Sending money across borders can feel like a complete gamble, especially for South African businesses. You’re often quoted a low upfront fee by your bank, only to find the real costs are lurking in the shadows—hidden in poor exchange rates and a string of mysterious bank fees that slowly chip away at your funds. This financial friction isn't just frustrating; it's a direct hit to your company's bottom line.

The Real Price of Traditional International Payments

For finance teams, paying an overseas supplier should be a straightforward part of doing business. But with the old-school banking system, the amount you send rarely matches what your beneficiary receives. This isn't just a rounding error; it’s by design. The entire system is built to be confusing, with costs buried where you won't spot them until the payment is already gone.

Two main culprits are responsible for this financial drain: inflated exchange rate spreads and correspondent bank fees. Let's pull back the curtain on how they really work.

Cracking the Code on Exchange Rate Spreads

When you Google an exchange rate, you’re looking at the mid-market rate. This is the genuine, wholesale rate banks use to trade currencies among themselves. It's the truest measure of a currency's value at any given moment.

But that's not the rate your bank gives you.

Instead, they add a markup—a "spread"—on top of it. It’s their profit margin for converting your Rands into Dollars, Euros, or whatever currency you need. A few percentage points might not sound like much, but on a large supplier payment, that small margin quickly balloons into a significant, unnecessary cost.

The Problem with Intermediary Bank Fees

Traditional international transfers are powered by the SWIFT network. Think of it as a series of connecting flights for your money. Instead of a direct route from your bank in Johannesburg to your supplier’s bank in Berlin, your funds might hop between one, two, or even three intermediary (or correspondent) banks to get there.

Here's the Catch: Each bank in that SWIFT chain takes its own processing fee right out of the money you're sending. This is precisely why your recipient often gets less than you sent—a scenario that can cause major headaches when you need to settle an exact invoice amount.

The worst part? These fees are almost always unpredictable and aren't disclosed upfront, making it impossible to budget with any real accuracy.

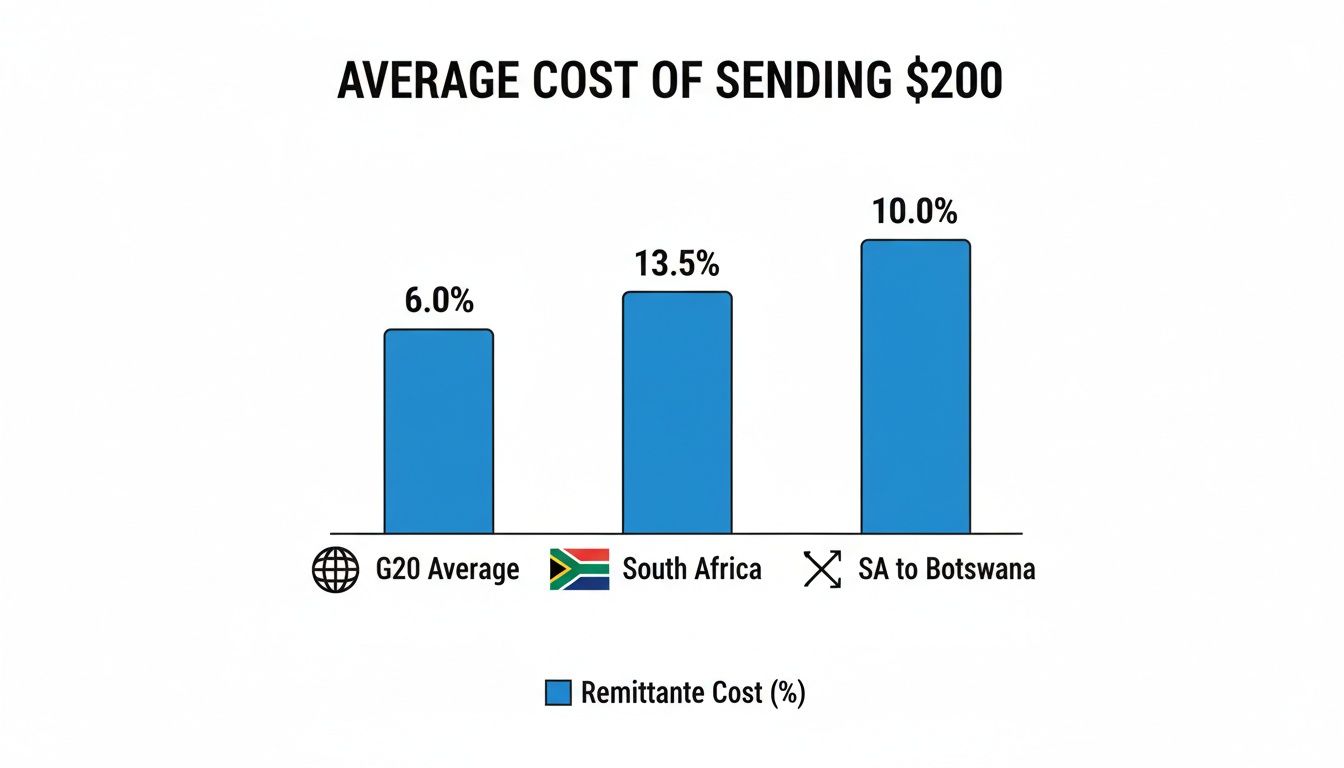

This chart shows just how badly South Africa compares to global averages when it comes to transfer costs.

The data speaks for itself. Sending money from South Africa, particularly to our neighbours, is far more expensive than the G20 average. It’s a massive challenge for local businesses trying to compete on a global stage.

In the first quarter of 2024, the average cost to send just $200 from South Africa was around 13.2 percent, which is more than double the G20 average of 6.39 percent. For payments to regional partners like Botswana, that cost skyrockets to an eye-watering 17.6 percent. You can dig into the numbers yourself in the full report on South African remittance costs on Statista.

A Side-by-Side Look: How Costs Add Up

To make this crystal clear, let's compare sending R100,000 to a supplier in the US.

Traditional Bank vs Zaro: A Cost Comparison for a R100,000 Transfer

This table illustrates the typical costs associated with sending R100,000 internationally through a traditional South African bank versus the Zaro platform, highlighting the impact of exchange rate spreads and hidden fees.

| Cost Component | Traditional Bank | Zaro |

|---|---|---|

| Transfer Fee (SWIFT) | R250 - R750 (variable) | R0 |

| Exchange Rate Spread | 1.5% - 3.5% (R1,500 - R3,500) | 0% (Mid-market rate) |

| Intermediary Bank Fees | R150 - R500 (unpredictable) | R0 |

| Platform Fee | R0 | 0.5% (R500) |

| Total Estimated Cost | R1,900 - R4,750+ | R500 |

The difference is stark. With a traditional bank, you're losing thousands of Rands to opaque markups and fees you can't even predict.

This is exactly the problem platforms like Zaro were built to solve. By giving you direct access to the real mid-market exchange rate with zero spread and completely sidestepping the SWIFT network, Zaro brings much-needed transparency and predictability back to your cross-border payments. It’s a direct model that ensures the amount you send is the amount that arrives—protecting your profits and your crucial supplier relationships.

Navigating Your First International Transfer

Before you even think about hitting ‘send’ on your first international payment, let’s talk about preparation. Getting this part right is the secret to avoiding those soul-destroying delays and compliance nightmares that can plague cross-border transactions.

Think of it like building a house—you can't start laying bricks without a solid foundation. The same goes for sending money overseas. A successful transfer is always built on accurate information and the right paperwork.

Gathering Essential Beneficiary Details

First things first: you need to get the beneficiary’s details absolutely perfect. I can’t stress this enough. Inaccurate or incomplete information is the number one reason international payments fail or get stuck in limbo for weeks. A single typo in an account number can send your funds on a wild goose chase through the global banking system.

To avoid this headache, you must have the following confirmed in writing from your recipient:

- Beneficiary's Full Name and Address: This has to match the name on their bank account to the letter. No nicknames or abbreviations, or the payment will bounce right back.

- Bank Name and Address: The full, official name of the recipient's bank and the specific branch address.

- Account Number or IBAN: For payments going to Europe and many other regions, the International Bank Account Number (IBAN) is the standard. For other countries, you'll need the local account number in its specific format.

- SWIFT/BIC Code: This is the bank branch's unique global address, a bit like a postal code for the financial world. It ensures your money gets routed to the correct institution.

Pro tip: Always double-check these details with your supplier or contractor before you start the payment process. A quick confirmation email can save you days of administrative pain and potential recall fees down the line. It's a non-negotiable step.

The Importance of Supporting Documents

For any business operating in South Africa, every single international payment needs to be justified with supporting documentation. This isn't just a "nice-to-have" for your records; it's a strict regulatory requirement from the South African Reserve Bank (SARB).

The exact documents you’ll need depend on what you're paying for. Paying an overseas supplier for a shipment of goods requires a different set of papers than paying for a monthly software subscription.

Common Scenarios and Required Documents:

| Payment Purpose | Required Documentation | Key Tip |

|---|---|---|

| Imported Goods | Pro-forma or final commercial invoice, Bill of Lading (if applicable). | The invoice must clearly list the goods, quantities, and total cost. |

| Software/Services | A valid service agreement or contract, a detailed invoice. | Make sure the invoice specifies the service provided and the payment period. |

| Royalties/Licensing | Licensing agreement, an invoice from the rights holder. | The agreement's royalty percentage or fee structure needs to be stated clearly. |

Having these documents organised and ready to go makes the entire process smoother, whether you're dealing with a traditional bank or a modern fintech platform.

Demystifying BOP Codes and KYB

Two other crucial elements you'll encounter in South Africa are Balance of Payment (BOP) codes and the Know Your Business (KYB) process. BOP codes are mandatory for SARB reporting—they’re simple numerical codes that classify the reason for your payment. For example, '101' is for imported goods. Using the correct code is essential for compliance.

The Know Your Business (KYB) process is how financial institutions verify your company's identity to prevent fraud and money laundering. It’s a foundational step for any platform you use to send money internationally.

Historically, KYB has been a slog. It meant mountains of paperwork and weeks of waiting for a bank to finally approve your business account. You’d have to submit certified copies of company registration documents, director IDs, proof of address—the list goes on.

This is exactly where modern platforms like Zaro completely change the game. Instead of that cumbersome, paper-based ordeal, Zaro offers a fully digital onboarding system. You can securely upload your documents and get verified in a fraction of the time, often within just a day or two. This speed is a massive operational advantage, getting you set up and transacting far faster than with legacy banks. It simply removes the friction so you can get back to what matters: running your business.

Choosing the Right Way to Pay Internationally

When you need to send money across borders, the method you choose has a huge impact on your bottom line. It’s not just about getting funds from A to B; it’s about how quickly, how cheaply, and how transparently that happens. For South African businesses, the choice usually comes down to two very different paths: the traditional bank wire or a modern fintech platform.

Making the right call here can genuinely save you thousands of Rands on a single transaction. Let’s get into what really matters when you’re weighing up your options.

The Old Guard: Bank Wires and the SWIFT Network

For decades, the only game in town for international payments was a bank wire transfer, which runs on the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network. You can think of SWIFT as a global messaging system for banks, letting them send payment instructions to each other.

It was a solid system for its time, but for today's businesses needing speed and certainty, it has some serious drawbacks.

- Painfully Slow: A SWIFT payment almost never goes straight from your bank to the recipient's. It usually hops between one and three "intermediary" banks along the way. Each stop adds another layer of processing, meaning a payment can take anywhere from 3 to 7 business days to land.

- Costs You Can't Predict: This "connecting flight" model for your money gets expensive. Each intermediary bank in the chain takes a slice for its troubles, deducting a fee directly from the amount you sent. This is exactly why your supplier often receives less than you intended, creating a nightmare of short-payments and reconciliation headaches.

- Murky Exchange Rates: As we’ve mentioned, banks don't offer the real mid-market exchange rate. They build in a significant markup, or "spread," which is basically a hidden fee that bloats the total cost of your payment.

This combination of slow settlement and hidden costs makes SWIFT a frustratingly inefficient way to manage your international payables.

The Modern Alternative: Direct Payment Rails

This is where fintech platforms like Zaro come in. They were built from the ground up to fix the problems baked into the SWIFT system. Instead of a long, clunky chain of banks, these platforms use direct payment rails and local banking networks to move money far more efficiently.

For a South African SME, this approach changes everything.

By completely sidestepping the SWIFT network, modern payment platforms get rid of those unpredictable intermediary bank fees that eat into your transfers. It means the full amount you send is exactly what your beneficiary receives. Every single time.

Let's say you're paying a supplier in Europe. A fintech platform will convert your Rands to Euros at the real mid-market rate, then pay the supplier from a local European account. The whole process is faster, cheaper, and infinitely more transparent.

A Head-to-Head Comparison

Let's put the two methods side-by-side to see how they stack up on the things your finance team actually cares about.

| Feature | Traditional Bank (SWIFT) | Modern Fintech (e.g., Zaro) |

|---|---|---|

| Speed | 3-7 business days | Same day to 2 business days |

| Exchange Rate | Marked-up rate (hidden spread) | Real mid-market exchange rate |

| Fees | High transfer fees + hidden intermediary fees | Low, transparent platform fee |

| Transparency | Low - final cost is often a nasty surprise | High - you see the full cost upfront |

| Recipient Amount | Unpredictable; often less than sent | Predictable; recipient gets the full amount |

The difference is stark. While banks feel familiar, their underlying model is outdated and costly. For any business that values efficiency and tight cost control, the fintech route delivers far more value.

Ultimately, deciding how you send money internationally is a strategic move. When you choose a platform that gives you the real exchange rate and avoids the slow, expensive SWIFT network, you’re not just saving on fees. You’re building predictability into your cash flow, strengthening supplier relationships with on-time payments, and freeing up your finance team from chasing down lost funds. It's about finally taking control of a critical business process that has been needlessly complicated for far too long.

Executing Transfers and Managing Foreign Exchange Risk

Once your paperwork is in order and you've picked a payment provider, it’s time to actually send the money. But this isn't just about clicking a button. This is where smart financial strategy comes in, turning a routine transaction into a chance to shield your business from the wild swings of the currency market. For any South African business trading internationally, getting a handle on foreign exchange (FX) risk is non-negotiable.

Simply relying on your bank's schedule means you’re stuck with whatever exchange rate they offer on the day you have to pay. It’s a purely reactive approach, and it can cost you dearly if the Rand takes a sudden dip against the Dollar or Euro just as a big invoice comes due.

Taking Control with Multi-Currency Accounts

There’s a much better way to operate: using multi-currency accounts. This simple change allows your business to hold funds in ZAR alongside other currencies like USD or EUR. Instead of being forced to convert Rands at a terrible rate to pay a dollar-denominated invoice, you can finally be strategic.

Picture this: you receive a payment from a client in the US. With a platform like Zaro, those funds land directly in your dedicated USD account. Suddenly, you have a massive advantage. You can hold onto those dollars and wait for a day when the ZAR/USD exchange rate is more favourable before bringing the money home to Rands.

This isn't just a defensive tactic; it’s about actively managing your cash and protecting your profit margins from being wiped out by currency volatility. You’re no longer a spectator but an active manager of your company's foreign currency.

Holding foreign currency allows you to decouple the timing of your payment from the timing of your currency conversion. This single shift gives you immense control over your costs and financial predictability.

Funding these accounts is refreshingly simple. To top up your Rand balance, you just make a standard local bank transfer into your Zaro ZAR account. The same goes for foreign currency—you can receive international payments directly into your USD account without any forced, immediate conversion.

The Practical Steps of Smart Execution

With your accounts funded, making a payment becomes a clear, straightforward process. You can forget about battling hidden fees or opaque exchange rates. The name of the game is precision and efficiency.

Here’s what the workflow typically looks like on a modern platform:

- Fund your account: You can either send a local EFT to your ZAR account or have an international client pay directly into your foreign currency account. The funds reflect quickly, sidestepping the usual SWIFT network delays.

- Choose your moment: You decide when to convert your money. With access to the real-time, mid-market exchange rate, you can pull the trigger when the numbers are working for you, not against you.

- Make the payment: Simply enter your supplier’s details, attach the invoice, and confirm the transfer. The platform handles all the tricky regulatory reporting in the background, including assigning the correct BOP code.

This process completely removes the guesswork. You see the exact rate and the low, transparent fee upfront. The amount you send is the amount that arrives—a small detail that goes a long way in keeping your international suppliers and contractors happy.

Of course, the mechanics of sending money are only part of the puzzle. It’s also vital to understand how these transactions fit into your company's bigger financial picture. If you're looking for more on this, you can learn how to improve cash flow in your small business.

Ultimately, mastering this stage means you stop reacting to the market and start engaging with it on your own terms. By using multi-currency accounts and real-time exchange rates, you can defend your business from FX risk and turn what was once a costly headache into a smooth, predictable part of your global operations. That kind of control is essential for any South African business serious about succeeding on the world stage.

Mastering Post-Transfer Compliance and Reconciliation

So, you’ve clicked "send" on that international payment. It feels like the finish line, but the race isn’t quite over. For any South African business, what comes after the money leaves your account is just as crucial as sending it in the first place. This is where smart compliance and reconciliation come in, ensuring your books are clean, your auditors are happy, and you’re meeting all your regulatory duties.

Too many finance teams get bogged down here, stuck in a reactive loop of manual clean-up. The goal is to shift gears—moving from tedious paperwork to a proactive, automated system that builds a clear, defensible audit trail for every single cross-border transaction.

Staying on the Right Side of SARB

Every international payment a South African business makes is under the watchful eye of the South African Reserve Bank (SARB). Proper reporting isn't just good practice; it's a legal must. A huge piece of this puzzle is correctly applying Balance of Payment (BOP) codes to each transaction.

These codes are simply a way to categorise the reason for the payment—was it for imported goods, a software licence, or paying a foreign consultant? Getting the BOP code right is vital for national reporting and keeps your business compliant. A simple mistake here can flag your account, leading to compliance queries and frustrating delays on future payments. It's also worth noting that in specific situations, like managing the aftermath of international asset sales, you need to understand distinct rules such as the Foreign Resident Capital Gains Withholding to ensure full compliance.

The stakes are high. South Africa's remittance market is a major economic force, valued at roughly USD 330 million in 2024. With digital payments making up about 64 percent of this, the demand for robust, compliant solutions for businesses has never been greater.

The Power of Automated Reconciliation

Let’s be honest, the old way of reconciling international payments is a nightmare. It usually involves a finance team member painstakingly combing through bank statements, trying to match payments to invoices while wrestling with confusing bank fees and ever-changing exchange rates. It's slow, tedious, and a breeding ground for human error.

This is where modern payment platforms like Zaro completely change the game. Instead of a messy paper trail and endless spreadsheets, you get one central, digital dashboard that logs a detailed history of every single transaction.

The real breakthrough is automation. A platform that gives you detailed, downloadable statements and syncs with your accounting software can shrink your reconciliation time from hours down to just a few minutes.

This automated approach delivers some serious wins for your finance team:

- Drastically Reduces Human Error: Automation gets rid of the typos and miscalculations that are almost inevitable with manual reconciliation.

- Frees Up Your Team: Instead of drowning in admin, your team can focus on strategic financial analysis that actually adds value.

- Creates a Perfect Audit Trail: Every payment is automatically logged with its invoice, BOP code, and the exact exchange rate, giving you an airtight record for any audit.

Building a Bulletproof Audit Trail

A strong audit trail is your company's best defence in any financial review. It provides clear, undeniable proof of what was paid, who it went to, when it was sent, and why. A modern payment platform builds this for you automatically, without you even thinking about it.

For every single international transfer, your system should instantly capture and link:

- Payment Confirmation: A digital receipt showing the precise amount sent in both ZAR and the foreign currency.

- Beneficiary Details: The recipient's full name, address, and bank information.

- Supporting Documents: The actual invoice or contract tied directly to the payment record.

- BOP Code: The specific SARB code used for that payment is logged right there.

With a platform like Zaro, this information is all kept in one organised place. No more frantic searches through old emails or shared drives for a missing invoice when the auditors come knocking. This level of organisation doesn’t just make audits a breeze; it gives you total financial visibility and control, solidifying your operational integrity as you grow globally.

The Future of African Cross-Border Payments

Anyone with their finger on the pulse of African business can feel it: the ground is shifting beneath our feet. We're in the middle of a massive change in how money moves across the continent, driven by a surge in intra-African trade and the incredible pace of digital finance adoption. This isn't just a minor update; it's a complete economic realignment.

We're seeing major initiatives like the Pan-African Payment and Settlement System (PAPSS) gain real traction. The whole point is to create a more unified market, cutting down our reliance on hard currencies like the dollar and slashing those painfully long settlement times. For South African SMEs, this means having a fast, affordable way to send money internationally is no longer a nice-to-have. It’s a core part of staying competitive. The old ways just don't cut it anymore.

The numbers tell a powerful story, too. Remittance inflows into Africa have soared past the USD 100 billion mark in 2024. That’s more than foreign direct investment and official aid combined. What's really interesting is that a fifth of that money is moving within Africa, a clear sign of strengthening economic ties between nations. The scale of this is staggering, as detailed in this analysis of the overlooked billions sustaining African households.

This is about more than just shaving a few points off your transfer fees. It’s about setting up your business to win in a more connected, digital-first Africa where being fast and efficient is everything.

This is exactly where modern, transparent platforms like Zaro come in. They help you sidestep the friction and high costs of traditional banking, giving you the confidence to dive into this new, interconnected marketplace.

Got Questions? We’ve Got Answers.

When it comes to sending money across borders, a few questions always pop up. Here are some straightforward answers to what we hear most often from South African businesses trying to navigate international payments.

What Paperwork Do I Really Need for Every Transfer?

Let's be clear: every single time your South African business sends money internationally, you have to provide supporting documents. This isn't a recommendation; it's a hard rule from the South African Reserve Bank (SARB), and there are no shortcuts.

What you'll need depends on why you're paying, but at a bare minimum, have these on hand:

- A valid invoice from your supplier. This is the most common requirement.

- A contract or service agreement, especially if you're paying for something like a recurring software subscription.

Getting this sorted out before you initiate a payment will save you from frustrating compliance delays. The best platforms let you upload these documents right alongside your payment instructions, keeping your audit trail clean and simple.

How Can I Stop Losing Money on Bad Exchange Rates?

The biggest mistake businesses make is simply accepting whatever exchange rate their bank offers. Those rates always include a hidden markup that eats directly into your profits. The key is to find a provider that gives you access to the real mid-market exchange rate – the one you see on Google or Reuters.

A multi-currency account is a game-changer here. It lets you receive and hold foreign currency (like USD or EUR) without immediately converting it. This gives you the flexibility to exchange it for Rands only when the rate is in your favour, shielding your business from sudden market dips.

This small shift in strategy puts you in control, rather than leaving your bottom line at the mercy of the bank's daily rate.

Seriously, How Long Does an International Transfer Take?

The timeline really depends on the rails your money travels on. If you're using a traditional bank wire, you're likely using the SWIFT network. Think of it as a flight with multiple layovers; the money has to pass through several intermediary banks, which is why it can take a frustrating 3 to 7 business days to land.

On the other hand, modern fintech platforms have built more direct routes. By cutting out the middlemen, they can get your payment to its destination much faster. In many cases, the funds will arrive within the same day or, at most, within 2 business days. That kind of speed and predictability makes a huge difference in keeping your international suppliers happy.

Ready to take control of your cross-border payments? With Zaro, you get access to real exchange rates, eliminate hidden fees, and execute transfers in minutes, not days. See how much you can save by visiting the Zaro website.