Navigating SA forex rates can feel like you're trying to hit a moving target. One minute you think you have your costs locked in, the next, a sudden swing in the rand's value has completely upended your budget. This constant uncertainty is a major headache for any business dealing with international payments, but it doesn't have to be.

Decoding the Rand and Finding Fair Value

So, what really makes the rand's value jump around so much? And how do banks and traditional providers often bury their fees in the exchange rates they offer? More importantly, how can your business find a genuinely fair and transparent rate every single time you need to exchange currency? We’ll get into the practical details to help you move from feeling confused to feeling in control. Let's break down how a clearer approach to forex can eliminate those common frustrations and protect your hard-earned profits.

The South African rand is famously volatile, which can be both a risk and an opportunity for businesses trading internationally. These ups and downs aren't random, though. They're driven by a combination of what's happening here at home and broader global market trends. Getting a handle on these drivers is the first real step toward smarter financial planning and managing your currency risk.

The Rand's Recent Journey

The currency's performance against major partners, particularly the US dollar, paints a vivid picture of its sensitivity. If you look back over the last five years, the rand has been on a rollercoaster. We saw this volatility firsthand when the USD/ZAR rate moved from around 14.5 to a peak near 19.93 in April 2025.

That dip was largely fuelled by rising inflation, political uncertainty, and the ripple effects of global events. More recently, the rand has shown signs of strength, which just goes to show how quickly market sentiment can change. For a deeper dive into its past movements, you can review the rand's historical performance.

Key Takeaway: The rand’s value is a direct reflection of South Africa’s economic health and its place in the world economy. For your business, this means global events can hit your bottom line almost instantly, affecting the cost of imports or the value of your export sales.

To give you a clearer picture, here's a look at some recent fluctuations and what they meant for businesses on the ground.

Recent ZAR to USD Exchange Rate Fluctuations

This table provides a snapshot of the rand's recent performance against the US dollar, highlighting its volatility and key milestones.

| Time Period | Key Rate or Event | Significance for Businesses |

|---|---|---|

| April 2025 | Rand weakens to a historic low of nearly R19.93 against the USD | Importers faced sharply higher costs for goods and raw materials. The price of paying international suppliers skyrocketed. |

| Mid-2025 | A period of relative stability, with the rate holding steady around the R18.50 mark. | Offered a brief window of predictability, making it easier for businesses to budget for international payments and costs. |

| Late 2025 | Positive investor sentiment sees the rand strengthen to below R18.00 to the dollar. | Exporters receiving USD payments saw their ZAR revenues decrease, while importers found their purchasing power improved. |

These examples show just how much external factors can impact your real-world costs and revenue from one month to the next.

Why This Matters for Your Business

This constant movement in SA forex rates creates a huge amount of uncertainty for any company making or receiving payments abroad. An unfavourable shift in the rate between when you send an invoice and when you actually get paid can quietly eat away at your profits. This financial guesswork makes accurate budgeting, forecasting, and long-term planning incredibly difficult.

To get on top of this, businesses need more than just a platform to send money—they need a partner who provides total clarity and fairness. This is especially critical when you're:

- Paying International Suppliers: You need to be sure that the amount you've budgeted in rands will actually cover the full invoice amount in dollars or euros when it's time to pay.

- Receiving Export Payments: You want to protect the value of your earnings when you convert that foreign currency back into rands.

- Managing Operational Costs: Budgeting for overseas software, paying international contractors, or covering travel expenses becomes a nightmare without a stable, predictable cost base.

By understanding the forces driving the currency and actively seeking out transparent pricing, you can turn forex from a source of stress into just another manageable part of running your business.

What Really Moves the South African Rand?

To get a real feel for what drives SA forex rates, it helps to picture two major forces at play. First, you have the local economic "weather" right here in South Africa. Then, you have the massive global "currents" that push and pull on our currency from thousands of kilometres away. It's the interplay between these two that causes the daily ups and downs you see in the market.

Let's start by looking closer to home.

South Africa's Internal Economic Climate

Several homegrown factors can have a swift and direct impact on how investors view South Africa.

One of the biggest players is the South African Reserve Bank (SARB). When the SARB decides to change the country's main interest rate (the repo rate), the rest of the world pays close attention.

Think of it this way: a higher interest rate is like a bank offering you a better return on your savings. This makes holding rands a more attractive proposition for foreign investors hunting for higher yields. As demand for the rand goes up, its value tends to climb. When the SARB cuts rates, the opposite happens—holding rands becomes less appealing, and the currency can weaken.

Then there's the issue of domestic inflation. This is simply the speed at which everyday prices for goods and services go up, eating away at your money's buying power.

If your rand buys you less petrol or fewer groceries this year compared to last, its actual value is dropping. High inflation can be a red flag for economic instability, making foreign investors anxious. They might sell off their rand-based investments, which puts downward pressure on the currency.

Finally, you can never underestimate the importance of political and social stability. Investors absolutely depend on predictability. Any hint of political uncertainty, policy shifts, or social unrest can frighten foreign capital away, causing a rapid outflow of money and a weaker rand. A stable, predictable environment, on the other hand, builds the confidence needed to bring in and keep foreign investment.

Global Currents and Commodity Tides

While what happens here matters a great deal, the rand is also at the mercy of events on the world stage. South Africa's economy is built on commodities, so our financial health is deeply connected to the global prices of the resources we sell.

The prices of key exports like gold, platinum, and coal create a powerful global current. When these commodities fetch high prices on the world market, South Africa earns more foreign currency (like US dollars). This flood of foreign cash increases the demand for rands as exporters convert their earnings back home, which in turn strengthens our currency.

The economic health of the world's biggest economies also creates tides that wash over SA forex rates.

- The United States Economy: Decisions made by the US Federal Reserve can create huge ripples. When the US raises its interest rates, the dollar becomes a more attractive investment. This often pulls money away from emerging markets like ours, weakening the rand in the process.

- China's Economic Performance: As one of our biggest trading partners, China's economic wellbeing is crucial. Strong demand from China for our raw materials is great for our export income and gives the rand a boost. But a slowdown in the Chinese economy can quickly translate to lower commodity prices and a weaker rand.

When you start to understand both the local weather and these global currents, you begin to see the story behind the numbers. It's this dynamic mix of domestic policy, investor mood, and international market forces that truly moves the rand each day.

How Global Trade Relations Impact the Rand

South Africa’s currency doesn't operate in a bubble. Its value is deeply intertwined with the daily rhythm of global trade, swinging with the deals we make and the relationships we maintain with our trading partners. For any business that buys or sells across borders, getting a handle on this connection is crucial.

At its heart, it all boils down to simple supply and demand. When we sell more to the world than we buy, we have what's called a trade surplus. Foreign buyers need our rands to pay for South African exports, which drives up demand and, naturally, strengthens our currency.

The opposite is a trade deficit, which happens when we import more than we export. In this scenario, more South Africans are selling rands to get their hands on foreign currency (like dollars or euros) to pay for those imported goods. This flood of rands into the market can cause its value to drop, directly impacting SA forex rates.

The Ripple Effect of Tariffs

Tariffs—which are essentially taxes on imported goods—are one of the most direct ways trade policy can stir the pot. While they might be put in place to shield local industries, they often send out economic ripples that can end up weakening the rand.

Think about it this way: imagine one of our major trading partners suddenly slaps a hefty tariff on a key South African export, like our wine or citrus. That single action sets off a chain reaction that affects our economy and the rand.

- Export Demand Plummets: The new tax makes our products more expensive for buyers abroad, so they buy less. This immediately cuts the flow of foreign currency coming into South Africa.

- Investors Get Nervous: That tariff injects a huge dose of uncertainty. Investors start to worry about our economic growth and the health of our key industries, which can lead them to sell their rand-based investments.

- The Risk of Retaliation: Trade spats are rarely one-sided. One tariff often invites another in response, sparking a tit-for-tat cycle that harms exporters on both sides and puts an even bigger damper on economic confidence.

This whole messy dynamic means that a single policy decision made thousands of kilometres away can have a very real impact on the cost of your next international payment.

A Real-World Example with the United States

Our relationship with the United States, South Africa's third-largest trading partner, is a perfect case study. In mid-2025, for example, the US placed a 30% tariff on several key South African exports, hitting vital agricultural sectors like wine and citrus hard.

This move immediately put downward pressure on the rand as investors fretted about the souring trade relationship and what it meant for future growth. When you consider that the US makes up about 7.5% of South Africa’s total trade, you can see how this kind of event creates massive currency uncertainty. If you want to see the broader trends, you can explore the latest data on South Africa's currency movements.

This situation perfectly illustrates the connection between geopolitics and your bottom line. Strained trade relations introduce risk, and in the world of forex, risk often translates into a weaker currency.

For a business involved in global trade, these aren't just news headlines—they're direct hits to your profit margins and budget forecasts. Keeping an eye on trade talks and geopolitical shifts isn't just a good idea anymore; it's a fundamental part of smart financial management.

When the rand weakens because of a trade dispute, importers suddenly face higher costs for their goods. Exporters might get a temporary boost if they can maintain their sales, but the overall volatility makes long-term planning a nightmare for everyone involved.

How to Measure the Rand's True Strength

Watching the ZAR/USD exchange rate is a common starting point, but it really only gives you a small part of the story. It’s a bit like judging a car’s performance just by looking at its top speed – you’re missing the full picture. To get a genuine feel for the rand's health, we need to look at how it performs against a whole group of currencies, not just one.

This is where two crucial concepts come into play: the Nominal Effective Exchange Rate (NEER) and the Real Effective Exchange Rate (REER). Think of these as more advanced diagnostic tools. They help us understand the rand’s true standing in the global economy and, importantly, how competitive South African businesses actually are.

Understanding the Sticker Price with NEER

You can think of the NEER as the rand's "sticker price." It’s a weighted average of the rand's value against a basket of currencies from our most important trading partners. When the NEER goes up, it means the rand has, on average, strengthened against this group of currencies.

This is a big step up from just looking at a single currency pair because it smooths out a lot of the daily noise. For instance, the rand might be weakening against the US dollar but strengthening against the euro and the pound at the same time. The NEER cuts through that confusion and gives you one number to track its overall performance.

But just like a car's sticker price doesn’t tell you anything about its running costs, the NEER doesn’t reveal the full story about our economic competitiveness. For that, we need to bring inflation into the equation.

Calculating the Total Cost with REER

This is where the REER comes in. If the NEER is the sticker price, the REER is the total cost of ownership. It takes the NEER and adjusts it for the difference in inflation between South Africa and our trading partners. This is hugely important because it uncovers the true purchasing power of our currency and shows how expensive our exports really are to the rest of the world.

Let's break it down with an example:

- Imagine South Africa’s inflation is running at 6%, but our main trading partners have an average inflation rate of only 2%.

- This means our local costs—labour, materials, everything—are rising much faster than theirs.

- Even if the NEER doesn't move an inch, our goods are effectively becoming 4% more expensive for foreign buyers each year.

The REER is what captures this hidden cost. A rising REER is a red flag, signalling that South Africa's exports are becoming less competitive on the global stage.

This dynamic is precisely why a "strong" rand isn't always good news. If the rand strengthens in real terms (a higher REER), it can hurt our local export-driven sectors because our products become pricier for international customers, potentially leading to lower sales and job losses.

The daily SA forex rates we see are constantly influenced by these deeper undercurrents. Historical data on these effective exchange rates reveals how the rand's competitiveness has shifted, especially during major economic events like the 2008 financial crisis and the 2020 pandemic. For South Africa's export economy to thrive, maintaining a competitive REER is absolutely vital. Our competitiveness takes a direct hit whenever our local inflation outpaces that of our partners. You can discover more insights about South Africa's exchange rate dynamics on fred.stlouisfed.org.

By looking beyond the simple ZAR/USD rate and getting to grips with the REER, businesses can gain a much more accurate view of the rand’s true strength and South Africa’s real position in the global marketplace.

Unmasking the True Cost of SA Forex Rates

When you glance at the SA forex rates on a news site or Google, you’re looking at what’s called the interbank rate. This is the wholesale price, the 'real' rate that banks use when they trade massive amounts of currency among themselves. Think of it as the purest form of an exchange rate.

But here’s the catch: the rate you see online is almost never the rate your business actually gets from a traditional bank. This gap between the wholesale price you see and the retail price you’re offered is where hidden costs start chipping away at your profits.

What Is The Forex Spread?

It’s a bit like buying produce from a supermarket. The store buys apples from a farmer at a wholesale price, then adds its own markup before putting them on the shelf for you. That difference is their profit margin, or spread.

Foreign exchange operates on the exact same principle. When you ask your bank for a ZAR/USD rate, they don't simply pass on the live interbank rate. Instead, they build their markup directly into the quote they give you. This is the forex spread, and it's a hidden fee that inflates the cost of every international payment you make.

The forex 'spread' isn't an itemised fee on your statement. It's a cost baked directly into the exchange rate itself, making it incredibly difficult for businesses to see what they're truly paying for international transfers.

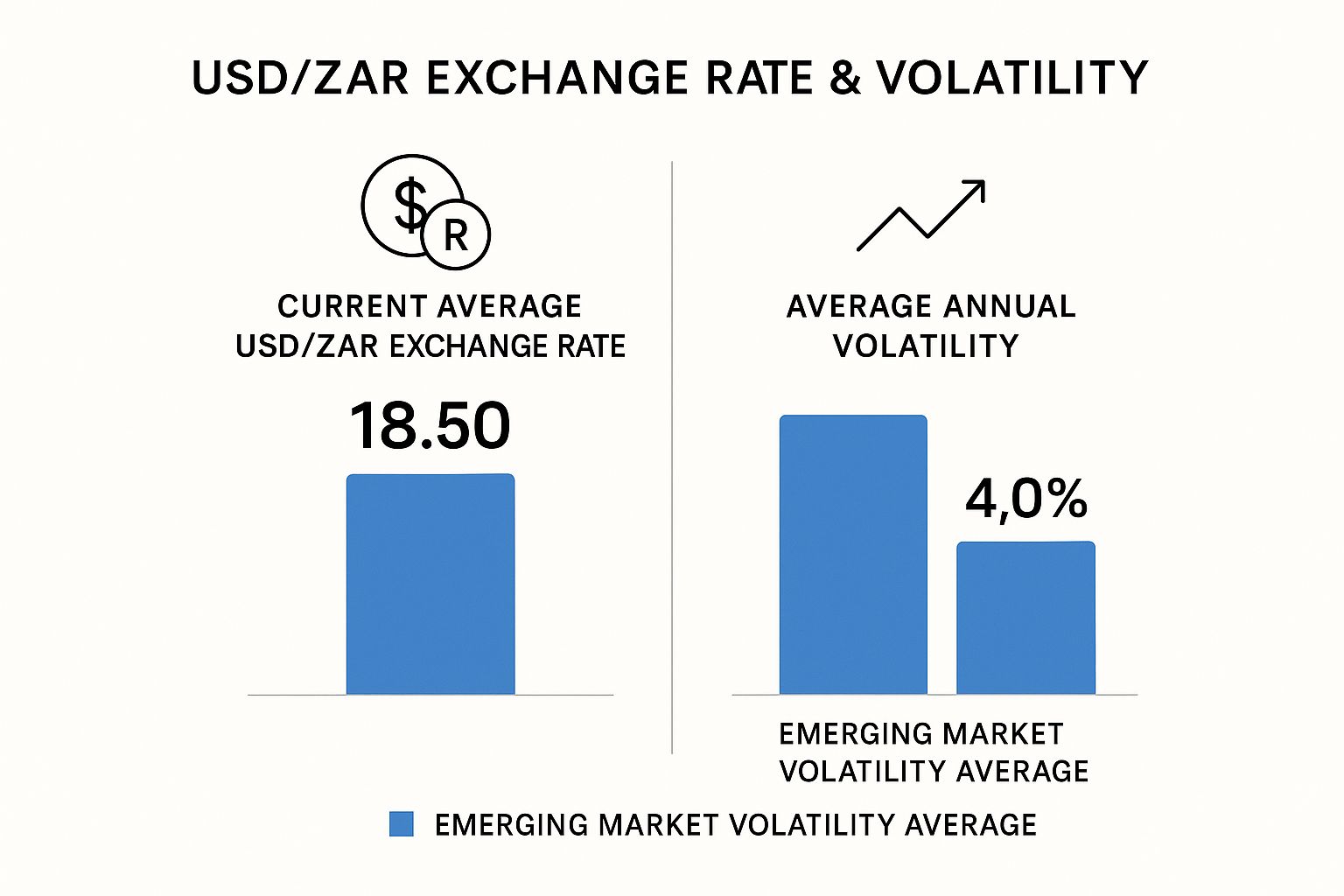

This infographic paints a clear picture of the South African rand's position, highlighting its average exchange rate and, crucially, its volatility compared to its peers.

As you can see, the rand’s annual volatility sits at 5.2%, a full point higher than the 4.0% average for other emerging markets. For any business dealing in forex, that extra volatility translates directly into financial risk.

How a Small Spread Snowballs into a Big Problem

A spread might look insignificant on the surface—often just a couple of percentage points. But its effect on your bottom line, especially with larger transfers, can be staggering. The bigger the transaction, the more a hidden spread quietly siphons from your business.

Let’s put it into perspective. Say your business needs to pay a US-based supplier an invoice for $50,000.

- The live interbank rate (the 'real' rate) is R18.50 to the dollar.

- Your bank, however, quotes you a rate of R18.87, which includes their hidden spread.

That difference of R0.37 per dollar might not seem like much at first glance. But once you run the numbers, the true cost becomes painfully obvious.

The Impact of Hidden Spreads on a R1,000,000 Transfer

The table below breaks down the real-world financial impact of that seemingly small markup. We'll compare a transfer using the true interbank rate against the typical bank rate to see how much a 2% spread really costs a business.

| Metric | Transaction with Zero Spread | Transaction with 2% Spread |

|---|---|---|

| Exchange Rate | R18.50 / $1 | R18.87 / $1 |

| Rand Cost to Buy $50,000 | R925,000 | R943,500 |

| Hidden Cost (The Spread) | R0 | R18,500 |

In this scenario, the spread has cost your business an extra R18,500 on a single payment.

This isn’t a service fee or a transaction charge—it’s pure profit for the provider, taken directly from your capital without ever being itemised. For any business trying to manage its cash flow, this complete lack of transparency is a serious problem.

Finding Transparent Pricing with Zero Spreads

After seeing how hidden spreads can eat into your profits, the big question is: how can my business break free? The answer isn't about finding a slightly better rate; it's about a complete shift in how you handle foreign exchange. A new generation of financial platforms is giving South African businesses direct access to the real interbank exchange rate, something that was once off-limits.

This model flips the whole system on its head. Instead of padding the rate to hide their profit, these providers work with a zero-spread policy. You get the genuine, live wholesale rate for every transaction—the very same one banks use when they trade with each other.

Their business model is refreshingly straightforward. You pay a small, fixed fee for the service, which is disclosed upfront. That's it. This means you know the true cost of your international payment before you click 'send', eliminating the guesswork and frustration that come with traditional forex.

The Benefits of a Zero-Spread Model

This transparent approach offers clear, powerful advantages for any South African business dealing with overseas payments. It puts you back in the driver's seat, enabling smarter and more confident financial decisions. The benefits are immediate and they stick around.

Here are the key advantages:

- Significant Cost Savings: When you cut out the hidden markup on the exchange rate, you save money on every single payment. Over a year, this can easily add up to tens or even hundreds of thousands of rands, cash that goes straight back to your bottom line.

- Predictable Financial Planning: Budgeting becomes a whole lot easier and more accurate when you know the exact cost of your forex. You can forecast expenses and plan for the future with real confidence, without having to guess what the bank's hidden spread might be on any given day.

- Complete Trust and Transparency: Working with a partner that shows you the real rate builds a foundation of trust. It’s a guarantee you’re getting a fair deal, freeing you up to focus on what really matters—running your business—instead of constantly double-checking your exchange costs.

The core idea is simple: You should pay for the service of moving your money, not be secretly overcharged through a poor exchange rate. A zero-spread model with a flat fee makes this a reality, offering businesses a fair and predictable way to manage their international finances.

How It Works in Practice

Let’s go back to that $50,000 invoice for your US supplier. With a platform like Zaro, the entire process looks different.

You’d see the live interbank SA forex rates—let's say it's R18.50 to the dollar. You lock in your trade at that exact rate. The cost to your business is R925,000, plus a small, clearly stated transaction fee. No nasty surprises, no hidden markups.

This model provides real, tangible value that stands in stark contrast to the murky pricing of traditional banks. For a South African business, this isn't just a small tweak; it's a fundamental move towards greater financial efficiency and control. It helps you protect your hard-earned money from being chipped away by hidden forex fees, ensuring it stays right where it belongs: in your business.

Got Questions About SA Forex Rates? We’ve Got Answers.

Alright, we’ve covered the big economic forces that nudge the rand up and down and peeled back the curtain on those sneaky hidden fees. Now, let's tackle some of the real-world questions that businesses grapple with every day. Think of this as your practical playbook for making smarter financial moves.

So, When Is the Best Time to Make an International Payment?

It’s tempting to try and game the system, isn't it? To watch the charts like a hawk and pounce the moment the rate looks favourable. But honestly, trying to "time the market" is a fool's errand. It's incredibly difficult, stressful, and not a sustainable strategy for any business.

Sure, you can keep an eye on big events, like when the South African Reserve Bank (SARB) has a meeting, to avoid making transfers during potentially choppy periods. But a far better approach is to stop guessing and start controlling what you can. Focus on locking in the best possible deal structure every time, not on predicting the rand's next move. A transparent rate with no hidden costs is worth far more than a lucky guess.

The smartest move isn't timing the market, but removing the hidden costs from your transactions. When you secure a zero-spread rate, you guarantee savings regardless of daily market fluctuations.

How Can My Small Business Handle the Rand's Wild Swings?

The rand's volatility is a real headache, especially for smaller businesses where every cent counts and unpredictable costs can wreck a budget. The good news is you're not helpless. There are some smart financial tools that can give you a buffer and bring some much-needed predictability to your international payments.

One of the most effective is a forward exchange contract (FEC). In simple terms, an FEC lets you lock in an exchange rate today for a payment you need to make in the future. This takes all the guesswork out of the equation. You know exactly what you'll pay, which makes budgeting and forecasting a whole lot easier. No more sleepless nights worrying if the rate will tank before your invoice is due.

Combining this with a zero-spread pricing model from your provider adds another powerful layer of defence. By cutting out the hidden markup, you’re already protecting your bottom line from unnecessary costs, which acts as a fantastic buffer against the rand’s notorious ups and downs.

Why Do I See Different ZAR Rates on Different Platforms?

This is a classic and completely valid source of frustration. You're trying to compare your options, but every bank, broker, and payment platform seems to be showing you a different ZAR rate. What gives?

The answer, nine times out of ten, is the spread. That’s the markup we talked about earlier. Most providers take the real, wholesale interbank rate and quietly add their own profit margin on top before showing you the 'customer rate'. Because each provider has a different business model and profit target, their markups vary—and so do the rates you see.

This is exactly why a zero-spread model is such a game-changer. It eliminates the confusion entirely. You get the real, uninflated rate, every single time. No smoke and mirrors, just pure transparency.

Ready to stop losing money to hidden fees and unpredictable SA forex rates? With Zaro, you get access to real exchange rates with zero spread. Take control of your international payments and see how much you can save. Discover transparent pricing with Zaro today.