Think of a forex brokerage as your business's passport to the global economy. In essence, it's a specialised financial firm that acts as a go-between, connecting you to the massive, fast-paced world of the foreign exchange (forex) market.

They are the essential link that allows your South African business to buy one currency by selling another. Without a brokerage, trying to pay an international supplier or receive foreign currency from a client would be incredibly complicated and expensive for any small to medium-sized enterprise (SME).

The Role of a Forex Brokerage Explained

Let's use a simple analogy. Imagine a forex brokerage is like a specialist travel agent, but instead of booking flights, they're arranging the movement of your money across borders. When you need to pay a supplier in the US, you have Rands but need US dollars. The brokerage is your agent, finding a seller for those dollars and making the trade happen for you.

They provide the entire infrastructure needed: the trading platform, live pricing, and the ability to execute the currency exchange. The forex market is the largest financial market on the planet, with trillions of dollars changing hands every single day. A good brokerage takes this intimidating, complex system and makes it accessible for your business.

To get a solid grasp of how this all works, it's helpful to understand the role of a financial broker more broadly. They are the partners who make cross-border business operations not just possible, but practical.

A Forex Brokerage's Key Roles at a Glance

So, what does a forex broker actually do for your business day-to-day? Here’s a quick breakdown of their main responsibilities.

| Core Function | What It Means for Your Business |

|---|---|

| Market Access | Gives you a direct line to the global currency market so you can actually buy and sell foreign currencies. |

| Price Provision | Provides real-time "buy" and "sell" prices for currency pairs like USD/ZAR, so you know the exact rate you're getting. |

| Transaction Execution | Handles the mechanics of swapping your Rands for another currency (or the other way around) on your instruction. |

| Account Management | Securely holds your funds, often in different currency wallets, and gives you detailed records of all your transactions. |

At the end of the day, the brokerage is the engine that converts one currency into another, making sure your international payments are made and your revenue from abroad gets home safely. They are the financial plumbing that underpins modern global trade, turning a logistical nightmare into a routine business task.

How Forex Brokerages Actually Make Their Money

To really get what a forex brokerage is, you have to follow the money. They provide a critical service, sure, but at the end of the day, they're a business. Their main source of income is cleverly woven into the very mechanics of currency exchange—it’s called the spread.

Ever looked up an exchange rate, say for USD to ZAR? You’ll always see two prices: a "buy" price (the bid) and a "sell" price (the ask). The buy price is what the broker is willing to pay you for your US dollars. The sell price is what they’ll charge you to sell you those same US dollars.

Notice something? The sell price is always a little bit higher than the buy price.

That small gap is the spread. Think of it as the broker’s built-in profit margin on every single transaction, their fee for making the trade happen. If a broker’s buy price for USD/ZAR is 18.20 and their sell price is 18.22, the spread is just 2 cents. It seems tiny, but when you multiply that by thousands of transactions a day, it adds up very quickly.

Decoding Broker Business Models

Beyond the spread, brokerages use different business models that dictate how they process your orders and handle their own risk. The two you’ll come across most often are Market Makers and ECN/STP brokers.

A Market Maker basically creates its own internal market. Picture them as a currency wholesaler. They purchase massive amounts of currency from big banks and other sources, then offer their own buy and sell prices directly to their clients.

- How they profit: Their main income is from the spread they set. But here’s the crucial part: they take the other side of your trade. If you’re buying USD, they are the ones selling it to you. This means they can potentially profit if your trade doesn't work out.

An ECN/STP (Electronic Communication Network / Straight-Through Processing) broker, on the other hand, is a pure middleman. They don't create a market. Instead, they connect your trade directly to a large network of liquidity providers, like major banks, investment funds, and even other brokers.

- How they profit: These brokers usually offer much tighter, more competitive spreads. Their profit comes from charging a small, fixed commission on each trade. Their goal isn't to trade against you; it's to facilitate as many trades as possible.

The key takeaway for any business is this: the broker's model directly impacts your costs and how your trades are handled. A Market Maker's interests might not always align with yours, while an ECN/STP broker makes money from volume, regardless of whether your trades win or lose.

Other Fees to Watch Out For

The spread might be the main cost, but it’s rarely the only one. To get a true picture of what your international payments will cost, you need to be on the lookout for a few other potential charges.

- Commissions: As we covered, this is the standard fee for ECN/STP brokers. It’s transparent, but you absolutely have to factor it into your total transaction expense.

- Swap or Rollover Fees: If you hold a currency position open overnight, you might be charged (or sometimes paid) an interest fee. This is more common for speculative traders, but it’s worth knowing about.

- Withdrawal and Deposit Fees: Some brokers will charge you just for moving your money into or out of your account. Always check their policy on this, as these fees can sting, especially if you’re making frequent transactions.

Getting a handle on these revenue streams is your first step in properly vetting a forex brokerage. It gives you the power to ask the right questions, dig into their fee structure, and make sure no hidden costs are silently eating away at your profits.

The Forex Brokerage Landscape in South Africa

For any South African business dipping its toes into international trade, getting to grips with the local forex environment isn't just a good idea—it's absolutely critical for security and smooth operations. The whole system is governed by one key player: the Financial Sector Conduct Authority (FSCA).

You can think of the FSCA as the referee for the entire financial industry. Its main job is to keep things fair, protect your business’s money, and make sure the market runs with integrity. The single most important decision you'll make is choosing a forex brokerage that is fully licensed and regulated by the FSCA. It's your non-negotiable first line of defence.

Why FSCA Regulation Is Your Safety Net

An FSCA license isn't just a piece of paper; it means a brokerage is legally bound to follow strict rules designed to protect your capital and ensure they operate transparently.

This gives you a few key protections:

- Segregated Client Funds: Regulated brokers must hold your company's money in bank accounts completely separate from their own. This is huge—it means your funds are safe even if the brokerage runs into financial difficulty.

- Fair Dealing Practices: The FSCA has rules in place to stop price manipulation. This ensures your currency exchanges are executed at fair market rates, ethically and above board.

- Local Accountability: If you ever have a dispute with an FSCA-regulated broker, you have a clear legal channel for recourse right here in South Africa. With an unregulated offshore company, you’re on your own with virtually no protection.

Choosing an unlicensed broker is like navigating treacherous waters without a life raft. The lure of slightly lower fees is never worth the risk of losing your entire capital to fraud or mismanagement.

South Africa is a major player in the African forex market. In fact, it's the continent's undisputed trading powerhouse, with a daily trading volume that tops $2.21 billion—a figure that completely overshadows other African nations. This activity is supported by a solid network of over 1,000 financial firms, many of which are forex brokerages operating under the watchful eye of the FSCA. You can find more insights in the African forex trading report on fnforex1.com.

The Home-Ground Advantage

Beyond the vital safety of FSCA regulation, working with a local brokerage brings some very real, practical benefits to your SME.

A South African-based forex brokerage gets the specific hurdles that local businesses face. They have hands-on expertise in navigating our country's complex exchange control regulations, which can be a massive administrative headache for importers and exporters trying to go it alone.

What’s more, these brokers usually offer ZAR-denominated accounts, which makes your accounting far simpler and cuts down on unnecessary conversion costs. You also get local customer support teams who are in your time zone and actually understand the realities of the South African business climate. This kind of localised knowledge makes a real difference in keeping your international payments running smoothly.

2. Brokerage vs. Payments Platform: Which Tool Is Right for You?

Choosing how your business handles international payments isn't just a small operational detail—it's a major strategic decision. You'll often hear about forex brokerages and dedicated cross-border payments platforms, and while they both deal with foreign currency, they are fundamentally different tools built for very different jobs. Getting this right is key to keeping your financial operations smooth and cost-effective.

A traditional forex brokerage is really a trading floor for your business. It’s designed for companies that are deeply involved in the currency markets, not just as a way to pay bills, but as a core part of their financial strategy. Think of them as a comprehensive toolkit for speculating on currency movements or using complex financial instruments, like forward contracts, to hedge against future rate changes.

On the other hand, a cross-border payments platform like Zaro is a specialist tool. It’s been engineered from the ground up to do one thing exceptionally well: make international payments simple, fast, and transparent. The goal here isn't to play the markets; it's to get money from A to B without the usual headaches and hidden fees that come with traditional banking.

Finding the Right Fit for Your Business

So, how do you know which one you need? It all comes down to what you’re actually trying to do. Are you running a treasury department that actively manages currency risk? Or are you a growing business that just needs to pay its international suppliers and remote team members without getting ripped off on exchange rates? Your answer points directly to the right solution.

Imagine a large mining company that needs to lock in an exchange rate for a massive equipment purchase from Germany that will only be paid for in six months. A forex brokerage is perfect for that. But what about a local software startup paying a team of developers in Kenya? They just need a straightforward, reliable way to send salaries each month without losing a big chunk to terrible rates and surprise bank charges. That’s where a payments platform shines.

At its core, the difference is all about intent. A brokerage is for managing currency as a financial asset. A payments platform is for using currency to run your day-to-day business as efficiently as possible.

Choosing Your Financial Tool: Brokerage vs. Payments Platform

To make it even clearer, let's put them side-by-side. Think about your business needs as you review this comparison—it should help you pinpoint exactly which tool is the right match for your goals.

| Feature | Traditional Forex Brokerage | Cross-Border Payments Platform |

|---|---|---|

| Core Purpose | Speculative trading and complex risk management (hedging). | Executing business payments and receiving international revenue. |

| Ideal User | Businesses with a treasury department actively managing FX risk. | SMEs and enterprises needing to pay global suppliers, staff, or receive funds. |

| Typical Fees | Spreads (markups on the exchange rate), commissions, and swap fees. | Often zero spread, using real exchange rates with a flat, transparent fee. |

| User Experience | Complex platforms with trading charts, leverage, and analytical tools. | Simple, intuitive interfaces focused on payment execution and tracking. |

In the end, it’s a classic case of specialists versus generalists. A forex brokerage gives you a powerful, but often complicated, system for engaging with the financial markets. A payments platform gives you a direct, cost-effective, and much simpler solution for the practical, everyday reality of doing business across borders. It strips out all the complexity to save you time and money on every single transaction.

How to Choose the Right Forex Broker for Your Business

Picking the right forex brokerage is one of the biggest financial calls your business will make. The right partner can save you thousands on currency conversions and make your international operations run smoothly. But the wrong one? That can expose your business to serious risks and a world of hidden costs.

This guide gives you a solid framework for vetting potential brokers. It’s all about making sure you partner with a firm that is secure, transparent, and actually gets what your business needs.

Your Step-by-Step Vetting Checklist

Work your way through this checklist when you’re looking at any forex brokerage. A confident "yes" to each of these points is a very good sign you’re on the right track.

Confirm Their FSCA Licence

This is the first thing you do. No excuses, no exceptions. You need to verify their Financial Sector Conduct Authority (FSCA) licence number on the official FSCA website. This is your proof that they are legally allowed to operate in South Africa and have to follow strict rules designed to protect your money.Analyse Their Fee Structure

You need total clarity on costs. Ask for a complete breakdown of their spreads, commissions, and any other charges that might pop up, like account maintenance or withdrawal fees. A good broker will be upfront about this. If they’re vague, it’s a massive red flag.Check for ZAR Currency Pairs

For any South African business, this is a must-have. Make sure the brokerage fully supports ZAR currency pairs, especially the big ones like USD/ZAR, EUR/ZAR, and GBP/ZAR. This is fundamental if you're paying international suppliers or getting paid from abroad, as it cuts out needless extra conversion steps.Evaluate Their Business Support

You're not a retail trader; you're a business with unique demands. How good is their customer support? Are they available during South African business hours? Will you get a dedicated account manager for your business account? When a large payment is on the line, you need to know you can get prompt, expert help.

It's also worth checking if their platform can integrate with essential market data management solutions. This ensures you're always working with accurate, real-time information to guide your decisions.

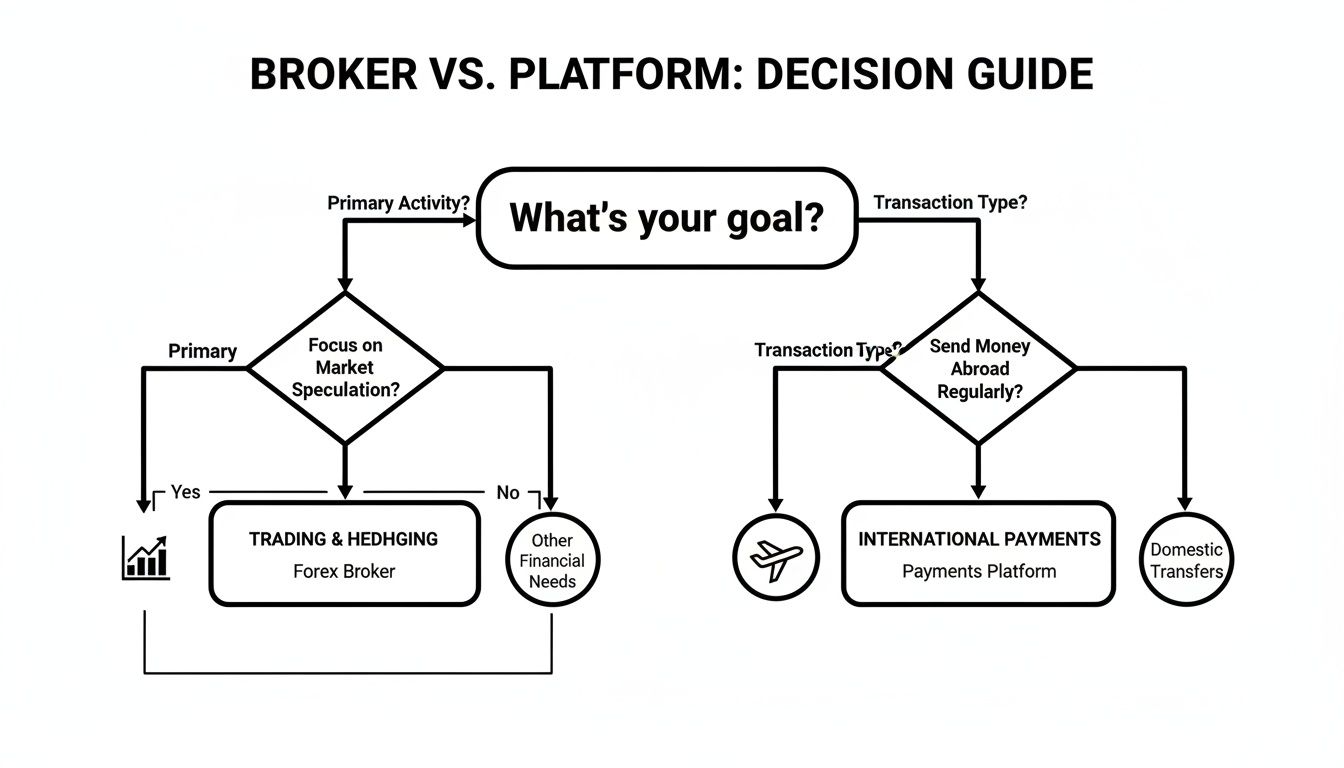

This visual guide can help you decide if your business truly needs the trading power of a broker or the payment efficiency of a platform.

As the decision tree makes clear, if your main goal is to manage currency risk or trade actively, a forex broker is the right tool for the job. But if you’re just focused on making international payments, a dedicated platform is the more straightforward solution.

Red Flags You Cannot Ignore

As you do your homework, keep a sharp eye out for these warning signs. Any one of them should be enough to make you walk away.

- Promises of Guaranteed Profits: Nobody can guarantee returns in the forex market. Ever. Claims like this are the calling card of a scam.

- Unclear Regulatory Status: If you can't easily find and verify their FSCA licence, you have to assume they don't have one.

- High-Pressure Sales Tactics: A professional brokerage will give you the facts and let you decide on your own time.

- Opaque Fee Structures: If they can't give you a straight answer on exactly what a transaction will cost, it's because there are hidden fees they don't want you to see.

Your capital is the lifeblood of your business. Protecting it has to be your number one priority. Never, ever compromise on regulation and transparency just for the illusion of a slightly better rate.

Essential Questions to Ask a Potential Broker

Before you sign anything, have these questions ready. The way they answer will tell you a lot about how they operate and if they’re a good fit for your SME.

- What is your execution model—are you a Market Maker, or do you use an ECN/STP model?

- Can you provide a detailed, all-in cost estimate for a typical transaction size for my business?

- What is your process for withdrawals, and what are the typical timeframes?

- What experience do you have helping South African businesses navigate exchange control regulations?

By taking this structured approach—using the checklist, watching for red flags, and asking the right questions—you can do your due diligence with confidence. This process will help you find a forex brokerage that acts as a true, trustworthy partner in your business's global growth.

Answering Your Top Questions About Forex Brokerages

Let's clear up some of the most common questions business owners have about using a forex brokerage. Getting straight answers to these will give you the confidence you need to manage your international payments smartly.

Does My Business Need a Ton of Capital to Get Started?

Not at all. There’s a persistent myth that forex is only for giant corporations slinging huge volumes of cash. But for an SME, you're not speculating—you're just trying to pay an invoice in another currency.

The only capital you really need is enough to cover the payment itself. The trick is to find a broker or a platform that doesn't hit you with high minimum deposits or confusing fees that mess with your cash flow.

Is It Safe to Use a Forex Brokerage in South Africa?

Yes, but with one massive caveat: it’s only safe if you work with a company that’s properly regulated. The single most important thing you can do is check that the brokerage is licensed by the Financial Sector Conduct Authority (FSCA).

The FSCA sets the rules of the game, making sure client money is protected and that everything is done transparently and fairly.

Using an unregulated offshore company is like walking a tightrope without a safety net. You're exposing your business to a huge risk of fraud with zero local legal recourse if things go wrong. Always, always verify a company’s FSCA license on the official regulator's website before you even think about sending them money.

This isn’t just a box-ticking exercise; it’s the fundamental layer of security for your business's capital.

How Is a Forex Broker Any Different From My Bank?

It really boils down to three things: cost, speed, and focus. Your bank can certainly handle an international payment for you, but it’s just one of a thousand things they do. It’s not their specialty.

Because it's a sideline for them, banks tend to offer wider spreads (which means worse exchange rates for you) and tack on higher fees, which are often buried in the fine print. Over time, that chips away at your profit margins.

A forex specialist, on the other hand, lives and breathes currency. They are built for this. This focus means they can usually offer much better rates and lower, clearer fees, which can add up to serious savings for your business.

On top of that, the whole process is just smoother with a dedicated provider.

- Better Rates: Specialists give you exchange rates much closer to the real, mid-market rate. More of your ZAR actually becomes the USD or EUR you need.

- Lower Fees: They often get rid of the annoying SWIFT and intermediary bank fees that are standard with traditional bank transfers.

- Faster Service: Their online platforms are built for one job: sending international payments. This makes the process quicker and far less clunky than navigating a corporate banking portal.

At the end of the day, picking a specialist over your bank for international payments is about choosing efficiency and cost-effectiveness for your business.

For South African businesses that need to pay global suppliers and get paid by international customers without the headaches and high costs, Zaro is the direct solution. We offer the real exchange rate with zero spread, crystal-clear fees, and a platform designed for speed. Find out how much your business could save by visiting https://www.usezaro.com.