For any South African business operating on the global stage, sending money overseas is a constant. It's just part of the daily grind. But let's be honest, it’s often a process bogged down by sneaky fees, painfully slow transfers, and a mountain of confusing compliance paperwork.

This guide is designed to clear the fog. We'll walk you through practical, real-world strategies to help your finance team handle cross-border payments like seasoned pros. It's time to move past the old-school banking headaches and find smarter ways to manage your money, cut costs, and get a real competitive edge.

Making International Business Payments Work for You, Not Against You

Sending funds to a supplier in Germany or bringing home revenue from a client in the US shouldn't feel like you're navigating a minefield. Yet, that's exactly the experience for many South African companies. Finance teams, exporters, and importers are constantly fighting a battle of opaque charges and frustrating delays that chip away at the bottom line.

The traditional route—your trusty bank—is often the biggest source of the problem. Banks have a knack for building their profit directly into the exchange rate they offer you, a rate that’s often nowhere near the actual market value. This hidden markup, piled on top of flat admin fees and the slow, meandering pace of the SWIFT network, eats into your capital with every single transaction.

A Smarter Way to Pay Is Here

Thankfully, things are looking up. The market for cross-border transfers in South Africa is currently valued at around USD 330 million and is expected to almost triple by 2030. This boom isn't just a number; it signals a massive demand for better, more transparent payment options. You can dive deeper into these trends with South African remittance market insights on Kenresearch.com.

This massive shift means it's time for businesses to get smarter about how they move money. Modern fintech platforms have emerged specifically to fix the problems created by legacy banking systems. They give businesses the power back by providing:

- Real Exchange Rates: You get the rate you see on the news or Google, with no hidden spreads. What you see is what you get.

- Clear, Upfront Fees: You’ll know the exact cost of a transfer before you hit send. No more nasty surprises.

- Quicker Payments: Many fintechs bypass the sluggish SWIFT network, meaning your recipient gets their money faster—sometimes in hours, not days.

- Easier Compliance: They offer tools and platforms designed to streamline the documentation and reporting process, taking a load off your team.

By stepping away from outdated banking habits, you can transform a costly operational chore into a genuine strategic advantage. This guide will show you exactly how. We’ll equip you with the knowledge to take firm control of your international payments, making sure every rand you send is working as hard as possible for your business.

Getting Your Business Ready for Overseas Transfers

Before you can even think about sending money across borders, there’s some essential prep work every South African business needs to do. Getting this groundwork right from the very beginning is the secret to avoiding frustrating delays and making sure your payments go through without a hitch. This isn't just about ticking boxes; it's about proving your business is a legitimate, verifiable entity to banks, payment providers, and regulators.

Think of it as laying a solid foundation. Without it, any attempt to move money internationally is on shaky ground and likely to get stuck. This initial phase is all about gathering the right paperwork and getting to grips with the verification processes known as Know Your Customer (KYC) and Know Your Business (KYB).

First Things First: Understanding KYC and KYB

At its heart, KYB is the due diligence that financial service providers are legally required to perform to confirm a business’s identity. It’s a non-negotiable step designed to clamp down on financial crimes like money laundering and fraud. For your business, this simply means providing a clear, auditable paper trail that proves who you are and who owns and controls the company.

While it might feel like a mountain of admin, a smooth KYB process is your express pass to making international payments. If you have everything ready, you can get verified quickly and start transacting without being held up.

You’ll want to have a standard set of documents on hand:

- Company Registration Documents: Your official CIPC (Companies and Intellectual Property Commission) registration papers are the starting point. They’re the core proof that your business legally exists.

- Proof of Business Address: A recent utility bill or a bank statement in the company’s name will do the trick. Just make sure it’s less than three months old.

- Director and Shareholder IDs: You'll need to supply certified ID documents and proof of address for all company directors and any major shareholders (usually anyone who owns 25% or more of the business).

A simple tip from experience: scan these documents and keep them in a secure, clearly labelled digital folder. It sounds basic, but this small bit of organisation can shave hours, if not days, off your onboarding time with a new payment provider.

The Next Hurdle: South African Reserve Bank Compliance

Once your business itself is verified, every single transfer you make comes with its own compliance checks, dictated largely by the South African Reserve Bank (SARB). This is where many businesses get tripped up if they aren't prepared.

The most important piece of the puzzle here is the Balance of Payments (BOP) reporting. Each time you send funds out of the country, you must declare the reason for the payment to SARB using a specific category code. This isn’t a suggestion—it’s a legal requirement for every cross-border transaction leaving South Africa.

For instance, paying an overseas supplier for goods you’re about to import would fall under the BOP code for ‘Advance payment for imports’. Paying for a monthly subscription to a US software company? That would use the code for ‘Computer services’. Getting the code right is crucial.

The Power of Proof: Supporting Documentation

Along with the BOP form, you absolutely have to provide a supporting document that backs up the reason you’ve declared. This is your evidence that the payment is for a legitimate business purpose.

Let’s take a common scenario: paying an invoice from a supplier in Germany. The commercial invoice they sent you is the key supporting document. It must clearly state:

- The supplier’s full name and their banking details.

- A clear description of the goods or services.

- The exact amount due and in what currency.

Without a valid invoice or contract that lines up perfectly with the payment details, your transfer will be flagged and almost certainly rejected. Financial institutions have a legal duty to verify why money is leaving the country, and your supporting documents are how they do it. I've seen countless payments fail because of a tiny mismatch between the invoice and the recipient’s bank account name. A quick double-check of those details before you hit 'send' can save you a world of trouble.

Choosing the Right Way to Send Money Internationally

When your business needs to move money across borders, the method you choose can make a huge difference to your bottom line. It’s not just about getting funds from South Africa to a supplier in another country; it’s about the true cost, the speed, and the clarity of the entire transaction.

For South African businesses, your options generally boil down to three main avenues: your everyday bank, the SWIFT network they use, and a new generation of specialised fintech platforms. Picking the right one means looking past the advertised fee to understand what's really happening with your money.

Traditional Banks: The Familiar But Flawed Option

Going to your primary business bank is often the default move. It feels safe, familiar, and integrated with your other accounts. But that convenience often comes at a steep, and frequently hidden, cost. Banks are well-known for building a hefty profit margin directly into the exchange rate they offer you.

What does this mean in practice? The rate you get is often significantly worse than the real, mid-market rate you’d see on Google or Reuters. This gap, called the exchange rate spread, is where banks make a killing on international transfers. It can quietly skim thousands of rands off a single large transaction without you even noticing.

On top of the inflated exchange rate, you’ll also get hit with fixed transaction fees that can be pretty expensive, especially if you’re making smaller, regular payments to overseas staff or suppliers.

The SWIFT Network: The Slow and Unpredictable Backbone

When you send an international payment through your bank, you’re actually using the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network. Think of it as a global messaging system for banks, allowing them to coordinate and move funds.

But here’s the catch: the journey is rarely a straight line. Your payment might have to hop between several correspondent banks before it reaches its final destination, a bit like taking a series of connecting flights. Each of these intermediary banks can take a slice of the pie, introducing extra fees that are often deducted from the amount you sent—without any warning.

This is a critical point many businesses miss. The amount you send is often not the amount that arrives. Those unpredictable correspondent fees mean your supplier could receive less than you intended, leading to reconciliation headaches and potential relationship issues.

The SWIFT network is also notoriously slow. A transfer can easily take 2-5 business days or even longer if there’s a hiccup anywhere in the chain. For businesses with tight deadlines, that kind of unpredictability is a major liability.

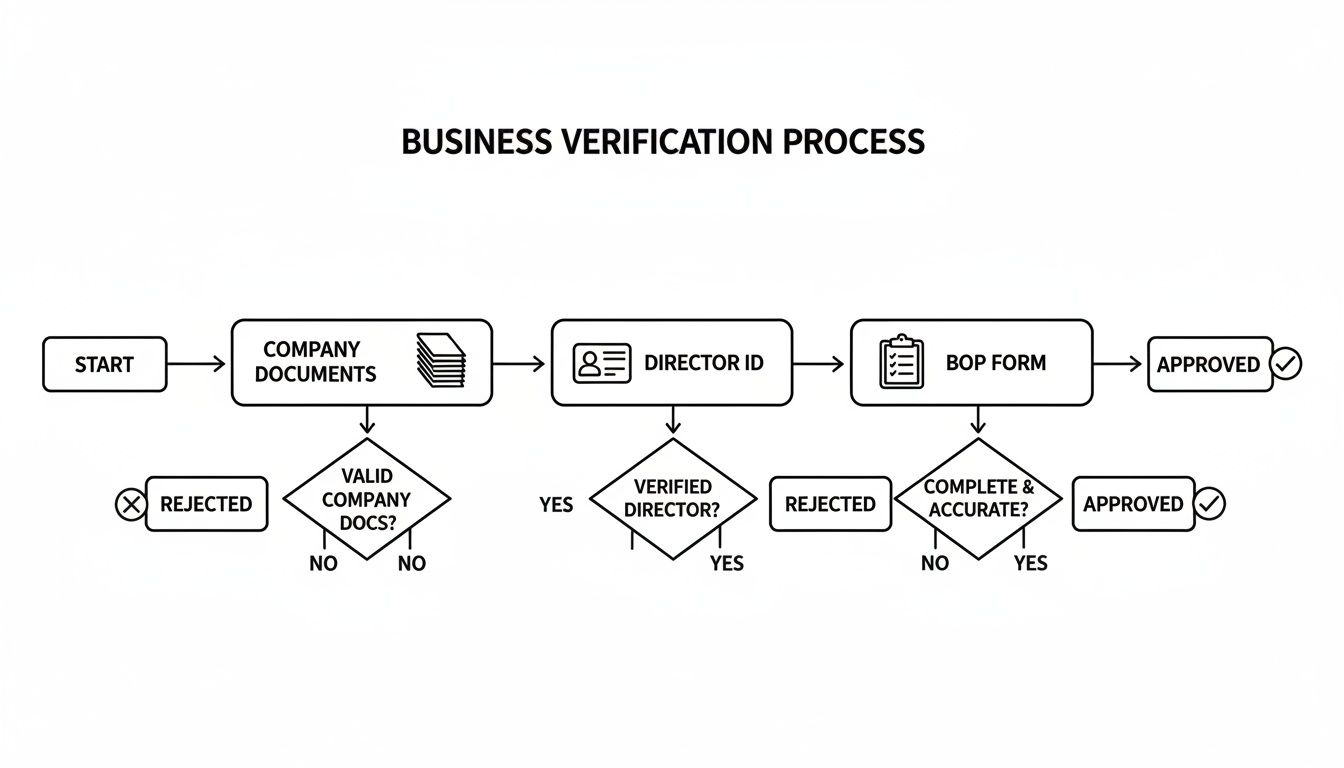

This visual guide breaks down the verification steps you’ll likely encounter with different providers, helping you get your ducks in a row ahead of time.

As you can see, having your company documents, director IDs, and BOP forms ready is the key to a smooth and fast verification process.

Fintech Platforms: A Modern Solution for Global Business

This is where specialised payment platforms like Zaro come in. They were built from the ground up to solve the very problems we’ve just talked about in the traditional banking system. Their entire approach is geared towards efficiency and transparency.

The biggest game-changer is getting access to the real exchange rate. Fintech providers don't typically load the rate with a hidden margin. Instead, they’ll charge a single, upfront, and usually much smaller fee for the entire transaction. That transparency alone can lead to huge savings.

But the benefits don't stop there:

- Speed: They often use their own payment networks, bypassing the slow, multi-step SWIFT system. This means funds can be delivered much faster, sometimes within 24 hours.

- Transparency: You see the exact cost and the final amount the recipient will get before you hit send. No more nasty surprises from hidden correspondent bank fees.

- Efficiency: The whole process, from signing up to sending money, happens on a clean digital platform. It simplifies everything, from compliance checks to keeping records.

To give you a clearer picture, here’s a quick comparison of how the different methods stack up for a typical South African business.

International Transfer Method Comparison for SA Businesses

| Feature | Traditional Banks | SWIFT Network (via Banks) | Fintech Platforms (e.g., Zaro) |

|---|---|---|---|

| Exchange Rate | Hidden mark-up (spread) applied; rate is worse than mid-market. | The rate is set by the initiating bank, which includes their mark-up. | Typically offers the real mid-market rate with no hidden spread. |

| Fees | High fixed transfer fees (e.g., R500+) plus the hidden exchange rate cost. | Multiple, often unpredictable, fees from intermediary banks are deducted from the total. | A single, transparent fee, often a small percentage of the transaction amount. |

| Speed | Slow, typically 2-5 business days. | The slowest part of the process; delays at any point in the chain are common. | Fast, often within 24 hours or even same-day for major currencies. |

| Transparency | Low. The final amount received can be less than expected due to hidden fees. | Very low. It's difficult to track fees or the exact arrival time. | High. You see the full cost breakdown and guaranteed arrival amount upfront. |

| Best For | Businesses making very infrequent, non-urgent payments who prefer their primary bank. | The underlying network for all bank transfers; not a direct choice. | Businesses making regular overseas payments who want to save money and increase speed. |

Ultimately, the choice depends on your business's priorities, but for any company looking to operate efficiently on the global stage, the benefits of modern fintech solutions are becoming impossible to ignore.

A Real-World Comparison: An Importer's Dilemma

Let’s put this into practice with a real-world scenario. Imagine your Cape Town-based business needs to pay a German supplier an invoice for €50,000.

Scenario 1: Using a Traditional Bank

The bank offers you an exchange rate of R20.50 to the Euro, even though the real mid-market rate is R20.00. On top of that, they charge a R500 transfer fee. Your total cost is R1,025,500. But that’s not the end of the story. An intermediary bank in the SWIFT chain deducts a €20 fee, so your supplier only gets €49,980, creating a shortfall and an awkward conversation.Scenario 2: Using a Fintech Platform

The platform gives you the real exchange rate of R20.00 to the Euro and charges a clear 0.5% fee (R5,000). Your total cost is R1,005,000. The full €50,000 arrives in your supplier's account, often the very next day.

In this single transaction, the fintech platform saved the business R20,500 and, just as importantly, prevented the payment shortfall and potential delays. Multiply that by dozens of payments a year, and the financial impact is massive. For any South African business looking to manage its international payments smartly, the choice becomes crystal clear.

Uncovering the True Cost of Your International Transfer

When you need to send money overseas, the first thing you probably see is the transfer fee. It's the number advertised upfront—often a flat Rand amount—and it looks simple enough. But in my experience, that fee is just the tip of a very large and expensive iceberg.

The real cost, and often the much bigger one, is cleverly hidden inside the exchange rate you're offered. This is where most traditional providers make their profit, and it’s a cost that can drain thousands from your business without you ever seeing a clear invoice for it.

To really get to grips with what you're paying, you have to look beyond the obvious. The total cost of any international transfer is actually made up of two parts:

- The Upfront Transfer Fee: A fixed administrative charge for processing the payment.

- The Exchange Rate Margin: The hidden cost, representing the difference between the rate you get and the real market rate.

Understanding both is the only way to accurately calculate the price of your transaction and protect your bottom line.

Demystifying the Real Exchange Rate

So, what exactly is this "real" exchange rate? It's officially known as the mid-market rate. This is the genuine, wholesale rate that banks and massive financial institutions use to trade currencies with each other. You can think of it as the midpoint between the buy and sell prices for a currency on the global market.

It's the rate you’ll see if you search on Google, XE, or Reuters. It's the purest form of the exchange rate, with no profit margin built-in. When you see ZAR/USD at 18.50 on a financial news site, that's the mid-market rate.

However, when you go to make a payment, most providers won't give you this rate. Instead, they’ll present you with their own, less favourable one. The difference between their rate and the mid-market rate is their profit, often called the spread or markup. And this is where the true cost of your transfer really lies.

The exchange rate spread isn't a fee; it's a hidden charge baked into the currency conversion itself. A seemingly small percentage difference can turn into a significant financial loss, especially on larger or recurring payments.

The Financial Impact of a Hidden Markup

Let's walk through a tangible example to see how this plays out for a South African business. Imagine your company needs to pay a US-based software supplier an invoice for $5,000.

You check the real mid-market rate and see it's R18.50 to $1. At this rate, the payment should cost you exactly R92,500.

Now, let's see what happens with a provider that adds a markup:

- Your bank offers you a rate of R19.05 to $1. This is a 3% markup on the mid-market rate.

- At this inflated rate, the $5,000 payment now costs you R95,250.

- On top of this, they charge a R500 transfer fee.

- Your total cost becomes R95,750.

In this scenario, the hidden exchange rate markup cost your business R2,750—more than five times the stated transfer fee. Now, imagine making this payment every month. That "small" 3% spread quietly siphons R33,000 from your business every single year, just for one supplier.

This isn't a niche problem. Sending money from the United States to South Africa, for instance, has an average total cost of 6.84%, with the exchange rate margin being a huge chunk of that. That’s well above the G20 average and puts a heavy burden on businesses that regularly transfer funds abroad. You can explore a detailed breakdown of these costs through remittance cost data for South Africa on Statista.com.

How to Calculate Your True Cost

Arming yourself with knowledge is the best defence against these hidden costs. Before you commit to any transfer, take these simple but powerful steps to work out the real price you're being asked to pay.

- Always Check the Mid-Market Rate: Use a neutral source like Google or XE.com to find the current, real exchange rate for your currency pair (e.g., ZAR to USD).

- Get a Final Quote: Ask your provider for a final, all-inclusive quote showing the exchange rate they are offering and all applicable fees. No estimates.

- Calculate the Markup: Compare their rate to the mid-market rate to find the percentage difference. This is your hidden cost.

- Add the Fees: Add the upfront transfer fee to the hidden markup cost to get the true total cost of your transaction.

By following this process, you shift from being a passive price-taker to an informed buyer. It empowers you to compare providers not just on their advertised fees, but on the total cost, ensuring you always get the best possible value for your business.

Mastering Compliance and Financial Risk Management

When your business sends money overseas, you're plugging into a global financial system. It’s a world that’s heavily regulated—and for good reason. The entire framework is designed to stop financial crime in its tracks. For any South African business, understanding and following these rules isn't optional; it's a core part of operating internationally.

Get it right, and compliance becomes a business asset, protecting you from crippling fines and reputational damage. Get it wrong, and you're in for a world of pain.

The whole system is built on two key pillars: Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT). These aren't just buzzwords. They are strict, legally-binding frameworks that force financial institutions to verify that your payments are legitimate and aren't funding illegal activities. This is precisely why your bank or payment provider hounds you for documentation—they have a legal duty to prove every transaction is above board.

Building Your Compliance Armour

Think of your compliance process as a suit of armour for your business. A solid framework protects you from risks and, just as importantly, ensures your legitimate payments sail through without getting flagged or stuck in limbo. Successfully navigating the complex web of international transfers requires a firm grasp of regulatory compliance risk management to sidestep the many potential pitfalls.

The best approach? Be proactive. This means having your house in order long before you even think about hitting 'send' on a payment.

Here’s a practical checklist to keep your business protected:

- Keep Invoices Ready: Every single international payment needs a valid commercial invoice or contract to back it up. Make sure these documents are crystal clear, detailed, and perfectly match the payment information you provide.

- Maintain an Audit Trail: Your payment platform should give you a clear, downloadable record of every transaction. This needs to show who authorised it and when. Come audit time, this is non-negotiable.

- Regularly Update KYB Info: Has a director or shareholder changed? Tell your payment provider immediately. Outdated company information is one of the most common reasons for failed compliance checks and payment delays.

The sheer scale of cross-border finance is staggering. Official remittance inflows to Africa recently topped USD 100 billion a year, with South Africa being a major net sender. These numbers don't even touch the massive informal market, which explains why regulators are so insistent on traceable, verifiable transactions to keep the financial system clean. You can dig deeper into this in a research paper on migration and cross-border payments on Resbank.co.za.

Implementing Strong Internal Controls

Strong internal controls are the foundation of smart financial risk management. It’s not just about having the right documents on file; you need a robust system that ensures payments are made correctly, by the right people, every single time. This becomes absolutely critical as your finance team grows.

A classic mistake is letting one person handle the entire payment process from start to finish. This creates a dangerous single point of failure, opening the door to both internal fraud and simple, costly human error. A multi-user approval system is a surprisingly simple but incredibly powerful fix.

For instance, set up a workflow where a junior team member can prepare a payment, but it can't actually be sent until a manager or finance director reviews and approves it. This two-step process adds a vital layer of oversight.

Modern fintech platforms, like Zaro, make this dead simple by offering enterprise-grade controls. You can customise permissions for every user on your team, setting clear limits on who can create new beneficiaries, who can initiate payments, and who has the final say.

This kind of setup delivers a few key wins:

- Reduces Error: A second pair of eyes is brilliant at catching typos in beneficiary bank details or incorrect payment amounts before the money leaves your account.

- Prevents Fraud: It makes it significantly harder for an unauthorised payment to slip through the cracks.

- Increases Transparency: You get a clear, automated audit trail showing exactly who did what, and when.

By embedding these compliance and risk management practices into your daily operations, you're doing more than just ticking regulatory boxes. You're building a resilient, efficient, and trustworthy financial engine that will support your business as it grows on the global stage.

Building an Efficient International Payment Workflow

Making a single international payment is easy enough. The real challenge, and where the big savings are, is building a solid, repeatable system that saves you time and money on every single transaction. It's about shifting your mindset from putting out fires to creating a well-oiled machine for all your global payments.

This isn't just about finding the cheapest rate for one transfer; it's about building a predictable and efficient process that becomes a strategic part of your business.

A great place to start is with your compliance documents. Stop scrambling for paperwork at the last minute. Keep a secure digital folder with all your essential KYB documents—your CIPC registration, director IDs, proof of address, etc.—always updated and ready to go. This simple habit means you can onboard with a new, better payment provider without any frustrating delays.

Weaving Payments into Your Daily Operations

Once your documents are in order, the next step is to properly embed your payment process into your company's financial heartbeat. This is where good accounts payable best practices become non-negotiable, especially when you're juggling the complexities of international transfers. It all boils down to having clear internal controls from day one.

A practical, real-world workflow should include these elements:

- A Pre-Payment Checklist: Before a single rand leaves your account, have a simple checklist. Does the invoice match the purchase order? Are the beneficiary's bank details exactly right? Have you got the correct BOP code? A quick check here saves massive headaches later.

- Multi-User Approvals: This is a simple but powerful control. Have one person set up the payment, but require a senior team member to give the final green light. This small step dramatically cuts down the risk of both innocent mistakes and costly fraud.

- Choosing the Right Partner for Good: Make a decision to standardise on a payment platform that gives you the real, mid-market exchange rate. This should be a hard-and-fast rule in your workflow, as it's the only way to permanently get rid of the hidden costs baked into poor exchange rates.

When you take deliberate control of your cross-border payments, you’re doing far more than just trimming costs. You gain a clearer view of your cash flow, slash the administrative load on your finance team, and build a much more resilient financial foundation for global growth.

Common Questions About Sending Money Abroad

Even with the best plan in place, a few questions always pop up when it's time to actually send money overseas. Let's tackle some of the most common queries we get from South African businesses, so you can handle the final details with confidence.

What Documents Do I Absolutely Need?

You'll need a core set of documents ready for any business transfer. Think of it as your "go-kit": your CIPC registration papers, proof of your business address (a recent utility bill works perfectly), certified IDs for all directors, and a valid tax clearance certificate.

But that's just for verifying your business. For the payment itself, you need proof. This means a commercial invoice or a formal contract that spells out exactly what the payment is for. This is non-negotiable and must be submitted with a correctly completed Balance of Payments (BOP) form, which is required for SARB reporting.

How Can My Business Secure Better Rates?

Honestly, the single biggest move you can make to get better rates and slash fees is to step away from traditional banks for your international payments. Your best bet is to partner with a specialist fintech platform.

Modern providers give you access to the real mid-market exchange rate—the one you see on Google—without baking in a hidden profit margin, or "spread." They usually charge a single, clear transfer fee, so you're not hit with the nasty surprise costs that make bank transfers so expensive. It’s a direct approach that shows you the true cost from the get-go.

How Long Does an International Transfer Take?

This really depends on the route you take. A standard bank transfer using the SWIFT network can drag on for 2-5 business days, sometimes longer if there are intermediary banks involved. It's an old system, and it can be frustratingly slow.

On the other hand, specialist fintech services are built for speed. Because they use their own modern payment networks, they can often get your money there within 24 hours. For major currency pairs, it’s not uncommon for the funds to land on the same day. That’s the kind of speed and predictability a global business needs.

Ready to stop overpaying on international transfers and take control of your global payments? Zaro offers South African businesses access to real exchange rates, transparent fees, and a powerful platform built for efficiency. See how much you can save with Zaro.