A South Africa forex broker is your direct line to the global currency markets. Think of them as your essential partner, the gateway that connects you to the massive world of foreign exchange. For South Africans, this market is brimming with opportunity, but let's be clear: choosing the right broker is the single most critical decision you'll make for trading safely and successfully.

Your Guide to Forex Trading in South Africa

Welcome to the energetic world of forex trading in South Africa, a true continental hub for currency exchange. Picture a vast, digital marketplace that never sleeps, where fortunes are made and lost on the fluctuating values of global currencies like the US Dollar, Euro, and Japanese Yen against our own South African Rand (ZAR).

This isn't some exclusive club anymore. South Africa has exploded into a hotbed for traders, thanks to user-friendly mobile platforms and a growing financial literacy across the country. The market is absolutely buzzing with activity, which presents both incredible opportunities and very real risks.

The Scale of the South African Forex Market

The sheer size of the forex market here is genuinely staggering. As the biggest player on the continent, South Africa sees a daily forex market turnover that rockets past $20 billion. This massive volume highlights just how dominant our nation is in regional currency exchange.

This activity is happening against a backdrop of a solid economic outlook, with growth for sub-Saharan Africa projected to climb to 4.2% in 2025. You can dig deeper into these dynamics in this detailed 2025 outlook for forex trading in Africa.

All this growth is fuelling a rapidly expanding base of retail traders, which has seen an annual growth rate of 30% since 2023. While our neighbours in Nigeria and Kenya are also seeing their markets grow, South Africa holds onto its top spot because our trading infrastructure is simply more advanced and reliable.

Key Takeaway: The mix of high trading volume, a strong economy, and top-tier infrastructure makes South Africa a fantastic place for forex trading. But be warned: this dynamic environment also ramps up volatility, making your choice of broker more important than ever.

Why Your Broker Choice Matters So Much

So, what does this all mean for you, the individual trader? It means that while the potential for profit is very real, so is the risk of loss. African currencies are notoriously volatile, often reacting sharply to global monetary policies. This creates a double-edged sword: it presents chances for bigger profits but also amplifies the danger of significant losses.

Your South Africa forex broker isn't just a platform; they are your primary partner in this complex arena. They execute your trades, give you the tools for analysis, and, most importantly, protect your funds. A poor choice here can be devastating.

- High Hidden Fees: Unseen spreads and commissions can bleed your account dry, turning what should have been winning trades into losses.

- Unreliable Platforms: Imagine your platform crashing right when you need to exit a trade during a market spike. It’s a recipe for disaster.

- Poor Security: An unregulated or shady broker puts your hard-earned capital at serious risk of fraud or just plain mismanagement.

- Conflict of Interest: Some brokers operate on a model where they profit when you lose. This creates a fundamental conflict that is stacked against your success from the start.

On the other hand, the right broker offers a secure, transparent, and smooth trading experience. They provide competitive fees, stable technology, and the regulatory oversight you need to navigate the markets with confidence. This guide is designed to walk you through everything you need to know to make that all-important choice.

Why FSCA Regulation Is Your Best Defence

In the high-stakes world of forex, regulation isn't just bureaucratic red tape—it's the most essential piece of armour you have. For anyone looking for a South Africa forex broker, getting to grips with our local regulator is the first real step toward trading with confidence.

Think of it like this: when you deposit money into a bank, you do it with the trust that strict rules are keeping it safe. The exact same principle should apply to forex trading. You absolutely need a powerful watchdog making sure your broker plays by the rules, operates ethically, and is completely transparent.

Here in South Africa, that watchdog is the Financial Sector Conduct Authority, better known as the FSCA.

The FSCA is the independent body in charge of supervising and regulating market conduct in South Africa. Its mission is crystal clear: protect financial customers like you by promoting fair treatment, making sure financial firms are solid, and upholding the integrity of our country's financial markets.

The Role of the FSCA in Protecting Traders

Let's be blunt. Choosing a broker with an FSCA licence isn't just a good idea; it should be a non-negotiable for any serious trader in South Africa. The oversight from the FSCA provides a critical safety net, shielding you from the very real dangers posed by unregulated, offshore companies.

An FSCA-licenced broker is legally bound to a strict set of rules designed entirely for your protection. These aren't just vague guidelines; they are concrete requirements that safeguard your capital and ensure you get a fair shot.

An FSCA licence is a clear signal that a broker has met high standards for financial stability, ethical conduct, and operational transparency. It’s the difference between trading in a regulated, secure environment and venturing into an unpredictable, high-risk territory.

So, what does this protection actually look like day-to-day? Let's break it down.

Key Protections Offered by FSCA Regulation

When a South Africa forex broker holds an FSCA licence, they must follow several crucial rules. These directly impact the safety of your money and the fairness of your entire trading experience.

1. Segregated Client Funds

This is arguably the most important protection of all. An FSCA-regulated broker is required by law to keep your trading funds in a bank account that is completely separate from their own company funds.

- Why it matters: If the brokerage runs into financial trouble or even goes bankrupt, your money can't be touched by its creditors. It remains your property, safe and sound. This one rule prevents the most catastrophic kind of loss.

2. Fair and Transparent Marketing

The FSCA comes down hard on how brokers can advertise. They are strictly forbidden from making wild promises of guaranteed profits or trying to downplay the very real risks involved in trading.

- Why it matters: This makes sure you get honest information, not hype. It helps you make clear-headed decisions based on reality, not on misleading claims designed to lure you in.

3. Negative Balance Protection

Many, though not all, FSCA-regulated brokers offer this feature. It means you can never lose more money than what you've deposited into your account, even if the market goes completely wild.

- Why it matters: This acts as a vital backstop. It prevents a nightmare scenario where a sudden, violent market swing could leave you owing your broker a huge amount of money.

By enforcing these standards, the FSCA creates a much safer trading landscape for everyone. And the best part? Verifying a broker’s licence is simple. You can check any broker’s Financial Service Provider (FSP) number on the official FSCA website to confirm their status.

This quick check is a powerful tool, allowing you to easily tell the difference between a legitimate, trustworthy partner and a potentially dangerous, unregulated operation. When it comes to your money, choosing an authorised South Africa forex broker is your best defence.

How to Evaluate and Compare Forex Brokers

Choosing a South Africa forex broker can feel a lot like buying a car. You get hit with flashy advertisements and promises of massive sign-up bonuses, which are like a shiny new paint job—they look great, but they tell you absolutely nothing about what’s under the bonnet. To make a smart choice, you need to think like a thorough mechanic, not just a window shopper.

This means you’ve got to move past the surface-level appeal and really dig into the components that will make or break your trading performance. Things like trading fees, platform stability, and customer support are the engine, transmission, and brakes of your trading journey. Getting them right is non-negotiable.

Start with the Broker's Business Model

Before you even glance at the fees, the very first thing to understand is how a broker actually makes its money. This is fundamental because it defines their relationship with you and can introduce potential conflicts of interest. It’s a critical first check.

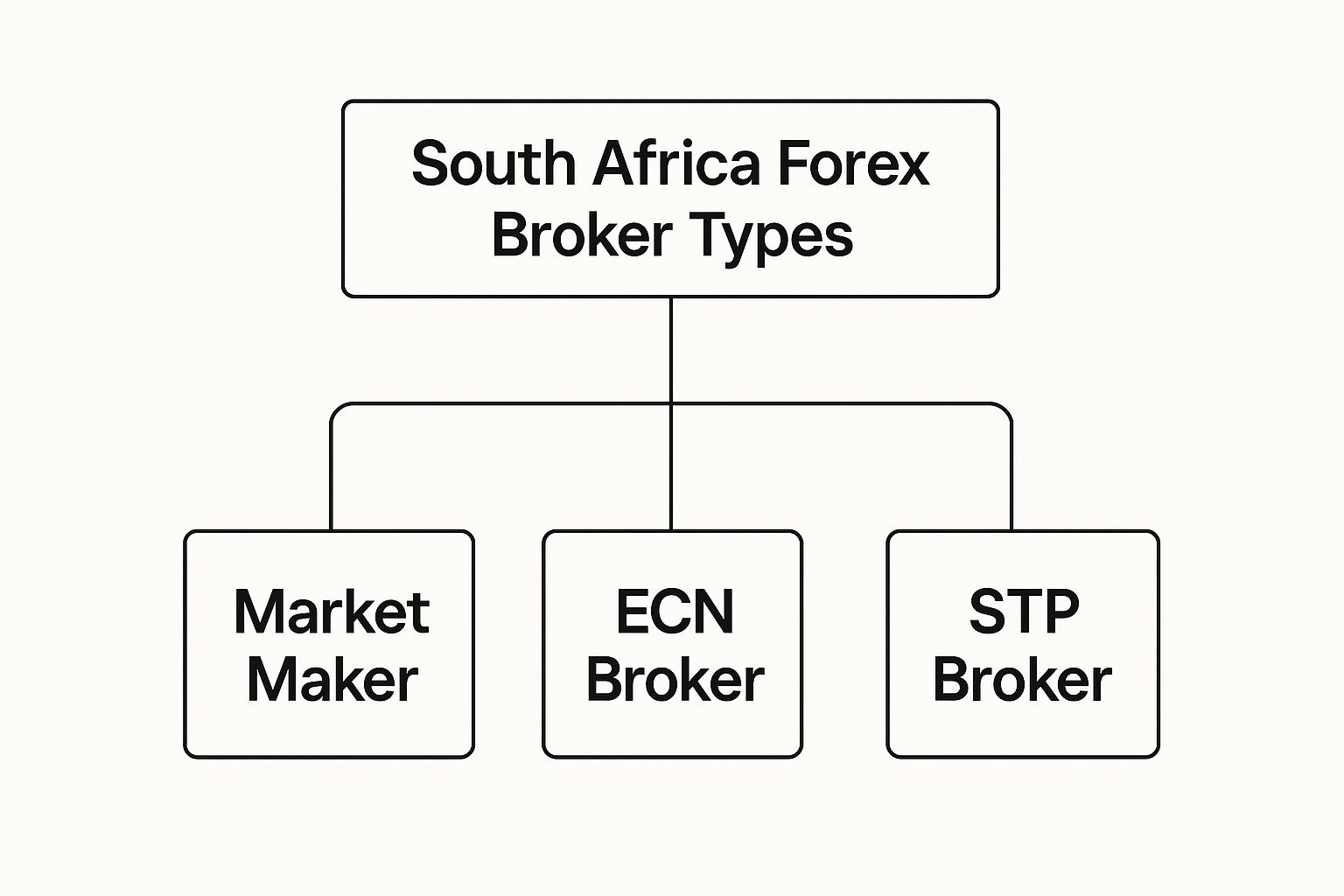

The infographic below breaks down the main types of brokers you'll come across in the South African market.

As you can see, brokers generally fall into one of three camps, each with a different way of handling your trades. Figuring out if a broker is a Market Maker, ECN, or STP is your first step in making sure their interests are aligned with yours.

Scrutinise the Trading Costs

Fees are the most direct drain on your trading capital. They can be complex and are often presented in confusing ways, so you must know exactly what you’re looking for. Even costs that seem tiny can compound over hundreds of trades and seriously erode your profits.

Here’s what to analyse:

- Spreads: This is simply the difference between the buy (ask) and sell (bid) price of a currency pair. The tighter the spread, the lower your cost to enter a trade. For most traders, this is the single most significant cost.

- Commissions: Some brokers, especially those using an ECN model, charge a flat commission for each trade. In return, they offer incredibly tight—or even zero—spreads. You'll need to do the maths to see if this model works out cheaper for your trading volume.

- Swap Fees (Overnight Fees): If you hold a position open past the market close, you'll either pay or receive a small fee called a swap. For long-term or swing traders, these fees can quickly add up and become a major expense.

- Deposit and Withdrawal Fees: A reputable South Africa forex broker should make it cheap and easy to move your money around. Prioritise brokers that support local bank transfers (EFT) with no fees attached.

The good news is that the South African market has become fiercely competitive. For 2025, many top-tier international brokers are tailoring their offerings for locals, with a big emphasis on keeping costs down. Fusion Markets, for instance, has built a reputation for offering some of the lowest forex spreads in the country. Other popular choices like IC Markets, Pepperstone, and Exness are also known for their minimal fees, fast digital account opening, and zero charges on deposits or withdrawals.

However, always remember that even with the best broker, trading is inherently risky. The data shows that approximately 70.64% of retail CFD accounts lose money. You can find more details on how these brokers stack up in this in-depth analysis of low-spread brokers in South Africa.

Broker Evaluation Checklist

To help you stay organised, here’s a quick checklist summarising the key factors to look for when comparing brokers. Think of it as your pre-flight inspection before you commit your capital.

| Evaluation Criterion | What to Look For | Why It Matters for ZA Traders |

|---|---|---|

| Regulation | FSCA authorisation | Ensures legal operation in SA and protection under local laws. |

| Business Model | Market Maker, ECN, STP | Determines potential conflicts of interest and execution quality. |

| Trading Costs | Low spreads, commissions, swap fees | Directly impacts your profitability on every single trade. |

| Funding Methods | ZAR accounts, local EFT | Avoids high currency conversion fees and speeds up transactions. |

| Trading Platform | MT4, MT5, cTrader | Reliability is key. A stable platform prevents costly execution errors. |

| Customer Support | Local phone number, 24/5 availability | Fast, accessible help is crucial when you have a live issue. |

Using a structured approach like this ensures you don’t get distracted by promotional hype and instead focus on what truly builds a solid foundation for your trading.

Evaluate the Trading Platform and Tools

Your trading platform is your command centre. It’s where you do all your chart analysis, execute your trades, and manage your risk. An unstable or clunky platform can lead to expensive mistakes and a whole lot of frustration.

A broker can offer the lowest fees in the world, but if their platform crashes during a critical market move, those savings are worthless. Platform reliability is non-negotiable.

Look for brokers offering industry-standard platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). These are the workhorses of the industry, known for their stability, powerful charting tools, and support for automated trading through Expert Advisors (EAs). Don't forget to check for a slick, user-friendly mobile app for managing trades when you're away from your desk.

Test Customer Support and Resources

When things go wrong—and trust me, at some point, they will—you need fast, competent help. Before you even think about committing real money, put the broker’s customer support to the test.

- Are they available 24/5?

- Do they offer local South African phone support?

- How quickly do they respond to live chat or emails?

Send them a few pre-sales questions. Gauge their response time and the quality of their answers. A broker that invests in excellent, accessible support is one that demonstrates a genuine commitment to its clients. By methodically checking each of these areas, you can choose a broker that acts as a true partner in your trading, not just a platform.

Decoding Different Forex Broker Models

Not all brokers are built the same. Far from it. The way a broker operates behind the curtain directly shapes your trading experience, your costs, and, frankly, your chances of success. When you understand a broker’s business model, you pull back that curtain. You see exactly how they handle your orders and, crucially, where their loyalties lie. For any trader choosing a South Africa forex broker, this isn't just trivia—it's fundamental.

Think of it like this. You could go to a single takeaway shop that makes one type of burger. They set the price, and you buy it directly from them. Or, you could go to a massive food market where dozens of vendors are all competing for your business, shouting out their best prices. Forex brokers fall into similar camps.

The real difference comes down to how your trade gets executed. Is the broker taking the other side of your bet themselves? Or are they passing your order along to a much larger network? This single question splits the industry into two main families: Dealing Desk and No Dealing Desk.

The Dealing Desk or Market Maker Model

A broker with a dealing desk is what we call a Market Maker. The name says it all—they literally "make the market" for their clients. When you click ‘buy’ on EUR/USD, they are the ones selling it to you. When you decide to sell, they are the ones buying it back. They create their own little ecosystem of liquidity by setting their own bid and ask prices.

This is the takeaway shop model. The broker sets the menu and the prices, and your order never leaves their kitchen. Their main income comes from the spread (the small difference between the buy and sell price) and by managing their overall risk across all client positions.

But here’s the catch. This setup creates an inherent conflict of interest. Because the Market Maker is on the opposite side of your trade, your loss can technically be their profit. Of course, any reputable, FSCA-regulated Market Maker has sophisticated systems to manage this risk, but the conflict is baked into the model. It's a key point for any trader who values pure transparency.

The No Dealing Desk Model

As you’ve probably guessed, No Dealing Desk (NDD) brokers don’t run their own dealing desk. Instead of being the counterparty, they act as a high-speed bridge, connecting your trade directly to a network of external liquidity providers. These are the big players—major banks, financial institutions, and even other brokers.

This is our "food market" model. You get direct access to all the vendors competing to give you the best deal. NDD brokers make their money in one of two ways: either by adding a tiny, fixed markup to the best spread they find or by charging a clear, upfront commission on each trade. Traders looking for lightning-fast execution and raw market access usually gravitate towards this model.

Key Takeaway: The simplest way to think about it is to ask: "Who am I trading against?" With a Market Maker, you trade against the broker. With an NDD broker, you trade with the broader market, and your broker is just the facilitator.

Within the NDD family, there are two main flavours that every South Africa forex broker client should get to know.

1. Straight Through Processing (STP) Brokers

STP brokers are all about automation. They route your orders electronically and instantly to their pool of liquidity providers, who then compete to fill your order at the best possible price. The broker typically adds a small, consistent markup to the best bid/ask price they receive, and this becomes the spread you see on your screen.

2. Electronic Communication Network (ECN) Brokers

ECN brokers push transparency and direct access to the absolute limit. They essentially create a digital marketplace—an ECN—where all participants can interact directly. This includes banks, institutions, and individual retail traders like you. It’s a level playing field.

This creates an open order book where everyone sees the best available bid and ask prices in real-time.

- Transparency: You get access to the raw, interbank spreads, which can be razor-thin and sometimes even zero.

- Cost: Instead of profiting from a wider spread, ECN brokers charge a small, fixed commission for executing your trade. It’s completely transparent.

- Execution Speed: With orders being matched automatically within the network, execution is often incredibly fast.

Ultimately, your choice depends entirely on your trading style. If you’re a beginner who values simplicity and predictable, fixed spreads, a well-regulated Market Maker can be a good starting point. However, if you’re a scalper, a news trader, or a high-volume day trader who lives and dies by tight spreads and instant execution, an ECN or STP model is almost always the superior choice.

Your Step-by-Step Guide to Opening an Account

Alright, let's get down to business. Moving from learning about trading to actually doing it can feel like a big leap, but opening an account with a South Africa forex broker is surprisingly straightforward when you know the steps. Forget the jargon and complexity; I’m going to walk you through the entire process, turning it into a simple, actionable plan.

The goal here is to take the guesswork out of it. With a clear roadmap, you’ll be set up and ready to go on a fully regulated platform in no time. Let’s do this together, from that first click on the registration page all the way to funding your new account.

Step 1: Start with a Demo Account

Before you even think about putting your own money on the line, the smartest first move is to open a demo account. Think of it as a flight simulator for traders. You get to pilot a trading platform in real-world market conditions, using virtual money, so there's absolutely zero financial risk.

Why is this so important? A demo account lets you:

- Learn the ropes: Get a feel for the trading software, whether it’s the popular MT4, MT5, or the broker's own platform. This is your chance to figure out how to place trades, set stop-losses, and read the charts without any pressure.

- Test-drive your strategy: Got a trading idea? See how it actually plays out in a live environment. This is your sandpit—make mistakes, learn from them, and fine-tune your approach without it costing you a cent.

- Feel the market’s pulse: Get a genuine sense of how currency pairs like the EUR/ZAR or USD/JPY move and behave during different times of the day.

Spending a couple of weeks in a demo account isn't just practice; it's an essential part of your education. It builds the confidence and practical skills you'll need before your hard-earned Rands are at stake.

Step 2: Register and Fill Out the Application

Once you’re comfortable navigating the demo platform, you’re ready for a live account. The entire registration is done online and, honestly, it usually takes less than 15 minutes.

You’ll kick things off by heading to your chosen broker’s website and hitting the "Register" or "Open Account" button. The first part is simple: just your basic details like name, email, phone number, and so on. After that, you'll move on to a slightly more detailed application form.

This form will ask about your financial situation (like your income and savings) and your trading background. Just be honest. These questions aren't there to be nosy; they're a regulatory requirement known as an "appropriateness assessment," which helps the broker ensure the products they're offering are right for you.

Step 3: Submit Your FICA Documents for Verification

Now for the most important part when it comes to security and regulation. To get your account up and running, every legitimate South Africa forex broker has to verify who you are according to FICA (Financial Intelligence Centre Act) rules. It’s the exact same anti-money laundering check your bank does.

You’ll need to have clear digital copies of two documents ready:

- Proof of Identity: A valid South African ID book/card, driver’s licence, or passport.

- Proof of Address: A recent utility bill, bank statement, or another official document (that’s less than three months old) showing your full name and physical address.

Pro Tip: Want to get verified without any delays? Make sure your documents are crisp and easy to read. Double-check that the name and address on your proof of address are an exact match for the details you entered when you signed up.

Step 4: Fund Your Account and Start Trading

Once your documents are checked and approved—which often happens in less than 24 hours—your live account will be activated. The final step is adding funds.

Good brokers will give you a few ways to deposit money, but for most South Africans, a local bank transfer (EFT) is the simplest and cheapest option. It’s a good idea to find a broker that offers ZAR-denominated accounts, as this helps you dodge unnecessary currency conversion fees.

With your account funded, you're officially ready to trade. Just remember the golden rules: start small, always manage your risk, and never trade with money you can't afford to lose.

Common Mistakes to Avoid When Choosing Your Broker

Every seasoned trader has a story about a lesson learned the hard way. Venturing into the forex market without knowing the common pitfalls is like trying to navigate the backstreets of Johannesburg without a map—you're bound to get lost, waste time, and probably lose some money along the way.

Think of this section as a conversation with a mentor who's seen it all. We’ll walk through the most frequent blunders that can trip up a promising trading career before it even gets going. By learning to spot these red flags, you can start your journey on the right foot with a broker who genuinely has your back.

Falling for Unrealistic Bonus Offers

Flashy sign-up bonuses are the oldest trick in the book, and unfortunately, they still work. A broker promising to double your deposit or offering "free money" might look tempting, but it’s almost always a trap designed to lock you in. These offers are tied to incredibly strict, often impossible, trading volume requirements you have to meet before you can touch any of your funds—including your own deposit.

It's a classic case of golden handcuffs. The bonus lures you in, but you end up chained to the platform, forced to over-trade just to meet the conditions. This pressure cooker environment is a recipe for reckless decisions and, ultimately, significant losses. A reputable South Africa forex broker doesn't need gimmicks; they compete on the quality of their service, tight spreads, and solid execution.

Key Takeaway: Real value isn't found in a bonus that encourages bad habits. It's in low spreads, reliable order execution, and strong regulation. Always read the fine print; if an offer sounds too good to be true, it is.

Overlooking the Importance of FSCA Regulation

This is, without a doubt, the single biggest and most dangerous mistake a South African trader can make. In the rush to get started, many newcomers skip the simple but vital step of checking a broker's regulatory status. Handing your capital to an unregulated, offshore broker is no different from giving your money to a complete stranger and hoping for the best.

When the Financial Sector Conduct Authority (FSCA) isn't in the picture, you have absolutely no protection.

- Your funds aren't safe: Unregulated brokers can mix your money with their own operational cash. If they go bust, your capital disappears with them.

- You have no legal power: If the broker refuses to process your withdrawal or engages in shady practices, there’s very little you can do to fight back.

- You're a prime target for scams: The unregulated space is a playground for fraudulent operations built for one purpose: to take your money.

Before you even think about depositing, verify the broker’s FSP number on the official FSCA website. This check takes less than a minute and is your number one defence against fraud.

Underestimating the Impact of High Fees

It’s easy to get fixated on chasing big wins and completely ignore the small costs that quietly eat away at your account. High spreads, commissions, and overnight swap fees are silent profit killers. A few extra pips on the spread might not feel like a big deal on one trade, but multiply that by hundreds of trades over a year. It adds up to a huge chunk of money that should have been yours.

Do your homework before you commit. Pull up the broker’s fee schedule and compare the average spreads on the currency pairs you trade most often. If you’re a swing trader who holds positions for days or weeks, pay very close attention to their swap fees. A truly competitive South Africa forex broker will be transparent about every single cost, because they have nothing to hide.

Your Top Questions About SA Forex Brokers, Answered

Jumping into the world of forex trading always kicks up a lot of questions, especially when you're just starting out. Getting straight, honest answers is the first step to building the confidence you need to trade well. Let's tackle some of the most common things people ask about choosing and using a South Africa forex broker.

We’ll get right into the practical stuff—from how much cash you actually need to start, to how you get your profits out, and what you need to tell the tax man.

How Much Money Do I Really Need to Start Trading?

This is probably the number one question we hear, and the answer is usually a lot less than you'd expect. Many brokers in South Africa have opened the doors wide by offering accounts with very low minimum deposits. You can often find brokers that will let you get started with as little as $50 or $100, which is about R900 to R1,800.

But here’s a word of caution: just because you can start that small, doesn't mean it's a good idea. Trading with a tiny account makes proper risk management almost impossible. One bad trade can sting, wiping out a huge chunk of your capital and leaving you with no room to manoeuvre. It’s often much smarter to start with an amount you're okay with losing, but that still gives you a fighting chance.

How Do I Get My Profits Out?

Withdrawing your money should be as painless as putting it in—if it isn't, that's a major red flag. Any respectable, FSCA-regulated broker will have a clear and simple withdrawal process. For those of us in South Africa, the best options are usually the most familiar:

- Local Bank Transfer (EFT): This is the go-to for most traders. It’s a direct transfer into your South African bank account, landing in ZAR. Simple.

- Credit/Debit Cards: You can usually withdraw funds straight back to the card you used to deposit in the first place.

- E-wallets: Digital wallets like Skrill and Neteller are also widely used and are known for their speed.

Heads Up: To prevent fraud and comply with anti-money laundering laws, brokers will almost always insist you withdraw funds using the same method you used for your deposit. Expect the whole process to take around 1-3 business days.

Do I Have to Pay Tax on Forex Profits in South Africa?

In a word, yes. Any profit you make from forex trading is considered taxable income in South Africa. The South African Revenue Service (SARS) generally looks at these earnings in one of two ways: as income from a speculative venture or as capital gains.

For most day-to-day retail traders, your profits will be taxed as regular income, which means you'll pay tax at your personal marginal rate. It's entirely your responsibility to declare this income. We always recommend speaking to a qualified tax professional to make sure you're ticking all the right boxes. Keeping meticulous records of all your trades—wins and losses—is non-negotiable for tax time.

Dealing with international finance can feel like a maze, but Zaro makes it refreshingly simple for your business. We give you the real exchange rate with zero spread, cutting out the hidden fees and nasty surprises that come with traditional banks. See how much you can save on your global payments by visiting https://www.usezaro.com today.