A treasury management system (TMS) is specialised software designed to centralise and automate a company's financial operations. Think of it as the central nervous system for your corporate treasury, connecting everything from cash flow and investments to risk management in one unified platform. It’s what allows your finance team to step away from clunky manual spreadsheets and into a world of real-time data and strategic oversight.

What Is a Treasury Management System Anyway?

Imagine trying to conduct an orchestra where every musician is playing from different sheet music. The result? Pure chaos. Missed cues, clashing notes, and a performance that quickly falls apart. For many businesses, managing corporate finances without a unified system feels exactly like this—a messy combination of scattered spreadsheets, disconnected bank accounts, and manual payment processes.

A treasury management system steps in as the conductor, bringing harmony and precision to your company’s financial operations. It isn’t just another piece of software; it's the central hub that pulls all your treasury functions together. By providing a single, real-time dashboard, it turns that scattered data into a clear, actionable view of your company's financial health.

From Manual Chaos to Automated Control

Without a TMS, treasury teams often get bogged down by repetitive, time-consuming tasks. Hours are spent manually downloading bank statements, reconciling accounts in Excel, and keying in payment details one by one. This manual approach isn't just slow; it’s a breeding ground for human error, which can lead to costly mistakes, missed payments, or compliance headaches.

The whole point of a treasury management system is to automate these routine processes. It creates a seamless flow of information by connecting directly to your company’s bank accounts, enterprise resource planning (ERP) systems, and other financial platforms.

A TMS fundamentally changes the role of a treasury department. It shifts the focus from tedious data collection and manual processing to high-value strategic analysis, risk management, and contributing directly to the company's bottom line.

The Clear Difference: Manual vs. Automated

The shift from manual processes to an automated TMS isn't just a small improvement—it's a complete change in how treasury functions. The table below lays out the key differences.

Manual Treasury vs Automated TMS: A Quick Comparison

| Function | Manual Process (Spreadsheets) | Automated TMS |

|---|---|---|

| Cash Visibility | Delayed, requires manual data consolidation from multiple bank portals | Real-time, consolidated view of all cash positions across all banks |

| Forecasting | Time-consuming, static, and often based on historical, outdated data | Dynamic, automated, and integrates real-time data for higher accuracy |

| Payments | Manual entry, multiple logins for different banks, high risk of error | Centralised payment hub, single interface, automated approval workflows |

| Bank Reconciliation | A tedious, line-by-line manual matching process in Excel | Automated matching of transactions, with exceptions flagged for review |

| Risk Management | Difficult to track FX or interest rate exposures in real-time | Automated monitoring of exposures with integrated hedging tools |

| Reporting | Manual report creation, often out-of-date by the time it's finished | On-demand, customisable reports with real-time, accurate data |

As you can see, automation doesn't just make things faster; it makes them smarter and more secure.

Quantifying the Impact of Automation

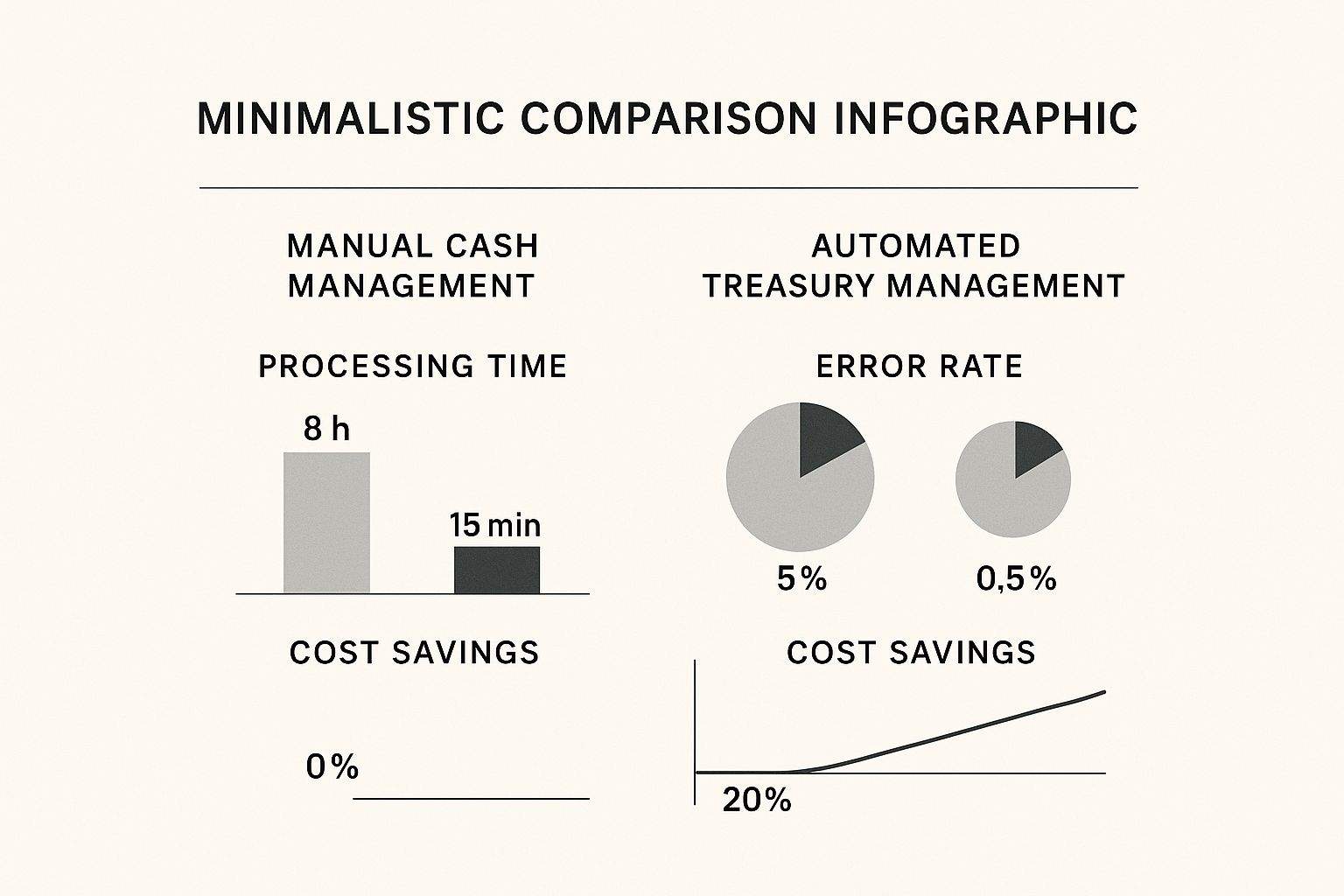

Moving to an automated treasury management system delivers tangible results you can actually measure—better efficiency, improved accuracy, and real cost savings. This infographic perfectly illustrates the stark contrast between the two approaches, showing just how much time and money can be saved.

The data makes it clear: automation can shrink tasks that once took a full day down to mere minutes, all while slashing costly errors. This is especially critical in complex economic environments.

Here in South Africa, the adoption of TMS solutions is growing as more organisations realise they need to optimise their finances. Companies have reported seeing up to a 30% improvement in cash visibility and a 25% reduction in transactional errors after putting a TMS in place. Despite some challenges, local firms are increasingly investing in cloud-based platforms to gain these advantages, a trend you can explore in this global treasury survey.

Unpacking the Core Functions of a Modern TMS

To really get what a treasury management system does, you need to lift the bonnet and have a look at the engine. A TMS isn't just another dashboard; it's a powerful suite of connected tools, all working together to give you total command over your company's financial world. Each function is designed to solve a specific, real-world challenge that treasury professionals wrestle with every day.

It's best to think of these functions not as a boring list of features, but as a set of capabilities that completely change how your business handles its money. They shift your team from putting out financial fires to strategically planning for the future.

Let’s break down these core components and see what they look like in action.

Mastering Cash and Liquidity Management

At its very core, a TMS is all about knowing exactly where your cash is and what it can do for you. This is the essence of Cash and Liquidity Management. It’s the critical difference between guessing your financial position and knowing it with absolute certainty.

A TMS gives you a single, real-time view of all your bank accounts, no matter the bank or currency. Forget the tedious process of logging into multiple online banking portals or waiting for monthly statements to arrive. This instant visibility lets you:

- Optimise Cash Positioning: You can immediately spot which accounts are holding surplus cash that could be invested, and which ones might need a top-up—all from one screen.

- Improve Cash Forecasting: By analysing past trends and current transactions, the system helps you predict future cash movements with far greater accuracy. This means you can see a shortfall coming long before it hits or plan for a major expense with confidence.

Think about a South African exporter for a moment. With a TMS, they know the precise second a large payment from an international client lands. This allows them to instantly convert the funds at a great rate or push them out to pay a critical supplier without a moment's delay.

This level of control is fundamental. It ensures your working capital is always productive, never just sitting idle or, worse, falling short right when an opportunity knocks.

It's no surprise that the global treasury management software market is projected to nearly double, from USD 4.8 billion in 2023 to around USD 10.2 billion by 2032, largely because of these powerful capabilities. Here in South Africa, firms are increasingly adopting technologies with AI and machine learning to get their cash forecasting spot-on. In fact, companies that invest in these advanced tools have reported up to a 20% improvement in forecast accuracy, leading to much faster, smarter decisions. You can get more insight into how businesses are choosing these systems in this J.P. Morgan overview.

Defending Against Financial Risk

Every business faces financial risks, but for those in international trade, the stakes are even higher. A sudden currency swing can wipe out your profit margin, and an unexpected interest rate hike can make your debt far more expensive. The Financial Risk Management function of a TMS is your company's financial shield against this volatility.

It provides the tools to see, measure, and then neutralise these threats.

- Foreign Exchange (FX) Risk: By pulling all your foreign currency exposures into one place, the system shows you exactly where you're vulnerable. From there, it can help you execute hedges to lock in exchange rates and protect your bottom line.

- Interest Rate Risk: The system can run scenarios showing how interest rate changes would impact your company’s loans and investments, giving you the clarity needed to make shrewd decisions about your debt portfolio.

Streamlining Payments, Investments, and Compliance

Beyond just visibility and risk, a modern TMS automates and simplifies the day-to-day financial grind. This is where you find massive efficiency gains.

Payment Processing A quality TMS includes a centralised payment hub. Instead of your team juggling payments across different bank platforms, they can initiate, approve, and track every single payment from one secure interface. This structured workflow slashes manual errors, boosts security with clear approval chains, and creates a perfect audit trail.

Debt and Investment Management This module helps you stay on top of your company’s investment portfolios and debt facilities. It tracks everything from maturity dates and interest payments to covenant compliance, making sure you meet every obligation and get the best possible return on your investments.

Financial Reporting and Compliance Finally, a TMS takes the pain out of reporting. It automates the creation of both standard and custom reports for cash positions, risk exposure, and performance analytics. This doesn't just save hundreds of hours; it guarantees that management and auditors get accurate, timely, and compliant financial data every time.

The Real Business Benefits of Using a TMS

While the features of a treasury management system sound great on paper, the real magic is what they unlock for your business. A TMS isn't just about speeding up treasury tasks; it’s about fundamentally changing your company's financial DNA. It helps your finance team shift from being reactive record-keepers to proactive strategists who deliver tangible results.

Investing in a TMS brings real strategic advantages you can see on the balance sheet and feel right across the company. Let's move past the technical talk and dig into the concrete business outcomes that a well-chosen system delivers.

Gaining Unprecedented Cash Visibility

Imagine trying to drive a car with a fogged-up windscreen, squinting to see just a few metres ahead. That’s what managing corporate cash without a TMS feels like. You're constantly making reactive, short-term decisions based on patchy information.

A treasury management system completely clears the fog. It gives you a crystal-clear, real-time view of every rand and dollar across all your accounts, no matter where they are. This isn't just a small convenience; it’s a strategic game-changer. With this level of visibility, your team can:

- Optimise Working Capital: Instantly spot idle cash sitting in low-yield accounts and put it to work earning better returns or paying down expensive debt.

- Make Proactive Decisions: Foresee potential cash shortfalls weeks in advance, not hours. This gives you plenty of time to arrange financing on favourable terms instead of scrambling for expensive, last-minute credit.

- Hedge Currency Exposure: For a South African exporter, seeing a large USD payment land in real-time allows for immediate action to lock in a favourable exchange rate, directly protecting your profit margins.

Improving Operational Efficiency and Accuracy

Manual treasury work is a huge drain on your team. It eats up valuable time with repetitive tasks like data entry, reconciling accounts, and building reports. Worse still, it’s a minefield for human error, where a single misplaced decimal can have massive financial consequences.

A TMS automates these soul-crushing tasks, freeing your skilled finance professionals from the tyranny of spreadsheets. This shift has two profound effects. First, it drastically cuts the risk of costly mistakes. Second, it lets your team redirect their energy to high-value activities like financial analysis, scenario modelling, and strategic planning.

By automating routine processes, a TMS empowers your treasury team to spend less time on what happened and more time on why it happened and what should happen next. This is the pivot from administrative work to strategic partnership.

Strengthening Financial Controls and Security

In a world of rising payment fraud and intense regulatory scrutiny, solid financial controls are non-negotiable. Think of a TMS as a fortress for your company's finances. It enforces strict, standardised workflows for every transaction, from the moment it's created to its final approval and settlement.

This structured process creates a clear audit trail and makes sure every payment follows company policy. The key benefits here are:

- Fraud Prevention: By centralising payments and enforcing multi-level approval rules, a TMS makes it significantly harder for fraudulent payments to ever slip through the cracks.

- Compliance and Reporting: The system automatically generates accurate, audit-ready reports, which simplifies compliance with regulations and gives management reliable data they can trust.

Elevating Treasury to a Strategic Business Partner

Ultimately, the biggest benefit of a treasury management system is how it elevates the treasury function itself. When your team is no longer bogged down by manual work and has instant access to real-time, accurate data, they become an invaluable source of strategic insight for the entire business.

Treasury can finally answer the big questions with confidence: Do we have the cash to fund that new expansion? What's our precise exposure to currency risk in our European markets? What would a 1% interest rate hike do to our debt costs?

This ability to provide data-driven answers transforms treasury from a back-office cost centre into a vital strategic partner that actively helps drive growth, profitability, and long-term financial health.

How to Choose the Right Treasury Management System

Choosing a treasury management system is a major decision that will ripple through your financial operations for years. It’s not just about buying a piece of software; it's about finding a long-term partner for your company's financial health. A hasty choice can lock you into a system that creates more problems than it solves, but getting it right means equipping your team with a tool that genuinely drives growth.

Think of this section as your practical buyer’s guide. We’ll walk you through a clear process to weigh your options, ask the important questions, and ultimately pick the perfect treasury management system for your business.

H3 Start With Your Unique Needs

Before you even glance at a vendor's website, the most critical step is to look inwards. You need a rock-solid understanding of your own operational needs and, more importantly, your pain points. What are the daily financial headaches holding your team back?

A fantastic way to start is by literally mapping out your current treasury workflows. Get it all down on paper: how you track cash positions, manage your foreign exchange risk, and how payments get approved and sent. This simple exercise will throw a spotlight on the bottlenecks, manual processes, and areas ripe for improvement.

Get your team together and ask some honest questions:

- Where are we burning the most hours on manual data entry or reconciliations?

- What are our biggest worries when it comes to currency swings or payment fraud?

- Can we see a clear, live picture of our total cash across all our different bank accounts? Right now?

- What financial reports does our leadership team constantly ask for that we struggle to pull together?

The answers to these questions will give you a detailed "wish list" of problems that need solving, which becomes the backbone of your evaluation.

H3 Key Evaluation Criteria to Consider

Once you have your needs clearly defined, you can start looking at potential TMS solutions. It's so important to see past the flashy sales pitches and focus on the core functions that will actually deliver value to your business.

The goal is to find a system that not only solves today's problems but can also grow with you. A treasury management system should be an asset that scales, not a liability you outgrow in two years.

Here is a checklist of essential criteria to guide you as you start talking to vendors.

TMS Selection Checklist

Choosing the right TMS requires asking the right questions. This checklist is designed to help you methodically evaluate potential systems and vendors to ensure they align with your specific business requirements, both for today and for the future.

| Evaluation Criteria | Key Questions to Ask |

|---|---|

| Integration Capabilities | How easily does your system connect with our specific ERP and accounting software? Can it integrate with all our South African and international banking partners? |

| Scalability | Can your system support our business as we expand into new markets or add more bank accounts and legal entities? |

| User Experience | Is the platform intuitive for our finance team? Can we get a trial or sandbox environment to test the user interface? |

| Security and Compliance | What security protocols do you have in place to protect our financial data? How do you ensure compliance with regulations like POPIA? |

| Vendor Reliability | What does your implementation process look like? What level of ongoing training and customer support do you provide? |

A thorough evaluation using these points will help you compare different systems on a like-for-like basis, making your final decision much clearer.

H3 Cloud-Based vs On-Premise Solutions

One of the biggest forks in the road you'll encounter is whether to go for a cloud-based (SaaS) solution or a traditional on-premise system that you host yourself. For most small to medium-sized businesses today, cloud-based systems have become the obvious choice. They generally come with lower upfront costs, much faster implementation times, and automatic updates, freeing you from the headache of managing your own IT infrastructure.

The numbers tell the same story. As of 2022, cloud-based solutions are the top pick for companies with less than USD 10 billion in revenue—a group that includes a huge number of South African enterprises. Global adoption jumped from 36% in 2019 to 42% by 2022. That said, challenges like tight budgets (an issue for 70% of organisations) and a lack of tech skills (56%) are still very real, which makes the affordability and user-friendliness of cloud platforms even more appealing. You can explore more of these global treasury trends and findings.

By carefully assessing your needs, thoroughly vetting vendors against these key criteria, and choosing the right deployment model, you can confidently select a treasury management system that will truly empower your finance team and support your company’s biggest goals.

A Financial Toolkit for Global Trade

For any South African business dipping its toes into global markets, the textbook definition of a treasury management system doesn't quite capture the full picture. The real test isn't just about managing cash flow; it's about defending your hard-earned profit margins against the brutal realities of cross-border trade. This is precisely where most generic systems stumble, and why a purpose-built financial platform becomes less of a tool and more of a vital partner for growth.

Imagine a design studio in Cape Town exporting beautiful, handcrafted goods to clients in Europe. The initial excitement of international orders is fantastic, but a quick look at their bank statements tells a less thrilling story. Every payment that arrives in Euros gets whittled down by unpredictable exchange rates and eye-watering bank fees. Paying their own overseas suppliers is a slow, expensive ordeal bogged down by hidden costs. Their revenue, won through skill and hard work, is being eroded before it even lands in their local account.

This is a story I've heard time and time again from South African exporters. The answer isn't a more complex spreadsheet; it's a financial toolkit designed from the ground up to solve these specific problems.

Protecting Profits from Currency Swings

By far, the biggest menace to an exporter's profitability is foreign exchange (FX) volatility. A sudden one-rand swing in the ZAR/USD rate can wipe out the profit on an entire shipment. A specialised platform like Zaro tackles this problem head-on by offering multi-currency accounts.

Instead of being railroaded into converting foreign currency into Rands the moment it arrives—at whatever rate the bank decides to offer that day—our Cape Town studio can now hold their Euros in a dedicated EUR account. This one change is a game-changer. It gives them the power to watch the market and choose the right moment to bring their money home, instantly shielding their profits from a sudden dip.

This isn't just about holding foreign currency; it's about reclaiming control. It shifts the business from being a passive victim of market whims to an active manager of its own financial future.

Slashing the Hidden Costs of Global Payments

Beyond the volatile rates, traditional international payments are notoriously expensive. Banks typically bake a hidden markup, or "spread," into the exchange rate they offer you and then add SWIFT fees for good measure. These costs quietly stack up, shaving a bit off every single transaction.

A platform built for exporters is designed to cut out this waste. Zaro, for instance, operates on the real exchange rate, which means no hidden spread and no SWIFT fees. For our design studio, the practical benefits are huge:

- Paying International Suppliers: When buying raw materials from Italy, they can simply fund their EUR account and pay the supplier directly. This sidesteps the costly double-conversion and fees their local bank would have charged.

- Receiving Client Payments: Their European clients can pay directly into the studio's EUR account, a process that’s cheaper and faster for everyone.

This direct, low-cost approach ensures more of the money they earn actually stays in their business, where it belongs.

A Simplified Workflow for International Trade

Finally, a specialised financial platform serves as a focused treasury management system for global commerce. It brings the entire international payments workflow together into one secure, easy-to-use dashboard. This delivers a level of control and efficiency that, until recently, was only accessible to massive corporations.

For the studio owner, this means no more logging into multiple banking portals or spending hours chasing up payment statuses. With enterprise-level controls like multi-user access and custom permissions, their finance team can manage transactions with confidence and security. They get a crystal-clear view of their international cash flow, which makes forecasting, planning, and growing the business a much more certain process. It’s the perfect financial toolkit for taking a brilliant local brand to the world stage.

Your Questions About Treasury Management Systems Answered

Even after seeing all the benefits, deciding to adopt new technology like a treasury management system can feel like a huge leap. That's perfectly understandable. When you're talking about investing in your company's core financial engine, you want to be absolutely certain you're making the right call.

To help clear things up, we’ve put together answers to the most common questions we hear from businesses just starting to explore treasury solutions. Think of this as a straightforward, jargon-free guide to help you get comfortable with the idea.

How Long Does Implementation Take?

This is usually the first thing on everyone's mind: "How long until we can actually use this thing?" The honest answer is, it depends. The timeline is shaped by how complex your finances are and which type of system you go for.

Not too long ago, traditional, on-site systems could easily take months—sometimes over a year—to install and get working properly. Thankfully, modern cloud-based systems have completely changed the game. For most mid-sized businesses, a cloud TMS can be up and running in just a few months. The key is having a solid project plan and a supportive vendor to keep everything moving.

Is a TMS Only for Large Corporations?

This is a common misconception that’s definitely worth clearing up. Maybe a decade ago, you’d be right. Back then, only massive multinational corporations had the kind of budget and in-house expertise needed for a sophisticated treasury management system. That's simply not the case anymore.

The shift to flexible, cloud-based Software-as-a-Service (SaaS) models has put these powerful tools within reach for businesses of all sizes. Today, a growing mid-sized South African company can access the very same financial controls and risk management tools that were once the exclusive playground of giant enterprises.

Think of the modern TMS as a great equaliser. It’s built to scale with you, giving smaller and medium-sized businesses the financial agility to compete on a bigger stage without the crippling upfront cost.

Can It Integrate with My Current Software?

Yes, without a doubt. In fact, if a TMS can't connect with your other tools, it’s not worth your time. A good system is designed to be the central hub for your entire financial world, not just another piece of software sitting in a corner.

Leading platforms are built specifically to talk to your existing stack. They use secure and proven methods to link everything up:

- ERPs and Accounting Software: Most come with pre-built connectors for popular software, ensuring data flows smoothly between your treasury and accounting teams.

- Banking Partners: They use secure APIs or established networks like SWIFT to connect directly to your banks. This is the magic that pulls in your bank data automatically for real-time cash visibility and easy reconciliation.

What Is the Typical Return on Investment?

Working out the ROI on a treasury management system goes way beyond just looking at the price tag. The real value comes from a host of improvements that ripple across the entire business.

The returns are driven by very real savings: lower bank fees, stopping expensive fraudulent payments before they happen, and massive time savings for your team thanks to automation. On top of that, better cash forecasting means you can put your reserves to work and earn higher yields. Many companies find they see a positive return on their investment within the first 12 to 24 months.

Ready to see how a purpose-built financial platform can act as the perfect treasury management system for your export business? Zaro offers multi-currency accounts, real exchange rates, and a streamlined workflow to protect your profits and simplify global trade. Learn how Zaro can empower your business.