If there's one tool that truly separates seasoned forex traders from beginners, it's the position size calculator. Think of it as your most important risk management ally. It takes the guesswork and emotion out of the equation, letting you figure out the exact lot size for any trade based on your specific account balance and how much you're willing to risk.

This simple tool transforms risk from a vague, scary concept into a hard, manageable number. Honestly, it’s the bedrock of any sustainable trading plan.

Why Position Sizing Is Your Strongest Trading Tool

It’s easy to get caught up chasing the perfect entry signal. So many traders obsess over finding that one flawless indicator, thinking it's the secret to profit. But here’s what experience teaches you: the real foundation of a long-term trading career isn’t about being right every time. It’s about managing your losses when you’re inevitably wrong.

And that’s where proper position sizing becomes absolutely non-negotiable.

The Foundation of Capital Preservation

Let's be blunt: trading without a calculated position size is just gambling. One oversized trade, placed on a whim or a gut feeling, can wipe out weeks of hard-earned profits. It’s a devastating blow that many new traders don’t recover from.

A position size calculator stops this from happening. It forces you to decide on your maximum acceptable loss before you even click the buy or sell button.

This simple act builds a defensive wall around your trading capital. It ensures that no single market swing can take you out of the game, giving you the resilience you need to show up and trade tomorrow.

"The core principle of position sizing is simple: Survive to trade tomorrow. By pre-defining your risk on every single trade, you remove the possibility of a catastrophic, account-ending loss."

Taming Your Trading Psychology

Emotional decisions are the number one enemy of consistent trading. When you use a calculator, you know the exact monetary value at risk if your stop-loss gets hit. This clarity is a game-changer. It helps to quieten down fear and greed, two of the most destructive emotions a trader can face.

When a trade goes against you, you can stay objective because you already know the loss is contained. It's all part of the plan.

For anyone in a fast-paced market, incorporating essential day trading tips is crucial, and they all point back to managing your trade size to protect your capital. This discipline is vital in high-volume, dynamic environments.

Just look at the South African forex market. It’s a regional powerhouse with a daily turnover that shoots past $2.21 billion. With roughly 190,000 traders active daily, using a reliable position size calculator forex traders trust is essential for anyone hoping to navigate that kind of action successfully.

Nailing Down the Numbers for Your Calculator

A position size calculator is a fantastic tool, but it's not a mind reader. The results it gives you are only as good as the numbers you plug in. It’s a classic case of "garbage in, garbage out." To get a trade size that actually protects your capital, you need to feed it four specific pieces of information.

First up is your account balance. This seems obvious, but you'd be surprised how many people use an old figure. You need the current, up-to-the-minute equity of your trading account. A quick peek at your trading platform is all it takes to get the exact number.

Next, and this is arguably the most critical input, is your risk percentage. This is where you decide how much you're truly willing to lose on this one trade. It’s a personal decision that reflects your own comfort level with risk.

Defining Your Risk and Placing Your Stop

So, how much should you risk?

- Most seasoned traders I know stick to a strict 1% risk per trade. It's a conservative approach that keeps you in the game long-term.

- Some traders with a higher risk appetite might push it to 2% or even 3%.

- Anything over 5% on a single trade is playing with fire. A bad losing streak at that level can wipe out a significant chunk of your account before you know it.

The third piece of the puzzle is your stop loss in pips. This number shouldn't be pulled out of thin air. Your stop loss has to be based on solid technical analysis—where the market tells you your trade idea is wrong. Think about placing it just beyond a recent swing high or low, or on the other side of a major support or resistance zone.

A rookie mistake is to set a stop loss based on how much money you want to lose. Don't do it. Let the chart dictate your stop loss level, then let the calculator figure out the position size to match your risk percentage.

Finally, the calculator needs to know the currency pair you're trading. This is crucial because the value of a pip changes from one pair to another. The pip value for a major like EUR/USD is completely different from an exotic pair like USD/ZAR, and the calculator needs to know which one it's dealing with to get the maths right.

When you're trading pairs with the Rand, it also pays to be aware of local economic news. For instance, data like South Africa's foreign exchange reserves—which saw a decline to $69.74 billion in September 2025—can create volatility and directly affect the ZAR's value. Keeping tabs on these reports gives you a much richer context for your trades. You can read more about the recent changes in South Africa's reserves for more insight.

Putting the Position Size Calculator to Work: A Real-World Example

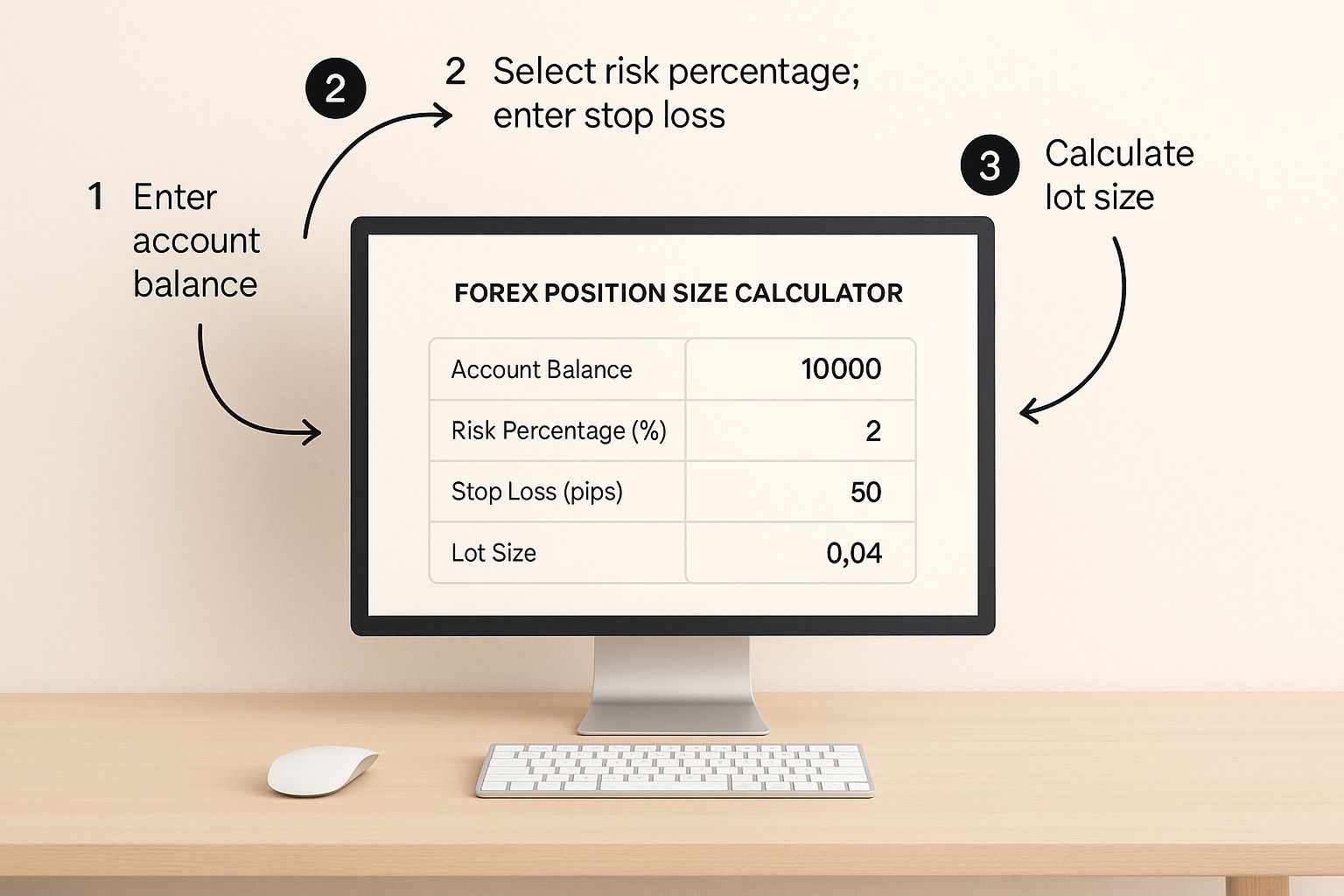

Alright, enough with the theory. Let's see how this actually works in practice. Using a position size calculator for forex is pretty simple once you get the hang of it, and a good example is the best way to make it click.

We'll follow a hypothetical South African trader with a ZAR-denominated account who's looking to trade a popular pair like EUR/USD.

This is what a typical calculator looks like. You’ll notice it has a few key fields you need to fill in to get your risk management sorted.

It’s a simple process, really. You plug in your account details and risk rules, and the calculator spits out the exact trade size. No more guesswork.

Plugging in Your Trade Details

Let's say our trader has an account balance of ZAR 100,000. She’s a disciplined trader and never risks more than 1% on a single trade. After doing her analysis on EUR/USD, she’s identified a good entry point and knows her stop-loss needs to be 25 pips away.

Here’s exactly what she would enter into a tool like the one from BabyPips:

- Account Currency: ZAR

- Account Balance: 100000

- Risk Percentage: 1

- Stop Loss (pips): 25

- Currency Pair: EUR/USD

The calculator takes these numbers and does all the heavy lifting in an instant.

Making Sense of the Results

The output is where the magic happens—this is the number you need to execute your trade correctly.

The calculator will first show you the amount you stand to lose in your account currency (in this case, ZAR 1,000, which is 1% of ZAR 100,000). But the most important piece of information is the position size.

For this trade, the calculator might suggest a size of 0.21 lots.

So, what’s a “lot”? It’s just the standard unit for measuring the size of a forex transaction. Getting comfortable with how the calculator’s result translates to your trading platform is absolutely vital for placing the trade correctly.

This result—0.21 lots—tells you that to stick to your 1% risk rule, this is the exact size your trade needs to be. When you go to your MetaTrader 4 or 5 platform to place the order, you’ll type "0.21" into the 'Volume' field.

To break it down further, that size is made up of different lot types:

- Standard Lots (1.00): These are 100,000 units of the base currency.

- Mini Lots (0.10): These are 10,000 units.

- Micro Lots (0.01): These are 1,000 units.

So, a position of 0.21 lots is the same as two mini lots (0.20) and one micro lot (0.01). This level of precision is what ensures your risk stays exactly where you planned it, down to the last rand.

Common Sizing Mistakes That Hurt Traders

Knowing how to use a position size calculator forex tool is one thing, but truly mastering risk means recognising the bad habits that can quietly sabotage your account. I've seen it countless times: a trader has a solid plan but falls into a common psychological trap, turning a sound strategy into a series of costly, impulsive decisions.

One of the most common—and dangerous—mistakes is getting stuck on a fixed lot size. A trader might get comfortable trading 0.10 lots, for instance, and just use that for every single setup, no matter the currency pair or the stop loss distance. This completely defeats the purpose of risk management. A 50-pip stop with that lot size is a much bigger Rand risk than a 20-pip stop. It’s inconsistent and, frankly, lazy.

The Pitfall of Emotional Sizing

Another major hurdle is what I call 'emotional sizing'—letting your feelings dictate your trade volume instead of your rules. You've probably felt this yourself. After a massive win, that feeling of invincibility creeps in, tempting you to double your next position to "ride the hot streak."

The flip side is just as damaging. A string of losses can make you so fearful that you shrink your position size to almost nothing. When a winning trade finally comes along, it’s too small to even dent the previous drawdown. This emotional rollercoaster is a recipe for inconsistent results and a choppy equity curve.

Remember, the market doesn't care about your last trade, and neither should your risk plan. Every new setup is a fresh event. It needs to be sized based on your unwavering risk rules, not your current mood.

Invalidating Your Own Calculations

The last mistake is a particularly sneaky one: moving your stop loss after the trade is live. Your initial calculation was based on a very specific stop distance. The moment you drag that stop further away because the trade is moving against you, you've thrown your entire risk plan out the window. You are now risking far more than you originally intended.

To build the kind of discipline that lasts, focus on these simple but powerful habits:

- Never use a fixed lot size. Ever. Calculate your position for every single trade based on your predetermined stop loss.

- Stick to your percentage. Your risk—whether it's 1% or 2%—should be a constant. Don't change it based on recent wins or losses.

- Respect your stop loss. Once it's set, that's it. Don't move it further away to give a losing trade "more room to breathe." Let the trade play out according to your plan.

Taking Your Position Sizing to the Next Level

Once you’ve got the hang of using a position size calculator for forex and it's become second nature, it's time to add a bit more sophistication to your risk management. Sticking to a strict, fixed risk percentage is a brilliant way to build discipline, but you'll find that seasoned traders often fine-tune their position size based on the quality of the trade they're looking at. This isn't about throwing your rules out the window; it's about making them smarter.

Think about it – not all trade setups are born equal. Some just jump off the chart at you, with every signal aligning perfectly. We can call these "A+" opportunities. Then there are others that tick the boxes of your strategy but maybe lack that one extra confirmation. Those are more like "B" setups.

Sizing Up Your Confidence in a Trade

Instead of applying a flat 1% risk to every trade, regardless of its quality, you can create a tiered system. This lets you be more strategic with your capital, putting more behind the trades you have the highest confidence in, based on your own solid analysis.

Let’s break down how this might work in practice:

- A+ Setups: These are your five-star, textbook trades. For an opportunity this good, you might decide to risk your maximum, say 1.5% of your account balance.

- B Setups: A solid, bread-and-butter trade that meets all your core criteria but isn't a rare gem. Here, you could stick to a standard 1% risk.

- C Setups: This is a marginal trade. It’s valid, but maybe the market is a bit choppy or it’s against the minor trend. For these, you could risk just 0.5% to test the waters without exposing yourself to significant loss.

Adopting a system like this keeps you well within your overall risk limits but gives you the flexibility to really push your advantage when a high-probability setup comes along.

The secret to making this work is objectivity. You absolutely must define what an A, B, or C setup looks like before you even think about placing a trade. Write down these rules and follow them religiously. This prevents you from making emotional decisions in the heat of the moment and convincing yourself a "C" trade is suddenly an "A+".

Another powerful technique is scaling. Your initial position size calculation is your foundation, but that doesn't mean it's set in stone. If a trade moves decisively in your favour, you can add to the position. By adding smaller chunks and, crucially, moving your original stop loss to break-even, you can amplify your potential profits without actually increasing your initial risk.

Your Top Position Sizing Questions, Answered

Even after you get the hang of using a position size calculator, a few practical questions always seem to come up in the real world of trading. Let’s walk through some of the most common ones I hear from other traders.

Should I Risk the Same Percentage on Every Single Trade?

This is a great question. While consistency is key in trading, that doesn't mean your risk has to be completely rigid. In fact, many seasoned traders develop a more flexible approach, adjusting their risk based on how confident they are in a particular trade setup.

For instance, you might set a hard personal limit that you’ll never risk more than 2% of your account on any one trade. That’s your ceiling. But for a setup that looks good, but not perfect, you might decide to risk only 1%, or even just 0.5%.

The core idea is to have a tiered system. This gives you the flexibility to be more aggressive on A+ setups while still protecting your capital on the less certain ones. Just never break your absolute maximum risk rule.

What if My Broker's Minimum Lot Size Is Too Big?

This situation happens all the time and it's a critical test of your discipline. Imagine your calculator tells you the correct position size is 0.05 lots, but your broker’s platform won't let you open a trade smaller than 0.10 lots. What's the right move?

The answer is simple, and it's non-negotiable: You skip the trade.

If the smallest position your broker allows is bigger than what your risk rules permit for that specific stop loss, then the trade is off the table. Forcing it with a larger lot size means you're gambling, not trading. The professional response is to either find a different setup where the stop loss fits the minimum lot size, or just move on. Protecting your capital is always priority number one.

How Often Must I Recalculate My Position Size?

Every. Single. Time. There are absolutely no shortcuts here.

Think about it: your account balance changes with every win or loss, the value of a pip is always shifting for different currency pairs, and your stop loss distance will be unique for every new trade you analyse.

Running the numbers through a calculator before you enter any position is the only way to guarantee your risk is precisely what you intended it to be. It’s a small bit of admin that enforces the discipline needed for long-term success.

For South African businesses managing international payments, that same financial discipline is crucial. Zaro gives you a powerful platform to control your cross-border transactions using real exchange rates with no hidden fees, offering the same precision for your business finances that a position size calculator brings to your trading. Find out more at https://www.usezaro.com.