If you're a business owner in South Africa, you've probably heard the term CPI thrown around, especially when it comes to the economy. So, what is CPI in South Africa, really? In simple terms, it’s our country's official scorecard for inflation.

Think of the Consumer Price Index (CPI) as a national shopping receipt that tracks the shifting prices of everyday essentials. It tells us how much more (or less) it costs to live this month compared to the last, or this year compared to the one before.

Understanding the Consumer Price Index in South Africa

Let's make it personal. Picture your own monthly grocery bill. You buy the usuals—bread, milk, petrol for the car, maybe some airtime. If your total till slip for the exact same items climbs from R3,000 one month to R3,150 the next, your personal cost of living has jumped.

The CPI applies this exact logic, but on a massive, national scale. The folks over at Statistics South Africa (Stats SA) are tasked with this huge job. They meticulously track a fixed "basket" of hundreds of goods and services that the average urban household buys.

A Look Inside South Africa's CPI Basket

This isn't a literal shopping basket, of course. It's a carefully constructed list of items, each given a specific "weight" based on how much of a typical family's budget it takes up. Here’s a simplified breakdown of what’s inside:

| Category | Description | Example Items |

|---|---|---|

| Food & Non-alcoholic Beverages | The daily essentials that fill our pantries. | Maize meal, bread, meat, milk, sugar, cooking oil. |

| Housing & Utilities | The cost of keeping a roof over our heads. | Rent, bond repayments, electricity, water, rates. |

| Transport | The costs of getting from point A to B. | Petrol, diesel, public transport fares, vehicle maintenance. |

| Miscellaneous Goods & Services | The broad category for everything else. | Insurance premiums, personal care items, data, bank fees. |

Every month, Stats SA fieldworkers collect thousands of price points for these items from shops and service providers all across the country. By comparing the total cost of this basket over time, they give us the official inflation rate we see in the news.

The Consumer Price Index is a critical piece of the puzzle, sitting alongside other key macroeconomic indicators that paint a broad picture of our economic health. It’s a direct measure of purchasing power and a vital sign of economic stability.

This isn't just a dry statistic; it tells the story of our economy. For example, during the turbulent political transition in the early 1990s, annual inflation skyrocketed to around 15.5% in 1991. By the time 1994 rolled around, it had cooled to an average of 9.9%, a clear sign of how economic policy and national stability directly impact our wallets.

Getting a solid grip on this concept is the first, most crucial step for any business owner. It’s the bedrock for making smarter decisions—from setting your prices and negotiating salaries to managing the very real financial risks that come with a fluctuating economy.

How CPI Is Measured and What the Numbers Mean

So, how does Statistics South Africa (Stats SA) actually figure out the CPI? It’s not just guesswork. They have a meticulous process they run every single month to get a reliable snapshot of the country's economic pulse. The whole thing starts with something called the CPI "basket."

Imagine a massive shopping trolley representing what the average urban household in South Africa spends its money on. It’s not just one trip to the shops, though. It's more like a whole year’s worth of expenses—everything from a loaf of bread and data bundles to a car service and rent—all bundled together.

The CPI Basket and Its Components

Of course, what we spend our money on changes. That’s why Stats SA doesn’t just stick with the same old basket forever. They update it periodically to keep it relevant. Think about it: a decade ago, landline phone costs might have been a big deal, whereas today, data usage is a much bigger slice of the household budget.

This reweighting is absolutely critical. If the basket was still based on 2010 spending habits, the CPI wouldn't accurately reflect the true cost of living today. That could lead to some seriously flawed economic policies and bad business decisions.

To get the prices for the thousands of items in this basket, fieldworkers from Stats SA collect data every month from a huge network of retailers and service providers all over the country. They visit big chain stores in the cities and smaller independent traders in more rural towns to gather all the raw data needed to calculate the final index.

Decoding the CPI Data You See

When you see the latest CPI figures on the news, they usually come with a bit of jargon. Getting a handle on these terms is the key to understanding what the numbers are really telling you, rather than just focusing on the single headline figure.

Here are the most common ones you’ll come across:

- Headline CPI: This is the big one. It’s the all-inclusive number that reflects the price change for the entire basket of goods and services. When you hear "inflation is at X percent," this is usually what they're talking about.

- Core Inflation: This version is a bit more specific. It strips out items with prices that jump around a lot, like food and fuel, which can be affected by everything from the weather to global oil politics. It gives you a much clearer picture of the underlying, long-term inflation trend without all the short-term noise.

- Month-on-Month (m/m): This simply shows the percentage change in the CPI from one month to the next. It’s a great way to spot immediate price movements and see if inflationary pressure is building up or cooling down right now.

- Year-on-Year (y/y): This is the metric you'll see most often. It compares the CPI of the current month to the same month last year. This smooths out any monthly blips and gives a much broader view of the annual inflation trend.

So, when you see a headline CPI of 5.2% year-on-year, it means that, on average, that massive basket of goods and services costs 5.2% more than it did twelve months ago. This is the figure that often keeps the South African Reserve Bank's Monetary Policy Committee up at night and directly influences everything from your pricing strategies to annual wage negotiations.

The Real-World Impact of CPI on Your Business

It's one thing to know the definition of CPI in South Africa, but it's another thing entirely to see its direct impact on your balance sheet. The CPI figure isn't just some abstract number for economists to debate; it has real, everyday consequences for your business operations, profitability, and long-term strategy.

When you see the CPI number go up, it’s a clear signal that the cost of doing business is on the rise. This puts an immediate squeeze on your profit margins. Your suppliers are paying more for raw materials and fuel, and you can be sure they’ll pass those increases on to you. Suddenly, your input costs are climbing, but you can’t always raise your own prices at the same rate without the risk of losing loyal customers.

Pricing Strategies and Contract Negotiations

A rising CPI forces some tough conversations about pricing. Do you absorb the extra costs and take a hit on your margins, or do you pass them on to your customers? There's no single right answer, but keeping a close eye on CPI trends gives you the hard data you need to justify any price adjustments and explain them clearly.

Beyond your own price list, CPI is a central figure in many of your most important formal agreements. It often dictates the annual increases in everything from employee salaries to long-term supplier contracts.

- Wage Negotiations: Employees and unions frequently use the official CPI rate as the starting point for demanding cost-of-living adjustments. A high CPI can lead to serious pressure for significant salary hikes just to maintain your team's purchasing power.

- Supplier Contracts: Many long-term agreements have escalation clauses tied directly to CPI. This means your costs for essential services or materials will automatically tick up with inflation, whether you're ready or not.

- Rental Agreements: Commercial property leases almost always feature an annual escalation based on CPI, which directly drives up your overheads.

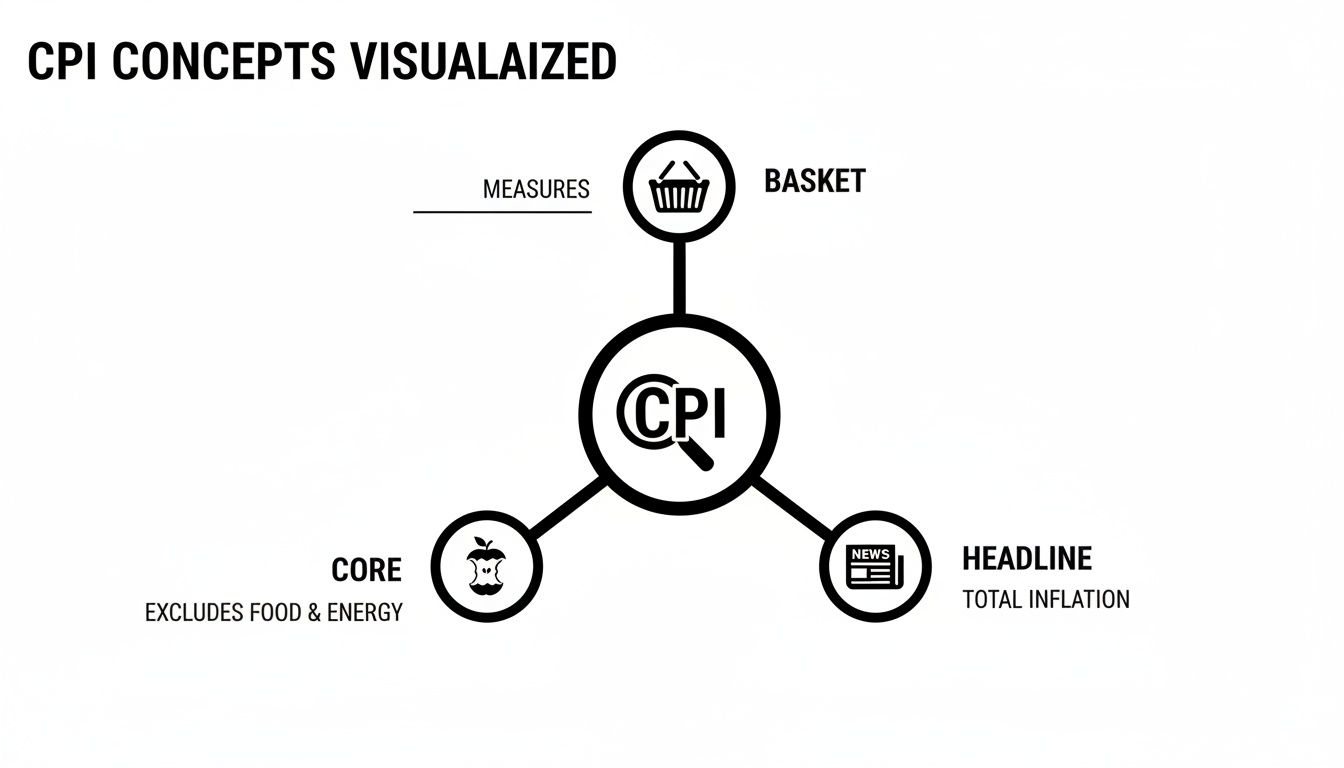

This diagram breaks down the different components that make up the headline CPI figure you hear about in the news.

Understanding the difference between the broad "basket" of goods, the volatile headline figure, and the more stable "core" inflation helps you see the complete story behind the numbers.

The Critical Link to Interest Rates and the Rand

Perhaps the most significant impact for South African businesses—especially those trading internationally—is the tight relationship between CPI, interest rates, and the Rand's exchange rate. The South African Reserve Bank (SARB) has a clear inflation target: keep CPI within a 3-6% range. When inflation consistently pushes above this target, the SARB’s typical response is to raise interest rates to cool down the economy.

Higher interest rates make borrowing more expensive for your business, but they also tend to attract foreign investment, which can strengthen the Rand. On the flip side, persistently high inflation eats away at our currency's value.

Think of it this way: if inflation is high, each Rand buys less here at home. This makes it less attractive to foreign investors, who might sell their ZAR holdings, putting downward pressure on the exchange rate and causing the Rand to weaken.

For an export-oriented SME, a weak Rand is a double-edged sword. Sure, your products become cheaper and more attractive for international buyers, but the dollars or euros you earn are worth less when you convert them back to Rands—all while you're facing higher local costs.

A look at historical data shows a clear pattern between periods of high inflation and a volatile Rand. Tracing CPI data back reveals how inflation has shaped our economic landscape, from a staggering annual average of 12.4% in 1983 to 9.0% in 1994, before policy reforms helped bring it under control. Understanding these patterns is crucial for managing cross-border cash flow. You can explore more about these historical trends and their impact on the South African economy.

To put it all together, here’s how inflation can influence different parts of your business.

How CPI Influences Key Business Decisions

| Business Area | Impact of High CPI (Inflation) | Impact of Low CPI (Disinflation) |

|---|---|---|

| Pricing Strategy | Pressure to increase prices to protect margins, risking customer loss. | Stable or falling prices; potential for promotions to gain market share. |

| Procurement | Input costs rise, requiring negotiation with suppliers or finding cheaper alternatives. | Lower input costs; opportunity to lock in favourable long-term supplier contracts. |

| Wages & HR | Increased demands for salary hikes to match the cost of living. | Less pressure on wage increases; focus shifts to non-monetary benefits. |

| Financing | Higher interest rates make borrowing more expensive, stalling expansion plans. | Lower interest rates make loans cheaper, encouraging investment and growth. |

| FX Management | Rand volatility increases, creating risk for importers and exporters. | More stable exchange rate, leading to more predictable international cash flow. |

Ultimately, a firm grasp of CPI isn't just about financial theory; it’s about making smarter, more resilient business decisions in a constantly shifting economic environment.

Making Sense of Recent CPI Trends

A single CPI number on its own doesn't really tell you much. To get the full picture, you have to look at the trends over time and ask why the numbers are changing. This means digging a little deeper than the headline figure to see what’s actually pushing prices up or down across South Africa.

When Stats SA releases the monthly CPI report, it’s not just one number. It’s a collection of stories about different parts of our economy. One month, a jump in global oil prices might be the main culprit, making transport more expensive for everyone. The next, a drought could hammer crop yields, causing food prices to climb.

By breaking down the data, you can start to see what’s really driving inflation and get your business ready for what’s likely coming next.

Key Drivers of South African Inflation

If you want a clearer view of the economic pressures we're facing, you need to know which items have the biggest say in the final CPI number. Certain categories consistently have an outsized impact simply because they take up a bigger slice of the average household's budget.

Here are the usual suspects to keep an eye on:

Food and Non-Alcoholic Beverages: These essentials are often a major source of inflation. When you look into South Africa's CPI food component, you see exactly how these items hit household budgets. History shows that the food index often climbs faster than the overall CPI during supply shocks, and recent reports prove how a shift in food prices can dramatically move the headline rate.

Fuel Prices: This one’s a double-whammy, tied to both global oil prices and the ZAR/USD exchange rate. The price of petrol and diesel creates a ripple effect across the entire economy, affecting everything from courier fees to the cost of getting produce onto supermarket shelves.

Electricity and Utilities: Administered prices, especially for electricity, are a massive and pretty much unavoidable driver of inflation for both regular households and businesses.

Looking beyond the headline number is crucial. High inflation driven by a temporary fuel price shock tells a very different story from persistent, broad-based price increases across multiple sectors, which might signal deeper economic challenges.

Putting Trends into Perspective

Context is everything. A single month’s figure might just be a blip on the radar, but a steady trend is something you need to pay close attention to. To get a proper perspective, it’s vital to compare the latest data against a few key benchmarks.

The most important benchmark is the South African Reserve Bank's (SARB) official inflation target range of 3-6%. When CPI creeps above this range and stays there, it’s a strong signal that the SARB might hike interest rates to cool things down. On the flip side, if CPI stays comfortably within that target, it suggests a more stable and predictable economic environment.

It also helps to compare today's figures to historical periods of high inflation. This gives you a sense of whether we're dealing with a short-term headache or settling into a longer, more concerning pattern. This kind of forward-looking thinking turns raw data into a strategic tool, helping you anticipate what’s around the corner and manage the risks before they become problems.

Protecting Your Business from Inflation and FX Risk

Knowing that high CPI and a volatile Rand pose a threat is one thing. Actually defending your business against them is another thing entirely. For any South African company with international ties, it's time to move beyond simply reacting to market shocks and start using financial tools built to handle these pressures head-on.

This is where a modern payments platform can be your best line of defence. Instead of being stuck with the marked-up exchange rates offered by the big banks, you can get access to the real, mid-market rate on your international payments. This one move immediately protects the value of your export earnings and cuts the cost of paying overseas suppliers.

Taking Control of Foreign Exchange Exposure

Managing your foreign exchange (FX) exposure shouldn't feel like a guessing game. It requires tools that give your finance team genuine control and clarity, letting them be proactive instead of just cleaning up after a market swing. The aim is to transform a major economic risk into just another manageable part of doing business.

Let’s get practical about how the right platform can help:

- Get the Real Exchange Rate: Lock in the actual spot exchange rate you see on the news, with no hidden spreads or surprise fees. The price you see is the price you get, which gets rid of those expensive "surprises" that often come with traditional bank transfers.

- Hold Multiple Currencies: Keep balances in both ZAR and major currencies like USD or EUR. This means you can get paid by international clients and hold onto those funds, waiting to convert them back to Rand when the rate is in your favour. It’s about giving you strategic control over your own money.

- Make Instant, Low-Cost Payments: Forget the slow and costly SWIFT network. Faster, more affordable international transfers improve your cash flow and build stronger relationships with partners who get paid on time, every time.

These features aren’t just nice-to-haves; they work together to build a powerful financial shield. By cutting out the middlemen and their unnecessary fees, you can insulate your profit margins from being chipped away by inflation and a weakening currency.

For a South African SME, this kind of control is a game-changer. It means that when you invoice a client in the US for $10,000, you can actually budget around receiving the full Rand equivalent at the real exchange rate—not some unpredictable amount that’s been whittled down by hidden bank fees and a poor rate.

Empowering Your Finance Team with Better Tools

At the end of the day, managing risk comes down to having the right information and being able to act on it fast. A single, centralised platform gives your team a clear, real-time picture of your international cash flow and currency positions.

With a platform like Zaro, your finance department gets direct access to the tools they need to tackle these challenges head-on. By offering real exchange rates with zero spread, Zaro helps you keep more of your hard-earned international revenue. Features like ZAR and USD accounts, paired with debit cards, give you the flexibility to operate globally without getting stung by bad exchange rates.

This approach gives you the visibility and control needed to navigate what CPI in South Africa truly means for your international finances, turning a source of stress into a well-managed part of your growth strategy.

Got Questions About CPI? We've Got Answers

The world of economics can feel a bit like alphabet soup, and CPI is one acronym that pops up constantly. If you're running a business in South Africa, you've probably wondered what it really means for you. Let's break down some of the most common questions we hear from business owners.

What’s the Difference Between CPI and Inflation?

It’s easy to use these terms interchangeably, but they aren't quite the same thing. Think of it this way: CPI is the thermometer, and inflation is the temperature it's showing.

The Consumer Price Index (CPI) is the tool itself. It’s a detailed list—a "basket" of goods and services—that tracks how the average price of things like bread, fuel, and rent changes over time.

Inflation, on the other hand, is the rate of change in that index. When the news reports that inflation is 5.6%, they're saying that the prices in the CPI basket have gone up by that much compared to the same time last year. It’s a measure of how quickly your money is losing its buying power.

How Often Does South Africa’s CPI Get Updated?

Statistics South Africa (Stats SA) doesn't keep us waiting. They release fresh CPI data every single month. This regular update gives everyone a real-time pulse on what’s happening with prices across the economy.

This monthly cadence is crucial. It allows businesses, consumers, and the South African Reserve Bank to make financial decisions based on the most current information available, not on old data.

Beyond the monthly numbers, the "basket" of goods itself is also reviewed and updated every few years. This is important because it ensures the CPI accurately reflects what South Africans are actually buying today, keeping the whole measurement relevant.

Why Does High CPI Often Lead to a Weaker Rand?

This is a big one for any business dealing with imports or exports. At its core, high CPI means your Rands simply don't stretch as far as they used to—the currency's power to buy things locally is shrinking.

International investors see this as a warning sign. An economy with persistent high inflation can look unstable. In response, they often sell their Rand-denominated assets (like stocks or bonds) and move their money into currencies they see as safer, like the US Dollar or Euro.

This sell-off floods the market with Rands, increasing supply. And just like with any product, when supply goes up and demand doesn't keep pace, the price—or in this case, the exchange rate—goes down. The result is a weaker Rand.

How Can My Business Actually Use CPI Data?

CPI isn't just a number for economists to debate. It's a practical tool you can put to work in your strategic planning.

Here are a few ways to make it work for you:

- Smarter Budgeting: Use the CPI trend to get a better handle on future costs. Think raw materials, transport, and utilities. This helps you build a budget that’s grounded in reality, not guesswork.

- Pricing Strategy: The data is a clear signal that your own input costs are rising. It gives you the justification you need to adjust your prices and protect your profit margins.

- Fair Salary Reviews: CPI provides an objective benchmark for cost-of-living adjustments and salary negotiations, making those conversations with your team more transparent.

- International Trade: By keeping an eye on CPI, you can better anticipate which way the Rand might be heading. This insight helps you time your foreign payments and decide when to bring export revenue back home.

Ready to protect your business from the risks of inflation and currency volatility? With Zaro, you can stop losing money to hidden markups and poor exchange rates. Access the real mid-market rate on all your international payments and take control of your global finances. Discover a smarter way to manage cross-border transactions.