For many South African businesses, sending money overseas feels like a necessary evil. It's a routine part of operations, but the costs can be surprisingly high and frustratingly unpredictable. The old-school banks have a knack for obscuring the true expense of these transactions, burying fees in poor exchange rates and a maze of charges that nibble away at your profit margins.

The Hidden Costs of Sending Money Overseas

Ever paid an international supplier and later discovered they received less than you sent? You're not alone. It’s a common story. A web of hidden fees and inflated exchange rates quietly siphons value from your transfer, turning what should be a straightforward payment into a costly headache. The first step to plugging these leaks is understanding exactly where your money is going.

The biggest culprit is the exchange rate spread. You won’t find this listed as a 'fee' on any statement. It’s the gap between the real, mid-market exchange rate (the one you see on Google) and the less favourable rate your bank gives you. That difference, or margin, is pure profit for the bank, paid for directly by your business.

It's More Than Just the Rate

But the spread is just the beginning. The costs keep piling on from there.

- SWIFT Fees: Banks charge you for using the global SWIFT network, which is the messaging system they use to route your payment internationally.

- Correspondent Bank Fees: Your money often doesn't go directly from your bank to your supplier's. It can pass through one or more intermediary (or 'correspondent') banks along the way, and each one takes a slice for their trouble. These charges often pop up unexpectedly.

- Receiving Fees: To add insult to injury, the recipient's bank might also charge a fee just for processing the incoming international payment.

These "small" charges add up fast. Suddenly, the amount you sent isn't the amount that lands, leading to short payments, awkward conversations with suppliers, and a nightmare for your accounts team during reconciliation.

Think about it this way: a R100,000 payment to a supplier in Germany could easily lose R2,000 to a poor exchange rate and another R800 in combined SWIFT and intermediary fees. That's a 2.8% loss before the money even gets there.

Let's look at a side-by-side comparison. The difference between using a traditional bank and a modern fintech solution for the same transfer can be quite stark.

Traditional Bank Fees vs Fintech Solutions for a R100,000 Transfer

| Cost Component | Typical Bank Transfer | Fintech Platform |

|---|---|---|

| Exchange Rate Spread | 1.5% - 3% (R1,500 - R3,000) | 0.2% - 0.5% (R200 - R500) |

| SWIFT/Admin Fee | R500 - R850 | R0 - R250 (often fixed) |

| Intermediary Bank Fees | R200 - R600 (often unknown) | R0 (uses direct payment rails) |

| Total Estimated Cost | R2,200 - R4,450 | R200 - R750 |

The table makes it clear: the seemingly small percentages and flat fees charged by banks accumulate into significant costs, whereas newer platforms build their model on transparency and efficiency, saving you real money.

The Pain is Even Greater Closer to Home

If you think global transfers are expensive, try sending money within the Southern African Development Community (SADC). For South African businesses, these regional payment corridors can be shockingly costly.

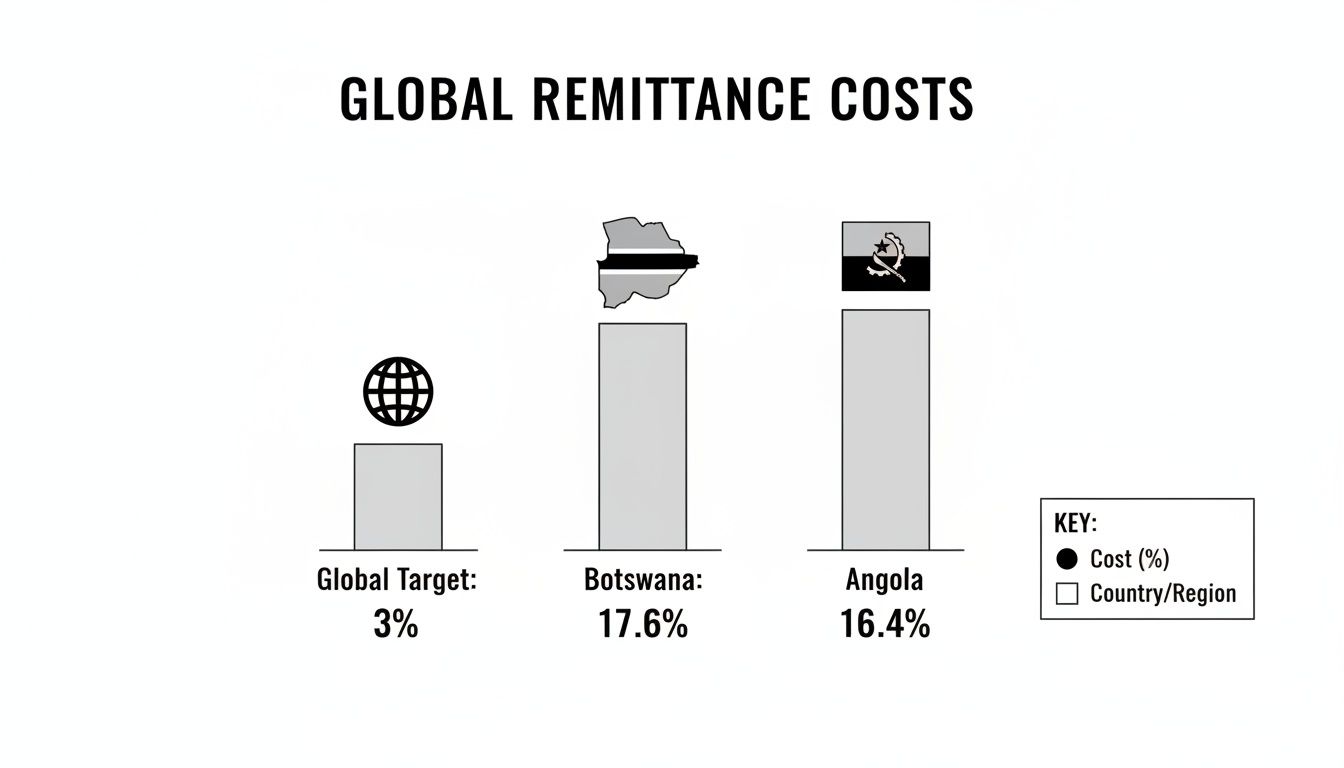

This chart isn't just data; it tells a story of lost opportunity. The cost to send money to key trading partners remains stubbornly high. A transfer to Botswana can cost up to 17.6% and one to Angola can hit 16.4%. These figures are a world away from the global Sustainable Development Goal target of 3%.

You can dig into the full research about these cross-border payment challenges for a deeper look, but the bottom line is simple: these exorbitant fees are a direct drag on regional trade and a real barrier to growth for businesses trying to operate across SADC.

Getting Through the Compliance Gate

Before you even start comparing exchange rates or transfer times, there’s a critical first step you can't skip: compliance. In South Africa, sending money across borders is a tightly regulated affair, and for good reason. It’s all about security and preventing financial crime.

This mandatory verification process is known as Know Your Business (KYB) or Know Your Customer (KYC). Don't see it as just another bureaucratic hurdle. The South African Reserve Bank (SARB) requires these checks to stop things like money laundering, and every legitimate payment provider is legally bound to follow these rules. They have to confirm your business is exactly who it says it is before they can move your money.

Getting this part right from the get-go saves you from maddening delays that could strain supplier relationships and throw a spanner in your operations.

Your Essential Document Checklist

The best way to sail through the onboarding process with any payment provider is to have your paperwork organised and ready to go. Think of it as getting your business’s passport ready for international trade. While the specifics can differ slightly from one provider to the next, the core documents are almost always the same.

Generally, you’ll need to have digital copies of these on hand:

- Company Registration Papers: Your official CIPC (Companies and Intellectual Property Commission) documents are the number one proof that your business is a legal entity.

- Proof of Business Address: A recent utility bill (less than three months old) or a bank statement that clearly shows your company’s physical address will do the trick.

- Director and Shareholder IDs: You'll need a clear copy of the South African ID book/card (or a passport for foreign nationals) for every director and significant shareholder—that usually means anyone who owns 25% or more of the business.

- Proof of Address for Directors: Each of those directors and key shareholders will also need to provide a recent utility bill or another official document to confirm where they live.

Expert Tip: A classic hold-up is when the details you provide for directors don't match what’s on record at the CIPC. Before you even start the application, double-check that all your company information is current with the CIPC. It’ll help you avoid an immediate red flag that can stop your application in its tracks.

Why This Diligence Really Matters

This verification process is about more than just satisfying the SARB. It’s a foundational security step that protects the entire financial system—your business included. A proper KYB process ensures the platform you're using maintains a secure network, which cuts down the risk of fraud for everyone involved.

On top of that, keeping payment data secure is non-negotiable, particularly if you're handling card payments. For a deeper dive into protecting cardholder information, it’s worth looking at a comprehensive PCI compliance guide.

By getting your documents in order ahead of time and understanding why these checks are in place, you can turn compliance from a potential roadblock into a quick, one-time setup. A little preparation here means you’ll be ready to make fast and affordable international payments without any last-minute panic for paperwork.

Choosing Your Funding and Payment Strategy

Alright, once your business is verified, we get to the heart of the matter: how are you actually going to fund these overseas payments? This is a bigger decision than it sounds. Are you paying suppliers straight from your ZAR account each time, or does it make more sense to hold a balance in a foreign currency like US dollars?

There's no single right answer here. The best strategy really hinges on your specific business model and how often you're sending money abroad. Think of this less as an admin task and more as a strategic move that can seriously affect your cash flow and how much risk you're exposed to.

Paying Direct from Your ZAR Account

For many businesses, especially those making one-off or infrequent international payments, paying directly from a ZAR account is the most straightforward route. It just makes sense.

Let's say you run a local boutique and you've found a fantastic supplier of unique textiles in Turkey. You only plan on importing one big shipment a year. In this case, setting up a whole foreign currency system is overkill. You simply convert the Rands you need into Turkish Lira for that single payment and you’re done. The trick is to find a provider who gives you a great ZAR-to-Lira rate right when you need it, keeping the cost of that one transfer as low as possible.

Holding Foreign Currency to Manage Volatility

Now, let's flip the script. If your business has regular, predictable overseas expenses, holding a foreign currency balance can be a game-changer.

Imagine you’re a South African tech company paying $5,000 every month for a critical piece of software from the US. Anyone who follows the markets knows the ZAR/USD exchange rate can be a rollercoaster. If you pay from your ZAR account each month, your Rand costs are going to be all over the place. One month that invoice costs you R92,000, and the next it’s suddenly R95,000—all because of market swings completely outside of your control. That makes budgeting a real headache.

A much smarter play is to open a USD wallet. This lets you buy dollars when the exchange rate looks good and keep them on hand. When the invoice arrives, you pay directly from your USD balance, completely sidestepping whatever the currency market is doing that day.

This simple shift turns a volatile cost into a predictable, fixed expense. It brings stability to your finances and puts you back in the driver's seat.

This strategy is particularly powerful for:

- Importers who need to pay regular supplier invoices.

- Exporters who get paid in USD and can use that same balance to pay their own international service providers.

- Tech Companies with recurring software-as-a-service (SaaS) subscriptions.

Modern fintech platforms have made this incredibly easy by offering multi-currency accounts. An exporter, for instance, can receive USD from a client in America and then pay a supplier in Europe in EUR, all from the same platform. This avoids the painful—and expensive—double conversion of USD to ZAR and then ZAR back out to EUR. It’s a clean, efficient process that saves a ton of time and money.

Executing Transfers with Control and Visibility

So, you’ve got your compliance documents lined up and your funding sorted. Now for the main event: actually sending the money.

This used to be the part where you’d cross your fingers and hope for the best. You'd send a payment into the ether and wait, sometimes for days, for a confirmation that never came. Thankfully, those days are over. Modern platforms give you the kind of control and transparency that turns a nerve-wracking process into a predictable one.

It all starts simply enough. You’ll add your international supplier as a beneficiary, punch in their banking details, and choose which of your currency wallets (ZAR or USD) to pay from. But behind this simple interface are some powerful, enterprise-level controls that put you firmly in the driver's seat.

Building a Secure Payment Workflow

Let's be realistic—as your business grows, you can't have a single person handling every international payment. It's not just inefficient; it's a huge security risk. This is where getting your internal payment workflow right becomes non-negotiable.

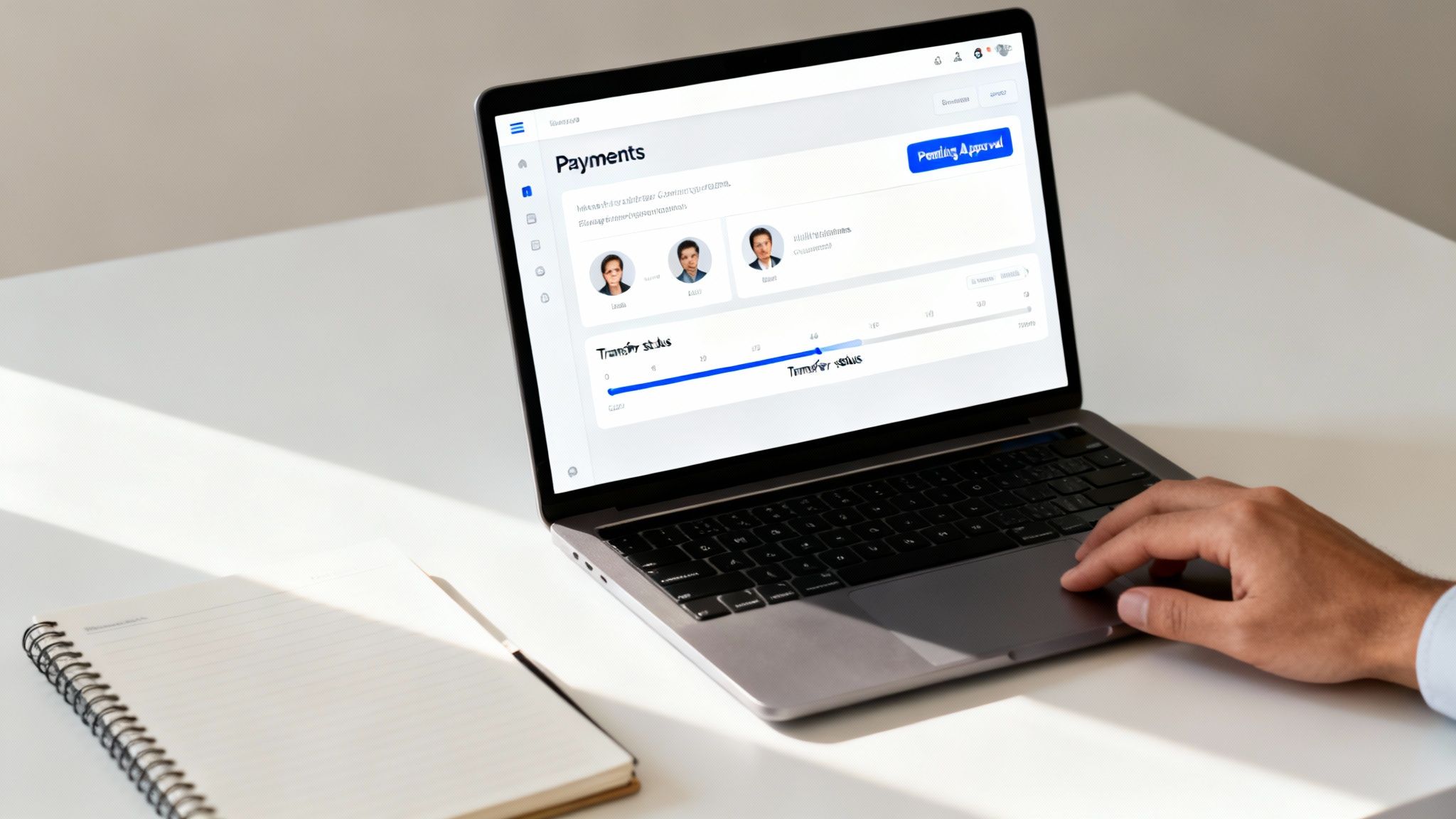

A good system lets you set up custom roles and permissions for your team. Imagine this scenario: a junior finance person prepares the payment by uploading the invoice and beneficiary details. But they don't have the authority to actually send the money. Instead, the transaction is flagged as 'pending'.

It then waits for a senior manager or your CFO to log in, review the details, and give the final authorisation. This separation of duties is a classic financial control used by large corporations, and it's now accessible to any growing business. It’s a simple but incredibly effective way to prevent costly errors or unauthorised payments.

This isn't just a nice-to-have feature. It’s a fundamental change in how you manage risk. You’re swapping manual checklists and verbal approvals for a secure, digital audit trail that gives you total confidence in every rand that leaves your accounts.

Gaining Full Transparency from Start to Finish

One of the biggest headaches with old-school bank transfers was the complete lack of visibility. Once you authorised the payment, the money disappeared into the SWIFT network for what felt like an eternity.

Today’s platforms have completely solved this. You get real-time tracking and instant notifications at every stage.

You’ll see when your payment is processed, when it clears, and exactly when it lands in your beneficiary’s account. This transparency is more than just reassuring; it allows you to keep your suppliers in the loop, which goes a long way in building trust and strengthening those critical relationships.

This kind of operational upgrade is a major reason why the South African cross-border transfer market is now valued at around USD 330 million. Business remittances for settling international invoices are a massive slice of that pie. For a deeper dive, check out this report on South Africa's cross-border transfer market.

Ultimately, executing the transfer is about much more than just clicking 'send'. It’s about having a system that gives you control, visibility, and security from start to finish. It turns what was once a high-risk, high-anxiety task into just another streamlined business operation.

Getting Your Ducks in a Row: Reconciliation and Reporting

You’ve sent the money, so the job’s done, right? Not quite. For any business that takes its finances seriously, what happens after the payment leaves your account is just as important. This is where many companies stumble, creating a messy administrative puzzle that can drag on for weeks.

Think about the old way of doing things: painstakingly matching each line item on your bank statement to a specific supplier invoice. It's a tedious, manual slog, and it's ripe for human error.

Modern payment platforms have completely changed this game. Instead of a chore, reconciliation becomes a simple, almost automated task. These systems generate detailed transaction reports you can import straight into your accounting software. Suddenly, a full day's worth of admin is done in minutes, letting your finance team focus on work that actually grows the business.

Keeping the Taxman Happy: Your Audit Trail

Good reconciliation isn't just about saving time; it’s about building a solid financial record that will stand up to scrutiny. Every international payment has tax and compliance implications, and you can be sure the South African Revenue Service (SARS) will want to see a clear, logical audit trail if they come knocking.

Your records need to be watertight. For every single payment, make sure you have:

- The proof of payment or transaction confirmation from your provider.

- The original supplier invoice that the payment relates to.

- A record of the exact exchange rate you secured for the transaction.

Think of a clean audit trail as your best defence in a SARS review. When your payment platform bundles all this data into one easy-to-download report, you're not just reconciling faster—you're building an audit-proof financial history with every transfer.

To take this a step further and really nail down your financial record-keeping for international payments, have a look at dedicated receipt management tools.

Why This Matters for South African Businesses

Efficiently managing these outbound payments is particularly crucial in the South African context. Remittance inflows—money coming into the country—are a tiny fraction of our GDP, just 0.24174%. This tells us that far more money is flowing out to international suppliers than is coming in.

This imbalance puts constant pressure on local businesses. Every payment for imported goods or services is a drain on our local reserves. You can discover more insights about South Africa's remittance landscape on Trading Economics.

By mastering this final step, you’re doing more than just improving your own efficiency. You’re turning a complex administrative headache into a smooth, controlled part of your operations, building a more resilient and financially robust business that’s ready to compete on the global stage.

Turning International Payments Into Your Competitive Edge

Sending money overseas shouldn't just be another line item on your expense report. For savvy South African businesses, it's a genuine opportunity to gain a competitive advantage. It's time to move beyond the slow, expensive, and often opaque world of traditional banking. By adopting modern fintech solutions, you can transform this everyday task into a strategic asset for your company.

Throughout this guide, we've broken down the practical steps you need to take full control of your global payments. You now have the knowledge to see past the headline exchange rates to the real costs, prepare the necessary compliance documents without fuss, and use the right tools to manage every transaction from start to finish. The key is a shift in thinking: international payments aren't just a cost to be cut, but a process to be perfected.

The core message is this: when you actively manage your international payments, you're not just saving a few Rands. You're directly cutting overheads, creating predictable cash flow, and building a far more resilient financial foundation for your business's global ambitions.

Building a Stronger Financial Core

Getting this right isn't just about efficiency; it strengthens your entire business from the inside out.

- Better Supplier Relationships: Nothing builds trust like fast, reliable payments where the full amount arrives as expected. This can even open the door to negotiating better terms down the line.

- Reduced Financial Risk: Having the ability to hold foreign currency balances acts as a buffer, protecting your budget and margins from the volatility of the Rand.

- Smarter Operations: When reconciliation and reporting are automated, you free up your finance team from tedious admin, allowing them to focus on more strategic, high-value work.

By embracing these modern approaches, you’re doing more than just sending money. You are actively improving your company's financial health and positioning it for smarter, more profitable growth on the world stage.

Got Questions? We've Got Answers

Sending money across borders can feel complicated, and it's natural for questions to pop up. Here are some of the most common things South African business owners ask, with straightforward answers to help you navigate your next international payment.

What Are the Main Hidden Fees in International Transfers?

The biggest culprit, almost every time, is the exchange rate spread. This is the sneaky margin a bank or provider builds into the exchange rate they offer you, which is different from the real, mid-market rate you see on Google.

On top of that, you'll often get hit with SWIFT network fees and correspondent (or agent) bank charges. Think of these as handling fees charged by intermediary banks as your money hops from one institution to another on its way to its destination.

The old-school banks tend to roll all these costs into a single, less-than-favourable exchange rate, making it almost impossible to figure out what you're really paying. Modern, transparent platforms, on the other hand, usually give you the real spot rate and charge a clear, upfront fee. No more nasty surprises.

How Long Does an International Transfer from South Africa Take?

This really depends on the rails your money travels on. A traditional bank transfer using the SWIFT network can take a frustratingly long time – anywhere from 3 to 7 business days is standard, and that's if there are no hitches along the way.

Fintech platforms are built differently. They use more modern payment networks, which is why they can get the job done much faster, often within 1-2 business days. For some popular currency routes, it can even be a same-day affair.

What Is the Difference Between KYB and KYC?

It's a simple but crucial distinction. KYC, or Know Your Customer, is all about verifying an individual's identity. KYB, or Know Your Business, does the same thing, but for a company.

For any South African business sending money abroad, the KYB process is a regulatory must-do. It means providing official company documents—like your CIPC registration, proof of address, and director IDs—to prove your business is legitimate. It’s a key step in preventing financial crime.

Can I Receive International Payments with the Same Platform?

Absolutely, and this is where things get really powerful for a global business. Many of the newer fintech platforms are built for two-way traffic, handling both payments you send and payments you receive.

They can set you up with dedicated multi-currency accounts, like a proper USD or EUR account in your business's name.

This opens up a world of possibilities:

- Get paid by international clients directly into an account in their own currency.

- Hold onto that foreign currency to shield your business from the ZAR's notorious ups and downs.

- Pay your overseas suppliers directly from that foreign currency balance, completely sidestepping expensive double-conversion fees (e.g., USD to ZAR, then back to USD).

It transforms a payment tool into a smart cash flow and treasury management system, saving you a fortune on fees and giving you real control over currency risk.

Ready to eliminate hidden fees and gain full control over your international payments? Zaro offers transparent, real exchange rates with no markups and no SWIFT fees. See how much you can save on your next transfer. Get started with Zaro today.