Let's break down what foreign exchange controls really mean. At its simplest, think of a country's economy like a large reservoir. Foreign exchange controls are the sluice gates that a government uses to manage how much money flows in and out. The goal is to keep the water level—the economy—steady and predictable.

Unpacking the Core Concept of Forex Controls

At its heart, foreign exchange control isn’t about building a dam to stop all cross-border money movement. It's really a set of official rules and policies a government puts in place to supervise transactions that involve foreign currencies. These regulations dictate who can buy or sell foreign currency, how much they can transact, and for what specific reasons.

Imagine a scenario without these controls. A wave of panic could spook investors, causing them to yank their money out of the country all at once. This would drain our economic "reservoir" to dangerously low levels. This sudden exodus is known as capital flight, a phenomenon that can shatter a currency's value and destabilise the entire economy. For many governments, especially in developing nations, these controls are a critical safety net.

So, Why Do Governments Bother with These Controls?

It all comes down to one main goal: maintaining economic stability. By carefully managing the flow of capital, a country can shield itself from the nasty side effects of global financial crises and unpredictable market swings. They are a fundamental tool in any government's economic survival kit.

The key objectives usually boil down to a few core things:

- Preventing Capital Flight: To stop a massive, sudden outflow of money that could otherwise crash the local currency.

- Managing the Exchange Rate: To influence the value of the national currency (like our South African Rand) to keep imports from becoming too expensive and ensure exports remain attractive to foreign buyers.

- Protecting Foreign Reserves: To make sure the country holds enough foreign currency, such as US Dollars or Euros, to cover essential imports and pay off its international debts.

- Guiding Economic Development: To channel investment into priority local sectors by making it less appealing or more complicated to simply send money offshore.

Consider this real-world example: during a period of economic uncertainty, a central bank might decide to limit the amount of foreign currency an individual can purchase for an overseas holiday. This isn't about punishing tourists. Instead, it’s a collective measure to protect the nation's finite foreign reserves for more critical imports, like fuel, machinery, or medicine. In South Africa, this crucial role is fulfilled by the South African Reserve Bank (SARB), which acts as the custodian of our financial stability through these carefully calibrated regulations.

The Story Behind South Africa's Forex Rules

To really understand foreign exchange control in South Africa, you have to look at its history. These rules weren't just invented overnight. They were forged in the crucible of global war, political upheaval, and economic survival, creating a unique regulatory story that still shapes our financial world today.

The story starts back in 1939. As part of the British Sterling Area during World War II, South Africa, along with the UK, brought in measures to manage capital. The main idea was simple: let money move freely within the Sterling Area but stop valuable 'hard currency' from leaking out to other countries. If you want to dive deeper, a comprehensive report from the Rand Commission details the evolution of these early regulations.

A Turning Point for Capital Controls

After the war, most countries started tearing down these financial walls. South Africa, however, went the other way. The real turning point came in 1961 after the Sharpeville tragedy. The event sparked massive capital flight as investors, spooked by the country's instability, pulled their money out.

This sudden exodus threatened to drain the economy of the capital it desperately needed for local liquidity and growth. So, what did the government do? It didn't just keep its exchange controls; it made them much stricter. The goal was no longer about wartime strategy but about protecting the entire national economy from devastating external shocks.

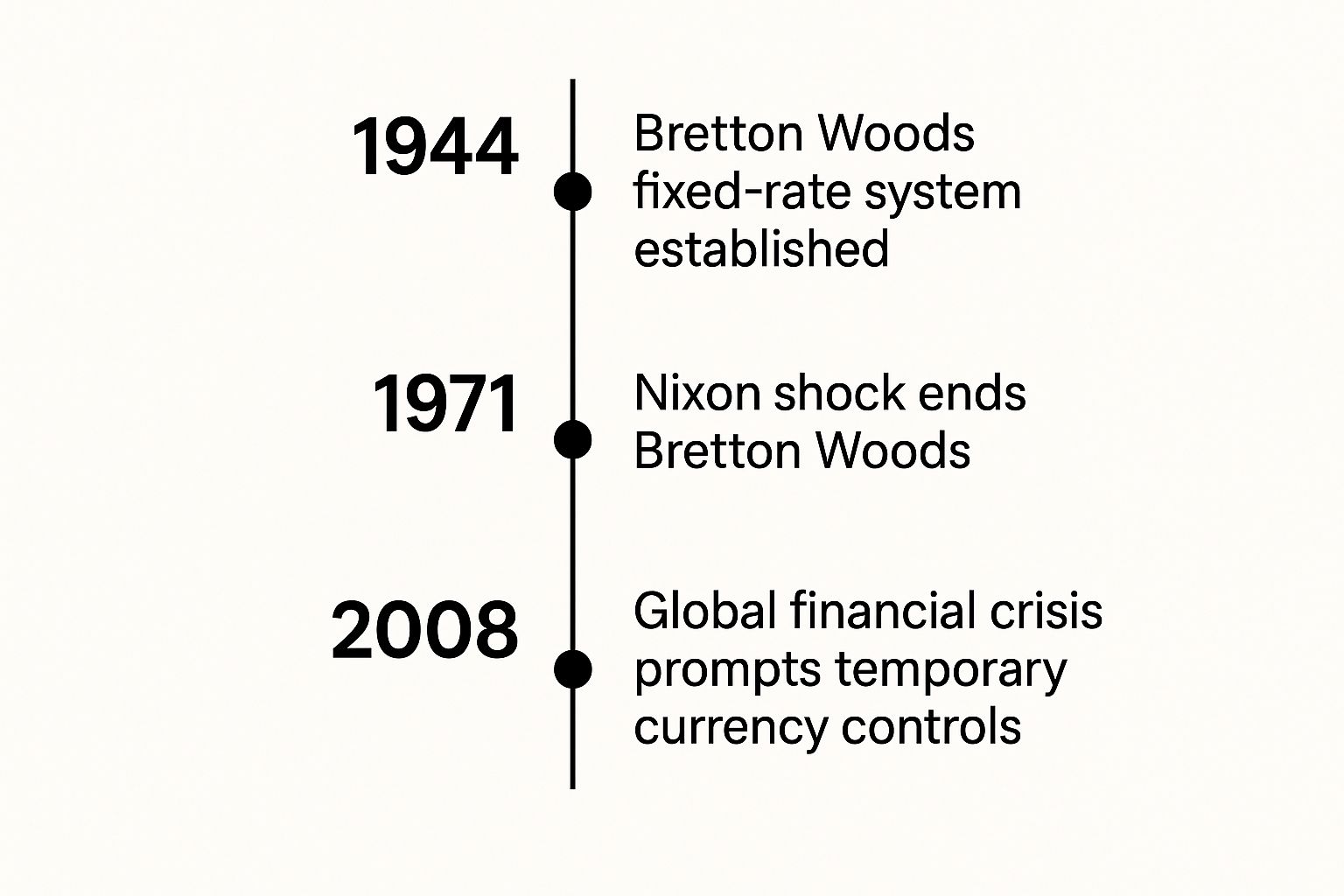

This timeline gives a great overview of how major global economic events have historically pushed governments worldwide to use currency controls.

As you can see, global crises like the collapse of the Bretton Woods system or the 2008 financial meltdown often lead governments to reconsider—and sometimes tighten—their grip on currency movements to keep their economies stable.

The Role of International Pressure

Things got even more intense from 1985 onwards. With international pressure mounting against the apartheid regime, South Africa was hit with crippling sanctions, trade boycotts, and widespread disinvestment campaigns. These moves put enormous strain on the country's balance of payments and the wider economy.

The government's response was to clamp down even harder. The system became incredibly restrictive, demanding prior approval for almost any capital moving out of the country by residents. Throughout this turbulent period, the chain of command for these economic defences was crystal clear:

- Policy: The Minister of Finance held the ultimate authority.

- Administration: The South African Reserve Bank (SARB) handled the day-to-day implementation and enforcement, acting on the government's behalf.

This journey through history tells us something vital: South Africa's exchange controls started as a standard wartime measure but grew into a fundamental tool for economic self-preservation. They were a direct response to decades of deep political and economic isolation, which created a regulatory system unlike almost anywhere else. This legacy is exactly why the post-apartheid era has been marked by such a cautious and gradual approach to loosening these controls.

Unpacking the Financial Rand Dual Currency System

As South Africa found itself increasingly isolated on the world stage, it had to get creative to protect its economy. The solution was one of the most unique financial mechanisms the country has ever seen: the Financial Rand (Finrand). This wasn't just another regulation; it was a full-blown dual currency system, born out of necessity for a very specific and difficult time.

It's a strange concept to grasp, but try to imagine two different types of Rand circulating at once. That was the reality of the Finrand system. It essentially split the country's financial activity into two distinct streams, each with its own exchange rate against foreign currencies.

Commercial vs. Financial Rand

First, you had the Commercial Rand. Think of this as the everyday currency. It was used for all the normal stuff – paying for imports, getting paid for exports, and other day-to-day trade. Its value was kept relatively stable, reflecting the real-time pulse of the country's trade.

Then there was the Financial Rand. This was the specialist currency, reserved almost exclusively for capital transactions. When a non-resident wanted to buy or sell a South African asset, like shares or property, they had to use the Financial Rand. This currency traded in its own separate, much more volatile market, and it was almost always worth significantly less than its commercial counterpart.

This split created a powerful economic buffer.

By making the Financial Rand less valuable, the system made it unattractive for foreign investors to sell their local assets and take their money out of the country. An investor pulling out would receive fewer US Dollars for their Rands, discouraging capital flight when the country could least afford it.

This dual-system officially kicked into gear in the mid-1980s, becoming a defining feature of South Africa's economy. Faced with crippling international pressure and sanctions during the apartheid era, the Finrand was a critical defence mechanism. It helped manage the balance of payments and stopped the economy from collapsing under the weight of capital pouring out of the country. For a deep dive, you can explore the Financial Rand and its role on Wikipedia.

The system was finally scrapped in March 1995, a truly historic moment. Its removal was a clear signal from the new democratic government. It showed the world that South Africa was ready to dismantle its old economic fortresses and rejoin the global financial community, opening the door to a more modern and integrated approach to foreign exchange.

How Modern Forex Controls Affect You Today

The rigid "exchange controls" of South Africa's past, which often felt like a tight gatekeeping system, have changed dramatically. Today's approach has moved away from outright prohibition and evolved into a framework built on currency surveillance and reporting. While the National Treasury still steers the overall policy, it's the South African Reserve Bank (SARB) that manages the day-to-day rules affecting your international transactions.

This modern system acknowledges a simple reality: in a global economy, capital must be able to move. The focus has shifted from trying to block money from leaving the country to ensuring that when it does, the process is transparent, properly declared, and stays within clearly defined limits. It's a significant move away from the dual-currency system that ended in 1995.

When the Financial Rand was abolished, South Africa transitioned from strict capital restrictions to a more liberalised approach focused on monitoring. Many controls were relaxed to attract foreign investment and normalise international trade. However, some rules remain in place to guard against sudden capital flight and currency volatility, which are crucial for protecting the nation's financial stability. You can actually explore the data yourself and see how the SARB supports market transparency with a wealth of historical rates and statistics on their website.

Your Personal and Business Allowances Explained

For individuals and businesses, getting to grips with today's rules really comes down to understanding your specific allowances. These are the annual limits set by the SARB for moving funds offshore. It’s best to think of them not as barriers, but as clearly defined pathways for sending money abroad legally and without any fuss.

The two main allowances you'll encounter as a South African resident are the Single Discretionary Allowance (SDA) and the Foreign Capital Allowance (FCA), which you might remember as the Foreign Investment Allowance.

Single Discretionary Allowance (SDA): This is your all-purpose annual allowance. Every South African resident over 18 can transfer up to R1 million offshore per calendar year without needing a tax clearance certificate. It’s designed for a wide range of personal uses, from paying for travel and sending gifts to making donations or covering alimony payments abroad.

Foreign Capital Allowance (FCA): If you're looking to make more significant international investments, the FCA is your next step. It allows you to transfer an additional R10 million offshore each calendar year. This allowance, however, has stricter requirements. You must be a taxpayer in good standing and get a Tax Compliance Status (TCS) PIN from SARS that is specifically for foreign investment.

It's absolutely crucial to remember that these allowances are separate and can be combined. You can use your R1 million SDA and, on top of that, apply for the R10 million FCA. This gives you a potential total of R11 million for offshore transfers in a single year, as long as you meet all the necessary criteria.

Key Foreign Exchange Allowances for South African Residents

To make things even clearer, this table breaks down the main allowances available to South African residents for moving funds abroad, as regulated by the SARB.

| Allowance Type | Annual Limit (per calendar year) | Purpose and Key Details |

|---|---|---|

| Single Discretionary Allowance (SDA) | R1 Million | For personal use like travel, gifts, or alimony. No tax clearance is required. |

| Foreign Capital Allowance (FCA) | R10 Million | Primarily for offshore investments. Requires a valid Tax Compliance Status (TCS) PIN from SARS. |

Understanding these allowances is the first step toward confidently managing your international finances. The modern system of foreign exchange control is far less about saying "no" and much more about asking "how," ensuring every transaction is properly accounted for to protect the broader economy.

The Real-World Impact on Businesses and Individuals

It’s easy to talk about foreign exchange controls as an abstract economic concept, but for South African companies and individuals, the impact is felt every single day. These rules aren't just lines in a policy document; they actively shape how we send and receive money across our borders, creating a distinct set of hurdles and considerations for anyone involved in international transactions.

Think about an entrepreneur with a growing export business. Paying an overseas supplier for essential materials isn’t as straightforward as making a local EFT payment. It’s a multi-step process. They need to ensure the payment fits into an approved transaction category, meticulously document everything, and process it all through an Authorised Dealer—typically their bank—which then reports the details to the South African Reserve Bank (SARB).

This administrative layer can feel like a constant drag on operations. It means more paperwork, potential delays waiting for approvals, and the need for specialised financial know-how just to stay compliant. When that same business wants to expand by acquiring a foreign company, the complexity ramps up significantly, demanding specific approvals and proof that the investment won’t harm our local economy.

The Practical Hurdles for Companies and Citizens

It’s not just big business feeling the pinch. Ordinary individuals run into these controls all the time. Whether you’re looking to invest in international shares, buy a property overseas, or send money to support family living abroad, you have to work within a strict system of allowances.

While this system is in place to safeguard the economy, it can be a source of real frustration. It forces you to carefully plan every international transfer to remain within the R1 million Single Discretionary Allowance. If you need to send more, you have to go through the process of getting tax clearance for the larger R10 million Foreign Capital Allowance. A simple mistake in tracking your allowances or a misstep in the rules can quickly lead to compliance headaches.

The heart of the matter is the friction these controls create. They are designed to be a protective shield for the economy, but in practice, they can slow down commerce, drive up administrative costs, and limit the financial freedom of South Africans wanting to build a global financial footprint.

A Relatable Scenario: Navigating the System

Let's ground this in a real-world example. Imagine a small tech startup in Johannesburg. They need to pay a monthly US dollar subscription for a critical piece of software. At the same time, the founder wants to begin building her own personal investment portfolio offshore.

Here’s how forex controls directly affect both goals:

The Business Payment: Every month, that software subscription is a cross-border transaction. It must be correctly categorised and processed via their bank, adding an extra, often manual, step to their accounting workflow.

The Personal Investment: To start investing, the founder has to use her personal allowances. She might dip into her R1 million Single Discretionary Allowance for an initial small investment, which is relatively simple.

Scaling the Investment: Once she decides to invest a more significant amount, she’ll need to apply for a Tax Compliance Status (TCS) PIN from SARS. This is the key to unlocking her R10 million Foreign Capital Allowance, and it’s only granted if her personal tax affairs are completely up to date and in good standing.

This simple scenario highlights how the regulations are woven into the fabric of both business and personal finance, demanding a sharp understanding of the rules and careful management to avoid any missteps.

Your Forex Control Questions Answered

Getting to grips with foreign exchange controls can feel like a maze, but a clear understanding of the rules is crucial for managing your money across borders. Let's tackle some of the most common questions South Africans have about these regulations.

We'll clear up the confusion around your personal allowances, the story with digital assets, and what actually happens if you make a mistake.

SDA vs FCA: What’s the Difference?

One of the first things people ask about is the difference between the Single Discretionary Allowance (SDA) and the Foreign Capital Allowance (FCA). It’s a great question. While both let you move money offshore, they’re designed for different things and have very different rules.

Single Discretionary Allowance (SDA): Think of this as your everyday, no-fuss annual allowance. Every South African resident over 18 automatically gets a R1 million limit per calendar year. You can use it for almost any personal reason you can think of—funding an overseas holiday, sending a cash gift to family abroad, or even just doing some online shopping from an international store. The best part? You don't need a tax clearance certificate from SARS to use it.

Foreign Capital Allowance (FCA): This one is all about serious investing. The FCA allows you to send an additional R10 million out of the country each year, but it's specifically for offshore investments. This could be anything from buying shares on a foreign stock exchange to purchasing a property overseas. To unlock this allowance, your tax affairs must be in perfect order, and you’ll need to get a Tax Compliance Status (TCS) PIN for foreign investment directly from SARS.

So, in short, the SDA is your easy-access, personal spending allowance. The FCA is the bigger, more regulated allowance meant for building an offshore investment portfolio. You can use both, giving you a potential total of R11 million a year to move abroad.

Can I Use My Allowance to Buy Cryptocurrency?

This is a hot topic, and for good reason. The official stance, however, has been quite clear and is evolving slowly. As it stands today, the South African Reserve Bank (SARB) does not allow you to use your annual allowances—neither the SDA nor the FCA—to buy cryptocurrencies directly from an offshore exchange.

The regulations are written to govern the movement of fiat currency (like Rands) for specific, approved purposes. Directly wiring Rands to an international crypto platform to purchase assets like Bitcoin or Ethereum simply doesn't fall under these approved categories.

It's vital to grasp this distinction: while owning crypto in South Africa isn't illegal, using your official forex allowances to buy it from foreign sources is a direct breach of the current exchange control regulations. This space is watched closely, so keeping up-to-date with SARB directives is essential.

What Happens If I Go Over My Foreign Exchange Limit?

Going over your forex allowance isn't something to take lightly. It's a serious compliance breach that can land you in hot water. The SARB and the Authorised Dealers (which is just the official term for your bank) track every single cross-border transaction tied to your name, so it's not a matter of if they'll notice, but when.

If you send more than your R1 million SDA or your R10 million FCA without getting the proper approvals, you've officially broken the exchange control rules. The fallout can vary based on how significant the breach is, but it could include:

- Financial Penalties: You could face a hefty fine, often calculated as a large percentage of the amount that was transferred illegally.

- Asset Seizure: In more serious situations, the authorities have the power to seize the funds or any assets purchased with them.

- Legal Action: Non-compliance can easily escalate into more formal legal proceedings.

The only smart approach is to be proactive. Keep a careful record of your international transfers. If you’re ever unsure about how much allowance you have left or whether a specific payment is allowed, your first port of call should be your bank or a financial advisor who specialises in this area.

For South African businesses feeling the pinch from high fees and slow transfer times on traditional cross-border payments, Zaro offers a straightforward alternative. We give you access to real exchange rates with no hidden costs, helping you manage payments to international suppliers and handle export revenues with transparency and efficiency. Take control of your global finances by visiting https://www.usezaro.com to learn more.