For South African businesses, sending money across borders is just part of the daily grind of global trade. But let's be honest, it's often a painful process—slow, surprisingly expensive, and unnecessarily complicated. While your bank might have been the go-to for years, it’s no longer your only choice. Getting to grips with the newer, smarter alternatives is key to staying competitive.

This guide is designed to be your practical roadmap, cutting through the jargon to help you manage cross-border payments like a pro.

Sending Money Across Borders The Modern Way

If you’re a South African business with international clients, suppliers, or staff, you know that getting international payments right isn't just an admin task. It’s a strategic move. Whether you're paying a supplier in China, covering salaries for a remote developer in Europe, or bringing home revenue from US sales, how you move that money directly hits your bottom line. Delays can sour relationships, and hidden fees can quietly eat away at the profits you've worked so hard to earn.

Not too long ago, sending money overseas involved a messy web of correspondent banks, fees that appeared out of nowhere, and settlement times that felt like a complete guess. The old-school SWIFT network often left businesses guessing about the real cost and when their money would actually land. Thankfully, things have changed.

The Shift to Smarter Payments

The rise of specialised financial technology has completely shaken up international business payments. These modern platforms are built from the ground up to solve the exact headaches that small and medium businesses face, offering a real alternative to the clunky legacy banking system. The goal? To make sending money abroad as straightforward and predictable as making a local EFT.

Here’s what makes these new solutions a better fit for most businesses:

- You actually know what you’re paying: They get rid of hidden exchange rate markups and surprise "intermediary bank fees," so the cost you see upfront is the cost you pay.

- Your money gets there faster: By using smarter networks, they can get your funds delivered in hours or a couple of days, not weeks.

- The process is simpler: Think easy-to-use online platforms that fit into your accounting workflow and help automate the tedious compliance paperwork.

- You have more control: Finance teams get proper tools, like multi-user access, real-time payment tracking, and solid security features for better oversight.

For a South African SME, picking the right payment partner is as important as picking the right supplier. A smart payment strategy can save you a surprising amount of money, free up your cash flow, and build stronger international relationships. It turns a frustrating chore into a real competitive edge.

This guide will give you the know-how to leave those outdated methods behind. We'll unpack everything from the hidden costs lurking in foreign exchange rates to the essentials of South African compliance. By understanding how to transfer money internationally the modern way, you can create a smooth payment system that helps your business grow globally—without the costly delays or nasty surprises.

How International Money Transfers Actually Work

To really get a grip on sending money overseas, it helps to lift the bonnet and see how the engine runs. The route your money takes across the globe has a massive impact on its speed, cost, and safety. For decades, one old-school system called all the shots, but now, thankfully, there are much smarter ways to do things.

Let's break down what actually happens when your rands leave South Africa. Think of the traditional banking system like booking a long-haul flight with a bunch of inconvenient layovers. This is the world of the SWIFT network.

The Traditional Route: The SWIFT Network

When you tell your local South African bank to pay a supplier in Germany, the money doesn’t just zip straight there. Instead, your bank sends a secure message through the Society for Worldwide Interbank Financial Telecommunication (SWIFT). At its core, SWIFT is a messaging system that connects thousands of banks all over the world.

Picture your payment as a passenger on a long journey. Your bank (the departure airport) sends out a message to find a connecting flight. This connection is handled by a correspondent bank—a huge international bank that has a working relationship with both your bank and the one you’re sending money to.

A correspondent bank is the financial equivalent of a layover airport. Your money stops there, gets processed, and is then sent on its way. The catch? Each “layover” adds time and, more importantly, a fee.

Sometimes, one correspondent bank isn't enough, especially if you're dealing with a less common currency or a more remote destination. Your payment might have to hop between two or three of these intermediary banks, with each one taking a slice for their trouble and adding another day to the trip. This is precisely why a standard SWIFT transfer can take a frustrating three to five business days (or even longer) to finally arrive.

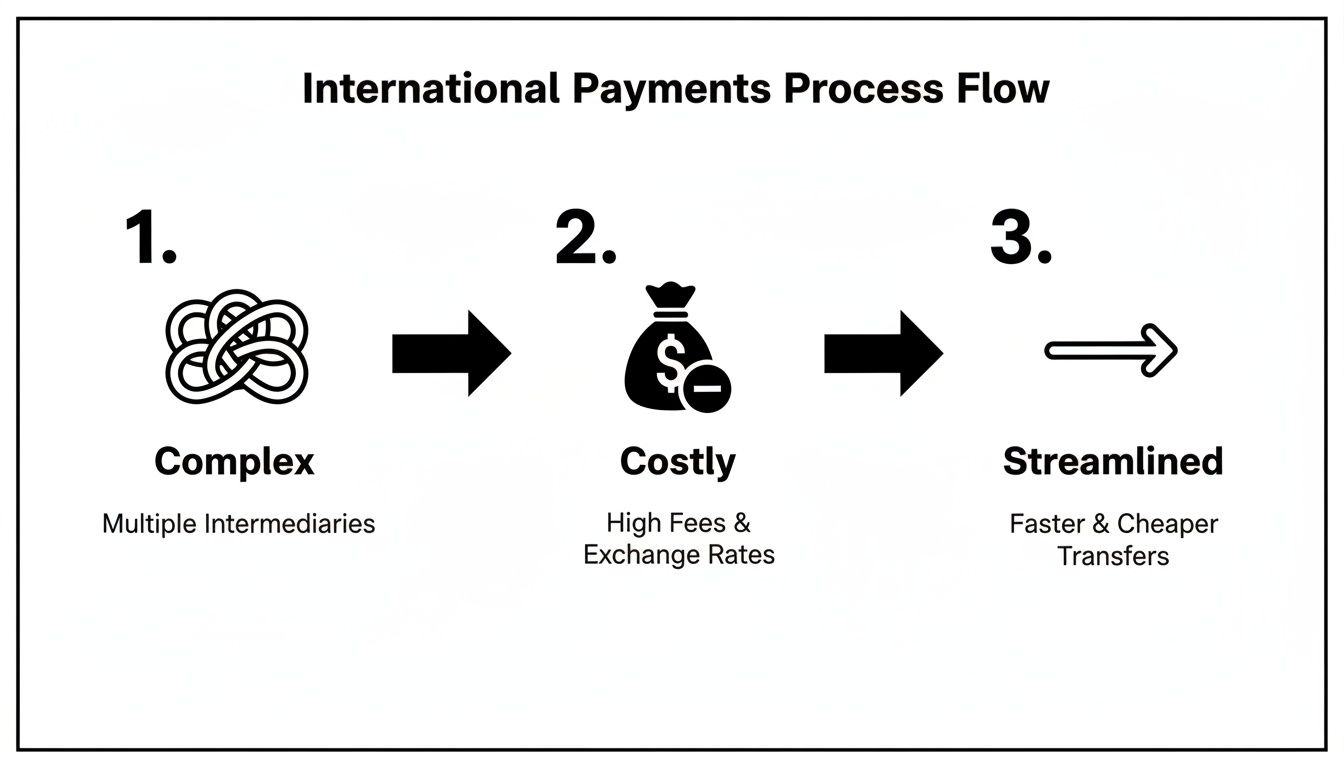

This chart shows how we're moving away from these tangled, expensive old routes towards much more direct, modern solutions.

The big takeaway here is that modern financial technology is all about cutting out those costly middlemen, creating a straighter, cleaner path for your money.

The Modern Fintech Alternative

Now, imagine booking a direct, non-stop flight instead. That’s the model modern fintech payment providers use. Rather than piggybacking on that complicated chain of correspondent banks, these companies have built their own payment networks. They do this by holding local bank accounts in dozens of countries, which turns a complex international transfer into a simple pair of local ones.

Here’s what that looks like in practice:

- You pay rands into the fintech’s South African bank account.

- The platform immediately tells its German bank account to pay the equivalent in euros to your supplier.

- Your money never actually has to cross a border through the clunky old SWIFT system.

This "direct flight" approach cuts out the intermediary banks entirely, which is why fintech transfers are so much faster and cheaper. You dodge all those processing fees and the delays that come with each layover. The demand for this kind of efficiency is booming, especially here in Africa.

In fact, South Africa's remittance market to the SADC region has exploded over the last decade. In 2016, formal payments to other SADC countries were just under R6 billion. By 2024, that figure had shot up to over R19 billion—more than a threefold increase. If you're interested in the data, you can dig deeper into these cross-border payment trends in the South African Reserve Bank’s conference papers.

Understanding this fundamental difference—the multi-stop SWIFT journey versus the direct fintech flight—is the first step to truly optimising your business's international payment strategy. It equips you to start asking the right questions about speed, transparency, and, of course, cost.

Comparing Your International Transfer Options

Choosing how you move money across borders isn't a one-size-fits-all decision. The best way to pay a massive supplier invoice from China is almost certainly the wrong way to handle a small monthly software subscription from the US. It all comes down to finding the right balance between speed, cost, security, and transparency for each specific payment.

Let’s break down the main players in the international payments game. Think of this as a head-to-head comparison to help you pick the right tool for the job, every single time.

International Money Transfer Methods at a Glance

Before we dive deep, here's a quick overview of your main choices. This table lays out the pros and cons of the most common methods available to South African businesses, so you can see at a glance which one might fit your needs.

| Method | Typical Speed | Cost Structure | Best For | Key Drawback |

|---|---|---|---|---|

| Bank (SWIFT) | 3-5 business days | High fixed fees + poor FX rates | Very large, security-critical payments | Slow, expensive, and lacks transparency |

| Fintech Platform | Hours to 1 day | Low/zero fees + excellent FX rates | Most business payments (suppliers, payroll) | Onboarding requires KYB verification |

| FX Broker | 2-3 business days | Lower fees + good FX rates | Large, frequent FX trades needing hedging | Can have minimum transfer sizes |

| Credit/Debit Card | Instant | Poor FX rates + foreign transaction fees | Small, recurring online purchases | Extremely expensive for large amounts |

As you can see, the right choice really depends on what you're trying to achieve—whether it's speed, cost savings, or a specific financial service. Now, let's explore what these options mean in practice.

Traditional Bank Transfers via SWIFT

This is the one most of us know. You walk into your bank (or log in online), give them the details, and they use the global SWIFT network to send your money on its way. The funds hop between several "correspondent" banks before finally landing in the recipient's account. It’s familiar, and it’s everywhere.

But that reliability comes at a steep price. SWIFT transfers are notoriously slow, often taking a painful 3-5 business days to clear. They're also usually the most expensive option. You get hit with high transfer fees, less-than-great exchange rates, and often, hidden fees from each of the intermediary banks that handle your money along its journey.

- The good: It’s secure, universally accepted, and you’re dealing with an institution you already know and trust.

- The bad: It’s incredibly slow, loaded with fees (both obvious and hidden), and offers zero transparency on the final cost.

Frankly, this method is best left for huge, one-off transactions where the peace of mind of using a major bank outweighs the serious drawbacks in speed and cost.

Modern Fintech Platforms

Fintech platforms were born out of the frustration with the old banking system. Companies like Zaro essentially built a smarter, more direct route for your money. They use their own networks and local bank accounts in different countries to completely bypass the slow, expensive SWIFT network.

What this does is turn a complicated international transfer into two simple local ones. The result? Your money arrives much faster—often within the same day—and the costs are slashed. By cutting out all the middlemen, fintechs can offer far better exchange rates and transparent, low fees. South African businesses are catching on fast; outward digital transfers are expected to make up about 64% of the remittance sector's revenue in 2024. If you're interested in the drivers behind this trend, you can discover more insights about the South African remittance market from IMARC Group's research.

Think of fintech platforms as the direct, non-stop flight for your money. They eliminate the costly and time-consuming layovers of the traditional banking system, getting your funds where they need to go faster and cheaper.

Specialised Foreign Exchange (FX) Brokers

FX brokers sit somewhere in the middle. They are specialists who live and breathe currency exchange, so they can often offer more personal service and better exchange rates than a bank, especially if you’re moving larger sums of money.

Many still rely on the SWIFT network to an extent, but because they deal in such high volumes, they can negotiate much better terms. A key advantage is that they often provide risk management tools like forward contracts, which let you lock in an exchange rate today for a payment you need to make in the future.

- Best for: Businesses with regular, significant foreign exchange needs that could benefit from a dedicated account manager and hedging tools.

- The catch: While better than the banks, they can still be slower and less user-friendly than a true fintech platform. They also frequently require minimum transfer amounts.

Credit and Debit Cards

For those small, recurring online payments—think software subscriptions, digital advertising, or online tool purchases—nothing beats the convenience of a corporate credit or debit card. The payment is instant, and the vendor gets their money right away.

That convenience, however, comes with a sting in its tail. The exchange rates you get from card providers are typically pretty poor. On top of that, they usually slap on a foreign transaction fee of 2-3%. This makes cards a terrible choice for anything beyond those small, necessary operational expenses.

Ultimately, the goal is to match the payment method to the payment's purpose. For the vast majority of your business's international transfers—paying suppliers, running overseas payroll, or bringing revenue home—a modern fintech solution delivers the best combination of speed, cost, and clarity, turning a major headache into a simple task.

Looking Beyond the Advertised Fee: What International Transfers Really Cost

When you need to send money overseas, the first thing you probably see is the advertised transfer fee. Many providers shout about "low fees" or even "zero fees," but that number is often just the tip of the iceberg. The real costs are usually tucked away where you can't easily see them.

Getting to grips with these hidden charges is crucial. It’s the only way to protect your profit margins and make smart financial decisions for your business.

The Biggest Culprit: The FX Margin

By far, the most significant and often invisible cost is the foreign exchange (FX) margin. This is simply the difference between the real, mid-market exchange rate—the rate banks use to trade with each other—and the less favourable rate your provider gives you.

Think of it as a hidden service charge baked right into the exchange rate. The provider pockets the difference, and this margin can easily cost you far more than any flat fee, especially on larger payments. A seemingly tiny percentage can quickly add up to thousands of rands lost.

A Real-World Example

Imagine your business needs to pay a US-based supplier $50,000. The true mid-market exchange rate is R18.50 to the dollar.

- Provider A (your bank) quotes you a rate of R18.87. This includes their 2% margin. The total cost to you is R943,500.

- Provider B (a modern fintech) offers you the mid-market rate of R18.50. Your total cost is R925,000.

In this scenario, that small 2% markup just cost your business an extra R18,500 on a single transaction.

This is exactly why focusing only on the upfront transfer fee is such a common mistake. The real battle for your bottom line is won or lost in the exchange rate you actually get.

Watch Out for Other Sneaky Charges

Beyond the FX margin, a few other fees can quietly inflate the cost of your payment, particularly if you’re using the old-school SWIFT network.

The frustrating part? These charges are often unpredictable and get deducted after you’ve sent the money, meaning your supplier ends up with less than you intended.

- Intermediary Bank Fees: When your funds travel via SWIFT, they often hop between several correspondent banks before reaching their final destination. Each of these banks can slice off a fee for handling the transaction, typically anything from $20 to $50 per bank.

- Receiving Bank Fees: Even when the money arrives, the recipient’s bank might charge a fee just for processing an incoming international payment. It’s another cost that’s nearly impossible to know about in advance.

These small deductions add up and create huge financial uncertainty. In certain payment corridors, the total costs can be staggering. Take the vital South Africa-Zimbabwe corridor, where average transfer costs can hover around a shocking 12.7%—miles away from the G20's target of 3%. You can dig deeper into these regional payment cost challenges in this IMF report.

To truly understand what you're paying, you need to calculate the total landed cost. This means demanding full transparency on both the exchange rate margin and all potential third-party fees before you hit "send." That clarity is what allows you to dodge expensive surprises and find a partner who actually values your business's financial health.

Navigating South African Compliance with Confidence

When you send money out of South Africa, it’s not just a simple transfer between your business and a supplier. You’re also operating within a specific regulatory framework, one designed to protect our national economy from financial crime and maintain stability. Getting to grips with these rules is the secret to making sure your payments go off without a hitch.

The two main players you need to know are the South African Reserve Bank (SARB) and the Financial Intelligence Centre (FIC). Think of SARB as the architect, setting the high-level exchange control rules. FIC, on the other hand, is the on-the-ground security, focused on preventing things like money laundering and the financing of terrorism.

These regulations aren't there to trip you up. They exist to ensure every transaction is legitimate, which builds trust in the entire financial system and ultimately helps every South African business that operates on the world stage.

Understanding Key Verification Processes

Before any financial partner can move your money, they have a legal duty to confirm who you are and what your business does. This is known globally as KYC (Know Your Customer) and KYB (Know Your Business), and it’s the bedrock of financial compliance.

For your SME, this usually involves providing a set of documents to your payment provider. It might feel like a bit of admin upfront, but a good partner will make this a smooth, one-time onboarding step.

Typically, you'll be asked for:

- Company Registration Documents: Your official CIPC registration papers.

- Proof of Business Address: A recent utility bill or a lease agreement for your office.

- Director and Shareholder Information: ID documents and proof of address for all directors and key shareholders (usually anyone holding 25% or more of the company).

This step is non-negotiable. It protects both you and the provider by ensuring everyone involved is legitimate, which is your first line of defence against fraud.

Think of KYB and KYC as the digital handshake that establishes trust. It confirms your business is real and that you have the authority to act on its behalf, creating a secure foundation for every transaction that follows.

Demystifying BOP Reporting and Its Purpose

You’ll quickly come across the term Balance of Payments (BOP) reporting. It’s a SARB requirement that means every single rand that leaves the country must be categorised with a specific code. This helps the government monitor the flow of funds in and out of South Africa for crucial economic planning and analysis.

Don't let the name intimidate you; it's simpler than it sounds. Your payment provider will give you a list of codes to select from. Paying a supplier for imported goods? You'll likely use code '101 - Merchandise'. Paying for a marketing service from a UK firm? There’s a different code for that.

Getting your BOP reporting right is mandatory. It ensures your payment is processed smoothly and keeps your business compliant with SARB. The best modern platforms make this incredibly easy by building the code selection right into the payment process, often as a simple dropdown menu. For businesses navigating complex regulations, robust compliance is critical, and you can learn more about the roles that support this, such as an Anti-Money Laundering (AML) Analyst Job Application Form.

By choosing a provider who truly understands these local rules, compliance stops being a hurdle and simply becomes part of your workflow. It gives you the peace of mind that every international payment you make is correct, secure, and fully aligned with South African law.

Choosing the Right International Payment Partner

Picking a partner to handle your international payments is far more than just ticking an admin box. It's a strategic move. The right choice can unlock serious savings, eliminate operational headaches, and give you a genuine competitive edge.

On the other hand, the wrong one can quietly eat into your profits, cause frustrating payment delays, and damage relationships with key suppliers.

To make a smart choice, you need a solid framework for comparing providers. This isn't just about chasing the lowest advertised fee; it’s about finding a partner whose service, costs, and tech truly fit how your business operates when you transfer money internationally.

But before you start window shopping, the first step is to look inwards.

First, Assess Your Own Business Needs

A provider that works wonders for a massive corporation could be a terrible fit for a growing SME. You need to get crystal clear on your own operational reality.

Start by asking yourself a few key questions:

- Transaction Volume and Frequency: Are you sending a few large payments each month, or hundreds of smaller ones? High-volume businesses can often negotiate much better rates.

- Target Countries and Currencies: Where is your money going? A provider with deep roots and a strong network in your key trade corridors will deliver better speeds and reliability.

- Payment Purpose: What are you actually doing? Paying overseas suppliers is very different from managing international payroll or bringing revenue home from foreign markets. For businesses with international teams, using specialised tools like the best global payroll software is often a necessity.

Answering these gives you a practical checklist. You can instantly filter out providers who aren’t a good match, saving you a huge amount of time.

Key Questions to Ask Every Single Provider

Once you've got a shortlist, it’s time to get down to the details. Don't be swayed by glossy marketing brochures. You need concrete answers that affect your bottom line and your team's sanity.

Go into every conversation armed with these questions:

- What is your complete fee structure? Ask for a full breakdown. That means transfer fees, monthly account fees, and—most importantly—their typical foreign exchange (FX) margin.

- How do you set your exchange rates? Are they based on the real mid-market rate, or is there a hidden spread? Ask for a live quote and compare it yourself to the real-time rate to see the true cost.

- What are your security and compliance protocols? How do you protect my funds and data? Crucially for us, are you fully compliant with South African regulations, including SARB and FIC requirements?

- Can I see the platform in action? Ask for a demo. Look for practical features like multi-user access for your finance team, real-time payment tracking, and integration with your accounting software.

Your goal is to find a partner who is as transparent as you are. If a provider gets cagey about their rates or fees, it’s a massive red flag. They're almost certainly hiding costs in the FX margin.

Choosing the right partner transforms international payments from a costly chore into a powerful business tool. It’s about more than just moving money; it’s about building a financial operation that is efficient, transparent, and ready for global growth.

A Few Common Questions We Hear

Even when you've got the basics down, a few practical questions always pop up. Let's tackle some of the most common ones we hear from finance teams across South Africa.

How Long Does an International Transfer from South Africa Really Take?

Honestly, it depends massively on the method you pick. If you go the traditional route with a bank's SWIFT transfer, you’re often looking at a wait of 3-5 business days. It can even drag on longer if the payment has to bounce between several intermediary banks.

On the other hand, modern fintech platforms have completely changed the game. They can often get your money there in a few hours or, at worst, by the next business day. The final speed really comes down to the destination country, the specific currencies involved, and how efficient your provider’s network is.

What's the One Document I Absolutely Can't Mess Up?

For most payments heading out of South Africa for goods or services, the commercial invoice is king. This is the piece of paper that proves to regulators like the South African Reserve Bank (SARB) that a real, legitimate transaction is taking place.

Your invoice needs to be crystal clear. It must spell out exactly what's being paid for, the full banking details of who you're paying, and the precise amount owed. If you're paying for something else, like royalties, you'll need the relevant legal agreement instead.

Can My Business Actually Hold Foreign Currency in South Africa?

Yes, you absolutely can. South African businesses are allowed to open what’s called a Customer Foreign Currency (CFC) account with an authorised dealer bank. Think of it as a powerful tool for managing your foreign exchange risk and cutting costs.

A CFC account lets you hold onto the foreign currency you earn from exports or other international income. You can then use those funds to pay your overseas suppliers directly. This simple step means you avoid converting the money into rands and then back out again, saving you from getting hit with FX conversion fees twice on the same cash.

Ready to escape hidden fees and slow transfer times? Zaro offers South African businesses access to real exchange rates with zero spread, ensuring your money arrives faster and at a predictable cost. See how much you could save on your next international transfer by visiting https://www.usezaro.com.