Trading commodities gives exporters and investors a way to buy or sell raw materials—grains, metals and energy—turning unpredictable markets into more predictable cash flows.

As a South African exporter, mastering these trades can protect your margins and fund growth.

Why Commodity Trading Matters

This guide uses real-world stories and concrete examples to show how commodity markets cushion your business against volatile price swings. You’ll follow a grain farmer who locks in prices long before planting season and discover how hedging converts uncertain forecasts into steady income.

Section Roadmap

- Market Mechanics: How supply, demand, spot deals and futures contracts set prices.

- Hedging Strategies: Like reserving a hotel at today’s rate to fix your costs.

- Trading Instruments: From forwards and futures to options and swaps.

- Risk Management: Margin calls, compliance checks and governance controls.

Hedging is like pre-booking accommodation at a fixed rate—to shield you from sudden price hikes.

South Africa’s openness to trade has hovered around 60–65% of GDP, underlining the outsized role commodities play in our economy. Learn more on the World Bank Indicator for Trade Openness.

From unpacking market basics to selecting instruments, building your strategy and navigating local compliance, you’ll finish this guide with a clear action plan tailored to your export profile and growth targets.

Key Benefits

- Stabilise Revenue: Lock in sale prices ahead of market swings.

- Cash Flow Visibility: Forecast income with greater confidence.

- Competitive Advantage: React faster to global price signals.

Next, we explore fundamental market actors—producers, consumers and speculators—before diving into the instruments exporters rely on most. Finally, we’ll tackle practical strategies, risk-management tools and compliance essentials so you can trade commodities with clarity and confidence.

Understanding Key Concepts

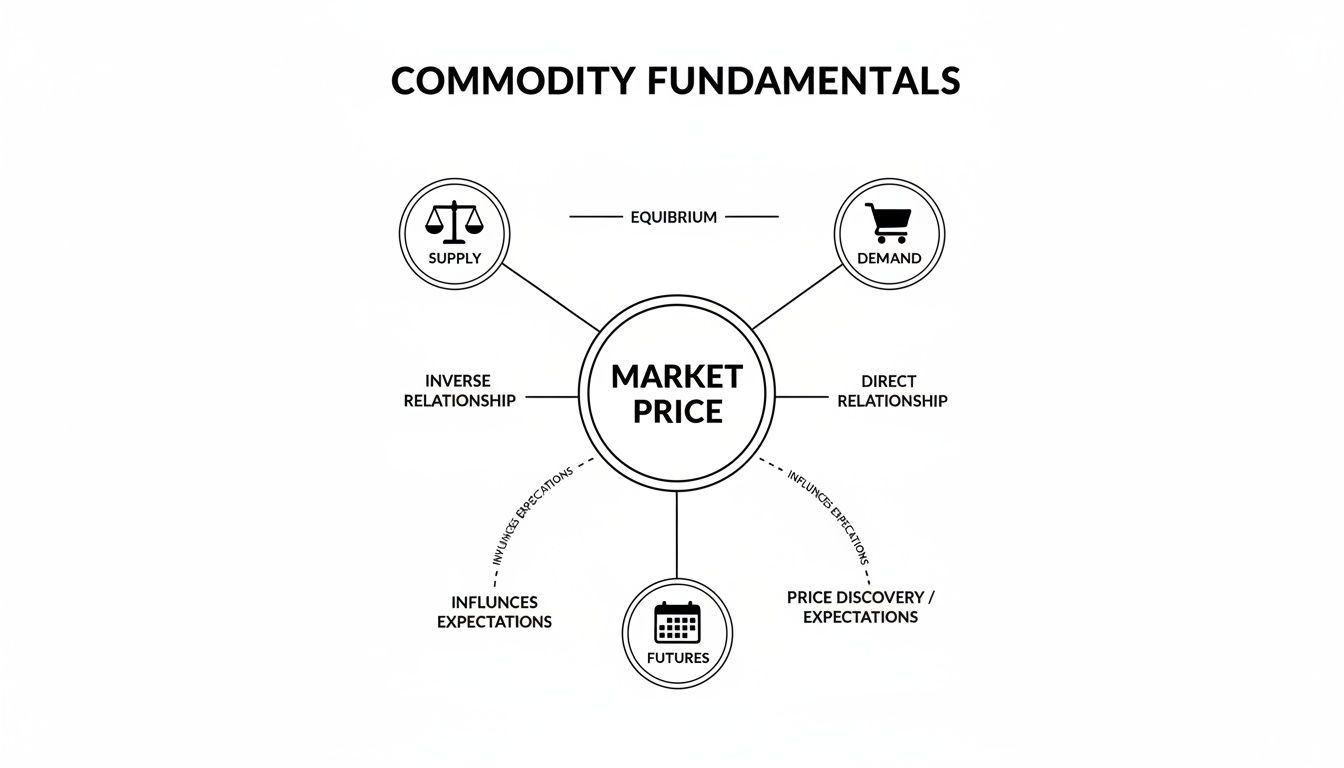

Commodity markets pivot on supply and demand forces, which set daily price benchmarks.

Spot trades settle immediately, while futures contracts lock in a price for delivery at a later date. Exporters rely on this gap to manage unpredictable revenue swings.

- Spot Trade Example: A miner sells gold at today’s rate for immediate delivery.

- Futures Contract: A farmer agrees now to deliver maize in three months at a fixed rand price.

Think of hedging as pre-booking a hotel room at today’s rate to dodge higher costs down the line.

By hedging, you freeze costs and protect your margin. If you lean toward speculation, you’re betting on price movements instead. That choice shapes your entire risk profile.

A maize producer might secure a rand price today to guarantee cash for new equipment. Another exporter could wait, hoping for a rally and bigger returns.

Supply Demand And Price

Price swings often start with supply gluts or shortages. When metal output surges, values tend to dip; a drought, by contrast, can send grain prices soaring.

Producers scan weather forecasts, while traders monitor inventory data. And when you’re exporting in rand, currency shifts add another layer of volatility.

Quality Grades Delivery Terms

Every commodity carries its own quality grades and delivery conditions. For example, platinum rated at 95% purity commands a premium over a 90% grade.

Delivery terms dictate who pays for what. Under FOB (Free On Board), the seller covers expenses up to port loading. With CIF (Cost Insurance and Freight), insurance and freight costs fall on the seller.

- FOB: Seller’s liability ends once cargo is on board.

- CIF: Seller arranges and pays for insurance plus freight to destination.

Practical Example

Imagine a steel mill importing iron ore on CIF terms. If ocean freight spikes, the mill’s landed cost jumps and margins shrink.

By switching to FOB, the mill takes control of logistics—selecting carriers and routes to manage costs. It’s a simple shift with big strategic impact.

Index Volatility Measurement

Indices like the Unit Value Index (UVI) chart price movements over time. According to Statistics South Africa, the Unit Value Index for exported commodities was 106.1 in December 2022, down 3.6% from November. The decline was driven by metal products, machinery and equipment (-3.1 percentage points), and ores and minerals (-0.7 percentage points). Learn more about the Unit Value Index findings

Grasping these fundamentals builds the confidence needed to choose the right instruments and strategies. Once these concepts click, exporters can structure effective hedges or take measured speculative positions. That practical understanding is the foundation of smarter commodity trading.

Market Participants And Instruments

Commodity markets bring together a variety of players, each with their own objectives and strategies. For South African exporters, recognising these roles is the first step towards crafting a successful trading approach.

- Producers supply the raw materials—from grains on a farm to minerals from a mine—shaping both grade and available volume.

- Consumers such as processing mills or smelters convert those inputs into finished goods, absorbing the flow of commodities.

- Speculators ride price swings using margin rather than taking delivery, hoping to turn volatility into profit.

- Arbitrageurs spot price gaps between markets, locking in risk-free returns when differences emerge.

- Brokers & Clearing Houses link buyers with sellers, ensure contracts settle smoothly and mitigate counterparty risk.

Understanding who does what helps you decide whether you’re hedging export revenues or seeking short-term gains.

On Exchange Versus OTC Platforms

On-exchange venues such as the Johannesburg Stock Exchange (JSE) offer centralised order books and transparent pricing. Here, everyone sees the same real-time bid/ask spreads and volume metrics, which support both risk management and price discovery.

In contrast, OTC platforms allow bespoke contracts with flexible terms. That freedom means exporters must manage bilateral risk—no clearing house stepping in if the other side can’t pay.

Instruments And Real Life Scenarios

Before locking in a deal, you need to pick the right tool. Below is a side-by-side look at the core instruments and how they fit into various strategies.

Comparison of Commodity Trading Instruments

| Instrument | Description | Common Uses |

|---|---|---|

| Forwards | Customised bilateral contract locking in a price for future delivery | Exporters fixing rand revenue |

| Futures | Standardised, exchange-traded contract with daily margining | Hedge large volumes and roll positions forward |

| Options | Right (but not obligation) to buy or sell at a set strike price | Cap downside while retaining upside potential |

| Swaps | Exchange of cash flows tied to commodity price indices | Swap floating market rates for fixed cash flows |

By now, you should see how each instrument aligns with specific goals. For instance, an exporter might use a forward to guarantee a rand price on a maize shipment. Meanwhile, a metals trader could buy a call option, anticipating a 20% rally in spot prices.

Choose the contract that matches your risk appetite and business objectives—this is how you bring predictability into the world of commodity trading.

Trading Strategies For Exporters

A forward contract is like booking a hotel room now for a stay months ahead. By fixing the price today, you protect your margin against sudden dips in the spot rate. In other words, you swap uncertain market moves for guaranteed rand receipts.

Forward Contracts And Margin Requirements

- Contract Size depends on your shipment volume and the commodity grade.

- Locked Price is the rand amount per tonne agreed when you trade.

- Initial Margin on forwards is typically zero, though credit checks apply.

- Settlement takes place at delivery or via a cash offset, so your revenue is secure.

However, if prices rally sharply, simple forwards leave you on the sidelines. That’s when futures spreads come into play.

Futures Spreads

Futures spreads bundle two contracts to capture changes in price differentials. Imagine you buy a December maize contract while selling March—you’re speculating on the carry between those months rather than outright direction.

- Lower Margin than outright futures

- Limited Directional Risk, focusing on the curve itself

- Daily Mark-to-Market with potential maintenance calls

“Spread trades let you profit from shifts in the price curve without full exposure,” says a JSE broker.

Beyond single-commodity plays, you can mix wheat and corn spreads to hedge local crop swings while staying tuned to broader markets. Next, you can roll these positions across harvest cycles.

Rolling Futures Across Harvest Cycles

- Enter a June wheat futures position before harvest at R3 500/tonne.

- Close that position in May to realise any gains or losses.

- Open December futures for the next season at prevailing rates.

- Adjust volume if crop forecasts shift, keeping margin calls in check.

| Action | Price Level | Margin Call |

|---|---|---|

| Open June | R3 500 | R2 000 |

| Close May | R3 600 | Zero |

| Open Dec | R3 650 | R2 100 |

This step-by-step routine extends your hedge across seasons and dovetails with your export schedule. From here, options strategies can add asymmetric risk control.

Options let you cap your downside while still enjoying any upside.

- Put Spreads: Buy a higher-strike put and sell a lower-strike one to reduce the premium.

- Call Overlays: Acquire calls above current spot to benefit if prices surge.

- Collars: Combine puts and calls to lock in a defined price corridor.

Currency Hedging Techniques

Sharp swings in the rand–dollar rate can erode export margins. To limit FX risk, exporters often:

- Lock in forward forex at the current spot rate with zero spread

- Use currency options to cap rand weakness

- Sync commodity and FX hedges so they share the same expiry date

Working with a modern payments partner like Zaro ensures your export earnings settle in rand or USD with no hidden spreads.

Protecting margins and managing currency risk underpin a predictable cash flow.

Use Zaro to manage your margin payments and hedging expenses seamlessly.

Visit Zaro to learn how seamless cross-border payments integrate with your commodity hedging workflows.

Start optimising exports today safely.

Managing Risks And Compliance

Risk management keeps your commodity trades on track. By breaking down market risk, credit risk and operational risk, you’ll spot trouble before it escalates. That way, you can put controls in place and carry on with confidence.

Below is a quick overview of common risks and how to tame them:

Risk Types And Mitigation Strategies

Here’s an at-a-glance table to map your key risks against proven safeguards. Use it as a starting point for building your own controls.

| Risk Type | Description | Mitigation |

|---|---|---|

| Market Risk | Price swings that eat into margins. | Hedge with forwards or futures. |

| Credit Risk | Counterparty failing to pay on time or at all. | Run credit checks and require margin deposits. |

| Operational Risk | Internal errors or process breakdowns. | Implement strict controls and schedule regular audits. |

By flagging these risks early, you can adapt your strategy, protect your bottom line and keep exporters moving forward.

Counterparty Checks And Margin Calls

Before you lock in a deal, vet your buyer thoroughly. A quick review of their credit score and payment history cuts the chance of nasty surprises.

Use margin calls as a pressure valve when prices shift too fast:

- Verify KYC documents and a valid trade licence at the outset.

- Tie margin thresholds to recent volatility so they flex when markets do.

- Automate notifications the moment collateral drops below your limit.

The screenshot below shows live JSE commodity indices and volume metrics.

These figures spotlight daily open interest trends and help you plan margin calls with precision.

Regulatory Reporting And AML Measures

Compliance in South Africa isn’t optional. You’ll need to follow SARB and FSB guidelines to the letter.

File your SARB reports every month and your full FSB returns once a year. Meanwhile, robust AML checks keep illicit funds out of your supply chain.

- Register with JSE or another approved OTC platform before trading.

- Submit monthly commodity positions to SARB using form COM2.

- File the annual FSP return with FSB.

- Screen all counterparties and staff for AML compliance.

“Integrating risk controls with real-time data cuts margin defaults by 35%,” says a senior compliance manager.

Round out your framework with quarterly internal audits. They help you catch gaps before they become costly.

Keeping risk and compliance in lockstep gives you a rock-solid foundation. That stability protects both revenue and reputation, so you can scale your export game with confidence.

Next up: run scenario drills and tabletop exercises to stress-test your procedures. After each export batch, review counterparty performance and reporting accuracy. This ongoing feedback loop ensures your trading operations stay calibrated and compliant.

Partnering with Zaro simplifies margin controls and reporting.

Benefits, Opportunities And Action Plan

Entering the commodities market can feel like adding an insurance policy to your export business. It helps smooth out the peaks and troughs in revenue, giving you more predictability.

To illustrate this, imagine a maize farmer who locks in a grain price before harvest. That agreement fixes future income and turns budgeting into a straightforward exercise.

- Price Hedging locks in a selling price today so a downturn won’t erode your margin.

- Enhanced Forecasting shines a light on future cash flows by securing revenue streams.

- Opportunity Capture opens the door to extra gains when prices spike unexpectedly.

Key Growth Sectors

Focusing on niche commodities is like picking the ripest fruit—when shortages hit, returns can be surprisingly large.

- Precious Metals act as a financial anchor, drawing investors when uncertainty rises.

- Critical Minerals, such as lithium and cobalt, form the backbone of the renewable-energy revolution.

- Agricultural Goods, from maize to soy, ride the wave of global population growth.

In October 2025, South Africa’s merchandise exports climbed to R192.183 billion, resulting in a trade surplus of R15.581 billion against imports of R176.602 billion. These figures underscore the country’s deep roots in commodity trade. Read more about these statistics in the SARS report here.

Action Plan Checklist

- Assess Your Export Exposure to pinpoint commodity and currency vulnerabilities.

- Select The Right Financial Instruments, whether forwards, futures or options.

- Define Governance Protocols for approvals, risk limits and regular reporting.

- Forge Relationships with trusted brokers or clearing houses to ensure swift execution.

- Implement Ongoing Market Monitoring so you can tweak your strategy as prices shift.

This practical roadmap helps you transform commodity trading from a guessing game into a reliable growth engine.

Continuous Improvement

Review your hedging approach at regular intervals to keep pace with shifting markets.

Refine your action plan based on performance data and emerging opportunities.

Start drafting your first trade.

Place the order.

Then mark your calendar for the day you celebrate another year of export success.

Frequently Asked Questions

How Does Hedging Protect Export Revenues?

Hedging locks in a sale price today for goods you’ll export later. If maize prices plunge after harvest, your rand receipts won’t budge. It’s like buying insurance on your budget—sudden market swings can’t derail your growth plans.

Which Instruments Suit Small-Scale Exporters?

Forwards are straightforward: you agree a rate, there’s no premium, and you know exactly what you’ll receive. Options cost a bit upfront but spare you margin calls while still letting you profit if rates move in your favour.

- Forwards require no advance payment, making them cost-effective.

- Options involve an upfront premium but eliminate surprise margin calls.

- Swaps can merge currency and commodity hedges, evening out cash flows.

“Options cap your downside while letting you ride price rallies,” says a seasoned commodity adviser.

Comparing Futures And Options

What Are The Cost Implications Of Futures Versus Options?

Futures charge lower transaction fees but demand daily margin calls if markets turn against you. Options ask for a premium up front yet free you from further collateral calls. Your choice hinges on cashflow comfort and risk tolerance.

| Feature | Futures | Options |

|---|---|---|

| Fees | Low | Premium Paid Up Front |

| Margin Call | Daily | None After Purchase |

| Flexibility | Fixed Obligation | Optional Execution |

Both tools can serve you well; weigh your willingness to handle margin calls against the cost of a premium.

How Do Regulatory Requirements Affect Commodity Trading In South Africa?

Trading on the JSE or an approved OTC platform means you must register and report on time. Monthly returns go to the SARB, and you submit an annual return to the FSB. Think of it as routine maintenance to keep your trading engine running smoothly.

- Submit Form COM2 to the SARB detailing your open positions.

- File the FSP Return to the FSB each year.

- Carry out AML checks on every counterparty before trading.

These steps ensure you stay compliant without derailing your operations.

Practical Tips For Traders

- Keep clear, dated logs of every contract and margin call.

- Schedule calendar reminders for all SARB and FSB submissions.

- Use real-time dashboards to monitor positions around the clock.

A well-structured compliance workflow cuts surprises and shields your export revenue.

Ready to optimise your export hedging process? Start today with Zaro for transparent, cost-effective cross-border payments. Visit Zaro