If you've ever had to send money internationally for your South African business, you know the drill. It often feels like you're navigating a labyrinth of high bank fees, confusing exchange rates, and frustratingly slow processing times. The old-school way to transfer funds abroad is just plain inefficient. Thankfully, modern fintech platforms like Zaro are offering a much faster, more transparent, and seriously cheaper way to get things done.

The Modern Way to Transfer Funds Abroad

For decades, South African businesses were stuck with the big banks for international payments. We just accepted the hidden markups on exchange rates and the week-long delays as "the cost of doing business." The whole process was a black box, leaving finance teams guessing the final cost until the money finally landed.

This isn't just a local headache; it's a recognised problem across the continent. Cross-border payment systems in sub-Saharan Africa are notorious for their high costs and lack of transparency. It's an issue that leaders like SARB Governor Lesetja Kganyago are actively trying to fix through better regional cooperation.

Why Fintech Is a Game-Changer

This is where financial technology platforms really shine. They were designed from the ground up to solve these exact frustrations. Instead of relying on the slow and clunky SWIFT network that bounces your money between several intermediary banks, they use smarter, more direct payment routes.

What does this actually mean for your business? A lot, it turns out.

- You get the real exchange rate. No more hidden spreads gobbling up your profits. You see the mid-market rate, so more of your rands turn into dollars, euros, or whatever currency you need.

- Fees are upfront and clear. With a service like Zaro, the price you see is the price you pay. Say goodbye to surprise SWIFT fees and other random charges that pop up on your bank statement.

- Your money moves fast. We're talking payments arriving in as little as one business day, not the 3-5 days that's typical with a traditional bank transfer.

The real magic of fintech is how it cuts out all the expensive and slow middlemen. That efficiency translates directly into real cost savings and much healthier cash flow for your business.

Let's look at a quick comparison to see how the two approaches stack up.

Traditional Banks vs Modern Fintech for International Transfers

| Feature | Traditional Banks | Zaro |

|---|---|---|

| Exchange Rate | Often includes a hidden markup or spread | Mid-market rate with full transparency |

| Fees | Multiple fees (SWIFT, intermediary, receiving) | One low, upfront fee. No SWIFT fees. |

| Speed | Typically 3-5 business days or longer | Often as fast as 1 business day |

| Transparency | Low. Final cost and arrival time are often unclear | High. You know the exact cost and timeline upfront |

| Process | Can involve paperwork and branch visits | Fully online, simple digital process |

The difference is pretty stark. As the world moves faster, financial institutions have to keep up. You can read more about recent trends in digital innovation in the banking sector to see just how quickly things are changing.

At the end of the day, choosing a modern platform to transfer funds abroad is about swapping an outdated system for one that's actually built for the realities of today's global economy.

How To Send International Payments with Zaro

Switching your business to a modern payment platform like Zaro takes all the usual headaches out of trying to transfer funds abroad. Forget about stacks of paperwork and long queues at the bank; now, you can handle everything online in just a few minutes.

Let's walk through exactly what it looks like to send money internationally with Zaro, from the initial setup to watching your payment land in real time.

First, Let's Get Your Business Account Ready

The first thing you’ll do is get your business account set up. This is a quick, one-time process that handles all the necessary security and compliance checks upfront, making sure your business is fully verified.

You'll start with a straightforward online sign-up and then upload your standard FICA (Financial Intelligence Centre Act) documents. This is a non-negotiable legal step for any financial institution in South Africa, designed to prevent financial crime.

For a typical business, you'll need:

- Company Registration Docs: Your CIPC papers.

- Proof of Business Address: A recent utility bill or a similar official document showing where you operate from.

- Director and Shareholder Info: IDs and proof of address for the key people in your company.

Once your documents are submitted and the team has verified your account, you’re good to go. The best part? You'll never have to do this again for future transfers, which is a massive time-saver.

Next, Create and Fund Your Payment

With your account up and running, you're ready to make your first international payment. This is where you really see the control and transparency come into play.

First, you’ll add your international supplier or recipient as a beneficiary. It’s just like adding a new local payee—you simply input their bank details.

The next bit is crucial: securing your exchange rate. Traditional banks often only reveal the rate after you’ve committed to the transfer. With Zaro, you see the live mid-market rate and can lock it in instantly. This is a huge advantage, as it protects your business from sudden currency dips. The rate you book is the rate you get. Guaranteed.

Think of it this way: Locking in a rate is a powerful budgeting tool. If you have a $10,000 invoice to settle in two weeks, you can secure the ZAR-to-USD rate today. This completely removes the risk of the rand weakening and suddenly making your payment a lot more expensive.

After booking your rate, all you have to do is fund the transfer. You just make a normal EFT from your South African bank account into your Zaro account. No complicated international wire instructions needed on your side. It’s genuinely as simple as paying a local supplier.

Finally, Track Your Funds in Real Time

One of the most common frustrations with old-school international transfers is the total lack of visibility. You send the money, and it vanishes into a black hole for a few days, leaving you and your supplier guessing. Modern platforms have completely fixed this with live tracking.

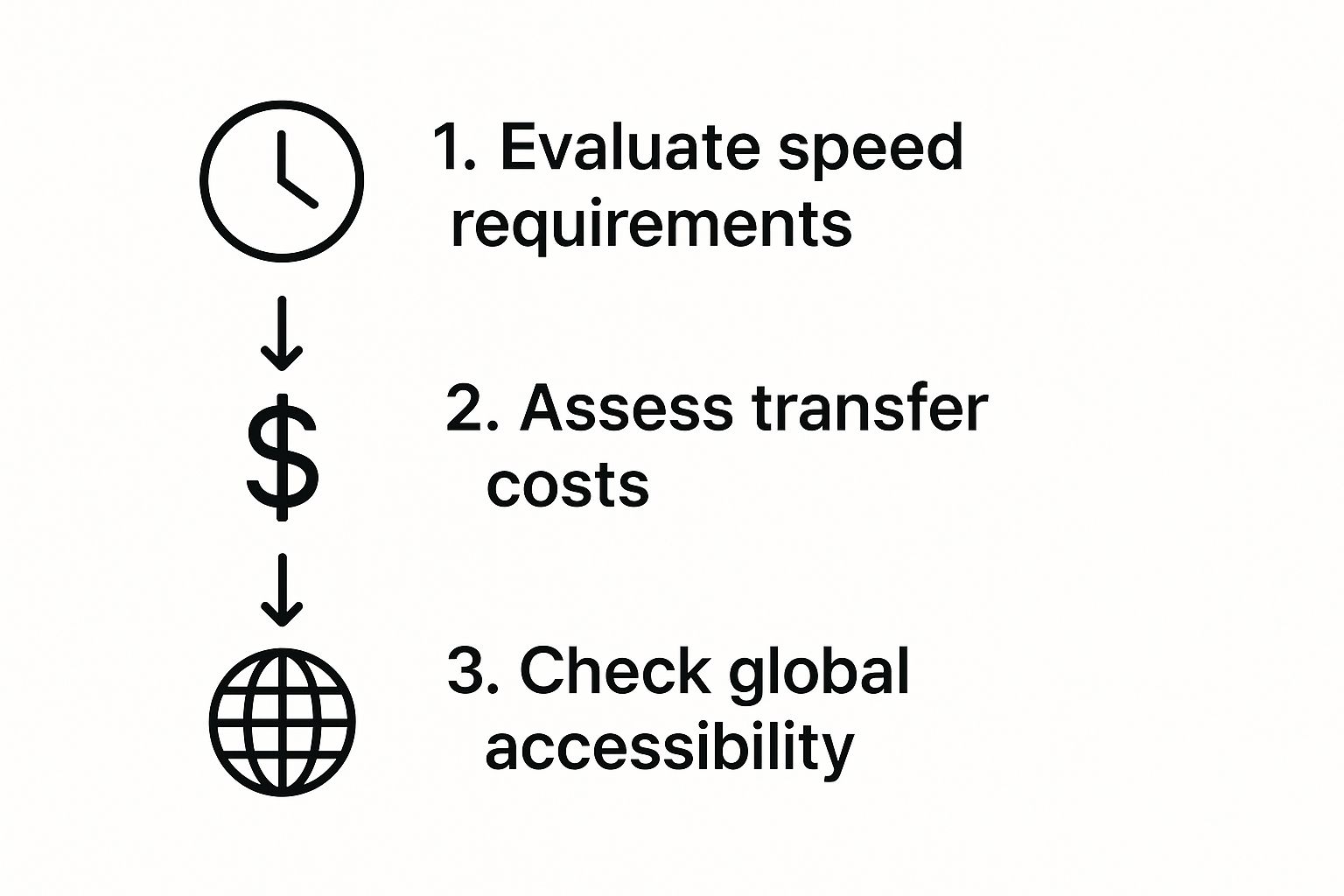

This image highlights the key things to weigh up when you need to transfer funds abroad.

As you can see, finding the right balance between speed, cost, and global reach is what really makes for an efficient payment strategy.

From the second you fund your Zaro transfer, you can follow its progress right from your dashboard. You’ll get notifications as the money is processed and another one the moment it's delivered successfully to your recipient. That kind of transparency gives you incredible peace of mind and helps you keep your suppliers in the loop, which goes a long way in strengthening those crucial business relationships.

Getting to Grips with South Africa’s Exchange Control Rules

When you’re moving money out of South Africa, you’ll inevitably run into exchange control rules. Let’s be clear: this isn’t just red tape; it’s a legal requirement. These regulations, governed by the South African Reserve Bank (SARB), are in place to carefully manage the flow of capital leaving the country. For any business, getting this right is non-negotiable if you want to avoid frustrating delays and potential penalties.

But here’s something many business owners don’t realise: for legitimate commercial transactions, the process is much simpler than you might think. Individuals are limited by a Single Discretionary Allowance (SDA) for personal transfers, but businesses operate differently. As long as you can show that a payment is for a valid, trade-related purpose, there isn't a hard annual cap on what you can send.

That’s a critical distinction. An individual has a set limit for sending money abroad for a holiday or as a gift. A business, on the other hand, can pay a $500,000 invoice for imported equipment without issue, provided the paperwork backs it up.

The Paperwork You'll Actually Need

So, what kind of proof does SARB require? It all boils down to one thing: demonstrating the legitimacy of your payment. You’re simply proving that the funds are for a genuine commercial transaction, not an unapproved capital transfer.

Typically, this means having one of the following on hand:

- Supplier Invoices: If you're paying for goods, a proper commercial invoice from your international supplier is the gold standard. It needs to detail the items, quantities, and the total cost.

- Service or Royalty Agreements: For payments to overseas contractors, consultants, or for things like software licences, you'll need the signed contract. This document should clearly outline the services being rendered and the agreed-upon payment terms.

Modern platforms like Zaro have smartly built this compliance step right into their workflow. You just upload the relevant invoice or agreement when you set up your transfer. This creates a clean, fully auditable trail that keeps you on the right side of the regulations without any extra admin headaches.

Cracking the BOP Code

Another term you'll encounter is the Balance of Payments (BOP) code. Think of it as a category tag for your transaction. Every time you send money abroad, you have to assign a specific code that tells SARB why the money is leaving. There are distinct codes for importing goods, paying for professional services, covering travel costs, and so on.

Getting the BOP code right is essential. It's the primary way SARB tracks the country's international financial activity. The wrong code can easily get your payment flagged or held up.

This system creates a transparent framework that helps maintain the stability of the national economy. While it requires a bit of diligence, it ensures all cross-border payments are properly accounted for. Understanding these local nuances is just as important as the financial rules themselves, a reality for any company looking to, for example, outsource to South Africa.

The good news is that Zaro makes this part easy. The platform presents a straightforward, categorised list of BOP codes, helping you pick the right one every single time and ensuring your transfer sails through without a hitch.

Here’s How South African Businesses Are Actually Using Zaro

Theory is one thing, but seeing how a modern payment solution works in the real world is what really matters. To give you a practical sense of what’s possible when you transfer funds abroad with a platform like Zaro, let's walk through a few stories from South African businesses that were probably facing the same headaches you are. These aren't just hypotheticals; they're real challenges with tangible results.

Paying an Overseas Supplier in USD

Let’s start with a common scenario. Imagine a growing e-commerce retailer in Cape Town importing handcrafted goods from China. Every month, they’re hit with a hefty invoice in US dollars. For years, they stuck with their traditional business bank, and the process was a constant source of frustration.

The bank’s exchange rate was a black box. They were losing 2-3% on the margin without even realising it until after the fact, which on a large invoice, quickly added up to thousands of rands in hidden costs. On top of that, the slow transfer times meant their supplier would often delay the next shipment until the funds cleared, causing a real bottleneck in their cash flow.

Switching to Zaro gave them two immediate wins:

- Real Cost Savings: They now see the real mid-market exchange rate and only pay a small, transparent fee. This instantly saved them a significant chunk of money on every single payment.

- Happier Suppliers: Payments now land within a day. Their supplier is happy, shipments are dispatched faster, and the whole supply chain just runs smoother.

This company turned a clunky, expensive operational chore into a quick, cost-effective process, freeing up cash to reinvest in stock and marketing.

Managing Payroll for a Remote Tech Team

Now, let's look at a Johannesburg-based software company. They have a brilliant team of freelance developers based in Portugal and Germany. As anyone who pays international contractors knows, this comes with its own set of challenges. Reliability and speed are everything—you simply can't have your team’s salaries arriving late.

Their old method was a painful one: individual wire transfers for each developer. It was not only time-consuming but also incredibly expensive with all the repeated bank fees. Come month-end, trying to reconcile these payments was an administrative nightmare for their finance team.

The core issue for any business paying international staff is consistency. Late or incorrect payments damage trust and can jeopardise your relationship with key talent.

With Zaro, they manage all their international payees from a single dashboard. They can lock in a favourable ZAR-to-EUR exchange rate for the entire payroll run, making their costs completely predictable. Payments are sent efficiently and tracked in real-time, giving both the company and its developers total peace of mind.

Receiving Payments from a UK Client

Finally, think about a Durban-based consulting firm doing great work for a client in the United Kingdom. Getting paid in British Pounds (GBP) used to be a bittersweet experience. They’d celebrate landing the project, only to lose a chunk of their revenue when converting it back to rands through their local bank.

They were completely at the mercy of whatever exchange rate their bank offered on the day, which was rarely in their favour. Zaro offered a much smarter way forward.

They now have a multi-currency account, which lets them receive GBP directly without any forced, immediate conversion. They can hold the pounds and choose to bring the money back to ZAR only when the exchange rate is strong. This gives them strategic control over their international earnings, instead of just taking whatever the bank gives them.

The Future of Payments Across Africa

If you've ever felt the frustration of trying to transfer funds abroad from South Africa, you're not alone. The high fees, slow processing times, and endless paperwork are part of a much bigger, continent-wide puzzle that, thankfully, is now being pieced together. We're in the middle of a massive shift towards a more connected and efficient financial ecosystem across Africa, one that’s set to make cross-border business far simpler.

For far too long, the basics of trade have been unnecessarily complex. Paying a supplier in a neighbouring country often meant a long, winding journey for your money—typically being converted into US dollars and routed through international banks before it even got close to its destination. This old system is finally being challenged.

The Rise of Pan-African Payment Networks

At the heart of this change are incredible initiatives designed to link Africa's economies directly. A prime example is the Pan-African Payment and Settlement System (PAPSS). While it's currently live in the West African Monetary Zone, PAPSS shows us what’s possible for the entire continent.

This system allows businesses to send and receive cross-border payments instantly, and crucially, in their own local currencies. It completely bypasses the slow and costly correspondent banking networks that have been the standard for decades. If you’re interested in the technicals, a recent payment infrastructure assessment offers some great insights into this new model.

This is a direct solution to the core problems of high costs and long delays, setting a brand-new benchmark for how intra-African trade should work.

By enabling direct, local-currency transactions, systems like PAPSS are removing some of the biggest barriers to regional commerce. This is the foundation upon which a more prosperous and interconnected African market will be built.

What This Means for Your Business

So, why does this bigger picture matter to your company? Because fintech platforms like Zaro aren't just clever tools; they are the on-the-ground reality of this new, forward-thinking vision. They give your business direct access to the speed, transparency, and savings that these new pan-African systems are pioneering.

When you adopt a modern payment solution, you’re not just solving an immediate problem—you're positioning your business to thrive in a more connected Africa. You’re gaining a real competitive edge.

- Slash Transaction Costs: Cutting out intermediary banks and unnecessary currency conversions puts real money back into your business.

- Improve Your Cash Flow: Faster payments mean your capital isn't stuck in limbo for days. It's working for you.

- Build Stronger Supplier Relationships: Nothing builds trust like paying on time, every time. Prompt and reliable payments are key to solid partnerships across the continent and beyond.

Getting on board with these tools today is about preparing your business for the future of African commerce—a future that’s arriving faster than you think.

Got Questions About Sending Money Abroad? We've Got Answers

When you're new to sending money overseas for your business, it’s natural to have a few questions. The world of international payments can seem a bit tangled at first, but once you get the hang of it, it’s actually quite straightforward. We’ve pulled together the most common queries we hear from South African business owners to help clear things up.

What Paperwork Will I Need to Get Started?

For your first account setup, you'll generally need your standard FICA documents – think company registration papers and proof of address. Nothing too surprising there.

The really important part comes with each individual payment. The South African Reserve Bank (SARB) needs to see supporting documents to verify that the transaction is legitimate. This usually just means having a supplier invoice or a service contract ready to go. Modern platforms like Zaro have a secure portal where you can upload these documents right alongside your transaction, which makes staying compliant incredibly simple.

How Do I Make Sure I'm Getting a Good Exchange Rate?

This is the big one, isn't it? It’s where so much money can be lost. High-street banks are notorious for adding a hefty, often hidden, markup to the exchange rates they offer. It’s a quiet profit-eater that can really add up over time.

To get a better deal, you really need to work with a foreign exchange specialist. They operate on much tighter margins and can offer you rates much closer to the real mid-market rate.

Here's a pro tip from experienced finance teams: lock in a favourable exchange rate ahead of time. This is a game-changer. It shields your business from the daily ups and downs of the currency market, meaning the amount you budget in rands is exactly what you'll pay, even if the invoice isn't due for a few weeks.

How Long Will It Take for the Money to Arrive?

The waiting game can be frustrating. A standard bank transfer using the SWIFT network can take anywhere from 2 to 5 business days. Sometimes it’s even longer if there are intermediary banks involved in the process, which is completely out of your hands.

This is where fintech solutions really shine. They often use newer, more direct payment networks, slashing transfer times down to just 1 or 2 business days. Plus, these platforms usually give you real-time tracking, so you can see exactly where your money is at every step of the journey. No more guessing games.

Are There Limits on How Much My Business Can Send Overseas?

Yes, South Africa does have exchange control regulations, but the rules are very different for businesses compared to individuals. The good news is that for legitimate trade purposes—like paying for imported goods or services—there isn't a specific annual cap.

As long as you provide the correct supporting documents for each transaction, you can send what you need to keep your business running. This is all about facilitating the global flow of commerce.

And the scale of these financial movements is massive. In 2024, remittance inflows to Africa hit an estimated USD 92.2 billion, a figure that represents a lifeline for millions and a crucial part of the continent's economy. As a regional economic hub, South Africa is right in the centre of this activity. If you're curious, you can dive into more data on financial flows across the continent to see the bigger picture.

For larger capital investments going abroad, you might need to look into a Foreign Investment Allowance (FIA), which involves getting a tax clearance certificate.

Ready to make your international payments faster, cheaper, and more transparent? Zaro gives you access to real exchange rates with no hidden fees. Learn more and get started today.