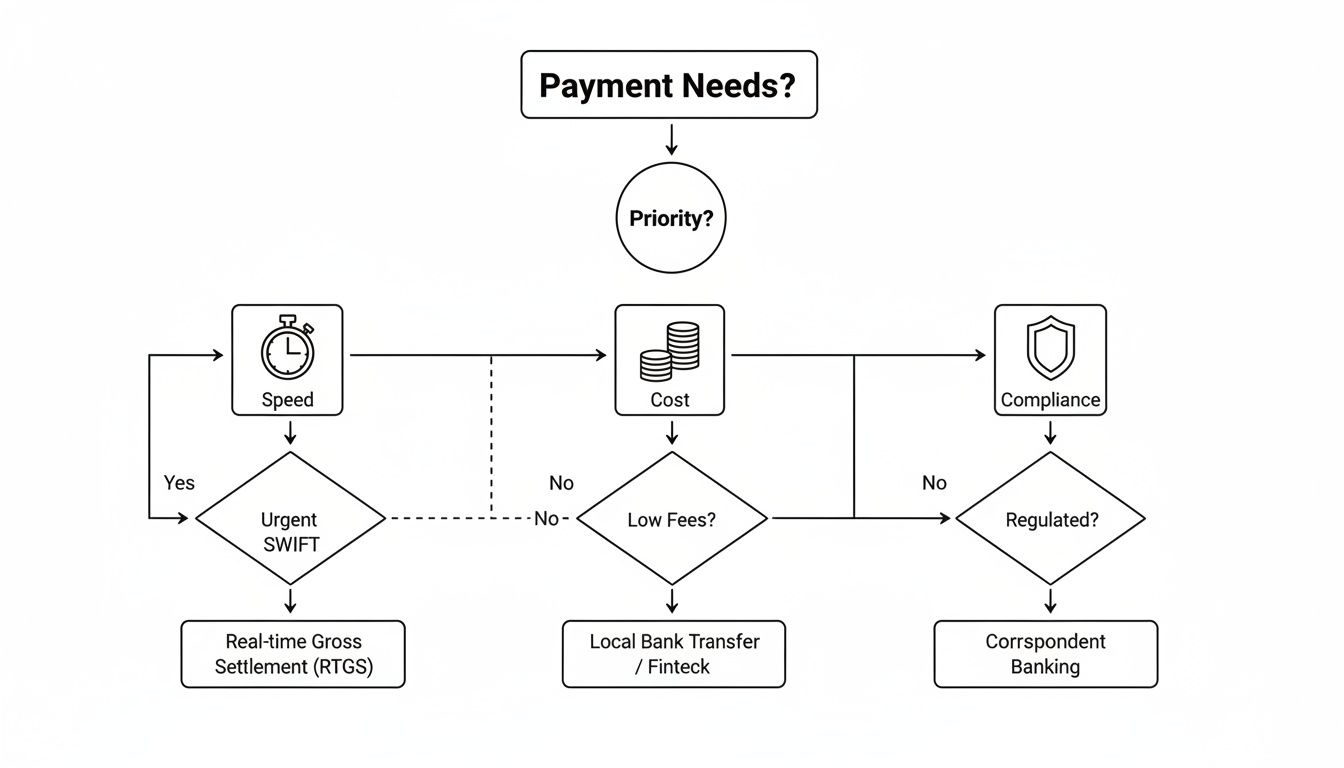

This chart breaks down how to choose a payment method based on what matters most to your business—whether that's speed, keeping costs low, or straightforward compliance.

As you can see, if your goal is simply to minimise costs, modern fintech platforms offer the most direct route. On the other hand, the old-school systems might be chosen for their universal reach, even if they come with higher fees.

The Traditional Route: SWIFT

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is the old guard of international payments. At its core, it's a secure messaging system that banks all over the world use to send payment instructions to one another.

Think of it like putting your money on a series of connecting flights. A payment from your business in Johannesburg to a supplier in Germany might have a layover with an intermediary bank in London or New York before it finally arrives. This roundabout journey is precisely why SWIFT transfers are notoriously slow, often taking 3-5 business days to finally land.

The real sting of SWIFT isn't just the waiting game. Each bank in that chain skims a fee off the top. This means you’re hit with high, often unpredictable, charges that are sliced from your payment before it even reaches the recipient.

Specialised Local Accounts: NOSTRO and VOSTRO

A more direct, though far more complex, route involves something called NOSTRO and VOSTRO accounts. It sounds technical, but the concept is straightforward. A NOSTRO account is just a bank account a local bank holds in a foreign country, in that country’s currency. A VOSTRO is the opposite—an account a foreign bank holds with a domestic bank.

For instance, a South African bank might keep a USD account with a partner bank in the States. This lets them settle USD payments more directly, cutting out some of the SWIFT "flights." While this can speed things up and lower costs, setting up and managing these relationships is a massive undertaking, usually only feasible for large financial institutions. For most SMBs, this isn't a path you can access directly, but you might benefit from it when your payment provider uses this kind of setup behind the scenes.

The Modern Alternative: Fintech Payment Rails

This is where things get interesting for today's businesses. New-school fintech platforms have built their own global networks from the ground up, often by smartly stitching together direct bank partnerships, NOSTRO/VOSTRO accounts, and local payment systems. They’ve essentially created a financial superhighway for your funds.

Instead of your money bouncing between multiple banks, a fintech provider will typically collect your ZAR locally, convert it to EUR using their own liquidity at the real exchange rate, and then pay your European supplier directly from their local EUR account. Simple.

This approach brings some huge advantages to the table:

- Speed: Payments often arrive the same day or the next.

- Cost: By cutting out the middleman banks, both upfront fees and hidden FX markups are slashed.

- Transparency: You get a clear picture of exactly how much the recipient will receive, with no nasty surprises.

The shift to these digital channels is completely reshaping the market. The South African remittance market, valued at around USD 243.9 million recently, is expected to climb to USD 415.4 million by 2033. This explosion is largely fuelled by digital adoption, with outward digital remittances already accounting for about 64% of the revenue. You can dig deeper into these trends in the full research on the South Africa remittance market from IMARC.

So, which pathway is right for you? To make it clearer, let's compare them side-by-side.

Comparing International Payment Routes for SMBs

| Feature | Bank SWIFT Network | Local NOSTRO/VOSTRO | Modern Fintech Rails |

|---|---|---|---|

| Typical Speed | 3-5 business days | 1-2 business days | Same-day to 24 hours |

| Cost Structure | High (R350-R850+ per transfer) plus hidden FX markups and intermediary fees. | Moderate, but high setup costs. Typically inaccessible for SMBs. | Low, transparent fees (often a small percentage or flat fee). No hidden markups. |

| Transparency | Low. Final amount received can be less than expected due to hidden fees. | High, but only between the two partnering banks. | High. You see the real-time exchange rate and the final payout amount upfront. |

| Best For | Large, one-off payments to obscure locations not served by modern networks. | High-volume currency corridors for large financial institutions. | SMBs paying international suppliers, contractors, and repatriating revenue. |

In the end, while SWIFT still has its place due to its sheer global reach, modern fintech rails deliver the speed, cost savings, and transparency that businesses need to operate efficiently in today's global economy.

Real-World Scenarios for South African Businesses

Knowing the theory behind international payments is one thing. Putting it into practice in your day-to-day operations is where you’ll really see the difference. Let’s walk through a few common situations that South African businesses like yours face every day. We’ll move past the jargon and get into practical steps for making smarter money transfers to south africa.

These examples shine a light on the typical friction points you’d hit with traditional banks and show how a more modern approach can fix them, saving you real time and money.

Paying an International Software Supplier in USD

Let’s say your growing tech company relies on a critical software tool from a supplier in the United States. The invoice for $5,000 just landed, and it needs to be paid. If you go through your bank, you know the drill: it’s slow, the fees are a mystery, and you’re never quite sure when the money will arrive. But with a fintech platform, you can handle this with complete control.

The first big win is locking in a good exchange rate. Instead of just accepting whatever rate the bank gives you that day—which always has a markup baked in—you get access to the live interbank or spot rate. This transparency is key. You see the exact ZAR amount needed to cover that $5,000 invoice right now, with no hidden surprises.

From there, it’s a simple process:

- You fund your account on the platform with a standard local EFT in ZAR.

- Instantly, you convert the ZAR to USD at that real-time spot rate you saw.

- You then send the payment to your supplier’s US bank account using their local details.

Because the payment moves on local rails instead of the clunky SWIFT network, your supplier gets the full $5,000 fast, often within 24 hours. On the compliance side, the platform simply prompts you to upload the supplier’s invoice and automatically generates the Balance of Payments (BoP) form, making SARB reporting painless.

Repatriating Revenue from European Exports

Now, let's flip that around. Your business exports beautiful artisanal goods to a distributor in Germany, and a payment of €20,000 has just come through for your latest shipment. The goal is simple: get that revenue back into South Africa as ZAR, without losing a huge chunk to fees and bad exchange rates.

The old way was painful. You’d have to wait for the SWIFT transfer to crawl its way to your account, getting clipped by intermediary banks along the way, before your local bank converted it at a pretty poor rate. That could easily cost you thousands of rands.

A much better way is to use a platform that gives you a unique, multi-currency account.

Your German buyer can pay the €20,000 directly into your own designated EUR account, just like a simple local transfer. This sidesteps all SWIFT-related delays and fees from the get-go. Once the funds arrive, you're in the driver's seat.

You can hold the money in EUR to pay other European suppliers or wait for a favourable ZAR exchange rate. When you're ready, you convert the €20,000 to ZAR at the real spot rate and pull it into your South African business bank account. The whole process is transparent, quick, and maximises the rand value of your hard-earned revenue. That kind of control over your currency is a massive advantage for managing cash flow.

Paying Multiple International Freelancers and Contractors

More and more South African companies are tapping into global talent—developers in Eastern Europe, designers in Southeast Asia, or virtual assistants from all over. In fact, many businesses now work with some of the best offshore virtual assistant companies to stay competitive.

But paying, say, ten freelancers in five different currencies through a bank is an absolute administrative nightmare. Every single payment is a separate, expensive SWIFT transfer with its own compliance hoops to jump through. It all adds up to huge bank charges and hours of mind-numbing manual work for your team.

This is exactly the kind of problem modern payment platforms were built to solve. You can simply upload a single file with all your freelancer payment details—their names, bank info, and payment amounts in their local currencies. The platform then takes care of all the payments in one go.

This bulk payment feature is a game-changer:

- Efficiency: One click instead of hours of repetitive data entry.

- Cost Savings: You dodge all those individual SWIFT fees and pay one small, transparent transaction fee.

- Simplified Compliance: The platform helps you manage all the necessary documents for each payee in one central, organised place.

This shift to faster, digital cross-border payments is a trend we're seeing across the board. A South African Reserve Bank assessment revealed that formal remittance outflows to SADC countries shot up from ZAR 6.0 billion to over ZAR 19.0 billion between 2016 and a recent year. That’s more than a threefold increase, while transaction volumes jumped from 4.8 million to 15.7 million. You can dig into these trends in the SARB-commissioned market assessment.

What these scenarios show is that with the right tools, South African SMBs can finally get past the old hurdles of international finance. Whether you're paying suppliers, bringing home revenue, or managing a global team, a modern approach turns complex headaches into simple, cost-effective operations.

Mastering Costs and Compliance in Cross-Border Transactions

When you’re moving money in and out of South Africa, it’s easy to get stung by hidden fees or tangled up in red tape. These aren't just minor annoyances; they can seriously eat into your profits and cause massive operational headaches.

Getting a firm handle on cost control and compliance is non-negotiable. It’s the key to protecting your bottom line and keeping your business running without a hitch. Let's pull back the curtain on what these payments really cost and what you need to do to stay on the right side of the regulations.

Uncovering the True Cost of Your Transfer

If you're using a traditional bank for international transfers, that upfront fee you see is just the tip of the iceberg. The real cost is buried in charges that banks prefer not to talk about.

The biggest culprit is the foreign exchange (FX) spread. This is simply the margin the bank adds on top of the real, mid-market exchange rate. They buy currency at one price and sell it to you at a less favourable one, pocketing the difference. On any significant transaction, this spread is almost always the single biggest cost you'll pay.

But the hits keep coming. You’ll also run into a minefield of other charges:

- SWIFT Fees: Every bank in the SWIFT network that touches your money along its journey takes a cut.

- Intermediary Bank Charges: So-called "correspondent" banks that help route the payment also charge their own fees.

- Receiving Bank Fees: Believe it or not, some banks will even charge the person you're paying just to receive the funds.

It’s death by a thousand cuts. These fees stack up, turning what looked like a decent deal into a painfully expensive transfer.

The real challenge for businesses is that these costs are often unpredictable. A small difference in the FX spread might not seem like much, but on a large invoice payment, it can add up to thousands of rands lost for no good reason.

Demystifying SARB Compliance and KYB

Beyond the costs, navigating South Africa’s regulatory landscape is another major hurdle. The South African Reserve Bank (SARB) has strict reporting rules to track capital flows, and getting it wrong can lead to payments being blocked or even fines.

At the heart of this is Balance of Payments (BoP) reporting. For almost every international payment, you have to submit a BoP form declaring the reason for the transaction. It's how SARB keeps tabs on the money crossing our borders.

On top of that, your financial provider must conduct Know Your Business (KYB) checks. This is basically a background check on your company to verify its legitimacy and prevent financial crime. It’s a crucial step, but with the old-school banks, it often becomes a slow, paper-heavy nightmare. And if your business handles card payments, you also need to get your head around security standards like PCI compliance.

High Costs in Regional Corridors

Nowhere are these high costs more obvious than in payments between neighbouring countries. An IMF–World Bank study of the South Africa–Zimbabwe corridor found that transfer costs could be as eye-watering as 12.7%. That’s a far cry from the G20’s target of 3%.

Looking at the bigger picture, the average cost to send USD 200 to South Africa was around 6.6% in 2023, still well above the G20 average of 5.62%. This is often because the system relies on cash, the networks are messy, and the whole process is just inefficient.

A Modern Approach to Cost and Compliance

The good news is that modern fintech platforms were built specifically to fix these problems. They tackle the cost issue head-on by giving you direct access to the real interbank exchange rate, which cuts out the hidden FX spread completely. The fees are clear and low, so you know exactly what you're paying before you hit "send."

These platforms also do the heavy lifting on the compliance side.

- Automated BoP Reporting: The system can often fill out or generate the required BoP forms for you using your transaction details.

- Digital Document Management: Forget paper files. You can upload and store your invoices right on the platform, keeping everything organised for SARB.

- Efficient KYB: The initial business verification is handled quickly and securely online, not through endless paperwork and branch visits.

This approach turns compliance from a manual, error-prone chore into a smooth, integrated part of your payment workflow. By picking a provider that’s built for transparency and automation, you can slash your costs and administrative burden, freeing up your team to focus on what actually matters—growing your business.

Getting Smart with FX Risk and Reconciliation

Once you've got your payment processes running smoothly, it’s time to shift from just making payments to actively managing the risks involved. For any South African business trading globally, the biggest risk is almost always foreign exchange (FX) volatility.

The rand-dollar or rand-euro exchange rate can move significantly, even in a single day. A swing of just a few percent can wipe out the profit on an export deal or make a supplier payment far more expensive than you budgeted for. This is where moving from reactive to proactive FX management becomes a game-changer.

Taming Currency Volatility

Your main weapon against unpredictable currency swings is using the right tool for the right situation. When it comes to your money transfers to south africa, you have two core options, each suited to different needs.

- Spot Rates: This is the live, real-time exchange rate for an immediate currency conversion. It’s perfect when you need to make a payment on the spot and you're comfortable with the current market rate.

- Forward Contracts: Think of this as a way to lock in an exchange rate today for a payment you’ll make in the future. You agree on a rate now for a transaction happening in, say, 30, 60, or 90 days.

Let’s say you need to pay a US supplier $10,000 in three months. If the Rand weakens against the Dollar in that time, that invoice could end up costing you thousands more than you planned. A forward contract takes that uncertainty off the table, giving your business predictable costs and protecting your margins.

Locking in a future exchange rate turns a volatile variable into a fixed cost. This is one of the most powerful moves a finance team can make to protect its budget and ensure cash flow stability in global operations.

Solving the Reconciliation Nightmare

The other major headache that trips up even the most seasoned finance teams is reconciliation. If you’ve ever found yourself squinting at a bank statement with a vague payment reference like "INTL PYMNT 4587," you know exactly what I mean. Trying to match these cryptic entries to specific invoices is a manual, time-consuming mess that's just begging for errors.

Traditional banks are notoriously bad at this. Their legacy systems often strip out crucial data, leaving your accounting team to play detective. This isn't just an administrative chore; it clouds your financial visibility and burns hours that should be spent on strategic analysis.

This is a problem modern fintech platforms were built to solve.

The Power of Clean Data and Automation

Unlike banks, these newer platforms are designed from the ground up with accounting integration in mind. Every single transaction is automatically enriched with clean, detailed data that includes everything your finance team needs:

- Clear Beneficiary Details: You see exactly who got paid.

- Invoice or Reference Numbers: Payment references are kept intact, not lost in transit.

- Precise FX Rates: The exact exchange rate applied is clearly recorded.

- Fee Breakdowns: All costs are itemised, so there are no hidden surprises.

This clean data then syncs directly with accounting software like Xero or Sage. Instead of laborious manual entry, transactions flow automatically into your general ledger, correctly categorised and ready for approval. This level of automation doesn't just save time—it gives you a crystal-clear, real-time view of your international cash flow. You can finally stop chasing paperwork and start making sharp, data-driven financial decisions.

Your Top Questions About Sending Money to South Africa, Answered

When you're managing international payments for your business, you need straightforward answers, not financial jargon. We get it. Let's tackle some of the most common questions we hear from South African businesses about moving money across borders.

What's Genuinely the Cheapest Way to Send Money to South Africa for My Business?

It’s a natural first question, and the answer almost never involves your primary business bank. While it might seem convenient, sticking with your bank is often the most expensive choice. The real costs aren't in the advertised transfer fees; they're buried in the exchange rate markups.

Fintech platforms have completely changed the game here. They’re built to avoid the costly "FX spread" – that hidden margin banks add to the real exchange rate. Instead, they give you direct access to the mid-market or spot rate, which is the true rate currencies are trading at.

A small difference in the exchange rate can save you thousands of Rands on a single large transaction. The cheapest provider isn't the one with the lowest fee; it's the one giving you the best rate.

By opting for a provider that offers transparent, low fees and zero currency markups, you ensure the maximum amount of your money gets where it’s supposed to go. Simple as that.

How Long Will an International Transfer to South Africa Actually Take?

The speed of your transfer comes down to one thing: the payment network being used.

If your money is sent via the old-school SWIFT network, which most banks still rely on, you're looking at a wait time of 3 to 5 business days. Why so long? Because your funds have to bounce between several intermediary banks before they finally land in the destination account.

Specialised payment providers, on the other hand, use modern payment rails that cut this time down dramatically. They do this by holding local bank accounts in multiple countries, allowing them to process payments much more directly.

What does this mean for you? Much faster transfers.

- Same-Day Processing: It’s quite common for funds in major currency corridors to arrive the very same day.

- Next-Day Settlement: In most other cases, payments land within 24 hours.

Of course, things like the currency pair, the destination country, and daily cut-off times can play a role. But switching away from SWIFT is the single biggest move you can make to speed up your international payments.

What Paperwork Does SARB Need for Business Transfers?

When it comes to international transfers, complying with the South African Reserve Bank (SARB) is non-negotiable. SARB needs to see documentation to track capital flows and confirm that every transaction is legitimate.

The exact requirements can shift a bit depending on the payment's purpose, but you'll almost always need a few core documents.

Your Go-To Documentation Checklist:

- Commercial Invoice: For any payment tied to goods or services, a detailed invoice is your proof of the transaction’s purpose.

- Balance of Payments (BoP) Form: This is the big one. It's a mandatory declaration to SARB explaining the reason for the transfer—be it for imports, professional services, or dividends.

- Transport Documents: If you're importing physical goods, you may also need to provide supporting documents like a Bill of Lading.

The good news is that modern payment platforms are designed to make this much less of a headache. They'll typically prompt you to upload everything you need directly in the system and can even help automate the BoP form generation. This takes a huge administrative load off your plate and helps keep you compliant without the fuss.

Ready to stop overpaying for slow international transfers? With Zaro, you get access to real exchange rates with zero spread and no hidden fees, turning complex cross-border payments into a simple, cost-effective process. Discover how you can transform your business payments today.