Diving into foreign exchange can feel like learning a new language, but some concepts are simpler than they first appear. Take the base currency, for example. In any currency pair, it's simply the first one listed. Think of it as the anchor of the entire transaction.

Its value is always one.

Your Guide to Understanding Base Currency

Imagine you're trying to measure a room. Without a tape measure, you'd be guessing. It would be inconsistent and confusing. In the world of foreign exchange, the base currency is that tape measure—it gives us a fixed point of reference.

When you see a currency pair like USD/ZAR, the USD is the base currency. The number next to it—the exchange rate—tells you how much of the second currency (in this case, the South African Rand) you need to buy exactly one unit of the base.

The Core Concept Explained

Let's put this into a real-world context. Think of it like you're at the shops. The base currency is the item you're buying, and the exchange rate is the price tag written in a different currency.

So, if the USD/ZAR exchange rate is 18.50, it means that one US dollar will cost you 18.50 Rands. The dollar is the product on the shelf, and the Rand is the money you're using to buy it.

This setup is the bedrock of currency trading, creating a universally understood system. It cleanly answers the question: "How many of currency Y do I need to get one of currency X?"

Key Takeaway: In any currency pair, the base currency always has a value of '1'. It acts as the benchmark, making forex quotes clear and consistent for everyone.

For a South African business, this isn't just financial jargon; it’s essential knowledge for managing your international payments. Whether you're paying a supplier in Europe (EUR/ZAR) or getting paid by a client in the UK (GBP/ZAR), the base currency is what anchors the value of that transaction.

Getting a solid grip on this concept is the first major step toward mastering your international finances. It helps you look past the numbers on a screen and see how global market shifts directly impact your company's bottom line, turning abstract data into actionable business insights.

How Currency Pairs Actually Work

So, how does this play out in the real world? It helps to think of it like shopping for imported goods. The base currency is the item you’re "buying," and the quote currency is the price tag telling you what you have to pay.

For any South African business dealing internationally, pairs like USD/ZAR, EUR/ZAR, and GBP/ZAR are part of the daily routine. In each of these, the first currency is the product, and our Rand is the cost.

This simple logic makes reading forex quotes surprisingly straightforward. If you see the USD/ZAR rate at 18.50, it means that one US Dollar—the item on the shelf—costs 18.50 South African Rands. Simple as that.

Decoding Common Forex Pairs

In foreign exchange, the base currency is the constant reference point for every transaction. This is especially true in South Africa, where so much of our trade is priced against major world currencies.

In the USD/ZAR pair, the US Dollar is the base currency, and the ZAR is the quote currency. The rate tells you exactly how many Rands you need to buy a single US Dollar. For a deeper dive into historical trends, the South African Reserve Bank is an excellent resource.

The Golden Rule: The base currency is always equal to one unit. It’s the fixed standard that keeps the global forex market consistent and understandable.

This core principle never changes, no matter which currencies you're looking at. To make this even clearer, here’s a breakdown of the pairs most relevant to local businesses.

Common Currency Pairs for South African Businesses

Here’s a quick-reference table that shows how this works for the pairs you’ll encounter most often.

| Currency Pair | Base Currency | Quote Currency | What the Rate Means |

|---|---|---|---|

| USD/ZAR | US Dollar (USD) | South African Rand (ZAR) | The number of Rands needed to buy 1 USD. |

| EUR/ZAR | Euro (EUR) | South African Rand (ZAR) | The number of Rands needed to buy 1 EUR. |

| GBP/ZAR | British Pound (GBP) | South African Rand (ZAR) | The number of Rands needed to buy 1 GBP. |

Once you get the hang of this, you’re no longer just looking at numbers on a screen. You’re interpreting what currency movements actually mean for your business—whether that’s for paying an overseas supplier or pricing your next export shipment.

The Story of the South African Rand

To really get a grip on the Rand's value today, you have to look back at its journey. The history of the South African Rand (ZAR) is a fascinating story of how a currency’s standing against giants like the US Dollar or British Pound is constantly shaped by history, politics, and major world events.

When the Rand first appeared in 1961, things were simple. It was pegged at two Rand to one British Pound, a clear reflection of the strong economic ties at the time.

But that stability was short-lived. The 1980s brought immense political and economic pressure, largely due to apartheid-era sanctions. This caused the Rand to devalue sharply against major currencies. By 1992, you needed about R3 to buy a single US dollar. Fast-forward to 1999, and that number had jumped to roughly R6 to the dollar. For a deeper dive, you can trace the historical path of the ZAR on Wikipedia.

This volatility wasn't just driven by local factors. Global shocks, like the September 11, 2001 attacks in the US, sent shockwaves across world markets and briefly pushed the exchange rate past R10 per USD.

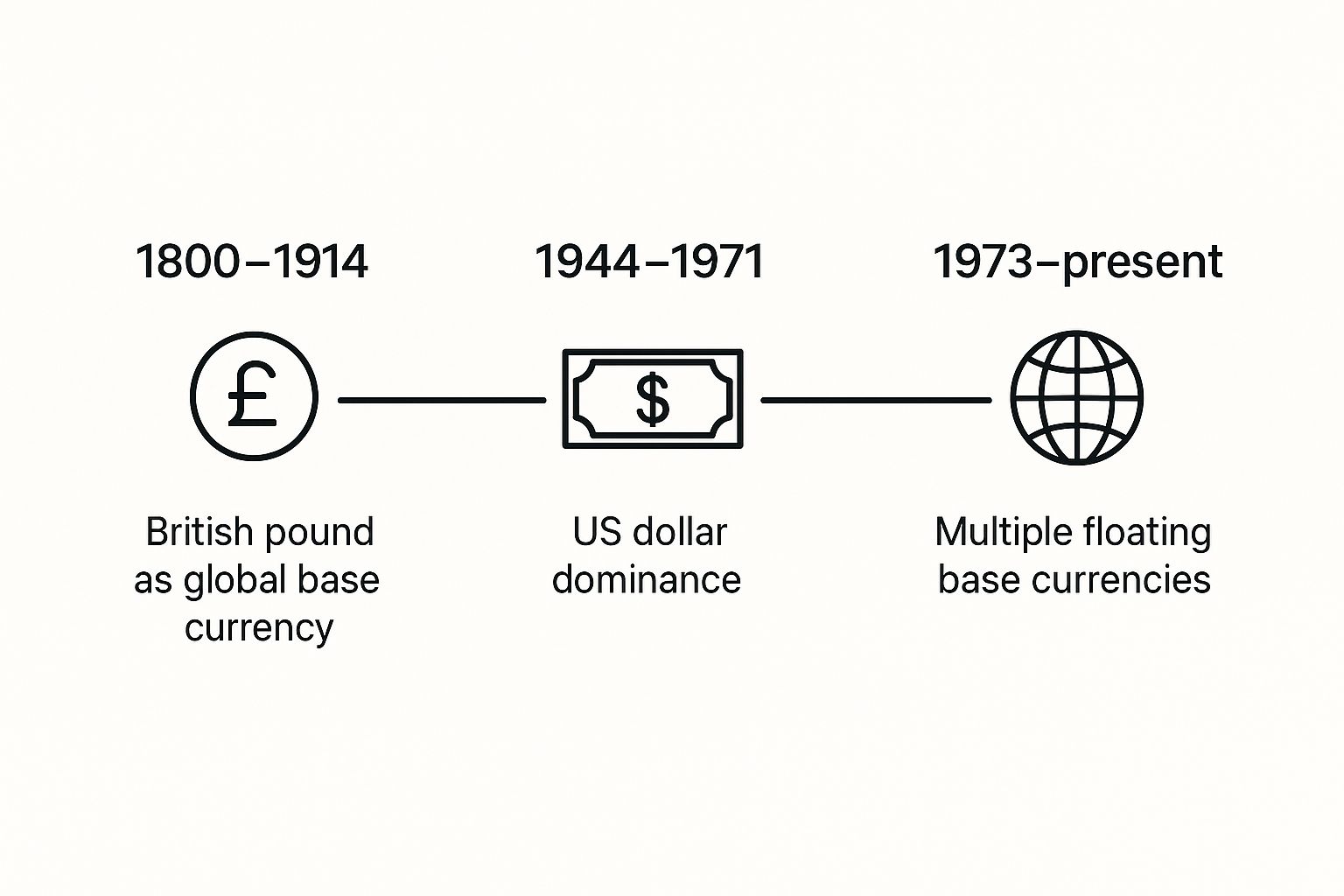

A Shifting Global Standard

The very idea of a single, all-powerful base currency has changed over the decades, and that directly affects how the ZAR is priced. This timeline gives you a great visual of the major shifts in global finance.

As the infographic shows, we've moved from an era dominated by the British Pound to the rise of the US Dollar, and now to a more complex system where several currencies hold significant influence. This journey proves that the Rand's daily ups and downs aren't random; they are the direct result of ongoing economic forces, both at home and abroad.

Key Insight: When you understand the Rand's history against major base currencies like the USD and GBP, abstract exchange rates suddenly become a real story of economic cause and effect.

For any South African business, this isn't just a history lesson. It's a practical reminder of why exchange rates are so unpredictable and why managing your forex risk is absolutely crucial for protecting your bottom line.

Why Base Currency Is Critical for Exporters

This is where the concept of a base currency stops being an academic idea and starts hitting your business where it counts. For any South African company that exports, the daily dance of exchange rates has a massive impact on your bottom line, especially when you’re getting paid in foreign currency.

Let’s put this into a practical scenario. Picture your business selling proudly South African goods to a customer in the United States. You send an invoice for $10,000. In this transaction, the US Dollar is the base currency for your payment. The actual rand value you pocket depends entirely on the USD/ZAR exchange rate at the exact moment you convert the funds.

That single detail—the exchange rate—introduces a huge amount of financial risk. A fluctuating rate means your export revenue is a moving target right up until it lands safely in your ZAR account.

A Tale of Two Exchange Rates

Think about how a small shift in the rate can directly affect your cash flow. Let's take your $10,000 sale and see what happens under two different market conditions:

- Scenario A: The exchange rate is 18.50 ZAR to the US dollar. Your $10,000 converts to a healthy R185,000.

- Scenario B: A week later, the rand strengthens slightly, and the rate moves to 18.10 ZAR. Now, that same $10,000 is only worth R181,000.

That’s a R4,000 difference on just one invoice, lost to nothing more than bad timing. This isn't just a number on a spreadsheet; it’s real profit that has vanished into thin air.

For an exporter, the exchange rate isn't just a number—it's your final selling price. Unpredictable rates mean you're essentially giving customers a discount you never agreed to.

This volatility is what turns the abstract idea of 'exchange rate risk' into a very real, very stressful business challenge. Simply accepting whatever rate your bank gives you on the day can silently chip away at your profits, month after month.

This is exactly why having a smart forex strategy is non-negotiable for any South African business trading internationally. Gaining control over your conversion rates is the key to protecting your margins, creating financial predictability, and ultimately, building a more resilient company.

Protecting Your Profits from Forex Volatility

If you're an exporter, you know the constant risk of currency fluctuations all too well. It's a significant challenge, but modern tools are thankfully giving businesses a powerful way to fight back. The key to protecting your profits is to step away from the often unfavourable rates offered by traditional banks and instead lock in the real exchange rate.

So, what is the "real" rate? Think of it as the mid-market rate you see on Google or financial news sites. It’s a pure, transparent number without the hidden markups or spreads that banks quietly build in. Getting access to this rate isn't just about saving a few cents here and there; it’s about fundamentally changing how you handle your international finances.

When you secure the real rate for your transactions, you bring certainty into what is otherwise an incredibly unpredictable process. This means you can finally plan and budget with accuracy, removing the currency guesswork that slowly eats away at your margins.

The Power of Transparent Pricing

Imagine knowing the exact Rand value of your export earnings before the money even lands. This is the kind of control that transparent, real-rate pricing gives you. It empowers your business to compete much more effectively on the global stage because your pricing is built on predictable outcomes, not currency gambles.

The way base currencies work, especially with the South African Rand, really shines a light on why this control is so vital. Take the USD/ZAR pair, for example. The US Dollar is the base currency, and its value against the Rand is constantly shifting due to both global and local pressures. Over a recent 12-month period, the Rand actually strengthened by about 2.05% against the dollar, but forecasts still point to plenty of fluctuation ahead. You can dive deeper into the data with the South Africa currency outlook at Trading Economics.

By locking in a real, transparent exchange rate, you essentially insulate your business from this daily market noise. You get to decide when to convert your funds, securing a rate that defends your profit margin.

This proactive approach puts you firmly in the driver's seat. Instead of being a passive victim of market volatility, you become an active manager of your own financial destiny. The benefits speak for themselves:

- Accurate Budgeting: Plan your finances with real confidence, knowing precisely what your foreign income is worth in Rands.

- Protected Margins: Remove the risk of a sudden, adverse rate change wiping out your hard-earned profit.

- Greater Control: Secure better, more predictable results on every single international transaction.

Clearing Up Your Base Currency Questions

You've got the basics down, which is great. Now, let's dig into the practical questions that usually come up when people are trying to get their heads around base currency. Think of this as the hands-on part of the guide, where we clear up any lingering confusion.

Is the Base Currency Always the Stronger One?

Not at all. This is probably the biggest myth out there. It’s easy to assume the first currency listed is the 'stronger' one, but its position is just about convention. It's the currency that equals 1 in the equation.

The "strength" of a currency has nothing to do with its spot in the pair; that's all about what the live market is doing. The base currency is simply the benchmark for the price quote, not a trophy for economic dominance.

How Can I Tell Which Is the Base Currency?

This is the easy part. It's always the first currency listed in the pair's three-letter code.

Take GBP/ZAR, for example. The British Pound (GBP) is the base currency. The exchange rate you see tells you how many units of the second currency (the quote currency, in this case, the Rand) it takes to buy one single unit of the first. It's a universal standard, so you’ll see this format on any forex platform you use.

Why Is the US Dollar Used as a Base Currency So Often?

The US Dollar's dominance as a base currency isn't an accident; it's because it's the world's primary reserve currency. For decades, global trade has leaned on the dollar. Major commodities, from oil to gold, are priced in USD.

This global reliance makes the dollar a natural anchor for many of the world's most-traded currency pairs. For South African businesses, the USD/ZAR pair is a perfect example of this in action.

Using the dollar as a common denominator simplifies international trade, creating a reliable reference point for pricing and transactions across the globe.

Can the South African Rand Be a Base Currency?

Absolutely. While you won’t often see it as the base against major currencies like the Dollar or Euro, the ZAR frequently takes the lead when paired with other African currencies.

A great example is the ZAR/BWP pair, where the Rand is priced against the Botswana Pula. Here, the exchange rate tells you how many Pula you'd need to buy one Rand. It all just depends on the specific pairing and the established market conventions for quoting it.

Ready to stop losing profits to hidden bank fees and volatile exchange rates? With Zaro, you get access to the real exchange rate, zero spreads, and no SWIFT fees on your international payments. Take control of your forex and protect your bottom line. Learn more at https://www.usezaro.com.