Trying to predict where the rand is headed against the US dollar can feel a lot like trying to forecast the weather in the Cape – it’s notoriously unpredictable. We’re likely in for continued volatility, with the currency’s fate tied closely to two major forces: what happens with global monetary policy and the state of South Africa's own economic backyard.

While we'll always see short-term ups and downs, the bigger picture will be painted by things like local interest rates, what the world is willing to pay for our commodities, and how international investors are feeling about emerging markets in general.

Understanding the Rand’s Current Trajectory

Figuring out the rand us dollar exchange rate forecast isn't about gazing into a crystal ball. It's more about understanding the powerful currents that pull the currency in different directions.

Think of it this way: the US Federal Reserve's decisions on interest rates are like a powerful global tide that affects all emerging market currencies. When the US raises rates, it tends to pull money towards the dollar, putting pressure on currencies like the rand. At the same time, we have our own local currents – things like South Africa's inflation figures, political stability, and load shedding woes – that can either magnify that global pull or help the rand hold its ground.

It's this constant tug-of-war that creates the volatility businesses and investors have to deal with. The key isn't to guess the exact rate next Tuesday, but to grasp what's driving the movements so you can make smarter financial decisions.

Recent Performance and Key Drivers

If you look at the rand's recent journey, you can see this dynamic playing out perfectly. The currency has been on a rollercoaster, reacting sharply to news from both home and abroad.

For example, in a single year, the US Dollar to South African Rand (USD/ZAR) exchange rate swung wildly, hitting a high of around 19.757 ZAR and a low near 17.347 ZAR. That’s a massive shift of almost 13.9% in its value. The weaker periods often line up with moments of global uncertainty or when the US tightens its monetary policy, making the dollar stronger. On the flip side, the rand typically gets a boost when the dollar eases off or when prices for South Africa’s key exports, like coal and platinum, are on the rise. For a deeper dive, you can explore the USD/ZAR exchange rate history on exchangerates.org.uk.

A volatile exchange rate isn't necessarily a weak one. It simply means the currency is highly sensitive to new information, whether that news comes from Washington D.C. or Pretoria. This responsiveness is a classic trait of emerging market currencies like ours.

To make sense of all this, let’s break down the main factors pulling the strings. The table below gives a snapshot of the key global and domestic forces that have been steering the ZAR/USD exchange rate lately.

Key Drivers of the Rand's Recent Performance

| Influencing Factor | Impact on the Rand | Recent Example |

|---|---|---|

| Global Interest Rates | Higher US interest rates tend to strengthen the USD, weakening the ZAR. | The US Federal Reserve's rate-hiking cycle has drawn capital towards the dollar. |

| Commodity Prices | As a commodity exporter, higher prices for SA's key exports (e.g., gold, platinum) support the ZAR. | A rally in precious metal prices provided temporary strength to the rand. |

| Domestic Inflation | High domestic inflation can lead the SA Reserve Bank to raise rates, which can attract foreign investment and strengthen the ZAR. | Persistently high inflation prompted the SARB to maintain a hawkish stance on interest rates. |

| Investor Sentiment | Global risk-off sentiment sees investors flee to 'safe-haven' currencies like the USD, weakening the ZAR. | Geopolitical tensions often lead investors to sell off emerging market assets, including the rand. |

| Local Economic Data | Poor economic data, like low GDP growth or high unemployment, puts downward pressure on the ZAR. | Weaker-than-expected GDP figures have weighed on the currency's performance. |

| Political Stability | Political uncertainty and concerns over governance can deter foreign investment, weakening the ZAR. | The run-up to national elections created significant market uncertainty. |

Getting a handle on these drivers is the first and most crucial step for anyone trying to interpret a rand us dollar exchange rate forecast and plan accordingly.

The Core Forces That Steer the Rand

Before we can even begin to talk about a rand us dollar exchange rate forecast, we have to pop the hood and look at the engine room. What are the fundamental forces that push and pull on the Rand’s value every single day? It’s not just one thing; it's a web of interconnected factors, both at home and abroad, that determines where the currency is heading.

Think of the Rand as a highly sensitive instrument. It reacts to shifts in the global economic winds and tremors in our local economy. A change in one area can easily ripple through the system, influencing how investors behave and, ultimately, the rate you see on your screen. Getting a handle on these mechanics is the first step to moving beyond just watching the numbers to actually understanding them.

The Magnetism of Interest Rates

One of the biggest movers is the interest rate differential. In plain English, that’s the gap between the interest rates set by the South African Reserve Bank (SARB) and those in other major economies, especially the United States. High interest rates are like a magnet for foreign money.

When the SARB offers better returns than, say, the US Federal Reserve, international investors send their capital our way to take advantage. This hunt for higher yield, known as the carry trade, means they have to buy Rands, which naturally pushes up its value. But when the tables turn and US rates start climbing, that gap narrows. The Rand suddenly looks less attractive, and capital often flows back out, weakening our currency.

These central bank decisions are the bedrock of currency movements. To get a feel for the impact of central bank rate decisions on global markets, it's worth seeing how these policies create ripples far beyond just the currency markets.

Fuelled by Commodities

South Africa's economy is built on its natural resources. We're a world leader in exporting precious metals like platinum and gold, not to mention industrial staples like coal and iron ore. What happens to the prices of these commodities on the global stage has a huge and direct impact on the Rand.

It’s pretty simple when you break it down. Commodity exports are our country’s main source of foreign currency.

- When commodity prices are booming, we earn more US dollars for the stuff we sell. To use that money back home, exporters have to sell those dollars and buy Rands. This increased demand strengthens the local currency.

- When commodity prices slump, our export earnings fall. That means fewer dollars flowing in, less demand for the Rand, and a weaker exchange rate.

This link ties the ZAR/USD’s fate directly to global economic health and industrial demand, particularly from manufacturing powerhouses like China.

The Mood of the Market

Finally, you can’t ignore the psychology of it all. Global investor sentiment is an incredibly powerful force. The Rand is what’s known as an emerging market currency, which for many global investors means "higher-risk, higher-reward". As a result, its value can swing wildly based on nothing more than the market's collective mood.

In times of global optimism—what traders call a 'risk-on' environment—investors feel adventurous. They pour money into assets that promise higher returns, and emerging markets like ours are first in line. This flow of capital gives currencies like the Rand a significant boost.

But when fear takes over—triggered by a geopolitical crisis, a pandemic, or recession warnings—the mood flips to 'risk-off'. Investors dump what they see as risky assets and run for cover in 'safe-haven' currencies, mainly the US dollar. This flight to safety can cause a sudden and brutal sell-off of emerging market currencies. The Rand is often hit hard in these moments, weakening dramatically, sometimes irrespective of what's happening in our own economy.

A Historical View of the Rand's Wild Ride

To have any hope of forecasting the rand's next move against the dollar, you first have to look in the rearview mirror. The rand’s history isn't a gentle, winding road; it’s a story of hairpin turns and sudden swerves, usually triggered by major global events or pressing issues right here at home.

These past episodes of volatility aren't just historical trivia. They give us the context we need to understand the market today. The currency’s journey is a direct reaction to economic shocks and shifts in investor confidence. By seeing how the rand has behaved during past crises and recoveries, we start to see patterns in its sensitivity.

It’s a bit like studying the fault lines in an earthquake zone. Knowing where the ground has shaken before helps you understand where the pressure might be building up next.

The Pandemic Shock and Commodity Rebound

The period from 2020 to 2024 is a fantastic case study in the rand's capacity for dramatic swings. When the pandemic hit, it caused a classic 'risk-off' stampede. Investors bailed on emerging markets and ran for the perceived safety of the US dollar, and the rand took a heavy punch.

The annual average exchange rate data paints a vivid picture of this rollercoaster. In 2020, the rand weakened to an average of 16.49 to the US dollar. But then, something remarkable happened. By 2021, it had bounced back strongly, averaging 14.78 ZAR/USD, largely thanks to a global economic rebound and booming prices for the commodities South Africa exports.

You can dig into the numbers yourself and discover more insights about these historical exchange rates on the St. Louis Fed's economic data site.

This chart from the St. Louis Fed perfectly captures the rand's journey, showing the significant strengthening in 2021 followed by a steady weakening trend through 2022 and 2023.

It’s a clear visual reminder of just how sensitive our currency is to changing global winds.

Domestic Headwinds and Global Policy Shifts

After that commodity-fueled recovery, a new storm started brewing. The rand began to lose ground again in 2022 and 2023, with the average rate slipping back to 16.36 and then tumbling further to 18.45 against the dollar. This time, it was a potent mix of global and local problems.

The rand's performance is often a story of two competing forces: the global economic climate and South Africa's own internal health. When both are under pressure, the currency gets hit from two sides at once.

Globally, central banks, led by the US Federal Reserve, started hiking interest rates aggressively to fight inflation. This made holding US dollars more attractive, sucking capital away from markets like ours.

Back home, a familiar list of domestic issues was weighing heavily on investor confidence:

- Persistent Energy Shortages: Worsening load shedding was a major drag on economic growth and soured the business outlook.

- Logistical Bottlenecks: Crippling problems at our ports and on our railways throttled the export economy.

- Political Uncertainty: Questions around policy and governance created another layer of risk that made foreign investors nervous.

These moments aren't just data points on a chart. They are real-world lessons in what moves the rand. They show that any credible rand us dollar exchange rate forecast has to balance the powerful tides of global finance with the strong currents of our own local economy.

How Experts Forecast the Rand's Next Move

Ever wonder how analysts come up with a rand us dollar exchange rate forecast? It's not about gazing into a crystal ball. Instead, it's a careful blend of art and science, where experts use established methods to get a complete picture of the market.

Think of it like a doctor diagnosing a patient. They don't just rely on lab results; they also conduct a physical examination. In currency forecasting, the two main approaches are fundamental analysis (the lab results) and technical analysis (the physical exam). One looks at the economic 'health' of a country, while the other reads the market's 'mood'.

The Economist's Approach: Fundamental Analysis

Fundamental analysis is all about the big picture. It’s a deep dive into South Africa's economic data to figure out the Rand's intrinsic or 'fair' value. Essentially, it's a thorough financial health check-up for the entire country.

Analysts using this method ask the big questions: Is our economy growing? Is inflation getting out of hand? How stable is the government's budget? They keep a close eye on the economy's vital signs, including:

- Interest Rates: As we've touched on, the gap between South African and US interest rates is a massive magnet for global capital.

- Inflation Rates: High inflation eats away at a currency's purchasing power, which almost always leads to it weakening over the long run.

- Economic Growth (GDP): A strong, growing economy is attractive to foreign investors, which naturally increases demand for the Rand.

- Political Stability: Nothing spooks investors like uncertainty. A stable and predictable political environment is absolutely crucial for confidence.

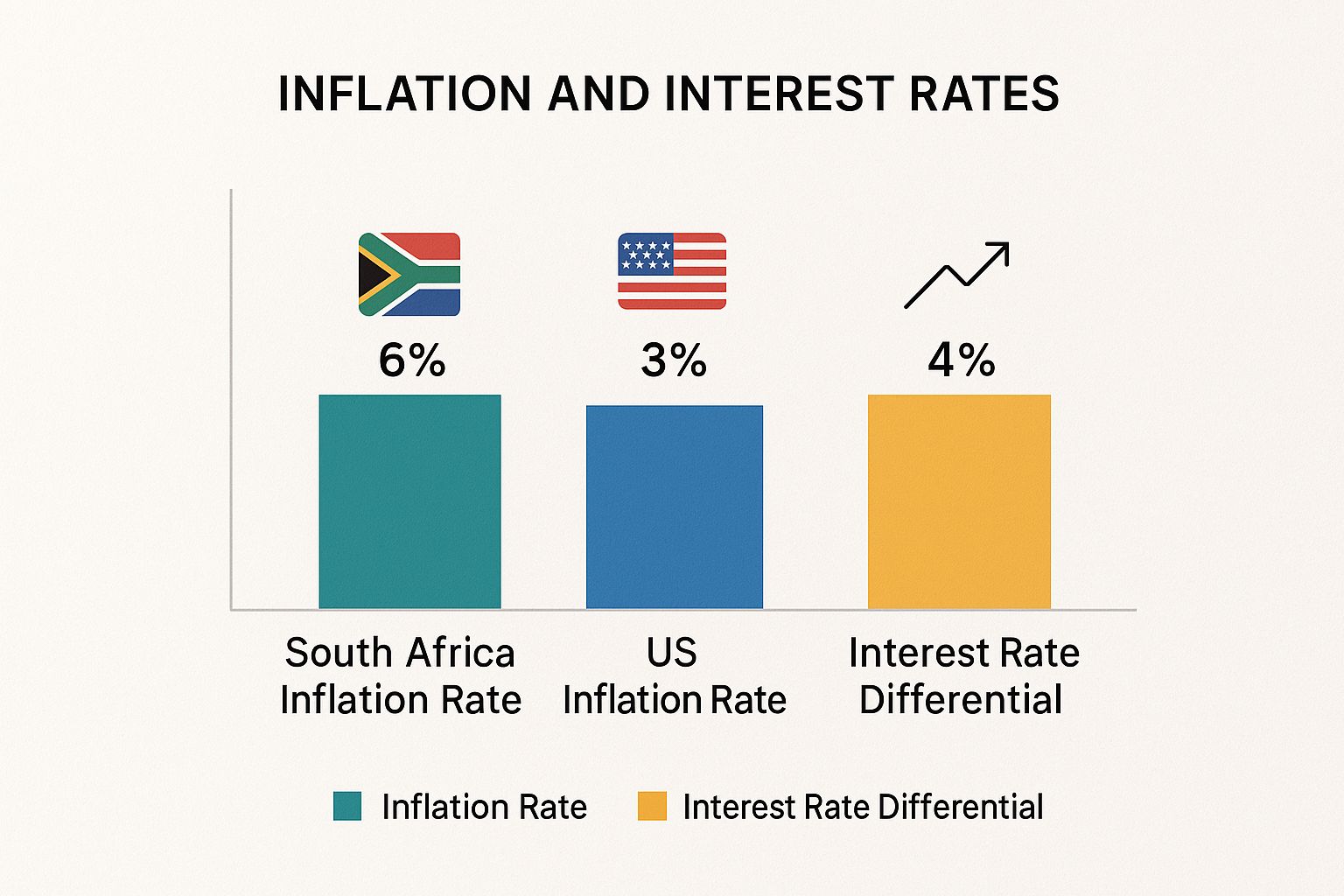

The infographic below gives a great visual comparison of how two of these core fundamentals—inflation and interest rates—stack up between South Africa and the US.

This chart really highlights the push-and-pull on the Rand. We have higher inflation, but we also have a significant interest rate advantage, which is the key ingredient that attracts those 'carry trade' investors.

The Chart Watcher's Method: Technical Analysis

If fundamental analysis is about the 'why', technical analysis is all about the 'what'. This is the art of reading charts. Technical analysts operate on the belief that all the fundamental news and economic data is already baked into a currency's price.

Their guiding principle is that history tends to repeat itself. They meticulously study past price movements and trading volumes, looking for patterns and trends that might signal where the rate is headed. It’s far less about economic reports and much more about raw market psychology.

A technical analyst might say, "I don't need to know if it's raining. I just see that everyone outside is carrying an umbrella, so I know what to do." They are focused entirely on the market's reaction, not the root cause.

Comparing Forecasting Methods

To make sense of these two schools of thought, it helps to see them side-by-side. Each has its own strengths and is suited for different objectives.

| Method | What It Measures | Key Indicators | Best For |

|---|---|---|---|

| Fundamental Analysis | A currency's 'intrinsic value' based on economic health. | Interest rates, GDP growth, inflation, political stability. | Long-term outlooks and identifying overall currency direction. |

| Technical Analysis | Market sentiment and psychology based on price action. | Chart patterns, support/resistance levels, moving averages. | Short- to medium-term timing and identifying entry/exit points. |

Ultimately, a complete forecast requires understanding what both the economic data and the market charts are telling you.

Blending Both for a Clearer Forecast

The most reliable forecasts rarely stick to just one method. True professionals blend both fundamental and technical analysis to get a more rounded, robust view.

Fundamental analysis helps set the long-term direction—is the Rand generally on a path to strengthen or weaken over the next year? Technical analysis then comes in to help time entry and exit points by pinpointing short-term market momentum.

For example, many professional projections blend these views. Some models predict a USD/ZAR rate of around 17.45 by the end of the fourth quarter, moving to 17.63 a year later. This kind of forecast considers fundamental drivers, like the expected interest rate policies from both the South African Reserve Bank and the US Federal Reserve. You can explore more detailed currency projections on tradingeconomics.com to see this in action.

By understanding how these two complementary approaches work together, you can better interpret the forecasts you read and appreciate the complex work behind predicting the Rand's next big move.

Practical Ways to Handle Currency Risk

Knowing what moves the rand us dollar exchange rate forecast is one part of the puzzle. The other, more critical part, is actually doing something about it to protect your business. For any South African company buying or selling internationally, the rand’s daily dance isn't just a headline—it's a direct hit or a boost to your bottom line.

Waiting for a currency swing to hit before you act is a recipe for disaster. The smart move is to plan ahead, building a financial shield that can absorb the rand's volatility. This turns a major business threat into a manageable operational task. Let's get practical and look at the tools you can use.

Lock in Your Rate with Forward Contracts

One of the most common and effective tools in the box is the Forward Exchange Contract (FEC). Think of it as a handshake with your bank to buy or sell a set amount of foreign currency on a future date, but at a price you agree on today.

Let's say you're an importer bringing in R2 million worth of equipment from the US, and you have to pay in 90 days. If the rand tumbles in those three months, the rand cost of that equipment could skyrocket, eating into your profit margin or even erasing it completely.

An FEC solves this. You lock in today’s exchange rate for that payment in 90 days. Done. All the uncertainty is gone. You know exactly what your import will cost in rands, making your budgeting solid and your profits secure, no matter what the market does.

Build in Some Wiggle Room with Currency Options

Forward contracts are great for certainty, but they're rigid. Once you're locked in, you can't take advantage if the rand suddenly strengthens and the rate moves in your favour. That’s where currency options offer a clever alternative.

A currency option gives you the right to exchange currency at a predetermined rate, but crucially, not the obligation. You pay a small fee (a premium) for this flexibility, a bit like buying insurance.

This approach is perfect when a deal isn't set in stone, like when you're bidding for an international project. If you get the contract, you can use the option to get your favourable rate. If you don't, all you've lost is the premium.

Simple Tools for Day-to-Day Business

Not every solution has to be a complex financial instrument. Some of the most effective strategies are simple, practical adjustments to how you operate.

Foreign Currency Accounts: Open and hold a US dollar account. This lets you receive payments from American clients and pay US suppliers directly in dollars. You cut down on constant currency conversions, which saves on fees and reduces your exposure to bad rates.

Spread Your Bets: Don't put all your eggs in one basket. By diversifying your suppliers and customer markets across different countries, you create a natural hedge. A strong rand might make your US exports less profitable, but it could also make your imports from Europe cheaper, helping to balance things out.

Invoice Smarter: If you have the negotiating power, try invoicing your international clients in rand. This neatly passes the currency risk from your business onto your customer. It’s not always possible, but it’s worth exploring.

These strategies are the building blocks of a solid risk management plan. To get a fuller picture of protecting your finances from all kinds of market shifts, it's worth learning more about managing investment risk effectively. A resilient business is protected from multiple angles. By using a mix of these tools, South African businesses can stop worrying about the rand us dollar exchange rate forecast and start navigating the global market with confidence.

Your Guide to Navigating the Rand's Future

Trying to predict the rand us dollar exchange rate forecast with perfect accuracy is a bit of a fool's errand. It's not about crystal ball gazing; it's about understanding the forces at play and building a solid game plan for your business. The rand's value is constantly caught in a tug-of-war between major global trends and our own economic realities here at home.

Getting a handle on this dynamic is the real secret to managing your currency exposure. While no one can tell you exactly where the ZAR/USD will be next quarter, knowing what drives it—from US interest rate decisions to our local inflation figures and commodity prices—gives you a massive advantage. You can start to anticipate how the market might react and build a strategy around it.

This guide has walked you through the tools to decode those influences. The most important thing to remember is that knowledge takes the guesswork out of the equation. It swaps last-minute panic for a proactive, strategic approach.

Your Core Takeaways

So, where do you go from here? The key is to cut through the daily market noise and focus on what really moves the needle for the rand’s long-term value.

Here’s a quick recap of the fundamental drivers to watch:

- Global Sentiment is King: Don’t ever underestimate this. The rand is incredibly sensitive to the mood of international investors. When they get nervous and pull back from risk, our currency almost always feels the heat, no matter how things look locally.

- Interest Rate Gaps Matter: The difference between South African and US interest rates is a huge deal. Think of it as a magnet for foreign investment—a wider gap in our favour tends to pull capital in and strengthen the rand.

- Domestic Health is Crucial: Our own backyard matters immensely. Factors like GDP growth, political stability, and fixing our energy supply are non-negotiable. A strong local economy acts as a crucial buffer when global storms hit.

The goal isn't to outsmart the market, because nobody consistently does. The goal is to build resilience within your business so that you're prepared for the market's inevitable swings. A smart currency strategy accepts volatility as a given and plans for it.

By using the risk management tools we’ve covered, like forward contracts or foreign currency accounts, you can build a financial shield. This turns currency risk from a wild, unpredictable threat into just another manageable part of doing business. You’re now far better equipped to face the rand's future with confidence.

Got Questions? We've Got Answers

Trying to make sense of the rand us dollar exchange rate forecast can feel a bit like reading tea leaves. It’s a complex world, and it’s natural to have questions. Let's tackle some of the most common ones that come up.

What’s the single biggest thing that moves the rand?

If you had to pin it on just one thing, especially in the short term, it would be global investor sentiment. Think of it as the world’s financial mood.

This mood swings between two states: 'risk-on' and 'risk-off'. When big international investors feel confident and optimistic ('risk-on'), they’re happy to put their money into assets that offer higher returns, even if they carry more risk. The South African rand is a perfect example. During these times, capital flows into South Africa, and the rand strengthens.

But when a crisis hits or uncertainty looms, that mood sours fast. Investors go 'risk-off', pulling their money out of emerging markets and rushing into 'safe-haven' assets like the US dollar. When that happens, the rand can take a nosedive, often completely ignoring any good news coming out of the local economy. It’s a powerful force.

Just how accurate are these ZAR/USD forecasts, really?

It's best to think of an exchange rate forecast as an educated guess, not a guarantee. The currency market is a whirlwind of countless factors—unexpected political shifts, sudden economic data, even pure market psychology—which makes pinning down an exact number incredibly difficult.

A forecast is a fantastic tool for getting a sense of the likely direction of the rand—is the tide coming in or going out? But it's not a crystal ball. Predicting the precise timing and magnitude of a move is where most forecasts fall short.

The smartest way to use them is as one piece of a bigger puzzle. Don't bet the farm on a single prediction. Instead, build a financial strategy that's resilient enough to handle the inevitable ups and downs, regardless of what the forecasts say.

Can I just use a simple moving average to predict where the rand is heading?

A simple moving average (SMA) is a great starting point for technical analysis. It helps smooth out the day-to-day noise and show you the general trend. For example, if the ZAR/USD price is consistently staying above its 50-day or 200-day moving average, that’s a classic sign of a strengthening trend for the rand.

But—and this is a big but—relying on just one indicator is a risky game. An SMA is a lagging indicator, which means it tells you what has been happening, not necessarily what's about to happen. It confirms a trend is underway but won't warn you when it's about to turn.

Seasoned traders never look at one tool in isolation. They combine SMAs with other indicators, like the Relative Strength Index (RSI), and—crucially—they layer that technical view with a solid understanding of the fundamental economic drivers. It’s about building a complete picture, not just looking at a single brushstroke.

Stop losing money to hidden fees and unpredictable bank rates. With Zaro, you get the real exchange rate, zero spread, and no SWIFT fees on all your international payments. Secure your profits and manage your foreign exchange with complete transparency. Learn how Zaro can protect your bottom line.