Absolutely, your forex trading profits are taxable in South Africa. The South African Revenue Service (SARS) generally treats these gains as part of your regular income. This means they get added to your other earnings for the year and taxed at your personal income tax rate, which can go up to 45%. Getting this right from the start is crucial for staying compliant.

Your Guide to Forex Trading Tax in South Africa

Trying to figure out the tax rules for forex trading can feel a lot like trading itself—confusing and full of surprises if you’re not prepared. Whether you’re just starting out or have been trading for years, a common point of uncertainty is how SARS actually views your profits. The question isn't if you need to pay tax, but how that tax is calculated.

Think of this guide as your roadmap. We’ll walk through your obligations for tax on forex trading in South Africa, breaking everything down into simple, manageable pieces. We're cutting through the dense legal speak to give you practical advice you can actually use.

Key Concepts We Will Cover

To get a firm grip on this, we’ll tackle a few critical areas:

- Hobby vs. Business: We'll look at how SARS decides if you're just a casual trader or running a full-blown trading business. This distinction is a game-changer for your tax situation.

- Income Tax vs. Capital Gains Tax: You'll understand the difference between these two and, crucially, why your forex profits will almost always fall under income tax.

- Record-Keeping and Reporting: We’ll cover the essential records you absolutely must keep and how to declare your trading income to SARS correctly.

Remember, the golden rule is that SARS almost always views forex trading profits as regular income. In South Africa, these profits are taxed under a progressive system, with rates starting at 18% and climbing to 45% depending on your total annual earnings. Unlike a salaried employee on PAYE, a forex trader needs to register as a provisional taxpayer. This means making at least two tax payments during the year and submitting an ITR12 return annually to avoid penalties. You can find out more about the tax implications for South African traders on CMTrading.com.

Determining if Your Forex Trading Is a Hobby or a Business

When it comes to the tax on forex trading in South Africa, the first and most important question SARS will ask is a simple one: are you a casual investor, or are you running a business? The answer to that question changes everything about how your profits are taxed.

Think of it like someone who enjoys fishing. If you spend a quiet weekend at the dam with a single rod, that's a hobby. But if you're running a commercial operation with nets, boats, and a crew, that’s a business. Both are catching fish, but their intent, scale, and level of organisation are worlds apart. SARS looks at forex trading through a very similar lens.

Getting this distinction right isn't just a minor detail; it's the very foundation of your tax obligations. Misclassifying your activities can lead to incorrect filings, and that could mean penalties down the road.

SARS Criteria for Classification

So, how does SARS decide? There isn't a single, simple test. Instead, they look at a collection of factors, often called the "badges of trade," to get the full picture of your trading activities. They’re essentially trying to figure out your true intention.

Here are the key questions they'll consider:

- Frequency and Volume: How often are you actually trading? A handful of trades a year might look like a long-term investment. Hundreds of trades a month? That starts to look a lot like a business.

- Intention: Were you aiming to make a quick, speculative profit, or were you holding a currency pair hoping for long-term growth? The shorter you hold your positions, the more it points towards a business motive.

- Degree of Organisation: Do you have a dedicated home office setup for trading? Are you using sophisticated software and following a strict, documented trading plan? A high level of organisation suggests a commercial enterprise.

- Capital Employed: Is a significant portion of your capital actively tied up and managed in your trading account? This signals a more serious, business-like approach rather than a passive investment.

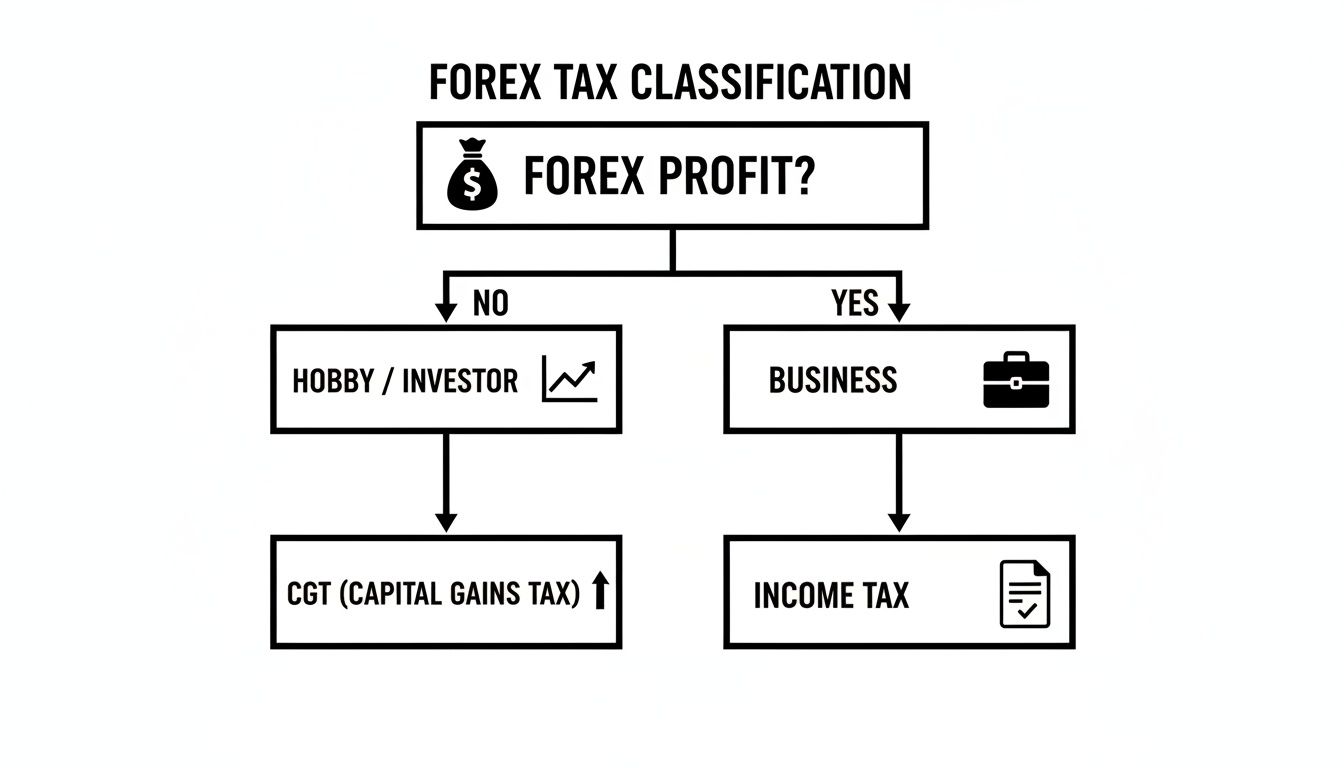

This flowchart breaks down how your trading style and frequency directly influence which tax you'll end up paying.

As you can see, the path to either Capital Gains Tax or Income Tax really begins with how SARS perceives your patterns and intent.

The Tax Impact of Each Classification

Understanding the classification is crucial because the tax hit is dramatically different for each. Let’s be clear: for the vast majority of retail forex traders in South Africa, their activity is considered a "scheme of profit-making."

Key Takeaway: If your trading is frequent, systematic, and geared towards short-term gains, SARS will almost certainly classify it as a business. Your profits will be treated as regular income and taxed at your marginal rate, which can go as high as 45%.

On the flip side, if your activities were genuinely infrequent and intended as a long-term hold, any gains could potentially be treated as capital. This would bring it under the Capital Gains Tax (CGT) rules, which have a much lower effective rate. Honestly though, this scenario is extremely rare for anyone who considers themselves an active forex trader. Understanding how tax authorities classify your trading is crucial, and further insights into general day trading tax deductions can offer a broader perspective.

Ultimately, you need to look at your own trading honestly and measure it against the criteria SARS uses. For most people actively clicking buy and sell in the forex market, the reality is simple: you're operating in a way that SARS will view as a business. It's best to accept that and prepare to be taxed on your income accordingly. This proactive mindset keeps you compliant and helps you avoid any nasty surprises from the taxman.

Income Tax vs Capital Gains Tax on Forex Profits

Once you’ve figured out how SARS is likely to view your trading activities, the next question is obvious: what does this mean for your bank account? Your profits will fall under one of two tax categories—Income Tax or Capital Gains Tax (CGT)—and the difference between them is massive.

Think of it like choosing between two roads to the same destination. One is a direct, high-speed toll road, and the other is a longer, scenic route with a much smaller fee. The path you take determines how much of your profit you get to keep.

For the overwhelming majority of active forex traders, that high-speed toll road is Income Tax. When you’re trading frequently, systematically, and with the goal of making short-term gains, SARS sees this as a business operation. As a result, your net trading profits are added straight on top of your annual income and taxed at your marginal rate.

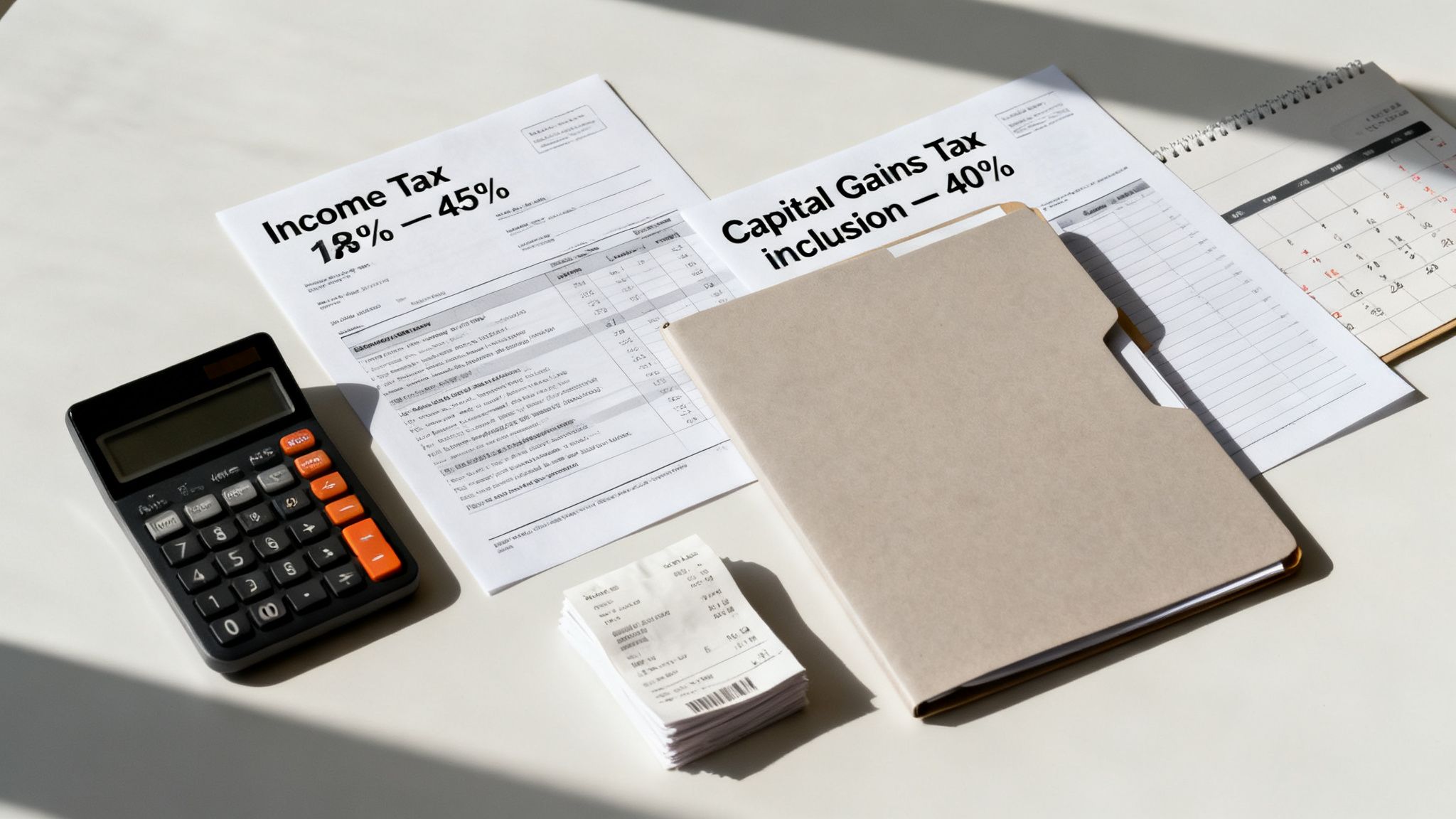

In South Africa, these income tax rates are progressive, climbing from 18% for lower earners all the way up to a hefty 45% for those in the top bracket. This means a very successful trader could see almost half of their hard-earned gains going straight to the taxman.

When Income Tax Is The Default

Income tax applies to any activity that SARS considers a "scheme of profit-making." It’s not just jargon; it’s the official term for any venture designed to make regular profits through active effort.

Imagine a day trader who opens and closes dozens of positions every week. Their entire strategy is built around profiting from tiny, quick price shifts. In the eyes of SARS, their intention is crystal clear: short-term speculation. This is business income, plain and simple.

Scenario Example: The Day Trader Thabo is a full-time day trader. In one tax year, he generates a net profit of R150,000 from his forex trading. He also has other income that places him in the 36% tax bracket. SARS will add his R150,000 trading profit to his other earnings, and that amount will be taxed at 36%. The tax bill on his trading profits alone comes to a significant R54,000.

This is exactly why a solid understanding of Calculating Profit and Loss is non-negotiable. Every single Rand of profit has a direct and immediate tax implication.

The Capital Gains Tax Alternative

On the other side of the fence, you have Capital Gains Tax (CGT). This is the "scenic route" reserved for profits made from selling a capital asset—something you typically hold as a long-term investment. The tax treatment here is far kinder.

Instead of taxing your entire profit, only a portion of the net capital gain gets added to your taxable income. For individuals, this "inclusion rate" is 40%. In practice, this means the highest effective tax rate you could possibly pay on a capital gain is just 18% (which is 40% of the top 45% income tax rate).

This table breaks down the core differences at a glance:

Income Tax vs Capital Gains Tax: A Forex Trader's Comparison

| Feature | Income Tax (Speculative Trading) | Capital Gains Tax (Investment Holding) |

|---|---|---|

| SARS Classification | Trading is a business or "scheme of profit-making." | Asset is held as a long-term capital investment. |

| Applicability | Applies to most active retail forex traders. | Rare for individuals; more likely for corporate hedging. |

| Taxable Amount | 100% of your net profit is added to your income. | Only 40% of your net capital gain is added to your income. |

| Tax Rate | Your marginal income tax rate (18% to 45%). | Your marginal rate is applied to the included 40%. |

| Maximum Effective Rate | 45% | 18% (45% of 40%) |

| Loss Treatment | Trading losses can often be offset against other income. | Capital losses can only be offset against capital gains. |

As you can see, the distinction isn't just academic—it has a profound impact on your final tax bill.

When Might Capital Gains Tax Apply?

So, when would a forex transaction ever qualify for CGT? It’s not common for individuals, but it's possible. The absolute key is proving a clear long-term investment intention, which is the exact opposite of typical trading behaviour.

Let's look at a corporate example. Say a South African company needs to pay a supplier in the US in twelve months' time. To protect itself from a weakening Rand, it buys US Dollars today and parks them in a foreign currency account for the entire year.

Scenario Example: The Corporate Hedger ABC Importers buys $100,000 and holds it for 14 months. When they finally use the funds, the Rand has weakened, and they’ve made a R200,000 gain. Because this was a passive, long-term strategy to hedge a specific business risk—not active trading—SARS would likely treat it as a capital gain. Only 40% of that R200,000 profit (R80,000) would be included in the company’s taxable income for the year.

For the average retail trader clicking away on a platform, trying to argue for CGT is an uphill battle you’re almost certain to lose. If you are actively managing your positions, you should work on the assumption that your profits are subject to Income Tax. It's the most realistic approach and will keep you on the right side of SARS.

Corporate Tax Obligations for South African Businesses

While individual traders have to figure out their progressive tax brackets, things look quite different for businesses dealing with foreign currencies. For companies like importers, exporters, and BPOs, foreign exchange isn't a side hustle—it's woven into the fabric of their daily operations. Getting a handle on corporate tax obligations is absolutely critical for staying compliant and managing currency risk properly.

When a South African company deals in foreign currency, any realised gains or losses hit its income statement directly. The good news for businesses is that the structure is far more predictable than the complex personal tax system. This clarity is a lifesaver for financial planning and budgeting, especially when you're dealing with the rollercoaster of currency markets.

The biggest difference comes down to the tax rate itself. South African companies that trade Forex as a core business activity face a flat corporate income tax rate of 27% to 28% on their taxable profits. This is a world away from the individual progressive brackets that can climb as high as 45%. While this predictability is welcome, it means businesses must keep flawless records for SARS audits. Profits and losses are treated just like any other business income, with trading losses offsetting future gains within the company. You can discover more about how corporate forex activities are taxed in South Africa.

That flat rate might simplify the maths, but it puts a huge emphasis on meticulous record-keeping. Every single transaction needs to be documented to back up the final taxable income figure you report to SARS.

Separating Operational FX from Speculation

For any corporate finance team, one of the most important jobs is to draw a clear line between two types of foreign exchange movements: operational and speculative. Making this distinction is vital for accurate financial reporting and tax compliance.

Operational FX Movements: Think of these as the gains or losses that come from your company's core business. An importer paying a supplier in US Dollars or an exporter getting paid in Euros will see these kinds of movements. They're simply a natural part of doing business internationally.

Speculative Trading: This is when a company actively trades currency pairs with the main goal of making a profit from market swings, completely separate from its primary operations. SARS sees this as a distinct revenue-generating activity.

Failing to keep these two separate can create a mess on your financial statements and attract the wrong kind of attention from SARS. A clean, clear audit trail for each type of transaction isn't just a good idea—it's non-negotiable.

A crucial takeaway for businesses is that both operational forex gains and speculative profits are generally considered part of the company's gross income. They are pooled together with other revenue and are subject to the standard corporate income tax rate.

This means managing currency exposure is more than just a treasury function; it’s a central part of your company's overall tax strategy.

Claiming Deductible Business Expenses

Just like any other business activity, the costs you incur "in the production of income" from your forex dealings are tax-deductible. This is a powerful tool for companies looking to lower their overall tax bill. The golden rule is that the expense must be directly linked to your forex management or trading activities.

Common deductible expenses for a business often include:

- Platform and Software Fees: Subscriptions for trading platforms, financial data terminals (like Bloomberg or Reuters), or specialised hedging software.

- Bank and Transaction Charges: Fees for international wire transfers, currency conversion costs, and charges from maintaining foreign currency accounts.

- Advisory and Consultation Fees: The cost of hiring forex consultants or tax advisors to help manage currency risk and keep you compliant.

- Data and Internet Costs: A reasonable portion of your connectivity costs that can be allocated to the finance department handling forex.

For any business, managing cross-border payments efficiently can make a huge difference to the bottom line—not just through better rates, but also through cleaner records for tax time. This is where modern fintech solutions really shine. Platforms like Zaro are designed to simplify these international money flows by offering transparent, real-exchange-rate transactions. That level of clarity makes it far easier for finance teams to track, record, and report every forex gain or loss accurately. When your tax submissions are both compliant and easy to defend, you can operate with much greater confidence. By cutting out hidden bank markups and providing detailed transaction histories, these tools help businesses manage their tax on forex trading in South Africa with precision.

Mastering Your Paperwork and Reporting to SARS

A profitable trading strategy is only half the battle. The other half? Diligent admin. When it comes to the tax on forex trading in South Africa, your compliance lives and dies by the quality of your records. If you can’t back up your numbers with a solid paper trail, you’ll have a tough time defending your declared profits and expenses to SARS.

Think of your records as the evidence you’d present to a judge. Each document validates your financial story. For both individual traders and businesses, having clear, organised transaction histories isn't just a good idea—it's non-negotiable if you want to be ready for a potential audit.

This kind of administrative discipline turns tax time from a panicked scramble into a calm, predictable process. It gives you the confidence that what you're filing is accurate and, most importantly, defensible.

Getting to Grips with Provisional Tax

If you’re earning income from sources outside of a regular salary—like forex trading—you can't just wait until the end of the year to pay your tax. The law requires you to register with SARS as a provisional taxpayer. This is a critical step that many new traders miss, often with painful consequences.

Provisional tax isn’t an extra tax. It's simply a way of paying your total income tax bill in advance, split into two payments during the tax year. This system helps you manage your cash flow and prevents that dreaded shock of a massive, unexpected tax bill after filing your annual return.

Mark these deadlines in your calendar:

- First Payment: Due by the end of August.

- Second Payment: Due by the end of February.

Missing these dates or under-declaring your income can lead to some pretty hefty penalties and interest charges from SARS.

Your Definitive Record-Keeping Checklist

Make no mistake: if SARS decides to review your tax return, the burden of proof is 100% on you. Your records are your only defence, so a well-organised file is an absolute must.

Here’s a checklist of the essential documents you need to keep on hand:

- Complete Broker Statements: Download every single monthly and annual statement. These need to show a full history of your trades, commissions, fees, and the resulting profit or loss.

- Bank Account Records: Keep statements for all local and international bank accounts you use to fund your trading and receive withdrawals. This is how you prove the flow of funds.

- Trade Confirmations: For larger or more complex trades, individual confirmation slips can provide the granular detail needed to clarify a specific transaction.

- ZAR Conversion Spreadsheet: You’ll need a detailed log showing the ZAR calculation for the opening and closing of every single trade, using the official SARS average exchange rates.

- Invoices for Expenses: Got a cost you want to claim? Keep the receipt. This includes things like platform subscriptions, data feeds, or any professional training courses.

Key Takeaway: Your goal is to build a financial narrative so complete that it’s unchallengeable. An auditor should be able to pick up your file and trace every rand from your bank account to your broker, through each trade, and back again, without hitting a single dead end.

How to Declare Your Profits on the ITR12

Once you've calculated your net profit or loss in ZAR for the tax year, it’s time to declare it on your annual ITR12 tax return. You won’t find a box specifically labelled "Forex Profits." Instead, you'll declare this income under the "Local Business, Trade and Professional Income" section of the return.

The figure you enter here is your final, calculated net profit after you’ve subtracted all allowable expenses. You don’t need to submit your massive spreadsheet of trades with the return itself, but you must have it ready to send at a moment’s notice if SARS requests it for verification. This is precisely why getting organised beforehand is so crucial.

For businesses, this whole process is integrated into your corporate income tax return (ITR14). While the principles of meticulous record-keeping are the same, the need for clear internal controls and documented financial governance is even greater. Strong systems ensure your company’s financial reporting is always accurate, compliant, and ready for scrutiny.

Common Mistakes to Avoid When Filing Forex Taxes

Let's be honest, figuring out the tax on your forex trading in South Africa can be a headache. But a few common slip-ups can turn that headache into a serious financial migraine. Getting a handle on these pitfalls is your best defence against unnecessary stress and, more importantly, a hefty bill from SARS.

The biggest mistake? Simply not declaring your profits. It's a surprisingly common myth that money made with an international broker is somehow off SARS's radar. That’s a dangerous assumption. As a South African tax resident, you’re liable for tax on your worldwide income, and SARS has robust agreements with global tax authorities to share information.

Make no mistake: failing to declare your profits isn't just an oversight; it's tax evasion. The penalties can be severe, racking up back-dated interest and, in serious cases, even leading to criminal charges. It's always, always better to be upfront.

Getting the Classification and Losses Wrong

Another classic error is misclassifying your trading activity. Many traders hope to pay the lower Capital Gains Tax rate, but if you're making frequent, short-term trades, you're running a business in the eyes of the taxman. SARS will treat your profits as income, and you'll be taxed accordingly. Filing under the wrong category will only lead to a nasty surprise down the line.

Tied to this is the tricky business of offsetting losses. A lot of people think they can just deduct any trading losses from their monthly salary. It's not that simple.

- The Salary Offset Trap: SARS can "ring-fence" your trading losses, especially if you're a high-income earner or have a history of losses. This means you can only use those losses to reduce future trading profits, not your primary income.

- You Need Proof: If you want to claim a loss against other income, the onus is on you to prove you had a genuine intention to make a profit. That means having a solid trading plan and meticulous records to back it up. Without that, SARS will likely dismiss your claim.

Sloppy Records and International Broker Blind Spots

Finally, the most common—and easily avoidable—mistake is just plain poor record-keeping. If you don't have a detailed log of every single trade, including the ZAR exchange rate on the day you opened and closed it, how can you possibly calculate your true profit or loss? You can't. And you'll have nothing to stand on if SARS decides to audit you.

Using an international broker without knowing your local obligations is another trap. It’s entirely on you to:

- Convert all your transaction data into ZAR using the official SARS average exchange rates.

- Make sure you've used the correct exchange control allowances (your Single Discretionary Allowance or Foreign Investment Allowance) to fund your account in the first place.

By steering clear of these common blunders, you can approach your tax return with confidence, knowing your affairs are in order and you’ve met all your obligations to SARS.

Got Questions About Forex Trading Tax? We’ve Got Answers.

Even when you think you have a handle on the rules, forex trading tax in South Africa can throw some real curveballs. Let's tackle some of the most common questions that pop up for traders and businesses, clearing up the grey areas.

Can I Deduct My Forex Trading Losses in South Africa?

That all comes down to how SARS sees your trading. If you’re trading as a full-blown business, then yes, you can typically deduct your net trading losses against other income, like your salary. This is a big deal as it can seriously lower your overall tax bill for the year.

But there’s a catch. SARS has a tool called "ring-fencing," which they can use, especially if you're a high-income earner or if your trading seems to consistently lose money.

When your losses get ring-fenced, you can't subtract them from your salary anymore. Instead, you have to carry them forward and use them only to offset future profits from your trading. The best way to avoid this is to keep meticulous records that prove you genuinely intended to make a profit.

Do I Have to Pay Tax on Profits From an International Broker?

Yes, you absolutely do. If you are a South African tax resident, you're taxed on your income from all over the world. It doesn’t matter one bit if your broker is in Johannesburg or London—those profits have to be declared to SARS.

It’s on you to convert every gain and loss from foreign currencies (like USD or EUR) into South African Rand (ZAR). For your tax return, you must use the official SARS average exchange rates for that specific tax year to get the numbers right.

How Would SARS Even Know I'm Trading Forex?

Hoping to fly under the radar is a strategy that’s pretty much guaranteed to backfire. SARS has some serious muscle when it comes to finding undeclared offshore income, thanks to powerful tools and international agreements.

Their main weapon is the Common Reporting Standard (CRS). This is a global pact where tax authorities automatically share financial information with each other. Because of the CRS, SARS gets data from banks and brokers in other countries, including details about accounts held by South African residents. They can see the money flowing in and out of your international brokerage accounts. Trying to hide your profits isn’t just risky—it’s a fast track to audits, heavy penalties, and interest charges that go all the way back.

For businesses juggling international payments and forex, keeping things clear for tax time is non-negotiable. A platform like Zaro cuts through the confusion by using real exchange rates, which means no hidden bank markups. This ensures your records are clean and accurate, making SARS compliance much simpler. You can get a handle on your cross-border finances at https://www.usezaro.com.