Think about the last time you made an international payment. It probably felt like you were sending money directly from your account to another, like a simple digital transfer. But what’s really happening behind the scenes is a complex, fascinating process powered by a system called SWIFT.

So, what exactly is a SWIFT payment? It’s not a bank and it doesn’t actually move your money. Instead, it’s a super-secure messaging network that lets banks all over the world talk to each other and authorise payments.

How the SWIFT Network Really Works

It’s a common misconception that SWIFT physically shuttles funds across borders. A better way to picture it is as a highly specialised, ultra-secure postal service just for financial institutions.

Let's say your business in South Africa needs to pay a supplier in Germany. When you set up the transfer, your bank in Johannesburg doesn't actually bundle up your rand and fly it over to Berlin. What it does instead is send a highly structured, encrypted message through the SWIFT network. This message is a set of instructions for the German bank, containing all the essential details—who's sending the money, who's getting it, how much, and all the relevant account information.

In essence, a SWIFT payment is the instruction to move the money, not the physical movement of the funds. The network's job is to make sure that order gets from your bank to the destination bank safely and without errors.

To give you a clearer picture at a glance, here’s a breakdown of its key features.

Key Features of a SWIFT Payment

| Feature | Description |

|---|---|

| Global Network | Connects over 11,000 financial institutions in more than 200 countries. |

| Messaging System | Facilitates secure communication and payment instructions, not the actual transfer of funds. |

| Standardised Codes | Uses SWIFT/BIC codes to uniquely identify banks worldwide, ensuring messages are routed correctly. |

| Security | Employs high-level encryption and security protocols to protect financial data. |

| Traceability | Provides a unique reference (UETR) for tracking the payment's journey across correspondent banks. |

This robust system is what underpins the vast majority of international trade and finance.

The Critical Role of SWIFT Codes

With thousands of banks operating worldwide, how does your payment instruction find its way to the right one? This is where SWIFT codes come in. You might also see them called Business Identifier Codes, or BICs.

Think of a SWIFT/BIC code as a unique postal code for a specific bank.

- SWIFT Code/BIC: It's an 8 or 11 character code. For example, the SWIFT code for Standard Bank of South Africa is SBZAZAJJ.

- Routing Information: This code breaks down into key details: the bank's identity, its country, its city, and sometimes even the specific branch.

When you enter a SWIFT code for an international payment, you’re giving your bank the precise "delivery address" for the payment message. This standardised format is the secret sauce that allows a bank in Durban to communicate flawlessly with a bank in Dubai, navigating the enormous complexities of global finance. Without this messaging backbone, the international trade we rely on would grind to a halt.

How a SWIFT Payment Travels Across Borders

To really get your head around what a SWIFT payment is, you need to follow the money on its surprisingly complex journey. Think of it less like a direct flight and more like a trip with a few layovers – each stop adds time and costs money. This is exactly why these transfers aren't instant and can come with some nasty surprises on the final bill.

Let's walk through a real-world example. Imagine your South African business needs to pay a supplier based in Germany. The process kicks off the second you hit 'send' on your payment instruction.

The First Leg: The Sending Bank

The journey starts right here, at your local bank in South Africa. When you authorise the transfer, your bank doesn’t actually bundle up your rands and ship them to Germany. Instead, it creates a highly secure digital message, which is usually an MT103 message. This is the official payment order.

Think of the MT103 as the official instruction manual for the entire transaction. Your bank takes the money from your account and then sends this secure message into the SWIFT network, addressed to the next bank in the chain.

The diagram below gives you a bird's-eye view of this process, showing how the SWIFT message acts as the connective tissue between your bank and the recipient's bank.

As you can see, SWIFT's main job is to ensure the message gets there securely. It doesn't physically move your money from A to B.

The Layover: Correspondent Banking

This is where things get complicated – and expensive. It’s highly unlikely your South African bank has a direct relationship with your supplier’s small regional bank in a German town. To bridge that gap, the system relies on correspondent banks, which are also known as intermediary banks.

These are typically huge, global banks that hold accounts for thousands of smaller banks worldwide, essentially acting as trusted go-betweens.

- First Stop: Your bank sends the MT103 message to its correspondent partner, which might be a major bank in London, telling it to pass the payment along.

- Possible Second Stop: That London bank might then forward the message and funds to another correspondent bank in Frankfurt that works directly with the final German bank.

Each bank in this chain takes a slice of the pie. They process the instruction, run their own compliance checks, and deduct a fee for their troubles. This is the main reason the amount your supplier receives is often less than the amount you sent.

The correspondent banking system is the glue holding international finance together. But it’s also the very thing that makes SWIFT transfers slow, opaque, and costly. Each "hop" adds another layer of time and fees.

The Final Arrival: The Beneficiary Bank

After hopping between banks, the payment instruction finally lands at your supplier’s bank in Germany. The end is in sight! The German bank gets the final MT103 message, does one last check of all the details, and then, at last, credits the funds to your supplier’s account.

This whole relay race, involving multiple banks in different time zones, is why a standard SWIFT transfer takes anywhere from 2 to 5 business days. A tiny typo in the beneficiary’s details or a compliance flag at any one of the stops can bring the whole process to a grinding halt, turning a routine payment into a logistical nightmare.

Unpacking the Real Cost of a SWIFT Transfer

On the surface, SWIFT seems like a dependable way to move money across borders. But for a South African business, what looks like a simple transfer can quickly become a costly headache. The fees pile up, chipping away at your profits and making it tough to budget accurately. Getting a handle on these costs is the first step to protecting your bottom line.

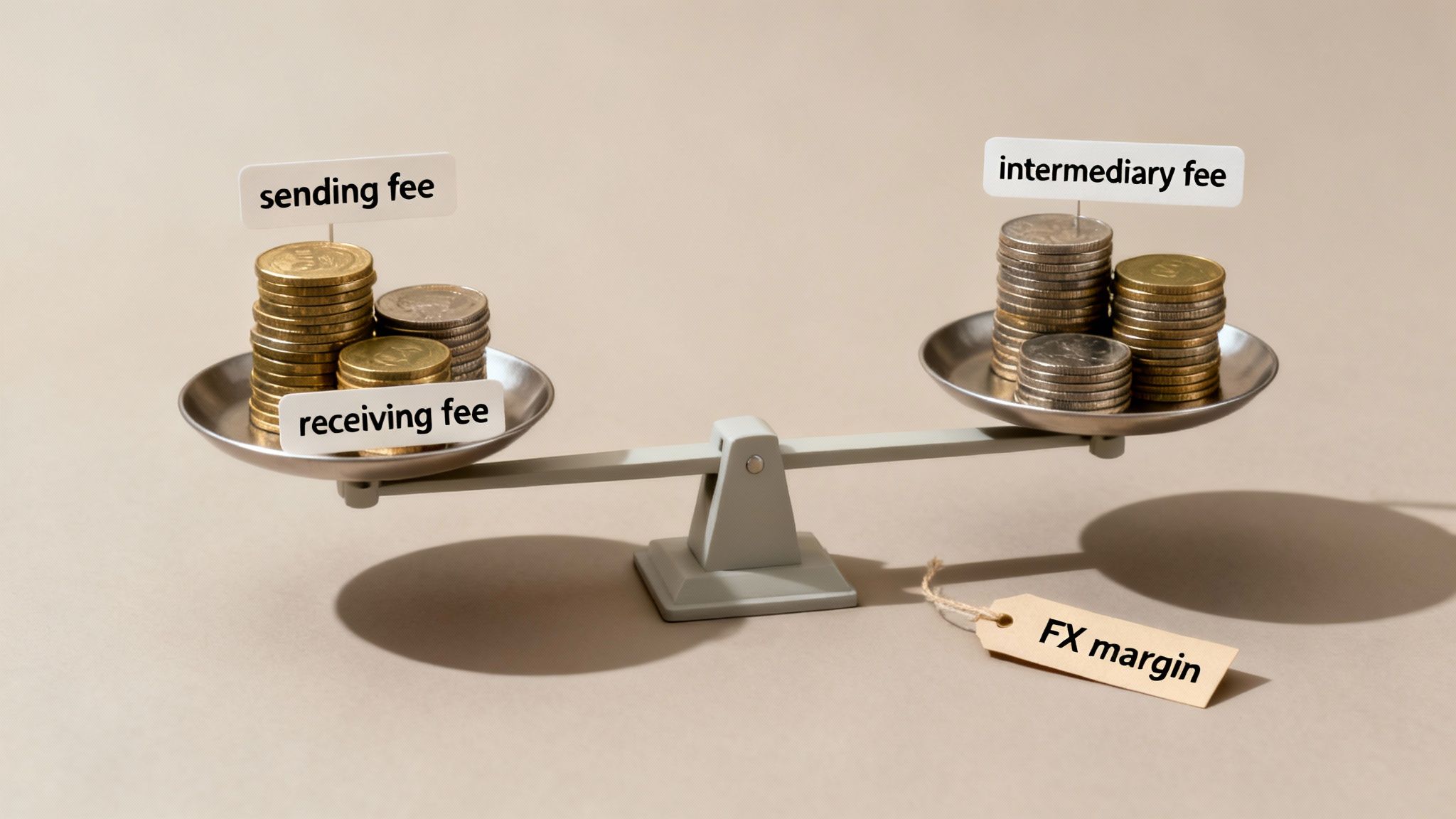

Let's be clear: the fee you're quoted upfront is almost never what you’ll actually pay. A single SWIFT payment triggers a domino effect of charges, starting with your bank, continuing with every bank in the middle, and ending with the recipient's bank.

Taking Apart the Fee Structure

One of the biggest frustrations with SWIFT is the surprise charges from correspondent banks. These are the middle-man institutions that pass your payment along. Each one takes its own slice for handling the transaction, typically anywhere from R300 to R800. This money vanishes before your payment even gets close to its destination.

To try and manage this, banks give you three main options for who pays the fees:

- OUR: You, the sender, cover everything. This includes your bank’s fee plus all the intermediary and receiving bank charges. It’s the priciest route, but it guarantees your supplier gets the exact invoice amount.

- BEN: The beneficiary (your recipient) foots the entire bill. All fees are simply subtracted from the money you sent, so they end up with less than you intended.

- SHA: This means the costs are shared. You pay your bank's sending fee, and your recipient covers the rest. It's the most common setup but often causes confusion and short payments.

The choice you make here isn’t just about money; it’s about relationships. If a supplier receives less than they’re owed because you chose BEN or SHA, you could be looking at payment disputes, damaged trust, and delays in getting your goods.

The Hidden Sting in the Exchange Rate

Beyond the explicit fees, the real kicker is often the foreign exchange (FX) margin. This is the markup your bank adds to the real, mid-market exchange rate—the one you see on Google. Banks buy currency at one price and sell it to you at a less favourable one, pocketing the difference.

This margin is usually a percentage, so on large transactions, it can quietly become the single biggest cost of your international payment.

To get a true picture of what you're spending, many businesses use some of the best business expense tracking apps to log all the fees and see the real impact of the exchange rates. You can't manage what you can't measure.

To make things even trickier, recent rule changes from the South African Reserve Bank (SARB) now require that payments to our neighbours in the Common Monetary Area (like Namibia and Eswatini) must also go through SWIFT. The goal was better tracking, but the result has been higher costs and slower payments on routes that used to be much simpler.

How to Track Your Payment and Stay Compliant

One of the biggest frustrations with international payments used to be the complete lack of visibility. You’d send the money off and then… wait. Was it stuck somewhere? Did it even arrive? Fortunately, things have improved, but navigating compliance is still a huge part of the process.

https://www.youtube.com/embed/Z88CUYci-Zc

For any South African business sending money overseas, security and traceability are built into the system. This means dealing with a series of strict compliance checks designed to keep the global financial system clean. Getting to grips with these rules is the secret to making sure your payments go through smoothly.

At the centre of it all are two acronyms you’ll hear a lot: KYC (Know Your Customer) and AML (Anti-Money Laundering). These aren't just banking jargon; they’re part of a worldwide effort to stamp out financial crime.

When you kick off a SWIFT transfer, every single bank involved in the chain has a legal duty to make sure the payment is legitimate. They have to check who the sender is, who the receiver is, and confirm that the money isn't tied to any illegal activity.

The Role of Compliance Checks

These compliance steps are non-negotiable, and they are one of the biggest reasons for payment delays. If a bank’s automated screening system flags anything—a name, a country, or even a keyword in the payment reference—it gets kicked over for a manual review. This can put your transfer on hold for hours, or sometimes even days, while a compliance officer digs deeper.

The best way to avoid these hold-ups is to be prepared. Make sure all your information is crystal clear from the start.

- Be specific with your payment reason: Vague references like "payment" or "invoice" are red flags. Instead, write something descriptive like, "Payment for Invoice #12345 - shipment of electronic components."

- Triple-check the beneficiary’s details: A tiny typo in a company name or address can create a mismatch that stops the whole process dead in its tracks.

- Have your paperwork ready: Be ready to supply supporting documents, like the actual invoice or a contract, if the bank asks for them.

While these checks can sometimes feel like a hassle, they are what build trust in the international financial system. They protect your business and everyone else from fraud, sanctions violations, and money laundering.

Gaining Transparency with SWIFT gpi

For years, tracking a SWIFT payment felt like sending a parcel without a tracking number. You sent it off and just hoped for the best, with no real way of knowing where it was. This "black box" was a major headache for businesses.

To fix this, SWIFT launched its Global Payments Innovation (gpi) initiative. You can think of it like the tracking service you get from a modern courier, but for your money. If your payment is sent through a bank that’s part of the gpi network, it gets a unique tracking code called a UETR (Unique End-to-End Transaction Reference).

This code lets you see where your payment is in real-time. You can track its journey through the correspondent banks, see exactly what fees have been taken off along the way, and get confirmation the moment it lands in the beneficiary's account. While not every bank in the world has signed up for gpi yet, its adoption is growing fast, bringing some much-needed transparency to an old and complex system.

Exploring Modern Alternatives to SWIFT

For decades, the SWIFT network has been the bedrock of global finance. But let's be honest, its reliance on a chain of correspondent banks creates real headaches for modern businesses. The delays, surprise fees, and lack of clarity are major stumbling blocks, especially for South African SMEs who need to manage their cash flow down to the last cent.

This frustration has paved the way for a new breed of financial technology. These modern platforms aren't just tweaking the old system; they're offering a completely different way to move money across borders, bypassing the slow and expensive intermediary bank chains altogether.

Instead of passing messages from one bank to the next, these platforms use technology to forge more direct payment routes. It's a fundamental shift that completely changes the game for international transfers.

The Benefits of Going SWIFT-Free

By sidestepping the correspondent banking maze, modern payment solutions offer powerful advantages that tackle the biggest weaknesses of traditional SWIFT payments. For businesses, the benefits are immediate and tangible.

What do these platforms typically bring to the table?

- Seriously Faster Settlement: Without all the bank-hopping, payments can land in hours or even minutes, not days. This is huge for your liquidity and keeps your suppliers happy.

- Clear, Lower Fees: Cutting out the middlemen means no more surprise deductions from intermediary banks. What you see is what you pay—a simple, upfront fee that’s usually much lower.

- Real Exchange Rates: Many of these new players give you the real, mid-market exchange rate, ditching the hidden markup banks bake into their rates. On a large transaction, this alone can save you a small fortune.

This move toward faster, more transparent payments is part of a much bigger trend in South Africa. The country’s real-time payments market is valued at USD 0.57 billion in 2025 and is expected to rocket to USD 2.75 billion by 2030. This explosive growth is fuelled by platforms that put speed and user experience first.

How Modern Platforms Boost Your Efficiency

It’s not just about speed and cost. These solutions are built for how businesses actually work today, offering features that give you far greater control and visibility over your international finances.

Modern payment platforms are not just an alternative to SWIFT; they represent a fundamental rethinking of how money should move across borders—prioritising directness, transparency, and speed over a legacy system built for a different era.

This efficiency also has a serious impact on compliance. While SWIFT is secure, its complexity can create blind spots in the payment chain. Direct payment systems simplify the entire flow, making it much easier to track funds and meet your regulatory obligations. Part of this is staying informed about global financial crime, which means monitoring crucial updates like FinCEN alerts regarding sanctions evasion.

For South African SMEs, these alternatives can turn international payments from a costly, time-consuming chore into a genuine business advantage. Platforms like Zaro are built to deliver on this promise, giving you access to real exchange rates, zero SWIFT fees, and a clear, fast, and secure way to handle your global transactions.

Common Questions About SWIFT Payments

Even with a solid grasp of how SWIFT works, practical questions always pop up when it's time to actually make a payment. For South African business owners, getting straight answers is crucial for managing cash flow and keeping suppliers happy. Let's tackle some of the most frequent queries I hear about the SWIFT system.

Is a SWIFT Code the Same as an IBAN?

It’s a great question, and the simple answer is no. They work together but do very different jobs.

Think of it like posting a letter overseas. The SWIFT code (you might also see it called a BIC) is like the city and postal code – it tells the global banking system exactly which financial institution to route the payment message to.

The IBAN (International Bank Account Number), on the other hand, is the specific street address and apartment number. It pinpoints the exact individual account at that bank where the money needs to land.

So, for payments heading to Europe or the Middle East, you'll almost always need both. But for other places, like the USA, you'll usually just need the bank's SWIFT code and the regular local account number.

Why Did My Beneficiary Receive Less Money Than I Sent?

Ah, the classic SWIFT problem. This is easily one of the most frustrating things about international transfers, and the culprit is almost always hidden intermediary bank fees.

As your payment hops from your bank to the beneficiary's bank, it often passes through one or more 'correspondent' banks along the way. Each of these banks can dip into the money and take a handling fee for their trouble.

This happens if the payment was sent with the 'BEN' (beneficiary pays all fees) or 'SHA' (shared fees) instruction. The problem is, you have no idea how many banks will be involved or what they'll charge, making the final received amount a complete guess.

The only way to ensure your supplier receives the full invoice amount via SWIFT is to select the 'OUR' fee option. This tells the banks you'll cover all charges, but be warned – it can get expensive. A better bet is often a service with a transparent, fixed fee structure.

How Can I Avoid Delays with My SWIFT Payment?

Accuracy. It all comes down to accuracy. The single best thing you can do to avoid a payment getting stuck is to double-check every single detail before you hit send. A tiny typo in a name or account number can flag the transfer for a manual review, instantly adding days to the process.

Be meticulous about these details:

- The beneficiary's full legal name and address (no nicknames!).

- The correct bank name and SWIFT/BIC code.

- The precise account number or IBAN.

Also, be specific in the 'reason for payment' field. A clear description like "Invoice #INV-4582 for IT services" sails through compliance checks much faster than a vague "payment". For anything truly urgent, it’s worth looking at modern, SWIFT-free alternatives that settle in minutes or hours, not days.

Can a SWIFT Payment Be Cancelled or Reversed?

Once the money is in the recipient's account, reversing a SWIFT payment is incredibly difficult – and often, flat-out impossible. It’s not like a local EFT where you can sometimes recall the funds with a quick phone call.

To get the money back, you’d need every single bank in the payment chain to cooperate, and most importantly, you’d need the recipient to agree to send the money back. It’s a slow, expensive, and frankly, rarely successful process. This is exactly why getting the details right the first time is so important. If you think you've been a victim of fraud, you must contact your bank the second you realise it to see if they can intervene before the transaction is finalised.

Ready to escape the high costs and slow speeds of traditional international payments? Zaro offers South African businesses access to real exchange rates with zero SWIFT fees, ensuring your money arrives faster and in full. Discover a smarter way to pay globally.