Sending money overseas is a day-to-day task for many South African businesses, but what does it really cost? Too often, the price you're quoted is just the tip of the iceberg. Hidden fees and less-than-ideal exchange rates can quietly chip away at your profits, making a standard payment far more expensive than it needs to be.

Let's pull back the curtain on these costs and show you how to protect your bottom line.

The Real Cost of Transferring Money Overseas

For most businesses, sending money internationally feels a bit like booking a flight online. You see a great price for the ticket, but once you’ve added baggage, chosen a seat, and paid the taxes, the final bill is a shock. International payments often follow the same script—the upfront transfer fee is just a fraction of the total cost.

The two biggest culprits inflating your bill are hidden exchange rate markups and a string of administrative fees. Most providers, especially the big banks, won't offer you the real-time, mid-market exchange rate. Instead, they give you a less favourable one and pocket the difference. This hidden fee is often called the "spread."

Unpacking the Hidden Expenses

To get a true picture of the cost, you have to look beyond the advertised rate. The total cost of sending money abroad is made up of several layers that stack up surprisingly fast.

Service Fees: This is the one you see upfront. It’s usually a flat fee or a percentage of the amount you’re sending, charged for handling the payment.

Exchange Rate Margin (The Spread): This is the most costly, and often least visible, expense. It’s the gap between the wholesale rate your provider gets and the retail rate they offer you.

Intermediary Bank Fees: If your payment travels via the SWIFT network, it can hop between several "correspondent" banks before reaching its final destination. Each of these banks can skim a fee off the top.

When you add it all up, a R100,000 payment can easily lose R3,000 to R5,000 in fees and poor exchange rates. That’s money gone before your supplier or partner even sees a cent.

This isn't just a small leak; it's a significant drain on your funds. Take payments from the United States to South Africa, for example. In early 2025, the average total cost was a staggering 6.84 percent, a figure that includes both the service fees and the exchange rate margin. That’s more than double the G20's target of getting global remittance costs down to 3 percent. You can dig into the numbers in the World Bank's detailed report.

Getting to grips with these different cost components is the first crucial step. Once you understand where your money is going, you can start building an international payment strategy that stops these unnecessary profit leaks for good.

Comparing Your International Payment Options

Choosing the right partner for sending money overseas can feel like navigating a maze. For any South African business, the path you take determines how much money actually arrives, how quickly it gets there, and how much of a headache the process is.

Typically, you're looking at three main routes: your trusted old bank, a specialised forex company, or one of the newer fintech platforms. Let's cut through the jargon and see how they really stack up.

Option 1: Traditional Banks and the SWIFT Network

This is the way it’s always been done. When you send money abroad through your bank, it travels on the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network.

Think of SWIFT as a series of connecting flights for your money. Instead of going direct, your payment might hop between several intermediary banks before it reaches its final destination. It’s a reliable system, but it has some serious drawbacks.

Every "stopover" on this journey can add delays and, crucially, extra fees. A single payment can easily take 3-5 business days to land, and you’re often left guessing what the final receiving amount will be after hidden correspondent bank charges are skimmed off along the way.

Option 2: Specialised Forex Providers

Specialist FX providers popped up to solve the biggest complaints about banks: high costs and slow service. These companies focus only on international payments, so they can usually offer better exchange rates and lower fees than the big banks.

They occupy a middle ground, giving you more competitive pricing without all the red tape of a massive financial institution. But here's the catch: while their rates look better, most still build a margin—or spread—into the exchange rate. This means you’re not getting the real rate, and a slice of your money is lost in the conversion.

Option 3: Modern Fintech Platforms

The newest players on the scene are the fintech platforms. These tech-first companies were built from the ground up to fix the problems inherent in the older systems. Many operate their own payment networks, completely bypassing the slow and expensive SWIFT system.

This direct approach brings some game-changing benefits:

- Speed: Transfers are often completed the same day, sometimes in just a few hours. No more waiting around for days.

- Cost Transparency: The best fintechs give you the mid-market exchange rate with no hidden spread. The fees are simple and clear from the start.

- User Experience: These platforms are built for modern business, with slick interfaces, multi-user access, real-time payment tracking, and automated reporting.

The core difference is the business model. Banks and many FX specialists make their profit from the exchange rate spread. In contrast, platforms like Zaro offer the real, zero-spread rate, which completely changes the cost equation for businesses that pay international suppliers or staff regularly.

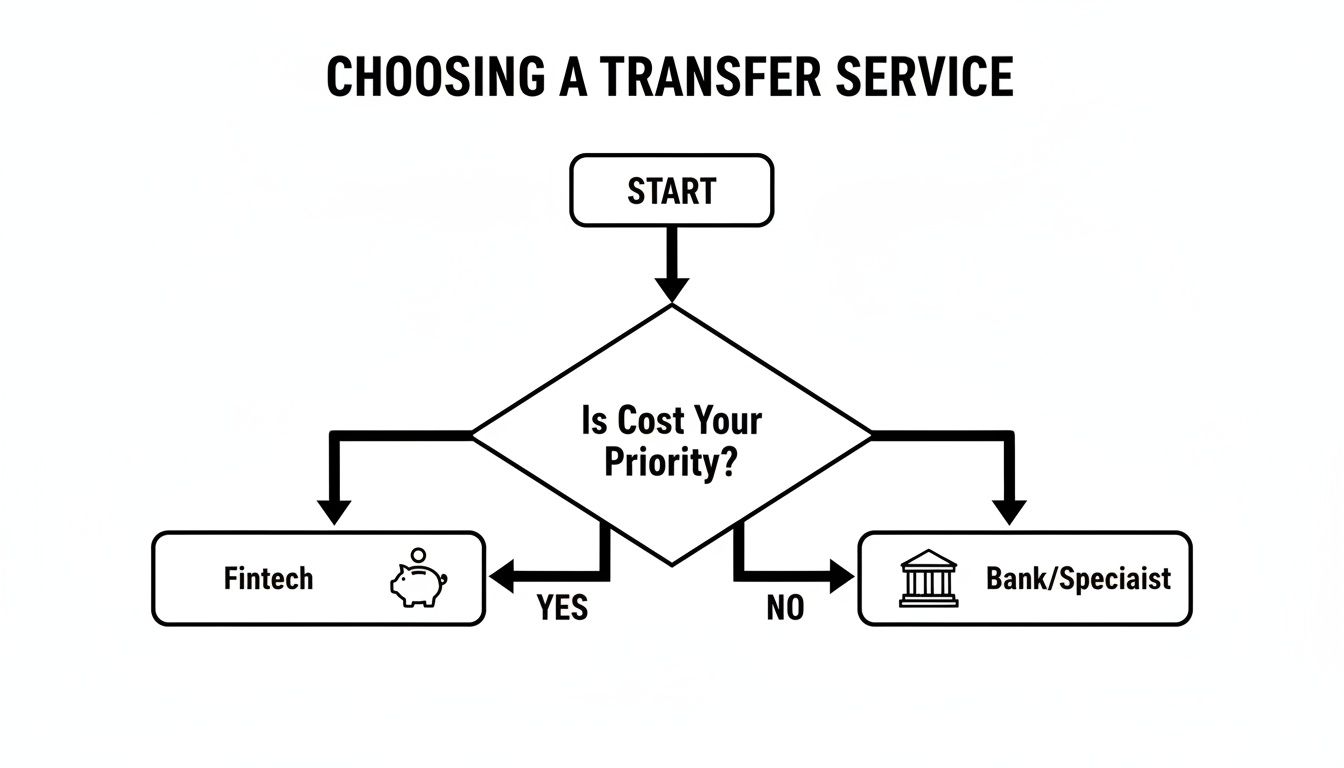

This flowchart can help you think through which option best suits your priorities, whether it's all about cost-saving or sticking with what you know.

As the diagram shows, it comes down to a simple but critical decision for any business: if minimising costs is your absolute top priority, fintech solutions are designed to deliver the most value.

International Money Transfer Methods at a Glance

Putting these options side-by-side really makes the differences pop. For most businesses, the final decision is a balancing act between cost, speed, and overall convenience.

Here’s a quick breakdown to help you compare.

| Feature | Traditional Banks (SWIFT) | Specialist FX Providers | Fintech Platforms (e.g., Zaro) |

|---|---|---|---|

| Exchange Rate | A retail rate with a significant markup (spread). | Better than banks, but still includes a hidden markup. | The true mid-market rate with zero spread. |

| Fees | High upfront transfer fees plus potential hidden intermediary fees. | Lower upfront fees, but costs are built into the rate. | Transparent, often low flat fees. Zero SWIFT fees. |

| Transfer Speed | Slow, typically taking 3-5 business days for funds to clear. | Faster than banks, usually 1-3 business days. | Fast, often same-day or within 24 hours. |

| User Experience | Can be cumbersome, often requiring branch visits or clunky online portals. | Better online experience, but may lack advanced business features. | Designed for business workflows with enterprise-grade controls. |

As you can see, the shift from traditional banking to modern fintech is a move towards greater transparency and efficiency. It’s also important to remember that country-specific rules can play a part, like the process for opening a non-resident bank account in Dubai if you have dealings in the UAE.

Ultimately, the best choice is the one that aligns with what your business values most.

Getting to Grips with South African Exchange Control Regulations

For any South African business sending money overseas, compliance isn't just an item on a checklist—it’s the absolute bedrock of every transaction. The rules laid out by the South African Reserve Bank (SARB) and the South African Revenue Service (SARS) can feel like a maze, but getting your head around them is non-negotiable for smooth and legal international payments.

Think of exchange controls as the highway code for moving money out of the country. They’re there to keep an eye on capital flows, protect the Rand, and maintain financial stability. Get it wrong, and you could be facing hefty penalties, frustrating delays, or even having your funds frozen.

The Core Concepts You Need to Know

The whole system boils down to allowances and reporting. While individuals have their Single Discretionary Allowance (SDA) and Foreign Investment Allowance (FIA), businesses play by a different set of rules tied directly to trade and investment.

The golden rule for businesses? You must have a legitimate reason for every single overseas payment. This is where your paperwork becomes your best friend.

- A Solid Commercial Purpose: You need to prove the funds are for valid business, like paying a supplier invoice for goods, settling up for services you’ve received, or making a direct investment abroad.

- Using Authorised Dealers: All your foreign exchange transactions have to go through an Authorised Dealer (AD) or an Authorised Dealer with limited authority (ADLA). These are your banks and other licensed institutions, and it's their job to enforce SARB’s rules.

- Reporting is a Must: Every transaction gets reported to the SARB. This is done using specific forms that classify the payment's purpose.

Authorised Dealers and Why BoP Reporting Matters

Your bank or payment provider essentially acts as a gatekeeper, making sure every Rand leaving South Africa is properly accounted for. They are legally on the hook to check that your transaction is legitimate and report it correctly.

This is where Balance of Payments (BoP) reporting comes into play. The BoP forms are the official way you tell the SARB why you’re sending money overseas. Each payment is given a specific category code that explains its purpose, whether it's for importing goods, paying for consulting, or handling royalties.

Getting BoP reporting wrong is an incredibly common pitfall. The wrong code can easily get your payment flagged for a review, creating delays and a mountain of admin you just don't need. It’s one of the biggest reasons to partner with a provider who really knows the ins and outs of South African compliance.

The sheer volume of these payments is climbing fast. South Africa is now a net remittance sender, and regional payment systems are seeing transaction values that are expected to hit the trillion-dollar mark by 2025. This growth just highlights why getting compliance right isn't just about following the law—it's a critical operational advantage. You can learn more about these cross-border payment trends directly from the SARB.

Using Automation to Cut Down on Risk

Manually handling this process is a real slog. You’re collecting invoices, filling out BoP forms for every single payment, and then submitting everything to your bank. It's slow and dangerously prone to human error. One small mistake could delay a critical supplier payment, hurting your business relationships and messing up your supply chain.

This is where modern fintech platforms completely change the game. They’re designed to turn this administrative headache into a simple, automated part of your workflow.

How automation makes life easier:

- Document Management: Upload and store all your supporting documents, like invoices, securely on the platform, attached directly to the payment they belong to.

- Simplified Reporting: The platform walks you through selecting the right BoP category, taking the guesswork out of the equation and dramatically reducing the risk of errors.

- Stress-Free Audits: With a perfect digital trail of every transaction and its paperwork, answering questions from SARS or your auditors becomes a quick and easy job.

By building compliance right into the payment process, you change it from a risky, manual task into a smooth, seamless part of your day-to-day finance operations. This doesn't just save your team hours of work; it gives you a solid, auditable record that ensures you’re always on the right side of the rules when transferring money overseas.

How to Manage Foreign Exchange Risk

When your business trades internationally, the deal you strike today isn’t always the deal you get tomorrow. The value of the Rand is in constant motion against currencies like the US Dollar or the Euro, and this ever-present wobble is what we call foreign exchange (FX) risk.

It might sound like a minor detail, but it can quietly eat away at your profits.

Let's say you agree to pay a US supplier $10,000 for a shipment of goods. On the day you sign the invoice, the exchange rate is R18.50 to the dollar, putting your cost at R185,000. But you only make the payment a week later. In that short time, the Rand has weakened to R19.20.

Suddenly, that same $10,000 invoice costs you R192,000. That’s a R7,000 loss that has nothing to do with your business operations and everything to do with market timing. For businesses with tight margins or frequent overseas transactions, this kind of unpredictability is more than just an inconvenience—it’s a genuine threat.

Are You Exposed to FX Risk?

Not every business feels the sting of FX risk in the same way. Your level of exposure really comes down to how much you rely on international trade and, crucially, the time gap between agreeing on a price and actually settling the payment.

Here are a few common scenarios where South African businesses find themselves vulnerable:

- Paying International Suppliers: If you’re invoiced in a foreign currency, any delay before payment gives the Rand time to weaken, pushing up your costs.

- Receiving Payments from Foreign Clients: When you invoice a client in dollars or euros, a strengthening Rand means that money will be worth less once you convert it back.

- Holding Foreign Currency: Leaving funds in a foreign currency account without a plan is a gamble. If that currency’s value drops against the Rand, so does the value of your cash.

The real enemy here is uncertainty. Without a strategy, you’re basically betting on the currency markets, hoping for a favourable move. A smart approach to managing FX risk isn't about outsmarting the market; it's about taking back control.

The good news is that you don't need a finance degree to protect your business. It's about using simple, effective tools to lock in some certainty and shield your bottom line from nasty surprises.

Practical Ways to Protect Your Margins

Think of managing FX risk like planning a long road trip. You could fill up your tank now at a price you know, or you could drive on, hoping the next petrol station isn't twice as expensive. Most of us would choose the certainty of a full tank at a predictable cost.

Here are two straightforward strategies to bring that same certainty to your international payments:

1. Forward Exchange Contracts (FECs)

This is your tool for planning ahead. A forward contract lets you lock in an exchange rate today for a payment you need to make in the future. You simply agree on a rate with your provider for a set amount and date. When it’s time to pay, you get that exact rate, no matter how much the market has jumped around in the meantime.

- The benefit? Absolute certainty. You know exactly what you'll pay or receive.

- Best for? Situations where you know the exact amount and timing of a future transaction, like paying a big supplier invoice that’s due in 90 days.

2. Spot Transactions with Real-Time Rates

For payments you need to make right now, the game is different. The goal here is to get the best possible live rate at the moment you transact. This approach works best when you have access to a platform that shows you transparent, real-time exchange rates without sneaky markups, allowing you to execute the transfer when the rate looks good.

- The benefit? You get full transparency and can act quickly to take advantage of favourable rates.

- Best for? Day-to-day payments, smaller amounts, or any time you need to send money urgently.

By using a mix of these two strategies, you can build a solid defence against currency swings. Use forward contracts to lock in costs for your large, predictable payments, and use real-time spot transactions for everything else. It’s a balanced and highly effective way to manage your risk when moving money across borders.

Your Step-by-Step International Transfer Checklist

Sending money overseas isn’t quite as simple as clicking a button. To make sure your funds land where they need to, on time and without any nasty surprises, you need a solid process. Think of this as a practical checklist for your finance team, breaking down each transfer into clear, manageable steps.

Following this game plan will help turn a potentially stressful task into a smooth, error-free part of your day-to-day operations.

Stage 1: Verify Beneficiary Details

Before you even think about sending the funds, get a second pair of eyes on every detail. The single most common reason payments fail is a simple typo in an account number or SWIFT code. These small mistakes lead to big headaches, like frustrating delays and extra fees to recall the payment.

- Beneficiary Name: Does it perfectly match the legal name on their bank account?

- Account Number/IBAN: Always get this in writing. A misheard number over the phone is a recipe for disaster.

- Bank Name and Address: This helps confirm you're sending funds to the right branch.

- SWIFT/BIC Code: This is the bank’s international postcode. It has to be correct.

Stage 2: Assemble Your Compliance Documents

This is a non-negotiable step for any South African business moving money offshore. Both SARB and SARS need to see a clear paper trail proving the payment is legitimate. Get your documents in order before you start the transfer to avoid any last-minute panic.

Usually, this just means having a supplier invoice that clearly states what goods or services you’re paying for. Having this ready prevents your payment from being held up by a compliance review. Regulations can differ greatly between countries, so it's wise to understand specific requirements, like those detailed in a guide on sending money abroad from Turkey for companies.

Stage 3: Choose the Best Transfer Provider

Don’t just default to your main business bank out of habit. As we’ve seen, your choice of provider has a huge impact on how much the transfer really costs and how quickly it arrives.

When comparing your options, look at the true cost—that’s the upfront fee plus the hidden margin in the exchange rate. A platform that gives you the real mid-market rate is almost always going to save your business money in the long run.

Stage 4: Lock In an Exchange Rate

Okay, you're ready to make the payment. Now it's time to manage your currency risk. If you’ve already booked a forward contract for a future payment, you're all set. If you're making a spot payment, you’ll need to execute the transfer at the best live rate you can find.

The Bottom Line: A transparent provider will always show you the live mid-market rate. This lets you see the final, all-in cost before you hit "confirm," protecting your profit margins from sneaky markups and guesswork.

Stage 5: Send and Track the Payment

With all the details checked and documents lined up, you can now confidently send the funds. A good, modern payment platform won’t leave you in the dark. It should offer real-time tracking, so you have full visibility from the moment the money leaves your account to the second it’s credited to your supplier.

Stage 6: Reconcile the Transaction

The final step is to close the loop in your accounting system. The payment needs to be matched against its corresponding invoice to keep your books tidy. This becomes much easier if your payment platform integrates with your accounting software or provides clear, downloadable statements. This final check ensures your records are accurate and creates a complete audit trail for peace of mind.

How Modern Fintech Simplifies Global Payments

After wrestling with the old way of doing international payments—navigating hidden fees, endless paperwork, and regulatory hoops—it’s obvious that the traditional system just isn't built for modern business. Fast-growing South African companies need a solution that moves at their speed. This is exactly where fintech platforms come in, changing the entire game by tackling the biggest headaches: cost, compliance, and control.

They don't just patch the old system; they rebuild it from the ground up. Instead of treating international payments as a painful cost of doing business, these platforms turn them into a streamlined, efficient part of your operations. By cutting out the slow and expensive middlemen and using smart technology, they deliver a payment experience that’s faster, cheaper, and completely transparent.

Eradicating Hidden Costs with True Rates

The biggest game-changer fintech introduces is the death of the hidden exchange rate markup. For years, businesses have been losing a slice of every single transaction to the "spread" that banks and traditional brokers quietly add to the exchange rate. Modern fintech platforms put a stop to that.

They give you the real, mid-market exchange rate—the one you see on Google—with zero spread. What you see is what you get. This simple act of transparency means you're no longer paying a secret fee on every currency conversion. On top of that, they eliminate SWIFT fees, so you don't get hit with unpredictable charges from intermediary banks along the way. The financial impact is immediate and significant.

A fintech approach turns an unpredictable expense into a predictable, low-cost operational task. By removing hidden markups and intermediary fees, businesses can save thousands of Rands on every significant transaction, directly protecting their profit margins.

This shift couldn’t come at a better time. South Africa's digital remittance market is on track to explode, projected to hit nearly USD 800 million by 2030. This growth is fuelled by a clear demand for faster, cheaper digital ways to send money overseas. For any business paying international supplier invoices or service fees, getting on board with these platforms is no longer a nice-to-have; it's becoming essential. You can get a deeper look into South Africa's digital payment trends to see where things are headed.

Automating Compliance and Enhancing Control

Cost savings are just the start. Fintech platforms also lift the heavy administrative burden of South African exchange control regulations. Let's be honest, manual compliance is not just slow; it's a massive operational risk. One wrong tick on a BoP form can stall a payment for days and create a compliance nightmare.

Modern platforms build compliance right into the payment workflow, making the whole process incredibly simple:

- Guided Reporting: The system actually helps you choose the correct BoP codes, which dramatically cuts down the risk of human error.

- Digital Document Storage: You can attach invoices and other supporting documents directly to the transaction. This creates a perfect, audit-ready digital paper trail.

- Automated Submission: All the compliance info is neatly packaged and sent to the Authorised Dealer for you, saving your team hours of soul-crushing admin.

And these platforms are designed with a finance team's real-world needs in mind. They come with enterprise-grade features that give CFOs and financial managers the oversight they need. Think multi-user access with custom permissions, which lets you delegate tasks without giving up control. A team member can set up payments, but only an authorised manager can hit the "approve" button. It’s this combination of automated compliance and tight, granular control that transforms a high-risk manual headache into a secure, smooth operation.

Frequently Asked Questions

When you start sending money across borders, questions are bound to pop up. It’s a complex space, but it doesn't have to be confusing. Here are some plain-English answers to the questions we hear most often from South African businesses.

How Long Does an International Transfer Take?

This really comes down to the rails your money travels on. If you go the traditional route with your bank's SWIFT transfer, you're looking at a wait time of anywhere from 3-5 business days.

Modern fintech providers, on the other hand, have built more direct routes. They can often get your money there within 24 hours, and in some cases, even on the same day. The difference is night and day.

What Is the Safest Way to Send Money Abroad?

Both established banks and reputable fintechs offer robust security. The non-negotiables you should look for are bank-level security protocols like two-factor authentication and end-to-end data encryption. This ensures your money and your data are locked down tight.

Crucially, make sure your provider is a registered Authorised Dealer or is partnered with one.

But honestly, the biggest risk isn't technology—it's human error. One wrong digit in an account number can send your funds into limbo. Always, always double-check the beneficiary's details before you hit send.

Do I Need to Report Every Overseas Payment?

Yes, absolutely. In South Africa, there's no getting around this. Every single cent that leaves the country for business purposes has to be reported to the South African Reserve Bank (SARB) via an Authorised Dealer.

This is handled through what are known as Balance of Payments (BoP) forms, where you simply categorise the reason for the payment—whether you're paying for imported goods, software subscriptions, or international consulting fees.

Can I Lock in an Exchange Rate for a Future Payment?

You certainly can, and it's a smart move for managing your currency risk. This is done with a financial tool called a Forward Exchange Contract (FEC).

An FEC lets you agree on an exchange rate today for a payment you know you need to make in the future. It’s a great way to protect your budget from any nasty surprises if the rand suddenly weakens.

Ready to stop overpaying on international transfers? Zaro offers transparent, real-time exchange rates with zero SWIFT fees, transforming how your business manages global payments. Discover a smarter way to pay your international suppliers.