Receiving an invoice in a foreign currency can feel a bit like a gamble, with your profits at the mercy of the ever-shifting Rand. But getting a handle on trading forex basics isn't about high-risk speculation. It's about taking back control of your business's finances and protecting your bottom line.

Why Forex Basics Matter For Your Business

Picture the foreign exchange (forex or FX) market as a massive, non-stop global bazaar. Instead of trading goods, people are buying and selling the world’s currencies. If your South African business pays overseas suppliers, receives payments from international clients, or manages a global team, you're already a player in this market, whether you realise it or not.

Every time you pay a US Dollar invoice or a European client pays you in Euros, you're making a forex trade. The real question is: are you getting a good deal?

The Hidden Costs in Currency Exchange

For years, businesses have defaulted to their banks for these kinds of transactions. It’s the familiar route, but it's often riddled with hidden costs and murky pricing. Banks typically add a significant markup to the actual exchange rate and layer on various fees that quietly chip away at your revenue.

This isn't just pocket change. A seemingly small percentage difference in the rate can mean losing thousands of Rands on a single large payment, directly hitting your profitability.

Understanding the fundamentals of forex helps you spot these hidden costs. Think of it as a core business skill—one that protects your capital and helps you stay financially sound in an interconnected world. And for a business in South Africa, this is especially important.

Our country is Africa's undisputed forex trading hub, with daily trading volumes topping a massive $2.21 billion. With around 190,000 active traders each day, it’s a dynamic centre for both individuals and institutions. You can learn more about Africa's top trading nations to see just how big this market really is.

The good news is that you no longer have to be a passive participant. Modern fintech solutions now give businesses a direct line to the forex market, offering far more cost-effective options and putting the control firmly back in your hands.

Mastering The Language Of Forex Transactions

To manage international payments effectively, you have to speak the language of the market. A lot of the confusing forex jargon feels like it's designed to obscure costs, but once you learn a few key terms, you can go from being a price-taker to an informed financial manager. This knowledge is your first real defence against the hidden fees that quietly eat into your profits.

At the core of every forex transaction is a currency pair. Think of it simply as a price tag. When you see USD/ZAR, it’s telling you exactly how many South African Rands (ZAR) it costs to buy one US Dollar (USD). This isn't just abstract theory; it's the real-world calculation behind every international invoice you pay or receive.

The Smallest Movements With The Biggest Impact

Currency pairs don't sit still; they're constantly on the move. These tiny fluctuations are measured in pips, which is short for "percentage in point." A pip is usually the smallest price change a currency pair can make. For most pairs, including the USD/ZAR, it’s the fourth decimal place (0.0001).

While a single pip might seem tiny and irrelevant, its financial impact grows dramatically with the size of your transaction. For example, a shift of just a few pips on a R500,000 payment to an overseas supplier could change your final cost by hundreds, if not thousands, of Rands. This is precisely why the exchange rate you're quoted deserves your full attention.

The real cost of a forex transaction is rarely the "fee" you see upfront. The most significant expense is often hidden inside the exchange rate itself, through something called the spread.

Uncovering The Spread: The Real Cost Of Exchange

The spread is the difference between the price a broker or bank will buy a currency from you (the bid price) and the price they will sell it to you (the ask price). This gap is their profit margin, and it's a cost passed directly onto your business.

Let's say the real, mid-market rate for USD/ZAR is 18.2050. Your bank might offer to sell you dollars at 18.2550 but only buy them back from you at 18.1550. That entire gap is the spread—a hidden fee that almost never appears on your transaction statement.

By getting comfortable with these terms, you gain the power to properly analyse any quote you receive. You can start asking sharper questions and find financial partners who offer genuine transparency, not just clever marketing. This shift in understanding is the first, most crucial step toward cutting your foreign exchange costs and boosting your company's bottom line.

Understanding Leverage And Managing Currency Risk

Leverage and risk are two sides of the same coin in the world of forex. While the term "leverage" might conjure up images of high-stakes trading, the principle behind it is incredibly important for any business that handles international payments.

Think of it like putting a deposit down on a house. You use a relatively small amount of your own money to control a much larger asset. In forex, leverage means you can open a large currency position with only a small amount of capital in your account. This has the effect of amplifying potential gains, but just as easily, it can magnify your losses.

Speculative traders use leverage to chase bigger profits, but for a business, its real value is in what it teaches us about risk. To really get to grips with this, a clear explanation of What is Leverage in Forex is essential, as it highlights both the power and the significant dangers.

From Speculation to Practical Risk Management

For a South African business, the goal isn't to use leverage for speculation. It's about defending against the currency risk that leverage brings into sharp focus. This is a risk your company faces every day.

Imagine you've just closed an export deal to the US worth thousands of dollars. In the time it takes for the payment to clear, a sudden drop in the ZAR/USD exchange rate could wipe out a chunk of your profit before the money even hits your account.

The reverse is also true. If you're paying an international supplier in Euros, an unexpected weakening of the Rand means that invoice will suddenly cost you far more than you budgeted for. This kind of volatility is a constant headache for financial planning and stability.

The heart of managing currency risk for a business isn’t about trying to predict where the market is going. It’s about creating certainty in your costs and revenues, no matter what the market does.

Your Best Defence is Cost Transparency

So, how do you protect your business from these swings? The smartest approach is to control the variables you actually can. Your best line of defence against market uncertainty is to work with a financial partner who provides completely transparent and predictable FX rates.

When you get access to the real exchange rate—without hidden spreads or surprise markups—you remove a massive layer of unpredictable costs. This gives you the power to:

- Budget with confidence, because you know the exact Rand cost of your international payments.

- Protect your profit margins from being eaten away by sneaky fees and unfavourable rates.

- Create financial stability by taking the guesswork out of your international cash flow.

Ultimately, understanding the basics of forex for your business isn't about chasing speculative gains. It’s about building a solid defence against financial uncertainty. That journey starts by demanding transparency and choosing partners who help you manage risk, not add to it.

How The Global Forex Market Actually Works

Unlike a stock exchange, the foreign exchange market isn't a physical building or a single entity. It’s a massive, decentralised web of banks, institutions, and traders all connected electronically, running 24 hours a day, five days a week. Grasping how this complex network is structured is key to understanding why your business might be paying more than it should for international transactions.

At the top of the food chain, you have the giants: central banks like the South African Reserve Bank (SARB) and the world’s largest commercial banks. They trade enormous currency volumes directly with one another, establishing the "interbank" rates you often see on the news.

Just below them are the smaller banks and financial institutions. They get their currency from the big players, but not before adding their own markup or "spread". This layered system means that by the time a rate reaches a small or medium-sized enterprise (SME), it has passed through several hands, with each intermediary taking a cut. That's precisely why the final cost gets inflated.

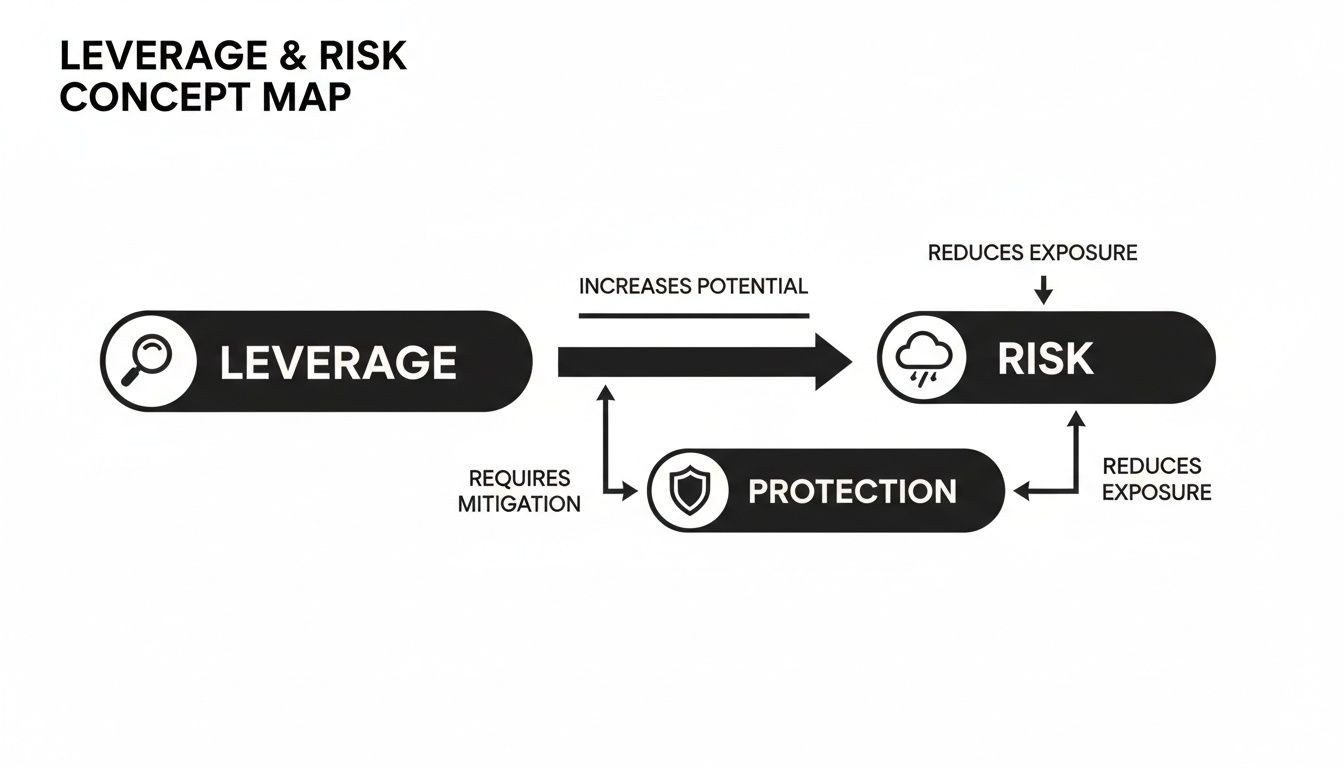

This concept map illustrates the delicate balance between using leverage, the risk it introduces, and the strategies needed to protect yourself.

It highlights a critical lesson: while leverage can amplify your financial power, it absolutely must be paired with solid risk protection to keep you safe.

Taking Control With The Right Tools

Knowing how the market is built is the first step. The next is to use its tools to your advantage—not as a speculator, but as a smart financial manager for your business. This is where getting to grips with a few basic order types can completely change how you handle your currency needs, shifting from being reactive to proactive.

Two order types are particularly powerful for any business dealing with foreign currencies:

- Market Order: This is the most straightforward instruction. You’re telling your provider to exchange your currency right now, at the best price available in that instant. It’s all about speed.

- Limit Order: This is a much more strategic move. You set a target exchange rate—one that’s better for you—and your order will only be filled if and when the market hits that price.

Let’s say you have a $50,000 invoice to pay a supplier in three weeks. Instead of just taking today’s rate, you could place a limit order. This tells your provider to automatically buy those dollars only if the Rand strengthens to your specified level. Suddenly, market volatility isn't just a threat; it's a potential opportunity.

This forward-thinking approach is especially important in a market as dynamic as ours. The South African foreign exchange market hit a staggering USD 3,861.60 million this year and is forecast to reach USD 6,852.50 million by 2033, fuelled by growing trade and investment. You can explore the full research on the South African FX market to see just how massive these currency flows are.

By understanding the market’s inner workings and using the right tools, you stop being a passive price-taker. You become an active manager of your company's currency exposure, turning a necessary cost into a part of your financial strategy.

Putting Your Forex Knowledge Into Practice

Getting to grips with the theory of currency exchange is one thing, but the real power comes from putting that knowledge to work for your business. This isn't about becoming a high-stakes day trader. It's about applying the fundamentals of trading forex basics to shield your profits, streamline your cash flow, and cut down on the hassle of international payments.

The best place to start is with a quick audit of your current forex process. Dig out the statements from your last few big international payments. Ignore the obvious "transfer fees" for a moment and zero in on the exchange rate you were actually given. Then, compare that rate to the mid-market rate for that specific day. The gap between the two is the hidden cost of the spread.

This simple exercise is often an eye-opener. It usually reveals that the biggest chunk of your FX cost isn't in the fees you see on the invoice, but in the less-than-ideal rate you’re getting. This lack of transparency slowly but surely eats away at your bottom line.

Auditing Your Real FX Costs

Let's walk through a common business scenario to see exactly how this plays out. Imagine your South African business has to pay a supplier in the US an invoice for $50,000. We'll look at two very different ways of handling this payment.

- Scenario 1: The Traditional Bank: You call your bank, and they quote you a USD/ZAR rate. This rate already has their markup (the spread) baked in, on top of which you'll pay a standard international transfer fee.

- Scenario 2: The Modern Fintech: You use a platform like Zaro that gives you access to the live, mid-market exchange rate without any hidden spread. You only pay a small, clearly stated transaction fee.

Now, let’s crunch the numbers and see the real-world difference.

| Cost Component | Traditional Bank Approach | Modern Fintech Approach (e.g., Zaro) |

|---|---|---|

| Exchange Rate | Mid-market rate + 2% spread | Real mid-market rate (zero spread) |

| Hidden Markup Cost | Approx. R18,200 on a $50,000 payment | R0 |

| Transaction Fee | Fixed fee (e.g., R500) | Small, transparent fee (e.g., 0.5%) |

| Total Payment Cost | Often unpredictable and inflated | Predictable and significantly lower |

In this example, the hidden spread alone costs the business over R18,000 on a single transaction. Over the course of a year, these hidden costs can easily add up to tens or even hundreds of thousands of Rands in lost profit.

Strategic Timing and Economic Stability

Beyond just trimming costs, managing forex effectively involves a bit of strategic timing. This isn't about trying to perfectly predict market movements—that's a fool's game. Instead, it's about being aware of major economic events, like interest rate announcements or new inflation data, that are known to cause a stir in the ZAR.

A country’s overall financial health is the backdrop to all of this. For instance, South Africa's gross foreign exchange reserves recently hit a record high. For anyone learning the basics of forex trading, these reserves act as a crucial stability anchor. They give the South African Reserve Bank (SARB) the firepower to step into the market and prevent wild swings in the ZAR—a huge benefit for businesses managing currency pairs like USD/ZAR. You can read more about South Africa's forex reserves to get a deeper understanding.

By simply having a clear picture of your FX costs and a basic awareness of what moves the market, you can start planning your large payments to sidestep periods of major uncertainty. This proactive approach turns currency management from a reactive, expensive headache into a genuine strategic advantage, giving you far more control over your company’s financial future.

Frequently Asked Questions About Forex For Businesses

Diving into the world of foreign exchange can bring up a lot of questions, especially when your company’s money is on the line. Getting clear, straightforward answers is essential. Below, we address some of the most common queries we hear from South African business leaders trying to get a handle on their international payments.

These are practical insights, designed to reinforce the core ideas of transparency and control we've covered. The goal isn’t just to understand the basics of forex trading, but to actually apply that knowledge to protect your bottom line.

What Is The Biggest Forex Mistake South African SMEs Make?

Hands down, the most common and expensive mistake is passively accepting whatever exchange rate your traditional bank offers, no questions asked. Those rates almost always have a hidden markup, the spread, baked into them, on top of any other fees you're told about.

This lack of transparency quietly eats away at your profit margins with every single international payment. By not seeing the gap between the real market rate and the rate they receive, businesses can lose a staggering amount of money over time. The solution is to demand clarity and find a partner that gives you direct access to real-time market rates.

The most powerful shift a business can make is moving from being a passive price-taker to an informed financial decision-maker. This begins with questioning the rates you are given and seeking out truly transparent alternatives.

How Can My Business Protect Itself From ZAR Volatility?

While there are complex financial hedging tools out there, the most effective strategy for an SME is to focus on what you can actually control. First up, you can eliminate unpredictable costs by choosing a foreign exchange provider that offers zero spreads and crystal-clear fees. This immediately gives you a stable, predictable cost base for every transaction.

Secondly, you can use your basic market knowledge to time your transactions better. For instance:

- Plan Around Key Announcements: If you know the ZAR often gets choppy around major economic news releases, you can try to schedule your currency conversions before or after those events.

- Use Multi-Currency Accounts: Holding funds in different currencies means you can convert them only when the exchange rate is more favourable for your business, rather than being forced to exchange on a specific day just to pay a bill.

Do I Need To Become A Forex Trader To Manage Payments?

Absolutely not. The goal for a business owner or financial manager isn’t to speculate on tiny currency movements to turn a profit. Your job is to manage your business's transactions with maximum efficiency and minimum cost.

That said, understanding the fundamentals of forex—what moves exchange rates, where the costs are hidden, and how the market really works—is critical. This knowledge transforms you from a passive participant into an informed decision-maker. It gives you the power to pick the right financial partners, question unfair fees, and ultimately shield your business from unnecessary costs and risk.

Ready to stop losing money on hidden fees and unpredictable exchange rates? With Zaro, you get access to the real, mid-market rate on all your global payments, with zero spread and zero SWIFT fees. See how much your business can save by taking control of your international transactions. Visit https://www.usezaro.com to get started.