Enterprise risk management (ERM) is a way of looking at risk from the very top of the organisation down. It's not about tackling problems in isolation; it’s about weaving risk awareness into the very fabric of your business strategy.

Instead of just reacting to individual threats, ERM gives you a complete, panoramic view of all the risks and opportunities on the horizon, helping ensure every decision you make supports your long-term goals.

What Is Enterprise Risk Management Really?

Let's cut through the jargon. Think of Enterprise Risk Management as the strategic navigation system for your entire export business. Traditional risk management is like having separate maps for different parts of a journey—one for the roads, one for the weather, another for traffic. It's useful, but nobody is looking at how a storm on one route might cause a traffic jam on another.

This is where many South African exporters get stuck. Their risk management often works in silos. The finance team is understandably focused on currency fluctuations. The logistics team is battling supply chain disruptions. Meanwhile, the sales department is managing client credit risk. Each team is solving its own puzzle, but no one sees how the pieces fit together to form the bigger picture.

ERM breaks down these silos. It shifts risk management from a disconnected, reactive chore into a proactive, strategic tool that drives real business value. It’s all about connecting the dots between seemingly unrelated risks to see the full threat and opportunity landscape.

This integrated approach is the secret sauce of ERM. It’s not just about dodging the storms, like a sudden fuel price hike or a crippling port strike. It's also about knowing how to position your sails to catch favourable winds, like a new trade agreement that suddenly cracks open a lucrative market.

Moving from Defence to Offence

One of the biggest mental shifts in ERM is moving from a purely defensive stance to a strategic one. Instead of just building walls to keep dangers out, a solid ERM framework helps you build a more resilient business that can adapt and even thrive amidst uncertainty.

This means you start asking bigger, more powerful questions:

- How might political instability in a key target market impact our five-year growth plan?

- What is our company's actual "risk appetite"? Are we taking on enough calculated risk to innovate and expand, or are we playing it too safe?

- How can we align our operational, financial, and strategic goals so we're better prepared to handle market volatility?

The Holistic Viewpoint

ERM knits together every part of your business, from governance and company culture right down to daily operations on the warehouse floor. It creates a common language and a clear framework for talking about risk. This ensures everyone, from the boardroom to the dispatch team, understands their role in protecting and growing the business.

For a South African exporter, this holistic view is critical. It allows you to see how loadshedding (an operational risk) disrupts your production schedules, which in turn jeopardises your ability to meet international delivery deadlines (a reputational risk), and ultimately impacts your power to secure future contracts (a strategic risk). ERM connects these dots into a single, coherent story.

By embracing this 360-degree perspective, your organisation can make smarter, more confident decisions. The end result is a business that isn’t just better protected from shocks but is also more agile and ready to jump on opportunities that your competitors might miss. In the complex world of international trade, that proactive edge is everything.

Understanding the Pillars of an ERM Framework

A truly effective Enterprise Risk Management program isn’t something you stumble into; it’s built on a solid, well-thought-out foundation. Think of it like an architect’s blueprint for a sturdy building. An organisation needs a proven framework to give its risk management efforts structure, purpose, and consistency.

These frameworks aren't meant to be rigid, complex rulebooks. Instead, they act as logical guides, ensuring your approach to risk is complete and, most importantly, directly tied to what you’re trying to achieve as a business.

For South African exporters, adopting a globally recognised framework creates a common language for tackling the unique challenges of international trade. It’s the difference between managing risk based on gut feeling and running a systematic, repeatable process. After all, any good ERM system is built on the foundational principles of risk management.

Choosing Your ERM Blueprint

Globally, two frameworks tend to dominate the conversation: COSO and ISO 31000. While they look a bit different on the surface, their core purpose is identical. They help you weave risk management into the very fabric of your organisation, from high-level strategic planning in the boardroom right down to daily tasks on the factory floor.

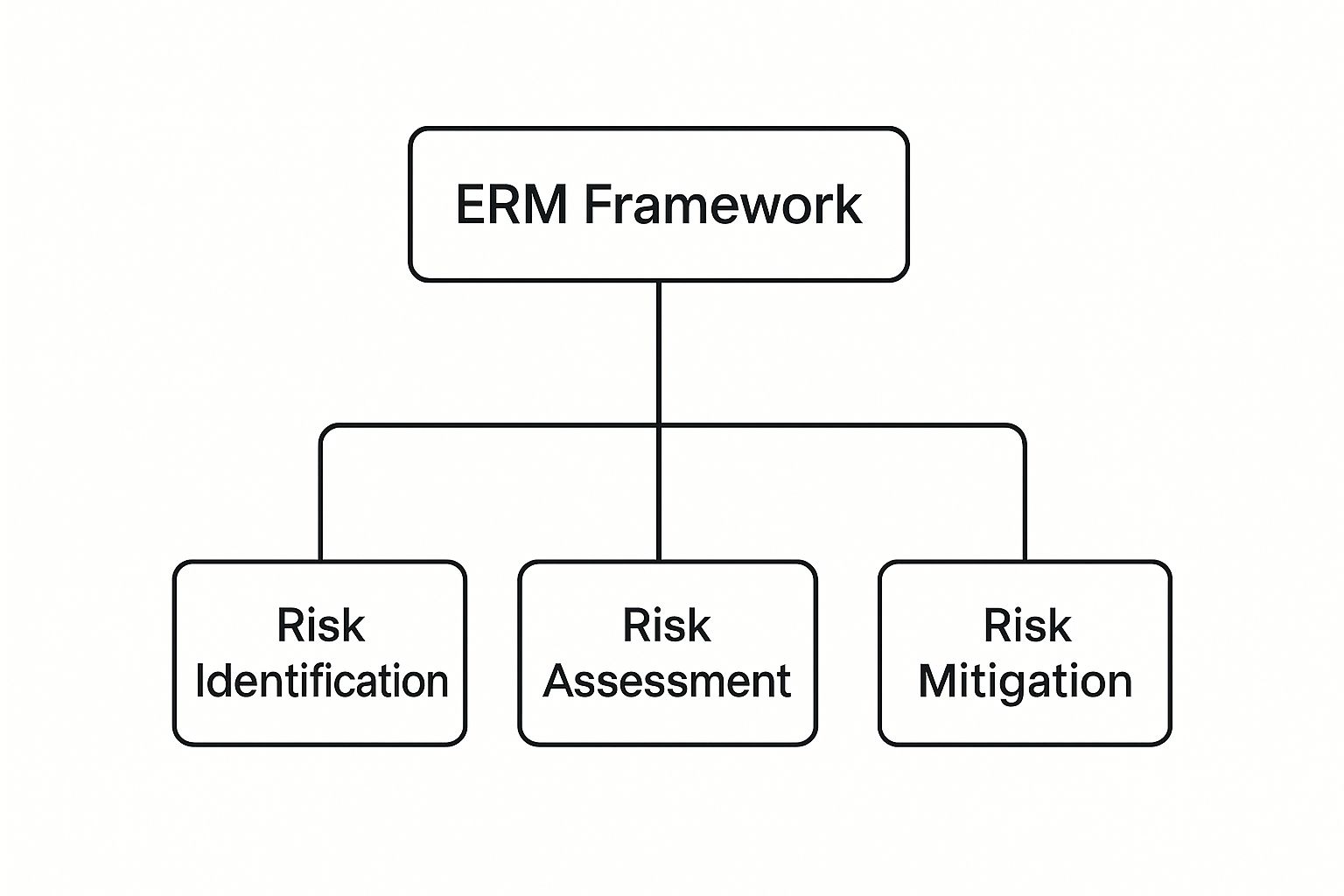

The image below breaks down the simple, three-stage logic that underpins most ERM frameworks. First, you figure out what could go wrong. Then, you assess how bad it could be. Finally, you decide what to do about it.

This simple hierarchy makes it clear: a successful risk strategy always starts with a thorough identification process, which then guides how you assess and ultimately manage those risks.

A Closer Look at the COSO Framework

The COSO ERM Framework is especially popular because it brilliantly connects risk management directly to business strategy and performance. It’s built around five interconnected components that work together, much like the vital systems in a human body—each one is distinct, but they all depend on each other for overall health.

Let's break down what these five pillars mean in practical terms for a South African exporter:

Governance & Culture: This is the bedrock. It’s all about setting the "tone at the top." Does your leadership team actively champion risk awareness, or is it just a box-ticking exercise? This involves cementing your company’s ethical values and assigning clear oversight for who is responsible for what.

Strategy & Objective-Setting: This component ties risk directly to your business goals. You don’t look at risk in a vacuum. First, you define your strategic objectives—say, breaking into a new European market. Then, you determine your risk appetite, which is simply the amount of risk you’re willing to take on to get there.

Performance: Here’s where the real hands-on work happens. You start by identifying specific risks (like potential shipping delays at the Port of Cape Town), figuring out their likelihood and potential impact, and then prioritising them. Only then can you decide on the right response.

Review & Revision: The world of risk is never static; things change. This pillar is about constantly monitoring how well your risk responses are working and whether the ERM program itself needs a tune-up. Are your controls effective? Have new threats emerged that you didn't see coming?

Information, Communication & Reporting: The final piece of the puzzle is about getting the right risk information to the right people at the right time. It means generating clear, useful reports that help leaders make informed decisions and encouraging open conversations about risk across every single department.

By following a framework like COSO, an exporter can ensure that every potential threat—from a sudden change in international shipping regulations to a new cybersecurity vulnerability—is systematically identified, analysed, and managed in a way that supports the company’s mission.

This isn’t just theory; this structured approach is already delivering results here in South Africa. Many of our State-Owned Companies (SOCs), for example, have successfully adopted frameworks like COSO and ISO 31000. Research shows they have built strong governance structures to monitor risk and maintain clear processes for keeping their critical risk registers up to date, ultimately building much-needed resilience.

The Core Components of a Modern ERM Programme

So, we've moved from the blueprint to the build. What are the actual working parts of a solid ERM programme? Think of it like a symphony orchestra. For the music to be powerful and coherent, each section—the strings, brass, woodwinds, and percussion—has to play its part in perfect harmony with the others.

A modern ERM programme works on the exact same principle. It’s not a single task you tick off a list, but a continuous cycle of connected processes. Each part builds on the last, creating a dynamic system that helps your organisation spot, understand, and respond to the full spectrum of risks out there. For South African exporters, really getting a handle on these components is the key to navigating the choppy waters of global trade.

Risk Identification: Scouting Your Business Environment

First things first: risk identification. This is the discovery phase, where you’re actively scouting your entire business environment—inside and out—for any potential threats or even opportunities. It’s about looking beyond the obvious stuff and asking, "What could actually stop us from hitting our targets?"

For an exporter in South Africa, this goes way beyond just looking at the balance sheet. You need to examine every single link in your value chain.

- Operational Risks: Are there potential weak spots at the Port of Durban that could hold up shipments? What will Stage 6 loadshedding really do to our production targets?

- Strategic Risks: How could a sudden shift in international trade policies block our access to key markets? Is a new competitor popping up in Europe that we haven't noticed?

- Financial Risks: How will the volatile Rand/Dollar exchange rate chew into our profits? What are the credit risks of taking on a big new international client?

- Digital Risks: Are our customer data and intellectual property properly locked down against cyber threats? Managing digital risks, including having a robust approach to web application security, is a non-negotiable part of protecting your assets and customer trust in today’s world.

Risk Assessment: Analysing Impact and Likelihood

Once you’ve spotted a potential risk, the next step is risk assessment. This is where you dig in and analyse what it could actually do to your business. It's not enough to just have a long list of potential problems; you need to truly understand them. This means looking at two key dimensions for each risk you've identified:

- Likelihood: How probable is it that this will actually happen?

- Impact: If it does happen, how badly will it hurt the business?

By scoring risks on both likelihood and impact, often on a simple 3x3 or 5x5 grid, you can start to prioritise what matters most. A risk that’s unlikely to happen and won't cause much damage can go on the back burner. But one that's highly likely and could be catastrophic? That needs your immediate attention. This simple process pulls risk management out of the realm of guesswork and into data-informed decision-making.

Risk Response: Deciding How to Act

After you've assessed and prioritised your risks, you have to decide what to do about them. The risk response component is where strategy really comes into play. You’ve basically got four main options for dealing with any given risk. The right choice will come down to your company's appetite for risk and the specific nature of the threat itself.

Your response to a risk is a strategic business decision. It should align with your company’s goals, resources, and willingness to accept uncertainty in pursuit of growth.

The four common ways to treat a risk are:

- Mitigate: Put controls or processes in place to reduce the risk's likelihood or its impact. A perfect example is installing backup generators to lessen the blow of loadshedding.

- Transfer: Shift the financial sting of the risk to someone else. Buying political risk insurance for shipments heading to an unstable region is a classic way to transfer risk.

- Avoid: Simply decide not to do the thing that creates the risk in the first place. This might mean choosing not to enter a particularly volatile new market.

- Accept: Consciously decide to live with the risk without taking any action, usually because the cost of fixing it is higher than the potential damage it could cause.

Monitoring and Reporting: Closing the Loop

Finally, remember that ERM isn't a one-time project. It’s a living, breathing process. The monitoring and reporting component is what makes sure the whole system stays effective over time. This involves keeping a close eye on your identified risks, checking how well your responses are working, and feeding key insights back to the leadership team.

This feedback loop is what transforms ERM from a compliance exercise into a powerful strategic tool. It gives decision-makers timely, relevant information, allowing them to adjust their game plan as conditions on the ground change. For an exporter, this could mean getting regular updates on supply chain performance, currency exposure, or new geopolitical tensions, making sure the business stays agile and resilient.

How ERM Delivers Real Strategic Advantages

When you're caught up in the daily grind of running an export business, putting resources into a formal Enterprise Risk Management programme can feel like a luxury you can't afford. It's easy to see it as just another line item on the budget. But that's a mistake.

Viewing ERM as a mere defensive shield misses the point entirely. A properly implemented ERM programme is a powerful strategic tool. It shifts your perspective from simply avoiding bad outcomes to actively navigating uncertainty with confidence.

Ultimately, it turns risk from a source of stress into a genuine competitive edge, helping you spot and seize opportunities that your more reactive competitors will almost certainly miss.

Sharper Strategic Decisions

One of the biggest payoffs of ERM is how it refines your strategic thinking. Without a complete, 360-degree view of your risk landscape, leadership teams are often making critical decisions based on gut feel or incomplete information. They’re flying partially blind.

ERM brings clarity and context to those big decisions. By mapping out potential risks and linking them directly to your business goals, you can weigh up your options with far greater insight.

Imagine you’re considering entering a new international market. A solid ERM process forces you to look at everything from the country's political stability and currency fluctuations to the reliability of its local supply chains. This gives you a much clearer picture of the real rewards versus the inherent dangers, letting you make a smarter, more calculated move.

This structured approach helps you put your resources—your money, time, and people—where they will have the most impact, focusing on projects with the best risk-adjusted returns.

A More Resilient Business

In international trade, disruption is guaranteed. It’s not a question of if, but when. A mature ERM programme is one of the best ways to build true organisational resilience, which is your ability to take a hit, adapt, and keep moving forward.

Think of it as a shock absorber for your entire operation. When the unexpected happens—a major port suddenly closes, a key supplier goes under, or a new set of trade tariffs gets announced—companies with strong ERM are ready.

They’ve already thought through these scenarios, identified their weak spots, and have contingency plans in place. This allows them to respond quickly and effectively while everyone else is scrambling. It’s this proactive stance that minimises downtime, protects your revenue, and guards your hard-won reputation.

Greater Stakeholder Confidence

At the end of the day, business runs on trust. Your investors, board members, lenders, and even your most important customers need to believe in your ability to manage uncertainty and protect the value you’ve created.

A formal ERM programme is clear, credible proof that your leadership is serious about governance. It shows a proactive and sophisticated management style that goes well beyond just ticking compliance boxes.

Research consistently shows that a well-embedded ERM programme encourages a culture of risk ownership and accountability across the business. This gives the board and executive team the assurance they need that risks are being managed properly at every level. You can read more in this research on how ERM boosts board confidence.

This confidence translates into tangible benefits. We’re talking about better lending terms, potentially higher company valuations, and stronger, more loyal partnerships with your international clients. It sends a powerful signal: your business isn’t just built for today’s market, it’s ready for whatever tomorrow throws at it.

Navigating South Africa’s Unique Risk Landscape

While the core ideas of Enterprise Risk Management are the same everywhere, how you apply them has to be intensely local. An ERM framework pulled straight from a textbook just won’t survive contact with the realities South African exporters face every single day. If you want to build a resilient export business here, your strategy must be rooted in the complex, interwoven risks that define our unique environment.

For any business in South Africa, risk is rarely a single, isolated problem. It's more like a tangled web where one issue feeds directly into another. Trying to manage these challenges one by one, after they’ve already happened, isn't sustainable—it's a recipe for firefighting. A proactive, holistic approach isn't just a "nice-to-have"; it's essential for survival and growth.

The Interconnected Web of Local Risks

You simply can't look at any single risk in isolation here. A solid ERM programme has to acknowledge how operational headaches, economic pressures, and social tensions all bleed into one another. This creates a uniquely challenging playing field for anyone trying to get their products to international markets.

Just think about how these challenges are connected:

Persistent Energy Insecurity: "Loadshedding" is so much more than an inconvenience. It completely throws off production schedules, drives up operating costs from running generators, and can fry sensitive equipment. This one issue creates a domino effect of financial and logistical problems.

Logistical Chokepoints: Our ports and rail networks are battling major efficiency and capacity issues. These bottlenecks lead to unpredictable delays, which in turn means risking missed delivery dates, facing penalty clauses, and damaging hard-won client relationships.

Regulatory and Policy Uncertainty: Frequent shifts in trade policies, BEE requirements, and other regulations create a constantly moving target. This volatility makes long-term planning incredibly difficult and can slam businesses with sudden compliance costs or shut them out of markets.

Social and Political Instability: With high unemployment, especially among the youth, and deep-seated inequality, the risk of protests and civil unrest is ever-present. These events can block transport routes, put staff in danger, and cause serious damage to property, disrupting the entire supply chain.

This isn’t just anecdotal. The 2025 IRMSA Risk Report pinpoints systemic risks like energy insecurity, weaknesses in governance, and social instability as the dominant threats. As IRMSA's CEO, Yvonne Mothibi, rightly warns, a reactive stance is no longer an option because the combined weight of these risks is now greater than the nation’s ability to bounce back. You can dig deeper into the 2025 strategic imperatives for South African businesses to get a fuller picture.

The table below summarises some of the top systemic risks that demand a strategic ERM focus.

Top Systemic Risks for South African Businesses

| Risk Category | Specific Examples | Potential Impact on Exporters |

|---|---|---|

| Operational & Infrastructure Failure | Prolonged loadshedding, water shortages, failing rail and port logistics. | Production halts, increased operational costs, shipping delays, missed deadlines. |

| Economic Instability | High inflation, currency volatility (Rand fluctuations), sovereign credit risk. | Unpredictable input costs, reduced profit margins, difficulty in pricing for foreign markets. |

| Socio-Political Instability | Civil unrest, strikes, community protests, high crime rates. | Supply chain disruptions, property damage, employee safety concerns, reputational risk. |

| Governance & Regulatory Risk | Policy uncertainty, corruption, complex compliance (e.g., BEE), trade tariff changes. | Increased cost of compliance, barriers to market access, legal challenges, planning difficulties. |

These interconnected threats paint a clear picture: waiting for a crisis to happen is no longer a viable strategy.

Why a Reactive Approach Is a Losing Strategy

When you’re always reacting, you’re always a step behind. You only fix the generator after it’s failed during a critical production run. You only find another shipping route after your cargo is stuck at a gridlocked port. This approach is incredibly expensive, inefficient, and corrosive to your reputation.

In the South African context, a purely reactive approach to risk is like trying to patch a leaking roof during a thunderstorm. A proactive ERM strategy is about reinforcing the entire structure before the storm even arrives.

It’s about anticipating how Stage 6 loadshedding will affect your international orders and building that possibility into your production plans and client conversations from day one.

Building a Fit-for-Purpose ERM Strategy

For a South African exporter, a truly "fit-for-purpose" ERM strategy has to be built on a deep and honest understanding of this local context. It means going beyond generic risk registers and starting to ask tougher, more specific questions that link global ERM principles to our on-the-ground reality.

This means getting practical:

- Mapping Interdependencies: Actively trace how a risk in one area (like social unrest) could set off a chain reaction elsewhere (like supply chain chaos and reputational damage).

- Scenario Planning: Game out realistic "what-if" scenarios based on local triggers. What happens if there's a prolonged national strike? Or a week-long power outage? Or a sudden change in import duties from a key trading partner?

- Building Agility: Create flexible operational plans that let your business pivot quickly when one of these systemic risks becomes a reality.

By adopting this localised, proactive mindset, South African exporters can turn risk management from a box-ticking exercise into a real strategic advantage. You’ll be building a business that isn’t just prepared for local challenges but is resilient enough to thrive because of them.

Navigating the Common Roadblocks in ERM Implementation

Let's be honest: putting a solid enterprise risk management programme in place isn't a simple, one-time task. It’s a genuine shift in how the entire business thinks and operates, and like any big change, it comes with its own set of challenges. If you ignore these potential hurdles, you risk creating an ERM system that just looks good on paper but adds more red tape than real-world value.

To get ERM off the ground successfully, you have to face these roadblocks head-on with a smart, practical plan. Interestingly, the biggest obstacles are rarely technical—they're about people. Things like getting real commitment from the top, tearing down the walls between departments, and shifting away from a simple "check-the-box" attitude are where most initiatives get stuck.

Getting True Backing from Leadership

Having a budget signed off is one thing, but getting genuine, active support from your senior leaders is a completely different ball game. Without it, ERM will always be seen as just another corporate chore, not the strategic necessity it truly is. The trick is to speak their language.

Forget talking only about risk mitigation. Instead, frame the discussion around creating value and boosting profitability. You need to show them how a deep understanding of risk leads to better strategic choices, more efficient use of capital, and a stronger position in the market. Your job is to prove that ERM isn't just a cost—it's a powerful tool for protecting and growing the company's bottom line.

A classic mistake is to pitch ERM as a purely defensive play. You’ll win over the C-suite by positioning it as a way to drive strategic growth and build resilience, clearly connecting risk management work to the company's core business goals.

Tearing Down the Silos Between Departments

ERM simply can't work if every department is its own little kingdom. The finance team is worried about currency fluctuations, logistics is focused on shipping delays, and sales is concerned with client creditworthiness. But the really big, dangerous risks? They often lurk in the gaps between these functions. You can’t get a complete picture of risk when information is trapped behind departmental walls.

To break down these silos, you need to establish shared goals and open up lines of communication. Cross-functional risk workshops can be incredibly effective here. Get leaders from different teams in a room together to map out a single, end-to-end process, like fulfilling a customer order, and get them to pinpoint the risks at every single step.

An exercise like this forces everyone to see how their department's risks affect the entire organisation. It builds a sense of collective responsibility and starts to cultivate the integrated, holistic view that is the absolute cornerstone of effective ERM.

Moving Past the "Tick-Box" Mentality

The last major hurdle is stopping ERM from becoming a mindless compliance exercise. If your people see risk management as nothing more than filling out forms to keep the auditors happy, your programme is dead in the water. The real aim is to weave risk awareness into the very fabric of your company culture.

The best way to do this is to tie risk management directly to performance and everyday decisions. Make it relevant to people's actual jobs. For instance, when a team is assessing a new potential supplier, their evaluation checklist should include practical, risk-based questions about that supplier's financial health or operational reliability. When you build risk thinking into the processes people already use, it stops being an extra task and becomes just a natural part of how they do business.

Got Questions About ERM? We've Got Answers

We're wrapping up with a few common questions that pop up when South African exporters start thinking about Enterprise Risk Management. Let's tackle them head-on to clear up any lingering doubts.

How Is ERM Actually Different from the Risk Management We Already Do?

This is a great question, and the difference really comes down to perspective. Think about it this way: traditional risk management often lives in its own little world. Your finance team worries about currency fluctuations, and your logistics manager is having sleepless nights over potential shipping delays. But are they talking to each other? Usually not.

That’s where ERM changes the game. It takes a bird's-eye view of the entire business. It's about understanding that a supply chain issue isn't just a logistics problem; it's a risk to your customer relationships and, ultimately, your reputation. ERM connects all the dots.

Imagine traditional risk management as individual security guards, each one watching a different door in a large building. ERM is the central control room that sees all the camera feeds at once, understanding how an issue at one door might affect the entire building.

It moves the conversation from simply putting out fires to making smarter, risk-aware decisions that actually support your overall business strategy.

We're a Small Exporter. Where on Earth Do We Start?

Jumping into ERM can feel like a massive undertaking, especially for a smaller team. The secret is not to overcomplicate it. You don't need a fancy, expensive system to get started.

Here’s a practical way to begin:

- Pinpoint Your "Crown Jewels": What are the absolute non-negotiables for your export business? Maybe it's that one major client contract, a crucial piece of machinery, or the reliability of your main supplier. Focus your initial risk assessment right there.

- Hold a Simple "What-If" Session: Get your key people together for an hour. The only agenda item? Brainstorm the top 10 things that could derail your business goals this year. This simple conversation is the first step to building a shared understanding of risk.

- Nominate a "Risk Champion": You don't need to hire a Chief Risk Officer. Just give one person the responsibility to keep the risk conversation alive, check in on progress, and make sure leadership stays in the loop.

How Do We Know if Our ERM Programme Is Even Working?

Measuring the success of ERM isn't as simple as looking at a single number on a spreadsheet. Often, the biggest win is what doesn't happen—the crisis you avoided, the disruption that never materialised.

Instead of a direct financial ROI, look for these signs of success:

- Fewer "Surprise!" Moments: Are you experiencing less unexpected operational hiccups or financial shocks? That's a huge win.

- Smarter Conversations: Is risk information actually being discussed when you make big strategic decisions? When you see your team asking, "What are the risks here?" you know it's working.

- Quicker Bounce-Back: When something does go wrong (and it will), how quickly and effectively do you recover? Improved resilience is a clear sign of a healthy ERM programme.

Ultimately, good ERM gives your leadership team the confidence to chase ambitious goals, because they have a much clearer picture of the obstacles that might be waiting down the road.

At Zaro, we provide South African exporters with a transparent and efficient way to manage their cross-border payments, helping you control currency risk and improve financial predictability. Learn more about our cost-effective payment solutions.