Ever wondered what the rand dollar exchange live rate actually is? Think of it as the real-time pulse of the global foreign exchange market. It's the exact price at which the South African Rand can be exchanged for the US Dollar at this very second.

It’s less of a fixed number and more like a constantly shifting score in a global economic match, updated moment by moment.

What Is the Live Rand Dollar Exchange Rate?

Picture a massive, 24/7 global auction where currencies are what’s on the block. The live rand-dollar rate is the winning bid at this exact instant. This isn't a price dreamed up by a single bank or government; it’s a direct result of the collective actions of millions of buyers and sellers worldwide.

This raw, underlying rate is officially known as the interbank rate or mid-market rate. It’s the wholesale price that massive financial institutions use when they trade huge volumes of currency among themselves. Because it sits squarely in the middle of the global buy and sell prices, it’s the purest, most accurate reflection of a currency's true value.

Why Is This Rate So Volatile?

That constant flickering you see in a live rate is the market reacting in real-time to global events. Every news headline, economic report, or political development can nudge the rate up or down.

The table below breaks down the key forces that keep the rand-dollar rate in constant motion.

Key Drivers of the Live ZAR/USD Rate

| Influencing Factor | Impact on Rand (ZAR) | Real-World Example |

|---|---|---|

| Economic Data | Positive data (e.g., low inflation, high GDP growth) typically strengthens the rand. | An unexpected interest rate hike by the South African Reserve Bank (SARB) makes holding rands more attractive, boosting its value. |

| Political Stability | Uncertainty or instability often weakens the rand as global investors get nervous and pull their money out. | A contentious national election or major policy uncertainty can cause a sharp drop in the rand's value against the dollar. |

| Commodity Prices | As a major commodity exporter, higher prices for gold, platinum, or coal usually strengthen the rand. | A surge in global gold prices often leads to a stronger rand, as it increases the value of South Africa's exports. |

| Global Market Sentiment | When investors are risk-averse, they tend to favour "safe-haven" currencies like the US dollar over emerging market currencies. | A global recession scare might cause investors to sell off their rand holdings and buy US dollars, weakening the ZAR. |

These factors work together, creating a dynamic and sometimes unpredictable environment. This volatility has led to some major swings over the years. The South African Rand (ZAR) hit an all-time high of 19.93 ZAR per USD in April 2025, a peak driven by a perfect storm of shifting commodity prices, local political developments, and a strengthening US economy. You can dig into more detailed charts and historical trends by exploring the South African Rand's performance on Trading Economics.

The Key Takeaway: The live rand-dollar exchange rate is the true benchmark. It's the baseline cost of currency before any banks or brokers add their markups. Getting to grips with this rate is the first step towards understanding the real cost of your international payments.

How Exchange Rate Fluctuations Impact Your Business

Those numbers ticking away on a rand dollar exchange live chart aren't just abstract data. For your business, they represent real rands and cents flowing in or out, with the power to make or break your profitability.

These daily movements can either give your bottom line a healthy boost or quietly eat away at your margins, sometimes turning what looked like a great deal into a loss almost overnight. Understanding exactly how this works is the first step to protecting your business from these invisible risks.

For South African companies, the direction of the currency swing creates a very different set of problems depending on whether you're bringing goods in or sending them out.

The Importer's Dilemma: A Weaker Rand

Let's say you run an electronics shop in Johannesburg and need to import $50,000 worth of components from the United States. You shake hands on the deal when the exchange rate is a neat R18.00 to the dollar.

- Your initial cost: $50,000 x 18.00 = R900,000

Simple enough. But by the time your payment is actually due a few weeks later, the market has shifted, and the rand has weakened. The new rate is now R18.60 to the dollar.

- Your new, higher cost: $50,000 x 18.60 = R930,000

In just a few weeks, your cost of goods has shot up by R30,000. That increase comes directly out of your profit margin, even though your supplier didn't change their price by a single cent. This is the hidden risk every South African importer has to manage.

For any business with cross-border transactions, getting a handle on these currency movements is essential when navigating the complexities of international trade and taxation.

The Exporter's Challenge: A Stronger Rand

Now, let's flip the scenario. Imagine a Cape Town wine farm that exports a large shipment to a distributor in California. The deal is priced in rands, agreed at R2,000,000.

When the deal is made, the exchange rate is R18.50 to the dollar. From the American buyer's perspective, the cost is:

- Buyer's initial cost: R2,000,000 / 18.50 = $108,108

But before the invoice gets paid, the rand strengthens to R17.50 against the dollar. Now, the cost for that same shipment becomes:

- Buyer's new cost: R2,000,000 / 17.50 = $114,285

All of a sudden, your wine is over $6,000 more expensive for your customer. This kind of unexpected price hike can make your product look uncompetitive, souring the relationship and maybe even jeopardising the sale itself.

These examples show exactly why just watching the live rate isn't enough. You need the right tools to actively manage its impact.

Uncovering the Hidden Costs in Currency Exchange

Ever looked up the rand-dollar exchange live rate on Google, felt good about the number, and then been shocked by the much worse rate your bank offered you? That’s not an accident. It's how the system is designed.

The gap between the "real" rate you see online and the rate you're actually quoted is where banks and traditional currency providers make their money. These costs are often tucked away, making it hard to see just how much you're paying. Understanding them is the key to protecting your profits on international deals.

What Is the Exchange Rate Spread?

The easiest way to think about the spread is like the markup on a t-shirt in a retail shop. The shop buys the shirt for a wholesale price and sells it to you for more. That difference is their profit.

Banks do the exact same thing with currency. They get dollars, euros, or pounds at the live "interbank" rate (the wholesale price) and then sell that currency to you at a less favourable rate (the retail price).

The spread is the difference between the mid-market rate and the rate you're offered. It's a hidden fee that directly eats into every transaction, meaning you get less foreign currency for your rands, or fewer rands for your foreign currency.

This is why a rate can look so different from one moment to the next. For example, it's not unusual for the USD/ZAR pair to swing from a low of 17.5526 to a high of 17.7202 in a single day. The market is always moving, and the spread is layered on top of that volatility. You can dig into these kinds of fluctuations using historical currency data on Investing.com.

Beyond the Spread: The Other Hidden Fees

Sadly, the spread is just the beginning. Old-school international payments often come with a whole menu of other charges that can sting.

- SWIFT Fees: When your payment travels through the global SWIFT network, various banks along the way can each take a slice of the pie. These fees are unpredictable and can range from R250 to over R750 for a single transfer.

- Admin Fees: This is often just a flat fee your bank charges for the "service" of processing an international payment—on top of the poor exchange rate they've already given you.

Let’s see what this looks like with a real-world example.

Comparing a $10,000 Transfer at Live vs Bank Rates

Here's a simple comparison showing how these hidden costs impact a standard $10,000 payment to an international supplier.

| Metric | Live Rate (via Zaro) | Typical Bank Rate |

|---|---|---|

| Exchange Rate | R18.50 per $1 | R18.90 per $1 (includes spread) |

| Cost to Buy $10,000 | R185,000 | R189,000 |

| Additional Fees | R0 | R500 (SWIFT + Admin) |

| Total ZAR Cost | R185,000 | R189,500 |

| Hidden Cost | - | R4,500 |

As you can see, the difference is significant. That R4,500 is pure cost that could have stayed in your business.

When all these costs are added up, the amount that actually lands in your supplier's bank account can be much less than you thought you sent. This isn't just about getting a good rate; it's about the wisdom of managing your money carefully to avoid these unnecessary costs. Once you know what to look for, you can start asking the right questions and find better, more transparent ways to manage your global payments.

Getting Your Hands on Live Exchange Rates

Knowing about the hidden costs banks charge is one thing. Actually doing something about it is a completely different ball game.

For a long time, South African businesses were simply stuck. You had to accept whatever inflated exchange rate and surprise fees your bank threw at you—it was just seen as the cost of doing business internationally. Thankfully, that's no longer the case. A new wave of financial platforms has emerged, built from the ground up to tackle this exact problem by offering a far more direct and honest alternative.

Platforms like Zaro are designed to give everyday businesses access to the true rand dollar exchange live rate. This is the same rate that, until recently, was reserved for the big banks and financial giants. Instead of burying their profit margin in the exchange rate, this new model is refreshingly simple: the currency conversion is separate from the fee. You see exactly what you’re paying, down to the last cent.

How These New Forex Platforms Work

The entire process is built to be fast and clear, cutting out the slow, expensive middlemen that clog up the old banking system. It usually boils down to three straightforward steps.

- Fast, Digital Onboarding: Forget about endless paperwork and queues at the bank. You can set up an account entirely online. A secure Know Your Business (KYB) check verifies your company’s details, and you’re often good to go within a single business day.

- Funding Your Account: Once your account is approved, you’ll get local ZAR account details. Topping it up is as simple as making a standard EFT from your existing South African business bank account. No fuss.

- Making International Payments: With funds in your account, you’re ready to make international payments at the live exchange rate you see on your screen. You get to decide when to lock in a rate that works for you, sending money directly to your supplier without the frustrating SWIFT delays and surprise fees.

This modern approach puts you back in control. Foreign exchange stops being an unpredictable expense and becomes a manageable part of your financial toolkit.

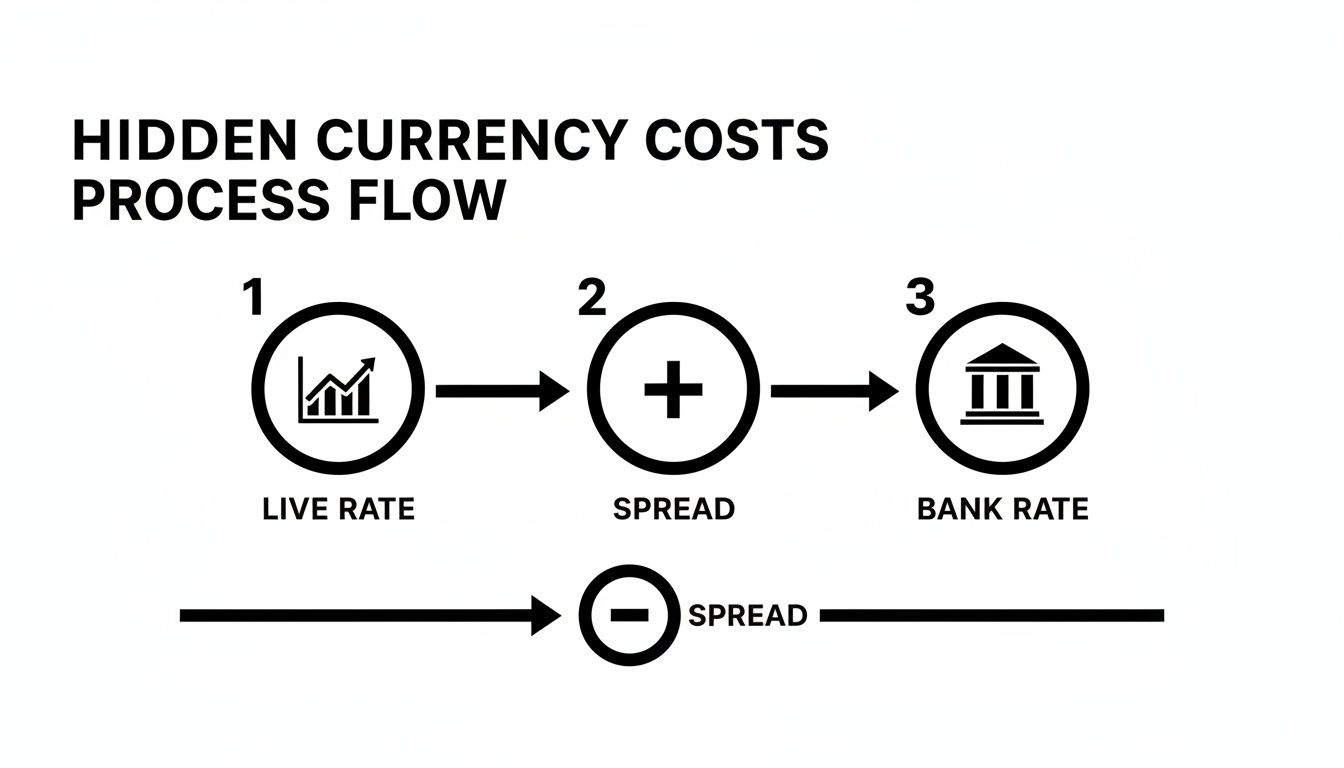

The diagram below shows exactly how traditional banks build hidden costs into their exchange rates.

As you can see, the rate your bank quotes you isn't the real one; it's the live rate plus their hidden profit margin, the spread.

Taking Back Control and Gaining True Transparency

The real game-changer here is the shift in power. You're no longer at the mercy of whatever rate your bank feels like offering you on any given day. Instead, you can finally start making strategic decisions.

By accessing the live mid-market rate, you eliminate the single biggest hidden cost in international payments—the exchange rate spread. This means more of your Rands become Dollars, Pounds, or Euros, strengthening your bottom line with every single transaction.

This level of transparency makes financial planning so much easier. When you need to send $10,000, you can be confident that $10,000 is what will land in your supplier’s account, without other banks taking a slice along the way. For any business that depends on solid supplier relationships and predictable cash flow, this reliability is a massive advantage. It means you can pay your invoices accurately and on time, every time.

Advanced Tools for Managing Forex Risk

Getting access to the live exchange rate is just the first step. For any business that regularly deals with international payments, learning to manage currency risk becomes a core part of a smart financial strategy. It’s the difference between simply reacting to market movements and actively anticipating them to protect your profits from wild, unpredictable swings.

Managing risk effectively isn’t about trying to predict the future with a crystal ball. It's about having the right financial tools on hand when you need them. Modern platforms now offer instruments that were once the exclusive domain of huge corporations, giving small and medium-sized businesses some serious firepower to control their exposure to currency fluctuations.

Go Beyond Single Transactions with Multi-Currency Accounts

Picture this: you receive a payment of $20,000 from a client in the United States. If you're using a traditional bank account, you’re usually forced to convert those dollars into rands right away, whether the rand dollar exchange live rate is good for you or not.

A multi-currency account completely changes the game.

A multi-currency account is like a financial toolbox. It lets you hold funds in different currencies—like USD, EUR, or GBP—all under one roof. This simple capability gives you incredible strategic flexibility.

Instead of being forced into a conversion, you can keep the $20,000 sitting in your USD balance. From there, you could use those dollars to pay an American supplier directly, completely side-stepping the need for a currency conversion and all the costs that come with it. Or, you could simply wait for the rand to weaken, converting your dollars only when the exchange rate is more favourable and maximising your ZAR income.

Gaining Control Over Global Spending

For businesses with teams that travel or make international purchases, expenses can quickly become a messy and expensive headache. Corporate cards built for international use, especially when paired with integrated expense reporting, are a fantastic solution for getting a real grip on your spending.

These tools bring a few major advantages to the table:

- Real-Time Spending Visibility: You can track every international transaction the moment it happens. No more guesswork or nasty surprises at the end of the month.

- Set Custom Spending Limits: Assign specific budgets and rules to individual cards or teams, which helps prevent overspending before it even starts.

- Automated Expense Reporting: Your team can snap photos of receipts and categorise expenses on the go, which drastically cuts down the admin burden on your finance department.

This kind of control is vital, especially when you consider the rand's long-term volatility. Data from the Federal Reserve paints a clear picture: the rand has been on a depreciating trend against the dollar, with the annual average rate shifting from 14.7751 in 2021 to 18.4535 in 2023. If you're interested in the long-term trends, you can explore the data for yourself on the FRED Economic Data website.

By using the right tools, you can turn this volatility from a constant threat into a manageable variable. Suddenly, foreign exchange isn't just a cost centre—it becomes a strategic part of your business.

A Few Common Questions About Exchange Rates

Getting your head around foreign exchange can feel like a lot, but a few core concepts are all you need to start making smarter decisions for your business. We get asked the same questions time and again by South African business owners, so let's break them down.

Here are some straightforward answers to help you navigate the world of international trade with a bit more confidence.

Is the Live Rand-Dollar Exchange Rate the Same Everywhere?

In a word, no. There’s an official “interbank rate,” which you can think of as the benchmark for the entire global market, but that’s not the rate you’ll ever actually get.

It helps to think of the interbank rate as the wholesale price of a currency. Every single provider, from the big banks and airport kiosks to a modern platform like Zaro, adds their own markup to that wholesale price. This markup, known as the "spread," is how they make their money.

So, where do the differences come in? It’s all about transparency and just how big that markup is.

- Traditional Banks: Usually have the biggest spreads. On top of that, they often layer on other costs like SWIFT fees, which means the rate you get is a long way from the real, live one.

- Forex Platforms: Their entire model is built on getting you a rate that’s much closer to the live interbank rate. Instead of a hidden spread, you’ll typically see a clear, upfront fee.

Your goal should always be to find a provider that gets you as close as possible to the live rate. It’s simple, really: the closer you are, the more of your money ends up where it’s supposed to go.

How Can I Protect My Business From Currency Volatility?

For any business dealing in dollars, managing currency risk is absolutely vital. One bad swing in the market can seriously eat into your profit margins. Big corporations have entire teams using complex tools like hedging, but there are much simpler, powerful strategies that work perfectly for small and medium-sized businesses.

The best approach isn't about reacting to bad rates—it's about having the tools to be proactive.

Proactive currency management isn’t about trying to predict the future. It's about having the right setup to control your exposure when the market inevitably moves. This turns forex from an unpredictable threat into just another manageable part of your business finances.

Here are two practical ways you can start protecting your business right now:

- Use Multi-Currency Accounts: Holding a dedicated USD account is a game-changer. When a US client pays you, the funds land in dollars. You’re not forced to convert to ZAR on a day when the rate is terrible. You can wait for a better moment or, even better, use those dollars to pay your own US-based suppliers, skipping conversion fees altogether.

- Set Up Rate Alerts: Most modern platforms let you set up simple alerts. You choose a target rate for the ZAR/USD pair, and you'll get a notification when the market hits it. This lets you pounce on good rates without having to stare at a screen all day.

How Is a Forex Platform Different From My Business Bank?

Think about what your traditional business bank is great at: local transfers, payroll, business loans. It's a master of domestic banking. But for most of them, international payments are an afterthought, a secondary service that isn't their core focus. The result? Uncompetitive exchange rates, slow transfers, and a whole lot of hidden fees.

A dedicated forex platform is the exact opposite. It was built from the ground up for one reason: to make international trade easier, cheaper, and faster.

Its whole world revolves around solving the specific problems global businesses face. That means giving you direct access to the rand dollar exchange live rate, showing you exactly what you’re paying in fees, and building tools like multi-currency accounts that are designed for importers and exporters.

Ultimately, you don't have to replace your bank. A forex platform simply complements it by handling the international side of your finances far more efficiently, saving you a small fortune and putting you back in control.

Take control of your international payments with Zaro. Get access to real exchange rates with zero spread and no hidden fees, ensuring your business saves money on every single transaction. See how much you could save and streamline your global finances by visiting the official Zaro website.