Understanding The Historical Foundation Of Exchange Control

To fully appreciate the nuances of South African exchange control regulations, looking at their historical roots is indispensable. Gaining insight into how South Africa established its unique system of exchange controls offers vital background for meeting current compliance obligations.

Tracing the development from initial wartime currency protections to today’s detailed rules shows how past events have molded the regulations that govern international financial dealings. This historical understanding is fundamental for comprehending existing requirements and foreseeing potential changes in the regulatory environment.

The Initial Spark: Wartime Protections and Sterling Area Membership

The origins of South Africa's exchange controls can be traced back more than 80 years, with foundations laid amidst international conflict and economic partnerships. The country's exchange control regulations were first established in 1939.

During this period, South Africa, as a member of the British Sterling Area, introduced limitations on capital moving to nations outside this bloc. The primary aim was to facilitate the free flow of money within the Sterling Area, especially with the United Kingdom. This supported the joint war effort and safeguarded common currency holdings under severe World War II economic pressures. These early measures were generally considered temporary responses to unusual global conditions.

Solidifying Controls: Post-War Adaptations and New Realities

When the direct impact of World War II lessened, many countries started to remove their wartime financial limitations. South Africa, however, took a different path. Although Sterling Area exchange controls were being dismantled elsewhere, South Africa extended and substantially modified its own controls in 1961.

This significant step indicated a conscious effort to create a lasting and separate national system for overseeing capital movements, which formed the basis for the distinct South African exchange control regulations present today. Explore this topic further

Several factors contributed to this different approach, showing an increasing aim to protect the national economy and more effectively manage the country's balance of payments. This historical background is crucial for making sense of why many current regulations exist. The initial focus on securing national financial interests and managing capital flow, influenced by both global situations and changing domestic economic plans, set the fundamental tenets of the system.

Understanding this history allows for better interpretation of specific rules and an appreciation of how continuous political and economic pressures have shaped these regulations. This knowledge provides businesses and individuals with the insight to approach current rules with more assurance and strategic thought.

How Political Forces Shaped Modern Exchange Controls

Early financial regulations encountered a major challenge during the apartheid era. This period significantly altered South African exchange control regulations.

Intense global political and economic pressures drove substantial changes to these controls. The framework developed then continues to have a noticeable impact on the current financial environment.

The Apartheid Era and Intensified Controls

Growing international criticism of apartheid led to widespread sanctions and disinvestment campaigns against South Africa. This situation created serious concerns for the government about capital flight, which is the rapid movement of large sums of money out of the country.

As a result, existing exchange controls were made much stricter and more detailed. The political and economic climate, especially in the mid-1980s, heavily influenced these South African exchange control regulations.

For example, in 1985, increasing international sanctions and disinvestment prompted the nation to establish extremely stringent exchange controls. These included major limitations on current account transactions and the important introduction of the dual rand system, a differentiated exchange rate. Discover more insights about this period of financial control

This era represented a clear move towards more intricate and confining measures. These were carefully planned to protect the country's declining foreign reserves and help maintain economic balance.

The Dual Rand System: A Key Mechanism

To manage these economic challenges, the dual rand system was a notable development. This system established two distinct exchange rates for the South African currency.

The commercial rand was used for current account transactions, such as the buying and selling of goods and services internationally. The financial rand applied to capital account transactions, like investments and disinvestments by individuals and companies not residing in South Africa.

Usually, the financial rand was valued at a significant discount compared to the commercial rand. This design aimed to make it more expensive for residents to transfer capital abroad and cheaper for non-residents to invest in South Africa, helping to carefully control capital movements.

The dual rand system was discontinued in March 1995 as South Africa transitioned to democracy. However, its core idea of separating and controlling different financial flows significantly influenced later regulatory approaches to South African exchange control regulations.

Legacy and Anticipating Future Shifts

The well-developed control systems created during those challenging years have been considerably reformed and made more open over time. Nevertheless, they still shape how current South African exchange control regulations are structured and applied.

The lasting effects from that period can be seen in the detailed compliance rules that remain and the historically wary stance on fully freeing up capital movements. Understanding how elements such as political stability, changing international relations, and the effects of economic sanctions previously shaped this framework is practically important.

This historical background is very useful for businesses and people in South Africa. It allows for better prediction of how current political and economic events might lead to future changes in exchange control policies.

Such insight is key for effective financial planning and getting ready for possible shifts in regulations.

Navigating The Regulatory Framework And Key Players

Working with South African exchange control regulations means you need a solid grasp of the authorities involved and the way the system functions. For anyone engaging in cross-border transactions, knowing the key institutions and the legal foundations of these controls is essential.

The Legal Bedrock And Core Institutions

South Africa's exchange control system is built upon a distinct legal groundwork. This set of rules governs the flow of currency into and out of the nation, affecting the daily financial dealings of people and companies alike.

Central to this framework are two key pieces of legislation: the Currency and Exchanges Act, 9 of 1933, and the Exchange Control Regulations, 1961. These acts establish the legal basis for applying and overseeing exchange controls. Policy management and execution have consistently been the responsibility of the Minister of Finance. The South African Reserve Bank (SARB) functions as the primary entity tasked with implementing these policies for the government and ensuring adherence to the laws. Further details on this legislative framework offer deeper insights into South Africa's exchange control.

Key Players And Their Roles

Grasping the hierarchy and specific duties within this regulatory environment is very helpful. The system involves several important entities:

- Minister of Finance: Holds the ultimate authority over exchange control policy.

- South African Reserve Bank (SARB): Through its Financial Surveillance Department (FinSurv), the SARB manages the daily application and enforcement of exchange controls. This department issues circulars, rulings, and guidance. It also possesses considerable authority, such as the power to investigate non-compliance and apply penalties. Lately, SARB has increased its monitoring, especially after South Africa was placed on the greylist by the Financial Action Task Force (FATF). This move aims to strengthen measures against anti-money laundering (AML) and counter-terrorist financing (CTF).

- Authorised Dealers: Usually commercial banks, these are designated by the SARB to handle exchange control transactions for their customers. They are the first stop for individuals and companies that need to conduct foreign currency transactions, submit applications, and adhere to South African exchange control regulations.

Policy To Practice: Liberalisation And Lingering Controls

For many years, South Africa has been progressively easing its exchange controls through a process of phased liberalisation. This gradual loosening of rules aims to attract foreign investment and better connect with the world economy. Even with these relaxations, some controls are still strongly maintained. The reasons often given include safeguarding the nation's balance of payments, maintaining currency stability, and stopping illegal money movements.

The administrative setup, which includes approval and reporting processes handled by Authorised Dealers and, for more intricate matters, directly by SARB, has a direct bearing on transaction speeds and the difficulty of compliance. Identifying the correct contact for specific issues and understanding these decision-making structures can make interactions with the regulatory system more efficient. Such awareness is important for fostering effective communication and ensuring that cross-border financial activities are conducted smoothly and in line with regulations.

Essential Business Compliance Strategies That Work

Effectively handling your company's international financial dealings relies heavily on adhering to South African exchange control regulations. Making these complex rules easier to understand and follow is vital for avoiding penalties and supporting your business's long-term expansion. As the South African Reserve Bank (SARB) steps up its monitoring, being proactive about compliance is absolutely essential.

Identifying Key Risk Areas in Business Transactions

To ensure good compliance, the initial step is to gain a clear picture of how South African exchange control regulations impact your particular business dealings. This means you'll need to carefully categorise the various kinds of transactions you undertake, such as making payments for imports, receiving funds from exports, managing foreign investments, handling intercompany loans, and processing service or management fees.

Every transaction category can come with its own specific approval and reporting rules. For instance, Authorised Dealers can often manage routine trade payments using their delegated authority, but larger or more intricate transactions usually require direct approval from the SARB. With the SARB increasing its enforcement actions, particularly due to South Africa's FATF greylisting, businesses need to be very careful about figuring out when and how to get the required permissions.

Understanding these distinctions is crucial. The following table, titled "Business Transaction Categories and Approval Requirements," offers a comprehensive comparison of different business transaction types and their corresponding approval requirements, documentation needs, and processing timeframes, helping to clarify these varied obligations.

| Transaction Type | Approval Required | Documentation | Typical Processing Time |

|---|---|---|---|

| Payments for Imports | Authorised Dealer / SARB (for high value) | Invoices, Shipping Documents, Import Permits | 1-3 Business Days |

| Receipts from Exports | Authorised Dealer | Export Declarations, Proof of Payment | 1-3 Business Days |

| Foreign Direct Investment | SARB (Direct Approval often needed) | Application, Business Plan, Source of Funds Proof | 4-8 Weeks (SARB) |

| Intercompany Loans | SARB (Direct Approval often needed) | Loan Agreement, SARB Approval Letter, Justification | 2-6 Weeks (SARB) |

| Service or Management Fees | Authorised Dealer / SARB (based on nature) | Service Agreement, Invoices, Proof of Service | 1-5 Business Days |

As the table illustrates, the requirements can differ significantly based on the transaction's nature and value. This variability underscores the importance of thoroughly assessing each cross-border activity to ensure all regulatory steps are correctly followed.

Implementing Solid Internal Compliance Systems

To manage these requirements effectively, setting up strong internal controls is a cornerstone. This involves developing clear internal processes for starting, approving, and keeping records of all cross-border financial activities. Meticulous record-keeping isn't just a good habit; it's a regulatory demand that can protect your business during SARB audits or inquiries.

Your connection with your Authorised Dealer, which is usually your bank, plays a vital role. They act as your main point of contact for most exchange control issues. Keeping lines of communication open and providing them with all the necessary information can help make processes smoother. Good internal systems and strong relationships with your Authorised Dealer combine to help ensure your documentation meets regulatory standards and supports your business goals.

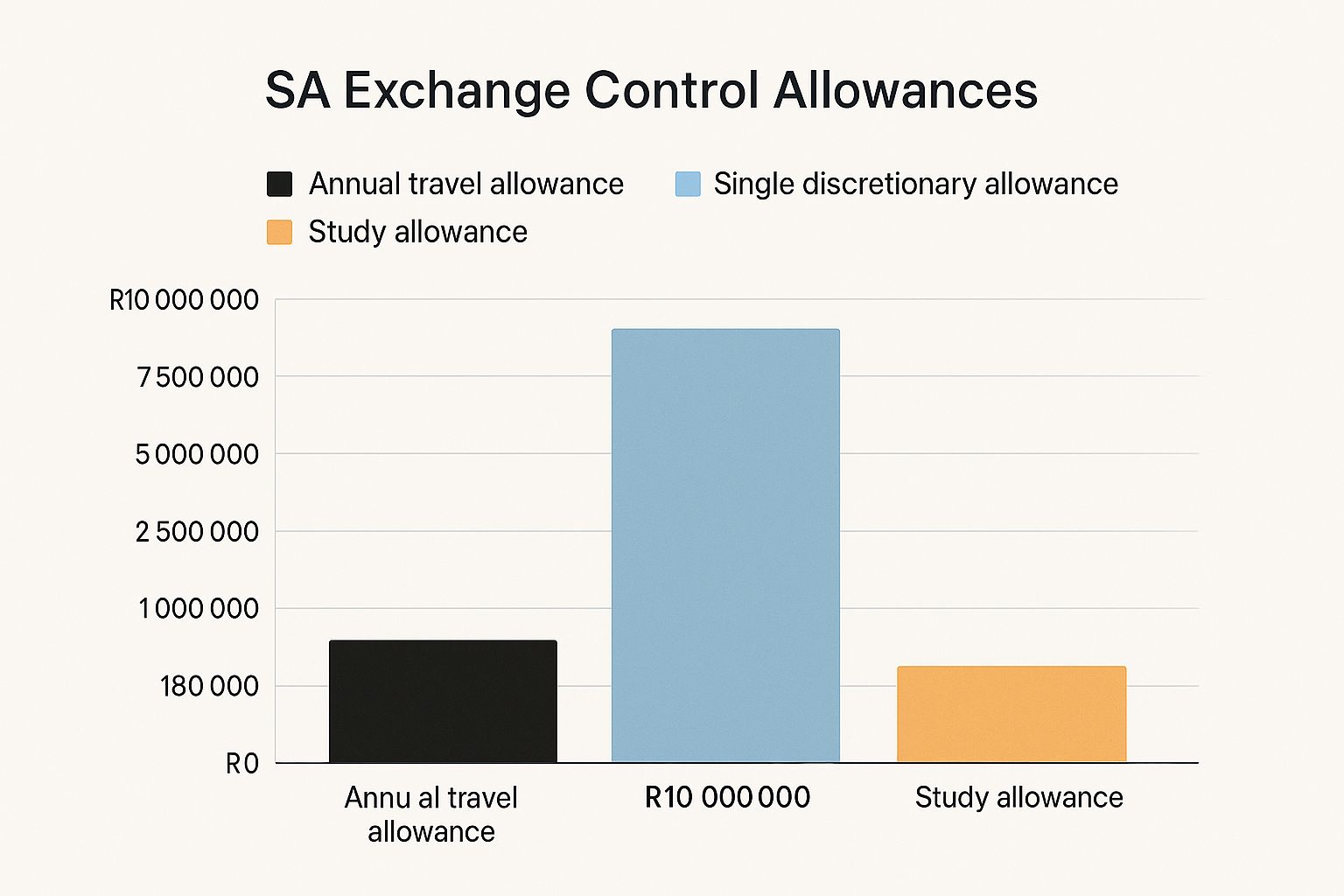

To get a sense of the specific nature of the controls set by South African exchange control regulations, consider the following infographic which shows key personal allowances.

This visual compares important figures such as the R1 million annual travel allowance and the R10 million single discretionary allowance. It highlights the precise limits individuals encounter, reflecting the kind of accuracy also expected in business transactions. Recognizing this detailed approach helps businesses prepare for the level of scrutiny their own compliance will face.

This visual compares important figures such as the R1 million annual travel allowance and the R10 million single discretionary allowance. It highlights the precise limits individuals encounter, reflecting the kind of accuracy also expected in business transactions. Recognizing this detailed approach helps businesses prepare for the level of scrutiny their own compliance will face.

Mitigating Risks and Handling Non-Compliance

Not following South African exchange control regulations, even if by accident, can result in serious problems. Frequent issues include hold-ups in operations because of missing paperwork, or even significant financial penalties. The SARB is empowered to levy fines as high as 40% of the transaction's value and can also direct banks to freeze accounts, effectively stopping business activities.

The best course of action is prevention: always obtain the required approvals before starting any transactions. If your business finds past instances where rules were not followed, making a full and frank disclosure to the SARB is usually the advised method to lessen potential fines. The central bank’s strict position means that taking a proactive and open approach to correcting any errors is key to staying in good regulatory standing.

Personal Foreign Transactions: What You Need To Know

When it comes to handling money across borders, individuals in South Africa, much like businesses, face a specific set of rules. Getting to grips with these personal elements of South African exchange control regulations is crucial for managing your international finances effectively and staying on the right side of the law. Knowing your yearly allowances and the steps for major events, such as emigration, helps you sidestep common issues.

Understanding Your Allowances

South African residents receive specific yearly allowances from the South African Reserve Bank (SARB) for moving funds out of the country. These allowances are structured to cater to different personal requirements while helping to manage the nation's foreign currency holdings.

Here’s a breakdown of the primary allowances:

- Single Discretionary Allowance (SDA): Each calendar year, adult South African residents can transfer up to R1 million offshore without needing a tax clearance certificate. This allowance can be used for any legitimate purpose, including travel, gifts, donations, and supporting family members overseas. Children under 18 also have a smaller discretionary allowance, typically R200,000 per year.

- Foreign Investment Allowance (FIA): For those looking to make more substantial investments abroad, there's the Foreign Investment Allowance (previously known as the foreign capital allowance). This allows individuals to transfer up to R10 million per calendar year offshore for investment purposes. However, unlike the SDA, accessing the FIA requires a Tax Clearance Certificate (TCC) specifically for foreign investment from the South African Revenue Service (SARS).

The Crucial Role Of Tax Clearance

When your international transactions are set to go over your Single Discretionary Allowance, or if you're planning to use your Foreign Investment Allowance, securing a TCC from SARS is a must. This certificate acts as proof that your tax matters are up-to-date and compliant. Your bank, known as an Authorised Dealer, will need this document before they can process these larger sums of money going abroad.

It is also possible to apply for amounts that exceed the R10 million FIA threshold. This involves a more comprehensive application submitted directly to the SARB, where you'll need to detail things like the origin of the funds and the intended investment. This process is more exacting, and approvals are considered on an individual basis.

Navigating Major Life Events And Investments

Significant changes in life often involve South African exchange control regulations, making careful preparation essential to ensure everything goes smoothly. Whether you're moving abroad or investing overseas, understanding the rules is key.

- Emigration: If you are formally emigrating from South Africa, there are specific processes to follow regarding the declaration and transfer of your assets. This is a substantial step and impacts how your remaining South African assets and future foreign capital transfers are treated under exchange control rules.

- Foreign Property and Investments: Purchasing property overseas or making other foreign investments typically falls under the FIA. It’s important to use the correct allowances and ensure all documentation, including the TCC, is in place. Be aware that restrictions might apply to certain types of investments, so it's wise to check with your Authorised Dealer.

- Inheritance: Receiving a foreign inheritance and bringing those funds into South Africa also has specific procedural requirements to ensure compliance with South African exchange control regulations.

Avoiding Common Mistakes And Staying Compliant

People sometimes make errors like not getting the necessary TCC, trying to send more money than allowed without getting prior approval from the SARB, or incorrectly stating why the funds are being transferred. The SARB has increased its scrutiny, especially since South Africa was placed on the FATF greylist, so not following the rules can lead to significant problems.

The penalties for non-compliance can be quite severe, potentially as high as 40% of the value of the transaction. In some instances, bank accounts could even be frozen.

It's also worth noting the situation with digital assets, such as cryptocurrencies. Currently, they don't fall under the definition of "currency" or "capital" according to existing South African exchange control regulations, based on recent court interpretations. However, this is an area that is changing quickly.

For certainty and to ensure you comply with all rules, it's always best to rely on official information and seek advice from Authorised Dealers when undertaking transactions across borders.

Ultimately, carrying out your own checks and consulting with your bank (your Authorised Dealer) before you undertake any personal foreign transactions is the most sensible course of action. This approach helps you stay fully compliant with all South African exchange control regulations and manage your international financial dealings without any hitches.

Future Trends And Regulatory Evolution

The world of South African exchange control regulations is constantly changing, influenced by global financial dynamics and the country's own economic requirements. Keeping up with these developments is crucial for anyone involved in cross-border transactions to ensure compliance and make informed financial choices.

These regulations are not set in stone; they adapt. Therefore, understanding the direction of these changes helps businesses and individuals prepare effectively.

Increased Scrutiny And Enforcement

There has been a noticeable increase in how strictly South African exchange control regulations are being enforced. A primary reason for this is South Africa's greylisting by the Financial Action Task Force (FATF), which has spurred the South African Reserve Bank (SARB) to heighten its oversight.

The SARB is concentrating on strengthening anti-money laundering (AML) measures and curbing unauthorized transfers of funds out of the country. This more stringent approach is clear from significant actions, such as when the SARB mandated a forfeiture exceeding ZAR 6 billion in one prominent case, demonstrating a firm stance. Previously, the SARB might have focused on more substantial non-compliance, but the current trend is to scrutinize all instances. As a result, businesses and individuals face a higher risk of penalties, which can include fines up to 40% of the transaction's value or even frozen bank accounts.

The Crypto Conundrum: A Regulatory Gap

New technologies, particularly digital assets like cryptocurrencies, present challenges to the existing framework of South African exchange control regulations. A High Court judgment from May 2025 (Standard Bank of South Africa v SARB) clarified that cryptocurrencies do not currently meet the definition of "currency" or "capital" under these specific regulations. This ruling, while providing some clarity, also underscores an area that is actively evolving.

This situation leaves a gap in regulation, as these digital asset activities presently operate outside the direct control of traditional exchange mechanisms. The court itself highlighted the pressing need for legislative reform. This strongly suggests that amendments to South African exchange control regulations concerning digital assets are on the horizon, intended to bring more certainty to this fast-growing field.

Preparing For What’s Next

Successfully managing this changing regulatory scene requires a proactive approach. The SARB has made it clear that adherence to South African exchange control regulations is a major priority. This involves several key actions:

- Ensuring upfront approvals: It is vital to obtain all necessary exchange control approvals before any transactions are made.

- Addressing past non-compliance: If there have been past irregularities, providing a full and frank disclosure to the SARB is recommended to potentially lessen any penalties.

- Staying informed: Keep a close watch on SARB announcements and policy documents, particularly those related to digital assets and AML obligations.

To better understand these developments, the table below summarizes significant exchange control changes in recent years. It shows how policies are evolving, reflecting both tightening in some areas and responses to new financial technologies.

Table: Recent Regulatory Changes and Their Impact

| Year/Period | Change | Impact | Affected Parties |

|---|---|---|---|

| Recent / Ongoing | Intensified SARB scrutiny; investigation of all instances of non-compliance. | Increased risk of penalties (including fines up to 40% of transaction value, potential for blocked bank accounts) for errors. | All entities engaging in forex |

| Recent / Ongoing | Heightened focus on AML/CTF due to FATF Greylisting; stricter due diligence requirements. | More thorough checks conducted by Authorised Dealers; comprehensive documentation is essential. | Businesses, individuals |

| May 2025 (context) | High Court ruling confirmed cryptocurrencies currently fall outside Excon Regulations; legislative review anticipated. | Current regulatory uncertainty; likelihood of new, specific regulations for digital assets in the future. | Cryptocurrency users, investors |

| Recent / Ongoing | Greater emphasis by SARB on preventing unauthorised capital outflows and ensuring legitimate transactions. | Stricter validation processes for transaction purposes and the sources of funds. | Importers, exporters, investors |

Grasping these key insights from recent regulatory shifts is crucial. The clear trend is towards more diligent oversight and the need for market participants to be thoroughly prepared.

Understanding these ongoing trends is essential for adapting your financial strategies. As South African exchange control regulations continue to change, maintaining diligence is paramount. For businesses looking for transparent and efficient ways to handle international payments within this complex environment, solutions like Zaro can offer valuable support.

Implementation Strategies And Best Practices

Successfully working with South African exchange control regulations means more than just knowing the rules; it requires putting them into practice effectively. For both companies and individuals, turning this regulatory knowledge into clear actions is vital for smooth foreign transactions. This means setting up strong systems and adopting methods that meet regulatory standards.

Building A Proactive Compliance Framework

A proactive approach is the foundation of good exchange control management. Instead of just reacting to problems, creating a solid compliance framework from the start can help avoid expensive mistakes and holdups. This process starts with a deep understanding of how South African exchange control regulations specifically affect your company's operations or your personal financial activities.

For businesses, this involves creating straightforward internal procedures for starting, approving, and recording all international transactions. Simple compliance checklists, customized for your usual transaction types, can make sure all necessary steps are consistently taken. For example, it's essential to have the correct mandates in place and to clearly state and support the purpose of every transaction with evidence. Such careful attention helps turn regulatory duties from a burden into a normal part of operations.

The Critical Role Of Documentation And Authorised Dealers

Keeping detailed records isn't just a clerical duty; it’s an important protective measure. It's crucial to maintain an organized and easily reachable collection of all relevant paperwork—such as invoices, contracts, approvals, and communications related to foreign exchange dealings. This documentation acts as evidence of compliance if the South African Reserve Bank (SARB) decides to carry out an audit or investigation.

Additionally, building a good working relationship with your Authorised Dealer (which is usually your bank) is extremely beneficial. They are your main point of contact for most exchange control issues and can offer essential advice. Keeping them updated and providing thorough documentation for transactions can greatly ease the approval process. An Authorised Dealer familiar with your business or personal transaction habits can offer better support in dealing with South African exchange control regulations.

Managing Non-Compliance And Heightened SARB Scrutiny

The regulatory scene has changed, with the SARB increasing its enforcement of South African exchange control regulations. This is partly due to South Africa's FATF greylisting. Consequently, even unintentional or careless non-compliance can result in serious consequences. Penalties can be substantial, potentially reaching fines of up to 40% of the transaction's value. In some instances, the SARB has ordered bank accounts to be frozen, bringing business activities to a halt. The significant Steinhoff forfeiture, which was more than ZAR 6 billion, highlights the SARB's serious approach.

If past non-compliance is found, the suggested course of action is often to make a full and frank disclosure to the SARB. This openness can lessen the impact of potential penalties. Common mistakes frequently arise from a lack of knowledge or an underestimation of the requirements, stressing the importance of continuous carefulness.

Anticipating Regulatory Shifts And Future Proofing

The rules surrounding South African exchange control regulations are not fixed; they change based on economic situations and global developments. For instance, recent court decisions have suggested that cryptocurrencies, in their current form, might not fit the traditional definitions of "currency" or "capital" under these regulations. This points to an area likely to see future legislative changes.

Staying informed about SARB announcements, policy changes, and circulars is therefore important. This awareness allows individuals and businesses to adjust their plans proactively, ensuring their compliance methods stay effective and in line with the current interpretation and enforcement of South African exchange control regulations. Such a forward-thinking strategy helps prepare your financial operations for unexpected regulatory adjustments.

For businesses dealing with the intricacies of international payments and aiming for compliance with South African exchange control regulations, finding effective solutions is important. Zaro provides a platform created to make cross-border transactions simpler, offering clarity and control over your global payments.