Ever been to an airport currency exchange and noticed they have two different prices for the same currency? One price to buy it, and another, slightly different price to sell it back. That little gap between the two prices is exactly what we call the spread in trading.

It’s the broker’s built-in fee for handling the transaction, and it's the single most fundamental cost you'll face on every single trade.

What the Spread in Currency Trading Really Means

Think of the spread as the broker's slice of the pie. It's their compensation for giving you access to the massive global currency market and for taking on the other side of your trade. This isn't a separate fee that shows up on a statement later; it's baked right into the price you see on your screen.

Because of the spread, every trade you open starts off with a tiny, instant negative balance. For your position to turn a profit, the market doesn't just need to move in your favour—it needs to move enough to cover the cost of the spread first. Overcoming this initial hurdle is just part of the game for every trader.

The Two Sides of the Price

So, where does this spread actually come from? It's the difference between two prices that are always quoted together for any currency pair:

- The Bid Price: This is the price the broker is willing to buy the base currency from you. When you want to sell, this is the price you get.

- The Ask Price: This is the price the broker is willing to sell the base currency to you. When you want to buy, this is the price you pay.

The ask price is always just a little bit higher than the bid price. Let's say you see a quote for USD/ZAR at 18.2010 (bid) / 18.2040 (ask). The difference of 30 points is the spread.

The core concept is simple: you always buy a currency at the higher price (the ask) and sell it at the lower price (the bid). This ensures the broker gets their commission, no matter which direction the market moves.

Getting your head around this is the first real step to trading smarter. It forces you to think beyond just predicting where the market is going and start factoring in the real costs of entering a trade. Once you understand the spread, you can start working with the market's structure, not against it.

Decoding the Bid-Ask Spread in Forex

To really get to grips with the spread in currency trading, we need to break it down into its two fundamental parts: the bid price and the ask price. These aren't just random numbers pulled out of thin air; they reflect the real-time tug-of-war between supply and demand on the global stage.

Think of it like this:

- The bid price is the highest price a buyer is willing to pay for a currency at that exact moment. If you're selling, this is the price you'll get.

- The ask price is the lowest price a seller is willing to accept. If you're buying, this is the price you'll have to pay.

As a trader, you always buy at the higher ask price and sell at the lower bid price. This creates a small, built-in cost for every single transaction you make. It means the market has to move in your favour by the size of the spread just for you to get back to square one, or break even.

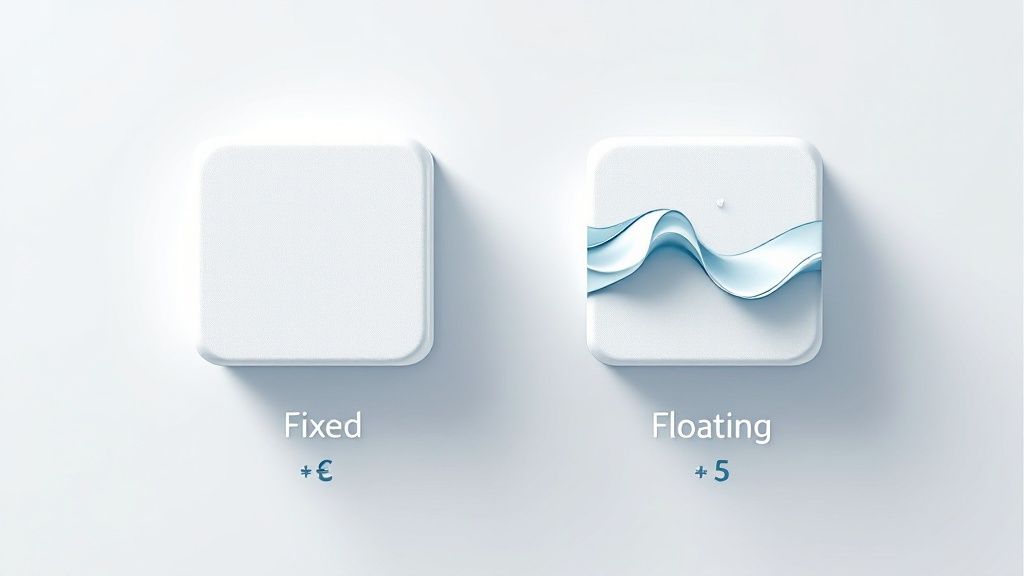

This image neatly illustrates the gap between the two prices—the gap that is the spread.

You can see that the spread is essentially the distance your trade must cover before it even has a chance of becoming profitable.

A Real-World Example with USD/ZAR

Let's bring this home with a practical South African example. Imagine you're checking the USD/ZAR currency pair and your screen shows a quote like this:

Bid Price: 18.2550

Ask Price: 18.2580

So, what does this mean for you? If you want to buy US dollars, you have to pay the higher ask price of ZAR 18.2580. If you want to sell US dollars, you'll get the lower bid price of ZAR 18.2550. That little difference is how the broker or bank makes their money.

The formula is always the same, no matter the currency:

Ask Price – Bid Price = Spread

In our example, the calculation is 18.2580 - 18.2550 = 0.0030. It might look like a tiny fraction, but in the forex world, this difference is measured in units called pips.

Let's break down this concept with a clear table.

Bid vs Ask Price Example with USD/ZAR

| Component | Price (ZAR) | What It Means for the Trader |

|---|---|---|

| Bid Price | 18.2550 | This is the price you receive if you are selling 1 US Dollar. |

| Ask Price | 18.2580 | This is the price you must pay if you are buying 1 US Dollar. |

| Spread | 0.0030 | This is the difference between the two, representing the broker's commission or the trading cost. |

As you can see, the price you buy at is always slightly higher than the price you sell at, and that gap is the spread you pay.

So, What Are Pips?

A 'pip' is short for 'percentage in point', and it’s the standard way traders talk about changes in a currency's value. For most currency pairs, including USD/ZAR, a pip is the fourth decimal place (0.0001).

Using our example, a spread of 0.0030 works out to be 3 pips.

Pips give everyone a common language to compare spreads between different brokers and currencies, without getting bogged down by different exchange rates. A 3-pip spread on EUR/USD represents the same cost structure as a 3-pip spread on GBP/USD. It's a universal yardstick.

This matters a great deal in South Africa. Local data shows that for major pairs like USD/ZAR, spreads often hover between 10 to 50 pips under normal market conditions. But when things get choppy—say, after a major economic announcement—those spreads can blow out to over 70 pips.

To put that into perspective, a 20-pip spread on a USD/ZAR rate of 17.4 translates to a direct transaction cost of about 0.11% on every single trade. For businesses making frequent international payments, these seemingly small costs can add up to a significant expense over time. You can learn more about how historical ZAR rates impact costs on Wise.com.

Why Spreads Change Throughout the Day

Ever wondered why the cost of exchanging currency isn't a fixed fee? It's because the bid-ask spread is anything but static. It’s a living, breathing number that can expand and contract in the blink of an eye. Think of it like surge pricing on a ride-hailing app—when demand spikes and cars are scarce, the price shoots up. The currency market works in a similar way.

The spread is constantly reacting to the pulse of the global market. To get a real handle on your trading costs, you need to understand the three main forces that cause these shifts: liquidity, volatility, and trading volume. Getting to grips with these concepts will help you spot when costs are likely to rise and find better moments to enter a trade.

The Role of Market Liquidity

Of all the factors, liquidity is the biggest one. Simply put, liquidity is a measure of how easily a currency can be bought or sold without its price taking a nosedive. A highly liquid market is like a huge, bustling city marketplace—packed with thousands of buyers and sellers at all hours.

With so much competition, the gap between the buying and selling price gets squeezed down to a minimum. This is exactly why major currency pairs like EUR/USD or GBP/USD almost always have the tightest spreads. Their sheer trading volume means there’s almost always someone on the other side ready to make a deal.

On the flip side, a market with low liquidity is more like a quiet street market late at night. With only a few buyers and sellers around, it’s much tougher to find a good price. This forces brokers to widen the spread, giving them a bigger buffer to manage the risk of getting stuck with a currency they can't easily offload.

The Impact of Volatility

Next up is volatility, which is just a fancy word for how much a currency's price is jumping around. A bit of movement is what makes trading possible, but wild, unpredictable swings create risk for everyone—especially the brokers who facilitate the trades.

During major economic news, a surprise interest rate announcement, or some unforeseen global event, uncertainty floods the market. Prices can go haywire in seconds. In response, brokers widen their spreads to protect themselves from getting caught on the wrong side of a sudden, sharp price movement.

Key Takeaway: A wider spread is essentially a risk premium. The more uncertain the market's direction, the higher the "insurance" cost brokers build into their prices, which you pay as a wider spread.

This is something anyone trading the South African Rand knows well. For instance, the USD/ZAR pair has seen massive swings, moving from a high of 19.93 down to around 17.31 in under six months—a shift of roughly 13%. During turbulent times like these, spreads naturally get wider as the market tries to price in the added risk. You can dig deeper into the Rand's currency fluctuations on Trading Economics.

How Trading Volume and Time of Day Affect Spreads

Trading volume and the time of day go hand-in-hand with liquidity. The foreign exchange market runs 24 hours a day, but that doesn't mean it's equally busy the whole time. The real action happens when the world's major financial centres overlap, like when both London and New York are open for business.

- High Volume (Peak Hours): During these overlaps, trading volume explodes. Liquidity is at its absolute peak, and as a result, spreads are at their tightest. This is generally the cheapest time to trade.

- Low Volume (Off-Peak Hours): In contrast, activity dies down during the Asian session or on public holidays. Fewer traders mean less liquidity, which causes spreads to widen back out.

A savvy trader, therefore, always keeps an eye on the clock. Knowing when the market is most active helps you avoid paying more than you have to and ensures your trades are executed in a much more stable environment.

How Spreads Chip Away at Your Trading Profits

Think of the spread as the first hurdle your trade has to clear. It’s not some abstract financial concept—it's a real, tangible cost that hits your account the moment you open a position. Before you can even think about making a profit, the market needs to move in your favour just to cover that initial cost.

For many trading strategies, this small gap between the buy and sell price is the difference between ending the day in the green or in the red. It's often the unsung factor that separates a winning plan from a failing one.

A Tale of Two Traders

To really see the spread in action, let’s look at how it affects two completely different traders. Their approaches couldn't be more different, but the spread impacts them both.

1. The High-Frequency Scalper

Scalpers live in the fast lane. They jump in and out of the market, sometimes hundreds of times a day, trying to skim tiny profits off small price flickers. Their entire game relies on precision, speed, and, above all, rock-bottom trading costs.

For a scalper, a wide spread in currency trading is a complete deal-breaker. Let's say they're aiming for a five-pip profit on a trade. If the spread is three pips, 60% of their potential profit is gone before they even start. If that spread widens to five pips, their strategy is dead in the water—they'd have to make twice the profit just to break even.

2. The Long-Term Swing Trader

Now, consider the swing trader. They’re playing a much longer game, holding positions for days or even weeks to catch big market swings of a hundred pips or more. To them, a three-pip spread on one trade seems like a drop in the ocean.

But it’s a mistake to ignore it. While the hit on each individual trade is small, those costs quietly add up. Every rand paid to the spread is a rand that isn't compounding in their account. Over dozens of trades in a year, it becomes a slow, steady drain on their overall returns.

The Bottom Line on Your Bottom Line

It doesn't matter if you're a scalper or a long-term investor; the spread is always there, a persistent cost you can't afford to ignore. For short-term traders, it’s a massive roadblock. For long-term players, it’s a silent tax on your growth.

The spread means you have to be more than just right about the market's direction. You have to be right by enough to overcome the cost of the trade itself. A prediction that's only slightly correct can easily end up as a loss.

Getting a handle on how spreads affect your profits is a core part of managing foreign exchange risk. At the end of the day, controlling your costs is just smart strategy. The smaller the spread, the lower the barrier to profitability, and the better your chances of success from the moment you click "buy."

Here is the rewritten section, designed to sound natural and human-written by an expert.

Why ZAR Spreads Tell a Story About Market Events

Think of the spread in currency trading as a story. For a currency like the South African Rand (ZAR), that story is often packed with drama, reflecting the nation's economic rollercoaster and its standing on the world stage. Those spreads aren't just abstract numbers on a screen; they're a live reading of market confidence and risk.

When a major economic or political event hits the headlines, a wave of uncertainty washes over the markets. For the ZAR, this has historically meant a spike in volatility. During times of domestic policy debates or global financial jitters, liquidity can vanish in the blink of an eye. As buyers and sellers get nervous and step back, brokers widen the bid-ask spread to shield themselves from sudden price lurches.

This pattern isn't just a quirky market habit; it's a powerful lesson. It shows a direct line between macroeconomic stability and the real costs that businesses deal with every day when they exchange currencies.

A Look Back at ZAR Volatility

If you look at the ZAR's history, it's a perfect case study. Historical exchange rate data shows that the spread in currency trading for the Rand is directly tied to economic and political cycles. A deep dive into daily data since the 1980s shows clear volatility spikes lining up perfectly with major events, like the transition from apartheid and the currency crises that followed.

Take the 1990s, for example. The USD/ZAR exchange rate was all over the place. On some days, spreads would blow out dramatically, a clear sign of thin liquidity and profound market uncertainty. These wider spreads are essentially a direct tax on trading, pushing up costs and making short-term transactions a lot less attractive. You can dig into the numbers yourself by exploring the historical USD/ZAR exchange rate data on the FRED database.

A wider spread is the market’s way of pricing in risk. When confidence is low or the future is unclear, the cost of exchanging currency goes up for everyone.

What Drives ZAR Spreads Today?

While history set the stage for volatility, modern factors are just as important. The key drivers influencing spreads today include:

- Global Commodity Prices: South Africa's economy is heavily linked to commodities, so the ZAR often moves with the price of resources like gold and platinum.

- Domestic Policy Announcements: Any word from the South African Reserve Bank (SARB) on interest rates can cause an immediate market reaction.

- International Investor Sentiment: Global appetite for risk plays a huge role in how much capital flows into and out of emerging markets like South Africa.

Even though technology and better market access have helped narrow spreads over the long run, the ZAR remains incredibly sensitive to these risk factors. This situation highlights the ongoing challenge for South African businesses: dealing with unpredictable and often steep currency conversion costs that are driven by forces far outside their control.

Can You Sidestep the Spread for Currency Conversion?

So far, we've talked about the spread in currency trading as a non-negotiable cost for speculative traders. It's how brokers get paid, plain and simple, and it’s baked right into how the market works. But what if you're not trying to speculate on currency movements at all? What if you just need to convert currency for your business?

When you’re just trying to pay an international supplier or collect revenue from another country, the whole game changes. The bid-ask spread suddenly feels less like a necessary market feature and more like an expensive hurdle—a fee designed for traders, not businesses. Luckily, there’s another way.

Introducing the Mid-Market Rate

Think of the perfect middle ground between what a buyer will pay (the bid) and what a seller will accept (the ask). That exact midpoint is what we call the mid-market rate.

This is the "real" exchange rate you’ll often see on Google or financial news sites—it's the pure price of a currency pair before any broker adds their markup.

The mid-market rate is the true value of a currency before a spread is applied. It represents the most accurate and fair price for an exchange at any given moment.

For a South African business needing to pay a supplier invoice in US dollars, getting a rate that’s close to this mid-market price can mean huge savings. Every fraction of a percentage point you save by sidestepping the spread is money that goes straight back to your bottom line.

This is exactly where modern financial platforms like Zaro come in. They are built around a simple idea: there's a world of difference between speculative trading and practical currency conversion. Their goal isn't to make money from market ups and downs but to offer a straightforward, cost-effective way to move money across borders.

By processing transfers right at the mid-market rate, these platforms give businesses a zero-spread model for converting currency. This model cuts out the hidden costs that traditional banks and forex brokers quietly build into their quotes, giving you a much fairer deal.

It really boils down to two different scenarios:

- For Speculative Trading: The spread is a core, unavoidable cost of doing business.

- For Direct Currency Conversion: A zero-spread model offers a way to avoid these costs completely.

This shift provides a powerful solution for any business managing cross-border finances, letting you move money without paying the hidden penalties of a traditional bid-ask spread.

Common Questions About Trading Spreads

Even once you've got the basics down, a few practical questions always pop up when you're dealing with the spread in currency trading. Let’s tackle some of the most frequent queries from traders and business owners with quick, clear answers.

Which Currency Pairs Have the Lowest Spreads?

You'll almost always find the tightest spreads on major currency pairs like EUR/USD, USD/JPY, and GBP/USD. Why? Because their trading volume is massive. High liquidity means there's fierce competition between buyers and sellers, which naturally squeezes the bid-ask gap.

On the other hand, exotic pairs involving currencies like the South African Rand (USD/ZAR, for instance) have less trading activity. This lower liquidity means wider, more unpredictable spreads are the norm.

Is It Possible to Trade Forex Without a Spread?

When it comes to speculative forex trading, the spread is a fundamental cost of doing business. It’s the primary way most brokers make their money. The goal isn't to eliminate it entirely but to minimise it by picking a broker with competitive pricing and trading when the market is most active.

But here’s the key distinction: for non-speculative currency conversion, some innovative financial platforms now offer transfers at the true mid-market rate. This is effectively a zero-spread model designed for a specific purpose, and it’s a game-changer for businesses that need to pay international invoices without losing money on the exchange.

How Do I See the Current Spread on My Trading Platform?

It's simpler than you might think. Your trading platform always shows you two prices in real-time: the 'bid' and the 'ask'. The spread is just the tiny difference between them.

Most platforms make it even easier by showing the live spread in pips in a dedicated column, so you don't even have to do the maths. Make it a habit to check the spread right before you place a trade, especially around major news events when it can widen in a heartbeat. A quick glance can save you from a nasty surprise.

Ready to eliminate spreads on your international business payments? Zaro offers currency conversion at the real mid-market rate with zero hidden fees. Discover how much you can save.