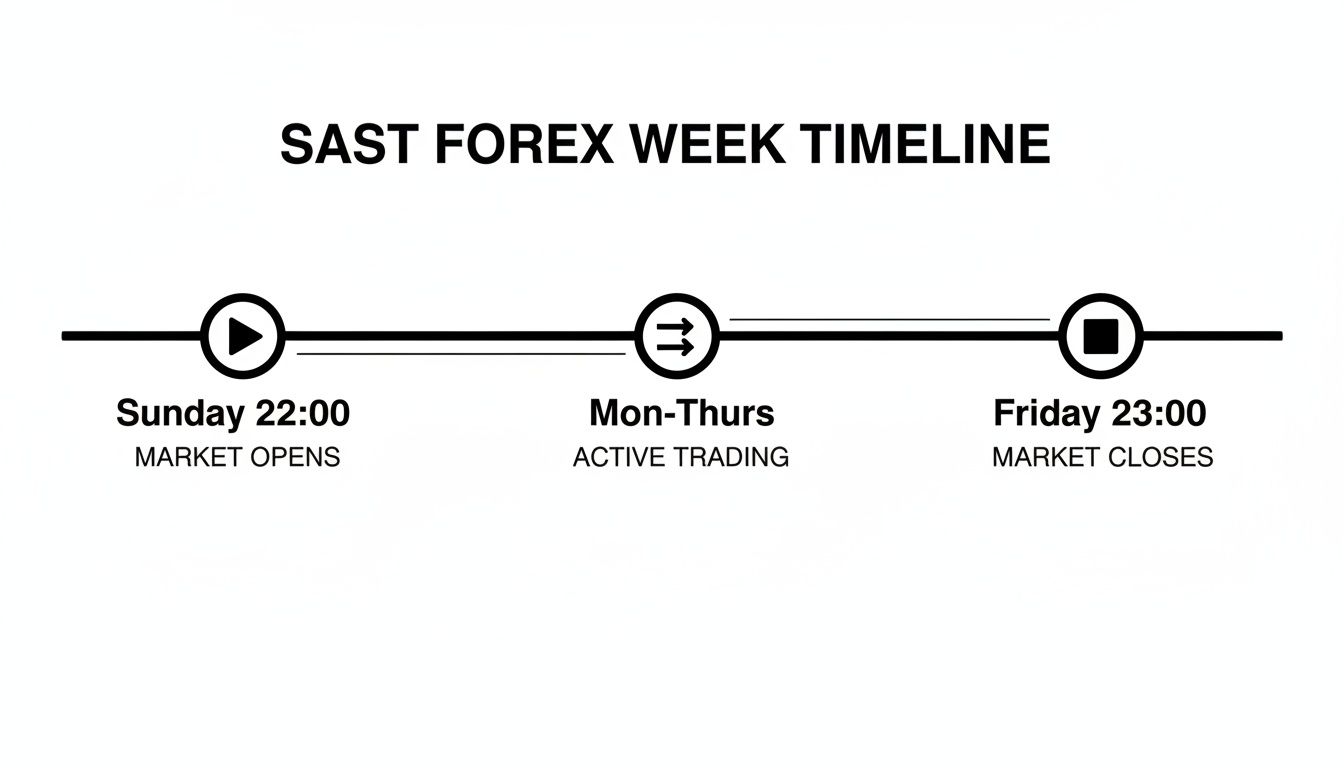

For South African businesses, the global forex market doesn't wait for Monday morning. Trading actually kicks off late on Sunday evening, usually between 22:00 and 23:00 SAST, and runs nonstop until it winds down late on Friday night.

Your Guide to Forex Market Hours in South Africa

Unlike a local stock exchange with set opening and closing bells, the forex market is a decentralised global network. It literally follows the sun, passing the baton from one major financial hub to the next, creating a continuous 24-hour trading cycle throughout the week.

This global relay race is broken down into four main trading sessions:

- The Sydney Session: This is where the trading week officially begins.

- The Tokyo Session: Overlapping with Sydney, this session brings major Asian currencies into the mix.

- The London Session: By far the largest and most important session, accounting for the highest trading volume.

- The New York Session: The final major session of the day, with a significant overlap with London.

From a South African perspective, this means the market is always moving. The timeline below gives you a clear picture of the trading week in our local time.

As the graphic shows, the market "wakes up" for us on Sunday night and stays active right through to the weekend break on Friday evening.

Global Forex Market Sessions in South African Standard Time (SAST)

To get practical, you need to know exactly when these sessions open and close in our local time zone, South African Standard Time (SAST). It's also crucial to remember how daylight saving in the Northern Hemisphere affects these times twice a year.

Here’s a clear breakdown of the four major sessions converted to SAST.

| Market Session | Opens (SAST) | Closes (SAST) | Key Currencies |

|---|---|---|---|

| Sydney | 23:00 | 08:00 | AUD, NZD |

| Tokyo | 01:00 | 10:00 | JPY |

| London | 09:00 (Winter) / 10:00 (Summer) | 18:00 (Winter) / 19:00 (Summer) | GBP, EUR, CHF |

| New York | 15:00 (Winter) / 16:00 (Summer) | 00:00 (Winter) / 01:00 (Summer) | USD, CAD |

These times are your roadmap to the market's most active periods. As you can see, the overlaps—especially between London and New York—are when trading volume and liquidity peak. More details on how these times impact trading strategies are often covered in guides on platforms like ig.com.

Why a 24-Hour Market Still Has a "Rush Hour"

Just because the forex market is technically open around the clock from Monday to Friday doesn't mean every hour is the same. Far from it.

Think of it like traffic on the N1. At 2 AM, the road is wide open. At 8 AM on a Tuesday, it’s a completely different story. The forex market has its own rush hours, and that's when things really get moving. These peak times are driven by two simple but powerful forces:

- Liquidity: This is just a fancy way of saying how many buyers and sellers are in the market at any given time. High liquidity means it's easy to trade large amounts of currency without causing a massive price swing.

- Volatility: This measures how quickly and dramatically prices are changing. High volatility creates both risk and opportunity.

When major financial hubs like London and New York are open for business at the same time, both liquidity and volatility shoot up.

The Magic of the Overlap

The real action happens when these major trading sessions overlap. The window when both London and New York are active is particularly explosive. It's a relatively short period, but a staggering 37% of all daily forex trades are crammed into these few hours.

This is the market's prime time. For a South African business needing to make or receive an international payment, this is your golden window.

During these peak hours, the intense competition means you get much better pricing. The "spread" – that small gap between the buy and sell price – gets tighter. A tighter spread means the transaction costs you less. Simple as that.

Trying to trade when only a single, smaller market is open is like trying to do your weekly shopping at a corner café late at night. The selection is poor, and the prices are high. For those exploring automated trading, sophisticated tools like scalping algorithms are designed specifically to capitalise on the rapid movements during these busy periods.

Ultimately, timing isn’t just a minor detail; it's a critical part of a smart currency strategy.

Finding the Best Times for Your ZAR Transactions

Alright, we’ve covered the global market rhythm. But what does this mean for your business and the South African Rand? Knowing the general market opening times is one thing; knowing the absolute best windows to execute your ZAR transactions is where the real advantage lies.

Here’s where a common—and often costly—misconception comes into play. You might think the best time to deal in Rand would be during local South African business hours. It makes sense, right? But in reality, the opposite is often true.

The prime time for the ZAR isn't the morning, but the South African afternoon. The real magic happens when the London and New York sessions overlap. This is the global "rush hour" for major currencies, and it pulls the ZAR right into the thick of the action.

Why the Afternoon Is King for the Rand

So, why is this? It's simple, really. While the forex market is a 24/5 beast, liquidity for the Rand isn't spread out evenly. It’s highly concentrated in windows tied to European and US trading hours.

A staggering 80% of all global Rand trading actually happens offshore. This means the market for ZAR is deepest and most active when traders in London and New York are at their desks. You can find more detail on how this offshore activity influences the Rand on DailyForex.com.

This afternoon surge in activity brings two massive benefits for your business:

- Tighter Spreads: More buyers and sellers means more competition. This narrows the gap between the buy and sell price, which directly lowers your transaction costs.

- Price Stability: Higher liquidity acts like a cushion. It allows you to execute large transfers without the price slipping away from you as the trade goes through.

As a CFO, timing is everything. A big USD payment pushed through at 10:00 AM SAST, when the market is thin, could cost you significantly more than the exact same payment made at 15:00 SAST during that peak London-New York overlap.

To put this into perspective, let's look at a quick example. Imagine your company needs to settle a $100,000 invoice with a supplier in the US.

- Morning Transfer (10:00 SAST): The market is quiet. With lower liquidity, the USD/ZAR spread is wider, and you might get a rate of 18.55. Your cost: R1,855,000.

- Afternoon Transfer (15:00 SAST): The market is buzzing. During peak liquidity, the spread tightens, and you secure a better rate of 18.51. Your cost: R1,851,000.

Just by waiting a few hours, your business saves R4,000. It might not sound like a fortune on its own, but think about that saving multiplied across all your international payments for the year. It adds up, and it goes straight to your bottom line.

How Poor Timing Can Silently Drain Your Company's Profits

Knowing the theory behind market hours is one thing, but seeing how it hits your company’s cash flow is what really matters. Let's be clear: getting your timing wrong isn't just a small oversight. It's a direct and often invisible tax that chips away at your profits with every single international payment you make.

Making a large currency transfer or bringing export earnings home during a quiet period—say, early in the morning before London and Europe have had their first coffee—is a bit like trying to sell your house in the middle of a national holiday. There are simply fewer buyers around, and the ones that are active know they can get a better deal. In the forex world, this means you're faced with wider spreads and price slippage, two hidden costs that go straight to your bottom line.

A Real-World Example of What Bad Timing Costs

Let’s put this into practice. Picture two identical South African companies that both need to settle a $250,000 invoice with a US-based supplier on the very same day.

- Company A (Poor Timing): The finance manager processes the payment first thing at 08:00 SAST. At this time, market liquidity is low as only the Asian markets are really up and running. The wider spread they're quoted results in an exchange rate of 18.60 ZAR to the US dollar. Their total cost comes to R4,650,000.

- Company B (Smart Timing): This team is more strategic. They wait until 16:00 SAST, right in the middle of the busy London-New York overlap. With so much activity, they get a much tighter spread and a better rate of 18.52 ZAR per US dollar. Their total cost? R4,630,000.

The difference is a massive R20,000 on just one payment. That’s R20,000 lost—or saved—purely based on when the transaction was executed. This is precisely the kind of hidden cost that businesses absorb when they don’t pay attention to market dynamics.

On top of that, poor timing opens the door to other problems like understanding slippage, where the price you get is worse than the price you expected when you clicked the button. For any South African business dealing in foreign currency, the lesson is clear: spreads can balloon outside of the main trading sessions. A payment made during the thin Asian hours could cost you several times more than the exact same payment made during the London-New York overlap. It’s a powerful argument for taking a much more deliberate approach to your foreign exchange.

How Market Closures, Holidays, and News Can Catch You Out

While the forex market runs 24 hours a day, that doesn't mean it's always business as usual. Knowing when the market is open is one thing, but understanding when it's effectively shut is just as critical for protecting your company’s bottom line.

The most predictable shutdown, of course, is the weekend. From late Friday night through to Sunday evening here in South Africa, the global markets take a breather. This weekly pause can be a real risk, leaving your business exposed if major political or economic news breaks while you're unable to act.

But it’s not just weekends you need to watch. Public holidays in the world’s major financial hubs can create what we call a "liquidity vacuum."

Why Holidays and News Releases Matter

A bank holiday in London or New York might feel a world away from your operations in South Africa, but its impact is very real. When a major financial centre closes, a massive chunk of trading volume disappears. This thins out the market, often leading to wider spreads and the kind of sharp, unpredictable price swings you want to avoid.

An even bigger source of short-term risk is scheduled economic news. These events can send currencies into a tailspin in a matter of seconds.

- Interest Rate Decisions: When central banks like the US Federal Reserve or the European Central Bank make an announcement, the market holds its breath.

- Inflation Reports: Data like the Consumer Price Index (CPI) can instantly reprice a currency.

- Employment Figures: The monthly US Non-Farm Payrolls report is notorious for causing huge market swings.

For any South African CFO or exporter, the takeaway is simple: you have to be aware of the global financial calendar. Trying to execute a large transaction moments before a major holiday or a key data release is like rolling the dice with your budget.

A solid currency strategy is built around planning. By scheduling your transfers to avoid these predictable periods of low liquidity or high volatility, you sidestep unnecessary risk and make sure you're transacting when the market is deep and stable.

A Smarter Way to Handle International Payments

Knowing when the forex market opens is a solid first step. It’s the kind of essential knowledge that helps you sidestep costly mistakes. But turning that insight into actual, tangible savings means you need to pair smart timing with the right financial tools.

Think about it: many businesses time their payments perfectly, only to watch their potential savings get devoured by the hidden fees and uncompetitive exchange rates offered by traditional banks. Especially during quieter market hours, banks are known to widen their spreads—that's the gap between the buy and sell rate—to reduce their own risk. For you, this means that even if you trade at the "best" time, you're likely not getting the best possible price.

A modern payment platform flips this situation on its head. It’s built to give you direct access to the real market rate, cutting out the layers of markups that quietly inflate your international payment costs.

Beyond Timing: Combining Strategy with Technology

Getting the best deal isn't just about when you make a payment; it's also about how you make it. When you combine your understanding of market liquidity with a platform built for transparency, you’ve got a seriously powerful strategy on your hands.

Here’s how it works in practice:

- Execute During Peak Liquidity: You use your knowledge of the London-New York overlap to schedule major transactions when spreads are naturally at their tightest. This puts the fundamental market conditions firmly on your side.

- Use a Transparent Platform: Next, you execute that transfer through a service that guarantees you the actual market rate, with no hidden markups or last-minute fees. This step ensures you actually keep the savings you've gained from smart timing.

This two-pronged approach takes the guesswork and inefficiency out of the equation—the very things that cost South African businesses millions every year. Your international payments shift from being a reactive headache to a proactive, strategic part of your business.

The goal is simple: to make sure the price you see is the price you get. This transforms international payments from an unpredictable cost centre into a manageable operational expense, giving you far greater control over your company's cash flow.

By connecting intelligent market timing with a transparent payment platform, you create a complete forex strategy. You don't just transact when the market is most competitive; you also ensure you're using a tool that passes those savings directly to your bottom line. This is how modern, savvy businesses handle their foreign exchange.

Take control of your international payments with Zaro. See the real exchange rate and eliminate hidden fees by visiting https://www.usezaro.com.