Trying to predict currency movements can feel a bit like forecasting the weather in the Cape—unpredictable and full of surprises. However, just like a seasoned weather forecaster looks at pressure systems and wind direction, we can look at key economic indicators for vital clues.

So, will the rand strengthen against the dollar? There’s no simple yes or no answer. The rand’s value is in a constant dance, swayed by the rhythm of South Africa's own economic health and the powerful beat of global market sentiment. While the rand can certainly enjoy short-term rallies, any lasting strength really hinges on solid, sustained improvements in these core areas.

What Moves the Rand to Dollar Exchange Rate

Before we can even begin to guess if the rand will strengthen, we need to get a handle on what makes it tick. Picture the ZAR/USD exchange rate as a seesaw. On one end, you have all the economic forces brewing within South Africa. On the other, you have the immense weight of the global economy and investor mood.

This balance is incredibly delicate and is almost never perfectly still. A nudge on one side inevitably triggers a reaction on the other, ultimately deciding whether the rand gains or loses ground against the mighty US dollar.

The Two Sides of the Seesaw

At its heart, the rand's value is a mirror reflecting how investors see South Africa's economic prospects when stacked up against those of the United States. This perception is constantly being shaped by a handful of key drivers, which we can neatly sort into two main camps.

Homegrown Factors: These are the forces originating right here in South Africa. Think of interest rate decisions from the South African Reserve Bank (SARB), our national inflation rate, GDP growth numbers, and, of course, the ever-present political climate. Good news on any of these fronts tends to attract foreign investment, which in turn strengthens the rand.

Global Headwinds: These are the external pressures, often completely outside of South Africa's control. The biggest player here is the strength of the US dollar itself. When the US Federal Reserve hikes its interest rates, the dollar becomes a more attractive investment, often pulling money away from currencies like ours.

The rand is what's known as an "emerging market" currency. This makes it particularly sensitive to the mood swings of global investors. When investors are feeling optimistic and willing to take chances (risk-on), they're more likely to buy assets in places like South Africa, giving the rand a boost. But when fear takes over (risk-off), they scramble for "safe-haven" currencies like the US dollar, causing the rand to weaken.

Another huge global factor is the price of commodities. South Africa is a major exporter of resources—gold, platinum, and coal, to name a few. When the global prices for these commodities are high, our economy gets a welcome injection of cash. This influx of foreign currency from exports creates higher demand for the rand, pushing its value up.

Grasping this constant push-and-pull between our local performance and global pressures is the first real step to forming an educated view on the rand's future. It’s never about one single event but rather the combined weight of all these interconnected forces.

A Look Back at the Rand's Recent Journey

To get a real sense of where the rand might be going, you first have to understand where it's been. The currency's recent history is a classic tale of volatility. It’s been a rollercoaster of dramatic highs and lows, often sparked by major events both at home and on the global stage. By digging into these patterns, we can get a much better feel for its sensitivities and how it behaves under pressure.

The rand’s path is rarely a straight line. Think of it as a barometer for how investors are feeling about emerging markets in general. When they're confident, the rand tends to strengthen; when fear sets in, it weakens. This makes it susceptible to sharp, sudden moves that can catch even the most experienced market watchers off guard.

We’ve often seen periods of strength tied directly to rising commodity prices, which is no surprise given how crucial exports are to South Africa's economy. When the world wants more of our platinum, gold, or coal, it gives the rand a powerful boost. On the flip side, homegrown challenges like persistent power shortages and political instability have frequently pulled it in the other direction.

From Record Lows to Surprising Recoveries

The rand's recent performance is a perfect showcase of its dual nature: both incredibly resilient and deeply vulnerable.

Take mid-2025, for example. In April of that year, the currency tumbled to an all-time low, with the USD/ZAR exchange rate hitting a staggering 19.93. It was a moment of serious concern. Yet, just a few months later, by 1 August 2025, it had staged an impressive comeback to around 18.05. This sharp rally is a textbook example of its capacity for a quick turnaround. You can dive deeper into this kind of data and the events behind it on sites like TradingEconomics.com.

Swings like this aren't unusual and are often heavily influenced by central bank decisions. Locally, one of the most powerful tools in the playbook is the adjustment of interest rates by the South African Reserve Bank (SARB).

An interest rate hike makes holding rands more attractive to foreign investors because they can earn a higher return. This increased demand can help strengthen the currency, acting as a defensive move against inflation and global economic shocks.

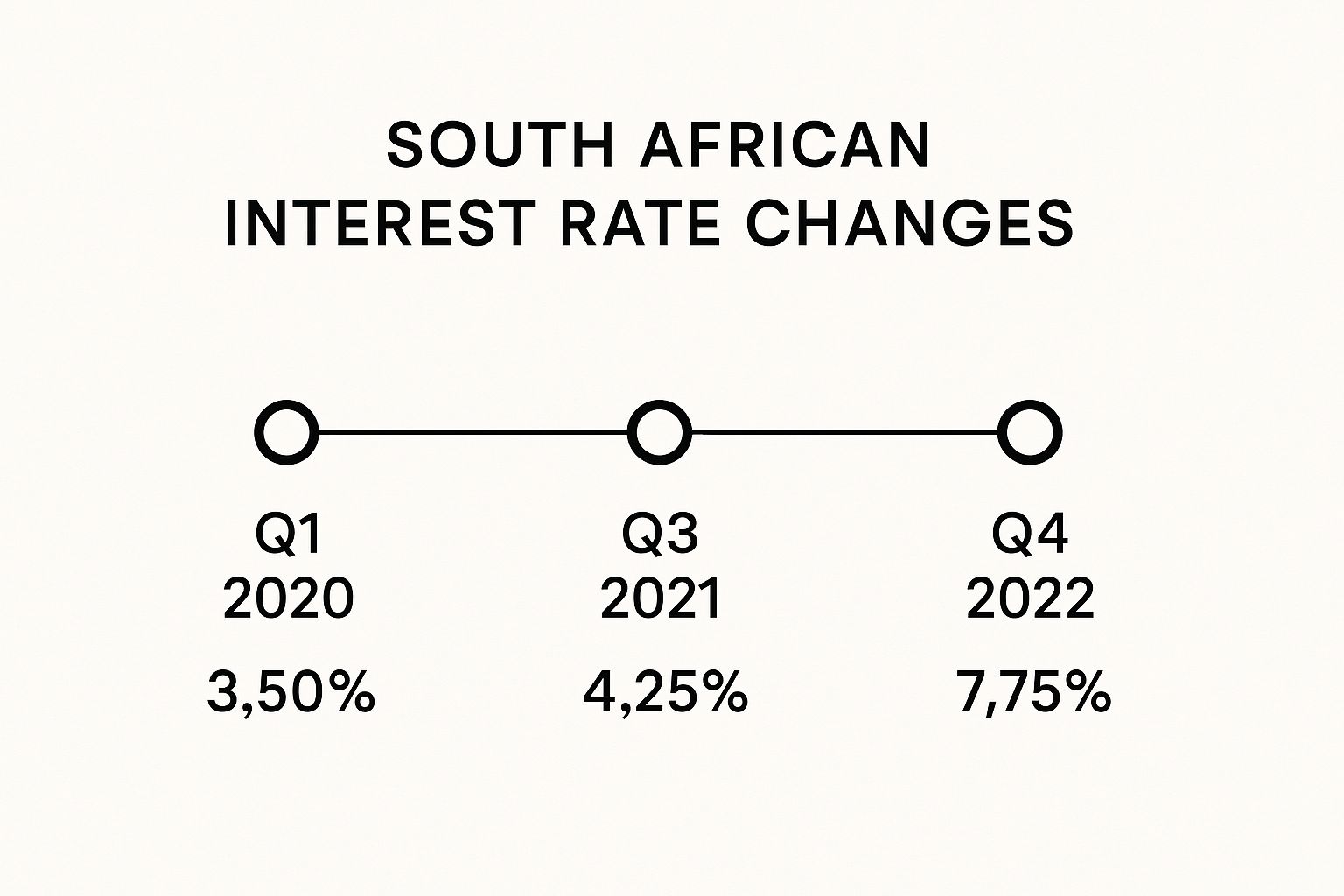

The timeline below really paints a picture of how the SARB has used rate adjustments to steer the economy through choppy waters.

The data clearly shows a steady tightening of monetary policy, with the repo rate climbing from 3.50% to 7.75%. This was a deliberate strategy aimed at reining in inflation and supporting the rand’s value.

Understanding this history—the constant tug-of-war between global shocks, commodity cycles, and our own domestic policies—is the bedrock for making sense of any forecast asking, "will the rand strengthen against the dollar?". It proves that while long-term pressures are very real, the rand is more than capable of significant short-term recoveries.

How South Africa's Economy Steers the Rand

The rand's value is deeply tied to South Africa's own economic report card. You can think of it as a direct reflection of the country's financial health, constantly being graded by global investors. When our domestic economy shows signs of strength and stability, foreign investment tends to flow in, which naturally boosts demand for the rand and pushes its value up against the dollar.

On the flip side, any signs of trouble—like sluggish growth or political uncertainty—can make investors nervous. This often leads them to pull their money out in search of safer havens, which in turn puts downward pressure on our currency. So, if we want to get a sense of whether the rand will strengthen against the dollar, the very first place to look is right here at home.

The Key Domestic Drivers

Three core domestic factors really act as the main controls for the rand's performance. International markets watch these indicators like a hawk, and any unexpected shifts can cause immediate currency fluctuations.

- Interest Rates: The South African Reserve Bank (SARB) uses interest rates as its primary tool for managing inflation and supporting the rand. When the SARB hikes rates, it offers better returns for foreign investors holding rand-denominated assets. This makes our currency more attractive and, all else being equal, stronger.

- Inflation: High inflation is a currency killer. It erodes purchasing power, making each rand worth less. When South Africa’s inflation rate climbs, especially if it outpaces that of the United States, it typically weakens the rand.

- GDP Growth: Gross Domestic Product (GDP) is the ultimate scorecard for economic health. Strong, consistent GDP growth signals a thriving economy, which attracts investment and bolsters the rand's value. A contracting or stagnant economy does the exact opposite.

Investor Confidence is Crucial: Beyond the hard data, the level of investor confidence plays a massive role. Political stability, clear government policy, and progress on structural reforms—like fixing our energy crisis—are absolutely vital. Uncertainty in these areas can quickly undermine any positive economic data, making investors hesitant to commit their capital.

Now, let's look at how these domestic factors directly influence the rand's strength in the real world. The table below summarises the key indicators and their typical effect.

Domestic Factors Influencing the Rand's Strength

| Economic Factor | Potential Impact on the Rand | Recent Trend |

|---|---|---|

| SARB Interest Rates | Higher rates generally strengthen the ZAR. | Rates have been held high to combat inflation. |

| Inflation (CPI) | High inflation weakens the ZAR. | Consistently hovering around the 5-6% mark. |

| GDP Growth | Strong growth strengthens the ZAR. | Often sluggish, struggling to gain momentum. |

| Political Stability | Stability boosts confidence and strengthens the ZAR. | A persistent source of uncertainty for investors. |

| Trade Balance | A surplus (more exports) strengthens the ZAR. | Varies, but often impacted by commodity prices. |

As you can see, a mix of high inflation, slow growth, and political headwinds has created a challenging environment for our currency.

Historical data reinforces this connection between domestic challenges and currency performance. A look at the rand's performance over the last five years reveals a gradual depreciation trend when measured in rand per dollar. For instance, the average dollar value one rand could buy has often hovered between 5 and 6 US cents. By August 2025, the rate was approximately R1 = $0.0554, with the six-month average sitting around 5.49 US cents.

This persistent pressure is linked directly to local economic factors, including those trade balance figures and inflation rates, which have averaged around 5-6%. You can dig deeper into this historical data on Wise.com. These figures clearly highlight how domestic realities—from interest rate policies to inflation—are priced into the currency, ultimately shaping its long-term path against the dollar.

Global Forces That Impact the Rand's Value

While South Africa's internal economic health certainly sets the stage, the rand's day-to-day performance is often a story written by powerful global forces. The currency doesn't operate in a vacuum. It's more like a small boat on a very large, and often turbulent, ocean. To truly get a handle on the question, "will the rand strengthen against the dollar?", we have to look beyond our borders.

The rand's journey is deeply tied to events happening thousands of kilometres away, from policy meetings in Washington to subtle shifts in market mood across Asia.

The US Dollar's Dominance

By far, the single biggest external factor is the strength of the US dollar itself. A great way to think of the ZAR/USD pairing is like a seesaw. When the dollar side gets heavier and rises in value, the rand side naturally goes down — even if absolutely nothing has changed within South Africa.

This is mostly driven by the US Federal Reserve, or "the Fed." When the Fed hikes its interest rates, it suddenly becomes more profitable for global investors to hold US dollars. This kicks off a huge demand for the dollar, pulling money away from other currencies, especially those from emerging markets like ours. A strong dollar almost always means a tough time for the rand.

The Mood of the Market

Global investor sentiment is another critical piece of the puzzle. The rand is often seen as a proxy for risk appetite, which is just a fancy way of saying how brave or scared investors are feeling. This creates two very different scenarios:

- Risk-On: When investors are feeling optimistic about the global economy, they're more willing to put their money into higher-risk, higher-return assets. Currencies like the rand do very well in these periods, attracting foreign cash and strengthening as a result.

- Risk-Off: When fear takes over—maybe due to a war, a looming global recession, or a financial crisis—investors run for the hills. They sell off their riskier assets and flock to "safe-haven" currencies like the US dollar, Swiss franc, or Japanese yen. The rand often gets hit hard during these risk-off waves.

The rand's value is often a barometer for global economic confidence. A strengthening rand can signal that international investors feel secure enough to venture into emerging markets, while a weakening rand often points to widespread fear and a retreat to safety.

Commodity Prices as a Lifeline

Finally, we can't forget that South Africa is a major resource-exporting nation. Our economic fortunes are closely linked to commodity prices, as we sell massive amounts of gold, platinum, iron ore, and coal to the rest of the world.

When global demand for these materials is high and their prices climb, it means more US dollars are flowing into South Africa to pay for our exports. To be used here, those dollars must be converted into rands, which increases demand for our currency and pushes its value up. On the flip side, a slump in commodity prices slows that inflow right down, putting the rand under pressure.

This constant push and pull from global factors is a huge reason for the currency's famous volatility. For instance, between August 2020 and August 2025, the rand swung wildly between R14 and R20 per dollar, a massive range shaped by these very forces. In just the week leading up to 3 August 2025, it shifted 1.68%, moving between R17.75 and R18.22. You can dig into more of the rand's past performance on Wise.com to see these patterns for yourself.

What Experts Predict for the Rand's Future

With all these local and global factors swirling around, it’s natural to wonder what the people who live and breathe this stuff—the financial analysts—are actually predicting. But if you ask them, "Will the rand strengthen against the dollar?", you won't get a simple yes or no.

Forecasting the rand isn’t about gazing into a crystal ball; it's about carefully weighing probabilities. The one thing almost every expert agrees on is that the rand will remain volatile. While the general consensus points to a slow, long-term slide against the US dollar, everyone expects sharp, short-term rallies along the way.

Bullish Scenarios for the Rand

So, what would it take for the rand to have a really good run? The optimistic, or "bullish," view relies on a few key things falling into place at the same time. Think of it as a perfect storm in South Africa's favour.

This best-case scenario would likely need:

- A Softer US Dollar: If the US Federal Reserve starts cutting interest rates more aggressively than expected, the dollar loses some of its shine for global investors. This gives currencies like the rand a chance to climb.

- A Commodity Boom: A sudden surge in the prices of South Africa’s key exports—think platinum, gold, and iron ore—would flood the country with foreign currency and give the rand a serious boost.

- Getting Our House in Order: Meaningful progress on domestic issues, especially ending load shedding and pushing through real, investor-friendly economic reforms, would do wonders for confidence.

If these stars align, some economists believe the rand could claw its way back towards the R17.00–R17.50 mark against the dollar.

The Bearish Viewpoint

On the flip side, the more cautious, or "bearish," view is firmly rooted in South Africa's stubborn structural problems and ever-present global risks. Those forecasting a weaker rand usually point to ongoing political uncertainty, sluggish GDP growth, and the constant threat of a global "risk-off" event, where investors dump riskier assets and run for the safety of the US dollar.

A key takeaway from most financial analysis is that while the rand has the potential for strong rallies, the underlying economic fundamentals and global conditions create a powerful headwind.

Under these more pessimistic conditions, many major banks see the rand drifting towards the R18.75–R19.50 range, or perhaps even higher, over the next 12 to 18 months.

Ultimately, whether the rand strengthens or weakens depends entirely on which of these economic stories plays out.

Here is the rewritten section, crafted to sound human-written and natural, as requested.

How the Exchange Rate Affects Your Wallet

That ever-shifting ZAR/USD number you see on the news? It’s far more than just data for traders and economists. The constant push and pull of the exchange rate directly influences your day-to-day life, shaping everything from your grocery bill to the cost of an overseas holiday.

It all boils down to a simple concept: purchasing power. When the rand weakens, you need more of them to buy something priced in dollars. This simple fact means that anything we import into South Africa – whether it's the fuel for your bakkie or the latest smartphone – gets more expensive for us here at home.

The Impact on Your Day-to-Day Costs

A weaker rand almost always means higher prices at the till. Think about it: South Africa brings in a huge amount of goods from overseas, like electronics, cars, and specialised machinery. When the rand’s value drops, the cost to import these items shoots up, and that increase often finds its way to the consumer price tag.

The most obvious example is the fuel price. Crude oil is traded in US dollars globally. So, when the rand takes a dip, it costs us more to import the same barrel of oil, and we all see the result at the petrol pump. This has a ripple effect, too. Higher fuel costs mean higher transport costs for businesses, who then have to pass that on when pricing everything from food to clothing.

For a South African business, the exchange rate is a classic double-edged sword. A weak rand is brilliant for anyone exporting goods. Suddenly, their products are cheaper and more attractive to international buyers. But for importers? It's a massive headache. Their costs skyrocket, leaving them to either absorb the financial hit or hike their prices for local customers.

Travel, Investments, and Your Global Reach

Planning a trip abroad? The exchange rate determines just how much fun you can afford to have. A strong rand is your best friend, making international travel cheaper because your rands stretch further when you convert them to dollars, euros, or pounds. When the rand is weak, however, that dream holiday can suddenly become a lot more expensive.

The same logic applies if you have investments outside of South Africa. The rand's performance can either boost or dampen your returns.

- A Weaker Rand: This can actually work in your favour. When you bring your dollar-based investment profits back home, each dollar converts into more rands, inflating your total return.

- A Stronger Rand: This has the opposite effect. Your dollar earnings will translate into fewer rands, effectively trimming your profits when you repatriate them.

At the end of the day, having a handle on whether the rand is likely to strengthen or weaken isn't just for financial analysts. It's practical, essential knowledge that has a very real impact on your personal budget and your business's bottom line.

Getting to Grips with the Rand's Fluctuations

It's natural to have questions when trying to understand the rand's often wild ride against the US dollar. Let's tackle some of the most common queries head-on, breaking down the complex forces at play into straightforward answers.

Think of this as a quick FAQ to clear up any lingering confusion and solidify your understanding of what makes our currency tick.

Is a Stronger Rand a Win for South Africa?

On the surface, it seems like a definite yes, but the reality is more complicated. A strong rand is great if you're a consumer. It means your rands go further when buying imported goods – everything from the fuel in your car to the latest smartphone feels cheaper.

However, for South African businesses that sell their products overseas, a strong rand can be a real headache. It makes our exports, like wine, fruit, and platinum, more expensive for international buyers. This can slash demand, hurting crucial industries and threatening jobs in sectors that are the backbone of our economy.

For most economists, the sweet spot isn't a super strong or super weak currency, but a stable one. Predictability is golden because it allows businesses to plan for the future with confidence, which is exactly what encourages long-term investment.

What's the One Thing That Moves the Rand the Most?

If only it were that simple! There isn't a single silver bullet. The rand's value is a cocktail of local and global ingredients, all mixed together and constantly changing. But if you had to point to one dominant force, it would be global investor sentiment.

As an emerging market currency, the rand is very sensitive to global risk appetite. When international investors are feeling nervous or fearful (what we call a "risk-off" environment), they tend to sell what they see as riskier assets – and the rand is high on that list. They then buy "safe-haven" currencies like the US dollar. This flight to safety can cause the rand to drop sharply, often no matter how good the news is back home.

How Do Commodity Prices Fit Into the Picture?

Commodity prices have a huge say in the rand's direction. South Africa is a powerhouse exporter of natural resources like gold, platinum, iron ore, and coal. Critically, these are all sold in US dollars on the world market.

So, when the prices for these commodities go up, the value of our exports rises with them. This brings a flood of US dollars into the country. Before that money can be spent here, it has to be exchanged for rands, which boosts demand for our currency and helps it strengthen. The opposite is also true: when commodity prices fall, our export earnings shrink, less dollar income flows in, and the rand comes under pressure.

Trying to manage your business's finances amidst these currency swings can feel like a constant battle. Zaro gives you a way to fight back by offering the real spot exchange rate with zero spread and absolutely no hidden fees. Stop guessing what international payments will cost and take back control. Explore how Zaro can protect your business from currency risk.