For a South African exporter, the selling price isn't just the number on your invoice. It’s the actual ZAR that lands in your bank account after the messy, often expensive, journey of an international payment is complete. Too often, what you charge and what you receive are two very different figures.

What Selling Price Really Means for Your Business

Imagine your international payment is a bucket of water you need to carry across a field. The amount your customer sends is a full bucket, but the field is full of small holes. With every step, a little water splashes out. What’s left when you finally get to the other side—that's your real selling price.

These "leaks" are a collection of predictable, yet easily overlooked, costs that silently eat into your revenue. For any local business trading across borders, getting to grips with these deductions is crucial for protecting your bottom line. If you ignore them, you're almost certainly earning far less than you think on every single sale.

The Profit Drains in International Payments

The gap between what you invoice and what you bank is caused by several factors. Each one might seem small on its own, but their combined effect can seriously damage your profitability.

Let's look at the main culprits that reduce the cash you actually receive:

- Bank Transfer Fees: These are the straightforward charges for processing international SWIFT payments.

- Currency Conversion Markups: This is the hidden fee banks build into the exchange rate, making sure you get less ZAR for your customer's currency.

- Intermediary Bank Charges: Sometimes, other banks in the payment chain take their own slice of the pie before the money ever reaches you.

These costs hit hard in South Africa's dynamic export economy. Take November 2025, when South African exporters generated an impressive R37.7 billion trade surplus from exports totalling R188.0 billion. While that's fantastic news, traditional banks often apply hefty markups of 5-10% on these cross-border payments.

Think about it: a small business bringing a $100,000 payment back home could lose between R50,000 and R100,000 to hidden fees in an instant. You can find more details about these trade figures in this SARS media release.

The true selling price is not what you charge, but what you keep. For exporters, this distinction is the difference between thriving and merely surviving in a competitive global market.

At the end of the day, your effective selling price is the final, settled amount that reflects what your business actually earns after the complex world of international finance has taken its share.

Essential Formulas to Calculate Your Selling Price

Knowing the theory is great, but when it comes to setting your prices, you need some solid formulas. Get it right, and you cover your costs and hit your profit targets. Get it wrong, and you're either leaving money on the table or scaring away customers.

The most direct way to tackle this is with cost-plus pricing. It’s a beautifully simple method: you work out every single cost involved and then add the profit you want to make on top. Think of it as building your price from the ground up, ensuring every sale actually makes you money.

The Cost-Plus Pricing Formula

This model is a favourite for a reason—it’s clear and predictable. You just add up all the expenses tied to making and delivering your product, then tack on your profit.

Here’s the formula: Selling Price = Total Cost Price + Desired Profit

Your Total Cost Price isn't just what it costs to make the item. It’s the sum of every rand spent getting that product into your customer's hands. This includes:

- The cost to manufacture or buy the product

- All shipping and logistics fees

- Insurance for the journey

- Any taxes and import duties

For instance, if you're exporting to Canada, getting a handle on the Canadian Customs Tariff and Harmonized System is non-negotiable. Those duties are a real part of your cost and directly impact your final selling price.

Markup vs Margin: A Critical Distinction

This is where so many businesses stumble. Markup and margin sound like they could be twins, but they're two very different ways of looking at profit. Mixing them up is a classic—and costly—pricing mistake.

Markup is the percentage you add to your cost to get your selling price. Margin, on the other hand, is the slice of your final selling price that is pure profit.

Let's break it down with the math:

- Markup % = (Profit / Cost Price) x 100

- Profit Margin % = (Profit / Selling Price) x 100

Here’s the key takeaway: a 50% markup is not a 50% profit margin. Your margin percentage will always be lower than your markup percentage because it’s calculated on a bigger number (the selling price).

Worked Example: Exporting South African Gin

Let's make this real. Imagine a distillery in Cape Town is sending a case of its finest artisan gin to a buyer in the United States.

- Total Cost Price (per case): R2,500. This number covers everything—distilling, bottling, shipping, and insurance.

- Desired Profit: The distillery decides on a 40% markup on their cost.

Step 1: Calculate the Profit Amount

- Profit = Cost Price x Markup Percentage

- Profit = R2,500 x 0.40 = R1,000

Step 2: Calculate the Selling Price

- Selling Price = Cost Price + Profit

- Selling Price = R2,500 + R1,000 = R3,500

So, the selling price is R3,500. This single figure covers all their expenses and locks in that R1,000 profit.

Now, what’s the profit margin? Let's check: (R1,000 Profit / R3,500 Selling Price) x 100 = 28.6%. See? A 40% markup resulted in a 28.6% margin. This is exactly why you can't use the terms interchangeably.

The Hidden Costs That Erode Your Profits

You’ve worked out your selling price, sent the invoice, and closed the deal. That’s a great feeling. But the number on that invoice often isn't what lands in your bank account, especially when you’re selling across borders.

A whole host of hidden costs, often lurking in the fine print of international transactions, can quietly eat into your profits. For South African businesses, these deductions can be particularly painful, turning what looked like a healthy sale into a much smaller final figure. Understanding these profit killers is the first step to protecting your bottom line.

The Trio of Profit Killers

When you receive money from overseas, it’s not a straight shot from your client's bank to yours. Think of it like a relay race where the prize money gets a little smaller with every handover. Three main culprits are responsible for this shrinkage.

- International Bank Transfer Fees: You’ll often see these listed as SWIFT charges. They’re the most obvious fee for sending money from one country to another.

- Currency Conversion Spreads: This one is sneaky. It's the hidden markup on the exchange rate. The bank gives you a rate that’s less favourable than the real market rate and simply pockets the difference.

- Intermediary Bank Fees: If your customer's bank doesn't have a direct link to your South African bank, the money has to pass through one or more "middleman" banks. Each one takes its own cut for helping the payment along.

These costs add up. For many South African exporters, the final ZAR amount they receive can be up to 10% less than what they expected based on the day's exchange rate. In fact, the South African Reserve Bank has pointed out that payment costs in certain African trade corridors average over 10%—a far cry from the G20’s goal of 3%. You can read more about these findings on cross-border payments.

Imagine sending an invoice for R100,000. After all the fees and a poor exchange rate, only R92,000 shows up. That R8,000 difference comes directly out of your profit margin. It’s a loss you have to absorb.

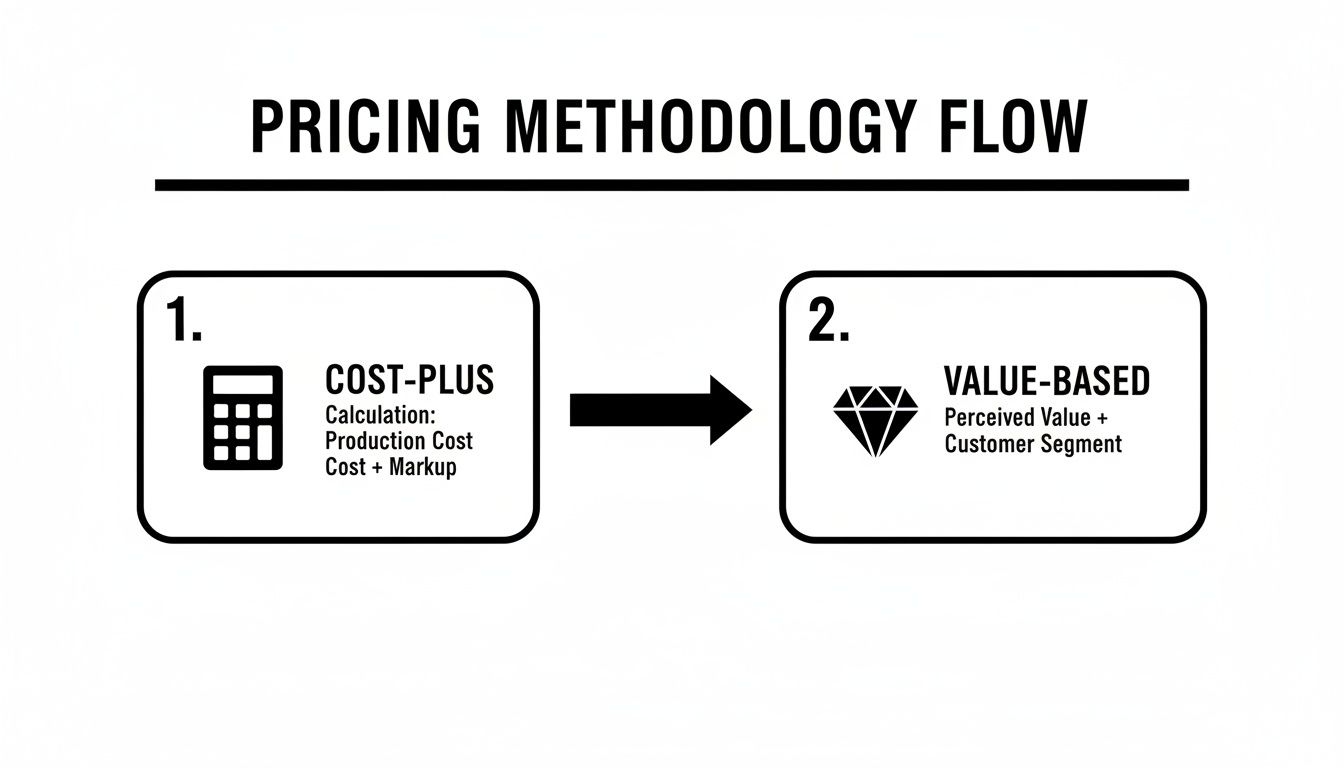

This is precisely why your initial pricing strategy is so important. You start with a cost-plus model to cover your basics, but you need to shift towards a value-based approach to build in enough of a buffer to absorb these transaction costs without hurting your business.

The flow here shows exactly that—once you've established your baseline cost, you have to think about perceived value to set a final price that can withstand the realities of international payments.

A Real-World Example of Eroding Profits

Let's walk through a realistic scenario. A South African consultant has just finished a project for a US client and sends an invoice for $10,000.

First, the client's bank in the US deducts a $45 SWIFT fee just to send the payment. The money then travels through an intermediary bank in Europe, which shaves off another $25 fee for its trouble.

Finally, the funds arrive at the consultant’s bank in South Africa. The bank applies an unfavourable exchange rate, costing the consultant an extra R3,500 compared to the real mid-market rate. On top of that, there's a R250 receiving fee.

Suddenly, that $10,000 invoice has shrunk considerably, and that's even before factoring in local taxes. Getting a firm grip on your financials, including using tools like the net working capital formula, is essential to spot and manage these hidden costs that quietly drain your profits.

Protecting Your Selling Price from ZAR Volatility

For any South African business selling to the world, figuring out a solid selling price is just the first hurdle. The real challenge? Protecting that price from the rollercoaster ride that is the Rand (ZAR). A bad day on the currency markets can vaporise your profit margin overnight.

Trying to manage this isn't just about watching market trends. As an exporter, you're juggling a unique set of obstacles. There are complex exchange control regulations to navigate, not to mention the steep, and often hidden, fees that traditional banks charge for international payments. It's a minefield for anyone just trying to earn a predictable income from their overseas sales.

To come out on top, you need to be proactive. Just waiting to see what the exchange rate is on the day your customer pays is a gamble you can't afford to take. It's all about taking back control.

Strategic Invoicing and Currency Management

One of the smartest moves you can make is to stop thinking in Rand when you deal with international clients. Shield your business by invoicing them in a more stable, globally recognised currency.

- Invoice in Hard Currency: When you send an invoice in US Dollars (USD) or Euros (EUR), you lock in the value of that sale. The immediate risk of a plummeting Rand is no longer your problem at the time of sale.

- Time Your Conversions: Once that USD or EUR lands in your account, the power shifts to you. You're not forced to accept the rate of the day. Instead, you can watch the market and choose to convert your funds back to ZAR when the timing is right for your bottom line.

This simple shift in process creates a vital buffer against the ZAR's notorious dips, turning what was once a massive risk into a strategic financial advantage.

Finding the Real Exchange Rate

Here’s a costly mistake many businesses make: assuming the exchange rate you see on Google or the news is the rate you’ll actually get. It almost never is. Banks bake a significant markup, known as a "spread," into the rate they offer you. This is another hidden cost quietly eating into your selling price.

Your goal should always be to get as close as possible to the mid-market rate. Think of this as the 'real' exchange rate—the true midpoint between what buyers are willing to pay and what sellers are asking for a currency, with no hidden bank fees attached.

Finding this rate is easy. Finding a financial partner who will actually give it to you is the tricky part.

Adopting Modern Fintech Solutions

This is precisely where modern fintech platforms are changing the game for South African exporters. The old-school banking system simply wasn't designed for the transparency and speed that global businesses need today. Fintech solutions, however, were built from the ground up to solve these exact problems.

When you partner with a modern payment provider, you can sidestep the slow, expensive legacy systems. These platforms often provide access to the real exchange rate with a very small, transparent fee instead of a hidden spread. This alone eliminates one of the biggest costs in cross-border trade.

More importantly, they give you the tools to actually manage your foreign currency. You can hold, manage, and convert funds on your own terms. Making the switch from a traditional bank to a fintech partner could be the single best decision you make to protect the international revenue you've worked so hard to earn.

How Zaro Helps You Reclaim Your Full Selling Price

Knowing about the hidden costs that eat into your revenue is one thing, but actually doing something about it is another. For South African exporters, the traditional banking system often feels like a leaky bucket—a big chunk of your hard-earned selling price simply vanishes before it ever lands in your account. This is exactly where modern financial platforms like Zaro change the game.

Instead of just accepting vague fees and poor exchange rates as a business expense, Zaro gives you the tools to take back control. The platform is designed to tackle the exact pain points that chip away at your profits. It ensures the selling price meaning for your business is what you actually keep, not just the number on your invoice. It’s a fundamental shift from losing money in transit to making the most of every single sale.

Eliminating the Biggest Profit Drains

The two biggest culprits in traditional cross-border payments are hidden currency markups and unpredictable SWIFT fees. Zaro was built specifically to solve these problems, offering a refreshingly transparent and much cheaper way to get paid.

- Receive Payments at the Real Exchange Rate: With Zaro, you get the mid-market exchange rate with zero hidden spreads. This means you’re getting the true value for your foreign currency, instantly shielding you from one of the biggest hidden costs in international trade.

- Say Goodbye to SWIFT Fees: The Zaro network bypasses the expensive and frustratingly slow SWIFT system entirely. No more surprise deductions from intermediary banks or hefty sending fees that slice into your payment before it even arrives.

By getting these two things right, Zaro helps you hold onto a significant percentage of your revenue on every transaction. We’re not talking about small change here; this is a direct and meaningful boost to your profit margin.

A Side-by-Side Comparison

The difference really hits home when you look at the numbers. Let’s compare a typical $10,000 international payment handled by a traditional bank versus the same payment coming through Zaro.

| Feature | Traditional Bank | Zaro |

|---|---|---|

| Exchange Rate | Mid-market rate + 2-5% markup | Real mid-market rate (zero spread) |

| SWIFT & Intermediary Fees | R850+ (Variable) | R0 (Zero fees) |

| Hidden Costs | High | None |

| Amount Received | Significantly Less | The Full Value |

Let’s break that down. In this scenario, a traditional bank’s hidden markup alone could cost you between R3,700 and R9,250 on a single $10,000 transaction (based on a R18.50/$ rate). With Zaro, that money stays right where it belongs: in your pocket.

At the end of the day, Zaro helps you secure your full selling price by offering complete transparency and cutting out the unnecessary fees that have held South African exporters back for too long. You get the clarity and control you need to manage your international finances properly, making sure your business receives every Rand it’s entitled to.

Here's the rewritten section, designed to sound like it was written by an experienced human expert.

A Hands-On Checklist to Nail Your Selling Price

Theory is one thing, but putting it into practice is what actually protects your bottom line. Think of this checklist as your action plan—a way to review, tweak, and strengthen your international pricing so you’re not leaving money on the table.

Each point here is a concrete step you can take right now to shield your revenue from those sneaky hidden costs and the ups and downs of the market.

Your Pricing Optimisation Plan

Ready to build a more bulletproof pricing model? Let's walk through it.

Get Real About Your Costs: I mean all your costs. It’s easy to remember production, but what about shipping, insurance, import duties, and even special packaging? You need to meticulously map out every single expense to get a true picture of your total cost. This isn't just admin; it's the bedrock of a profitable selling price.

Question Your Bank's FX Rates: Don't just accept the exchange rate your bank offers you. It's almost never the real one. Ask them directly: "What's your FX spread?" and "What are all the transfer fees?" Compare their quote to the mid-market rate you see online. The difference is your money, and you'll be surprised how much it can be.

Pick the Right Pricing Model for the Job: Is a straightforward cost-plus model enough for you? Or does your product's value in the market allow for a value-based approach that builds in a healthier buffer for those "just in case" costs? Your model needs to fit your product and the market you’re selling into—there's no one-size-fits-all answer here.

A smart pricing strategy isn't just about covering your costs. It's about seeing the financial friction in international trade before it happens and building a defence against it.

Quote Smarter, Not Harder: When invoicing international clients, consider using a stable currency like the US Dollar or Euro. This simple switch takes the immediate risk of a fluctuating Rand off your shoulders. It puts you back in control, letting you decide the best time to convert your earnings back into ZAR.

Use a Payment Solution That's Actually on Your Side: It’s time to move away from traditional systems. Switching to a modern fintech platform that gives you the real exchange rate without hidden markups is probably the single most powerful move you can make. It's the quickest way to ensure the selling price you worked so hard to calculate is the amount you actually get.

Your Selling Price Questions, Answered

Let’s get into some of the questions that often come up for South African entrepreneurs dealing with pricing and getting paid from overseas. Getting these concepts straight is key to protecting your hard-earned revenue.

What's the Real Difference Between Markup and Margin?

This one trips up a lot of people, but it’s quite simple when you think about it. Markup is what you add on top of your cost to get to your selling price. Profit margin, on the other hand, is the slice of the final selling price that’s actually profit.

They sound similar, but they're calculated differently. A 50% markup on your cost will always give you a smaller profit margin percentage, because the margin is calculated on the bigger final price.

Where Can I Find the True Mid-Market Exchange Rate for ZAR?

Don't rely on the rate your bank shows you; that’s their rate, not the real one. The mid-market rate is the true exchange rate—the midpoint between what banks are buying and selling a currency for, with no hidden fees baked in.

You can find this rate on independent sources like Google Finance or XE.com. Use this as your benchmark. It shows you exactly what you should be getting before the banks add their slice.

The difference between the mid-market rate and the rate you're offered is a hidden cost. Knowing the real rate is the first step to avoiding it.

Why Does the Money I Receive Never Match My Invoice Amount?

It’s a massively frustrating experience, right? The shortfall almost always comes down to two culprits. First, hidden currency conversion markups slice off a piece of the value. Second, traditional SWIFT payments often pass through intermediary banks, and each one takes a fee before the money ever lands in your account.

These little deductions add up, which is why the ZAR amount that hits your bank is nearly always less than what you invoiced for.

Is It a Hassle to Switch to a Modern Payment Platform?

Not at all. Good fintech platforms are built to make your life easier, and that includes the sign-up process. Getting started is usually a simple online process designed around security and compliance (like Know Your Business checks).

Once you're set up, the time saved and the money kept through transparent rates and no hidden fees make the initial effort well worth it. It’s a small step that makes a huge difference compared to sticking with an old-school bank.

Ready to stop losing your profits to hidden fees and unpredictable exchange rates? Zaro gives you the real mid-market rate with zero hidden spreads, ensuring the selling price you set is the money you keep. Learn more about how Zaro protects your profits.