For any South African business operating on the global stage, paying international suppliers or invoices can feel like navigating a minefield. You’re often hit with a confusing mix of hidden fees, sluggish transfer times, and a mountain of compliance paperwork. The old way of doing things through traditional banks often chips away at your profits, with poor exchange rates and high costs turning a simple payment into a major headache.

The New Rules for Sending Business Payments Overseas

For years, South African businesses have just put up with the frustrating reality of international payments. The routine is all too familiar: you log into your bank's portal, try to decipher the real cost of the transaction buried in the exchange rate, and cross your fingers it arrives on time. This isn't just a small annoyance; it's a direct blow to your bottom line with every single overseas payment you make.

These traditional hurdles cause very real problems. Let’s say you need to pay a critical supplier in China. A delay of three to five business days – which is pretty standard for many banks – can bring your entire supply chain to a screeching halt. Then there’s the confusing paperwork for South African Reserve Bank (SARB) compliance, which often leaves your finance team bogged down in admin instead of focusing on growing the business.

Shifting Away from Traditional Banking Hurdles

The core issue here is a lack of transparency and speed. The systems most banks use weren't designed for the fast-paced, agile world we operate in today. This leads to a few key pain points for businesses trying to manage their international payments effectively:

- Hidden Exchange Rate Markups: Banks love to advertise "low fees," but they make their money by building a hefty profit margin into the exchange rate. The rate you get is often far worse than the live market rate.

- Slow Settlement Times: The standard SWIFT network passes your money through several intermediary banks. Each one adds delays and, in some cases, their own extra fees along the way.

- Complex Compliance Processes: Manually uploading invoices and providing justification for every payment is slow and opens the door to human error, risking even more delays.

The true cost of an international payment isn't the transfer fee they advertise. It’s the money you lose to a bad exchange rate. For a business paying suppliers overseas regularly, this can easily add up to tens of thousands of rands lost every year.

A Modern Alternative for Global Payments

Thankfully, things are finally changing. Fintech platforms like Zaro were built from the ground up to solve these exact problems. Instead of leaning on outdated banking infrastructure, they give you direct access to the real, live exchange rates without any hidden markups. This simple shift gives your business the clarity and control it needs to manage international finances properly.

By bringing all your payments into one place, automating compliance checks, and showing you all the costs upfront, these platforms turn a complicated mess into a simple, predictable task. It’s a move away from a slow, costly system to a smart, efficient financial workflow.

This quick comparison really brings the differences to life.

Traditional Banks vs Modern Platforms: A Quick Comparison

When you compare the old way with the new, the advantages for your business become crystal clear. It's not just about saving money on fees; it's about gaining efficiency, transparency, and predictability in your financial operations.

| Feature | Traditional Banks | Modern Platforms (e.g., Zaro) |

|---|---|---|

| Exchange Rate | Includes a significant hidden markup | Real-time market rate with zero spread |

| Transfer Speed | 2-5 business days (or more) | Often within 1-2 business days |

| Fee Structure | Complex mix of SWIFT and transfer fees | Simple, transparent transaction fee |

| Compliance | Manual, often paper-based process | Integrated digital document submission |

Ultimately, choosing a modern platform means you're no longer at the mercy of opaque systems. You get to keep more of your own money, save valuable time, and focus on what actually matters—running and growing your business.

Getting to Grips with the Real Cost of International Transfers

When you need to send currency overseas, the first price you see is almost never what you actually pay. The real kicker is the exchange rate markup—a subtle but costly fee that quietly eats away at your profit margins every time you make a payment.

This hidden charge is simply the gap between the live, mid-market exchange rate (what the currency is actually worth) and the less favourable rate your bank or provider offers. A small transfer fee might seem like a bargain, but the markup is where the serious costs lie, especially if your business makes regular or large international payments.

The Two Sides of Transfer Costs

To get control over these costs, you first have to understand them. When you send money abroad through traditional channels, you’re essentially paying for two different things.

- The Advertised Fee: This is the upfront charge, often called a "transfer fee" or "SWIFT fee." It’s what everyone sees, but it’s usually just the tip of the iceberg.

- The Exchange Rate Markup: This is the hidden, percentage-based fee. For example, a bank might buy US dollars at R18.50 but sell them to you at R18.95. That 45-cent difference on every single dollar is their profit, and it adds up incredibly fast on a sizeable invoice.

This problem isn’t just for businesses. South Africa has notoriously high personal remittance fees. Sending money to neighbouring countries like Mozambique and Zimbabwe can cost anywhere from 11.8% to 15.8%, with some banks charging a staggering 22.4%. These figures dwarf the global average of about 6.2%, as highlighted in remittance cost findings from the IMF, showing just how expensive it can be to move money across borders here.

A Real-World Cost Comparison

Let's put this into perspective. Say your business has to pay a US supplier an invoice for $10,000.

You get two quotes on the same day. A major local bank quotes you an exchange rate of R18.95 per dollar, plus a R500 SWIFT fee. At the same time, Zaro offers you the real exchange rate of R18.50 per dollar, with a transparent 0.5% transaction fee.

Here’s how that actually breaks down:

| Cost Factor | Major Local Bank | Zaro Platform |

|---|---|---|

| Exchange Rate | R18.95 per USD | R18.50 per USD |

| Cost to Buy $10,000 | R189,500 | R185,000 |

| Transaction Fee | R500 (SWIFT fee) | R925 (0.5% of R185,000) |

| Total Cost | R190,000 | R185,925 |

On this single transaction, the bank's hidden markup cost your business an extra R4,075. If you're paying several international invoices a month, these hidden fees can easily climb into the tens or even hundreds of thousands of rands lost every year.

This shows why just looking at the flat transfer fee is a mistake. The real damage is done in the exchange rate spread. Choosing a platform that gives you the real market rate delivers immediate, predictable, and significant savings for your business.

Getting Your Business Account Set Up for Overseas Payments

Sending money overseas for your business shouldn't feel like you're stuck in the dark ages of paperwork and long queues. With modern platforms, the whole process is much faster, but there's a trick to making it seamless: get your documents in order before you start. This single step is the biggest time-saver.

This initial setup is really about verifying that your business is legitimate and compliant with South African financial regulations. For a platform like Zaro, this is all done online, but they are thorough to ensure security for everyone involved. Think of it as building a solid foundation of trust right from the get-go.

When you land on the Zaro sign-up page, you'll see it’s designed to be simple and to the point.

The clean layout immediately highlights what most businesses want: better rates and faster transfers. This straightforward approach is a good sign of what's to come.

Getting Your Verification Documents Together

To avoid any frustrating delays, it's best to have all your documents scanned and ready to go. For any South African registered business, this is what you’ll need:

- Company Registration Papers: These are your official CIPC (Companies and Intellectual Property Commission) documents. They're non-negotiable proof that your business is legally registered in SA.

- Proof of Business Address: A recent utility bill or a bank statement works perfectly, as long as it’s less than three months old and clearly shows your company's physical address.

- Director and Shareholder Info: You'll need certified ID copies and recent proof of address for all directors. The same applies to any shareholder who owns 25% or more of the business.

From my experience, the most common reason for a hold-up is a blurry scan or an expired ID. Take a moment to check that every digital copy is clear, current, and legible. It will save you a lot of back-and-forth later.

This entire verification process is about meeting Know Your Business (KYB) requirements. It's a standard and crucial step to prevent money laundering. Honestly, a platform that takes KYB seriously is one you can feel confident trusting with your company's money.

Walking Through the Onboarding Process

Once you have your document folder ready, the actual sign-up is a breeze. You’ll start by creating a profile with your basic company details. The system will then guide you to upload the documents you've just prepared.

After you've submitted everything, the verification team takes over. As long as all your documents are correct, this review is surprisingly quick—often completed within a single business day. You'll get an email as soon as your account is approved and ready for action.

And just like that, you're set to fund your account and make your first international payment.

For companies that deal with specific regions regularly, it's also smart to understand the banking landscape there. For instance, if you have suppliers in Turkey, learning about the process of opening a business bank account in Turkey can make your financial operations even smoother.

Making Your First International Payment: A Walkthrough

Alright, your Zaro account is verified and funded. Now comes the part you’ve been waiting for: paying that first international invoice without the usual headaches. Let's walk through just how simple it is to send currency overseas when you're not wrestling with a clunky old bank portal.

First things first, you need to set up the person or business you're paying—your beneficiary. This is the one step where you want to be extra careful. Get their full business name, address, and banking details spot on. For most overseas payments, that means having their correct IBAN (International Bank Account Number) and the bank’s SWIFT/BIC code. Taking a minute to double-check these details now will save you from a world of frustration and delays down the line.

Adding a Beneficiary and Locking in Your Rate

Once your beneficiary is saved, they’re in the system for good, making future payments a breeze.

Ready to pay? Just select who you’re paying, what currency they need, and how much you're sending. It’s that intuitive.

Let's say you owe a supplier in Germany €5,000. You'll simply pick your ZAR wallet to pay from, choose EUR as the currency you're sending, and pop in the amount. Instantly, the platform shows you the live, mid-market exchange rate and a single, transparent fee. No hidden markups, no nasty surprises. What you see is exactly what you get.

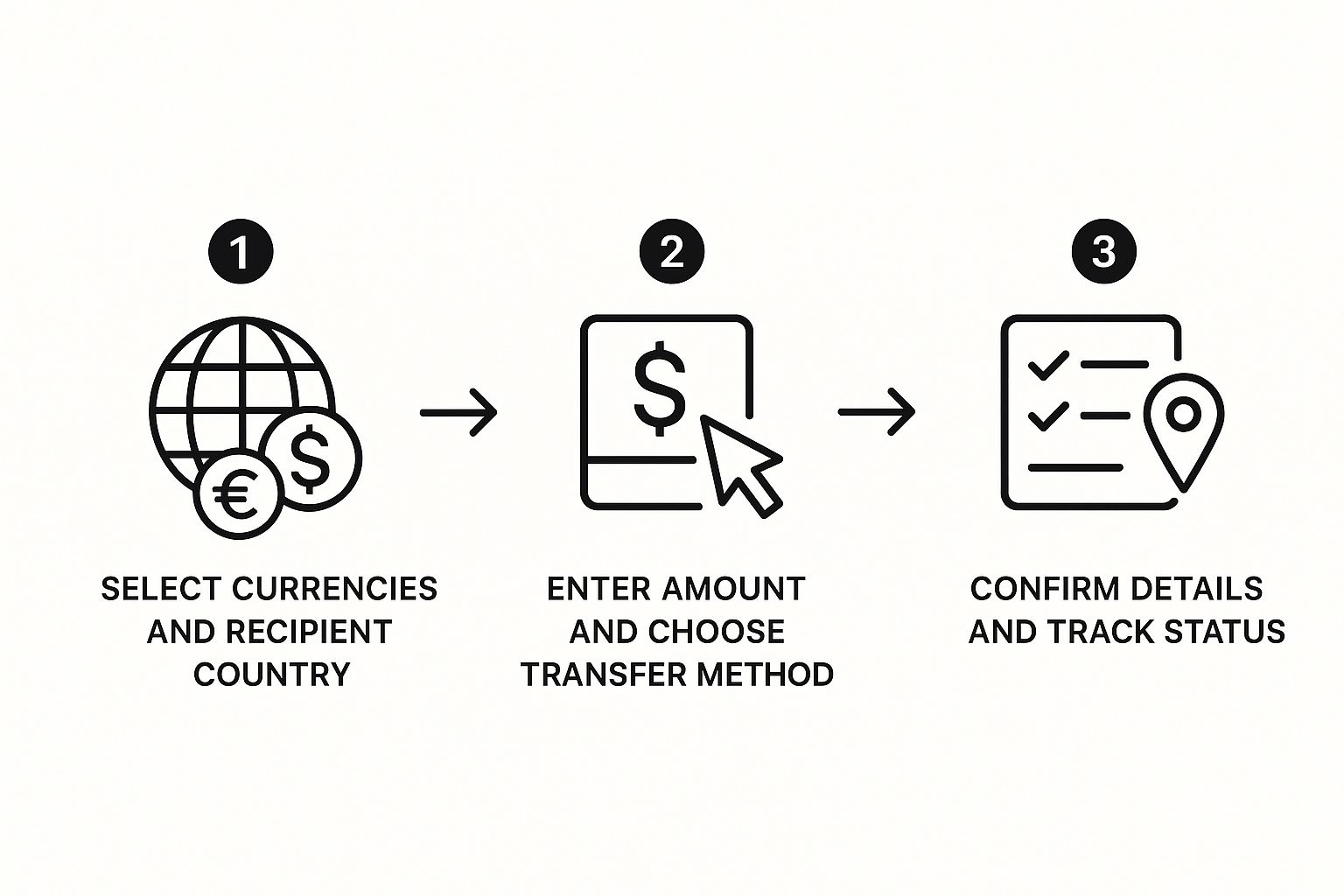

This is the general flow you'll follow.

The best part? Before you hit 'confirm', you get to lock in that live rate. This is a game-changer. It means your business is protected from any sudden currency dips while the payment is in transit. The rate you agree on is the rate you get, ensuring your supplier receives the exact amount they're expecting.

Finalising and Tracking Your Payment

Give everything one last look on the confirmation screen: the amount, the rate, the fee, and your supplier's details. If it all looks good, you authorise the payment. At this point, you’ll be asked to upload the invoice for that payment. This is a crucial step for SARB compliance, and it's all handled neatly right inside the platform.

Once confirmed, your money is officially on its way. But unlike the old days of sending a payment and hoping for the best, you’re not left in the dark. We've all felt that "black box" anxiety with traditional bank transfers, wondering where the money is. Zaro gives you real-time tracking, so both you and your supplier can see exactly when the payment is processed and when it lands. Total peace of mind.

This kind of efficient, transparent system is essential, especially in a country that’s a major hub for funds moving across the continent. Remittance inflows to Africa have seen strong growth, reaching an estimated USD 92.2 billion—that's about 5.2% of the continent's entire GDP. A huge portion of these funds goes towards essentials like education and healthcare, which really underscores why reliable transfer systems matter so much. You can dig deeper into African remittance trends on RemitScope.

Smarter Ways to Manage Your Overseas Payments

It’s easy to see an international payment as just another line item on your to-do list. But I’ve learned that the smartest businesses treat every overseas transfer as a strategic financial decision. When you send currency overseas, you’re doing more than just paying a bill; you’re managing cash flow, navigating risk, and strengthening crucial supplier relationships. This calls for a much more thoughtful approach than simply paying invoices as they land in your inbox.

Shifting your mindset from reactive to proactive can make a world of difference. Instead of being at the mercy of the market, you can start making currency fluctuations work for you. By keeping an eye on exchange rate trends, you can time your larger payments for moments when the rand is stronger. This simple act can stretch your capital further and directly boost your profit margins on imported goods or services. It’s about turning a cost centre into a real strategic advantage.

Automate and Organise Your Workflow

If you’re dealing with regular international suppliers, automation is your best friend. Seriously, it's a massive time-saver. You can set up recurring payments for those fixed monthly invoices—think software subscriptions or consultant retainers—which cuts down on admin and guarantees you never miss a payment. Your suppliers stay happy, and your team can focus on work that actually grows the business.

Beyond just automation, keeping immaculate records is absolutely non-negotiable for any South African business sending money abroad. There are a couple of critical reasons for this:

- SARB Compliance: The South African Reserve Bank demands a clear paper trail for all funds leaving the country. Having clean, organised records makes any potential audit painless and ensures your business stays on the right side of the regulations.

- Financial Reconciliation: Accurate records make your internal accounting a breeze. When your payment platform’s data lines up perfectly with your invoices, your finance team can reconcile accounts in a fraction of the time.

A well-organised international payment system does far more than just move money. It creates a clear, auditable trail that strengthens your financial controls and gives you a real-time view of your global spending. That clarity is the foundation for accurate forecasting and budgeting.

Building a Robust Financial Picture

This level of detail and organisation feeds into a much bigger financial picture for your company. While business payments and personal remittances are different beasts, the flow of money is a vital economic indicator. In 2020, for instance, remittance inflows made up about 0.24% of South Africa’s GDP.

Taking the time for understanding financial analytics can offer incredible insights, helping you connect the dots between your overseas payments and overall business performance. Ultimately, a strategic approach changes your international payment process from a reactive chore into a powerful tool for better financial management and growth.

Common Questions About Sending Money From South Africa

Sending money overseas from South Africa always comes with a few questions, especially when it's your business's cash on the line. The world of international payments has its own language of regulations and processes. Getting your head around the key rules and common worries from the start can make all the difference.

I've chatted with countless business owners who get stressed about compliance, how long transfers take, and the ever-shifting currency markets. These are completely valid concerns, but they’re easily sorted with the right information and a decent platform. Let's break down some of the most common questions I hear from South African businesses.

What SARB Regulations Should My Business Know About?

The South African Reserve Bank (SARB) keeps a close eye on all money leaving the country through a system called exchange control. This isn't designed to make your life difficult; it’s there to make sure every international transfer is legitimate.

For your business, this simply means you need to provide a reason and have the paperwork to back it up for every payment. Usually, this is just the supplier's invoice. Modern platforms like Zaro build this step right into the payment process, prompting you to upload documents as you go. It's also smart to keep track of your business's annual foreign investment and discretionary allowances.

How Long Do International Transfers Usually Take?

Waiting for money to land can be a massive headache. If you've ever sent funds via your bank's SWIFT system, you’ll know that payments can take 2-5 business days—and sometimes even longer if they get stuck with an intermediary bank somewhere.

This is where newer financial technology really makes a difference. These services often use more direct payment routes, cutting out the slow, clunky SWIFT process. With a platform like Zaro, the money often lands in your beneficiary's account within just 1-2 business days. For some major currency routes, payments can even arrive the very same day, which is a game-changer when you have an urgent supplier to pay.

The difference between a five-day and a one-day transfer can be the difference between a smooth supply chain and a costly production halt. Speed and reliability are just as important as cost when choosing a payment partner.

Can I Protect My Business From Currency Fluctuations?

Yes, and you absolutely should. The currency markets can be wild. A sudden dip in the rand's value could mean that $10,000 invoice suddenly costs you thousands more than you budgeted for.

This is why locking in an exchange rate is such a powerful tool. When you set up a transfer on a specialised platform, you can secure the live rate for a set period. It means the rate you see when you click 'confirm' is exactly the rate you get, no matter what the market does while your funds are on their way. This simple feature takes the guesswork out of international payments and protects your profit margins from those unpredictable swings.

Ready to take control of your international payments? Zaro offers South African businesses real exchange rates, transparent fees, and a simple, secure platform to manage it all. Stop losing money on hidden markups and slow transfers.